Te

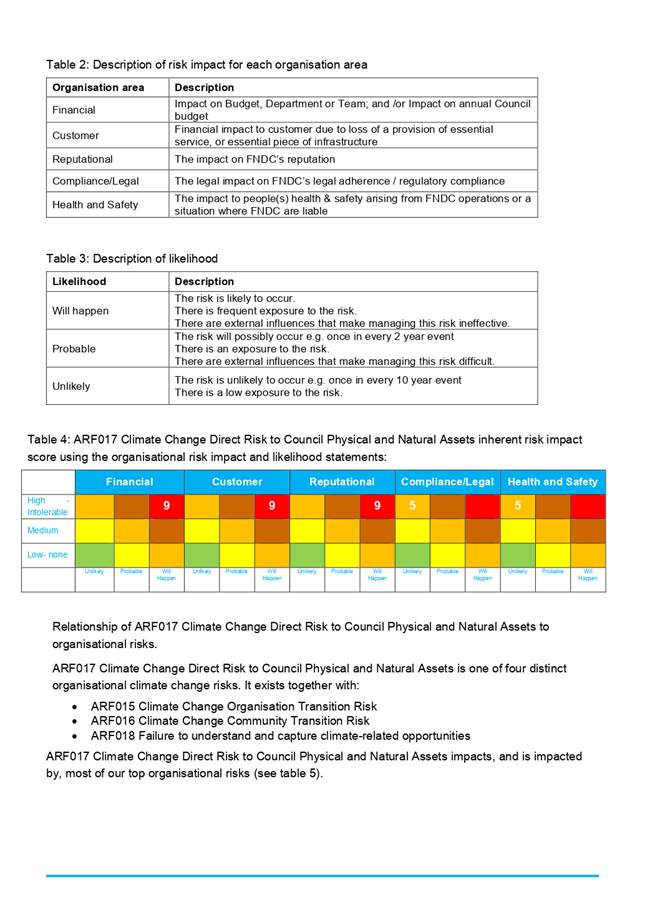

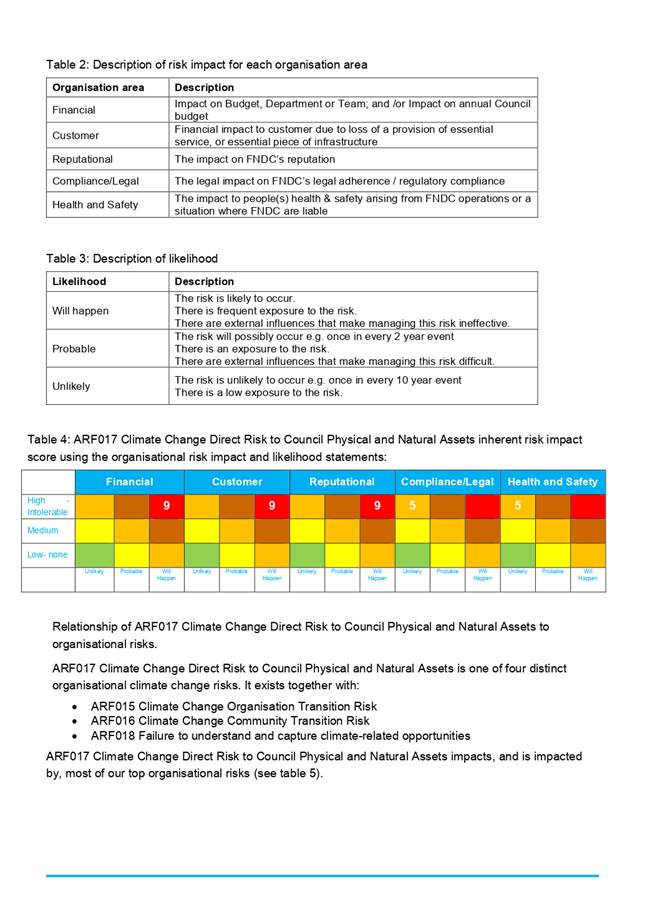

Kaunihera o Tai Tokerau ki te Raki

AGENDA

Assurance, Risk and Finance Committee Meeting

Wednesday, 2 February 2022

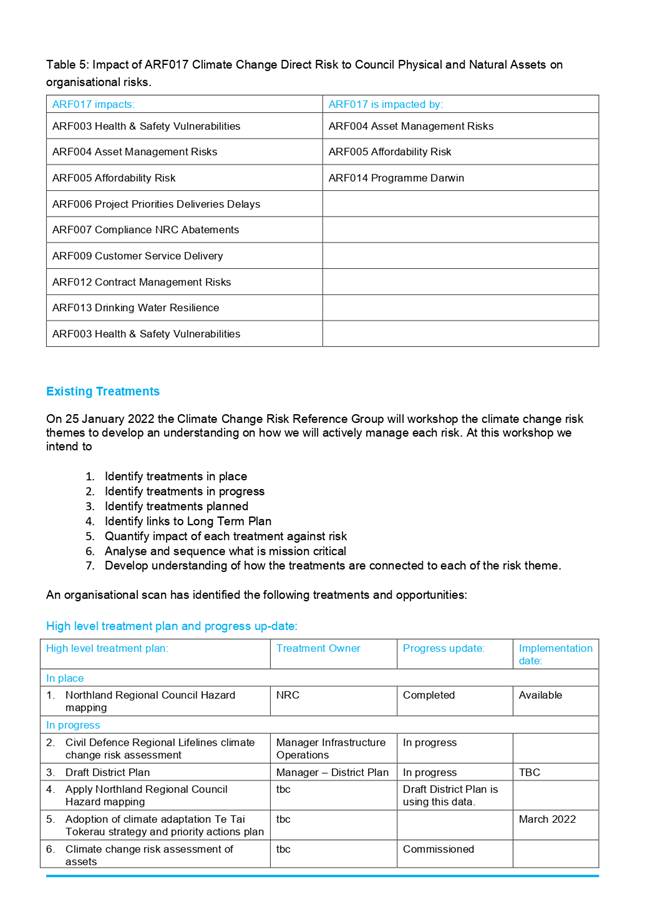

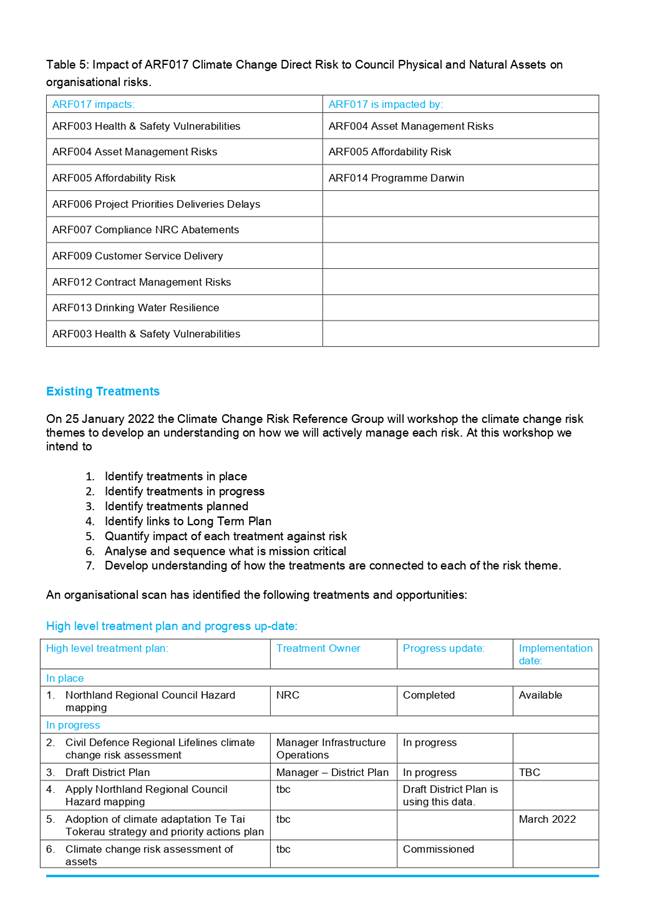

|

Time:

|

9.30 am

|

|

Location:

|

Virtually via Microsoft Teams

|

Membership:

Member John Vujcich - Chairperson

Member Bruce Robertson –

Deputy Chairperson

Mayor John Carter

Deputy Mayor Ann Court

Cr Mate Radich

Cr Rachel Smith

Cr Kelly Stratford

Cr Moko Tepania

Member Mike Edmonds –

Kaikohe-Hokianga Community Board Chairperson

Member Adele Gardner – Te

Hiku Community Board Chairperson

|

|

Authorising Body

|

Mayor/Council

|

|

Status

|

Standing Committee

|

|

COUNCIL

COMMITTEE

|

Title

|

Assurance, Risk and Finance

Committee Terms of Reference

|

|

Approval Date

|

19 December 2019

|

|

Responsible Officer

|

Chief Executive

|

Purpose

The purpose of the Assurance,

Risk and Finance Committee (the Committee) is to assist and advise the

Governing Body in discharging its responsibility and ownership of finance, risk

and internal control.

The Committee will review the

effectiveness of the following aspects:

·

The robustness of financial management

practices.

·

The integrity and appropriateness of

internal and external reports and accountability arrangements.

·

The robustness of the risk management

framework.

·

The robustness of internal controls and

the internal audit framework.

·

Compliance with applicable laws,

regulations, standards, and best practice guidelines.

·

The establishment and maintenance of

controls to safeguard the Council’s financial and non-financial assets.

·

Data governance framework

To perform his or her role

effectively, each Committee member must develop and maintain

his or her skills and knowledge,

including an understanding of the Committee’s responsibilities, and of

the Council’s business, operations, and risks.

Membership

The Council will determine the

membership of the Assurance, Risk and Finance Committee including at least one

independent appointment with suitable financial and risk management knowledge

and experience.

The Assurance, Risk and Finance

Committee will comprise of at least five elected members (one of which will be

the chairperson), and one independent appointed member.

|

Mayor

Carter

|

|

John

Vujcich – Chairperson

|

|

Bruce

Robertson – Deputy Chairperson and Independent Member of the Committee

|

|

Moko

Tepania

|

|

Mate

Radich

|

|

Rachel

Smith

|

|

Kelly

Stratford

|

|

Ann

Court

|

|

Mike

Edmonds

|

|

Adele

Gardner

|

Non-appointed

Councillors may attend meetings with speaking rights, but not voting rights.

Quorum

The quorum at a meeting of the Assurance, Risk and Finance Committee is 4

members.

Frequency of

Meetings

The Assurance, Risk and Finance Committee shall meet every 6

weeks, but may be cancelled if there is no business.

Power to

Delegate

The Assurance, Risk and

Finance Committee may not delegate any of its responsibilities, duties or

powers.

Committees

Responsibilities

The Committees responsibilities

are described below:

Financial

systems and performance of the Council

·

Review the Council’s financial

and non-financial performance against the Long-Term Plan and Annual Plan

·

Review Council quarterly financial

statements and draft Annual Report

Far

North Holdings Limited (FNHL)

·

Recommend to Council the approval of

statement of intent and Annual Report (s67 LGA)

·

Receive 6 monthly report on operations

(s66 LGA)

·

Receive quarterly financial statements

·

Recommend appointment of directors of

FNHL

Risk

Management

·

Review appropriateness of

Council’s risk management framework and associated procedures for

effective risk identification, evaluation, and treatment

·

Receive and review risk management

dashboard reports

·

Provide input, annually, into the

setting of the risk management programme of work

·

Receive updates on current litigation

and legal liabilities

Internal

Audit and Controls

·

Review whether management has in place

a current and comprehensive internal audit framework

·

Receive and review the internal audit

dashboard reports

·

Provide input, annually, into the

setting of the internal audit programme of work

·

Review whether there are appropriate

processes and systems in place to identify and investigate fraudulent behaviour

The

Committee will manage Council’s relationship with external auditor.

The

Committee will approve applications to declare land abandoned and any other

such matters under the Rating Act.

Rules and

Procedures

Council’s

Standing Orders and Code of Conduct apply to all the committee’s

meetings.

Annual reporting

The Chair of the Committee will

submit a written report to the Chief Executive on an annual basis. The

review will summarise the activities of the Committee and how it has contributed to the Council’s

governance and strategic objectives. The Chief Executive

will place the report on the next available agenda of the governing body.

ASSURANCE, RISK AND FINANCE COMMITTEE - MEMBERS REGISTER

OF INTERESTS

|

Name

|

Responsibility (i.e.

Chairperson etc)

|

Declaration of

Interests

|

Nature of Potential

Interest

|

Member's Proposed

Management Plan

|

|

Hon John Carter QSO

|

Board Member of the

Local Government Protection Programme

|

Board Member of the

Local Government Protection Program

|

|

|

|

Carter Family Trust

|

|

|

|

|

John Vujcich (Chair)

|

Board Member

|

Pioneer Village

|

Matters relating to

funding and assets

|

Declare interest and

abstain

|

|

Director

|

Waitukupata Forest Ltd

|

Potential for council

activity to directly affect its assets

|

Declare interest and

abstain

|

|

Director

|

Rural Service Solutions

Ltd

|

Matters where council

regulatory function impact of company services

|

Declare interest and

abstain

|

|

Director

|

Kaikohe (Rau Marama)

Community Trust

|

Potential funder

|

Declare interest and

abstain

|

|

Partner

|

MJ & EMJ Vujcich

|

Matters where council

regulatory function impacts on partnership owned assets

|

Declare interest and

abstain

|

|

Member

|

Kaikohe Rotary Club

|

Potential funder, or

impact on Rotary projects

|

Declare interest and

abstain

|

|

Member

|

New Zealand Institute

of Directors

|

Potential provider of

training to Council

|

Declare a Conflict of

Interest

|

|

Member

|

Institute of IT

Professionals

|

Unlikely, but possible

provider of services to Council

|

Declare a Conflict of

Interest

|

|

Bruce Robertson

(Deputy)

|

Chair/Deputy Chair of a

number of Audit and Risk Committees: Far North Auckland Bay of Plenty

Regional Tauranga Thames Coromandel Hamilton Waipa Otorohanga Waitomo

Environment Southland Invercargill Southland.

|

|

There is a low level of

there being a potential interest conflict. An outside potential is water

reform and ‘discussion’ of one north regional water company in

loving North AKD with Watercare.

|

I remain aware of my

roiled and will Raise any matter with the Mayor/CEO and chair of ARF should

any matter potentially conflict.

|

|

Currently None are

North AKD. Previously I have Undertaken work on Okara Park with Whangarei DC.

|

Advisory Work.

|

Okara Park is a

regional Stadium. Matter solely related Governance and role of DC. Low risk

of conflict.

|

|

|

Deputy Mayor Ann

Court

|

Waipapa Business

Association

|

Member

|

|

Case by case

|

|

Warren Pattinson

Limited

|

Shareholder

|

Building company. FNDC

is a regulator and enforcer

|

Case by case

|

|

Kerikeri Irrigation

|

Supplies my water

|

|

No

|

|

District Licensing

|

N/A

|

N/A

|

N/A

|

|

Ann Court Trust

|

Private

|

Private

|

N/A

|

|

Waipapa Rotary

|

Honorary member

|

Potential community

funding submitter

|

Declare interest and

abstain from voting.

|

|

Properties on Onekura

Road, Waipapa

|

Owner Shareholder

|

Any proposed FNDC

Capital works or policy change which may have a direct impact

(positive/adverse)

|

Declare interest and

abstain from voting.

|

|

Property on Daroux Dr,

Waipapa

|

Financial interest

|

Any proposed FNDC

Capital works or policy change which may have a direct impact

(positive/adverse)

|

Declare interest and

abstain from voting.

|

|

Flowers and gifts

|

Ratepayer 'Thankyou'

|

Bias/

Pre-determination?

|

Declare to Governance

|

|

Coffee and food

|

Ratepayers sometimes

'shout' food and beverage

|

Bias or

pre-determination

|

Case by case

|

|

Staff

|

N/A

|

Suggestion of not being

impartial or pre-determined!

|

Be professional, due

diligence, weigh the evidence. Be thorough, thoughtful, considered impartial

and balanced. Be fair.

|

|

Warren Pattinson

|

My husband is a builder

and may do work for Council staff

|

|

Case by case

|

|

Ann Court - Partner

|

Warren Pattinson

Limited

|

Director

|

Building Company. FNDC

is a regulator

|

Remain at arm’s

length

|

|

Air NZ

|

Shareholder

|

None

|

None

|

|

Warren Pattinson Limited

|

Builder

|

FNDC is the consent

authority, regulator and enforcer.

|

Apply arm’s

length rules

|

|

Property on Onekura

Road, Waipapa

|

Owner

|

Any proposed FNDC

capital work in the vicinity or rural plan change. Maybe a link to policy

development.

|

Would not submit.

Rest on a case by case basis.

|

|

Mate Radich

|

No form received

|

|

|

|

|

Kelly Stratford

|

KS Bookkeeping and

Administration

|

Business Owner,

provides bookkeeping, administration and development of environmental

management plans

|

None perceived

|

Step aside from

decisions that arise, that may have conflicts

|

|

Waikare Marae Trustees

|

Trustee

|

Maybe perceived

conflicts

|

Case by case basis

|

|

Bay of Islands College

|

Parent Elected Trustee

|

None perceived

|

If there was a

conflict, I will step aside from decision making

|

|

Karetu School

|

Parent Elected Trustee

|

None perceived

|

If there was a

conflict, I will step aside from decision making

|

|

Māori title land

– Moerewa and Waikare

|

Beneficiary and husband

is a shareholder

|

None perceived

|

If there was a

conflict, I will step aside from decision making

|

|

Sister is employed by

Far North District Council

|

|

|

Will not discuss

work/governance mattes that are confidential

|

|

Gifts - food and

beverages

|

Residents and

ratepayers may ‘shout’ food and beverage

|

Perceived bias or

predetermination

|

Case by case basis

|

|

Taumarere Counselling

Services

|

Advisory Board Member

|

May be perceived

conflicts

|

Should conflict arise,

step aside from voting

|

|

He Puna Aroha Putea

Whakapapa

|

Trustee

|

May be perceived

conflicts

|

Should conflict arise,

step aside from voting should they apply for funds

|

|

Kawakawa Returned

Services Association

|

Member

|

May be perceived

conflicts

|

Should conflict arise,

step aside from voting should they apply for funds

|

|

Whangaroa Returned

Services Association

|

Member

|

May be perceived

conflicts

|

Should conflict arise,

step aside from voting should they apply for funds

|

|

National Emergency Management

Advisor Committee

|

Member

|

|

Case by case basis

|

|

Te Rūnanga ā

Iwi o Ngāpuhi

|

Tribal affiliate member

|

As a descendent of Te

Rūnanga ā Iwi o Ngāpuhi I could have a perceived conflict

of interest in Te Rūnanga ā Iwi o Ngāpuhi Council

relations

|

Declare a perceived

conflict should there appear to be one

|

|

Te Rūnanga ā

Iwi o Ngāti Hine

|

Tribal affiliate member

|

Could have a perceived

conflict of interest

|

Declare a perceived

conflict should I determine there is a conflict

|

|

Kawakawa Business and Community

Association

|

Member

|

|

Will declare a

perceived conflict should there appear to be one

|

|

Sport Northland

|

Board Member

|

May be perceived

conflicts

|

Should conflict arise,

step aside from voting

|

|

Kelly Stratford -

Partner

|

Chef and Barista

|

Opua Store

|

None perceived

|

|

|

Māori title land

– Moerewa

|

Shareholder

|

None perceived

|

If there was a conflict

of interest, I would step aside from decision making

|

|

Rachel Smith

|

Friends of Rolands Wood

Charitable Trust

|

Trustee

|

|

|

|

Mid North Family

Support

|

Trustee

|

|

|

|

Property Owner

|

Kerikeri

|

|

|

|

Friends who work at Far

North District Council

|

|

|

|

|

Kerikeri Cruising Club

|

Subscription Member

|

|

|

|

Vision Kerikeri

|

Financial Member

|

|

|

|

Rachel Smith

(Partner)

|

Property Owner

|

Kerikeri

|

|

|

|

Friends who work at Far

North District Council

|

|

|

|

|

Kerikeri Cruising Club

|

Subscription Member and

Treasurer

|

|

|

|

Vision Kerikeri

|

Financial Member

|

|

|

|

Town and General

Groundcare Limited

|

Director/Shareholder

|

|

|

|

Moko Tepania

|

Teacher

|

Te Kura Kaupapa

Māori o Kaikohe.

|

Potential Council

funding that will benefit my place of employment.

|

Declare a perceived

conflict

|

|

Chairperson

|

Te Reo o Te Tai Tokerau

Trust.

|

Potential Council

funding for events that this trust runs.

|

Declare a perceived

conflict

|

|

Tribal Member

|

Te Rūnanga o Te

Rarawa

|

As a descendent of Te

Rarawa I could have a perceived conflict of interest in Te Rarawa Council

relations.

|

Declare a perceived

conflict

|

|

Tribal Member

|

Te Rūnanga o

Whaingaroa

|

As a descendent of Te

Rūnanga o Whaingaroa I could have a perceived conflict of interest in Te

Rūnanga o Whaingaroa Council relations.

|

Declare a perceived

conflict

|

|

Tribal Member

|

Kahukuraariki Trust

Board

|

As a descendent of

Kahukuraariki Trust Board I could have a perceived conflict of interest in

Kahukuraariki Trust Board Council relations.

|

Declare a perceived

conflict

|

|

Tribal Member

|

Te Rūnanga

ā-Iwi o Ngāpuhi

|

As a descendent of Te

Rūnanga ā-Iwi o Ngāpuhi I could have a perceived conflict of

interest in Te Rūnanga ā-Iwi o Ngāpuhi Council relations.

|

Declare a perceived

conflict

|

|

Mike Edmonds

|

Chair

|

Kaikohe Mechanical and

Historic Trust

|

Council Funding

|

Decide at the

time

|

|

Committee member

|

Kaikohe Rugby Football

and Sports Club

|

Council Funding

|

Withdraw and abstain

|

|

Adele Gardner

|

N/A - FNDC Honorarium

|

|

|

|

|

Te Hiku Education Trust

|

Trustee

|

|

|

|

Te Ahu Charitable Trust

|

Trustee

|

|

|

|

ST Johns Kaitaia Branch

|

Trustee/ Committee

Member

|

|

|

|

Te Hiku Sports Hub

Committee

|

Committee Member

|

|

|

|

I know many FNDC staff

members as I was an FNDC staff member from 1994-2008.

|

|

|

|

|

Partner of Adele

Gardner

|

N/A as Retired

|

|

|

|

2 Nga Whakapāha Me Ngā Pānga Mema / Apologies

and Declarations of Interest

Members need to

stand aside from decision-making when a conflict arises between their role as a

Member of the Committee and any private or other external interest they might

have. This note is provided as a reminder to Members to review the matters on

the agenda and assess and identify where they may have a pecuniary or other

conflict of interest, or where there may be a perception of a conflict of interest.

If a Member

feels they do have a conflict of interest, they should publicly declare that at

the start of the meeting or of the relevant item of business and refrain from

participating in the discussion or voting on that item. If a Member thinks they

may have a conflict of interest, they can seek advice from the Chief Executive

Officer or the Team Leader Democracy Support (preferably before the meeting).

It is noted

that while members can seek advice the final decision as to whether a conflict

exists rests with the member.

3 Te

Tono Kōrero / Deputation

No requests for deputations were received at the time of the

Agenda going to print.

4 Confirmation

of Previous Minutes

4.1 Confirmation

of Previous Minutes

File

Number: A3525653

Author: Casey

Gannon, Meetings Administrator

Authoriser: Aisha

Huriwai, Team Leader Democracy Services

Purpose of the Report

The minutes are attached to allow the Committee to confirm

that the minutes are a true and correct record of previous meetings.

|

Recommendation

That the Assurance, Risk and Finance Committee confirms

the minutes of the Assurance, Risk and Finance Committee meeting held 1

December 2021 as a true and correct record.

|

1) Background

Local Government Act 2002 Schedule 7 Section 28 states that

a local authority must keep minutes of its proceedings. The minutes of these

proceedings duly entered and authenticated as prescribed by a local authority

are prima facie evidence of those meetings.

2) Discussion and Options

The minutes of the meetings are attached.

Far North District Council Standing Orders Section 27.3

states that no discussion shall arise on the substance of the minutes in any

succeeding meeting, except as to their correctness.

Reason

for the recommendation

The reason for the recommendation is to confirm the minutes

are a true and correct record of the previous meetings.

3) Financial Implications and Budgetary

Provision

There are no financial implications or the need for

budgetary provision as a result of this report.

Attachments

1. 2021-12-01

Assurance, Risk and Finance Committee Minutes [A3509906] - A3509906 ⇩

Compliance schedule:

Full consideration has been given to the provisions of the

Local Government Act 2002 S77 in relation to decision making, in particular:

1. A

Local authority must, in the course of the decision-making process,

a) Seek

to identify all reasonably practicable options for the achievement of the

objective of a decision; and

b) Assess

the options in terms of their advantages and disadvantages; and

c) If

any of the options identified under paragraph (a) involves a significant

decision in relation to land or a body of water, take into account the

relationship of Māori and their culture and traditions with their

ancestral land, water sites, waahi tapu, valued flora and fauna and other

taonga.

2. This

section is subject to Section 79 - Compliance with procedures in relation to

decisions.

|

Compliance

requirement

|

Staff

assessment

|

|

State the level of significance

(high or low) of the issue or proposal as determined by the Council’s

Significance and Engagement Policy

|

This is a matter of low

significance.

|

|

State the relevant Council

policies (external or internal), legislation, and/or community outcomes (as

stated in the LTP) that relate to this decision.

|

This report complies with the

Local Government Act 2002 Schedule 7 Section 28.

|

|

State whether this issue or

proposal has a District wide relevance and, if not, the ways in which the

appropriate Community Board’s views have been sought.

|

It is the responsibility of each

meeting to confirm their minutes therefore the views of another meeting are

not relevant.

|

|

State the possible implications for Māori

and how Māori have been provided with an opportunity to contribute to

decision making if this decision is significant and relates to land and/or

any body of water.

|

There are no implications for Māori in confirming minutes from

a previous meeting. Any implications on Māori arising from matters

included in meeting minutes should be considered as part of the relevant

report.

|

|

Identify persons likely to be

affected by or have an interest in the matter, and how you have given

consideration to their views or preferences (for example,

youth, the aged and those with disabilities).

|

This report is asking for minutes

to be confirmed as true and correct record, any interests that affect other

people should be considered as part of the individual reports.

|

|

State the financial implications

and where budgetary provisions have been made to support this decision.

|

There are no financial implications

or the need for budgetary provision arising from this report.

|

|

Chief Financial Officer review.

|

The Chief Financial Officer has

not reviewed this report.

|

|

Assurance, Risk

and Finance Committee Meeting Agenda

|

2 February 2022

|

MINUTES OF Far North District Council

Assurance, Risk and

Finance Committee Meeting

HELD AT THE Council

Chamber, Memorial Avenue, Kaikohe

ON Wednesday, 1

December 2021 AT 1.30 pm

PRESENT: Chairperson

John Vujcich, Member Bruce Robertson, Cr Mate Radich, Cr Rachel Smith, Cr Kelly

Stratford, Member Mike Edmonds, Member Adele Gardner

IN

ATTENDANCE: Shaun Clarke (Chief Executive Officer), William J Taylor, MBE

(General Manager Corporate Services), Dean Myburgh (General Manager District

Services), Andy Finch (General Manager Infrastructure and Asset Management),

Darren Edwards (General Manager Strategic Planning and Policy)

1 Karakia

TimatAnga – Opening Prayer

|

Motion

|

|

Resolution 2021/1

Moved: Chairperson

John Vujcich

Seconded: Cr

Rachel Smith

That Councillor David Clendon be permitted speaking

rights.

Carried

|

2 Ngā Whakapāha Me Ngā Pānga Mema / Apologies and Declarations of Interest

|

Apology

|

|

Resolution 2021/24

Moved: Chairperson

John Vujcich

Seconded: Deputy

Chairperson Bruce Robertson

That the apology received from His Worship the Mayor,

Deputy Mayor Ann Court, and Councillor Moko Tepania be accepted and leave of

absence granted.

Carried

|

3 Ngā Tono Kōrero / Deputation

There were no deputations for this meeting.

4 Confirmation

of Previous Minutes

|

4.1 Confirmation

of Previous Minutes

Agenda item 4.1 document number

A3051559, pages 12 - 18 refers.

|

|

Resolution 2021/25

Moved: Member

Adele Gardner

Seconded: Cr

Kelly Stratford

That the Assurance, Risk and Finance Committee confirms

the minutes of the Assurance, Risk and Finance Committee meeting held 20

October 2021 as a true and correct record.

Abstained: Rachel Smith

Carried

|

5 Reports

|

5.1 Request

Decision on Climate Change Risk Recommendations

Agenda item 5.1 document number

A3475964, pages 19 - 52 refers.

|

|

Resolution 2021/26

Moved: Cr Rachel Smith

Seconded: Cr

Kelly Stratford

That the Assurance, Risk and Finance

Committee:

a) Removes

ARF001 Climate Change risk from the top organisational dashboard.

b) Adopts

four climate change risks onto the top organisational risk dashboard. The

four risks are:

i) ARF015 Climate Change

Organisation Transition Risk

ii) ARF016 Climate Change Community

Transition Risk

iii) ARF017 Climate Change Direct Risk to

Council Physical and Natural Assets

iv) ARF018 Failure to understand and

capture climate-related opportunities.

c) Establishes

regular risk progress reports, for each risk, to the Assurance, Risk and

Finance Committee.

d) Rescores

risks and reports, at least annually, a climate change risk management

overview to the Assurance, Risk and Finance Committee on the management and

progress to treat the climate change risks.

Carried

|

|

Suspension of Standing Orders

|

|

Resolution 2021/27

Moved: Chairperson

John Vujcich

Seconded: Cr Rachel

Smith

A motion was moved that Assurance, Risk and Finance

suspend standing order number 20.2 Time Limits on Speakers.

Carried

|

|

Resumption of Standing Orders

|

|

Resolution 2021/28

Moved: Chairperson

John Vujcich

Seconded: Cr

Rachel Smith

A motion was moved that Assurance, Risk and Finance

Committee resume standing order 20.2 Time Limits on Speaks.

Carried

|

6 Information

Reports

|

6.1 December

2021 Risk Management Report

Agenda item 6.1 document number

A3472394, pages 53 - 113 refers.

|

|

Resolution 2021/29

Moved: Cr

Rachel Smith

Seconded: Cr

Kelly Stratford

That the Assurance, Risk and Finance Committee receive

the report December 2021 Risk Management Report.

Carried

|

|

6.2 People

and Capability Quarterly Update: 1 July - 30 September 2021

Agenda item 6.2 document number

A3475610, pages 114 - 118 refers.

|

|

Resolution 2021/30

Moved: Deputy

Chairperson Bruce Robertson

Seconded: Chairperson

John Vujcich

That the Assurance, Risk and Finance Committee receive

the report People and Capability Quarterly Update: 1 July - 30 September

2021.

Carried

|

|

6.3 Council

Financial Report for the Period Ending 31 October 2021

Agenda item 6.3 document number

A3480782, pages 119 - 138 refers.

|

|

Resolution 2021/31

Moved: Cr

Rachel Smith

Seconded: Chairperson

John Vujcich

That the Assurance, Risk and Finance Committee receive

the report Council Financial Report for the Period Ending 31 October 2021.

Carried

|

|

6.4 Level

of Service KPI Quarter 1 Performance Report for 2021-2022

Agenda item 6.4 document number

A3481087, pages 139 - 163 refers.

|

|

Resolution 2021/32

Moved: Cr

Rachel Smith

Seconded: Cr

Kelly Stratford

That the Assurance, Risk and Finance Committee receive

the Level of Service KPI Quarter 1 Performance Report for 2021-2022.

Carried

|

|

6.5 Elected

Members Sensitive Expenditure

Agenda item 6.5 document number

A3430657, pages 164 - 165 refers.

|

|

Resolution 2021/33

Moved: Cr

Kelly Stratford

Seconded: Deputy

Cahirperson Bruce Robertson

That the Assurance, Risk and Finance Committee receive

the report Elected Members Sensitive Expenditure.

Carried

|

|

6.6 Sustainable

Procurement Update - December 2021

Agenda item 6.6 document number

A3452628, pages 166 - 168 refers.

|

|

Resolution 2021/34

Moved: Chairperson

John Vujcich

Seconded: Cr

Rachel Smith

That the Assurance, Risk and Finance Committee receive

the report Sustainable Procurement Update - December 2021.

Carried

|

At 3:12 pm, Cr Kelly Stratford left the meeting. At 3:15 pm,

Cr Kelly Stratford returned to the meeting.

7 Te

Wāhanga Tūmatati / Public Excluded

RESOLUTION TO

EXCLUDE THE PUBLIC

|

Committee Recommendation

Moved: Chairperson

John Vujcich

Seconded: Deputy

Chairperson Bruce Robertson

That the public be excluded from the following parts of

the proceedings of this meeting.

The general subject matter of each matter to be considered

while the public is excluded, the reason for passing this resolution in

relation to each matter, and the specific grounds under section 48 of the

Local Government Official Information and Meetings Act 1987 for the passing

of this resolution are as follows:

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Ground(s) under section 48 for the

passing of this resolution

|

|

7.1 - Confirmation of Previous Minutes

|

s7(2)(h) - the withholding of the information is

necessary to enable Council to carry out, without prejudice or

disadvantage, commercial activities

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

7.2 - Tender Panel Report June -

November 2021

|

s7(2)(i) - the withholding of the information is

necessary to enable Council to carry on, without prejudice or disadvantage,

negotiations (including commercial and industrial negotiations)

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

7.3 - Technology Update Report

|

s7(2)(j) - the withholding of the information is

necessary to prevent the disclosure or use of official information for

improper gain or improper advantage

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

7.4 - Far North District Council

Current Legal Action and Potential Liability Claims as at 15 November 2021

|

s7(2)(g) - the withholding of the information is

necessary to maintain legal professional privilege

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

CARRIED

|

|

Confirmation of Information and Decisions to

be released in Public

|

|

Resolution 2021/27

Moved: Cr

Kelly Stratford

Seconded: Cr

Rachel Smith

That the Assurance, Risk and Finance Committee confirms

the information and decisions contained in the part of the meeting held with

public excluded remain

in public excluded.

Carried

|

|

Resolution to Readmit the Public

|

|

Resolution 2021/28

Moved: Cr

Kelly Stratford

Seconded: Member

Adele Gardner

That the Assurance, Risk and Finance and Committee

moves out of Public Excluded and into Ordinary Committee meeting.

Carried

|

8 Karakia

Whakamutunga – Closing Prayer

9 tE

kAPINGA hUI

/ Meeting Close

The meeting closed at 4:13 pm.

The minutes of this meeting were confirmed at the Assurance, Risk and Finance Committee Meeting held on 2 February 2022.

...................................................

CHAIRPERSON

5 Reports

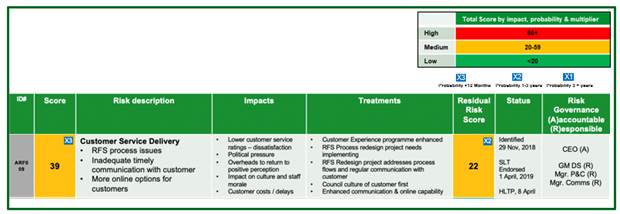

5.1 Recommendation

to remove ARF009 Customer Service Delivery risk from the organisational risk

dashboard

File

Number: A3545470

Author: Tanya

Reid, Business Improvement Specialist

Authoriser: William

J Taylor MBE, General Manager - Corporate Services

Take Pūrongo / Purpose of the Report

To seek approval to remove ARF009 Customer Service Delivery

risk from the organisational risk dashboard.

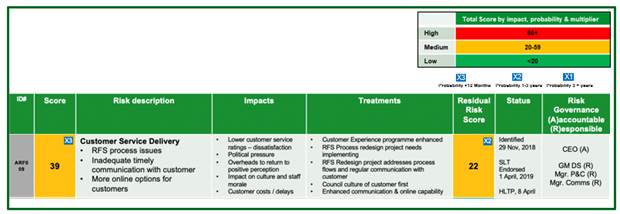

WhakarĀpopoto matua / Executive Summary

· ARF009

Customer Service Delivery risk is an organisational risk in the

Operational/Financial category (whole of business view of the Council)

performance including service/services delivery, risk and finance.

· Of

the 12 risks adopted in May 2019 the ARF009 Customer Service Delivery risk was

the lowest priority risk with a medium impact score of 39.

· A

comprehensive treatment plan has been deployed. Improvements from the

treatments are now being experienced. The risk trend continues to decline and

is now scored below that of the desired residual risk score target of 22.

· With

a total residual impact score of 11 this risk is now assessed as low impact and

unlikely to occur.

A recommendation to demote

ARF009 Customer Service Delivery risk from the organisational risk dashboard is

supported by the total risk score and probability, and the controls in place.

|

tŪtohunga

/ Recommendation

That the Assurance, Risk and

Finance Committee approves the removal of ARF009 Customer Service Delivery

risk from the organisational risk dashboard.

|

1) TĀhuhu kŌrero / Background

In November 2018 Elected Members workshopped and agreed their

top organisational risk dashboard. The top organisational risk dashboard was

adopted on 30 May 2019. Of the 12 risks originally on their risk dashboard the

ARF009 Customer Service Delivery risk with a score of 39 was scored lowest

equal (four risks all scored 39). This is a medium impact risk.

Table 1: November 2018 ARF011 Organisational Cohesion Risk

description and scoring

Description of risk and

impact

Customer Service Delivery is the efficient and cost-effective

delivery of required Council services to residents, ratepayers, and the

community.

This includes timely processing and communication with the

public around services.

The context around this risk, at the time this risk was

raised in 2018:

· Inefficiencies with Council service processing and information flows

– including the RFS process – which caused delays in processing

requests and affected timely communication with customers.

· Frustrated customers often call elected members who needed to

escalate or facilitate information back to the customer.

· At that time customer satisfaction was linked to CEO KPI 6.2 –

and is impacted by this risk. There remains a headline CEO KPI on customer

service delivery.

· Customer service is a key component of the FNDC Customer Experience

programme and is reported on regularly.

2) matapaki me NgĀ KŌwhiringa /

Discussion and Options

The Customer Experience Programme exists to delivery only

what customers want, in a way that leaves nothing to chance so our

customers’ impressions of FNDC are exactly as intended.

In 2021 we changed how we gather our customer feedback to a

digital platform called AskNicely that helps us to monitor our performance,

understand our customers experiences and act on their feedback. The short

survey gives them the opportunity to tell us their story and what is important

to them. We have had a phenomenal response from our customers, having received

over 4,500 responses in the first 10 months. Our leaders and staff have also

embraced the tool and we are using it to:

· Recover

bad experiences

· Build

on our customer culture (praise and coaching)

· Gaining

a better understanding of our customers and moments that matter to them

· Finding

improvement ideas

· Using

‘voice of customer’ to inform business decisions

Table 2: Improving Customer

Satisfaction scores

Below are some examples of customer focused improvements:

· Online

services: Rates & water rates payments, rates enquiry (registered users),

dog re-registrations, events, permits & licenses (including special liquor

license, General Manager’s certificate, earthworks Permit, vehicle

crossing permit), Kotu Library, improved GIS Maps, BC applications, LIMs,

property file requests.

· Focus

on and achieving regulatory timelines: Building consents, LIMs

· Business

intelligence: BCA, resource consents

· Improved

workflows delivering efficiency: the new on-line events process

· Process

reviews: relaunch of the process diagram tool Promapp, customer journey

mapping, building internal and external knowledge bases (website, TK3)

· Automation

of process where appropriate: events, LIMs, property files, templated letters

· Born

digital opportunities have been captured: BCA, reviewing of forms and approval

processes

· Great

Workplaces: distributed working through the COVID-19 pandemic resulting in

improved service levels

· Elected

Members protocols have been developed and are in place.

· Training:

corresponding with customer, dealing with aggressive customers

· Tools

for internal and customer use: field tablets, mobile inspections, mobile RFS

application, MyFNDC app.

Assessment of risk, impact and likelihood

Table 3: Description of the Customer Service Delivery risk

from Corporate Services Risk Register

|

Group / SLT

|

Risk level

|

Inherent Risk

|

Risk description

|

Because of

|

There is a chance that…

|

leading to…

|

|

|

|

|

Corporate Services

|

Organisational

|

11

|

Operational/Financial

|

As we exist

to serve the people of the Far North District we need to have a customer

centric culture, customer friendly knowledge and processes with effective

tools.

|

If staff do

not have the attitude, tools, knowledge or processes we do not deliver customer

centric outcomes

|

Resulting

in customers who are unhappy with the services we provide. The poor customer

experience negatively impacts our reputation further impeding our ability to

deliver services.

|

|

The risk was scored by identifying both the risk impact for

five organisational areas (see Table 3) and the likelihood of the risk

occurring (see Table 4). For each organisational area, the risk impact is given

a score of “High to Intolerable”, “Medium” or

“Low to None” and the likelihood is rated as either “Will

happen”, “Probable” or “Unlikely” (see table 5)

making this a low-none impact risk with a score of 11. The likelihood of the

risk materialising is assessed as “unlikely (table 6)

Table 4: Description of risk impact for each organisation

area

|

Organisation

area

|

Description

|

|

Financial

|

Impact on Budget, Department or Team; and /or Impact

on annual Council budget

|

|

Customer

|

Financial impact to customer due to loss of a

provision of essential service, or essential piece of infrastructure

|

|

Reputational

|

The impact on FNDC’s reputation

|

|

Compliance/Legal

|

The legal impact on FNDC’s legal adherence /

regulatory compliance

|

|

Health and Safety

|

The impact to people(s) health & safety arising

from FNDC operations or a situation where FNDC are liable

|

Table 5: Description of likelihood

|

Likelihood

|

Description

|

|

Will happen

|

The risk is likely to occur.

There is frequent exposure to the risk.

There are external influences that make managing

this risk ineffective.

|

|

Probable

|

The risk will possibly occur e.g. once in every 2

year event

There is an exposure to the risk.

There are external influences that make managing

this risk difficult.

|

|

Unlikely

|

The risk is unlikely to occur e.g. once in every 10

year event

There is a low exposure to the risk.

|

Table 6: ARF009 Customer Service Delivery risk impact score

using FNDC matrix:

|

|

Financial

|

Customer

|

Reputational

|

Compliance/Legal

|

Health and Safety

|

|

High -

Intolerable

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medium

|

|

|

|

|

|

|

|

5

|

|

|

|

|

|

|

|

|

Low- none

|

1

|

|

|

1

|

|

|

|

|

|

|

3

|

|

1

|

|

|

|

|

Unlikely

|

Probable

|

Will Happen

|

Unlikely

|

Probable

|

Will Happen

|

Unlikely

|

Probable

|

Will Happen

|

Unlikely

|

Probable

|

Will Happen

|

Unlikely

|

Probable

|

Will Happen

|

ARF009 Customer Service Delivery risk is an organisational

risk in the Operational/Financial category (whole of business view of FNDC

performance including service/services delivery, risk, finance, environmental).

Organisational risks may impact on the Council achieving its vision, mission

and community outcomes. With a total residual impact score of 11 this risk is

now assessed as low impact and unlikely to occur, see table 6.

Table 7: ARF009 Customer Service Delivery risk map as

assessed December 2021

|

|

Total Risk

|

|

High - Intolerable

|

|

|

|

|

Medium

|

|

|

|

|

Low- none

|

X

|

|

|

|

|

Unlikely

|

Probable

|

Will Happen

|

This reduction in risk score has been achieved through

proactive changes and controls. Current ARF009 Customer Service Delivery risk

controls in place are:

1. Corporate Services Group Risk Register:

continue risk management via the Corporate Services Risk Register.

2. Digital customer feedback tool for all

customer facing services and applications. This provides real-time voice of the

customer insights and benchmarking.

3. Reporting

framework:

a. Six

monthly reporting to Elected Members

b. Quarterly

CEO KPI reports

c. Weekly

People Leader updates

d. Quarterly

one on ones with teams

4. Managers

and team members have access to their own customer feedback

5. Customer

excellence programme

6. One

of three priorities in our three-year strategy – enriching our culture

for our customers which include two major initiatives captured within the

customer experience programme.

A recommendation to demote

ARF009 Customer Service Delivery risk from the organisational risk dashboard is

supported by the total risk score and probability, and the controls in place.

Take

Tūtohunga / Reason for the recommendation

The recommendation to demote ARF009 Customer Service

Delivery risk from the organisational risk dashboard is supported by the total

risk score of 11; the unlikely probability of the risk occurring; the

monitoring and managing of the risk on the Corporate Group Risk Register; and

the controls in place.

3) PĀnga PŪtea me ngĀ

wĀhanga tahua / Financial Implications and Budgetary Provision

There is no financial implication or request for budgetary

provision.

Āpitihanga

/ Attachments

Nil

Hōtaka Take Ōkawa / Compliance Schedule:

Full consideration has been given to the provisions of the

Local Government Act 2002 S77 in relation to decision making, in particular:

1. A

Local authority must, in the course of the decision-making process,

a) Seek

to identify all reasonably practicable options for the achievement of the

objective of a decision; and

b) Assess

the options in terms of their advantages and disadvantages; and

c) If

any of the options identified under paragraph (a) involves a significant

decision in relation to land or a body of water, take into account the

relationship of Māori and their culture and traditions with their

ancestral land, water sites, waahi tapu, valued flora and fauna and other

taonga.

2. This

section is subject to Section 79 - Compliance with procedures in relation to

decisions.

|

He

Take Ōkawa / Compliance Requirement

|

Aromatawai

Kaimahi / Staff Assessment

|

|

State the level of significance

(high or low) of the issue or proposal as determined by the Council’s

Significance and Engagement Policy

|

The recommendation in this report

does not meet the thresholds as per the Council’s significance and

engagement policy.

|

|

State the relevant Council

policies (external or internal), legislation, and/or community outcomes (as

stated in the LTP) that relate to this decision.

|

Risk Management Policy.

|

|

State whether this issue or

proposal has a District wide relevance and, if not, the ways in which the

appropriate Community Board’s views have been sought.

|

None.

|

|

State the possible implications for Māori

and how Māori have been provided with an opportunity to contribute to

decision making if this decision is significant and relates to land and/or

any body of water.

State the possible implications and how this

report aligns with Te Tiriti o Waitangi / The Treaty of Waitangi.

|

The recommendation in this report

does not have any direct implications for Māori.

|

|

Identify persons likely to be

affected by or have an interest in the matter, and how you have given

consideration to their views or preferences (for example – youth, the aged

and those with disabilities).

|

There are no affected or

interested parties to this recommendation.

|

|

State the financial implications

and where budgetary provisions have been made to support this decision.

|

There is no financial implication

or request for budgetary provision.

|

|

Chief Financial Officer review.

|

The Chief Financial Officer has

reviewed this report.

|

6 Information

Reports

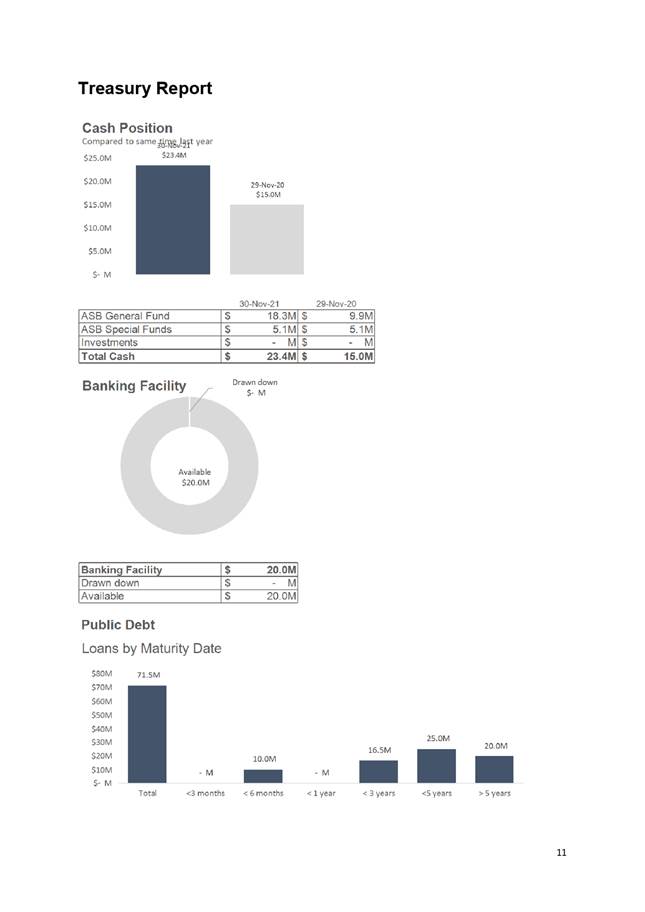

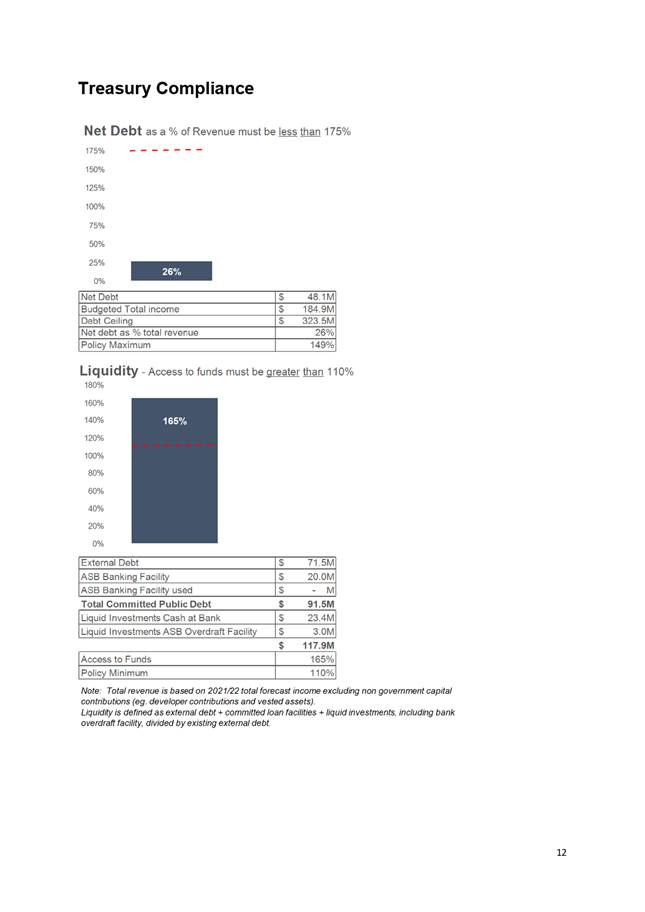

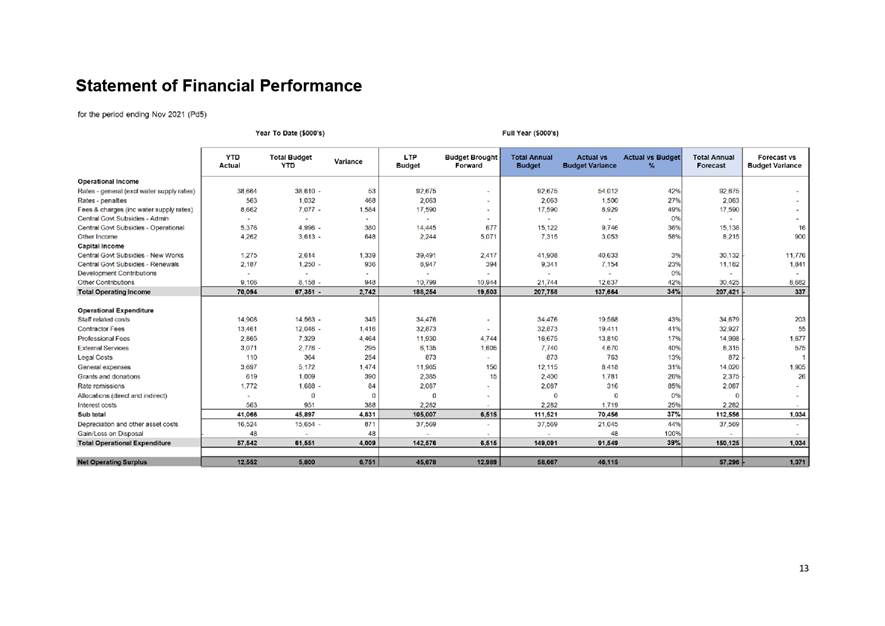

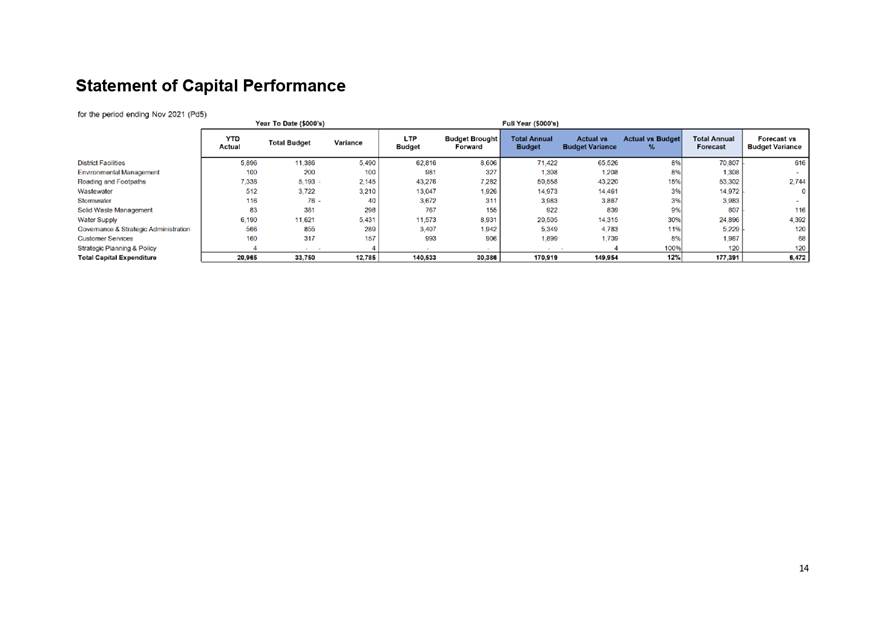

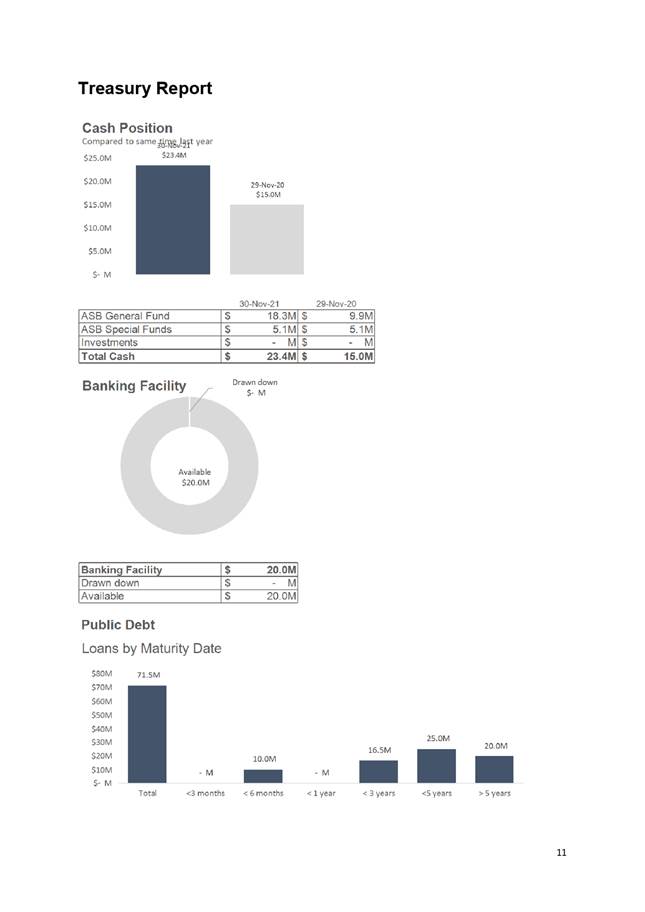

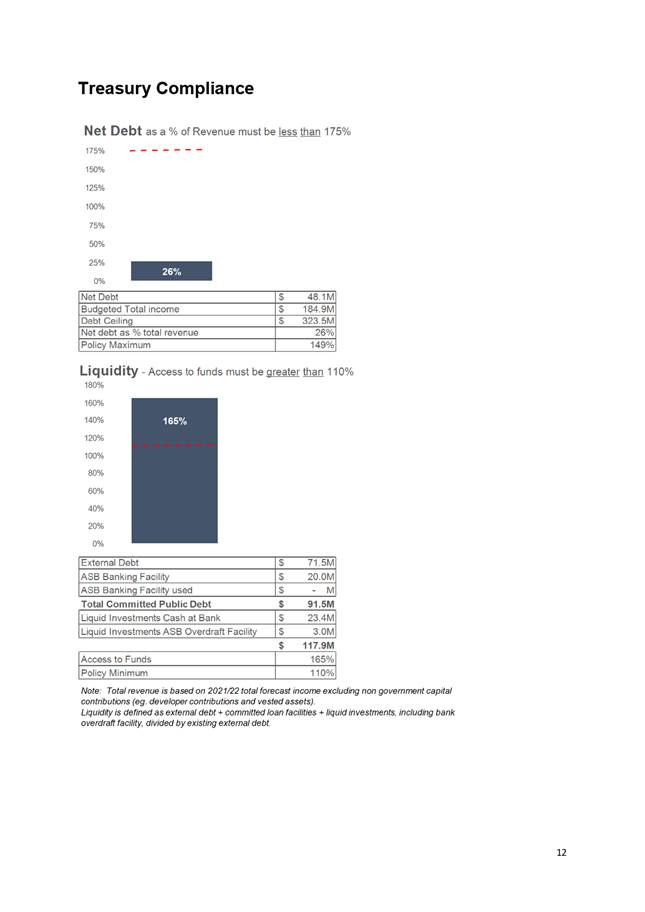

6.1 Council

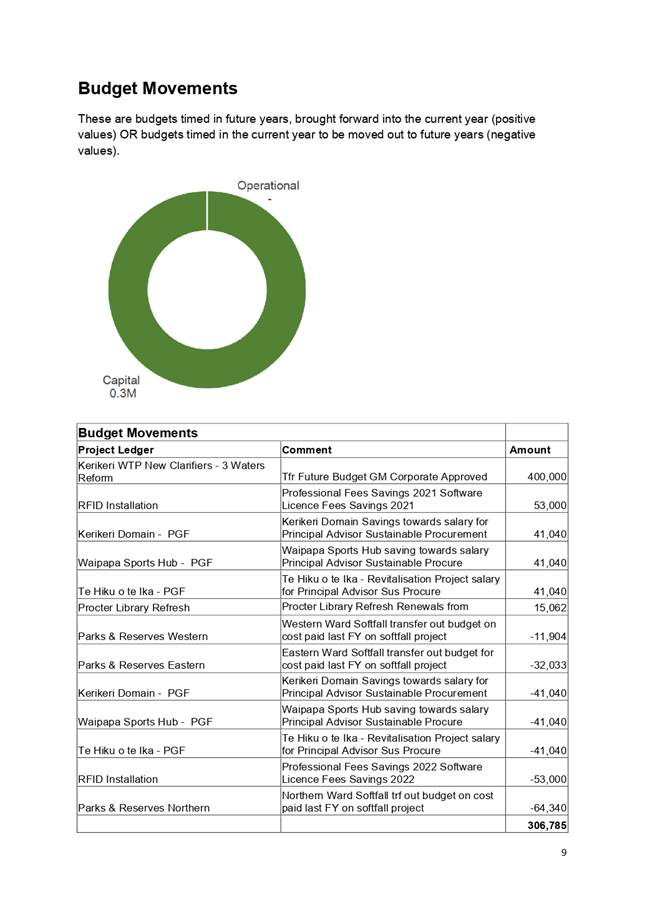

Financial Report for the Period Ending 30 November 2021

File

Number: A3542579

Author: Angie

Thomas, Manager - Accounting Services

Authoriser: Janice

Smith, Chief Financial Officer

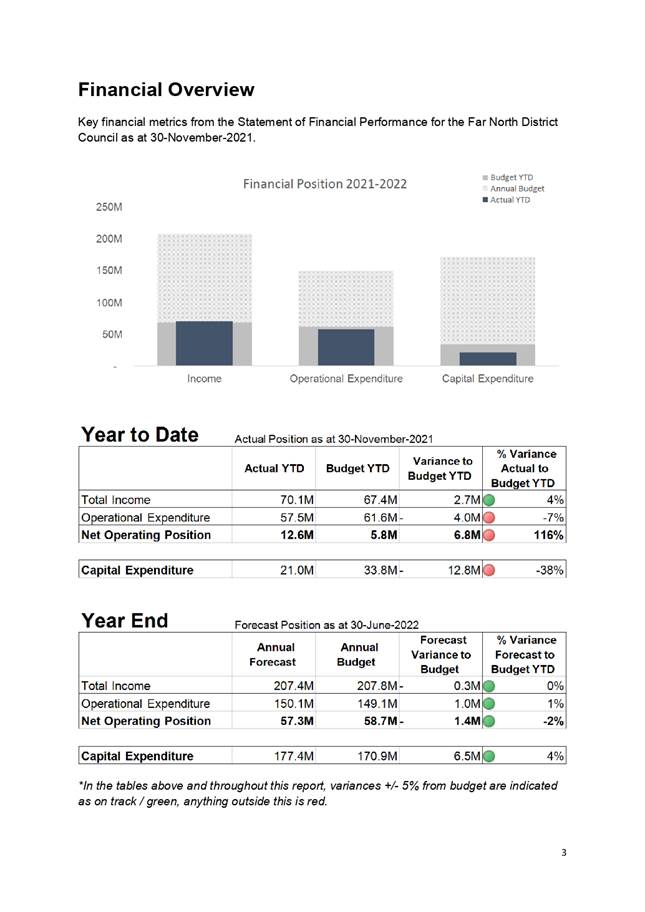

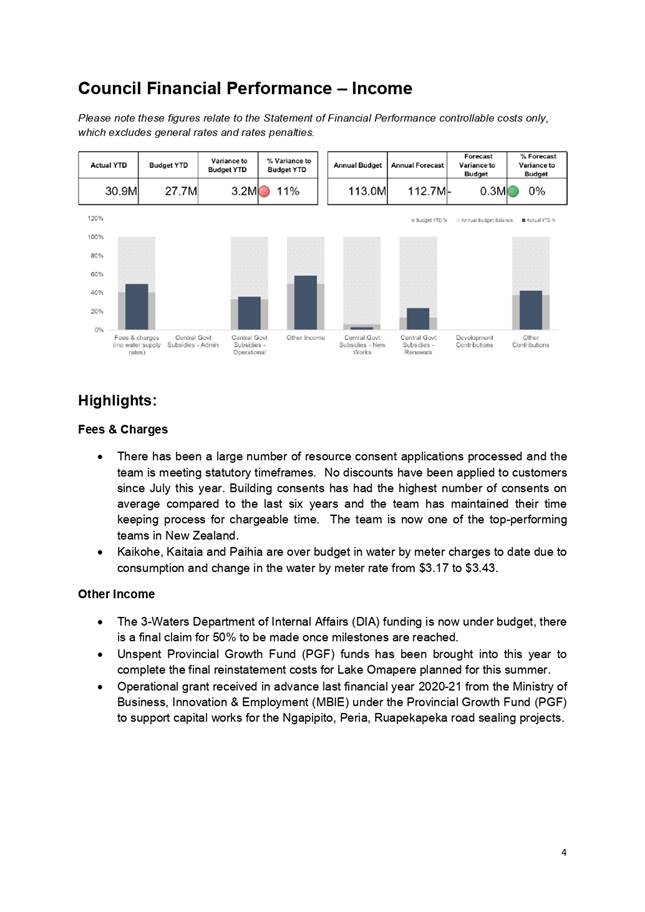

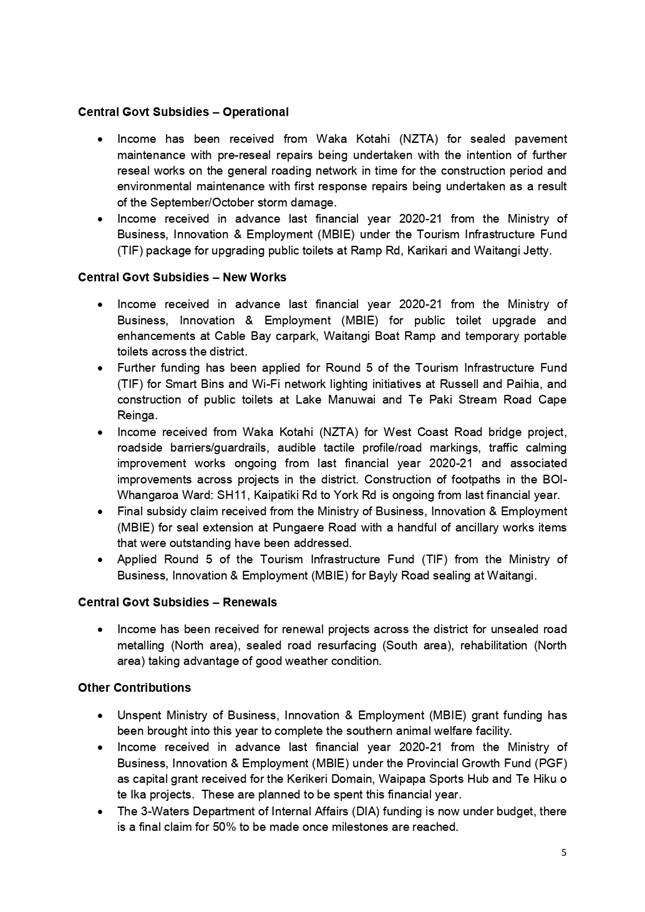

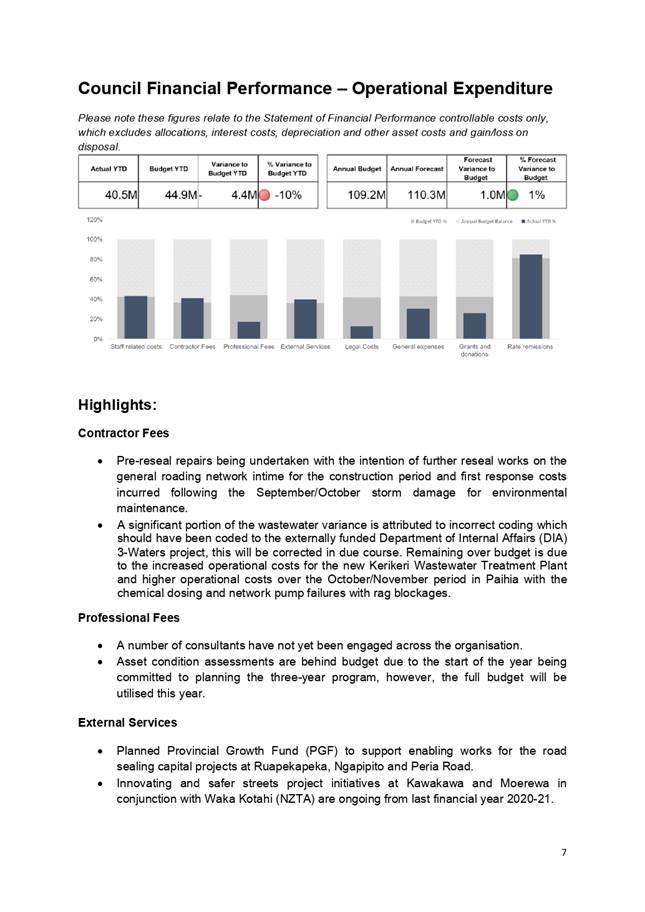

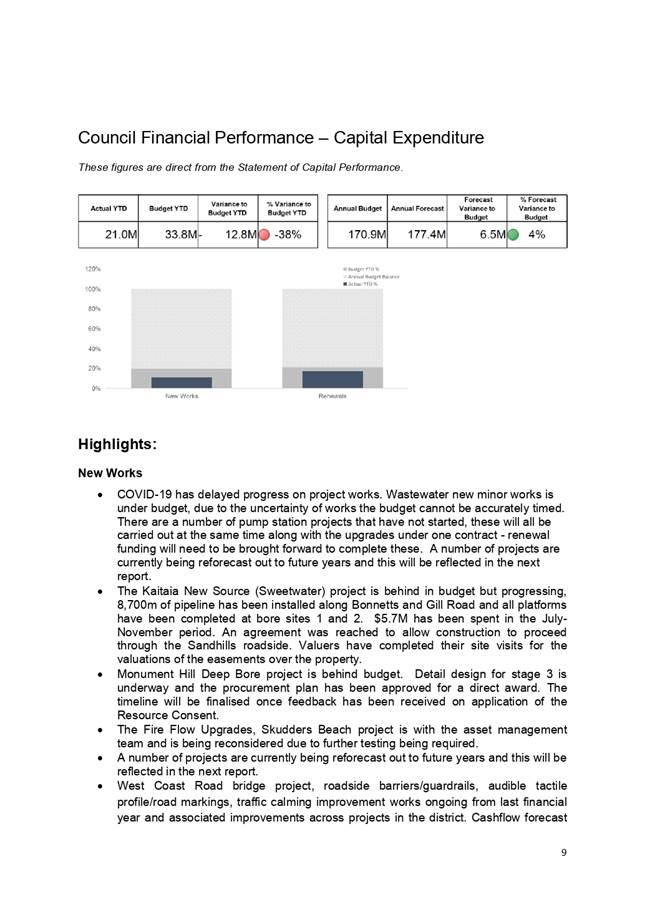

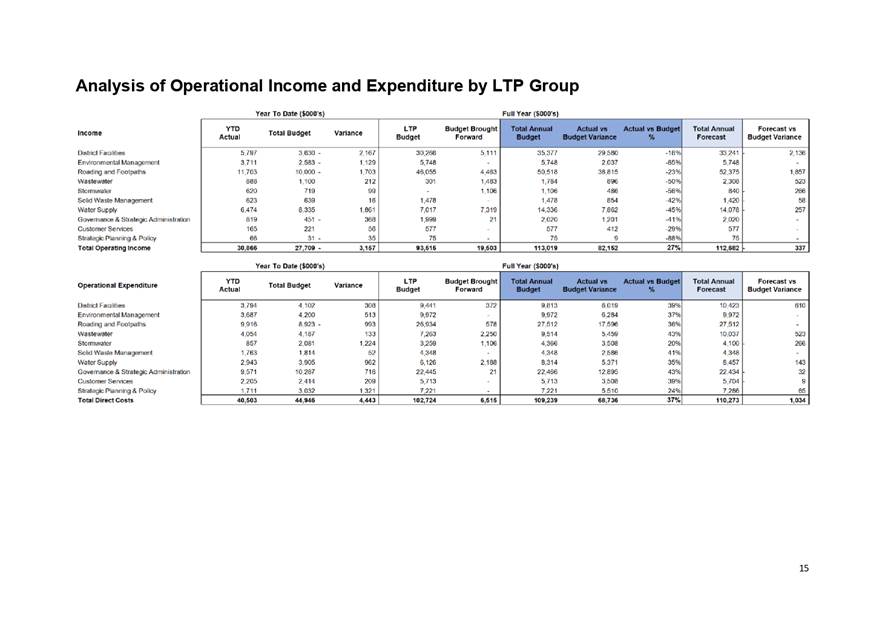

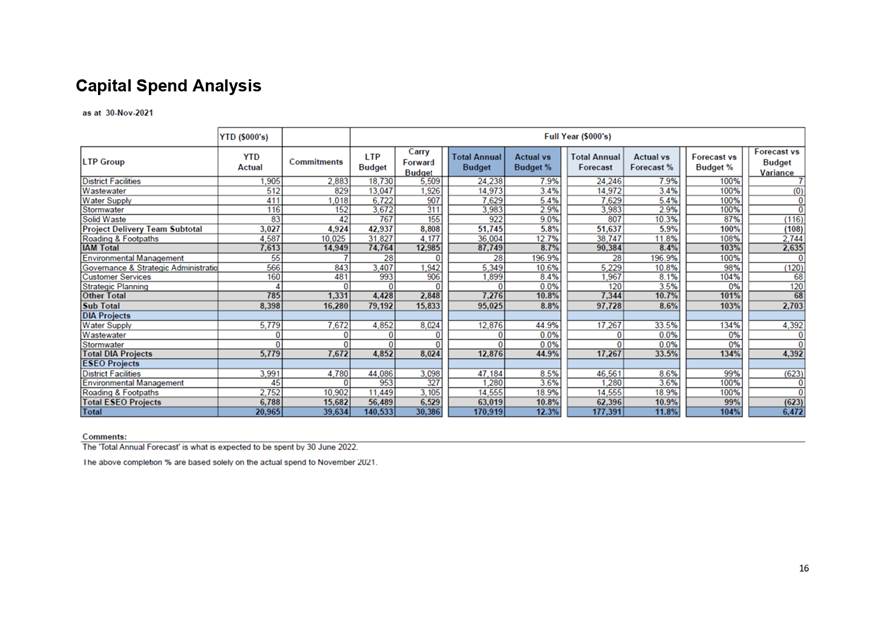

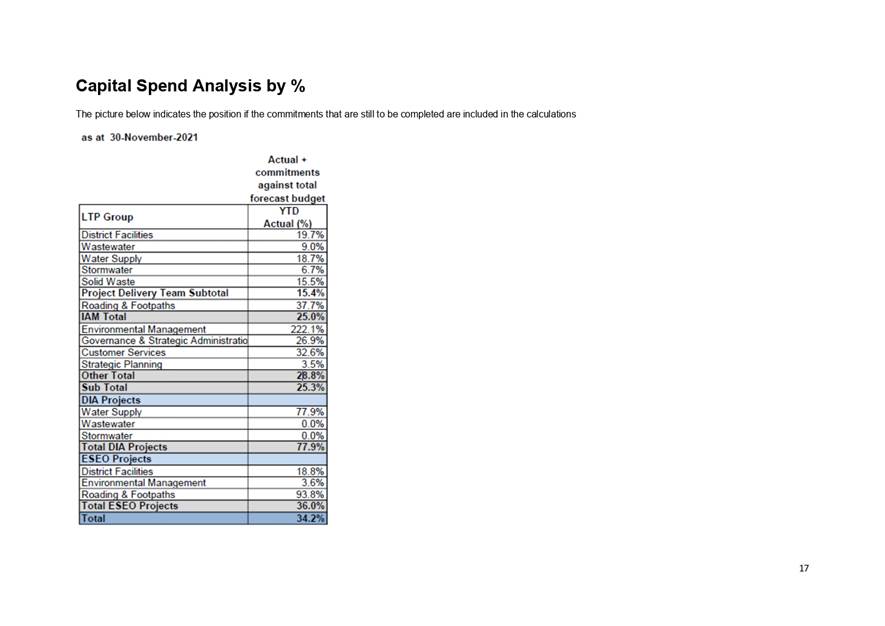

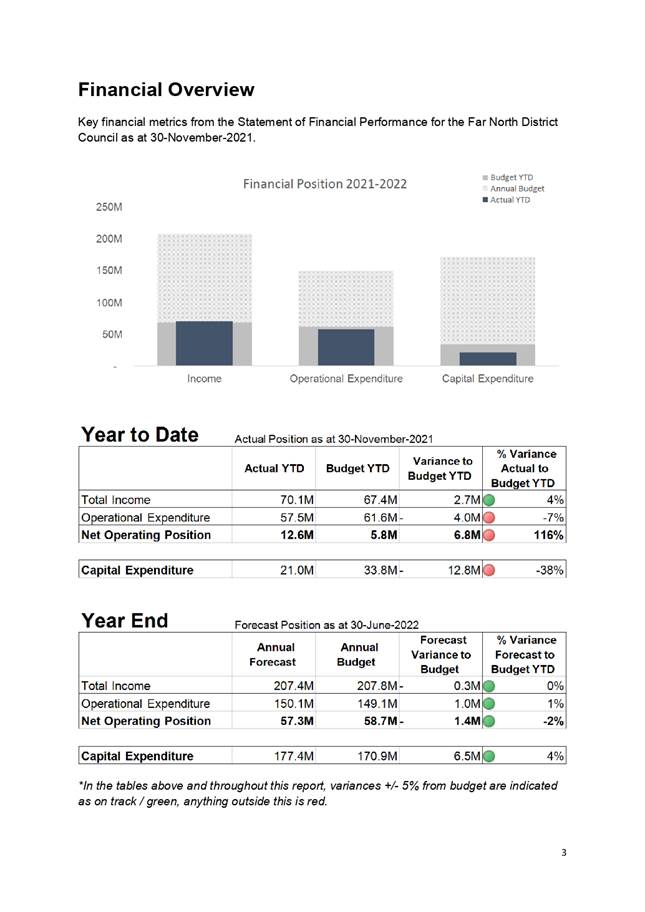

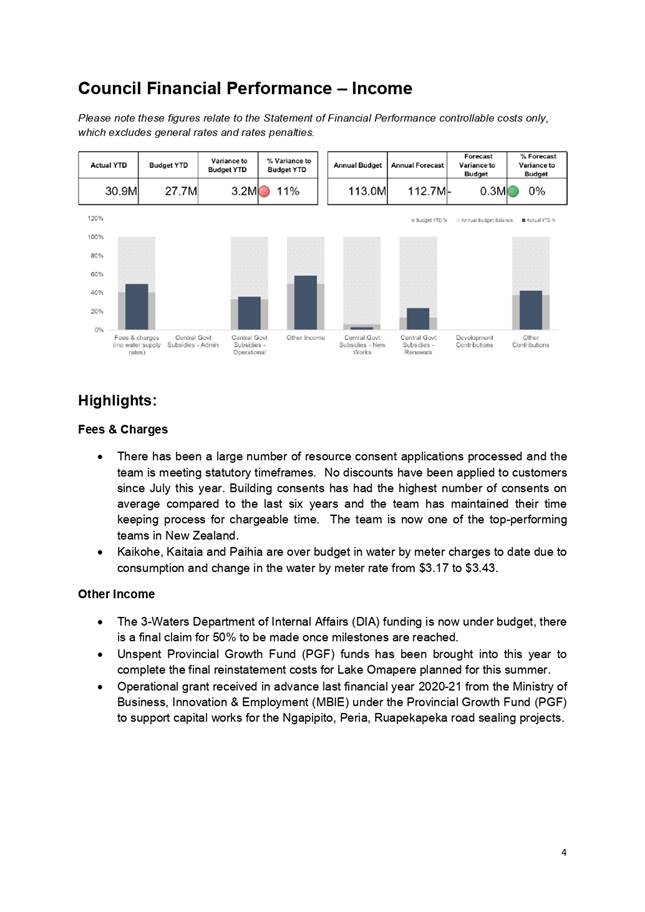

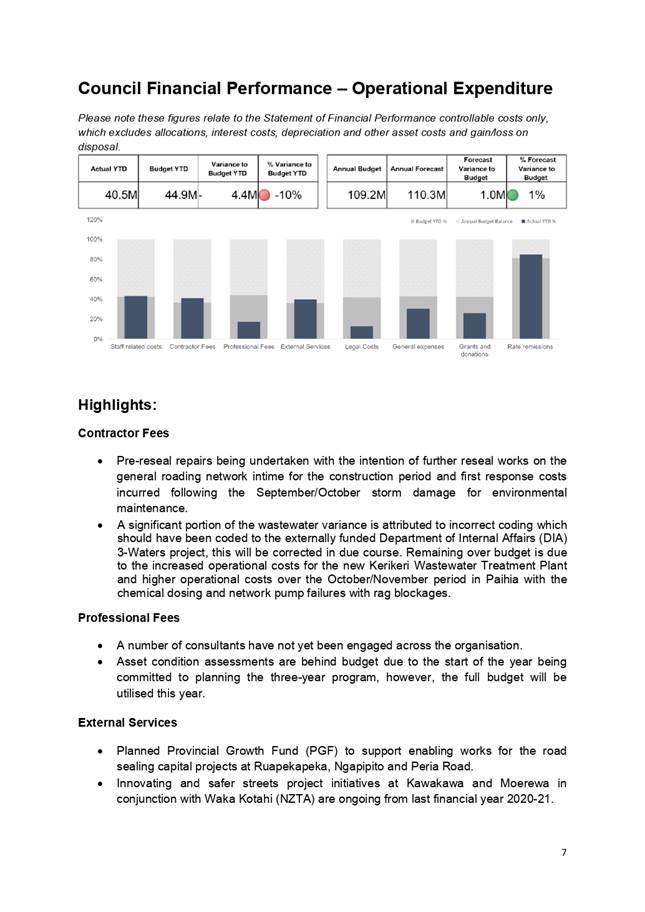

TE TAKE PŪRONGO / Purpose of the Report

To provide an overview

and information on the current financial position and performance of the Far

North District Council as at 30 November 2021.

TE WHAKARĀPOPOTO MATUA / Executive

SummarY

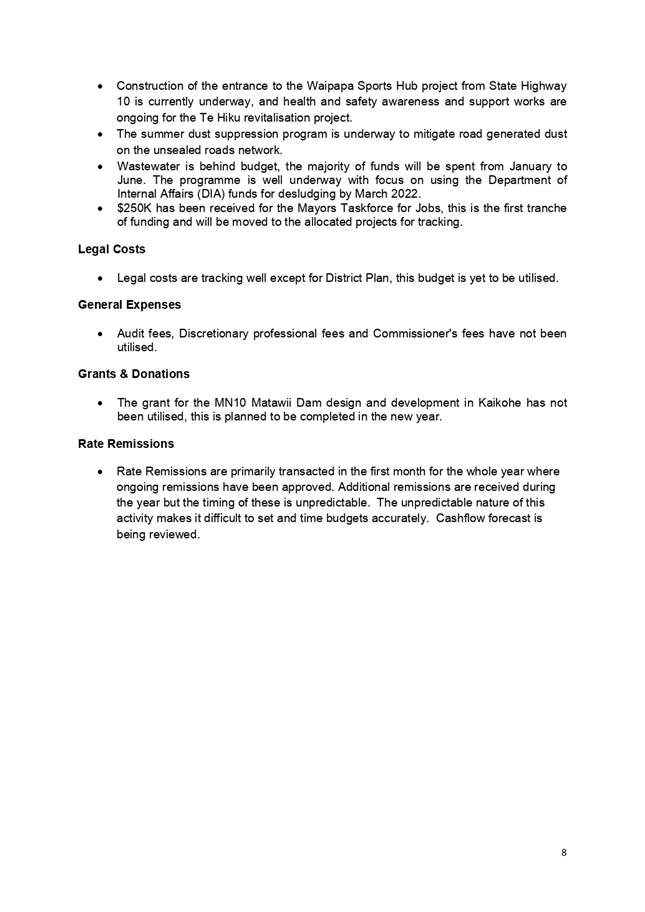

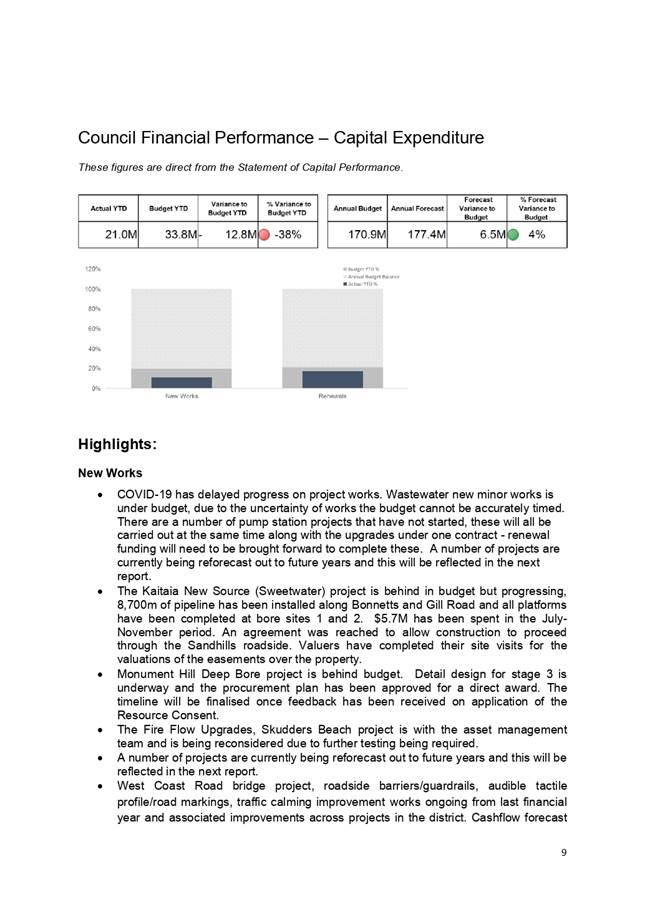

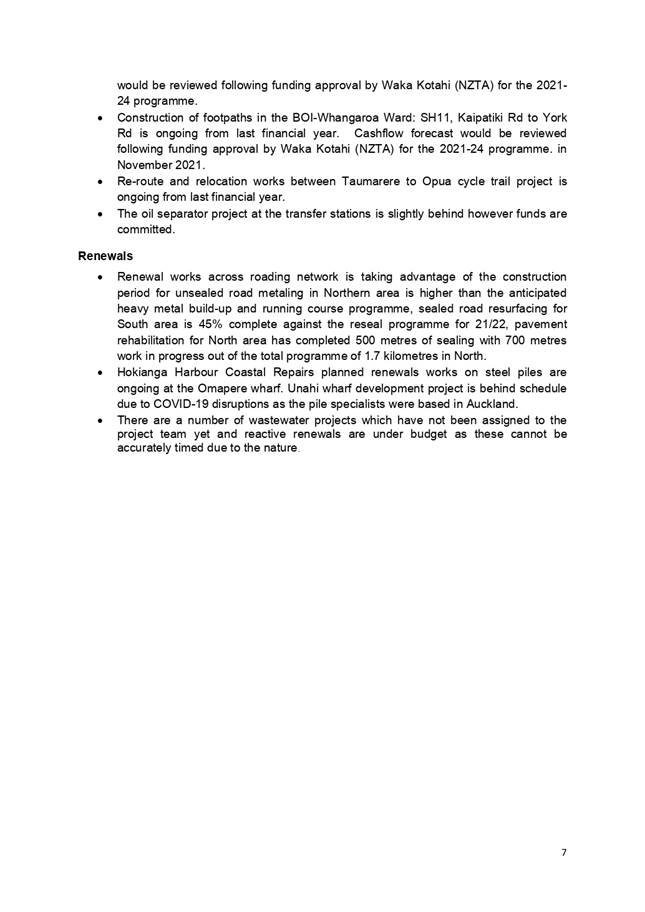

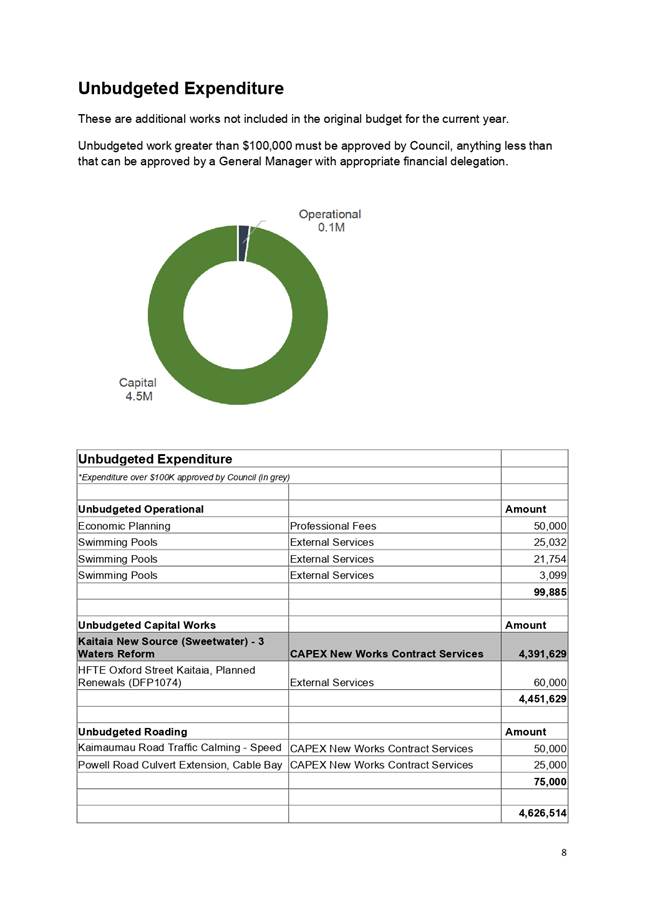

This report provides a summary overview, Statement of Financial Performance,

Capital Performance and Borrowing and Investment reports.

|

NGĀ

TŪTOHUNGA / Recommendation

That the Assurance, Risk and Finance Committee receive

the report Council Financial Report for the Period Ending 30 November 2021.

|

TE tĀHUHU KŌRERO / Background

This report provides

financial information as at 30 November 2021.

TE MATAPAKI ME NGĀ KŌWHIRINGA /

Discussion and Next Steps

The report is for

information only.

NGĀ PĀNGA PŪTEA ME NGĀ WĀHANGA

TAHUA / Financial Implications and Budgetary Provision

There are no financial

implications or budgetary provisions required as a result of this report.

ngĀ

Āpitihanga / Attachments

1. Council

Financial Report Nov 2021 (Pd5)_FINAL - A3542603 ⇩

|

Assurance, Risk

and Finance Committee Meeting Agenda

|

2 February 2022

|

6.2 February

2022 Risk Management Report

File

Number: A3547055

Author: Tanya

Reid, Business Improvement Specialist

Authoriser: William

J Taylor MBE, General Manager - Corporate Services

TAKE PŪRONGO / Purpose of the Report

To provide an information report on organisational risk

management, emergent risk, scheduled risk progress reports for the

organisation’s top risks and business continuity planning.

No

decision is required.

WHAKARĀPOPOTO MATUA / Executive SummarY

·

Risk progress updates are provided for six of the top

organisational risks. This includes the first risk progress report for ARF017

Climate Change Direct Risk to Council Physical and Natural Assets. Four of the

scheduled risk progress reports report an increasing risk trend.

·

Additionally, there is a separate decision report to the

Assurance, Risk and Finance Committee recommending that the ARF009 Customer

Service Delivery risk is demoted form the organisational top risk dashboard.

·

Risk management at a group and departmental level continues as

does identifying essential services to be supported by business continuity

plans.

·

One new emergent risk has been identified.

|

TŪTOHUNGA

/ Recommendation

That the Assurance, Risk and Finance Committee receive

the report February 2022 Risk Management Report.

|

tĀHUHU KŌRERO / Background

The top organisational risks are risks that may impact on

Council achieving its vision, mission and community outcomes and are regularly

reported to the Assurance, Risk and Finance Committee to ensure they are being

appropriately managed. A number of these risks are subject to external

influences which may affect effective council operations.

Table 1 provides a risk snapshot of the Assurance, Risk

and Finance Committee Organisational Risk Dashboard with inherent and residual

risk scores as accepted by this Committee, risk owners, risk progress report

frequency and the risk trend as assessed by the risk subject matter experts.

Further these risks have been categorised into three themes – Climate

Change, Enterprise Governance and Infrastructure and Asset Management Risks.

Table 2 details the 2022 risk progress report schedule.

The schedule has synchronised risk progress reports to enable the Assurance,

Risk and Finance Committee to view reports on interconnected risks. The

reporting schedule for ARF009 Customer Service Delivery will be confirmed

depending on the outcome of the decision report tabled on this meeting’s

agenda.

|

Table 1: Top organisational risk

dashboard

|

Key to trend of risk rating:

|

|

Decline

|

|

|

No change/stable

|

|

|

Increase

|

|

Risk ID:

|

Risk title

|

Inherent risk score

|

Trend of risk rating

|

Residual risk score

|

Accountable

Risk Governance

|

Responsible

Risk Governance

|

Report

schedule

|

Report tabled:

|

|

Climate Change

|

|

ARF015

|

Climate Change Organisation Transition Risk

|

31

|

|

|

CEO

|

GMSPP

|

3 Monthly

|

|

|

ARF016

|

Climate Change Community Transition Risk

|

39

|

|

|

CEO

|

GMSPP

|

3 Monthly

|

|

|

ARF017

|

Climate Change Direct Risk to Council Physical and Natural Assets

|

37

|

|

|

CEO

|

GMSPP

|

3 Monthly

|

Feb 22

|

|

ARF018

|

Failure to understand and capture climate-related opportunities

|

29

|

|

|

CEO

|

GMSPP

|

6 Monthly

|

|

|

Enterprise Governance

|

|

ARF003

|

Health & Safety Vulnerabilities

|

46

|

|

34

|

CEO

|

CPO

|

3 Monthly

|

Feb 22

|

|

ARF005

|

Affordability Risk

|

45

|

|

26

|

CEO

|

GMSPP

|

6 Monthly

|

Dec 21

|

|

ARF009

|

Customer Service Delivery

|

39

|

|

22

|

CEO

|

CT&TO

|

3 Monthly

|

Dec 21

|

|

ARF010

|

Data Governance Risks

|

39

|

|

14

|

CEO

|

CEO

|

6 Monthly

|

Dec 21

|

|

Infrastructure and Asset Management Risks

|

|

ARF004

|

Asset Management Risks

|

45

|

|

18

|

CEO

|

GMIAM

|

6 Monthly

|

Feb 22

|

|

ARF006

|

Project Priorities Deliveries Delays

|

45

|

|

14

|

CEO

|

GMIAM

|

3 Monthly

|

Feb 22

|

|

ARF007

|

Compliance NRC Abatements

|

45

|

|

18

|

CEO

|

GMIAM

|

6 Monthly

|

Dec 21

|

|

ARF012

|

Contract Management Risks

|

39

|

|

14

|

CEO

|

GMIAM

|

3 Monthly

|

Feb 22

|

|

ARF013

|

Drinking Water Resilience

|

35

|

|

|

CEO

|

GMIAM

|

3 Monthly

|

Dec 21

|

|

ARF014

|

Programme Darwin

|

35

|

|

13

|

CEO

|

GMIAM

|

3 Monthly

|

Feb 22

|

|

|

|

|

|

|

|

|

|

|

|

Table 2: 2022 risk

progress report schedule

|

|

2022 ARF meeting date:

|

02/02

|

16/03

|

27/04

|

22/06

|

22/07

|

31/08

|

|

ARF015

|

Climate Change Organisation Transition Risk

|

|

ü

|

|

ü

|

|

ü

|

|

ARF016

|

Climate Change Community Transition Risk

|

|

ü

|

|

ü

|

|

ü

|

|

ARF017

|

Climate Change Direct Risk to Council Physical and Natural Assets

|

ü

|

|

ü

|

|

ü

|

|

|

ARF018

|

Failure to understand and capture climate-related opportunities

|

|

|

|

ü

|

|

|

|

ARF003

|

Health & Safety Vulnerabilities

|

ü

|

|

ü

|

|

ü

|

|

|

ARF005

|

Affordability Risk

|

|

|

|

ü

|

|

|

|

ARF009

|

Customer Service Delivery

|

tbc

|

|

|

|

|

|

|

ARF010

|

Data Governance Risks

|

|

|

|

ü

|

|

|

|

ARF004

|

Asset Management Risks

|

ü

|

|

|

|

ü

|

|

|

ARF006

|

Project Priorities Deliveries Delays

|

ü

|

|

ü

|

|

ü

|

|

|

ARF007

|

Compliance NRC Abatements

|

|

|

|

ü

|

|

|

|

ARF012

|

Contract Management Risks

|

ü

|

|

ü

|

|

ü

|

|

|

ARF013

|

Drinking Water Resilience

|

|

ü

|

|

ü

|

|

ü

|

|

ARF014

|

Programme Darwin

|

ü

|

|

ü

|

|

ü

|

|

|

|

Externally funded shovel ready, economic stimulus employment

opportunity projects

|

|

ü

|

|

|

|

|

MATAPAKI ME NGĀ KŌWHIRINGA /

Discussion and Next Steps

Organisational risk management

ARF009 Customer Service Delivery risk is subject to a

separate decision report which recommends the demotion of this risk from the

organisational risk dashboard due to the reduction of the inherent risk score

and probability of this risk materialising, and the controls in place. This

reduction in risk score has been achieved through proactive changes and

controls. Management of this risk will continue via the Corporate Services Risk

Register.

Emergent risk:

One new emergent risk has been identified with the initiation

of the Ngapuhi Mana Whakahono ā Rohe. Specifically, the emergent risk is

focussed on our ability to meet the statutory timeframe to review all Council

policies and process within six months of completing the agreement. This risk

was identified in work completed in 2018 and is captured in the Strategic

Planning and Policy Group risk registers as SPP01 / 02 and 03. A high level

process was developed in 2018 to support this statutory process. An internal

hui /workshop with a cross-functional team of 17 staff, supported by the

Principal Advisor Organisational Performance & Transformation and the

Project and Change Specialist, has been planned for January 2022. A full report

on the arrangements (such as tasks, risks, governance and milestone dates) will

be made to the Strategy and Policy Committee.

Context and background:

A Mana Whakahono is a binding statutory arrangement that

provides for a more structured relationship under the Resource Management Act

1991 to provide an opportunity for tangata whenua and local authorities to come

together under the RMA. The intent of Mana Whakahono is to facilitate improved

working relationships between tangata whenua (through their iwi authority or

hapū) and local authorities and to enhance Māori participation in resource

management and decision-making processes under the RMA.

The emergent risk identified in October 2020, the

financial and legal risks due to the effects of climate change, has been

removed from table 3 as this risk has been accepted as a top organisational

risk, ARF015 Climate Change Organisation Transition Risk.

Table 3: Table of identified emergent risk

|

Emergent risks

|

Presented to ARF:

|

Progress

|

|

1. The risk of externally funded shovel ready, economic

stimulus employment opportunity projects due to the impact of the COVID-19

pandemic.

|

October 2020

|

The Assurance, Risk and Finance Committee received a

report at September 2021 meeting. Next report is scheduled in six months,

March 2022 dependent on the, yet to be released, Assurance, Risk and Finance

Committee 2022 schedule.

|

|

2. District Services have proposed to escalate one of

their top group risks for consideration of inclusion on the top organisational

dashboard.

|

October 2020

|

It is proposed that this be included in the

Assurance, Risk and Finance Committee risk workshop agenda.

|

|

3. The risk of not fit for purpose business continuity

arrangements.

|

October 2020

|

This was subject to a report at the December 20

Assurance, Risk and Finance Committee meeting.

A progress up-date is provided under the group risk

section.

|

|

4. Government’s Three Waters Reform programme.

|

December 2020

|

The Government has announced an integrated package

of reform proposals (four new, large water service delivery entities)

together with a financial support package.

|

|

1. Potential impact of the Worksafe decision, in

December 2020, to charge 13 parties over the Whakaari/White Island tragedy;

and the government review of WorkSafe New Zealand’s performance

of its regulatory functions in relation to activities on Whakaari White

Island.

|

February 2021

|

Impact to be considered when further information is

to hand.

Independent review of WorkSafe in relation to

Whakaari/White Island released 22/10/2021. The review found that WorkSafe

fell short of good practice in its regulation of activities on Whakaari White

Island over the 2014-19 period. The review says that improvements are needed

in WorkSafe’s management of the adventure activities system.

|

Organisational risk progress reports:

Following discussions at the December 2021 Assurance, Risk

and Finance Committee meeting work is progressing to establish an Affordability

Risk Reference Group to theme and prioritise ARF005 Affordability risk. To date

terms of reference, including proposed membership, have been drafted. An

Affordability risk hui has been scheduled for 11 February 2022.

Six scheduled risk progress reports, including high level

treatment plan progress, are provided with highlights and analysis of risk

progress below. Four (50%) of the scheduled risk progress reports report an

increasing risk trend. More detail is available in the attached risk progress

reports. Of the 10 top organisational risks in Enterprise Governance and

Infrastructure and Asset Management Risks 60% identify the risk trend as

increasing, 20% are stable and 20% are decreasing.

Risk progress reports – highlights and analysis:

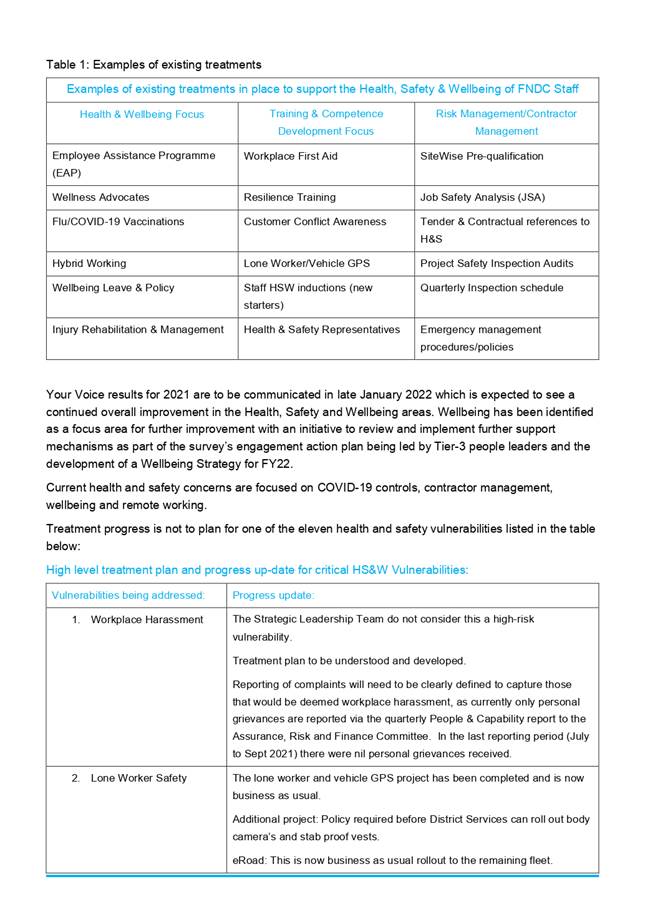

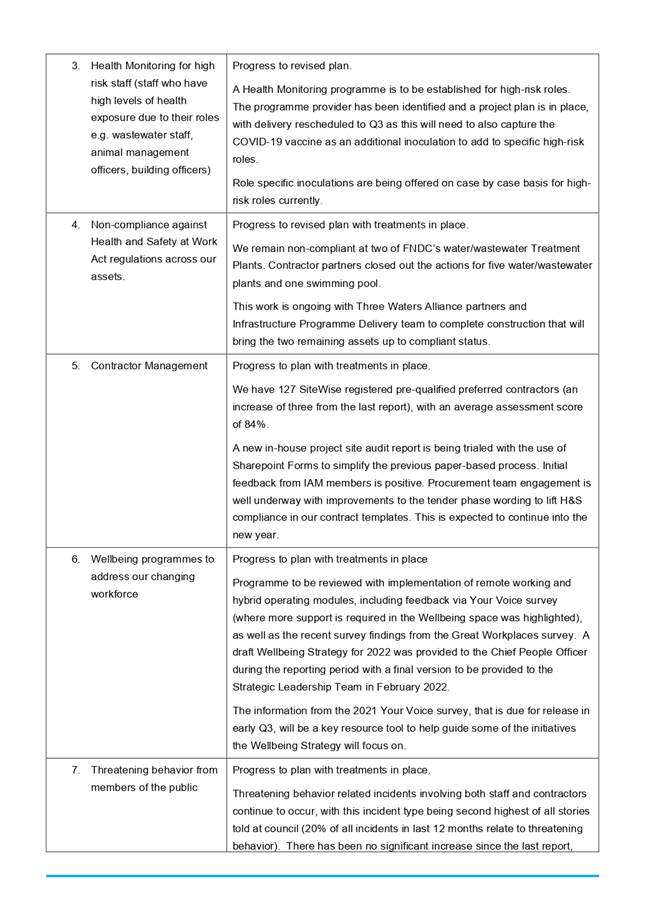

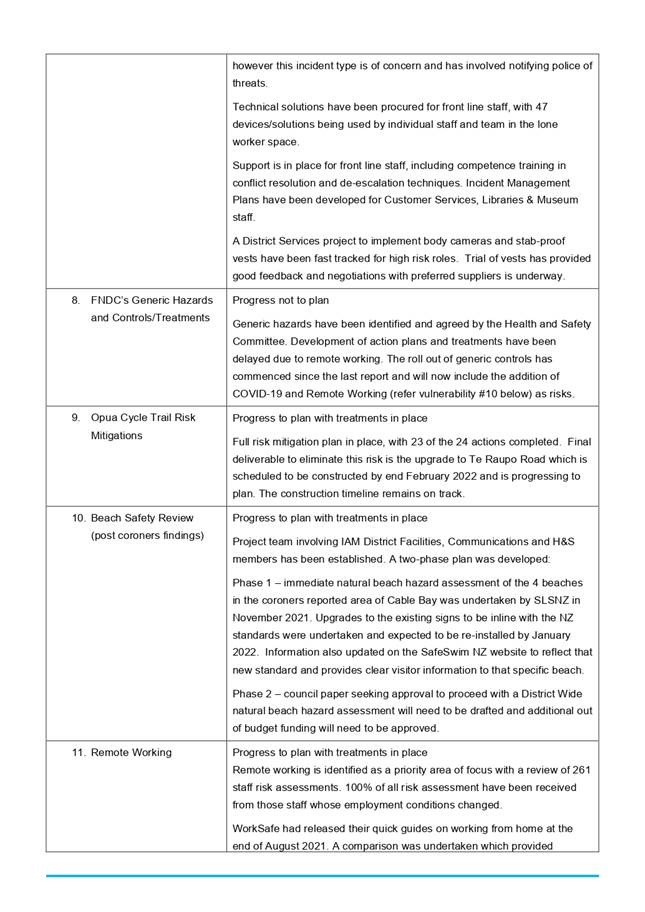

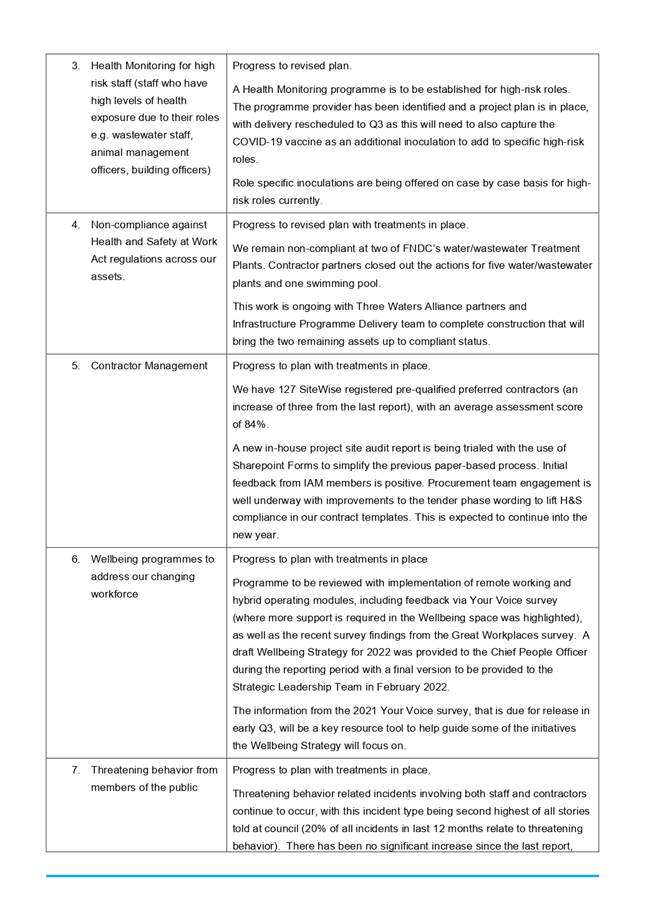

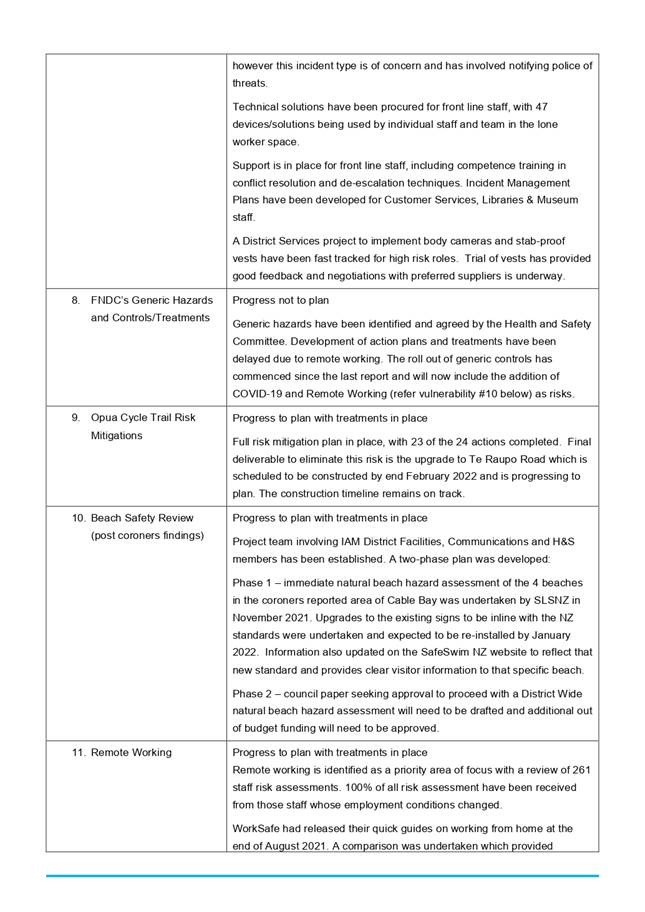

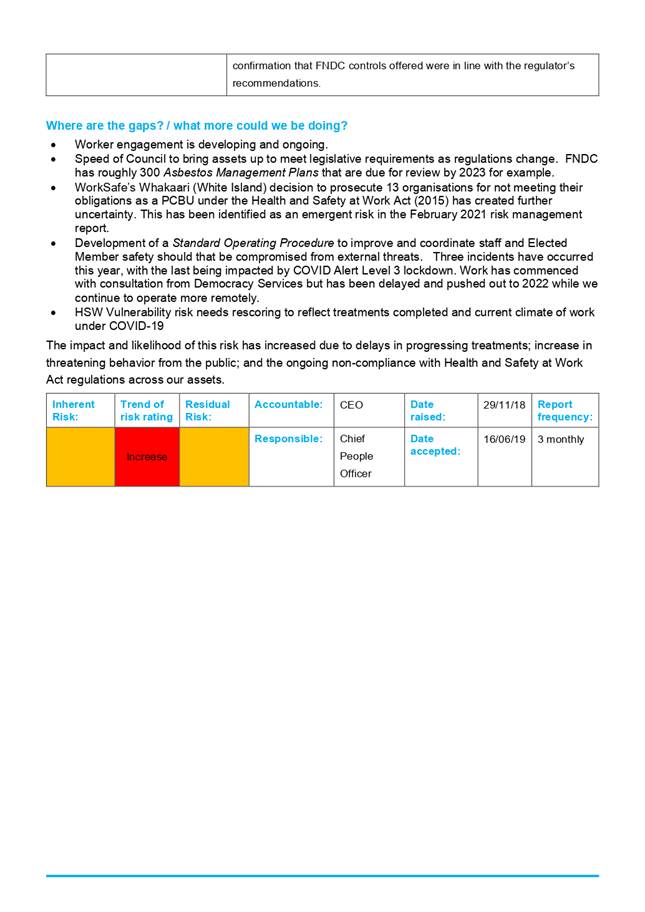

1. ARF003

Health & Safety Vulnerabilities Risk Progress Report. The inherent risk

rating trend has been assessed as increasing due to

treatment plan progress; increase in threatening behavior from the public; and

the ongoing non-compliance with Health and Safety at Work Act regulations

across our assets.

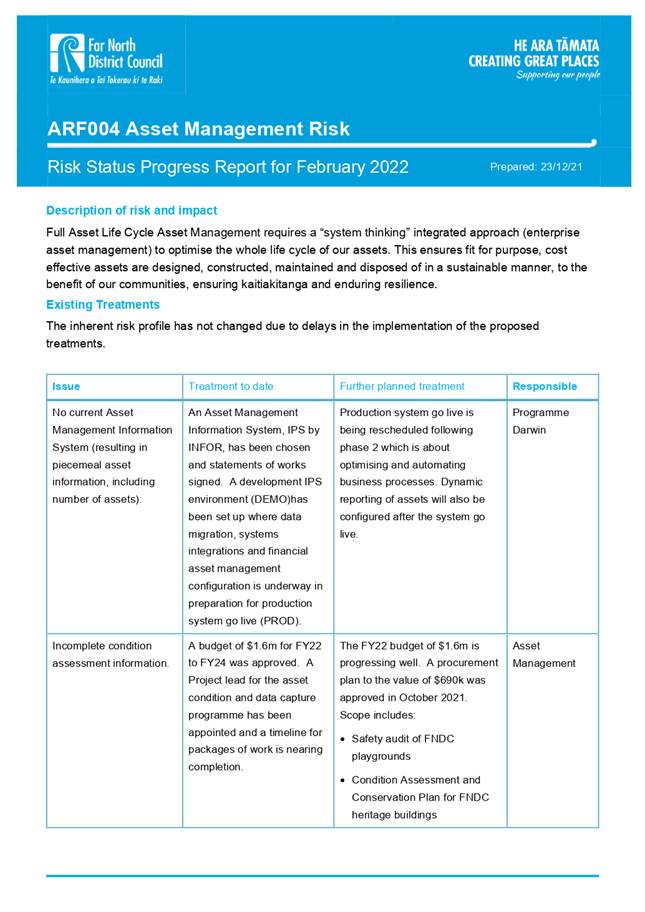

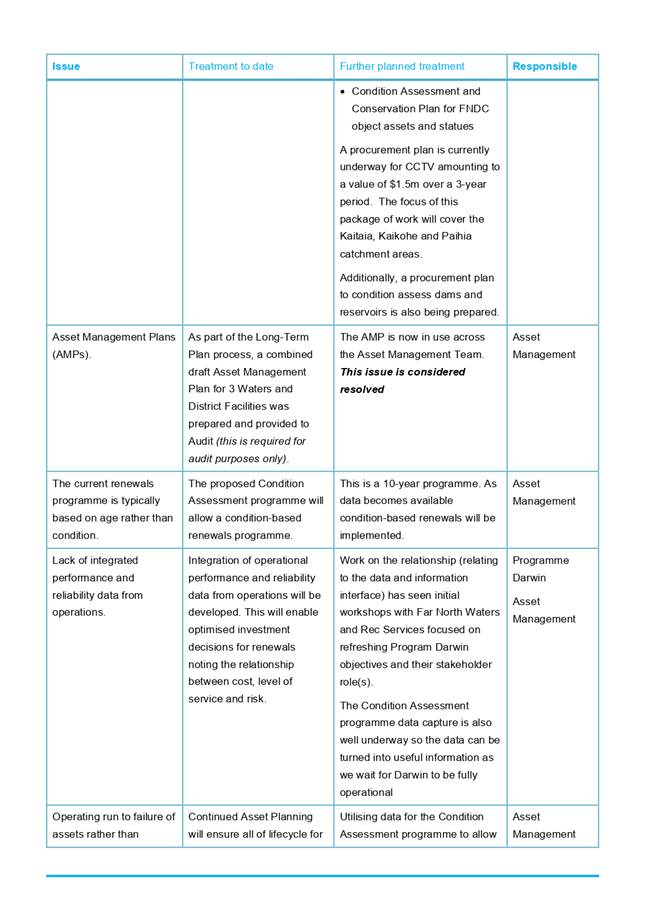

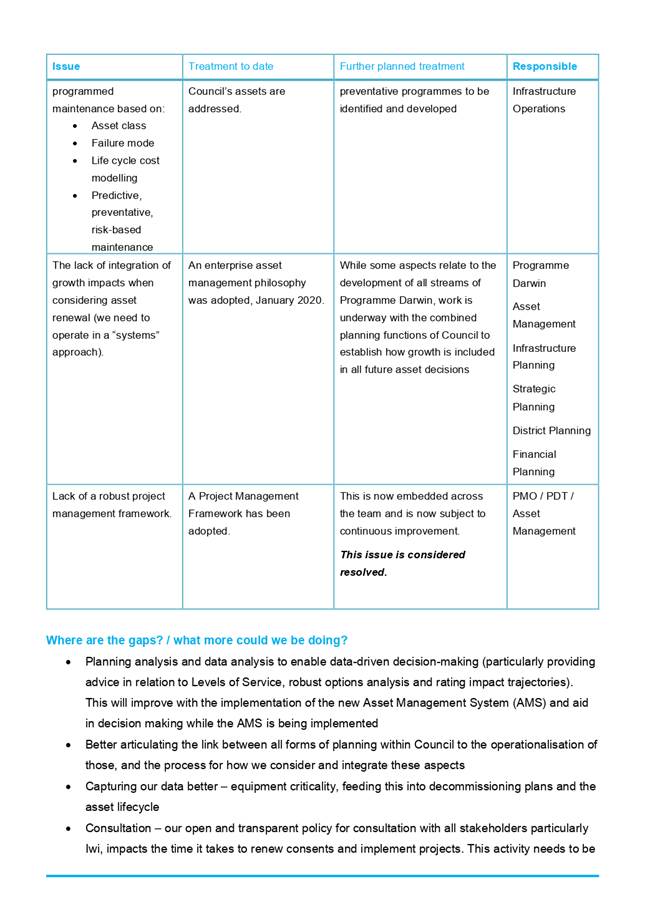

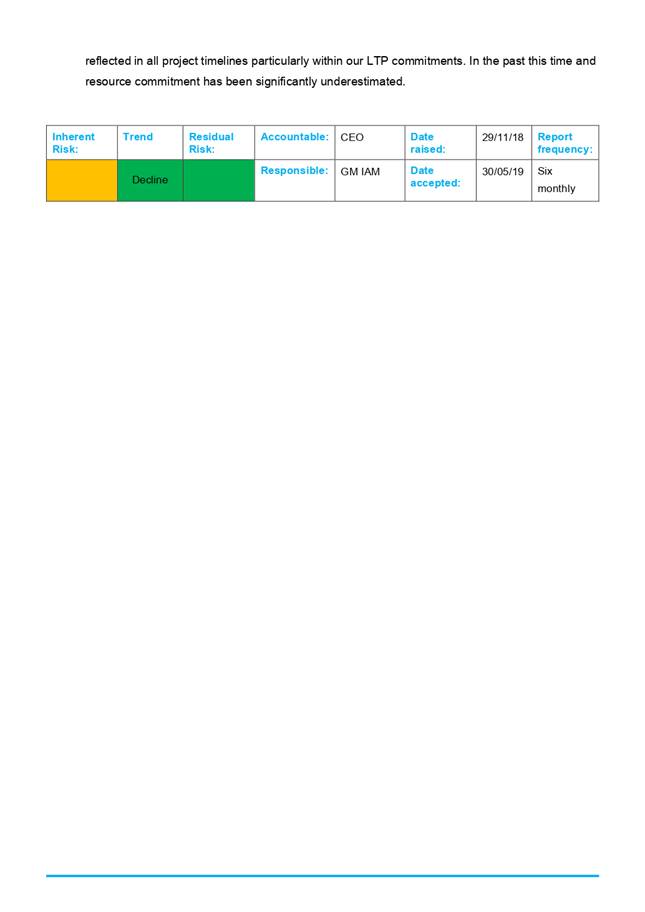

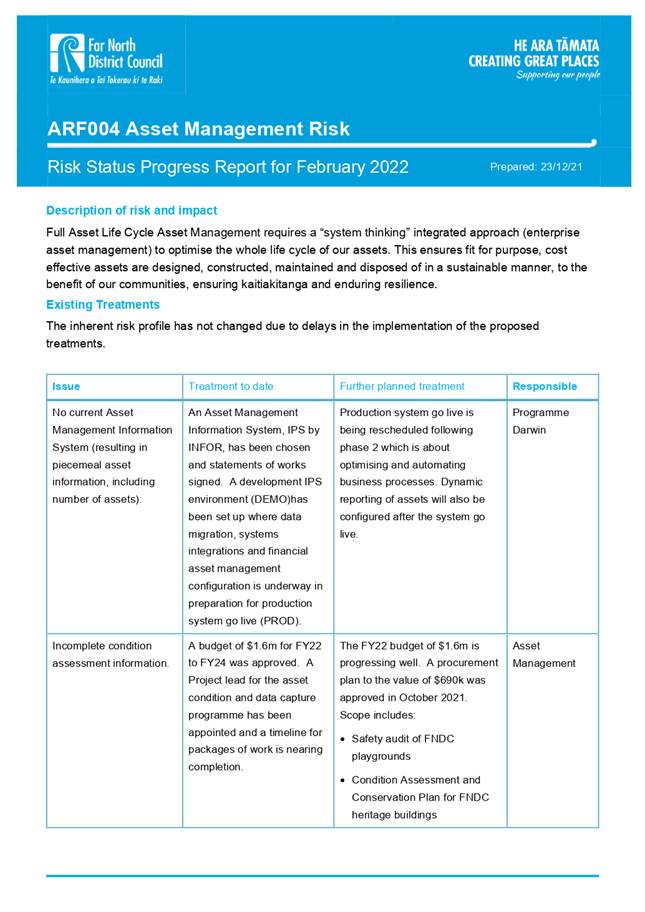

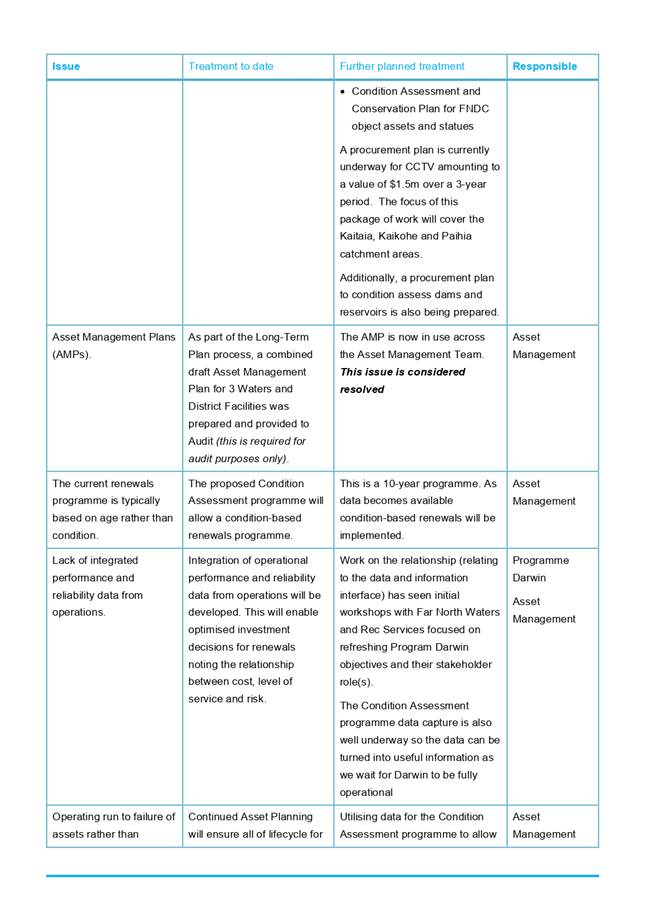

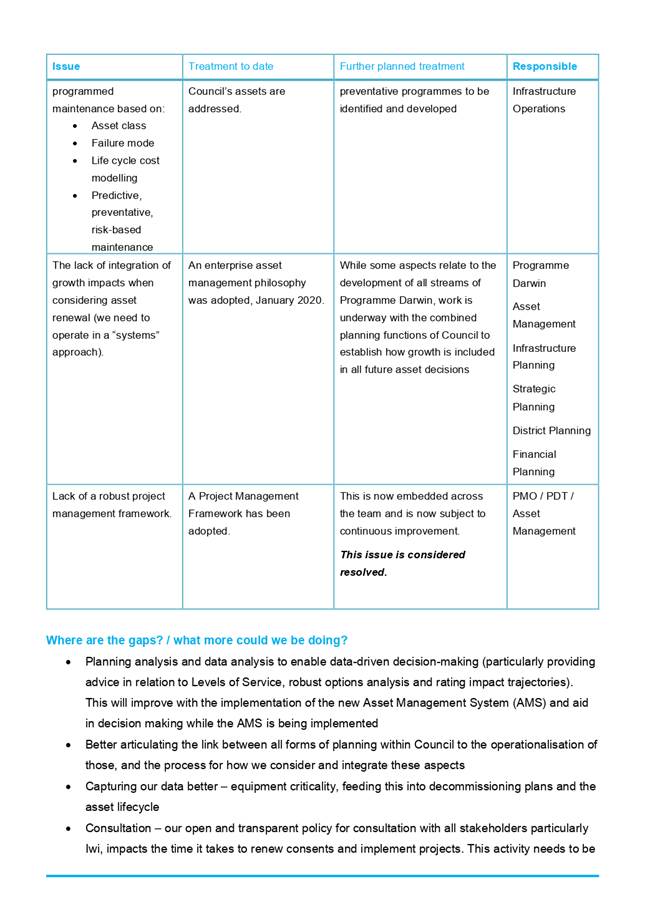

2. ARF004

Asset Management Risk Progress Report. The inherent risk rating trend has been

assessed as declining due to the implementation of two treatments - Asset

Management Plans and project management framework – and progress made

against other treatments.

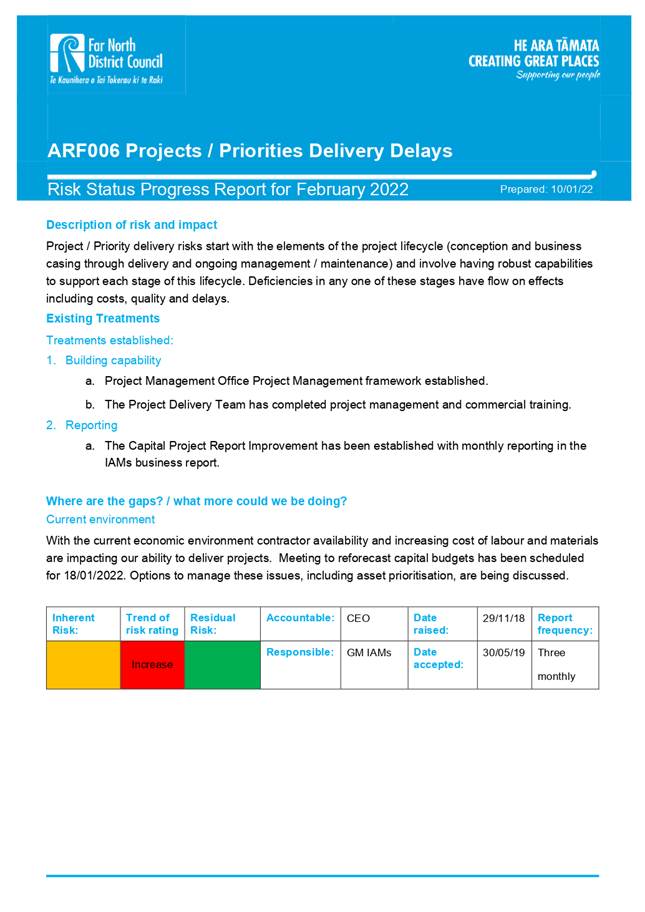

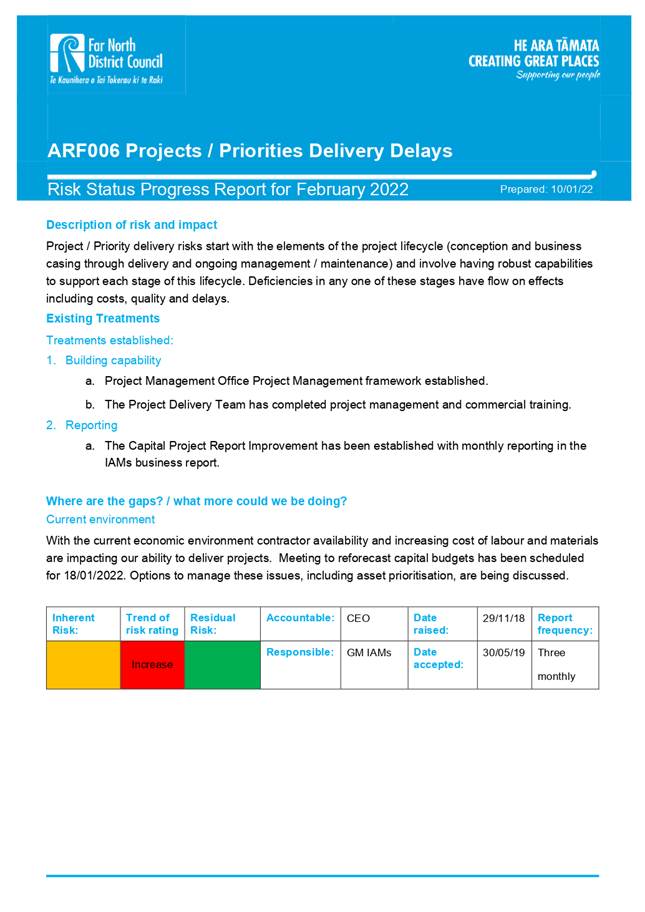

3. ARF006

Project Priorities Deliveries Delays Risk Progress Report. The inherent risk

rating trend has been assessed as increasing due to impact of the

external environment we are working in. Issues being experienced are -

contractor availability and increasing cost of labour and materials.

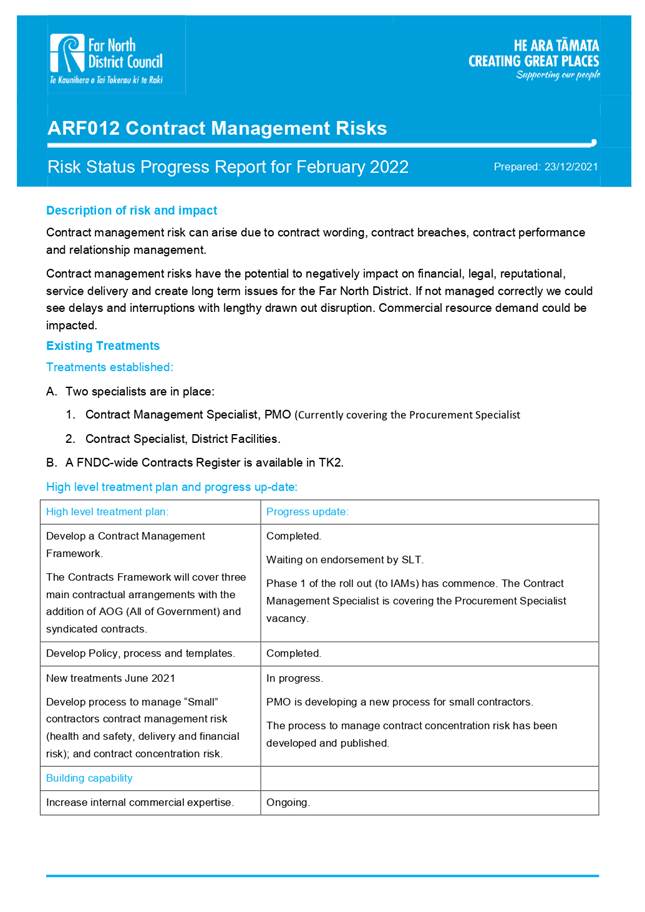

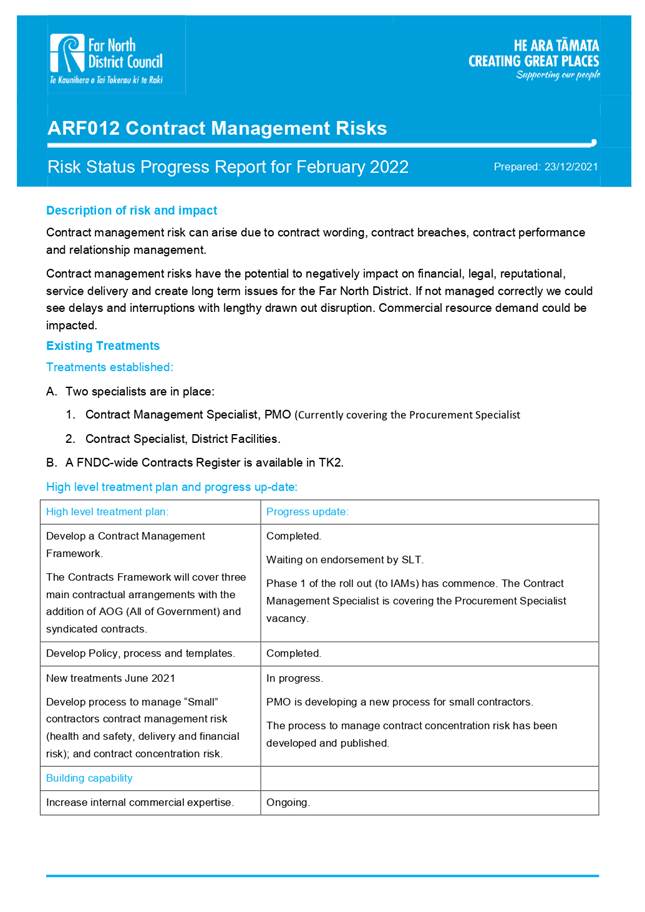

4. ARF012

Contract Management Risk Progress Report. The inherent risk rating trend has

been assessed as stable due to the progress against treatments such as

the new contracts register and contract management framework.

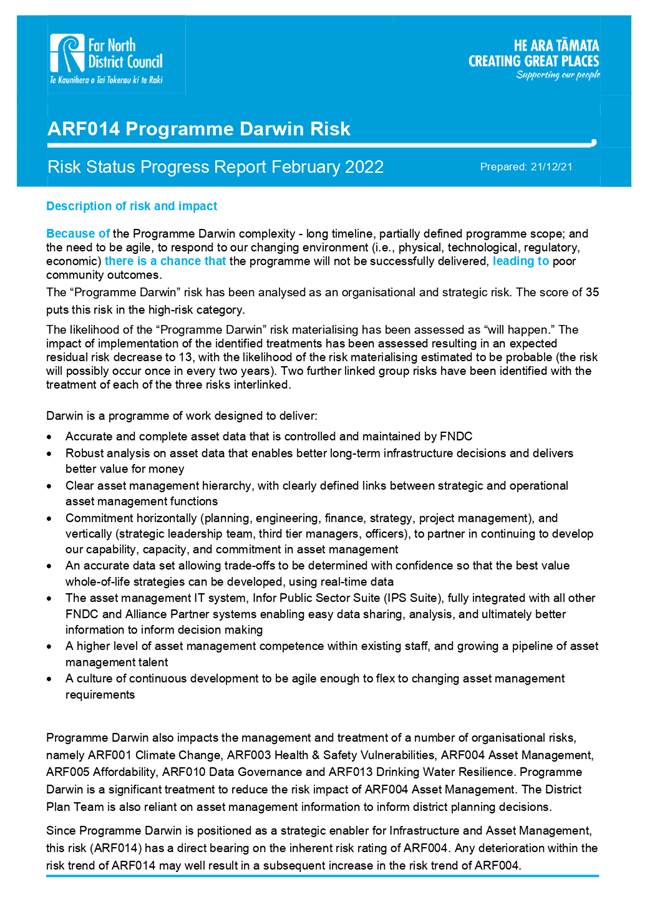

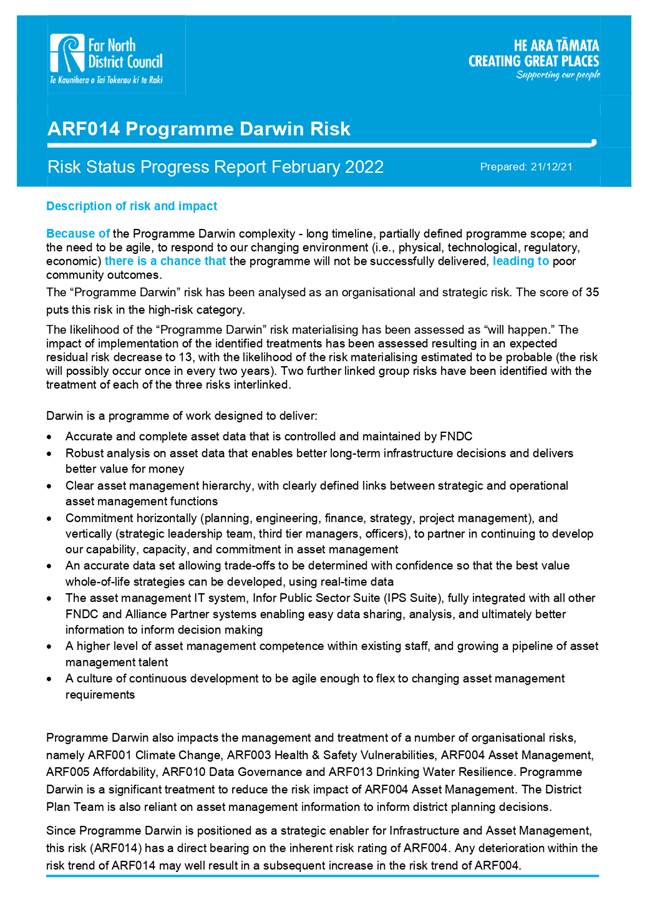

5. ARF014

Programme Darwin Risk Progress Report. The inherent risk rating trend has been

assessed as increasing as treatments to reduce either the impact or

probability of this risk are yet to be confirmed or implemented. A working

group is to be established early 2022 with governance oversight provided by the

Assurance, Risk and Finance Committee.

6. ARF017

Climate Change Direct Risk to Council Physical and Natural Assets Risk Progress

Report. The inherent risk rating trend has been assessed as stable. Work

is underway to identify a programme of treatments.

No additional reporting requirement for the top

organisational risks has been identified.

Group

Risk Up-date

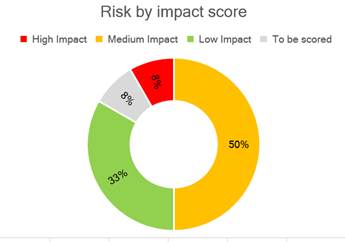

Group

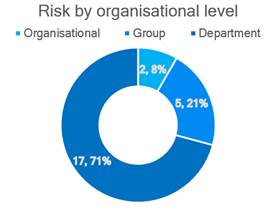

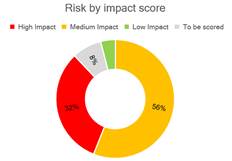

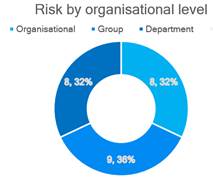

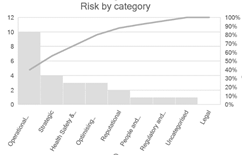

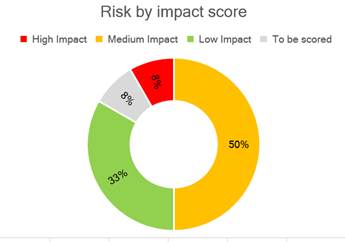

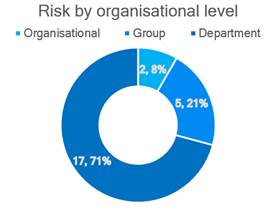

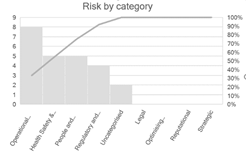

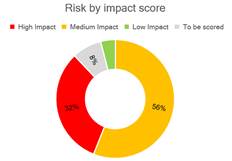

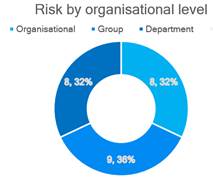

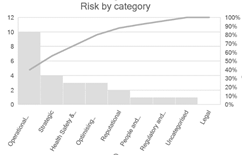

Risk dashboards

The dashboards provide

information on:

· the total number

of identified risks;

· the percentage of

risks assessed categorised as high, medium or low impact score;

· the level of the

risk within Council (Department, Group or Organisation level risk); and

· the risk

description by category (see table 4):

o Health, Safety & Wellbeing

o Legal

o Operational / Financial

o Optimising efficiency

o People and culture

o Regulatory and Compliance

o Reputational / Strategic.

|

|

District Services Risk

Dashboard

|

Review Date: 10/01/22

24 risks

|

|

|

|

|

|

|

|

|

|

|

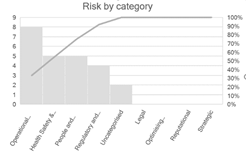

IAM Group Risk Dashboard

|

Review Date: 10/01/22

25 risks

|

|

|

|

|

|

Assurance, Risk

and Finance Committee Meeting Agenda

|

2 February 2022

|

|

Table 4: Key to

risk category

|

|

|

|

Risk Description

|

Description of category

|

Example

|

|

Health Safety &

Wellbeing

|

a work environment that

is without risk to health and safety, so far as is reasonably practicable

|

Lone worker vulnerability

|

|

Legal

|

Application of the law

(and its consequences) to FNDC actions

|

Court action

|

|

Operational/Financial

|

Whole of business view of

FNDC performance including service/services delivery, risk, finance,

environmental,

|

Affordability

|

|

Optimising efficiency

|

Managing the present,

lineal response to what exists today such as system, Continuous Improvement,

process

|

Born digital improvements

e.g. BCA application

|

|

People and culture

|

Capability, mindsets,

behaviour

|

Disability awareness

workshops

|

|

Regulatory and Compliance

|

Conforming to rules,

external = law or regulation; internal = policies

|

Audits

|

|

Reputational

|

The external estimation

in which FNDC and brand is held

|

Customer service delivery

|

|

Strategic

|

Adapting to change:

Innovation / create the future / selectively forget the past

|

Climate change /

Affordability

|

|

|

|

|

|

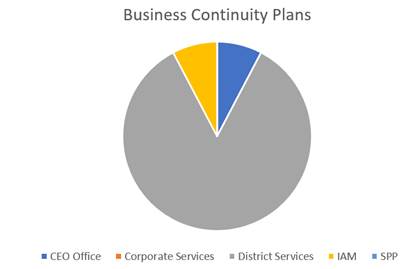

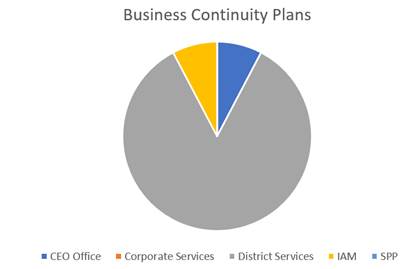

Business

continuity arrangements

The COVID-19 crisis response and crisis management teams

continue to manage the Council’s COVID-19 response. Operating protocols

have been updated and communicated to staff to support the transition to the

traffic light system. Risk assessments, using the Worksafe COVID-19 Vaccination

Risk Assessment tool, have been completed to identify roles that will require

staff to be vaccinated.

Progress

to refresh Council’s business continuity arrangements:

· Corporate

Services Third Tier People Leaders have met and agreed essential services.

Business Continuity Plans are now being drafted for these essential services.

· Work

on IAM business continuity plans for essential services continues.

· People

& Capability have completed their business continuity plan.

· The

District Services and Strategic Planning & Policy Groups have completed

their business continuity plans for essential services.

In total 12 business continuity plans have been completed

distributed through the groups as illustrated in the chart below.

PĀNGA PŪTEA ME NGĀ WĀHANGA

TAHUA / Financial Implications and Budgetary Provision

No

additional budgetary provision is requested.

Āpitihanga

/ Attachments

1. 2022

02 ARF003 Health Safety and Wellbeing Vulnerabilities Risk Progress Report -

A3546998 ⇩

2. 2022

02 ARF004 Asset Management Risk Progress Report - A3546092 ⇩

3. 2022

02 ARF006 Projects Priorities Delivery Delays Risk Progress Report - A3546997 ⇩

4. 2022

02 ARF012 Contract Management Risk Progress Report - A3547122 ⇩

5. 2022

02 ARF014 Programme Darwin Risk Progress Report - A3546056 ⇩

6. 2022

02 ARF017 Climate Change Direct Risk to Council Physical and Natural Assets

Risk Progress Report - A3546094 ⇩

|

Assurance, Risk

and Finance Committee Meeting Agenda

|

2 February 2022

|

|

Assurance, Risk and

Finance Committee Meeting Agenda

|

2 February 2022

|

|

Assurance, Risk and

Finance Committee Meeting Agenda

|

2 February 2022

|

|

Assurance, Risk

and Finance Committee Meeting Agenda

|

2 February 2022

|

|

Assurance, Risk and

Finance Committee Meeting Agenda

|

2 February 2022

|

|

Assurance, Risk and

Finance Committee Meeting Agenda

|

2 February 2022

|

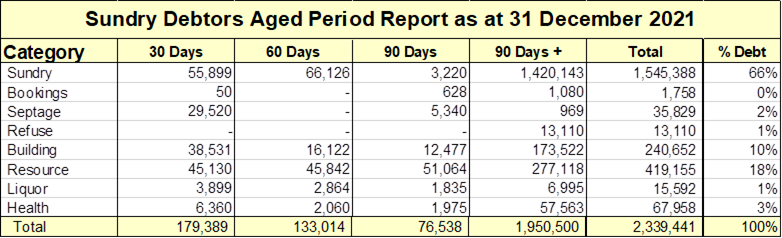

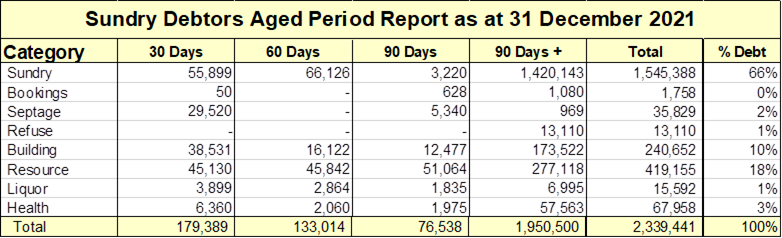

6.3 Revenue

Recovery report - 31 December 2021

File

Number: A3550161

Author: Margriet

Veenstra, Manager - Transaction Services

Authoriser: William

J Taylor MBE, General Manager - Corporate Services

TAKE PŪRONGO / Purpose of the Report

The purpose of this report is to provide quarterly reporting

to the Far North District Council Assurance, Risk, and Finance Committee.

WHAKARĀPOPOTO MATUA / Executive SummarY

This is the second report for the financial

year 2021-22 and provides information on action taken to collect the

current and arrears balances for

rates, water and sundry debt so far this year, and to

provide information on how collection is tracking against targets.

|

TŪTOHUNGA

/ Recommendation

That the Assurance, Risk and Finance Committee receive

the report Revenue Recovery report - 31 December 2021.

|

tĀHUHU KŌRERO / Background

·

This document has been prepared to

outline current and arrears balances for rates, water and Sundry debt

as of 31 December 2021 and the actions taken by

the debt management team for the collection of the General Title

rates and water, and sundry debt.

·

This information is part of the

standing items reported to the Committee on a regular basis.

MATAPAKI ME NGĀ KŌWHIRINGA /

Discussion and Next Steps

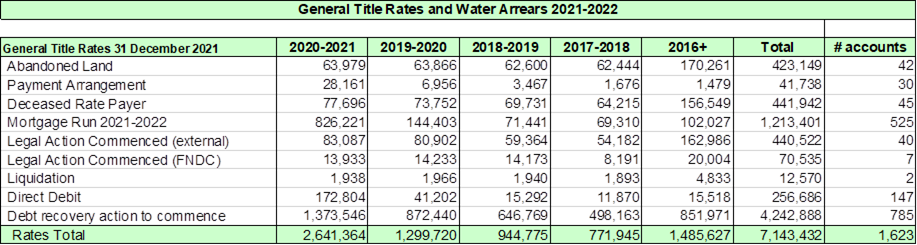

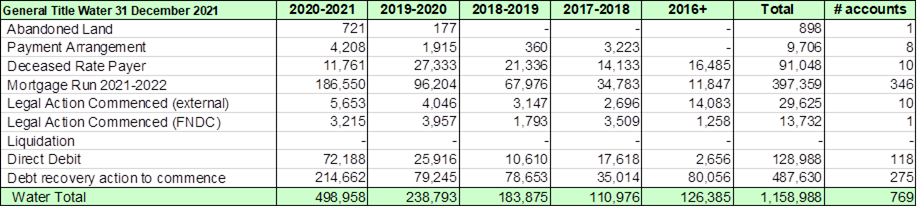

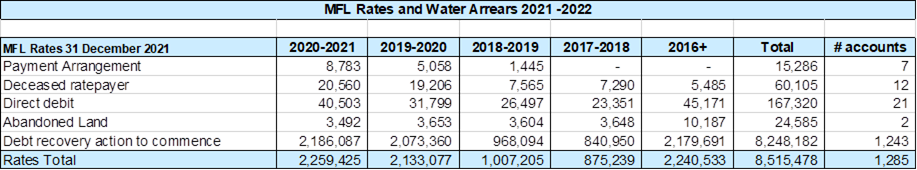

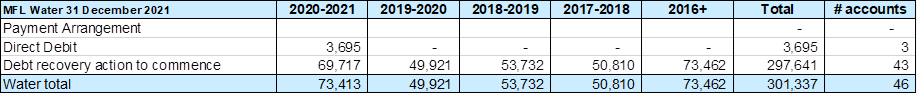

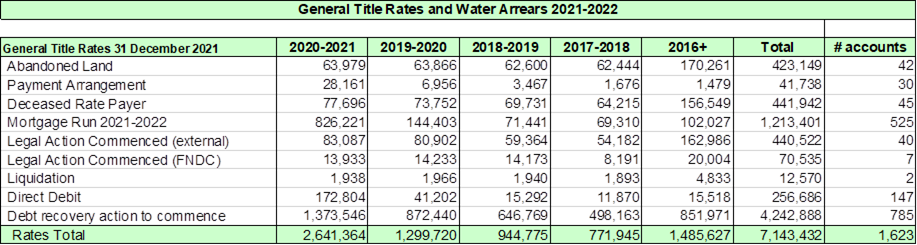

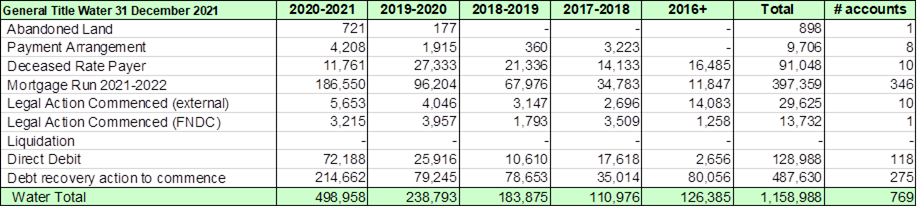

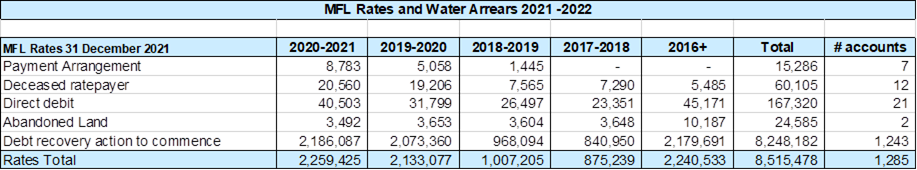

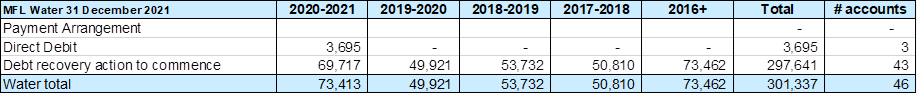

The data provided is for General Title

and Maori Freehold Land rates and water accounts with sundry debtors

shown in a separate table. Since the 1st of July 2021,

the General Title rates total arrears balance has been reduced

by 24% and water rates by 32%.

General Title rates and water debt

Key actions since the last report:

· This year, mortgage demand batches are

split by mortgagee rather than the arrears value to streamline

communications with the banks and financial institutions.

· Debt management have completed calling all