Te

Kaunihera o Tai Tokerau ki te Raki

AGENDA

Assurance, Risk and Finance Committee Meeting

Wednesday, 2 December 2020

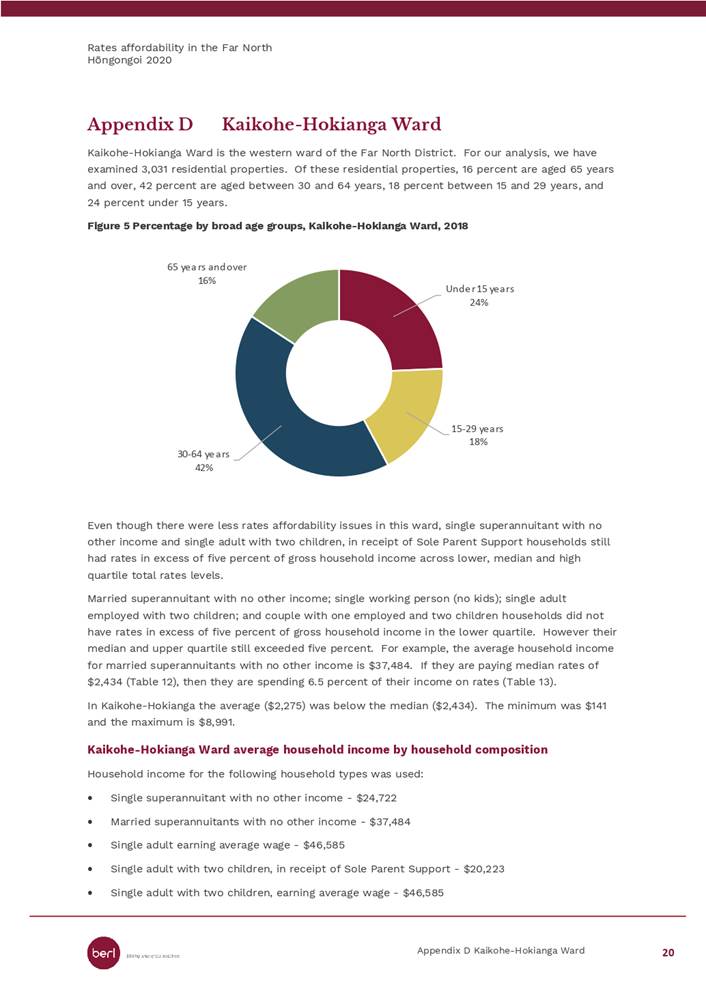

|

Time:

|

1.00 pm

|

|

Location:

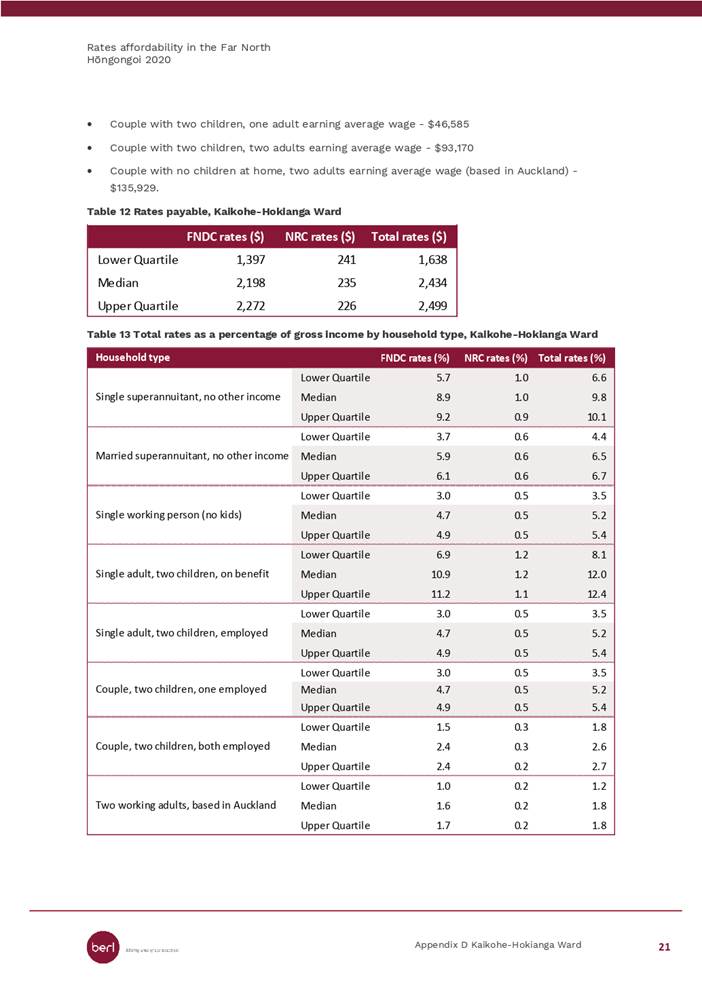

|

Council Chamber

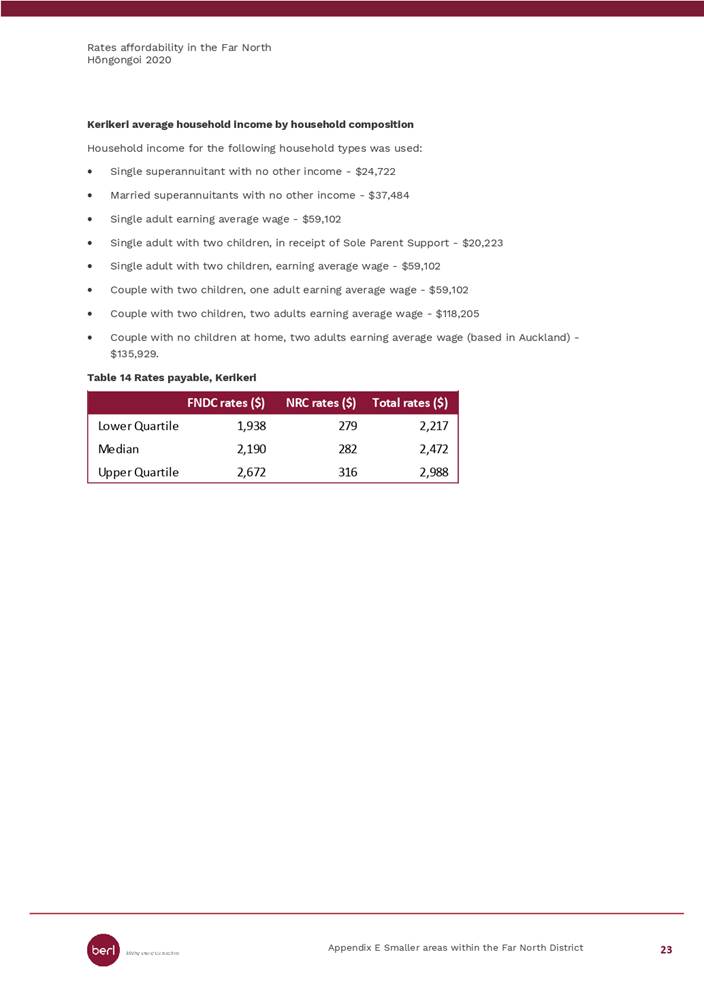

Memorial Avenue

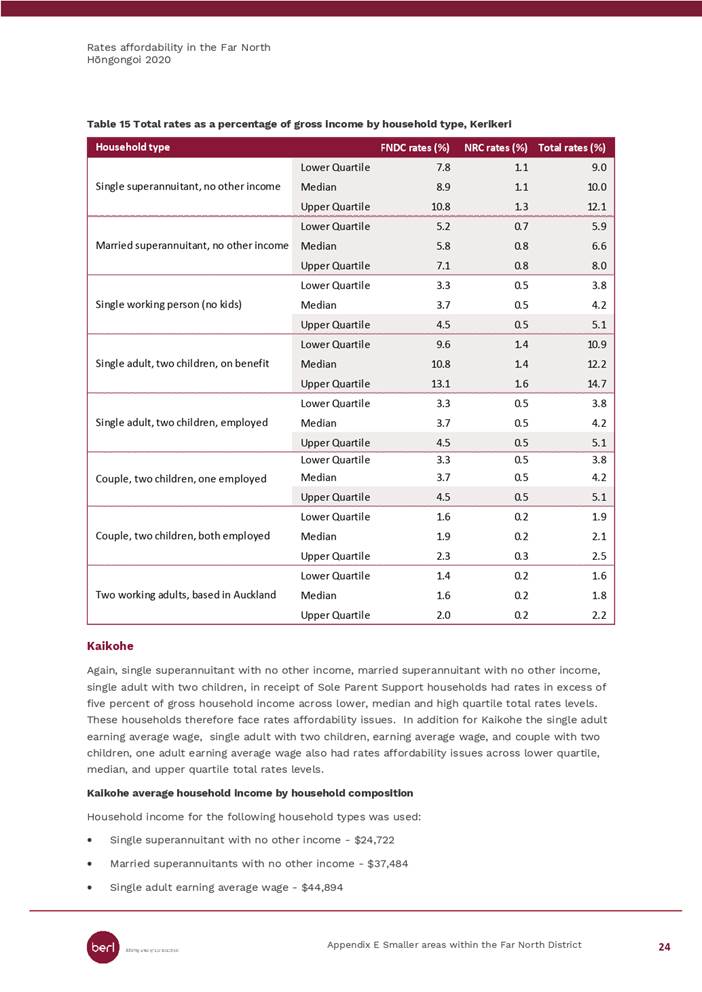

Kaikohe

|

Membership:

Cr John

Vujcich - Chairperson

Member Bruce

Robertson

Mayor John

Carter

Deputy Mayor

Ann Court

Cr Mate

Radich

Cr Rachel

Smith

Cr Kelly

Stratford

Cr Moko

Tepania

Kaikohe-Hokianga

Community Board Chairperson Mike Edmonds

|

|

Authorising Body

|

Mayor/Council

|

|

Status

|

Standing Committee

|

|

COUNCIL COMMITTEE

|

Title

|

Assurance, Risk and Finance

Committee Terms of Reference

|

|

Approval Date

|

19 December 2019

|

|

Responsible Officer

|

Chief Executive

|

Purpose

The purpose of the Assurance,

Risk and Finance Committee (the Committee) is to assist and advise the

Governing Body in discharging its responsibility and ownership of finance, risk

and internal control.

The Committee will review the

effectiveness of the following aspects:

·

The robustness of financial management

practices;

·

The integrity and appropriateness of

internal and external reports and accountability arrangements;

·

The robustness of the risk management

framework;

·

The robustness of internal controls and

the internal audit framework;

·

Compliance with applicable laws,

regulations, standards and best practice guidelines;

·

The establishment and maintenance of

controls to safeguard the Council’s financial and non-financial assets;

·

Data governance framework

To perform his or her role

effectively, each Committee member must develop and maintain

his or her skills and knowledge,

including an understanding of the Committee’s responsibilities, and of

the Council’s business, operations and risks.

Membership

The Council will determine the

membership of the Assurance, Risk and Finance Committee including at least one

independent appointment with suitable financial and risk management knowledge

and experience.

The Assurance, Risk and Finance

Committee will comprise of at least five elected members (one of which will be

the chairperson), and one independent appointed member.

|

Mayor

Carter

|

|

John

Vujcich – Chairperson

|

|

Bruce

Robertson – Deputy Chairperson and Independent Member of the Committee

|

|

Moko

Tepania

|

|

Mate

Radich

|

|

Rachel

Smith

|

|

Kelly

Stratford

|

|

Ann

Court

|

|

Mike

Edmonds

|

|

Adele

Gardner

|

Non-appointed

councillors may attend meetings with speaking rights, but not voting rights.

Quorum

The quorum at a

meeting of the Assurance, Risk

and Finance Committee is 4 members.

Frequency of

Meetings

The Assurance, Risk and Finance Committee shall meet every 6

weeks, but may be cancelled if there is no business.

Power to

Delegate

The Assurance, Risk and

Finance Committee may not delegate any of its responsibilities, duties or

powers.

Committees

Responsibilities

The Committees responsibilities

are described below:

Financial

systems and performance of the Council

·

Review the Council’s financial

and non-financial performance against the Long Term Plan and Annual Plan

·

Review Council quarterly financial

statements and draft Annual Report

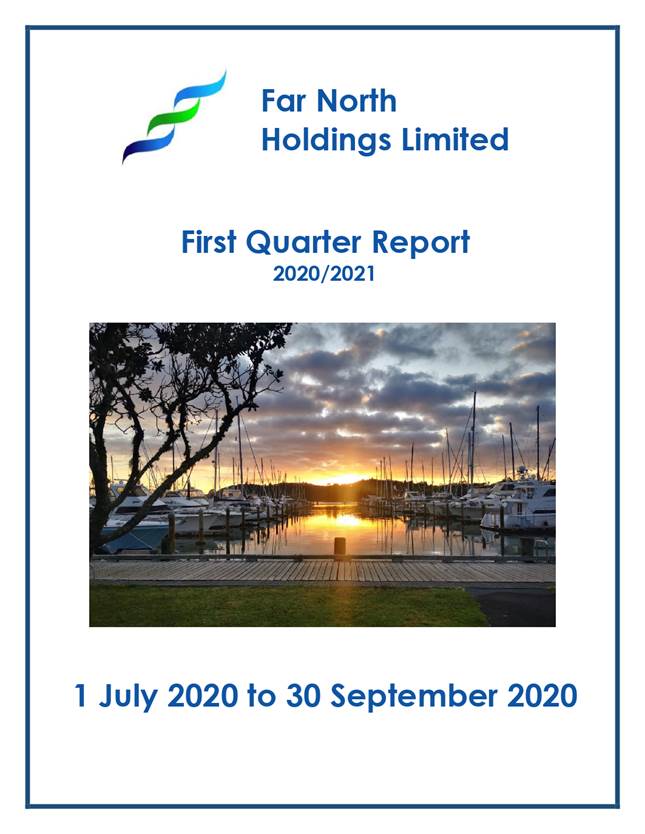

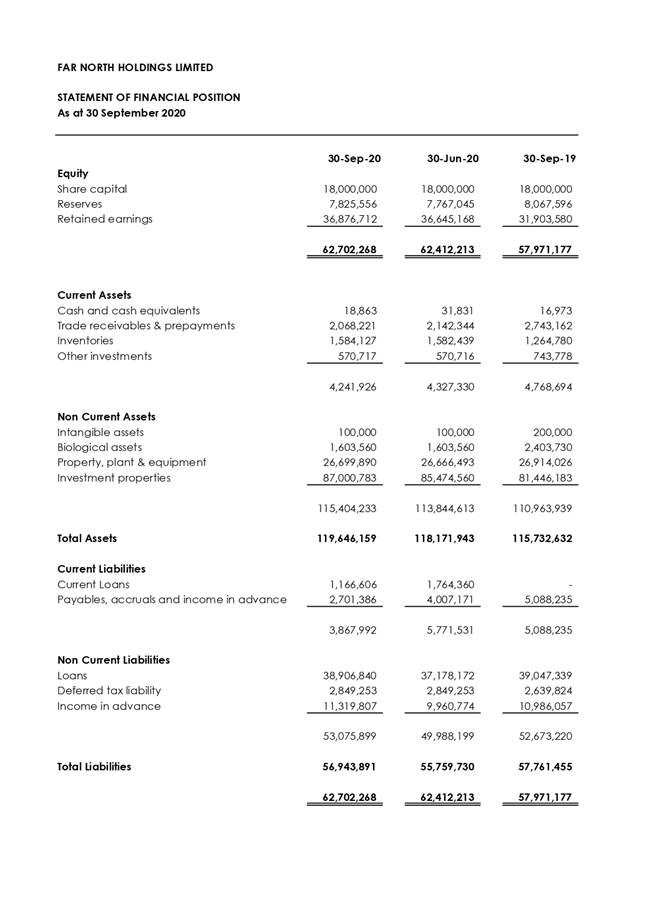

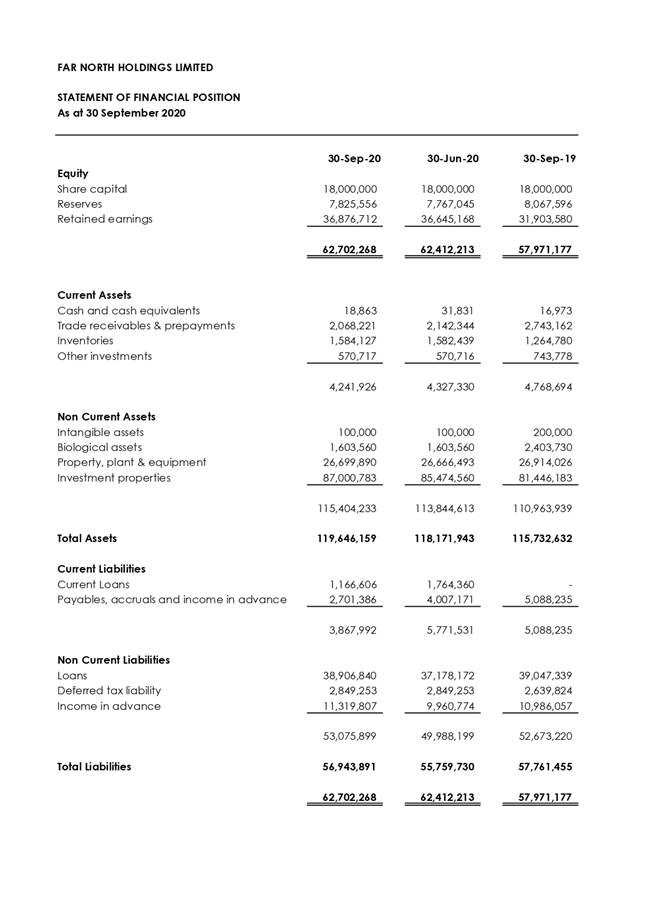

Far

North Holdings Limited (FNHL)

·

Recommend to Council the approval of

statement of intent and Annual Report (s67 LGA)

·

Receive 6 monthly report on operations

(s66 LGA)

·

Receive quarterly financial statements

·

Recommend appointment of directors of

FNHL

Risk

Management

·

Review appropriateness of

Council’s risk management framework and associated procedures for

effective risk identification, evaluation and treatment

·

Receive and review risk management

dashboard reports

·

Provide input, annually, into the

setting of the risk management programme of work

·

Receive updates on current litigation

and legal liabilities

Internal

Audit and Controls

·

Review whether management has in place

a current and comprehensive internal audit framework

·

Receive and review the internal audit

dashboard reports

·

Provide input, annually, into the

setting of the internal audit programme of work

·

Review whether there are appropriate

processes and systems in place to identify and investigate fraudulent behaviour

The

Committee will manage Council’s relationship with external auditor.

The

Committee will approve applications to declare land abandoned and any other

such matters under the Rating Act.

Rules and

Procedures

Council’s

Standing Orders and Code of Conduct apply to all the committee’s

meetings.

Annual reporting

The Chair of the Committee will

submit a written report to the Chief Executive on an annual basis. The

review will summarise the activities of the Committee and how it has contributed to the Council’s

governance and strategic objectives. The Chief Executive

will place the report on the next available agenda of the governing body.

ASSURANCE, RISK

AND FINANCE COMMITTEE - MEMBERS REGISTER OF INTERESTS

|

Name

|

Responsibility (i.e. Chairperson etc)

|

Declaration of Interests

|

Nature of Potential Interest

|

Member's Proposed Management Plan

|

|

Hon John Carter QSO

|

Board Member of the Local Government Protection Programme

|

Board Member of the Local Government Protection Program

|

|

|

|

Carter Family Trust

|

|

|

|

|

John Vujcich (Chair)

|

Board Member

|

Pioneer Village

|

Matters relating to funding and assets

|

Declare interest and abstain

|

|

Director

|

Waitukupata Forest Ltd

|

Potential for council activity to directly affect its assets

|

Declare interest and abstain

|

|

Director

|

Rural Service Solutions Ltd

|

Matters where council regulatory function impact of company services

|

Declare interest and abstain

|

|

Director

|

Kaikohe (Rau Marama) Community Trust

|

Potential funder

|

Declare interest and abstain

|

|

Partner

|

MJ & EMJ Vujcich

|

Matters where council regulatory function impacts on partnership

owned assets

|

Declare interest and abstain

|

|

Member

|

Kaikohe Rotary Club

|

Potential funder, or impact on Rotary projects

|

Declare interest and abstain

|

|

Member

|

New Zealand Institute of Directors

|

Potential provider of training to Council

|

Declare a Conflict of Interest

|

|

Member

|

Institute of IT Professionals

|

Unlikely, but possible provider of services to Council

|

Declare a Conflict of Interest

|

|

Bruce Robertson

(Deputy)

|

Chair/Deputy Chair of a

number of Audit and Risk Committees: Far North Auckland Bay of Plenty

Regional Tauranga Thames Coromandel Hamilton Waipa Otorohanga Waitomo

Environment Southland Invercargill Southland

|

|

There is a low level of

there being a potential interest conflict. An outside potential is water

reform and ‘discussion’ of one north regional water company in

loving North AKD with Watercare.

|

I remain aware of my

roiled and will Raise any matter with the Mayor/CEO And chair of ARF should

any matter potentially conflict.

|

|

Currently None are North

AKD. Previously I have Undertaken work on Okara Park with Whangarei DC.

|

Advisory Work.

|

Okara Park is a regional

Stadium. Matter solely related Governance and role of DC. Low risk of

conflict.

|

|

|

Deputy Mayor Ann

Court

|

Waipapa Business Association

|

Member

|

|

Case by case

|

|

Warren Pattinson Limited

|

Shareholder

|

Building company. FNDC is a regulator and enforcer

|

Case by case

|

|

Kerikeri Irrigation

|

Supplies my water

|

|

No

|

|

Top Energy

|

Supplies my power

|

|

No other interest greater than the publics

|

|

District Licensing

|

N/A

|

N/A

|

N/A

|

|

Top Energy Consumer Trust

|

Trustee

|

Crossover in regulatory functions, consenting economic development

and contracts such as street lighting.

|

Declare interest and abstain from voting.

|

|

Ann Court Trust

|

Private

|

Private

|

N/A

|

|

Waipapa Rotary

|

Honorary member

|

Potential community funding submitter

|

Declare interest and abstain from voting.

|

|

Properties on Onekura Road, Waipapa

|

Owner Shareholder

|

Any proposed FNDC Capital works or policy change which may have a

direct impact (positive/adverse)

|

Declare interest and abstain from voting.

|

|

Property on Daroux Dr, Waipapa

|

Financial interest

|

Any proposed FNDC Capital works or policy change which may have a

direct impact (positive/adverse)

|

Declare interest and abstain from voting.

|

|

Flowers and gifts

|

Ratepayer 'Thankyou'

|

Bias/ Pre-determination?

|

Declare to Governance

|

|

Coffee and food

|

Ratepayers sometimes 'shout' food and beverage

|

Bias or pre-determination

|

Case by case

|

|

Staff

|

N/A

|

Suggestion of not being impartial or pre-determined!

|

Be professional, due diligence, weigh the evidence. Be thorough,

thoughtful, considered impartial and balanced. Be fair.

|

|

Warren Pattinson

|

My husband is a builder and may do work for Council staff

|

|

Case by case

|

|

Ann Court - Partner

|

Warren Pattinson Limited

|

Director

|

Building Company. FNDC is a regulator

|

Remain at arm’s length

|

|

Air NZ

|

Shareholder

|

None

|

None

|

|

Warren Pattinson Limited

|

Builder

|

FNDC is the consent authority, regulator and enforcer.

|

Apply arm’s length rules

|

|

Property on Onekura Road, Waipapa

|

Owner

|

Any proposed FNDC capital work in the vicinity or rural plan change.

Maybe a link to policy development.

|

Would not submit.

Rest on a case by case basis.

|

|

Mate Radich

|

No form received

|

|

|

|

|

Kelly Stratford

|

KS Bookkeeping and Administration

|

Business Owner, provides book keeping, administration and development

of environmental management plans

|

None perceived

|

Step aside from decisions that arise, that may have conflicts

|

|

Waikare Marae Trustees

|

Trustee

|

Maybe perceived conflicts

|

Case by case basis

|

|

Bay of Islands College

|

Parent Elected Trustee

|

None perceived

|

If there was a conflict, I will step aside from decision making

|

|

Karetu School

|

Parent Elected Trustee

|

None perceived

|

If there was a conflict, I will step aside from decision making

|

|

Māori title land – Moerewa and Waikare

|

Beneficiary and husband is a shareholder

|

None perceived

|

If there was a conflict, I will step aside from decision making

|

|

Sister is employed by Far North District Council

|

|

|

Will not discuss work/governance mattes that are confidential

|

|

Gifts - food and beverages

|

Residents and ratepayers may ‘shout’ food and beverage

|

Perceived bias or predetermination

|

Case by case basis

|

|

Taumarere Counselling Services

|

Advisory Board Member

|

May be perceived conflicts

|

Should conflict arise, step aside from voting

|

|

Sport Northland

|

Board Member

|

May be perceived conflicts

|

Should conflict arise, step aside from voting

|

|

Kelly Stratford -

Partner

|

Chef and Barista

|

Opua Store

|

None perceived

|

|

|

Māori title land – Moerewa

|

Shareholder

|

None perceived

|

If there was a conflict of interest, I would step aside from decision

making

|

|

Rachel Smith

|

Friends of Rolands Wood

Charitable Trust

|

Trustee

|

|

|

|

Mid North Family Support

|

Trustee

|

|

|

|

Property Owner

|

Kerikeri

|

|

|

|

Friends who work at Far

North District Council

|

|

|

|

|

Kerikeri Cruising Club

|

Subscription Member

|

|

|

|

Rachel Smith

(Partner)

|

Property Owner

|

Kerikeri

|

|

|

|

Friends who work at Far

North District Council

|

|

|

|

|

Kerikeri Cruising Club

|

Subscription Member and

Treasurer

|

|

|

|

Moko Tepania

|

Teacher

|

Te Kura Kaupapa Māori o Kaikohe.

|

Potential Council funding that will benefit my place of employment.

|

Declare a perceived conflict

|

|

Chairperson

|

Te Reo o Te Tai Tokerau Trust.

|

Potential Council funding for events that this trust runs.

|

Declare a perceived conflict

|

|

Tribal Member

|

Te Rūnanga o Te Rarawa

|

As a descendent of Te Rarawa I could have a perceived conflict of

interest in Te Rarawa Council relations.

|

Declare a perceived conflict

|

|

Tribal Member

|

Te Rūnanga o Whaingaroa

|

As a descendent of Te Rūnanga o Whaingaroa I could have a

perceived conflict of interest in Te Rūnanga o Whaingaroa Council

relations.

|

Declare a perceived conflict

|

|

Tribal Member

|

Kahukuraariki Trust Board

|

As a descendent of Kahukuraariki Trust Board I could have a perceived

conflict of interest in Kahukuraariki Trust Board Council relations.

|

Declare a perceived conflict

|

|

Tribal Member

|

Te Rūnanga ā-Iwi o Ngāpuhi

|

As a descendent of Te Rūnanga ā-Iwi o Ngāpuhi I could

have a perceived conflict of interest in Te Rūnanga ā-Iwi o

Ngāpuhi Council relations.

|

Declare a perceived conflict

|

|

Mike Edmonds

|

Chair

|

Kaikohe Mechanical and Historic Trust

|

Council Funding

|

Decide at the time

|

|

Committee member

|

Kaikohe Rugby Football and Sports Club

|

Council Funding

|

Withdraw and abstain

|

2 Apologies

and Declarations of Interest

Members need to

stand aside from decision-making when a conflict arises between their role as a

Member of the Committee and any private or other external interest they might

have. This note is provided as a reminder to Members to review the matters on

the agenda and assess and identify where they may have a pecuniary or other

conflict of interest, or where there may be a perception of a conflict of

interest.

If a Member

feels they do have a conflict of interest, they should publicly declare that at

the start of the meeting or of the relevant item of business and refrain from

participating in the discussion or voting on that item. If a Member thinks they

may have a conflict of interest, they can seek advice from the Chief Executive

Officer or the Team Leader Democracy Support (preferably before the meeting).

It is noted

that while members can seek advice the final decision as to whether a conflict

exists rests with the member.

3 Deputation

No requests for deputations were received at the time of the

Agenda going to print.

4 Confirmation

of Previous Minutes

4.1 Confirmation

of Previous Minutes

File

Number: A3005557

Author: Casey

Gannon, Meetings Administrator

Authoriser: Aisha

Huriwai, Team Leader Democracy Services

Purpose of the Report

The minutes are attached to allow the Committee to confirm

that the minutes are a true and correct record of previous meetings.

|

Recommendation

That the Assurance, Risk and Finance Committee confirms

the minutes of the Assurance, Risk and Finance Committee meeting held 21

October 2020 as a true and correct record.

|

1) Background

Local Government Act 2002 Schedule 7 Section 28 states that

a Local authority must keep minutes of its proceedings. The minutes of these

proceedings duly entered and authenticated as prescribed by a Local authority

are prima facie evidence of those meetings.

2) Discussion and Options

The minutes of the meetings are attached.

Far North District Council Standing Orders Section 27.3

states that no discussion shall arise on the substance of the minutes in any

succeeding meeting, except as to their correctness.

Reason

for the recommendation

The reason for the recommendation is to confirm the minutes

are a true and correct record of the previous meetings.

3) Financial Implications and Budgetary

Provision

There are no financial implications or the need for

budgetary provision as a result of this report.

Attachments

1. 2020-10-21

Assurance, Risk and Finance Committee Minutes [A2987394] - A2987394 ⇩

Compliance schedule:

Full consideration has been given to the provisions of the Local

Government Act 2002 S77 in relation to decision making, in particular:

1. A

Local authority must, in the course of the decision-making process,

a) Seek

to identify all reasonably practicable options for the achievement of the

objective of a decision; and

b) Assess

the options in terms of their advantages and disadvantages; and

c) If

any of the options identified under paragraph (a) involves a significant

decision in relation to land or a body of water, take into account the

relationship of Māori and their culture and traditions with their ancestral

land, water sites, waahi tapu, valued flora and fauna and other taonga.

2. This

section is subject to Section 79 - Compliance with procedures in relation to

decisions.

|

Compliance

requirement

|

Staff

assessment

|

|

State the level of significance

(high or low) of the issue or proposal as determined by the Council’s

Significance and Engagement Policy

|

This is a matter of low

significance.

|

|

State the relevant Council

policies (external or internal), legislation, and/or community outcomes (as

stated in the LTP) that relate to this decision.

|

This report complies with the Local

Government Act 2002 Schedule 7 Section 28.

|

|

State whether this issue or

proposal has a District wide relevance and, if not, the ways in which the

appropriate Community Board’s views have been sought.

|

It is the responsibility of each

meeting to confirm their minutes therefore the views of another meeting are

not relevant.

|

|

State the possible implications for Māori

and how Māori have been provided with an opportunity to contribute to

decision making if this decision is significant and relates to land and/or

any body of water.

|

There are no implications for Māori in confirming minutes

from a previous meeting. Any implications on Māori arising from matters

included in meeting minutes should be considered as part of the relevant

report.

|

|

Identify persons likely to be

affected by or have an interest in the matter, and how you have given

consideration to their views or preferences (for example,

youth, the aged and those with disabilities).

|

This report is asking for minutes

to be confirmed as true and correct record, any interests that affect other

people should be considered as part of the individual reports.

|

|

State the financial implications

and where budgetary provisions have been made to support this decision.

|

There are no financial implications

or the need for budgetary provision arising from this report.

|

|

Chief Financial Officer review.

|

The Chief Financial Officer has

not reviewed this report.

|

|

Assurance, Risk and Finance Committee Meeting Agenda

|

2 December 2020

|

MINUTES OF Far North District Council

Assurance, Risk and

Finance Committee Meeting

HELD AT THE Council

Chamber, Memorial Avenue, Kaikohe

ON Wednesday, 21

October 2020 AT 1.00 pm

PRESENT: Cr

John Vujcich, Member Bruce Robertson (via VC), Deputy Mayor Ann Court, Cr Kelly

Stratford, Cr Moko Tepania, Cr Rachel Smith

IN

ATTENDANCE:

1 Karakia

Timatanga – Opening Prayer

|

2 MEMBERSHIP OF COMMITTEE

|

|

Resolution 2020/1

Moved: Cr John Vujcich

Seconded: Deputy

Mayor Ann Court

That the Assurance, Risk and Finance

Committee recommend to Council that Cr Rachel Smith be appointed as a member

of the Assurance, Risk and Finance Committee.

.Carried

NOTE: There is an item on the Council agenda

to formalise this appointment among others at the Council meeting next

Thursday. This appointment is already in hand via the report following on

from previous conversations

|

|

3 Apologies and declarations of interest

|

|

Committee

Resolution 2020/2

Moved: Cr John Vujcich

Seconded: Cr

Kelly Stratford

Apologies for absence from His Worship the Mayor, Cr

Mate Radich, Mike Edmonds and an apology for lateness from Cr Moko Tepania

were accepted.

Carried

|

4 Deputation

5 Confirmation

of Previous Minutes

|

5.1 Confirmation

of Previous Minutes

Agenda

item 4.1 document number A2969318, pages 12 - 18 refers.

|

|

Resolution 2020/3

Moved: Cr John Vujcich

Seconded: Cr

Kelly Stratford

That the Assurance, Risk and Finance Committee confirms

the minutes of the Assurance, Risk and Finance Committee meeting held 9

September 2020 as a true and correct record.

Carried

|

Cr Moko

Tepania joined the meeting at 1:19 pm.

6 Information

Reports

|

6.1 2020-10-21

Revenue recovery report

Agenda

item 5.1 document number A2962676, pages 19 - 25 refers.

|

|

Resolution 2020/1

Moved: Cr Kelly

Stratford

Seconded: Cr John

Vujcich

That the Assurance, Risk and Finance Committee receive

the report “2020-10-21 Revenue recovery report”.

Carried

|

|

6.2 Council

Financial Report for the Period Ending 31 August 2020

Agenda

item 5.2 document number A2967248, pages 26 - 39 refers.

|

|

Resolution 2020/2

Moved: Cr Kelly

Stratford

Seconded: Member

Bruce Robertson

That the Assurance, Risk and Finance Committee receive

the report Council Financial Report for the Period Ending 31 August 2020.

Carried

|

|

6.3 Tender

Panel Quarterly Information Report May – August 2020

Agenda

item 5.3 document number A2963355, pages 40 - 53 refers.

|

|

Resolution 2020/3

Moved: Cr Kelly

Stratford

Seconded: Cr John

Vujcich

That

the Assurance, Risk and Finance Committee receive the report Tender Panel Quarterly Information Report May –

August 2020.

Carried

|

|

6.4 Internal

Audit and Assurance - October 2020

Agenda

item 5.4 document number A2967061, pages 54 - 57 refers.

|

|

Resolution 2020/4

Moved: Cr Kelly

Stratford

Seconded: Cr Moko

Tepania

That the Assurance, Risk and Finance Committee receive

the Internal Audit and Assurance – October 2020 report.

Carried

|

|

6.5 Risk

Management - October 2020

Agenda

item 5.5 document number A2960017, pages 58 - 70 refers.

|

|

Committee Resolution 2020/5

Moved: Cr John Vujcich

Seconded: Cr Moko

Tepania

That the Assurance, Risk and Finance Committee receive

the Risk Management - October 2020 report.

Cr Stratford left the meeting 2:29 pm and returned 2:33

pm.

Carried

|

|

6.6 Organisational

Risk Assessment for Programme of Externally Funded Projects

Agenda

item 5.6 document number A2970308, pages 71 - 84 refers.

|

|

Committee Resolution 2020/6

Moved: Cr Kelly

Stratford

Seconded: Cr John

Vujcich

That the Assurance, Risk and Finance Committee:

a) receive

the Organisational Risk Assessment for Programme of Externally Funded

Projects report; and

b) request

regular risk progress reports on the Programme of Externally Funded Projects.

Carried

|

7 Karakia

Whakamutunga – Closing Prayer

Cr Stratford

closed with a karakia.

8 Meeting

Close

The meeting closed at 3:05 pm.

The minutes of this meeting were confirmed at the Assurance, Risk and Finance Committee Meeting held on 2 December 2020.

...................................................

CHAIRPERSON

5 Reports

5.1 Recommendation

to Remove ARF008 Civil Defence Risk from the Organisational Risk Dashboard

File

Number: A3005979

Author: Tanya

Reid, Business Improvement Specialist

Authoriser: William

J Taylor MBE, General Manager - Corporate Services

Purpose of the Report

To approve the removal of ARF008 Civil Defence risk from the

organisational risk dashboard.

Executive Summary

· ARF008 Civil Defence is an organisational risk in the

Operational/Financial category (whole of business view of Far North District

Council (FNDC) performance including service/services delivery, risk, finance,

environmental).

· Of the 12 risks adopted in May 2019 the Civil Defence risk was the

eighth highest priority risk with a medium impact score of 42.

· The total residual impact score has been rescored.

· The residual risk is assessed as a low impact score of 11.

· This risk is assessed as low impact and unlikely to occur.

|

Recommendation

That the Assurance, Risk and Finance Committee approves

the removal of ARF008 Civil Defence risk from the organisational risk

dashboard.

|

1) Background

November 2018 elected members workshopped and agreed their

top organisational risk dashboard which was adopted on 30 May 2019. Of the 12

risks originally on their risk dashboard the Civil Defence risk was the eight

highest priority risk with a medium impact score of 42. The Civil Defence

Emergency Management Act sets out how civil defence should be managed around

New Zealand.

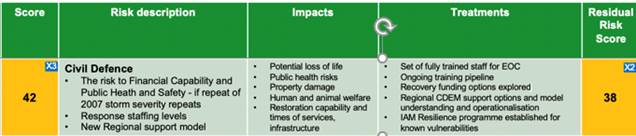

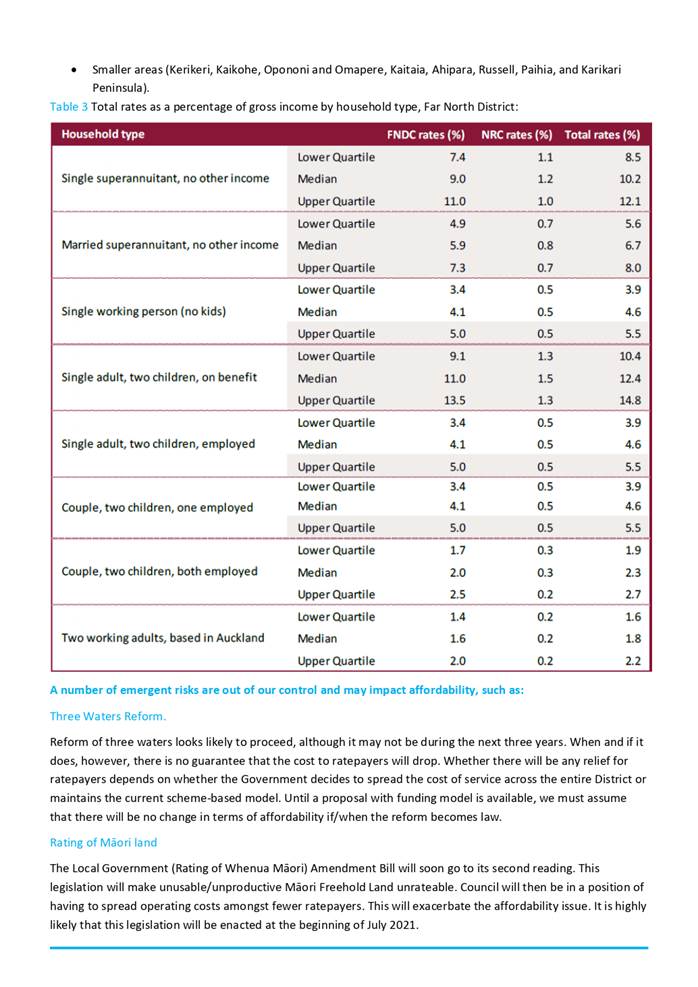

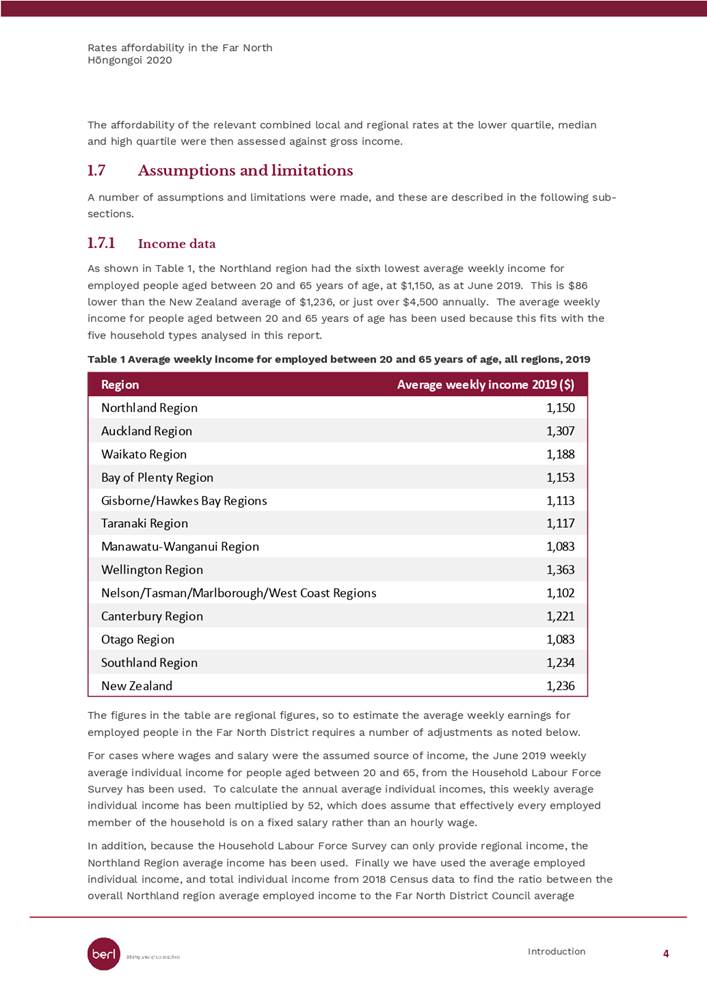

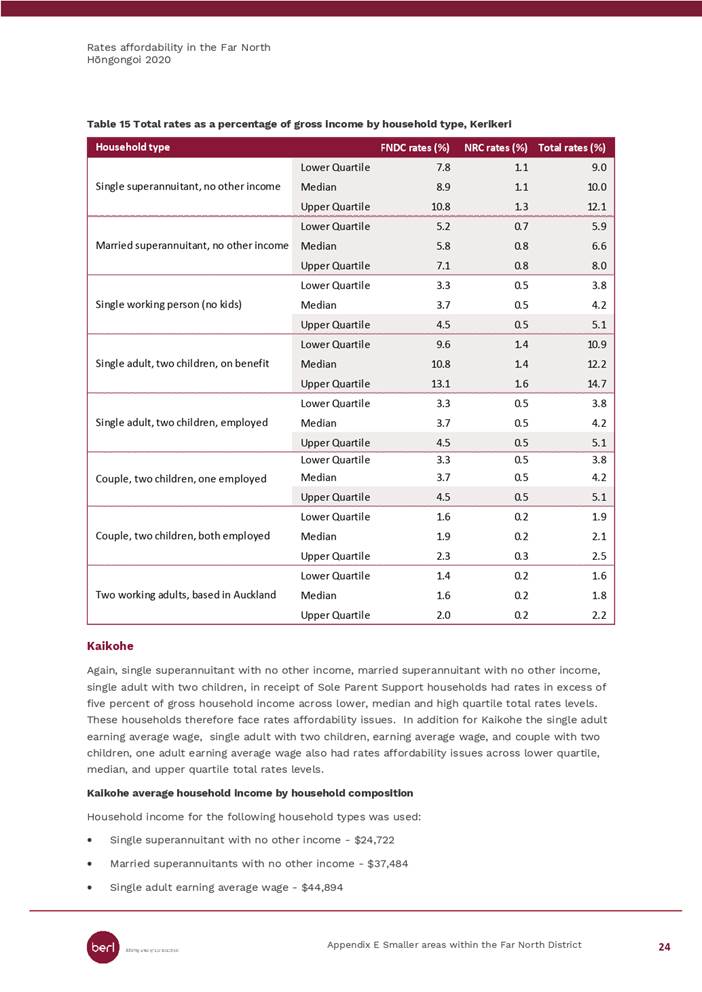

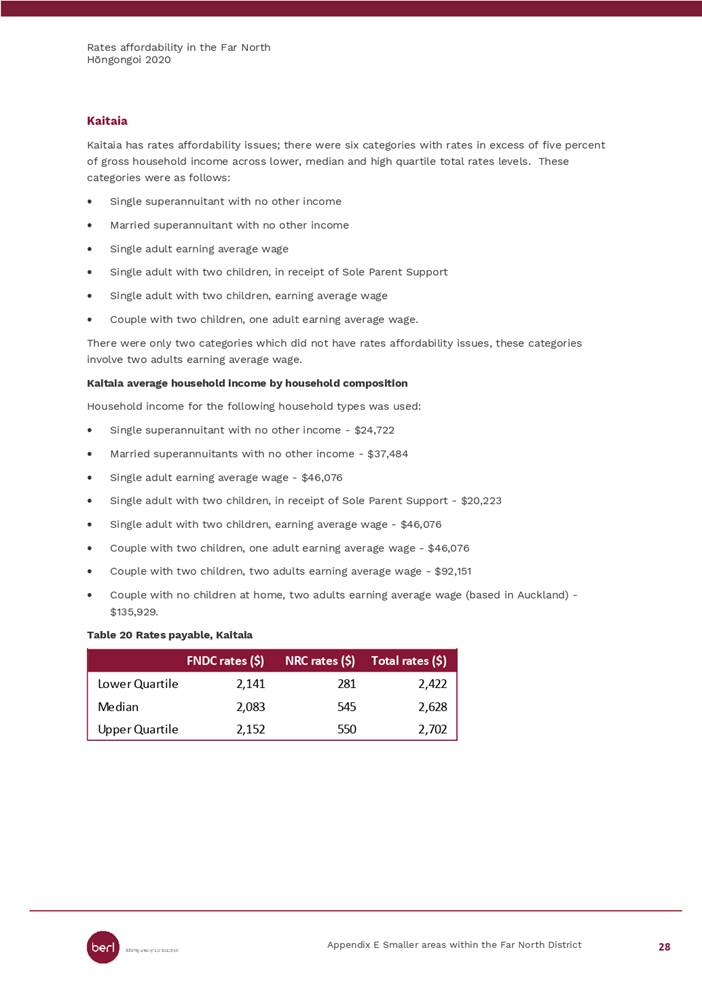

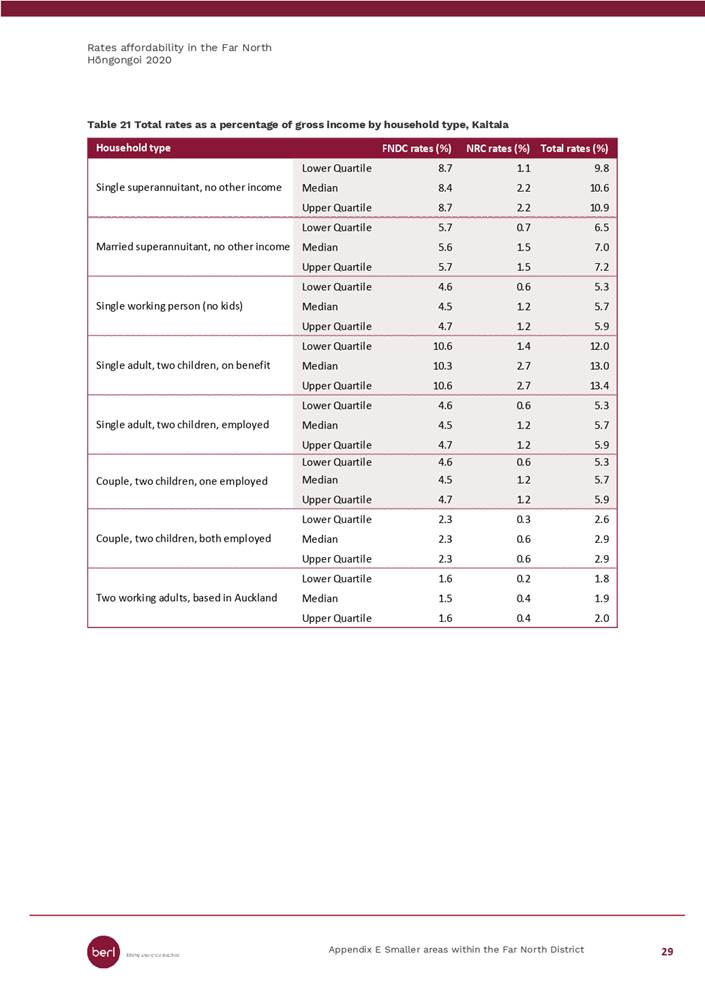

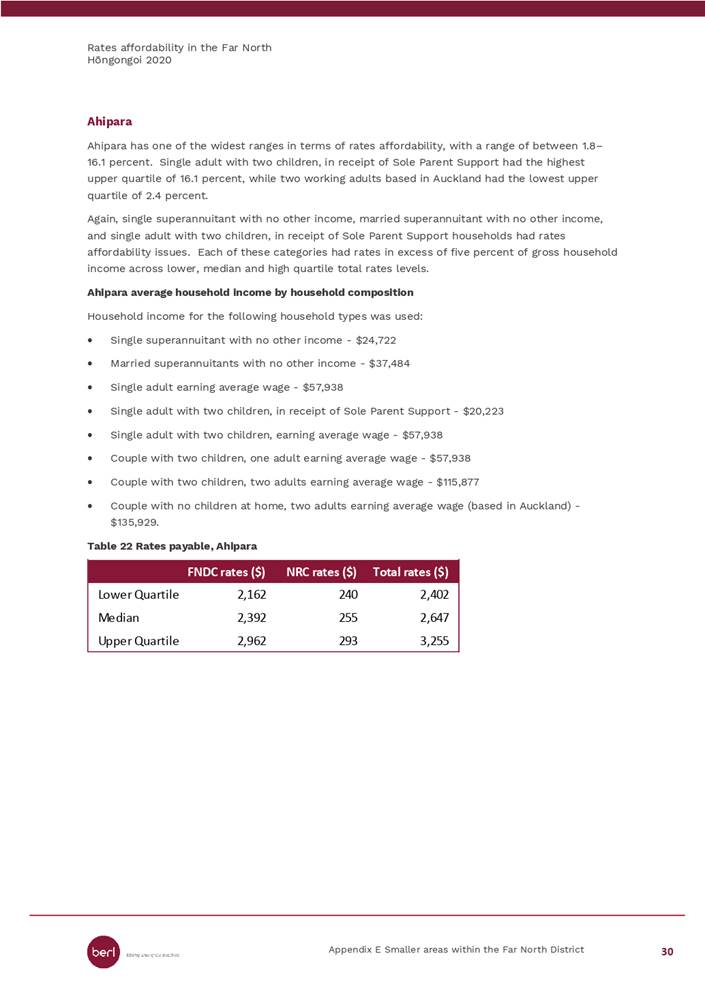

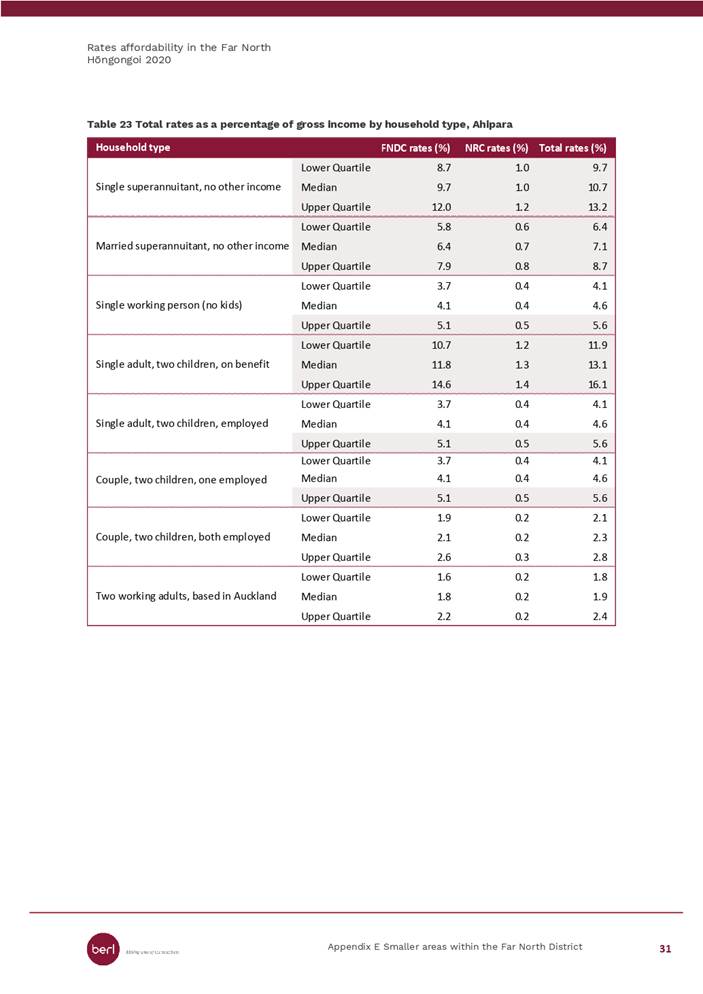

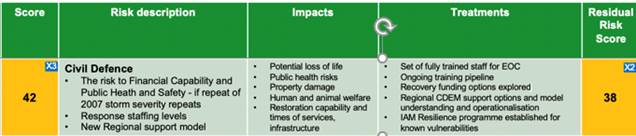

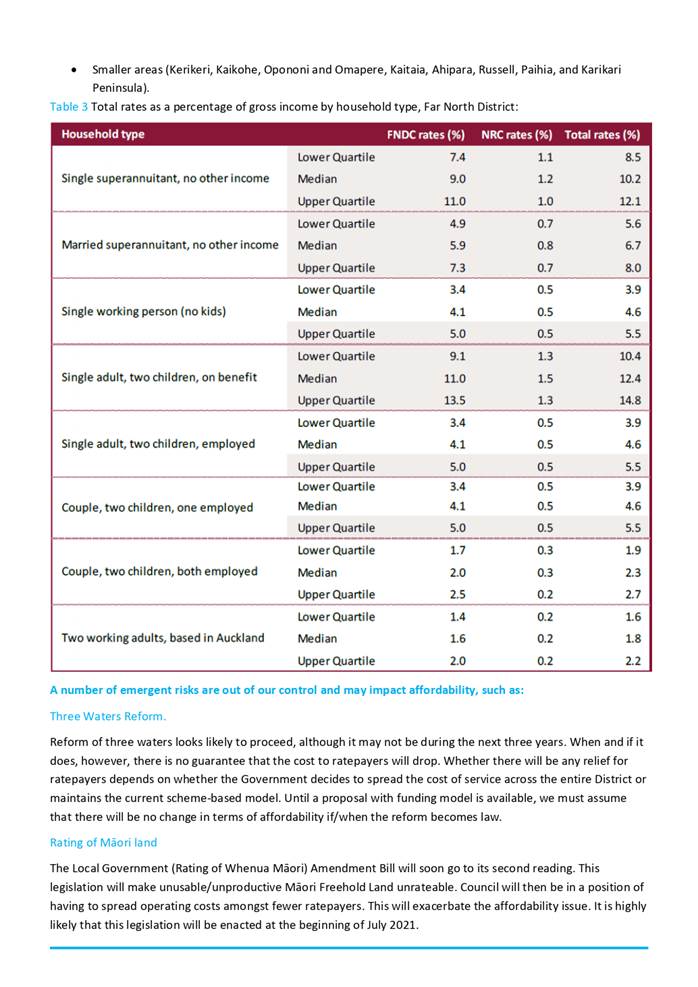

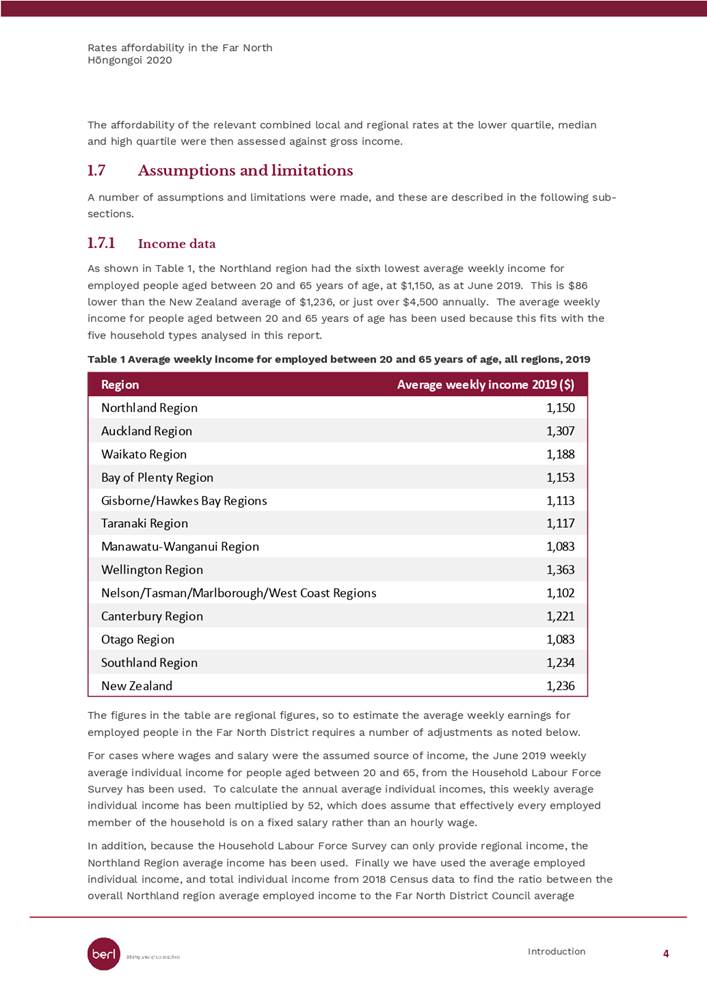

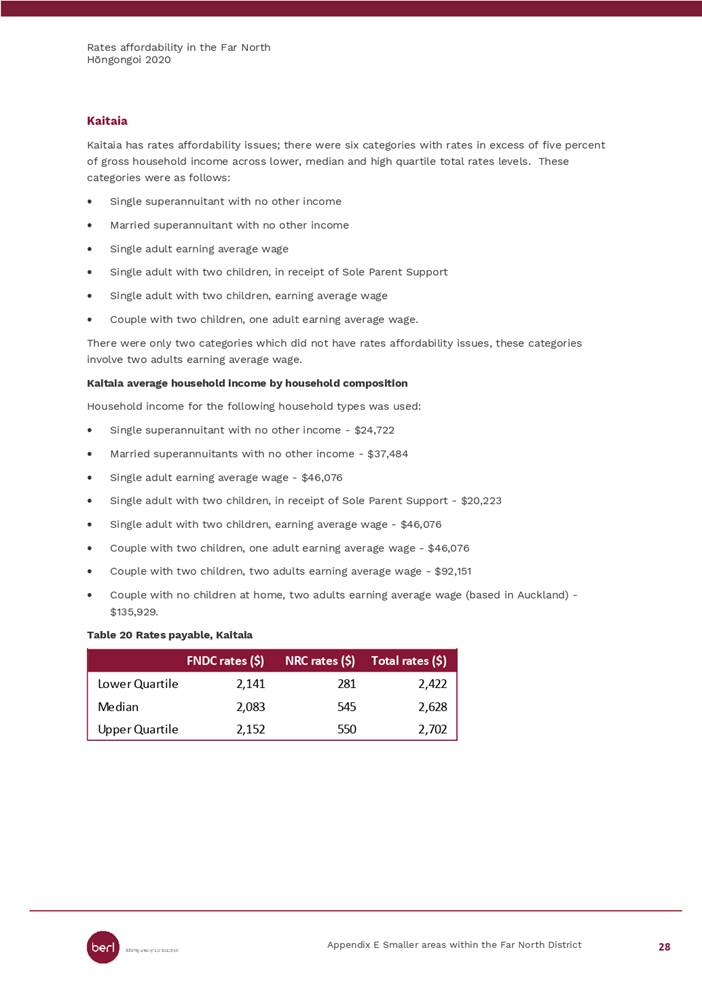

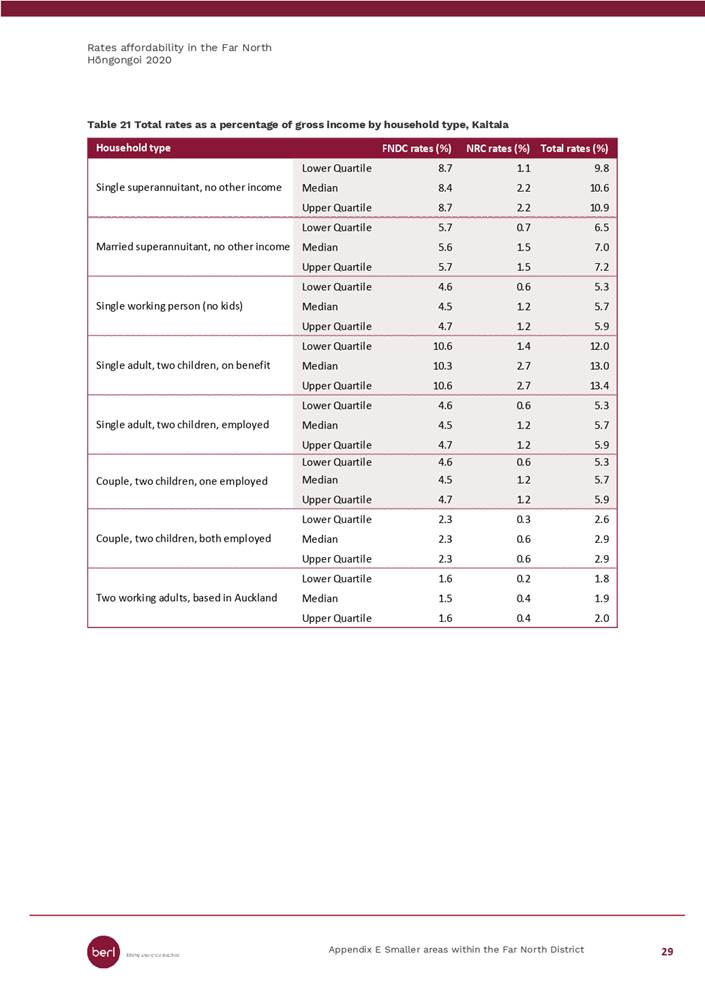

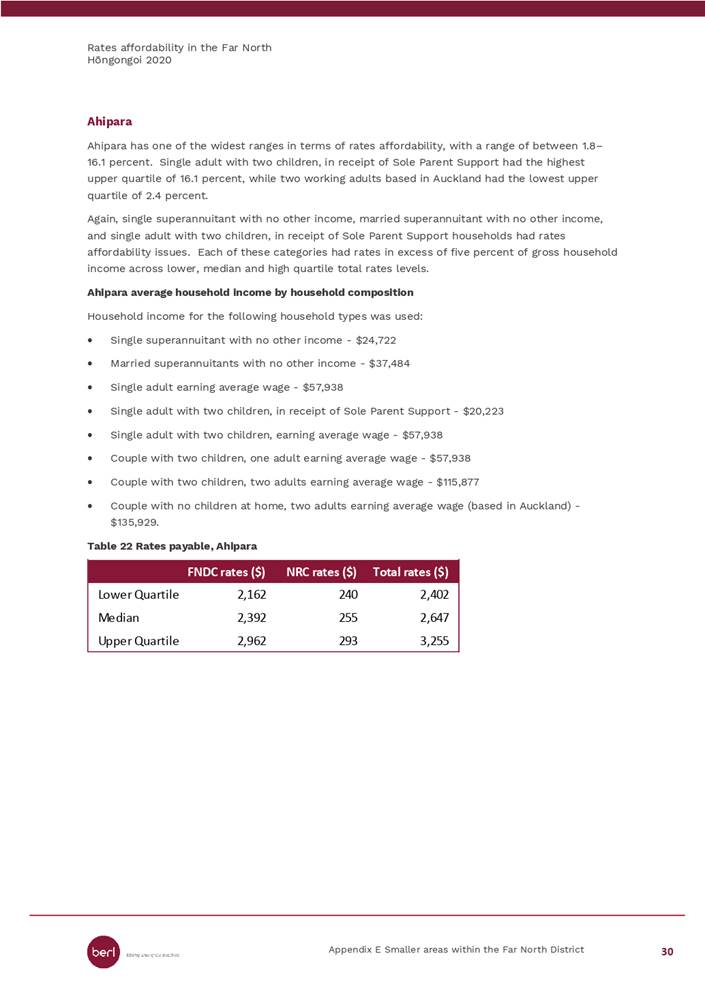

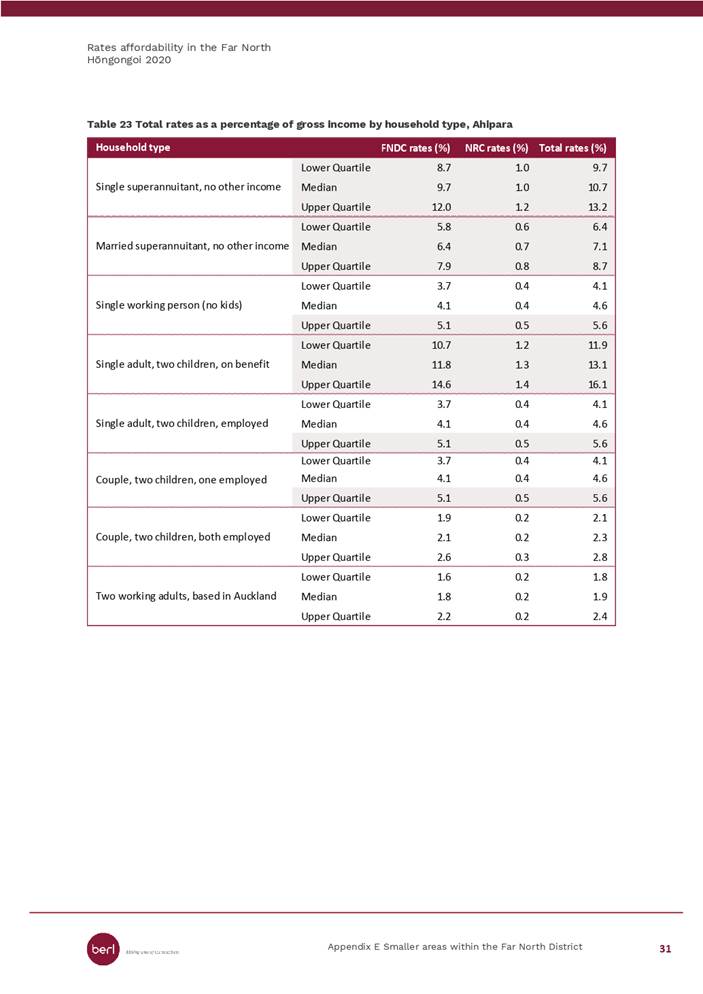

Table 1: November 2018 ARF008 Civil Defence risk

description and scoring

Risk scores help us to understand the severity of each risk.

In November 2020, after implementing and testing the recommended treatments,

ARF008 Civil Defence risk was rescored, using the FNDC risk matrix.

2) Discussion and Options

In

Northland we have the Northland Region Civil Defence Emergency Management

(CDEM) Group that manages civil defence activities.

The Northland Regional Council and the region’s three

district councils, along with agencies such as the police and fire service, are

all members of this group.

The CDEM Group works together to:

· reduce

the potential effects of hazards;

· promote

community and Council readiness (preparedness) to respond to emergencies;

and

· help

the community to recover after an event.

The Group also organise an annual Northland Civil Defence

Forum.

The Northland Civil Defence Emergency Management (CDEM) Group

has prepared the Northland Civil Defence Emergency Management Plan to

demonstrate how CDEM will be delivered in the region from 2016 - 2025. Their

four goals are:

Goal 1. Increasing community awareness, understanding,

preparedness and participation in CDEM; through public education initiatives

and community-led CDEM planning.

Goal 2. Reducing the risks from hazards in Northland; by

improving the Group’s understanding of hazards and by developing and

monitoring a Group-wide risk reduction programme which demonstrates how

individual agency initiatives contribute to overall regional risk reduction.

Goal 3. Enhancing capability to manage civil defence

emergencies; through increasing the number and capability of CDEM staff and by

having effective plans, systems and procedures in place to respond to

emergencies.

Goal 4. Enhancing capability to recover from civil defence

emergencies; through a continued focus on Recovery Plans, Professional

Development and Exercises.

The regional structure of the Northland Civil Defence includes:

· Group

appointments: nine group controllers who are rostered to ensure 24/7 cover;

group welfare and recovery managers; with

· Local

controllers, welfare and recovery managers.

Since November 2018 a number of recommended treatments have

been completed, including testing of the Northland Civil Defence arrangements.

Table two provides a summary of these treatments and the outcomes achieved.

Table two: ARF008 Civil Defence risk treatments and the

outcomes:

|

Recommended treatments / improvements for

FNDC in Civil Defence capability are:

|

Outcome

|

|

• Ensure

the new shared services arrangement is fully understood by all SLT, line

managers and Emergency Operations Centre (EOC) staff.

|

Implemented and tested:

· 2019/2020

districtwide drought

· COVID-19

· July

2020 flood event

|

|

• Management

to continue to encourage their staff to attend Civil Defence Coordinated

Incident Mangement System (CIMS) training, and ensure we are able to staff a

contingent of EOC roles for an event lasting more than 36 hours.

|

Currently there are 42 trained staff on the CIMS register

with ongoing training offered through Northland Civil Defence.

|

|

• Ensure

the FNDC EOC (Kaikohe) has access to required comms, generator and resources

to function for 48-36 hours.

|

These resources are in the vault at Kaikohe Headquarters

where a generator is also located. This back-up generator is tested on a

regular schedule.

|

|

• Promote

resilience plan work with communities for severe weather, tsunami and other

emergencies

|

45 Community Response Plans have been developed in

partnership with Northland communities to provide Localised emergency

procedures and advanced preparation for the risks that they face. These are

located: https://www.nrc.govt.nz/civildefence/community-response-plans/

|

|

• Ensure

managers charged with decisions to support response and recovery are fully

aware of their responsibilities and special responsibilities such as Finance,

and Infrastructure and Asset Management (IAMS) to maintain momentum eg.

Deploying field staff for condition assessments

|

Manager - Infrastructure Operations, is responsible for

managing the Northland Region Civil Defence Emergency Management (CDEM) Group

relationship. Additional support for the COVID-19 Pandemic, with terms of

reference response, is provided by the General Manager District Services

Additionally a Crisis Management Team was set up to provide leadership

through the twin crises of the 2019/2020 drought and COVID-19 pandemic. The

Crisis Response Team, modelled on the Civil Defence Coordinated Incident

Management System, co-ordinated the delivery of the FNDC twin crises

response. This crisis response showcased the Council’s agility, key

resources were redeployed, and executive focus shifted. The crises also saw

our workforce suddenly distributed while continuing to inform and deliver

essential services to our users. A “lessons learned” exercise has

been completed to capture the knowledge and understanding gained from this

experience.

|

|

• Known

at-risk infrastructure to be built into upgrade / resilience / funding plans

|

No projects currently identified.

|

Reason

for the recommendation

Risk scores help us to understand the severity of each risk.

ARF008 Civil Defence risk has been rescored, after treatment (and testing of

these treatments), using the FNDC risk matrix. The rescoring is captured in

table 3.

Table 3: Rescoring ARF008 Civil Defence risk using FNDC

matrix:

|

|

Financial Risk

|

Customer Risk

|

Reputational Risk

|

Compliance/Legal Risk

|

Health and Safety Risk

|

|

High - Intolerable

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medium

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

|

Low- none

|

X

|

|

|

|

X

|

|

X

|

|

|

X

|

|

|

|

|

|

|

|

Unlikely

|

Probable

|

Will Happen

|

Unlikely

|

Probable

|

Will Happen

|

Unlikely

|

Probable

|

Will Happen

|

Unlikely

|

Probable

|

Will Happen

|

Unlikely

|

Probable

|

Will Happen

|

ARF008 Civil Defence is an organisational risk in the

Operational/Financial category (whole of business view of FNDC performance

including service/services delivery, risk, finance, environmental).

Organisational risks may impact on council achieving its vision, mission and

community outcomes. With a total residual impact score of 11 this risk is

assessed as low impact and unlikely to occur, see table 4.

Table 4: ARF008 Civil Defence risk map as assessed

November 2020

|

|

Total Risk

|

|

High - Intolerable

|

|

|

|

|

Medium

|

|

|

|

|

Low- none

|

X

|

|

|

|

|

Unlikely

|

Probable

|

Will Happen

|

This reduction in risk score has been achieved through

proactive changes and implementation of controls. Current ARF008 Civil Defence

controls in place are:

1. IAMS Group Risk Register: continuing risk

management via the IAMS Group Risk Register.

2. Relationship Management: The Manager -

Infrastructure Operations is responsible for managing the Northland Region

Civil Defence Emergency Management (CDEM) Group relationship.

3. Training: FNDC continue to be encouraged to

complete CIMS training which is offered as part of the Northland Civil Defence

arrangements.

4. Community Response Plans: 45 Community

Response Plans are in place.

5. FNDC business continuity programme refresh

underway.

6. Staff with CIMS capability: FNDC has

demonstrated the capability to stand up both a Crisis Management Team and

Crisis Response Team, or and EOC as required for greater than 36 hours.

A recommendation to demote ARF008 Civil Defence risk from the

organisational risk dashboard is supported by the low total risk score and the

controls in place.

3) Financial Implications and Budgetary

Provision

There is no financial implication or request for budgetary

provision.

Attachments

Nil

Compliance schedule:

Full consideration has been given to the provisions of the Local

Government Act 2002 S77 in relation to decision making, in particular:

1. A

Local authority must, in the course of the decision-making process,

a) Seek

to identify all reasonably practicable options for the achievement of the

objective of a decision; and

b) Assess

the options in terms of their advantages and disadvantages; and

c) If

any of the options identified under paragraph (a) involves a significant

decision in relation to land or a body of water, take into account the

relationship of Māori and their culture and traditions with their

ancestral land, water sites, waahi tapu, valued flora and fauna and other

taonga.

2. This

section is subject to Section 79 - Compliance with procedures in relation to

decisions.

|

Compliance

requirement

|

Staff

assessment

|

|

State the level of significance

(high or low) of the issue or proposal as determined by the Council’s

Significance and Engagement Policy

|

The recommendation in this report

does not meet the thresholds as per the Council’s significance and

engagement policy.

|

|

State the relevant Council

policies (external or internal), legislation, and/or community outcomes (as

stated in the LTP) that relate to this decision.

|

Risk Management Policy.

|

|

State whether this issue or

proposal has a District wide relevance and, if not, the ways in which the

appropriate Community Board’s views have been sought.

|

The recommendation in this report

has neither District wide nor relevance to an individual Community

Board.

|

|

State the possible implications for Māori

and how Māori have been provided with an opportunity to contribute to

decision making if this decision is significant and relates to land and/or

any body of water.

|

The recommendation in this report

does not have any direct implications for Māori.

|

|

Identify persons likely to be

affected by or have an interest in the matter, and how you have given

consideration to their views or preferences (for example – youth, the

aged and those with disabilities.

|

There

are no affected or interested parties to this recommendation.

|

|

State the financial implications

and where budgetary provisions have been made to support this decision.

|

There is no financial implication or request for budgetary

provision.

|

|

Chief Financial Officer review.

|

The Chief Financial Officer has

reviewed this report.

|

6 Information

Reports

6.1 December

Risk Management Report

File

Number: A3002968

Author: Tanya

Reid, Business Improvement Specialist

Authoriser: William

J Taylor MBE, General Manager - Corporate Services

Purpose of the Report

To provide a report on organisational risk management, emergent risk and

scheduled (and unscheduled) risk progress reports for the organisation’s

top risks.

Executive Summary

·

Three emergent risks reflect potential impact to Council of

proposed Government changes.

·

Risk progress updates are provided for four of the top

organisational risks. Two of these risks are assessed as decreasing residual

risk score; one assessed no change to the risk score; and one risk has

increased.

·

An additional report recommends the removal of a risk from the

organisational dashboard.

·

Progress on group risk continues.

|

Recommendation

That the Assurance, Risk and Finance Committee receive

the report December Risk Management Report.

|

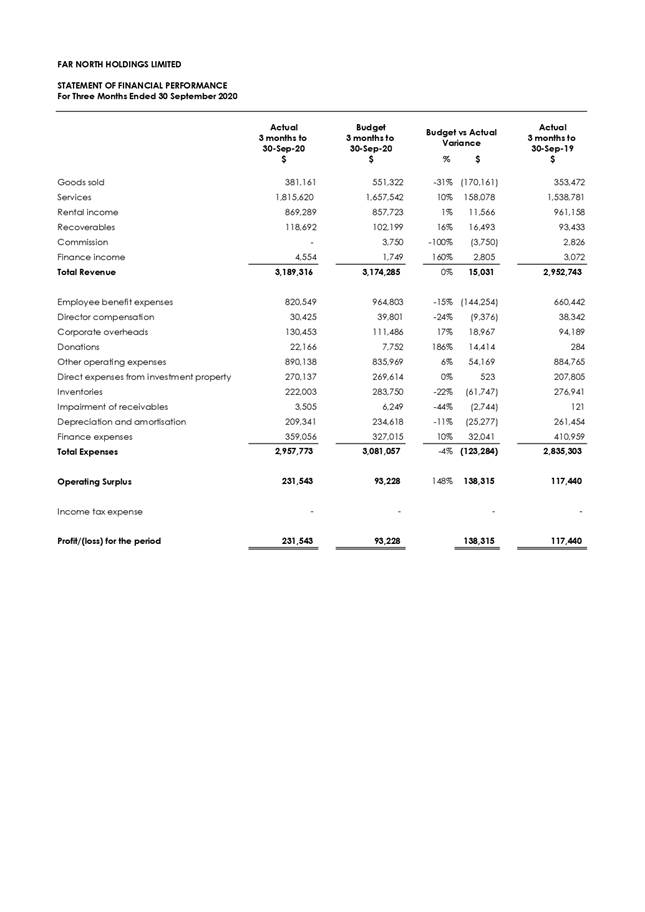

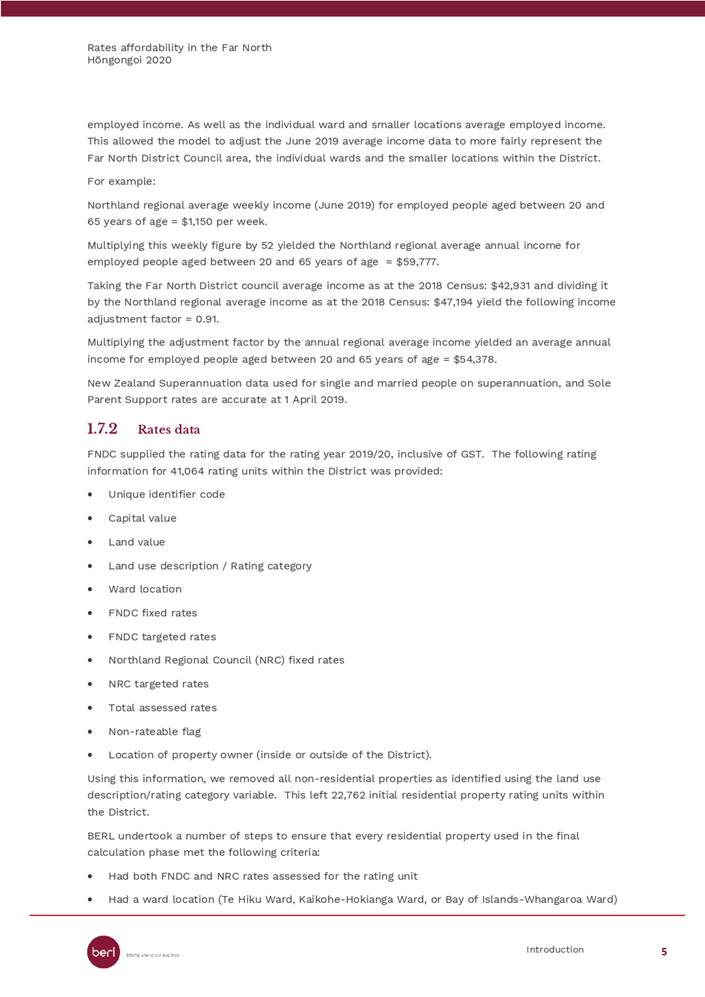

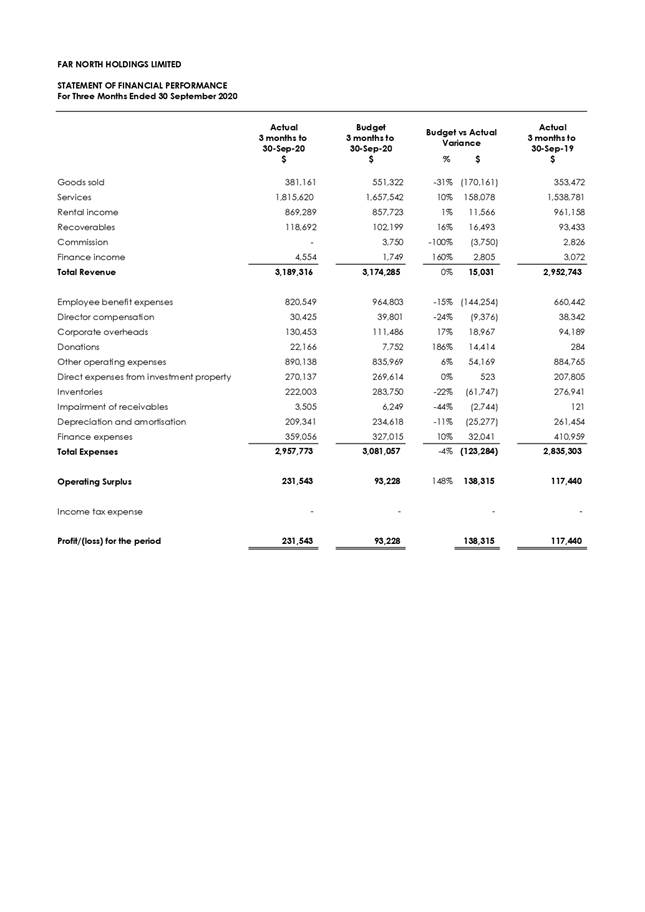

Background

The top

organisational risks are risks that may impact on Council achieving its vision,

mission and community outcomes and are regularly reported to the Assurance,

Risk and Finance Committee to ensure they are being appropriately managed. A

number of these risks are subject to external influences which may affect

effective Council operations. The table below provides a risk snapshot of the

Assurance, Risk and Finance Committee Organisational Risk Dashboard with inherent

and residual risk scores as accepted by the Committee, and the risk progress to

the residual risk score as assessed by the risk subject matter experts.

A programme of deep dive workshops is planned for these risks. The first

of two deep dive workshops for ARF005 Affordability risk has been completed,

with the second workshop to be scheduled.

The Transformation and Assurance team continues to work with the

organisation to refresh and establish Group risk registers, with treatment

plans, and regular reviews.

|

Top organisational risk summary:

|

Key

|

¯

|

Risk is decreasing.

|

|

|

-

|

No change.

|

|

|

|

Risk is increasing.

|

|

|

Risk #:

|

Risk title

|

Inherent

risk score

|

Change to

risk score

|

Residual

risk score

|

Accountable

Risk Governance

|

Responsible

Risk Governance

|

Risk

Progress Report

schedule

|

Risk

Progress Report ARF agenda:

|

|

ARF001

|

Climate Change

|

63

|

-

|

30

|

CEO

|

GMSPP

|

6 Monthly

|

Sept 20

|

|

ARF002

|

BCA Status Risk

|

51

|

¯

|

18

|

CEO

|

GMDS

|

Monthly SLT/ARF/Council

|

|

|

ARF003

|

Health & Safety Vulnerabilities

|

46

|

|

34

|

CEO

|

Manager P&C

|

2 Monthly

|

Sept 20

|

|

ARF004

|

Asset Management Risks

|

45

|

-

|

18

|

CEO

|

GMIAM

|

6 Monthly

|

Sept 20

|

|

ARF005

|

Affordability Risk

|

45

|

|

26

|

CEO

|

GMSPP

|

6 Monthly

|

Dec 20

|

|

ARF006

|

Project Priorities Deliveries Delays

|

45

|

-

|

14

|

CEO

|

GMIAM

|

2 Monthly

|

Oct 20

|

|

ARF007

|

Compliance NRC Abatements

|

45

|

¯

|

18

|

CEO

|

GMIAM

|

6 Monthly

|

Dec 20

|

|

ARF008

|

Civil Defence

|

42

|

¯

|

38

|

CEO

|

GMIAM

|

6 Monthly

|

Dec 20

|

|

ARF009

|

Customer Service Delivery

|

39

|

-

|

22

|

CEO

|

Manager P&C

|

2 Monthly

|

Oct 20

|

|

ARF010

|

Data Governance Risks

|

39

|

¯

|

14

|

CEO

|

CEO

|

6 Monthly

|

Dec 20

|

|

ARF011

|

Organisational Cohesion Risks

|

29

|

¯

|

14

|

CEO

|

CEO

|

6 Monthly

|

Sept 20

|

|

ARF012

|

Contract Management Risks

|

39

|

-

|

14

|

CEO

|

GMIAM

|

2 Monthly

|

Oct 20

|

|

ARF013

|

Drinking Water Resilience

|

39

|

-

|

ARF to agree level residual risk

|

CEO

|

GMIAM

|

3 Monthly

|

Dec 20

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assurance, Risk and Finance Committee Meeting Agenda

|

2 December 2020

|

Discussion

and Next Steps

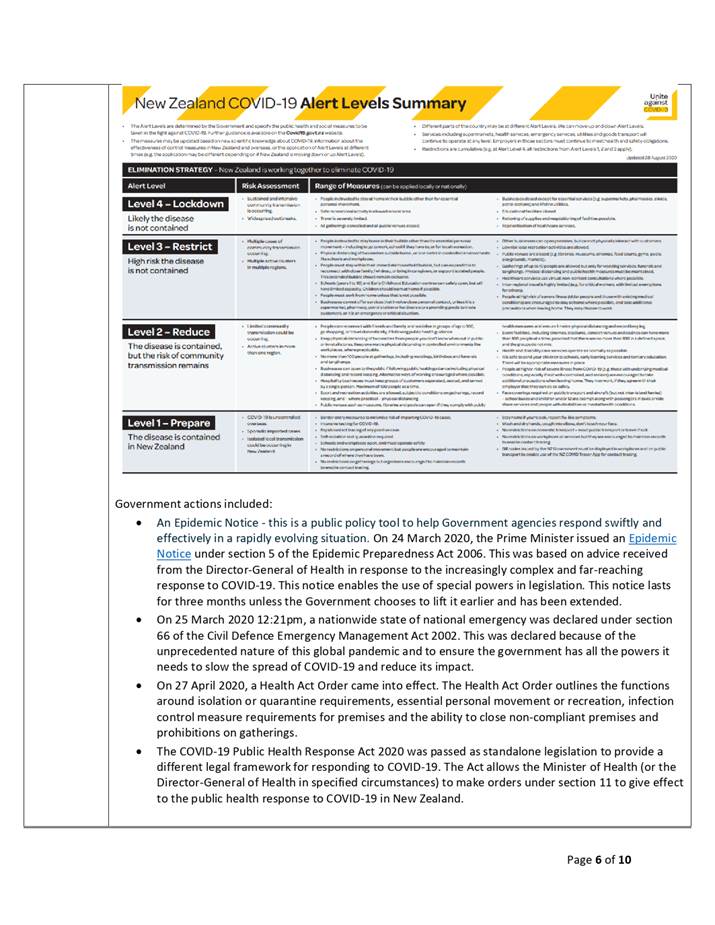

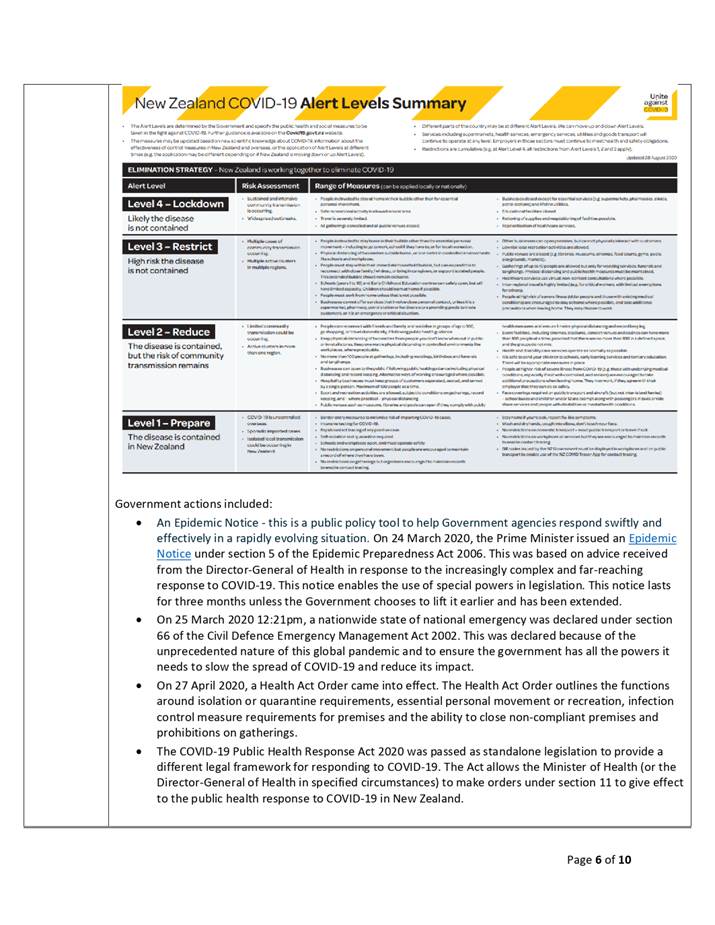

Emergent Risk:

Three further emergent organisational risk has been identified:

1. Extending the Government Procurement Rules to Government

entities in the New Zealand public sector; and

2. Central/Local Government Three Waters Reform Programme

3. Whenua Māori rating

To provide a fuller view of the risk landscape a table of previously

identified emergent risk is provided (see Table 1).

Description and high-level analysis of emergent risk:

1. The Ministry of

Business, Innovation and Employment (MBIE) is undertaking a public consultation

(closing 23 November) to understand the potential benefits, opportunities, and

other impacts of extending the Government Procurement Rules to a wider set of Government

entities in the New Zealand public sector.

MBIE rationale

for this proposed change is that each year the New Zealand public sector spends

around $42 billion on goods, services and works from third party suppliers to

build infrastructure and provide public services. The size and nature of this

spend means that there is an opportunity for Government procurement to achieve

better social and economic outcomes for New Zealanders, as well as meeting the

public’s expectation that taxpayer money is spent appropriately and

competently by Government organisations. In the current policy settings, Government

is limited in its ability to influence Government procurement policies in the

State and Public Sector.

MBIE have

identified several potential benefits and what they describe as “some

likely costs and other impacts” to extending the Government Procurement

Rules to include Local Government. This will include Far North Holdings

Limited.

Local Government

procurement specialists are making submissions.

While the full

impact of these changes is currently unknown a review of the proposed change by

FNDC has identified the following emergent risk:

The proposed Government

changes, to Local Government procurements of $100,000 and greater, means that

there is a chance procurements will cost more, take longer, and mandatory

processes will require more staff time to manage and deliver. The changes have

the potential to lead to negative economic impact within the district as Local

suppliers may reduce participation due to increased cost and complexity of

procurements. Projects will take longer to deliver due to extended procurement

timelines and negatively impact affordability due to the increased costs to

FNDC to administer the Rules which include new reporting and planning requirements.

2. Over the past three

years, Central and Local Government have been considering solutions

to challenges facing delivery of three waters services to communities.

This has seen

the development of new legislation and the creation of Taumata Arowai, the new

Water Services Regulator, to oversee and enforce a new drinking water

regulatory framework, with an additional oversight role for wastewater and

stormwater networks.

The Government

has indicated that its starting intention is public multi-regional models for

water service delivery to realise the benefits of scale for communities and

reflect neighbouring catchments and communities of interest. There is a

preference that entities will be in shared ownership of Local

authorities. Design of the proposed new arrangements will be informed by

discussion with the Local Government sector.

With the options

and proposals to be developed the impact of any reform changes on both FNDC,

and the communities we serve, are unknown.

3. The Government is

proposing amendments to the Local Government (Rating) Act 2002 to promote the

development of Māori freehold land and to modernise the rating legislation

relating to Māori freehold land. The Local Government (Rating of Whenua

Maori) Amendment Bill will soon go to its second reading. This legislation will

make unusable/unproductive Māori Freehold Land unrateable. Council will

then be in a position of having to spread operating costs amongst fewer

ratepayers. This will exacerbate the affordability issue. It is highly likely

that this legislation will be enacted at the beginning of July 2021.

Table 1: Table of identified emergent risk

|

Emergent Risks

|

Presented to Assurance, Risk and Finance Committee

|

Progress

|

|

1. The risk of

externally funded shovel ready, economic stimulus employment opportunity

projects due to the impact of the COVID-19 pandemic.

|

October 2020

|

Subject of a report to the Assurance, Risk and Finance

Committee meeting of October 2020.

|

|

2. The financial and

legal risks due to the effects of climate change. Timing of a report on this

risk, to the Assurance, Risk and Finance Committee meeting, is to be

determined.

|

October 2020

|

|

|

3. District Services

have proposed to escalate one of their top group risks for consideration of

inclusion on the top organisational dashboard.

|

October 2020

|

It is proposed that this be included in the Assurance,

Risk and Finance Committee risk workshop agenda.

|

|

4. The risk of not fit

for purpose business continuity arrangements.

|

October 2020

|

This will be subject to a report at the December 20

Assurance, Risk and Finance Committee meeting.

|

Organisational risk progress reports:

Four scheduled risk progress reports, including high level treatment plan

developments, are provided with highlights and analysis of risk progress below.

More detail is available in the attached risk progress reports.

No additional reporting requirement for organisational risk has been

identified.

A separate report is recommending the

removal of ARF008 Civil Defence Risk from the organisational risk dashboard

with ongoing risk oversight on the Infrastructure and Asset

Management (IAMS) Group Risk Register.

A recommendation to remove a second organisational risk, ARF002 BCA

Status Risk, will be made when the MBIE report has been received confirming the

successful October 2020 BCA audit outcome.

Work has commenced to provide an understanding of effectiveness of

controls within the organisational risk context.

Risk progress report – highlights and analysis:

1. 2020 12

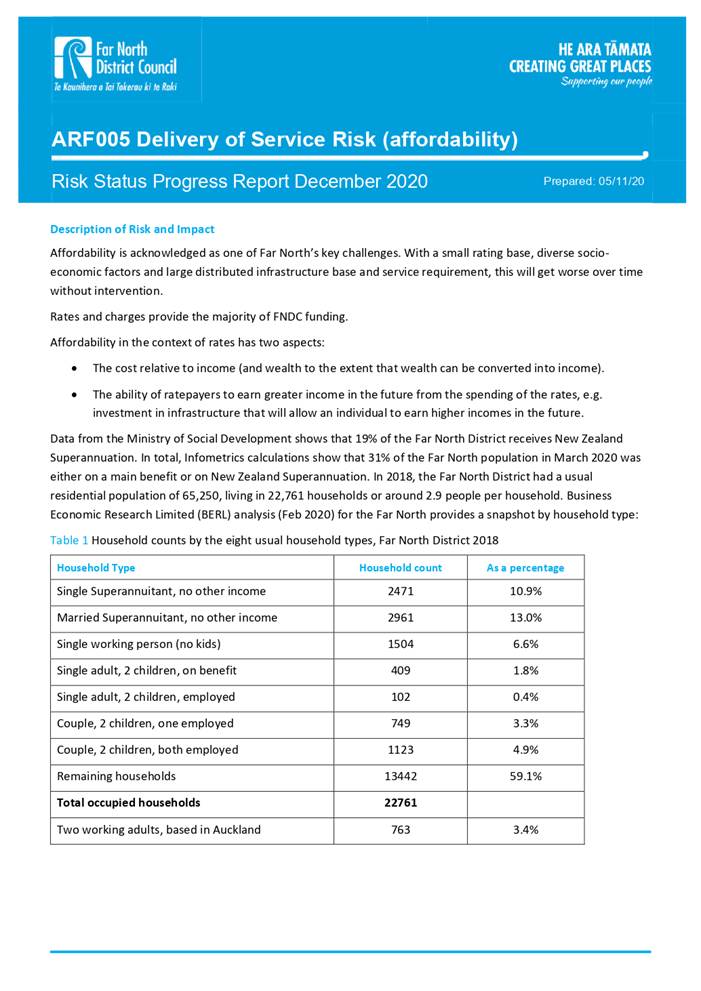

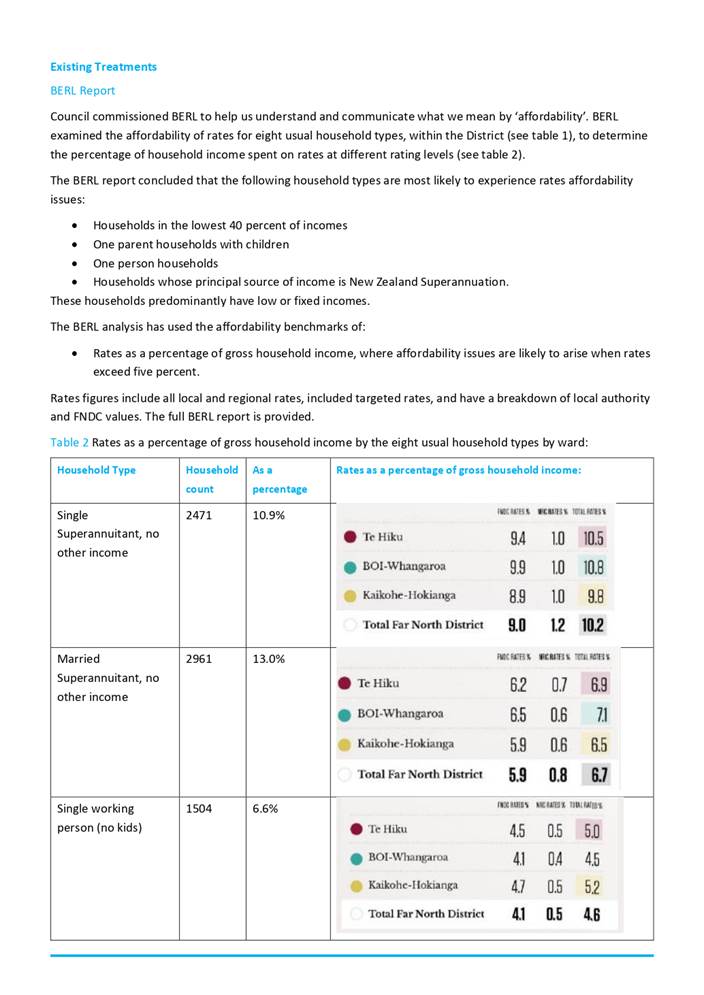

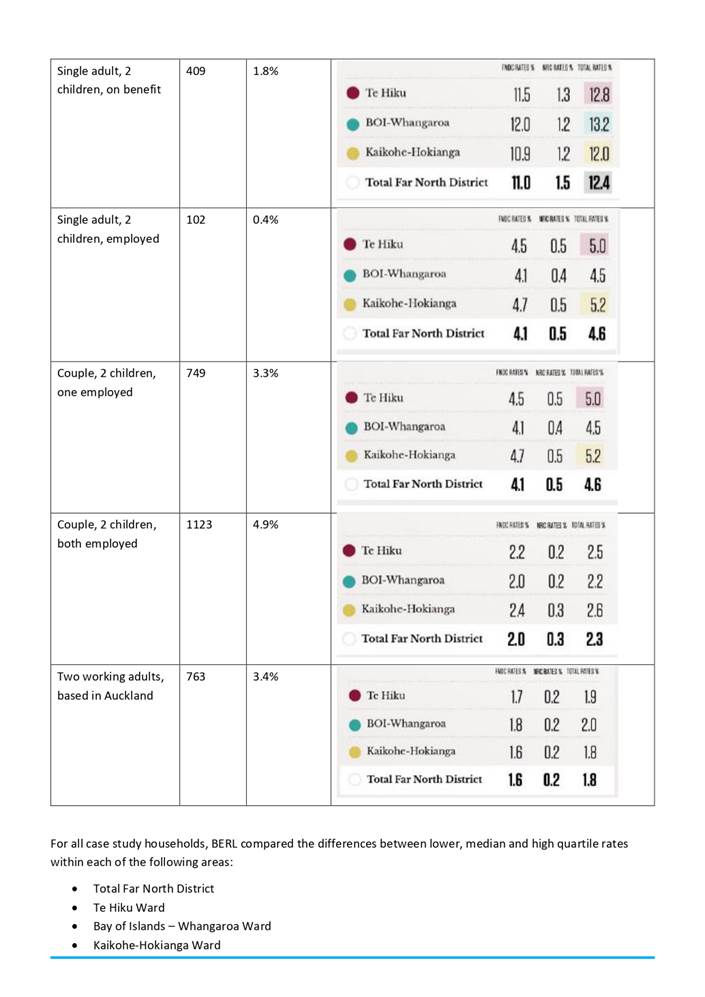

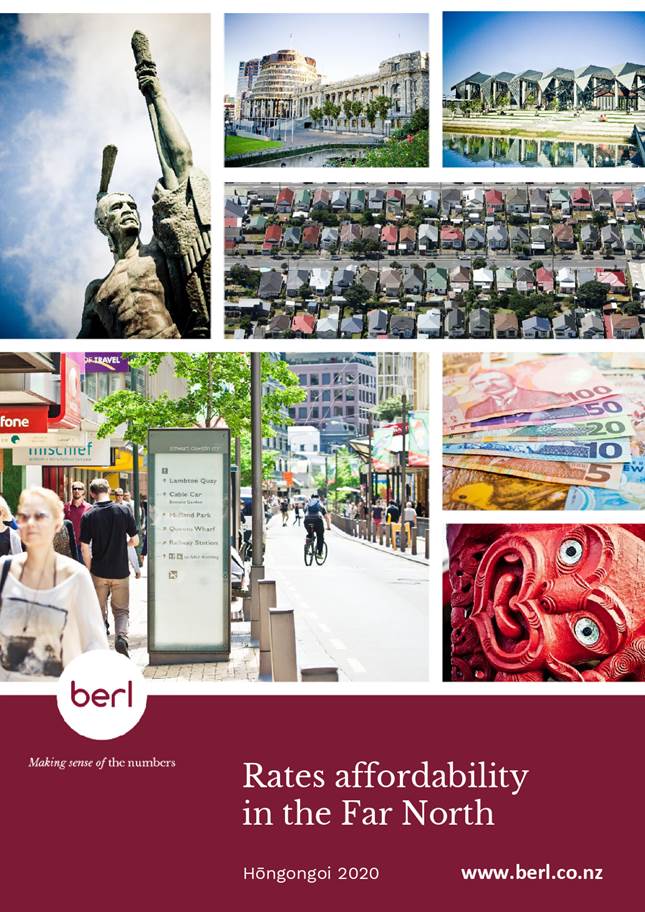

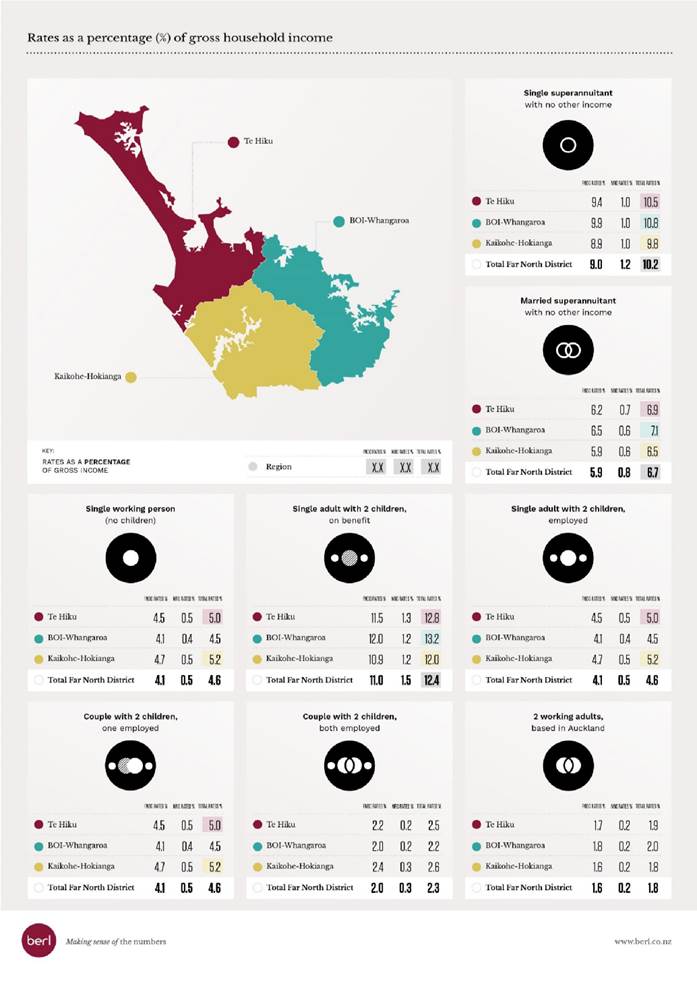

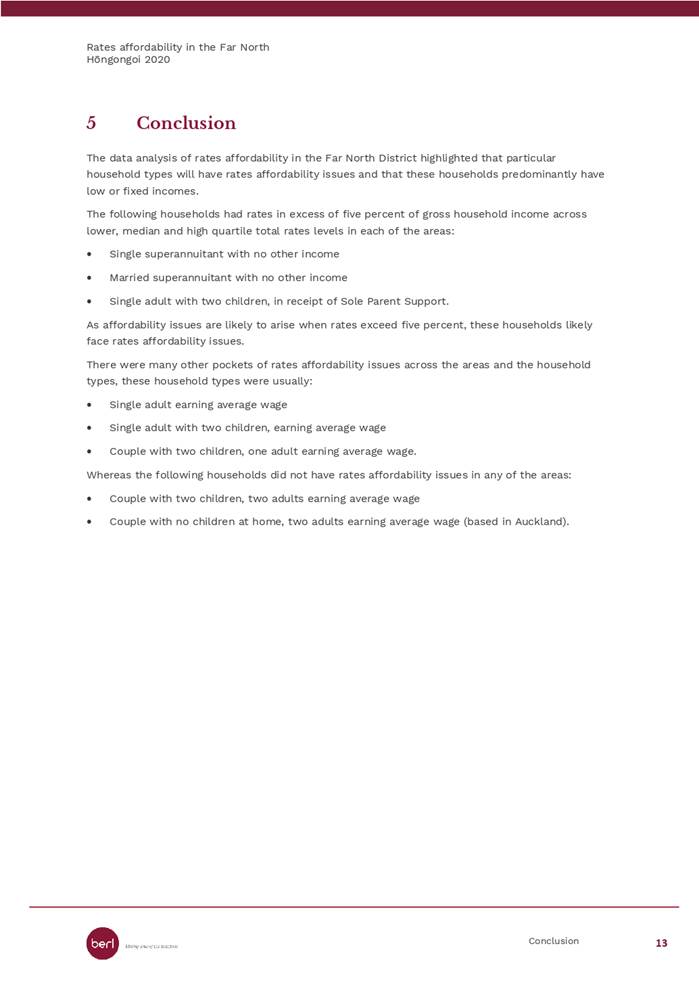

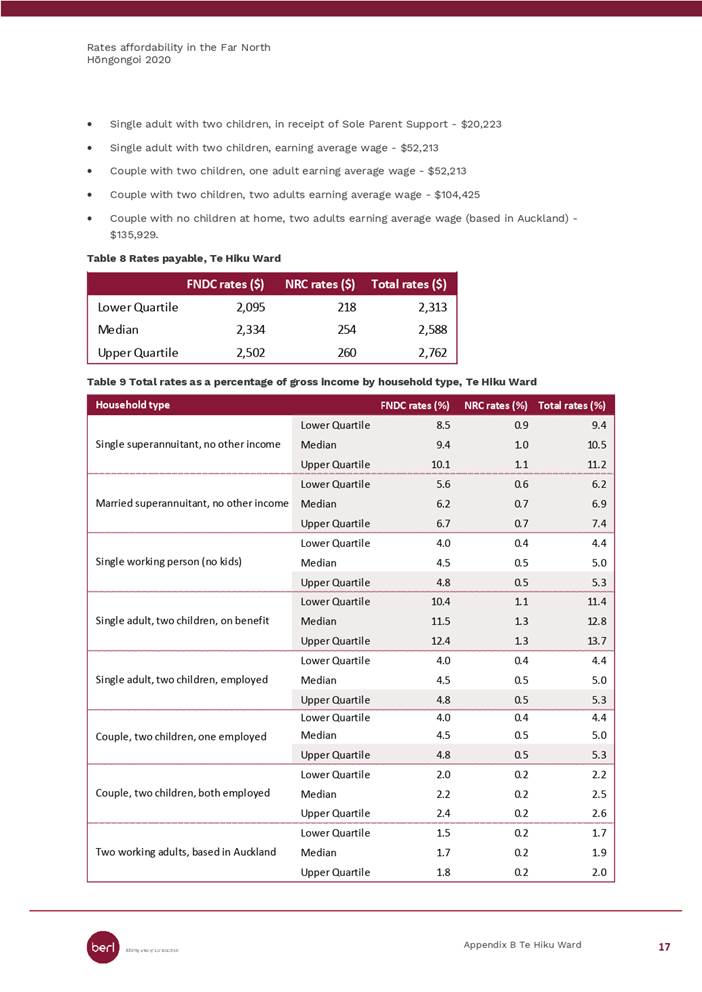

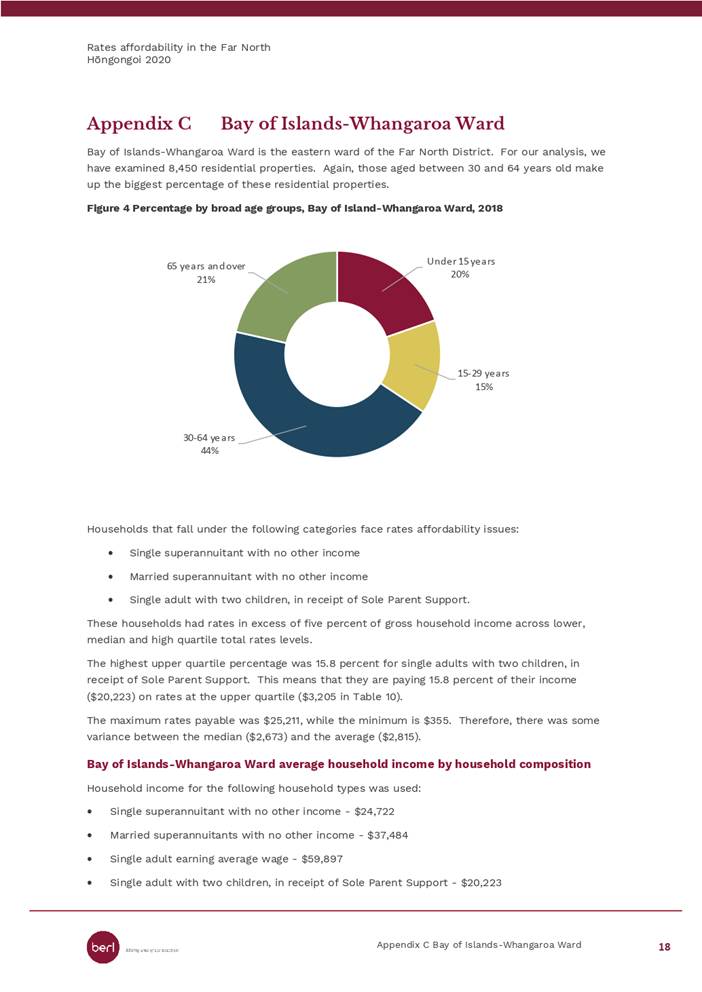

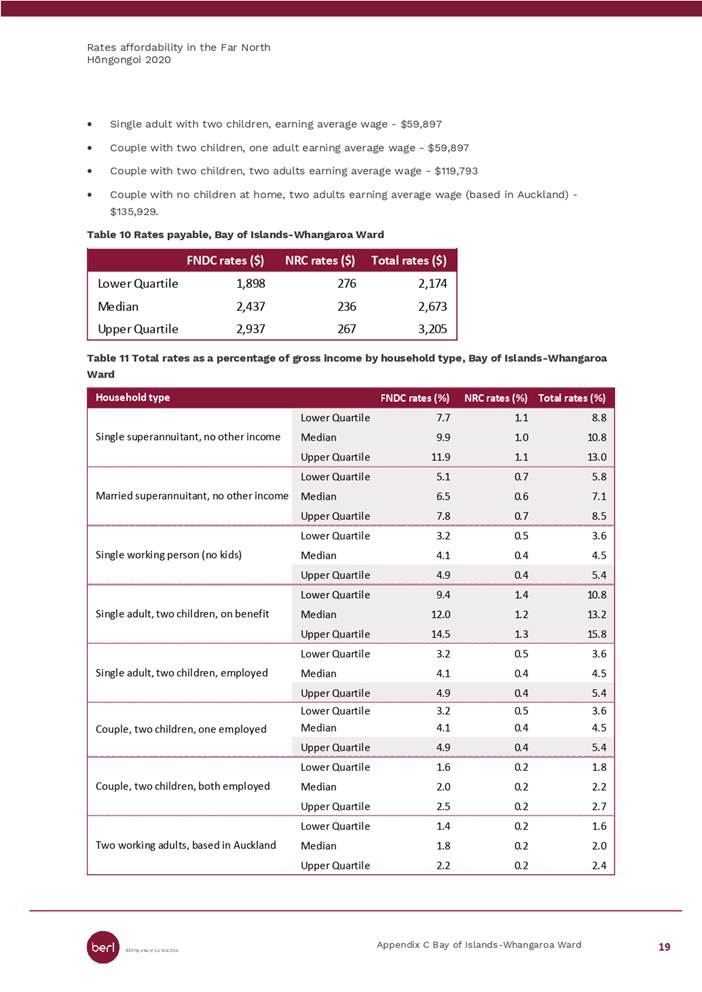

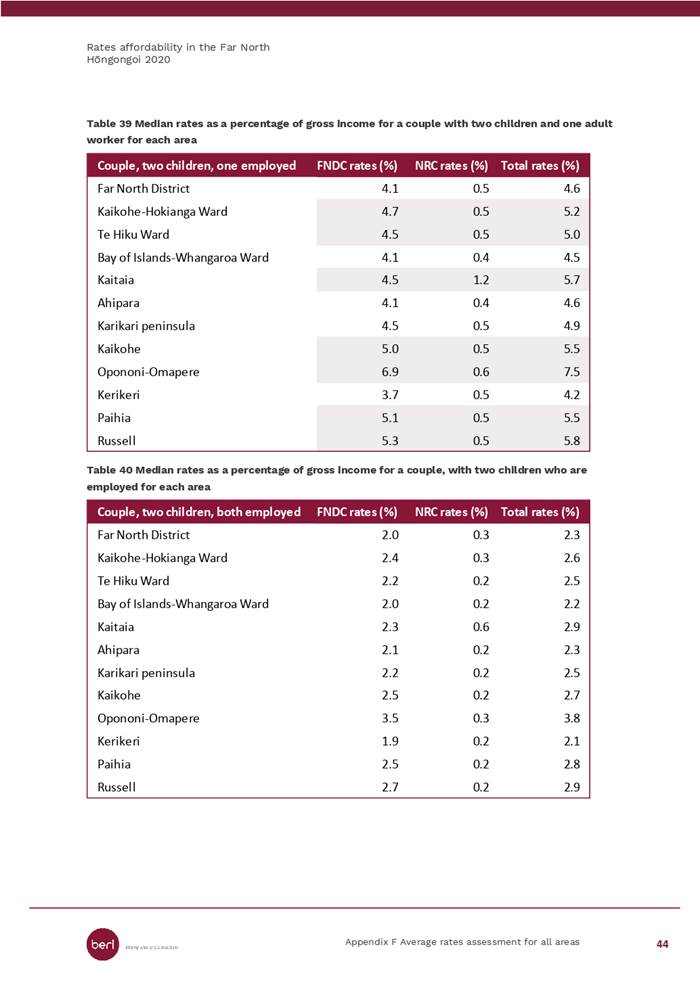

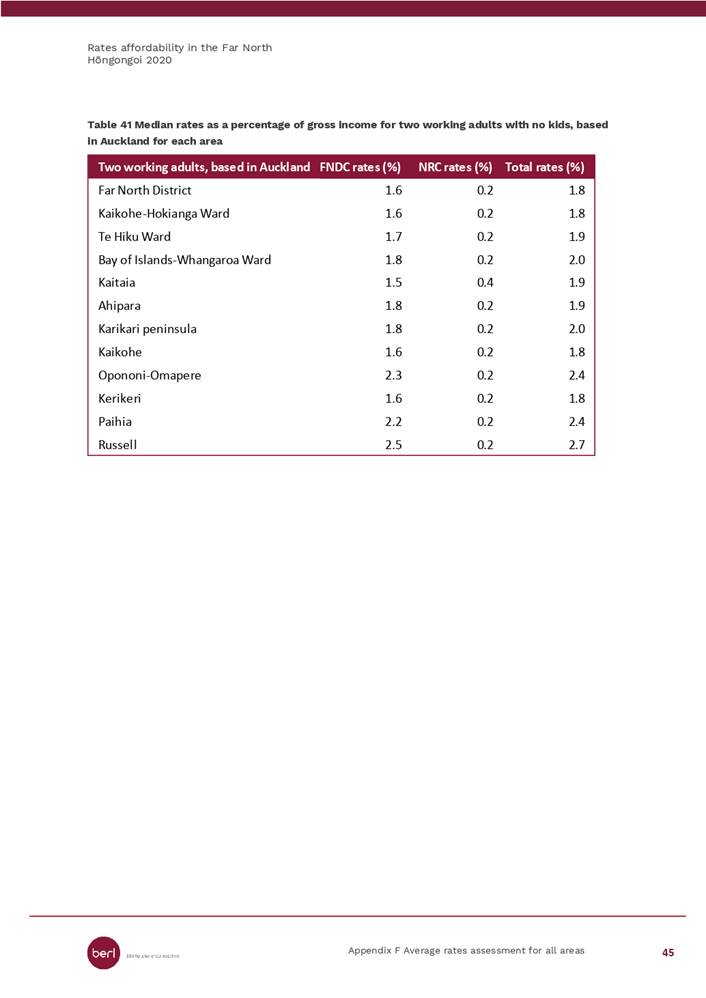

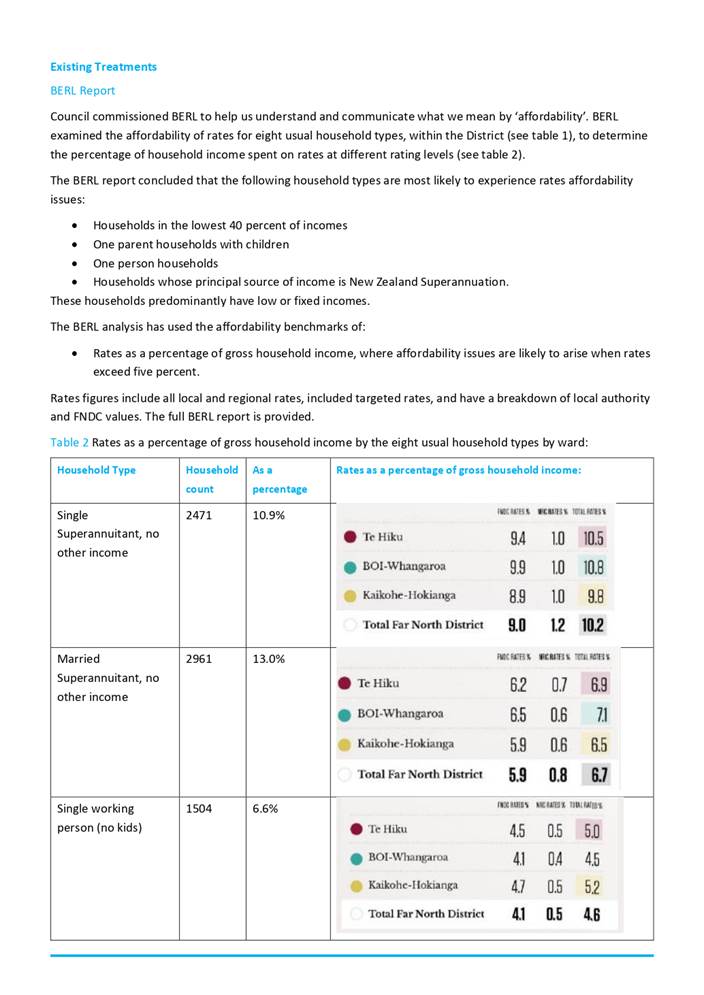

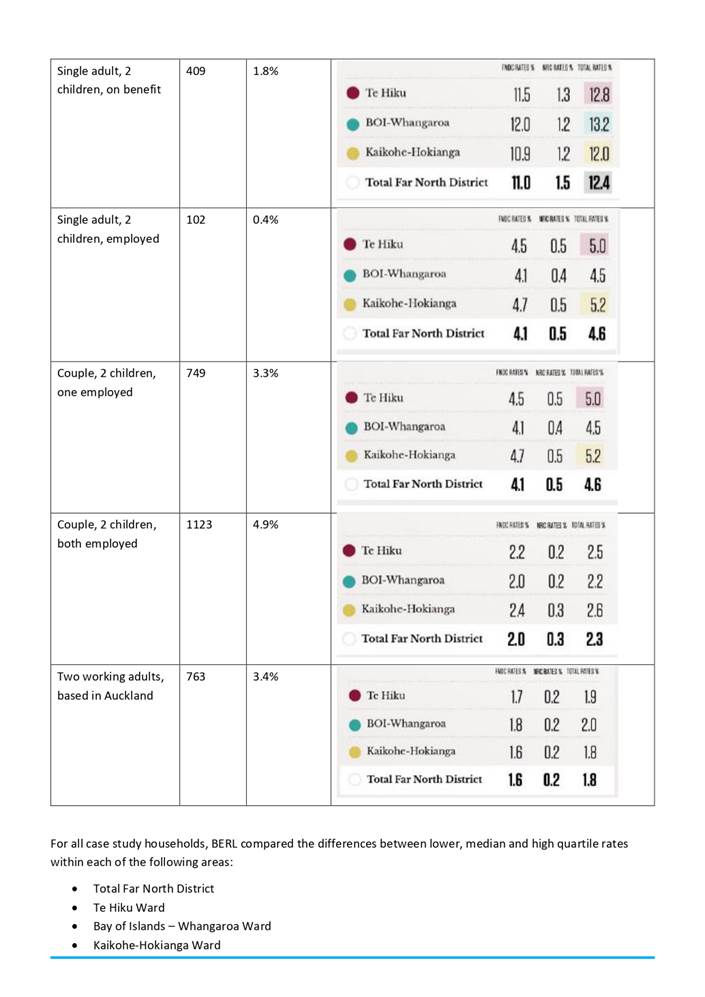

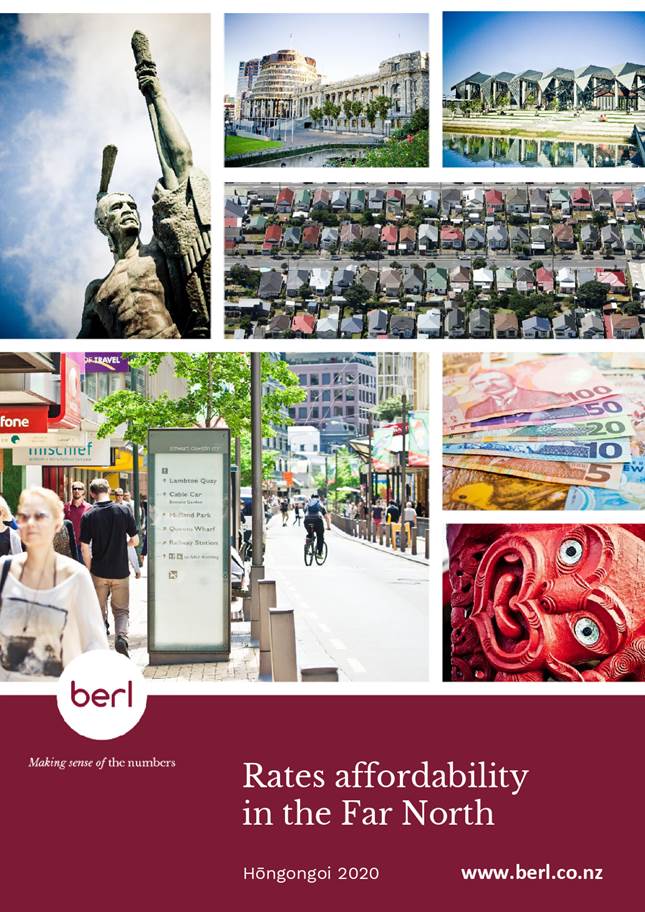

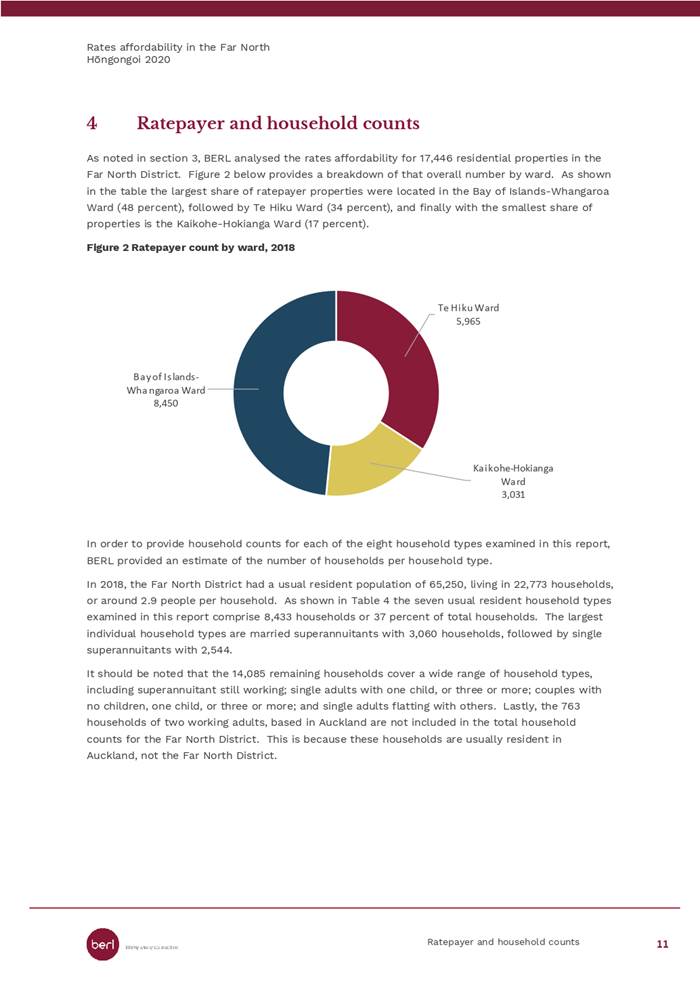

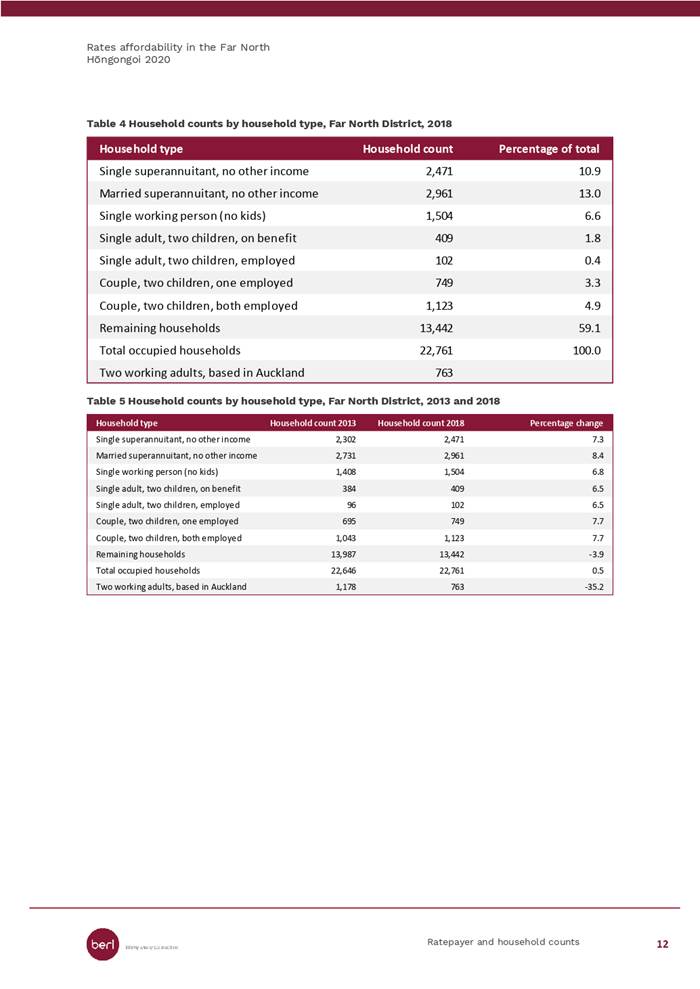

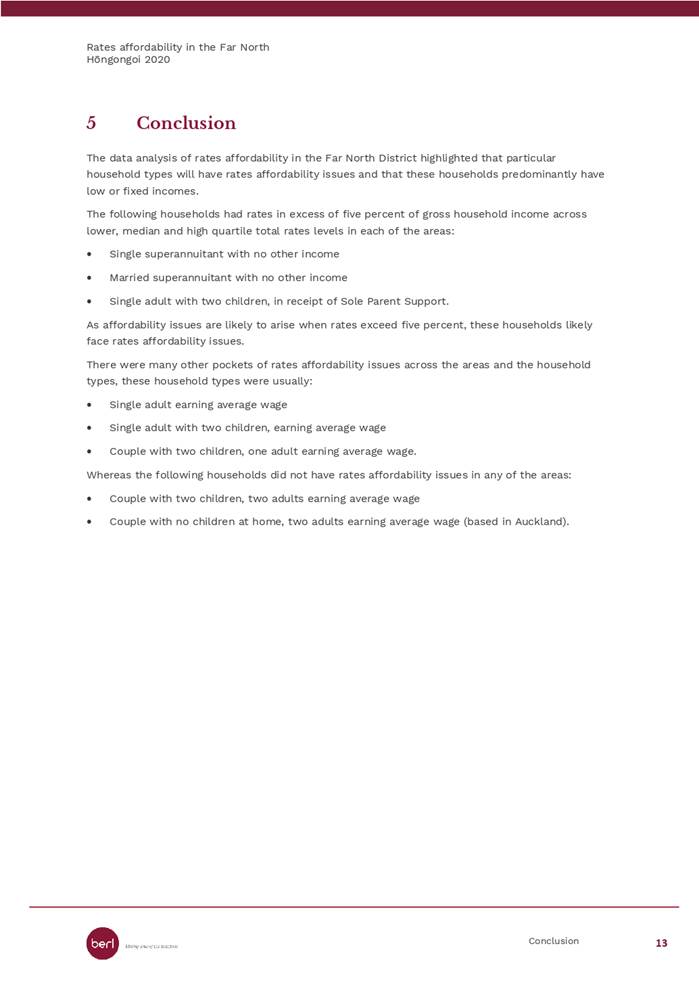

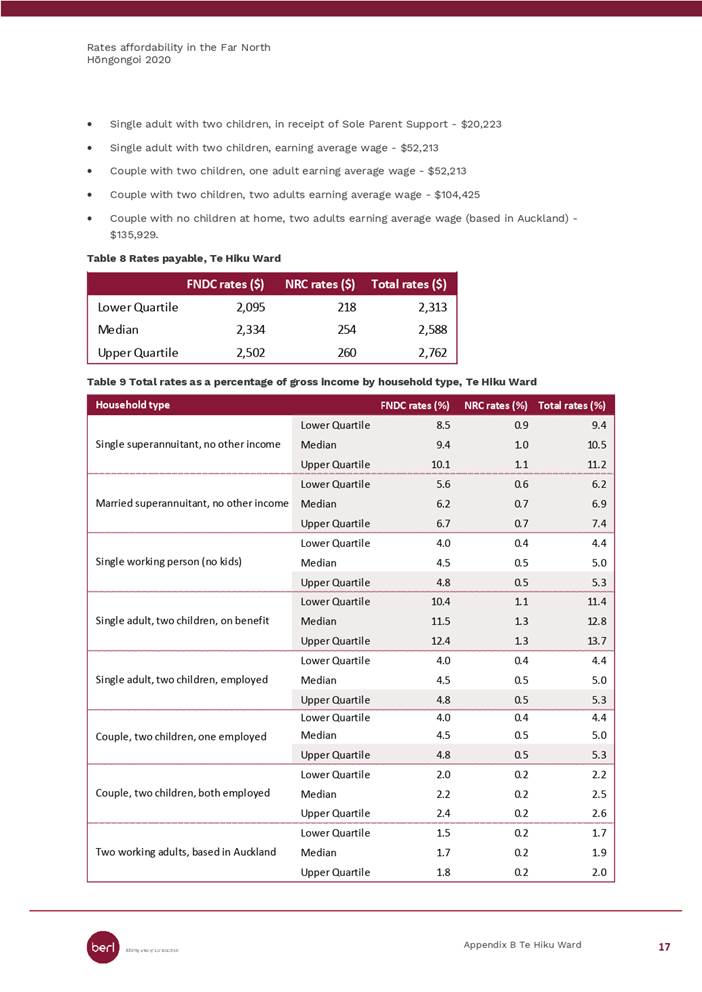

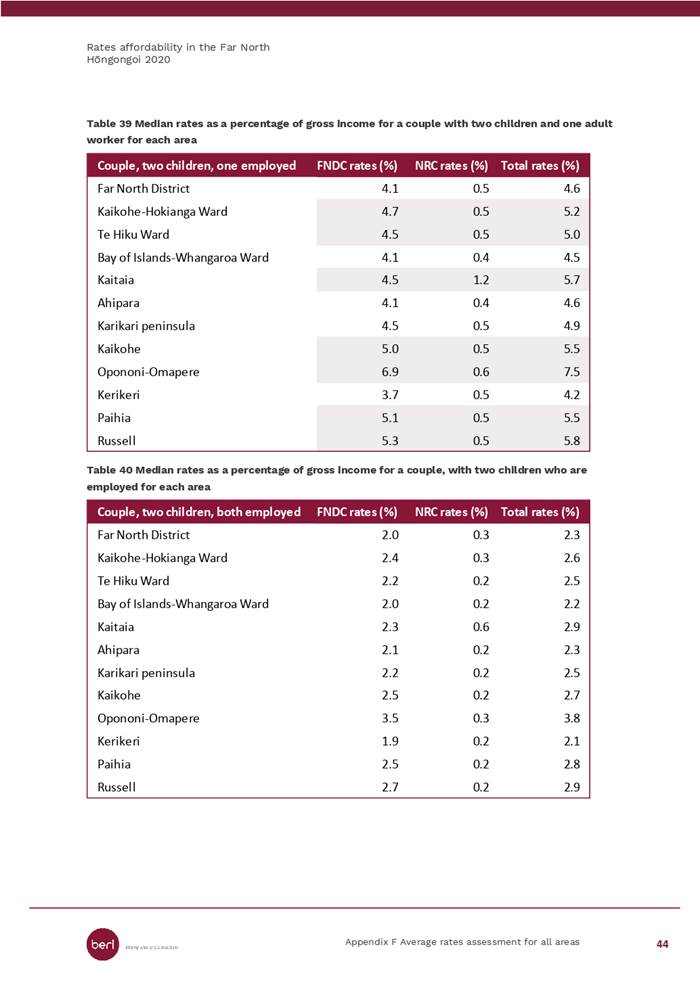

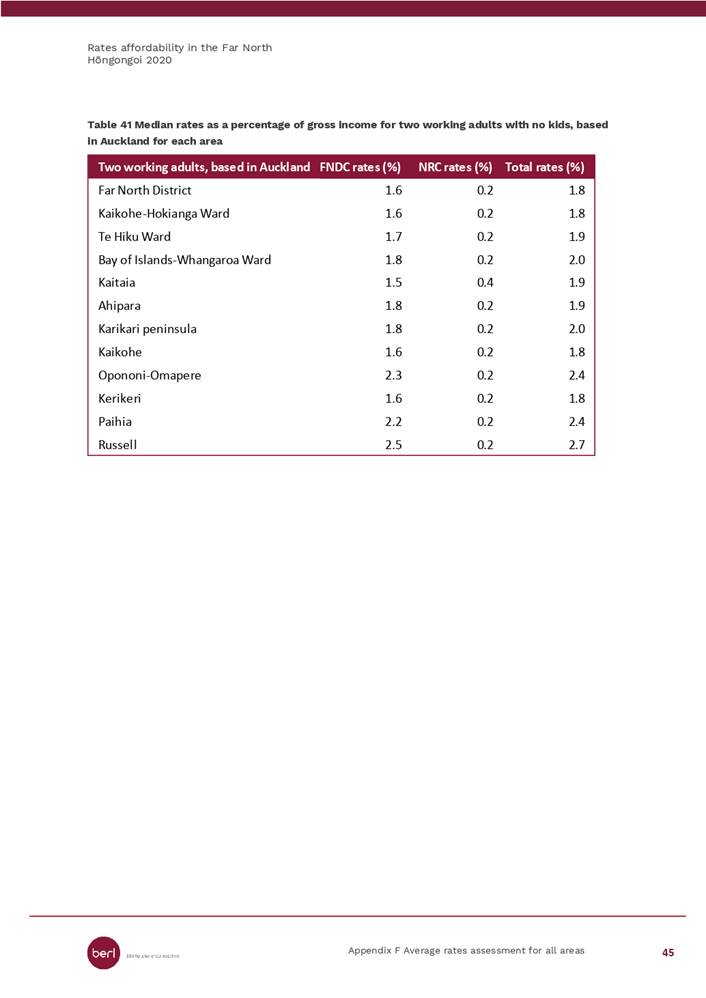

ARF005 Delivery of Service Risk (affordability) Risk Progress Report: The

inherent risk profile has been assessed as increasing. As rates and charges are

Council’s major form of funding there are limited interventions

available. To inform our understanding, Council has commissioned Business and

Economic Research (BERL) to provide an analysis of rates affordability to

determine the percentage of household income spent on rates at different rating

levels, for eight usual household types.

2. 2020

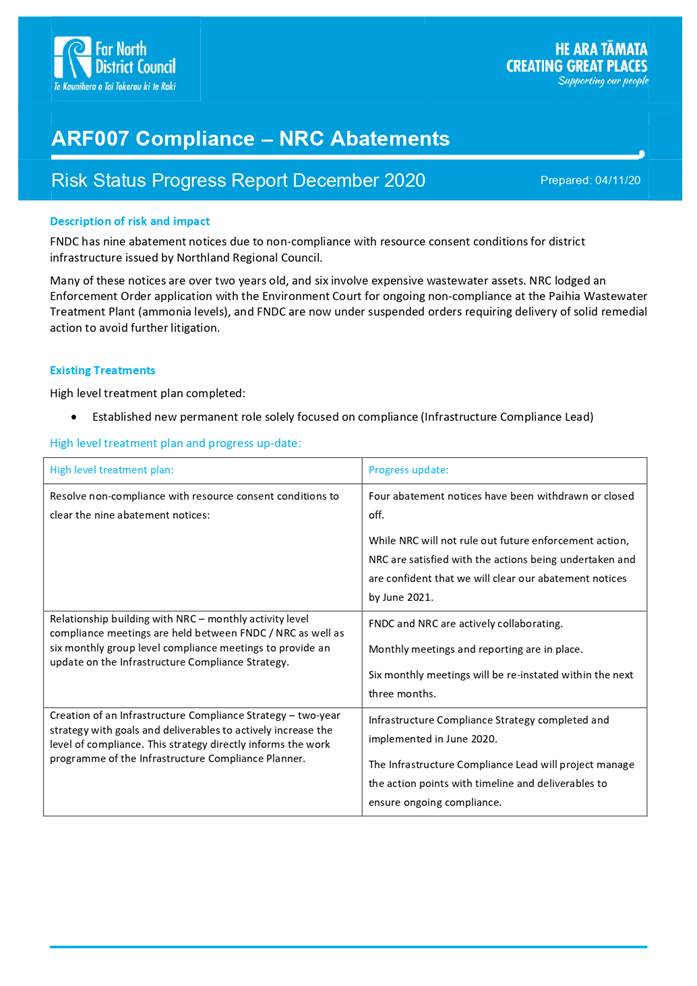

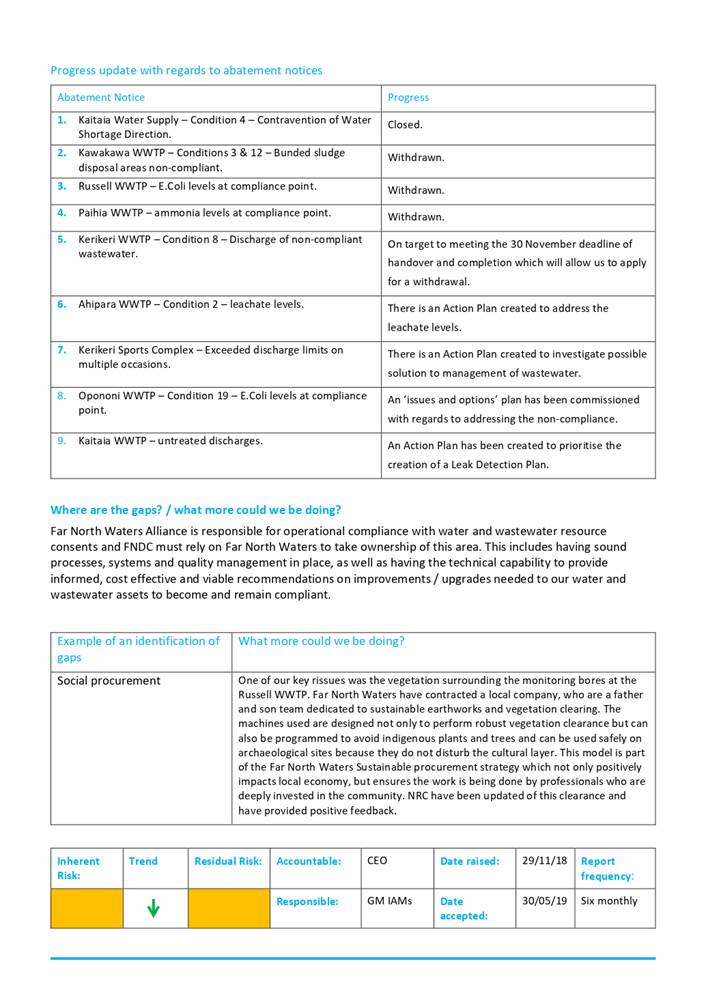

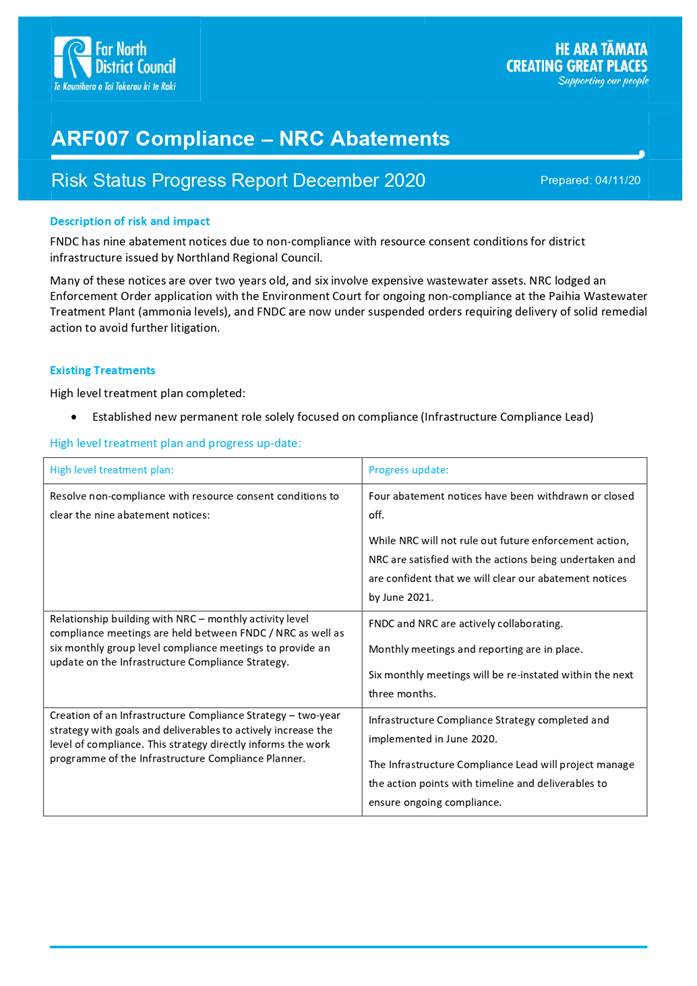

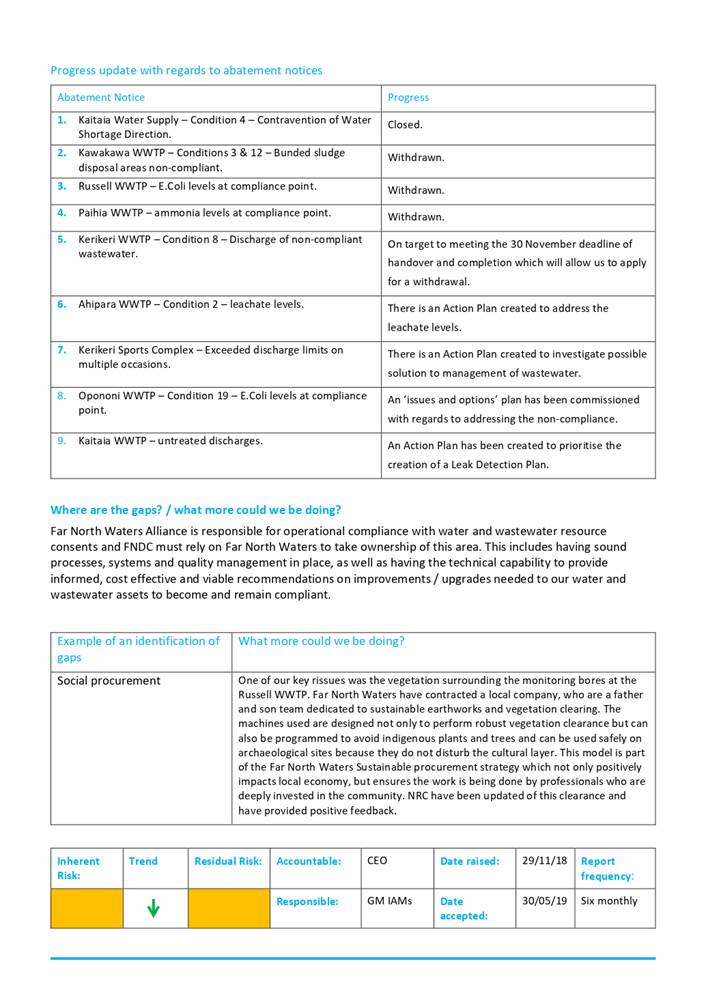

12 ARF007 Compliance Northland Regional Council (NRC) Abatements Risk Progress

Report: The inherent risk profile has been assessed as improved 44%, four of

the nine, abatement notices cleared and a confirmed plan and timeline to clear

the remaining five abatement notices.

3. 2020

12 ARF010 Data Governance Risk Progress Report: The inherent risk profile has

been assessed as improved (risk is decreasing) as several improvement

initiatives in key business areas have improved data governance.

4. 2020

12 ARF013 Drinking Water Resilience Risk Progress Report: The inherent risk

profile has been assessed as not changed. IAMS are actively working on

treatments including a programme of drought resilience work for 20/21 financial

year.

Group Risk

To enable and empower the organisation the Transformation and Assurance Team

will refresh their collaborative work programme to complete the establishment

of Group Risk Registers and risk management process. The District Services

Group Risk Register is established with regular risk discussions taking place.

Our goal is for Group Risk Registers to capture and maintain information

on the identified risks and will be used to inform elected members. At the Top

Organisational Risk Dashboard elected member workshop these risks will be

reviewed, with escalation and de-escalation of risks onto the organisational

dashboard as agreed.

Summary of Group Risk Registers:

|

Group Risk Register:

|

Number of identified risks:

|

Number of high impact/likelihood risks:

|

Commentary:

|

|

CEO Office

|

No risks have been identified.

|

|

One risk workshop with the

Communications team has been completed.

|

|

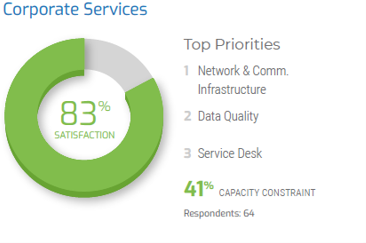

Corporate Services

|

35 departmental risks. No group risks

have been identified.

|

Two departmental risks have an inherent

risk score of 39 or greater.

|

Departmental and group risks to be completed.

Follow up sessions have been completed.

|

|

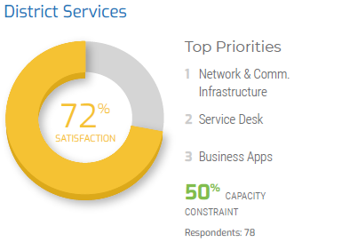

District Services

|

19 risks, made up of 15 departmental

risks and four group risks.

|

Three departmental and one group risk

have an inherent risk score of 39 or greater.

|

Proposed escalation of their top group

risk, at the ARF risk workshop, for consideration of inclusion on the top organisational

dashboard.

|

|

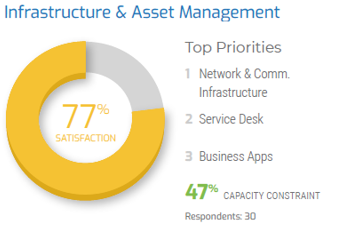

Infrastructure and Asset Management

|

44 risks, made up of 17 departmental

risks; 18 group risks; and one organisational risk.

|

Three departmental; four group risks;

and one organisational risk have an inherent risk score of 35 or greater.

|

Follow up sessions have been completed.

|

|

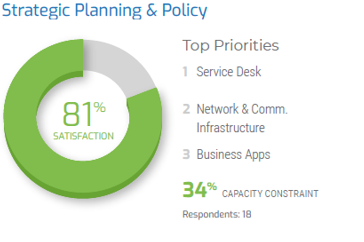

Strategic Planning and Policy

|

Six risks, three organisational with the

remaining unclassified.

|

One risk has an inherent risk score of

35.

|

Risk register progress has been

temporarily put on hold due to current workload issues.

|

Financial Implications and Budgetary Provision

No

additional budgetary provision is requested.

Attachments

1. 2020 12 ARF005

Delivery of Service Risk (Affordability) Progress Report - A3002951 ⇩

2. Far North Rates

Affordability Report - A3002966 ⇩

3. 2020 12 ARF007

Compliance NRC Abatements Risk Progress Report - A3002950 ⇩

4. 2020 12 ARF010

Data Governance Risk Progress Report - A3002949 ⇩

5. 2020 12 ARF013

Drinking Water Resilience Risk Progress Report - A3002946 ⇩

|

Assurance, Risk and Finance Committee Meeting Agenda

|

2 December 2020

|

|

Assurance, Risk and

Finance Committee Meeting Agenda

|

2 December 2020

|

|

Assurance, Risk and

Finance Committee Meeting Agenda

|

2 December 2020

|

|

Assurance, Risk and

Finance Committee Meeting Agenda

|

2 December 2020

|

|

Assurance, Risk and

Finance Committee Meeting Agenda

|

2 December 2020

|

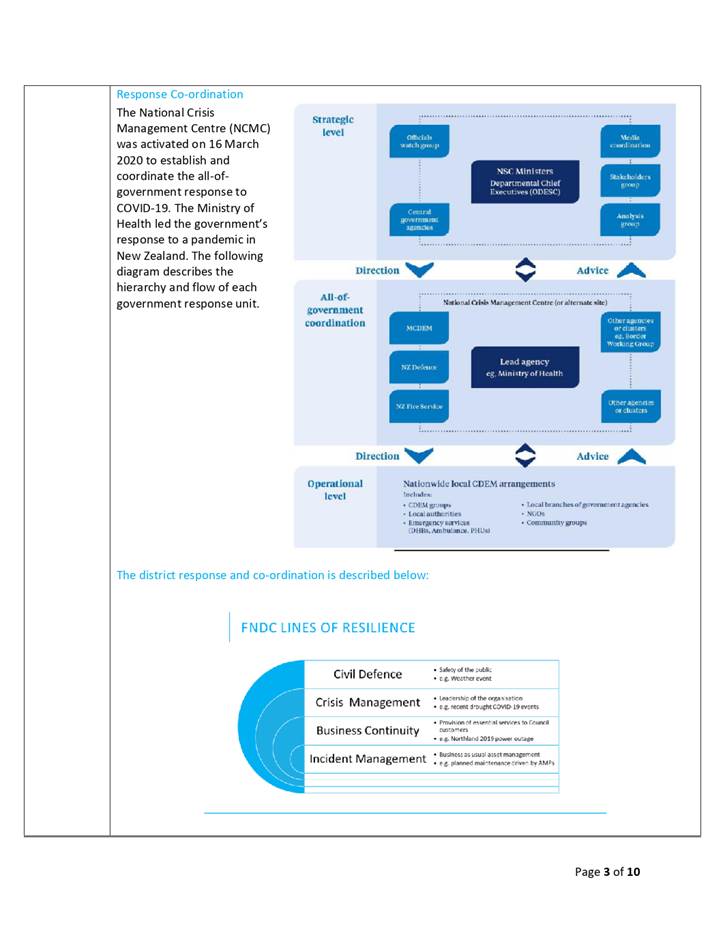

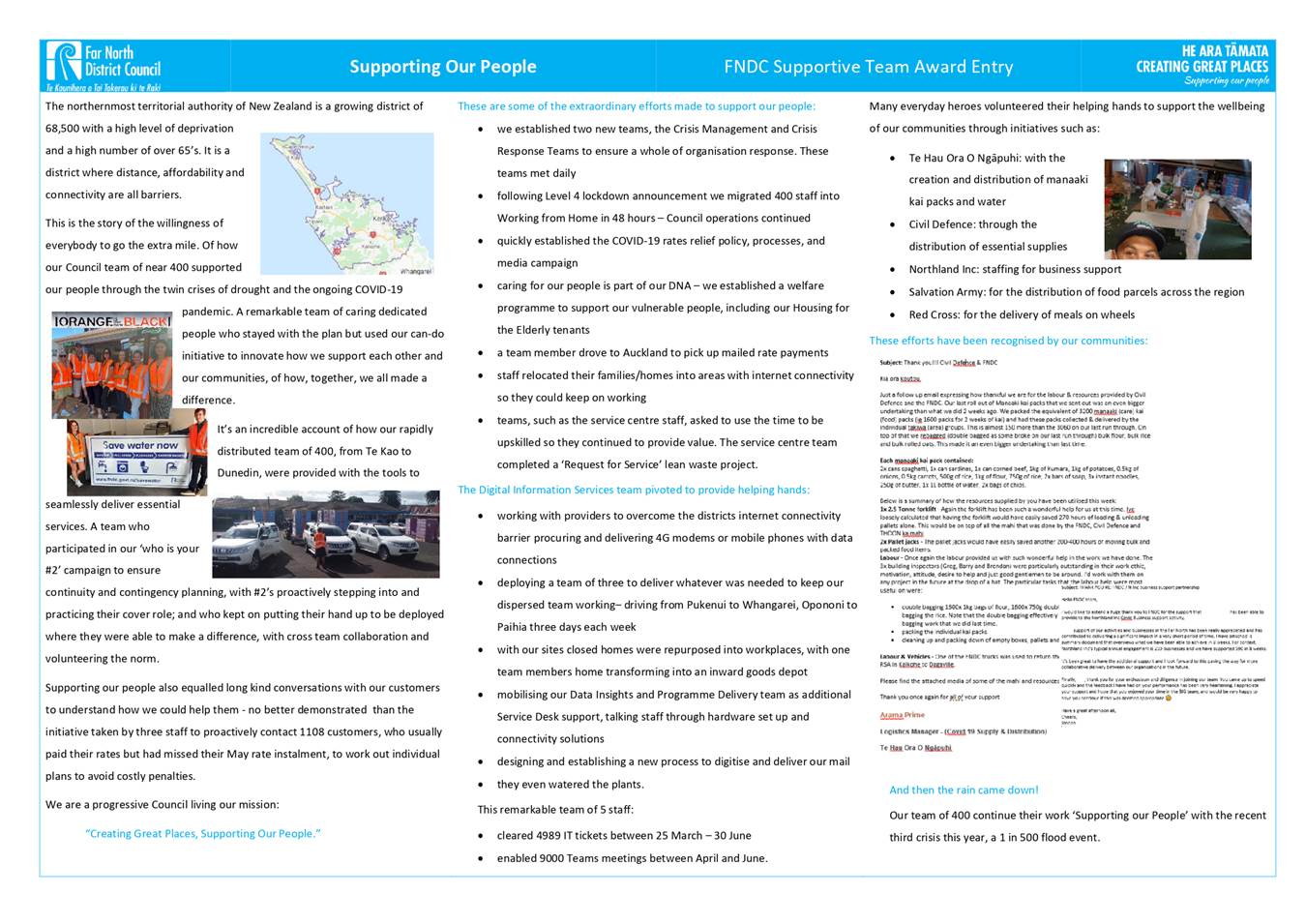

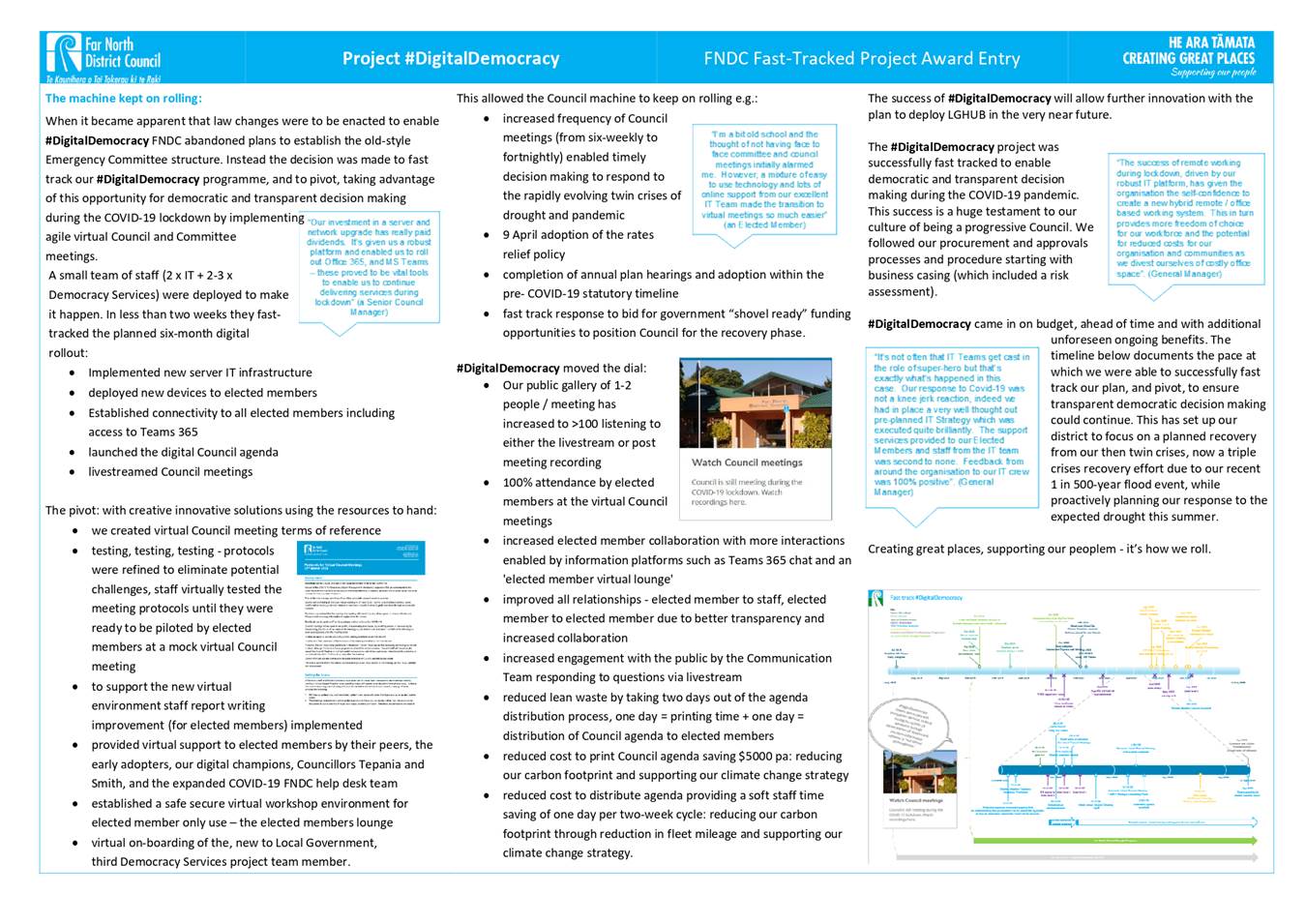

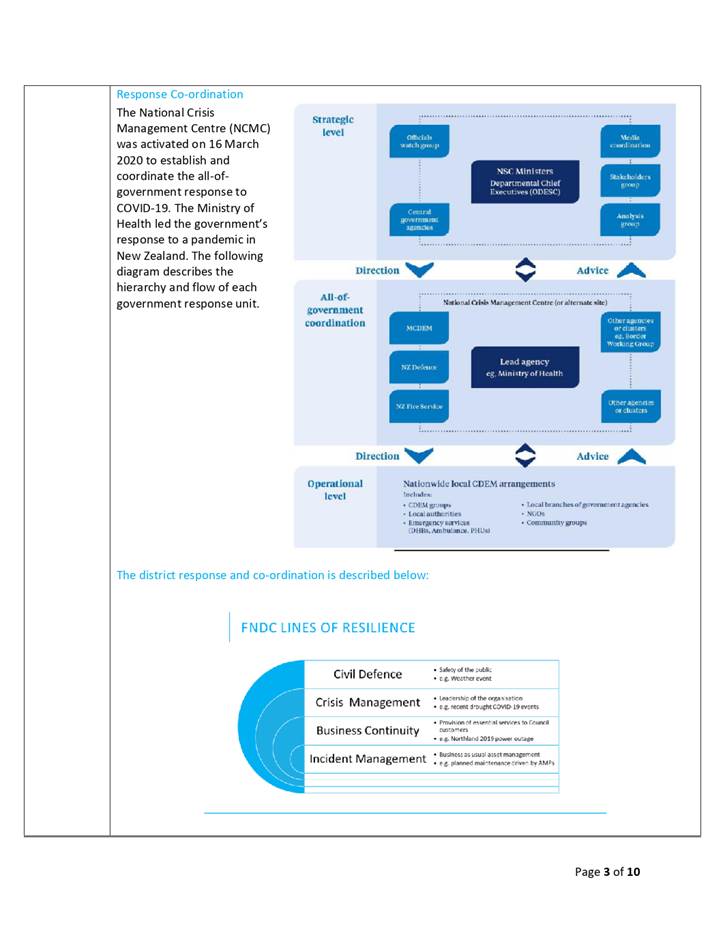

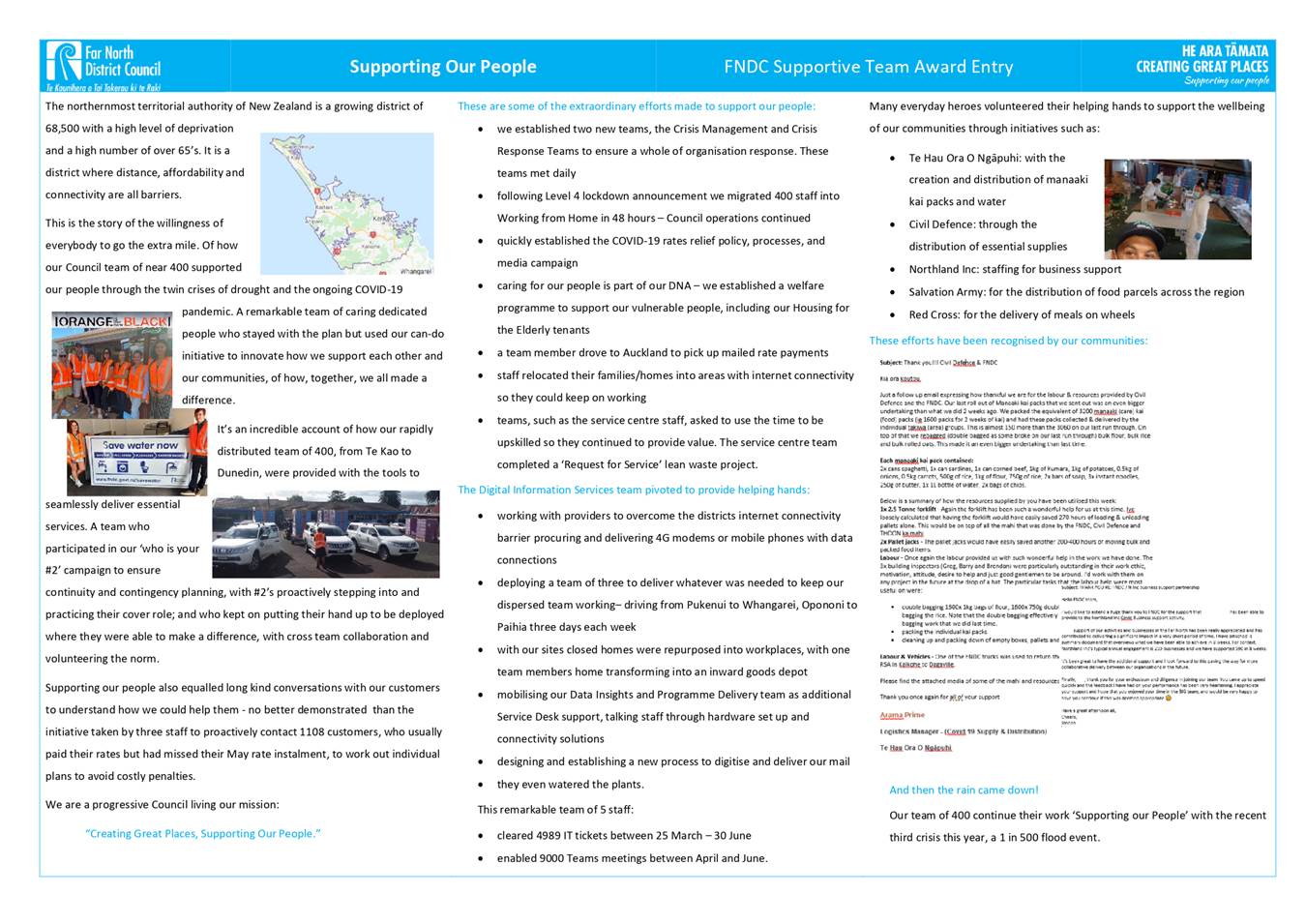

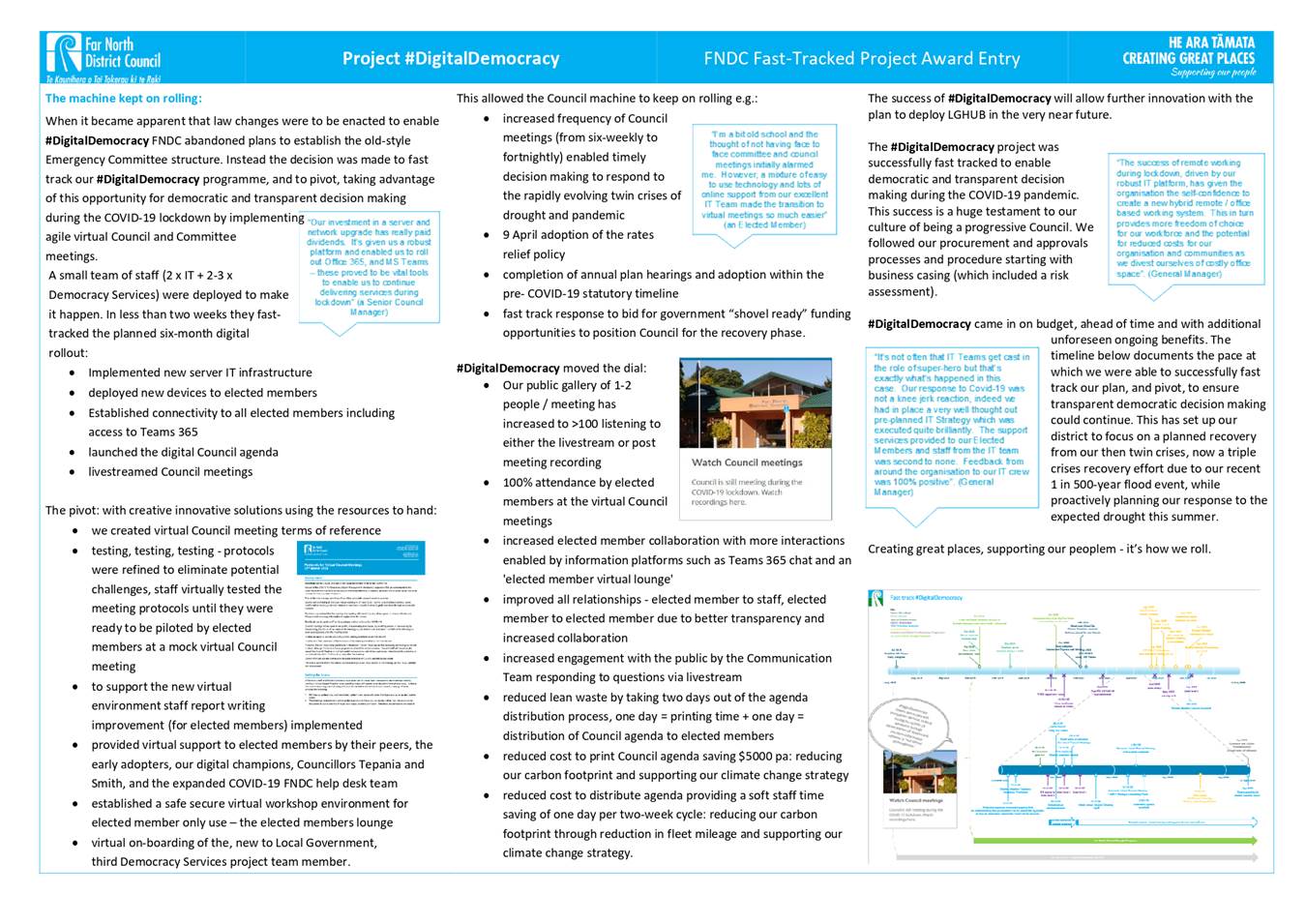

6.2 Lessons

Learned From Our Twin Crises: 2019/2020 Far North Drought and COVID-19 Pandemic

File

Number: A3002989

Author: Tanya

Reid, Business Improvement Specialist

Authoriser: William

J Taylor MBE, General Manager - Corporate Services

Purpose of the Report

To provide a report on

the lessons learned from managing two crises, the 2019/2020 Far North drought

and the COVID-19 pandemic response.

Executive Summary

·

Learning from these experiences is Central to our identity as a

progressive Council.

·

A lesson learned exercise captures the knowledge and

understanding gained by this experience. It is a principal component of an

organisational culture committed to continuous improvement and adaptive

management.

·

These Lessons Learned, from our twin crises, will inform the

evolution of our business continuity and crisis management processes to reduce

the potential for future failure and mishap and to reinforce the positive.

|

Recommendation

That the Assurance, Risk and Finance Committee receive

the report Lessons Learned From Our Twin Crises: 2019/2020 Far North Drought

and COVID-19 Pandemic.

|

Background

In February 2020, the

Council set up both a Crisis Management Team (CMT) and a Crisis Response Team

(CRT).

These teams were set up

to manage the Council’s response to the dual crises of the 2019/2020

district-wide drought and the 2020 COVID-19 pandemic.

Discussion and Next Steps

Learning from these

experiences is Central to our identity as a progressive Council. A lesson

learned exercise captures the knowledge and understanding gained by this

experience.

Three groups of staff

(CMT, CRT and supporting staff), totalling 33, participated in separate bespoke

Lessons Learned workshops. Design of these workshops was based on an agile

retrospective and identified:

• what

we did well

• the

challenges faced

• what

we will do differently next time.

A number of initiatives

are in place, or planned, to use these learnings to evolve our business

continuity and crisis management processes.

The full Lesson’s

Learned report is attached.

Financial Implications and Budgetary Provision

No

additional budgetary provision is requested.

Attachments

1. 2020 10 Lessons

learned from the twin crises report - A3007269 ⇩

2. FNDC Supporting

Team Award Entry - A3002994 ⇩

3. FNDC Fast-Tracked

Project Award Entry - A3002993 ⇩

|

Assurance, Risk and Finance Committee Meeting Agenda

|

2 December 2020

|

|

Assurance, Risk and

Finance Committee Meeting Agenda

|

2 December 2020

|

|

Assurance, Risk and Finance Committee Meeting Agenda

|

2 December 2020

|

6.3 Internal

Audit and Assurance - December 2020

File

Number: A3001786

Author: Celine

Carlisle, Audit and Assurance Specialist

Authoriser: William

J Taylor MBE, General Manager - Corporate Services

Purpose of the Report

To provide the Assurance,

Risk and Finance Committee with an update on internal and external audits, and

any associated recommendations.

Executive Summary

This report provides an

update on internal and external audit recommendations. Since the last report on

21 October 2020 no recommendations have been freshly completed. Consideration

of more meaningful reporting, tracking and measuring of all recommendations has

begun. Design work for this reporting process is being tested. Additional data

is being collected for input of these new measures. More dynamic reporting will

ensure active solutions capture, uphold and reinforce the original intent of

each audit recommendation. An additional output of these measures will be community

enhancing solutions that work and better flow of audit recommendations through

to completion.

|

Recommendation

That the Assurance, Risk and Finance Committee receive

the report Internal Audit and Assurance - December 2020.

|

Background

There are active plans in

place to complete most outstanding recommendations. For those that have stalled

the new reporting system will ensure they are completed in a timely manner.

Audit recommendations as

at 12 November 2020:

|

ID

|

Audit Name

|

Title

|

Assigned To

|

Priority

|

Status

|

Description

|

|

23

|

Internal Audit –

Information Security

|

External user access

and authentication

|

Lisa Huria, Celine

Carlisle

|

Must do

|

Almost complete

|

Network logon account

internal audit completed.

Progress:

IT team actioning audit

findings.

|

|

28

|

Internal Audit –

Information Security

|

Project Security Risks

|

Michelle Sharp

|

Should do

|

Underway

|

Information security

controls need to be factored into Council's project management framework to

ensure associated risks are managed.

Progress:

The Project Management

Office (PMO) continue to develop a checklist upholding information security

for project delivery, completion December 2020. Information Security

considerations to be included in Project Management Framework training to all

key staff and inductions.

|

|

58

|

KPMG - Procurement

|

Spend monitoring

|

Petrina Keane

|

Should do

|

Underway

|

Implement quarterly

procurement spend analysis.

|

|

59

|

KPMG - Procurement

|

Spend monitoring

|

Petrina Keane

|

Should do

|

Underway

|

As part of the spend

analysis process, integrate category spend management on a periodic basis.

|

|

74

|

2017 Audit NZ Interim

Annual Management Report

|

Legislative Compliance

System

|

Celine Carlisle

|

Should do

|

On hold

|

Audit NZ recommend a

mechanism for monitoring compliance with legislative requirements is put in

place as part of the Council’s overall risk management strategies.

Stakeholder interviews

completed. A range of possible solutions have been investigated. The next

step is to procure a legislative compliance system, and this will be

considered in future budgets.

|

|

99

|

Contract Management

Review

|

Set contract management

guidelines

|

Warren Ure

|

Must do

|

Underway

|

Focus to set

organisation wide contract management guidelines, encompassing the three main

contractual areas: physical works, fixed term operational and maintenance,

and goods and services. This encompasses the four contract stages: contract

planning and development, contract execution, contract management and

contract review/close-out.

Progress:

Contract Management

Policy and Framework progressing.

|

|

105

|

2018 Audit NZ Final

Annual Management Report

|

Resource Management

Deposits (Bonds)

|

Ian Wilson

|

Must do

|

On hold

|

When testing the

liability balance related to resource management deposits, Audit NZ found

some deposits in the listing were received 18 years ago.

They recommended

resource management deposits be reviewed and an assessment made as to whether

they still meet the definition of a liability. If not, they should be

released to revenue.

The Compliance Team

have undertaken analysis and site inspections to determine which bonds can be

refunded.

|

|

111

|

Three Waters Interim

Alliance Agreement Review

|

Education of Alliance

contracts and principles

|

Glenn Rainham

|

Should do

|

Underway

|

Greater education for

staff regarding expectations of an Alliance contract and understanding of the

Alliance principles.

Toolbox sessions are

held regularly with Far North Waters.

|

|

115

|

Three Waters Interim

Alliance Agreement Review

|

Agree on Key

Performance Indicators (KPI)

|

Glenn Rainham

|

Should do

|

Underway

|

Agree on the

KPI’s through the Alliance Management Team, including finance and

contract performance, proactiveness and innovation, and co-developed Health

and Safety.

|

|

123

|

2019 Audit NZ Final

Annual Management Report

|

Deferral of capital

expenditure

|

Andy Finch

|

Must do

|

Underway

|

Audit NZ recommend the

Council consider the impact of deferred capital expenditure on asset

condition and any potential impact this may also have on Council’s

asset valuations and impairment assessments for future reporting cycles.

Council has commenced

Programme Darwin which is aimed at addressing issues with asset management.

Delivery of the capital programme being one of these issues. Council is

reviewing the capital programme to ensure it is achievable from inception and

limited to what can reasonably be delivered.

|

|

138

|

LGOIMA Compliance and

Practice Report

|

Amend operational

guidance on staff intranet to comply with LGOIMA

|

Carla Ditchfirled-Hunia

|

Must do

|

Almost complete

|

SLT approved the

policy. Legal Services working with Communications and IT teams to place it

on the Intranet.

|

|

139

|

LGOIMA Compliance and

Practice Report

|

Develop a Proactive

Release Policy

|

Carla Ditchfield-Hunia

|

Must do

|

Almost complete

|

The Proactive Release

Policy is nearing completion. As a result of the adoption of this

policy, Legal Services will commence work on establishing the processes for

proactive release of information, as well as how we manage publicly excluded

items according to the policy guidelines. The Proactive Release Policy is

complete and adopted.

Progress:

The Ombudsman has been

updated on progress as it continues.

|

Complete:

0

Almost complete: 3

Underway:

7

On hold:

2

Total:

12

Financial Implications and Budgetary Provision

This report is for

information only.

Attachments

Nil

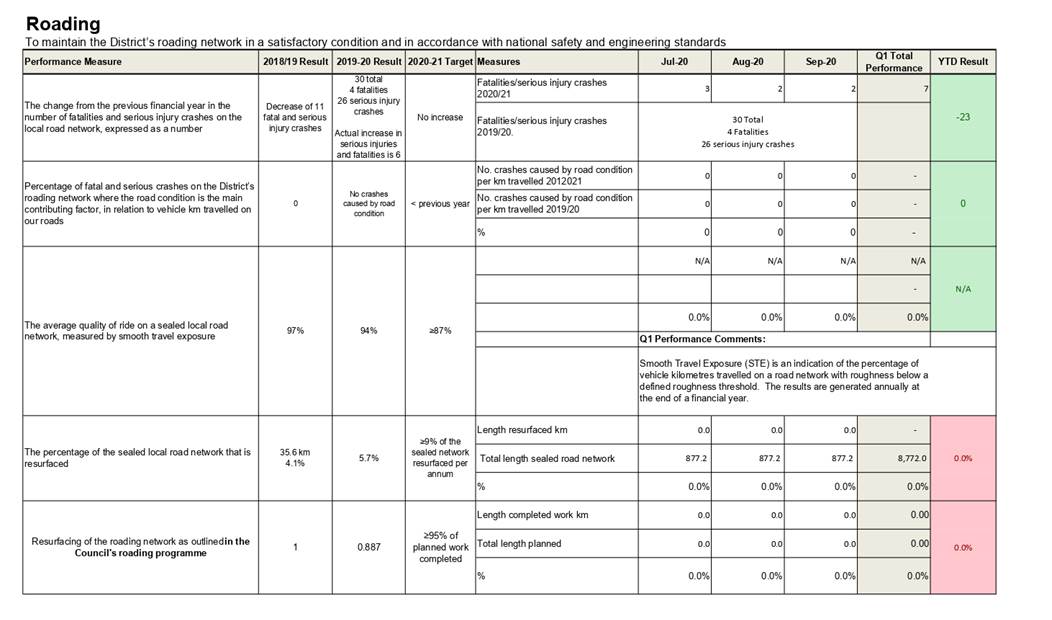

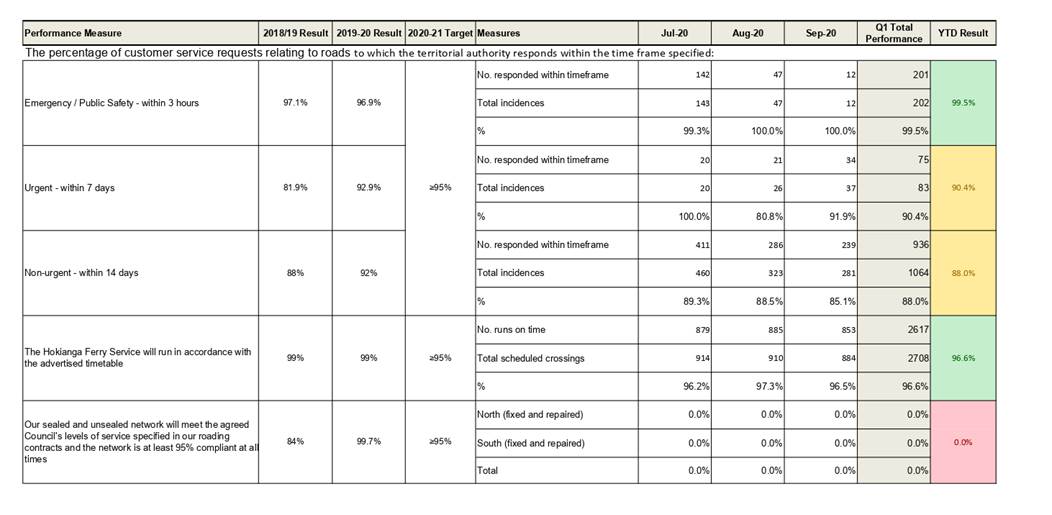

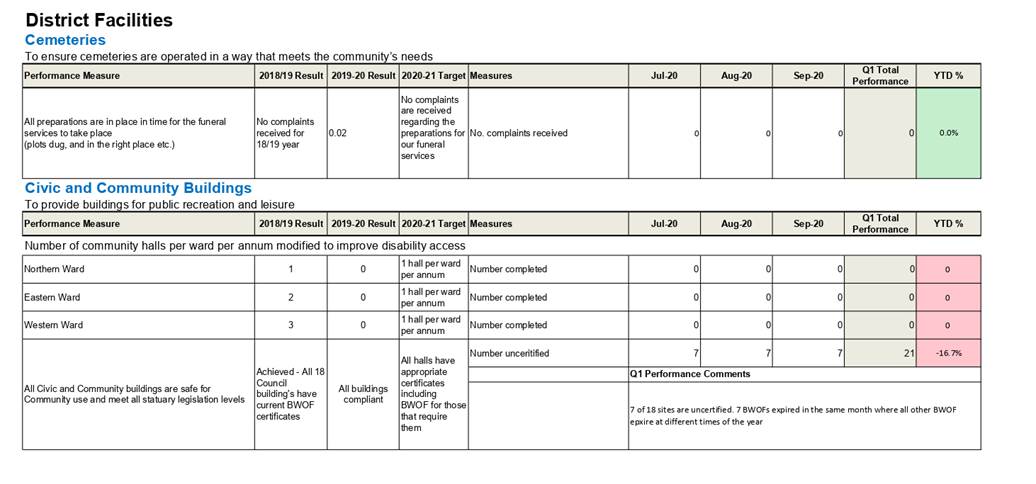

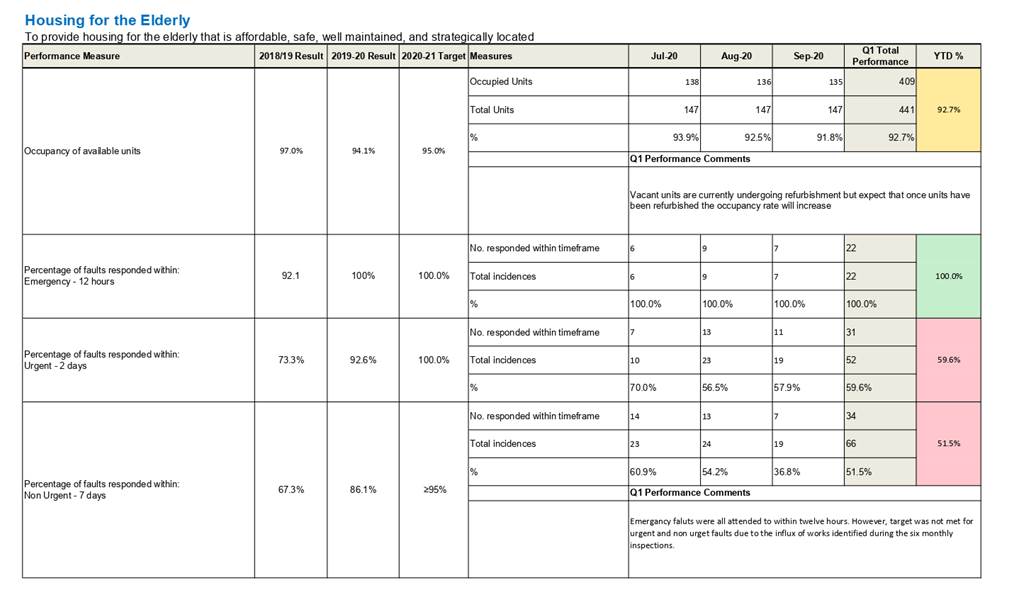

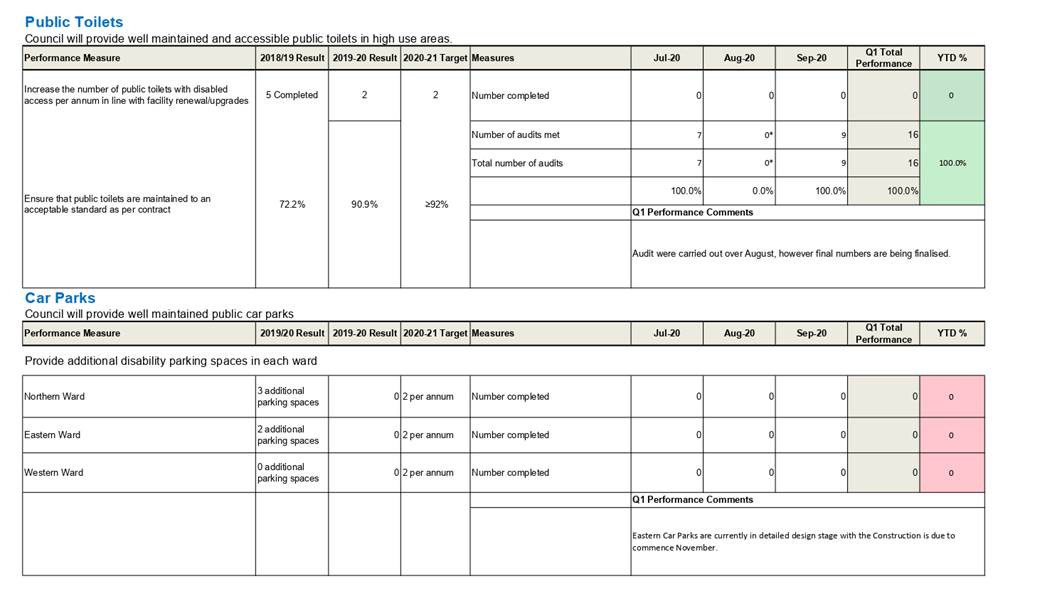

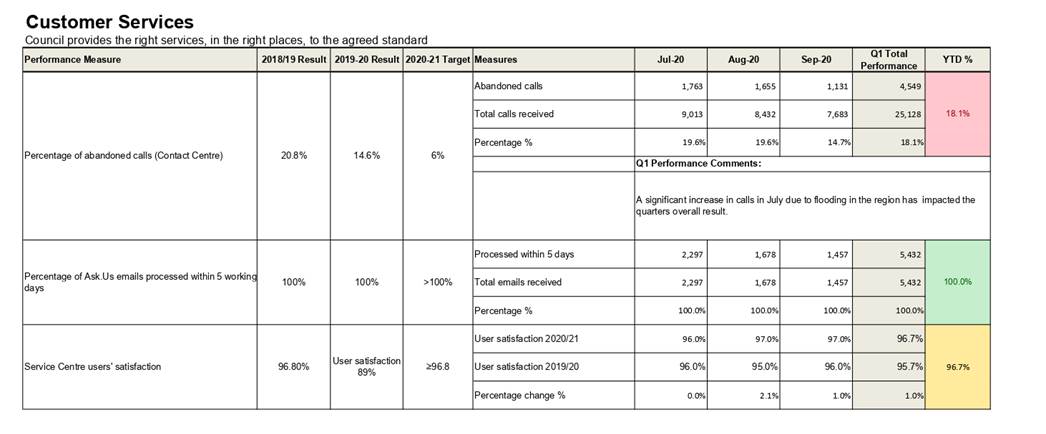

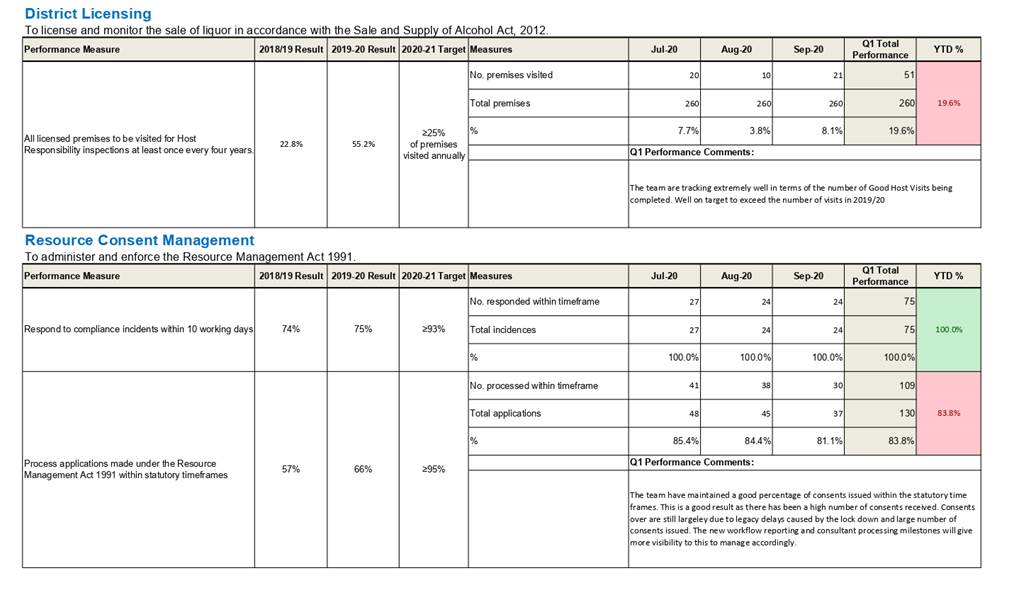

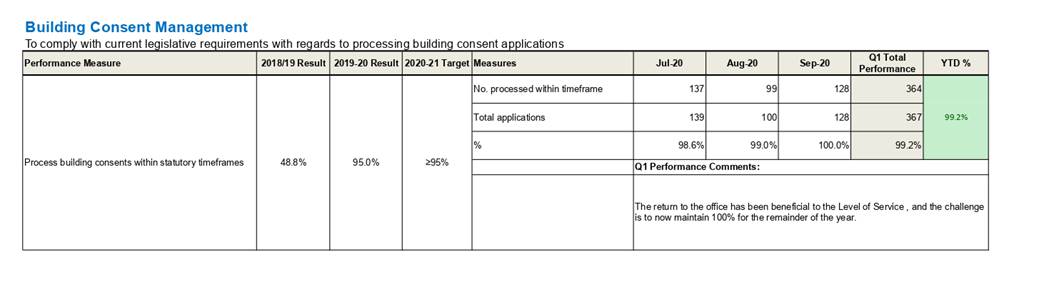

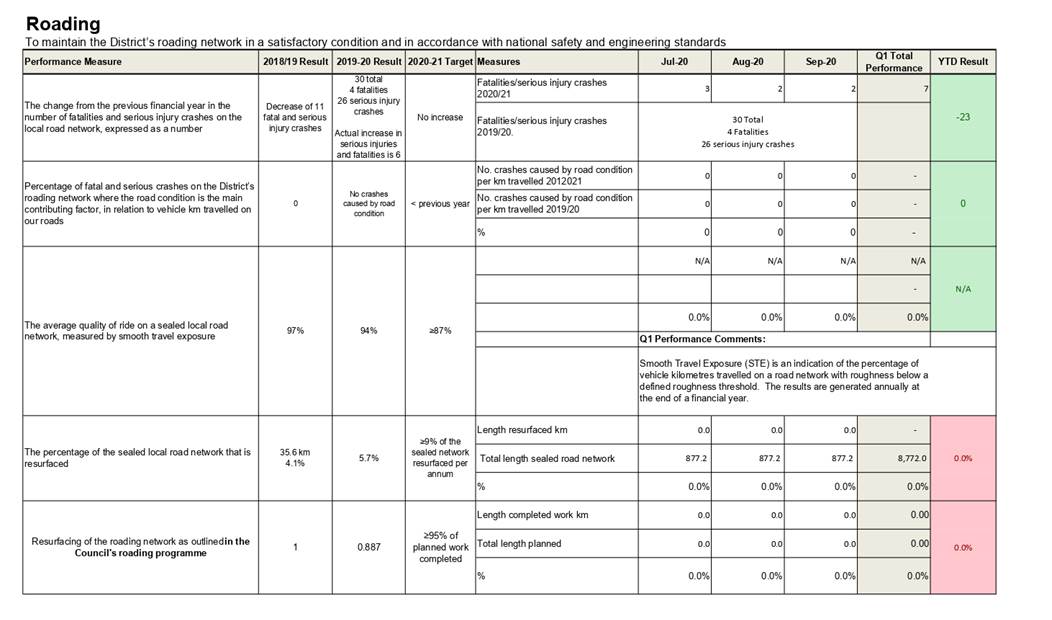

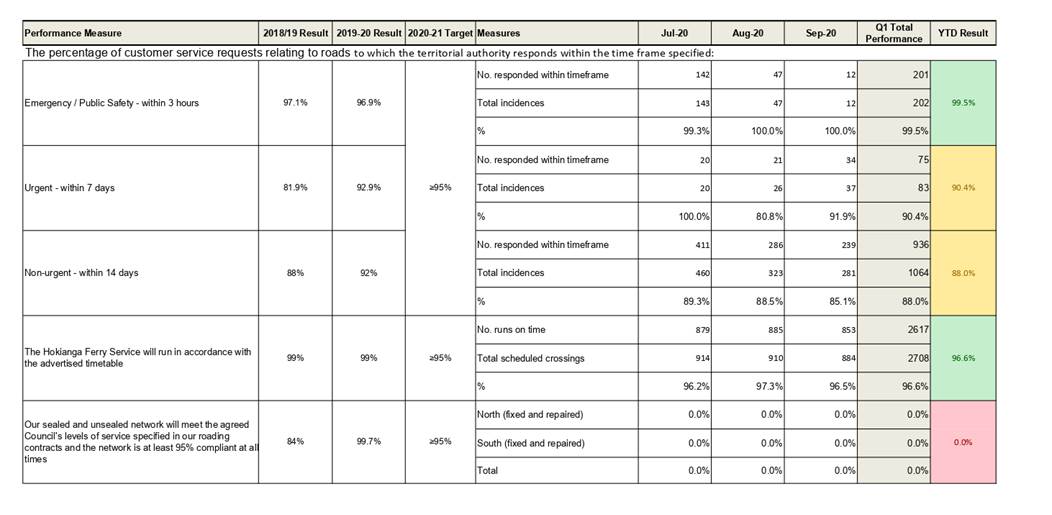

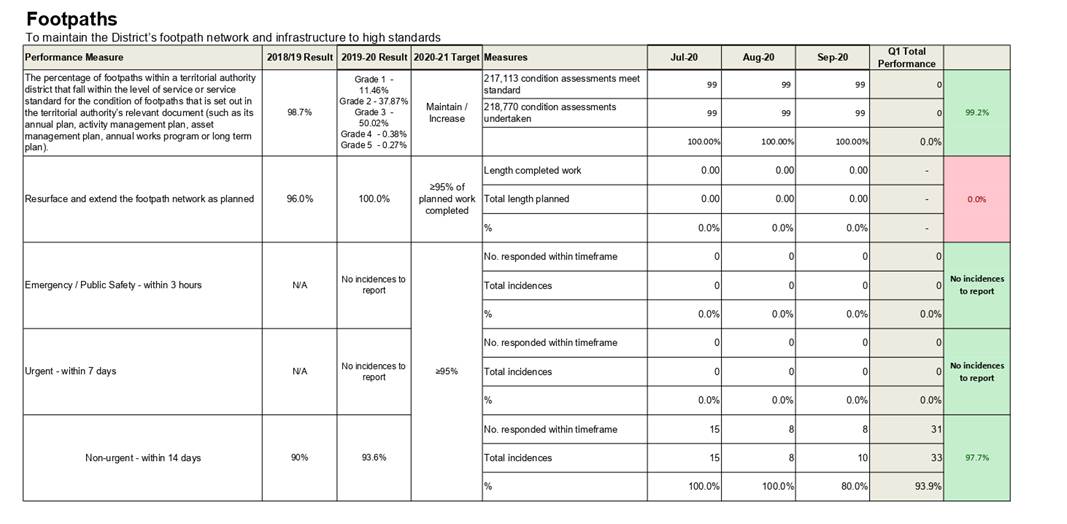

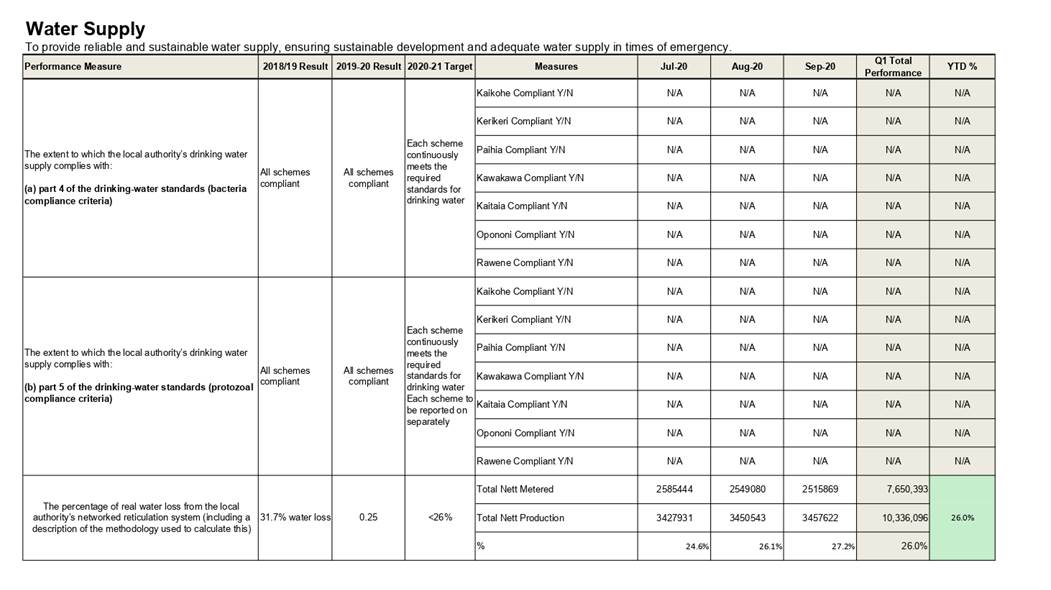

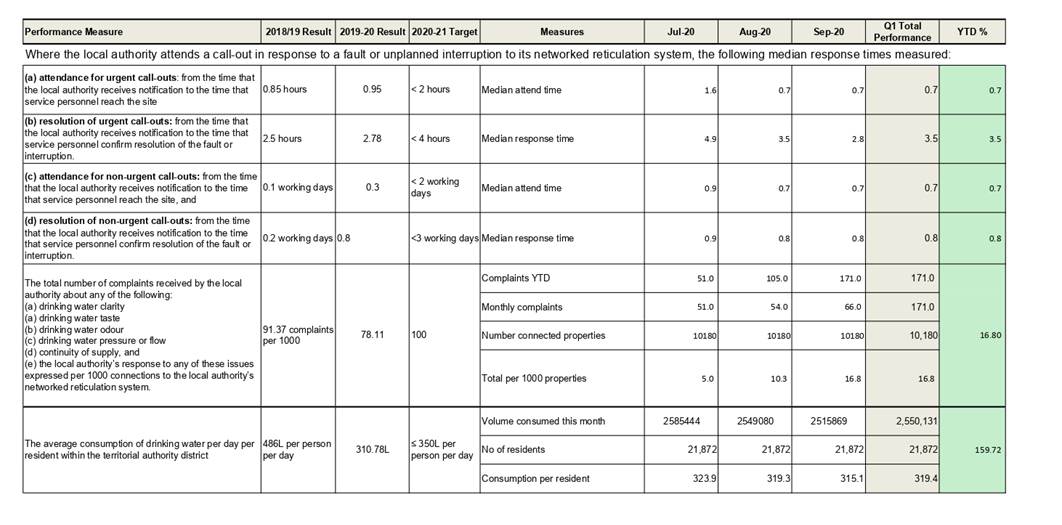

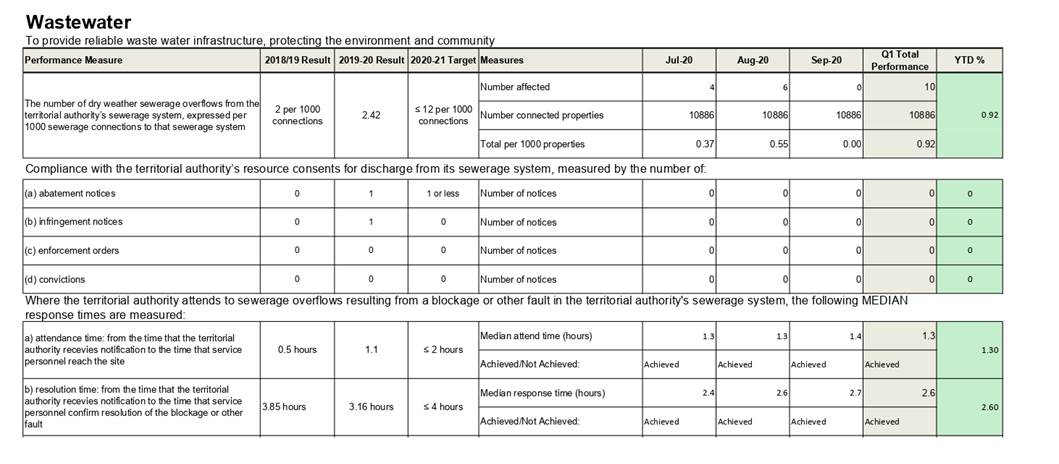

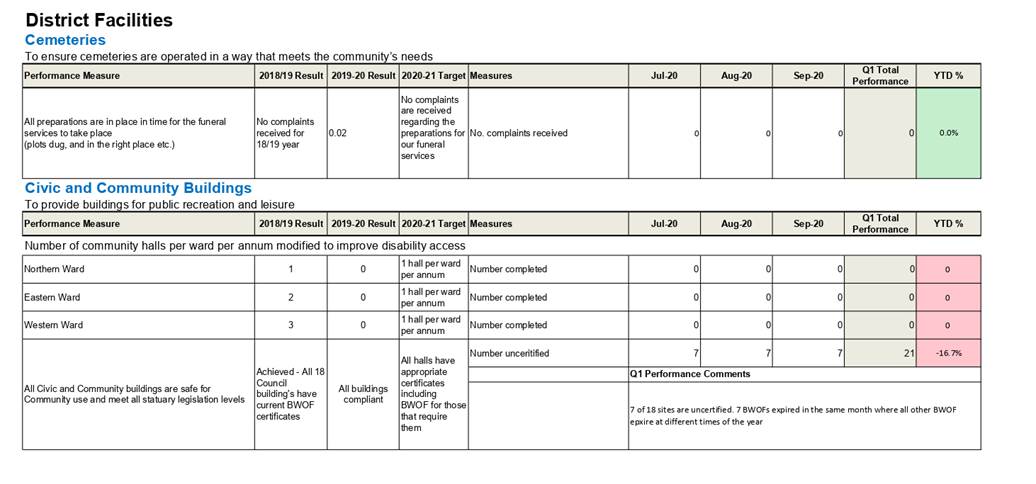

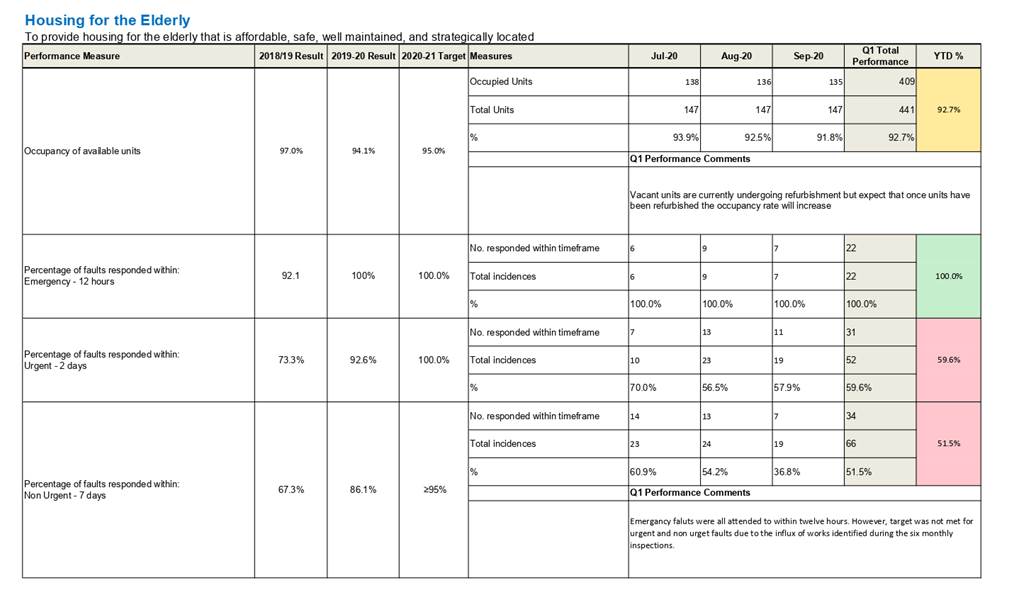

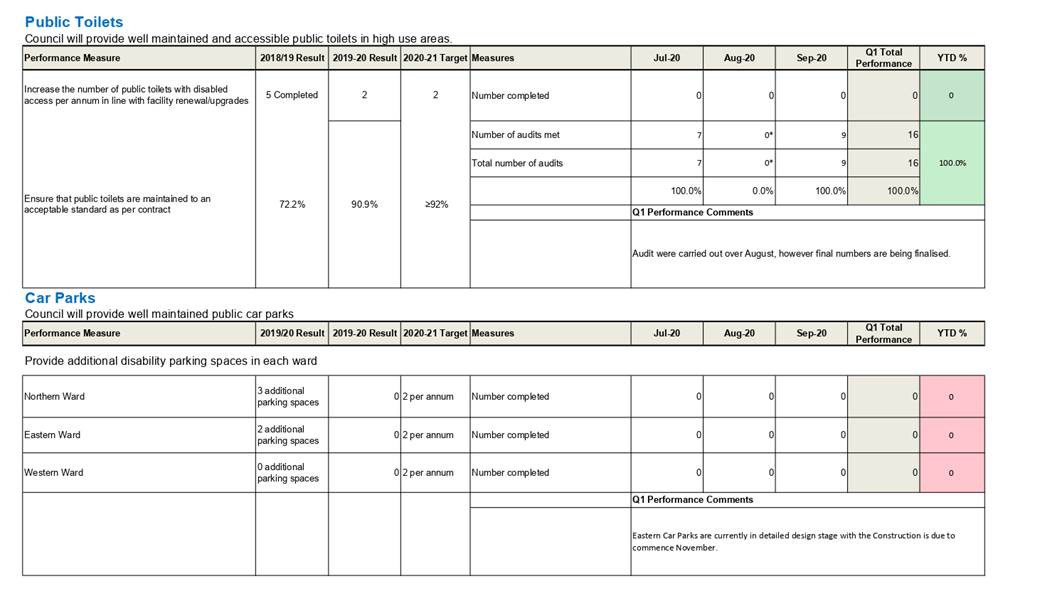

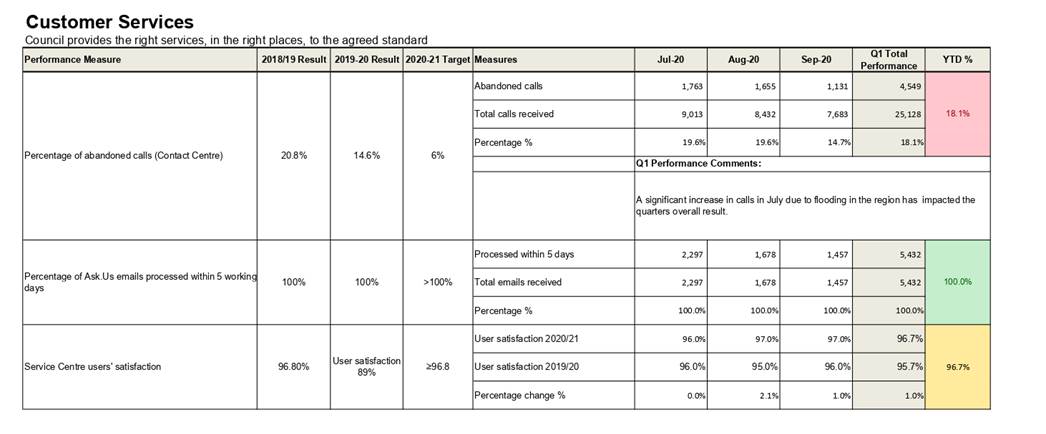

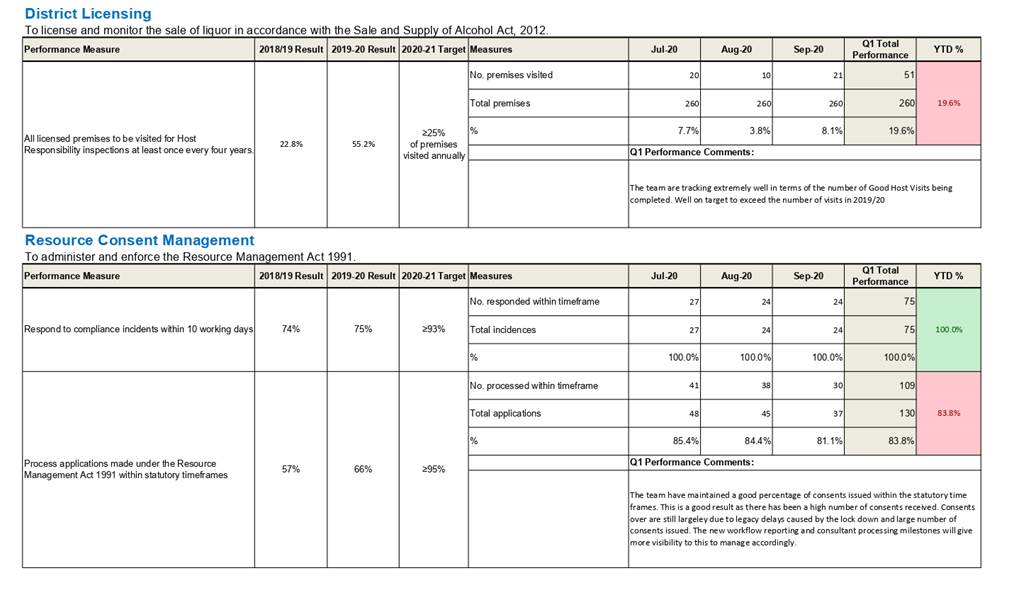

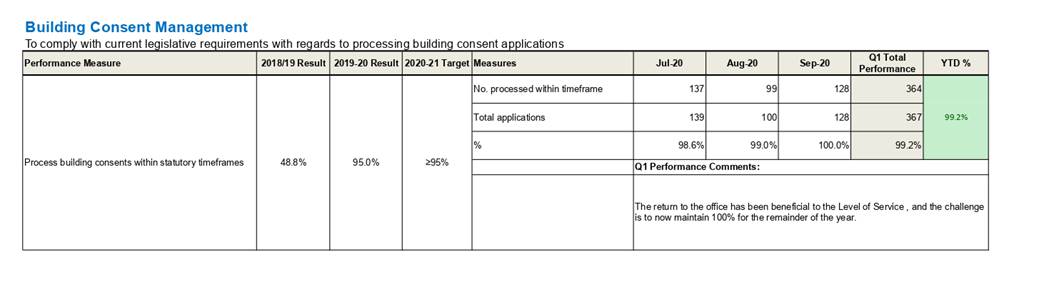

6.4 Level

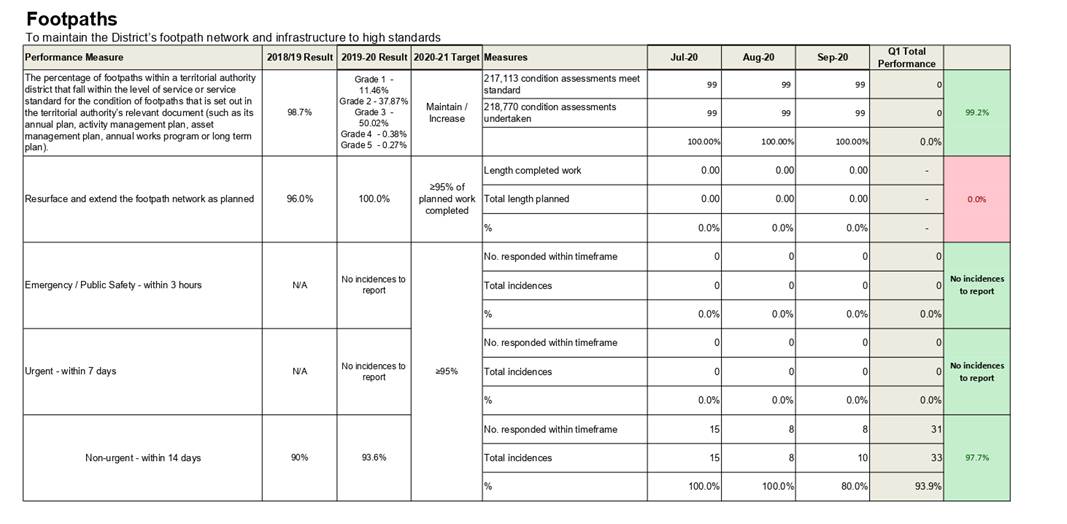

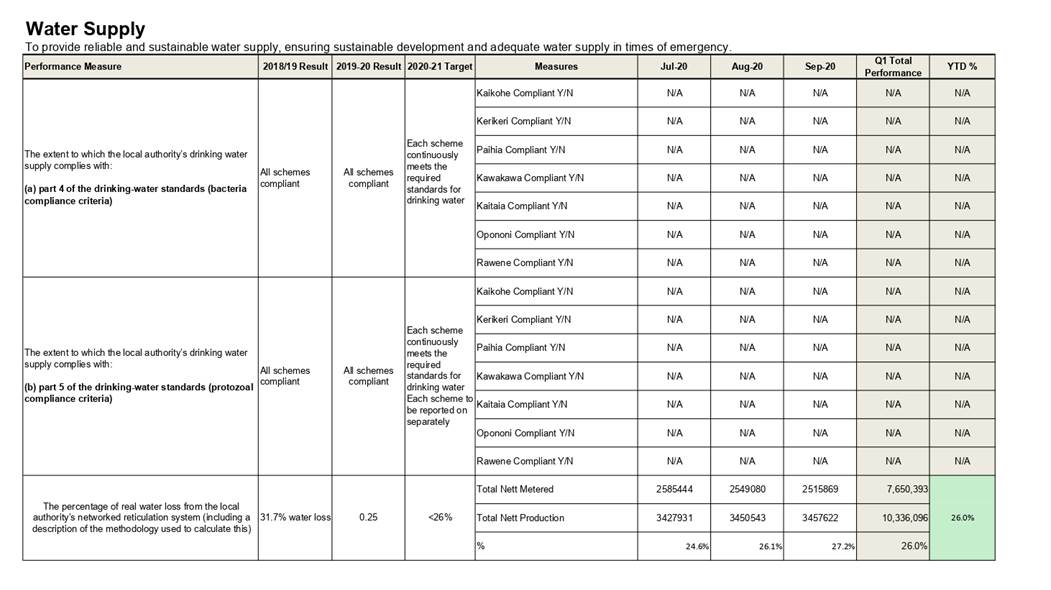

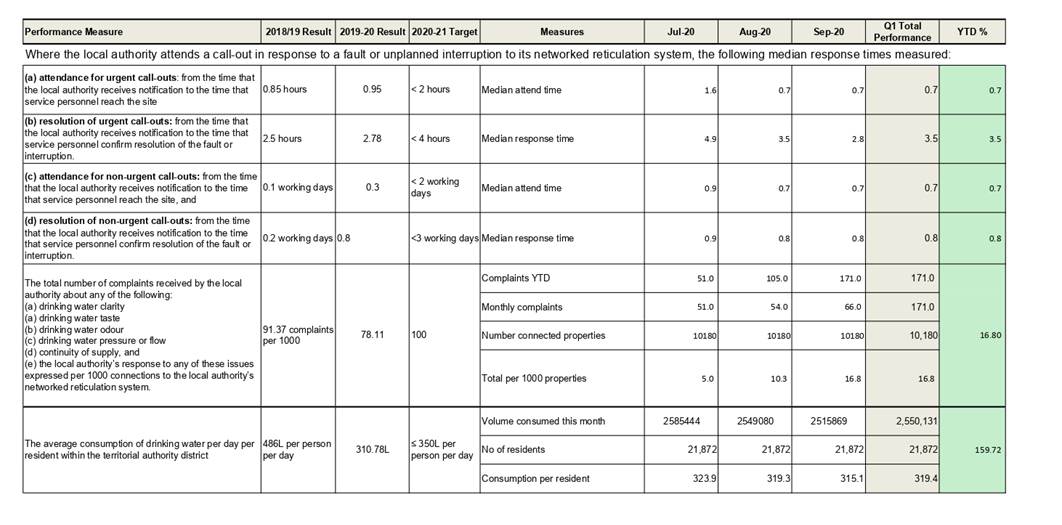

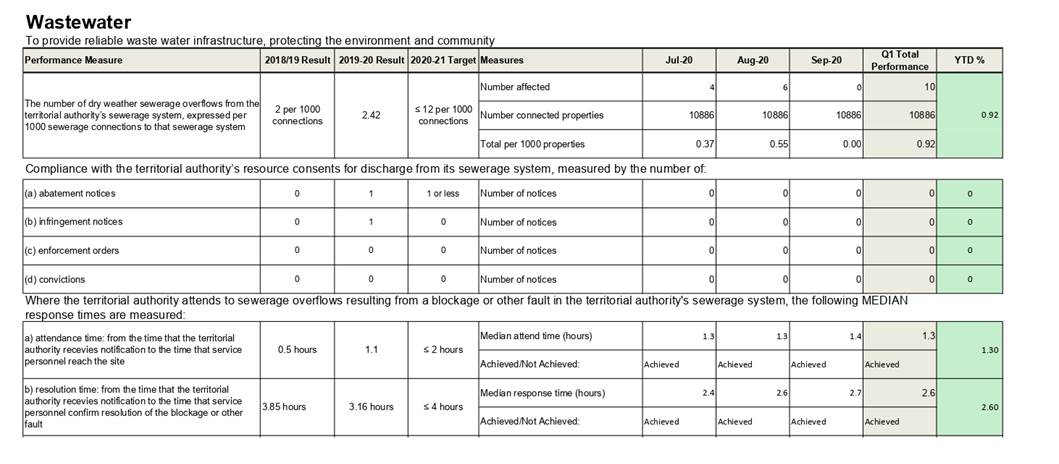

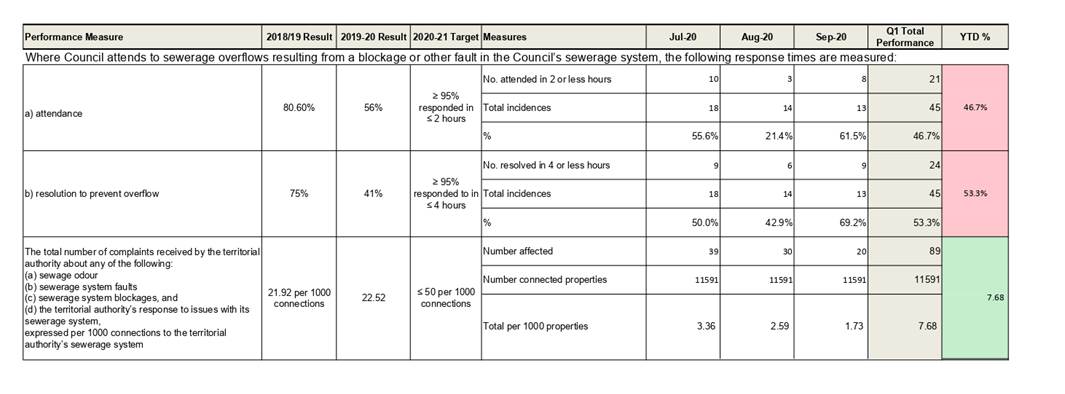

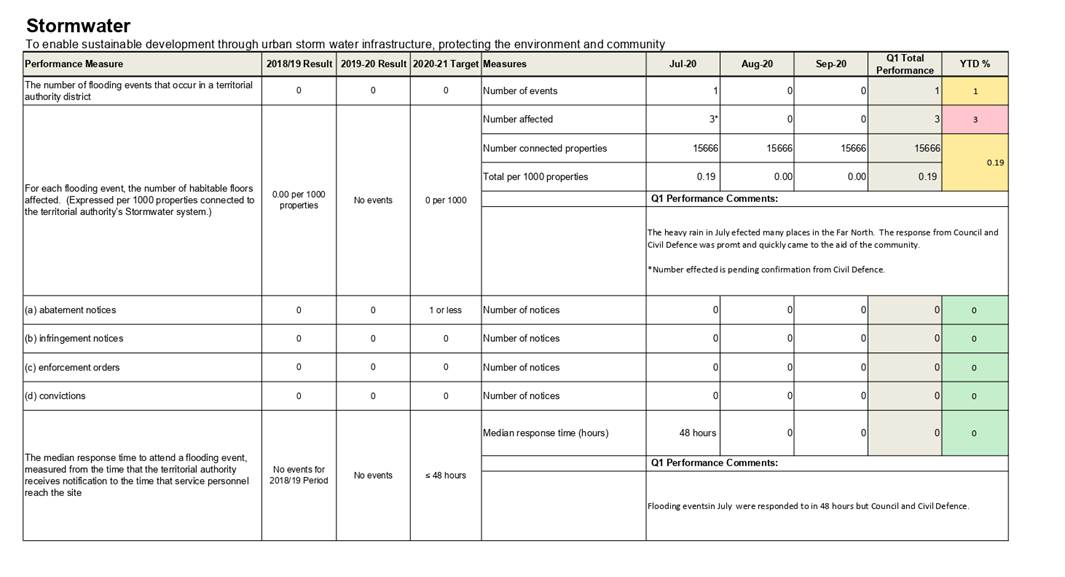

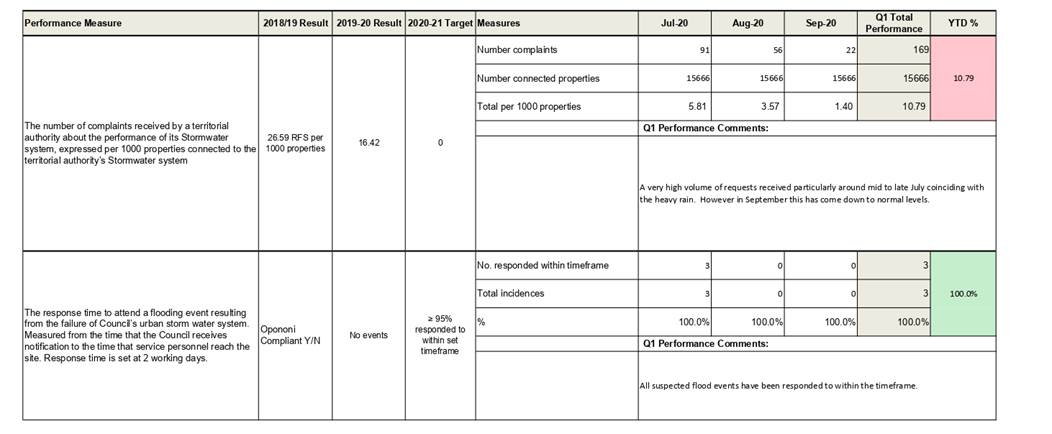

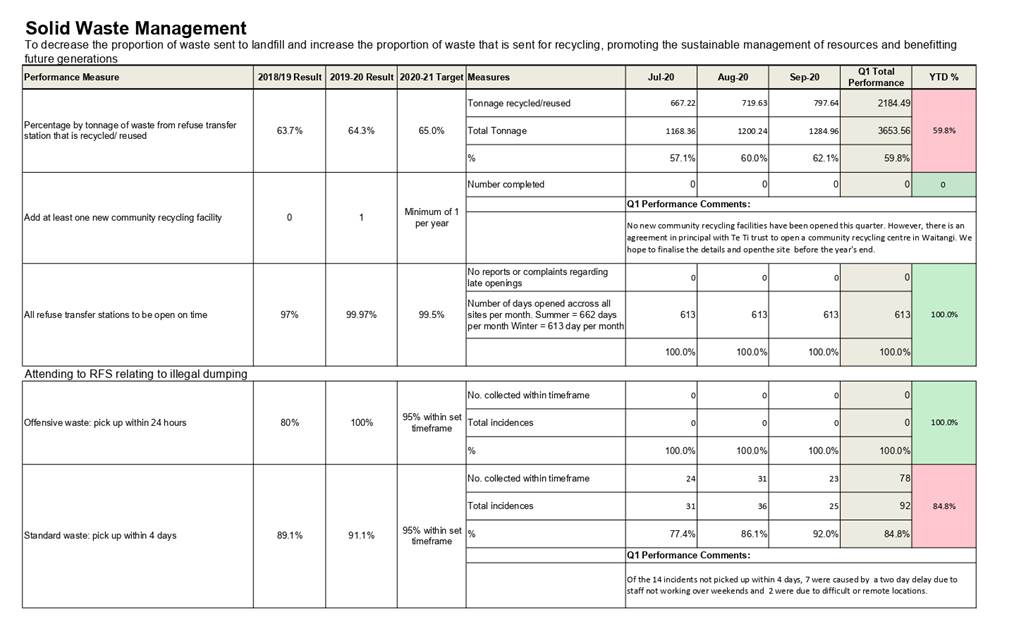

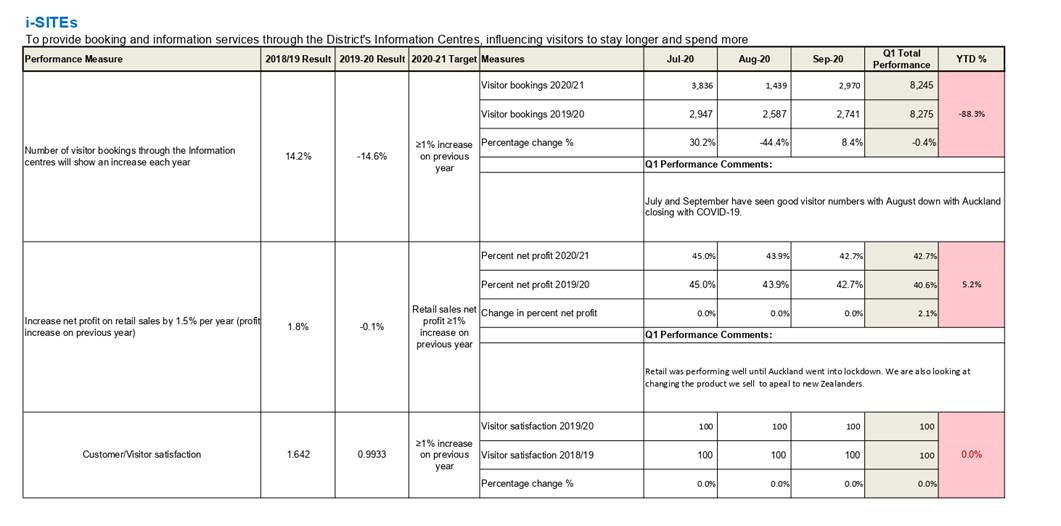

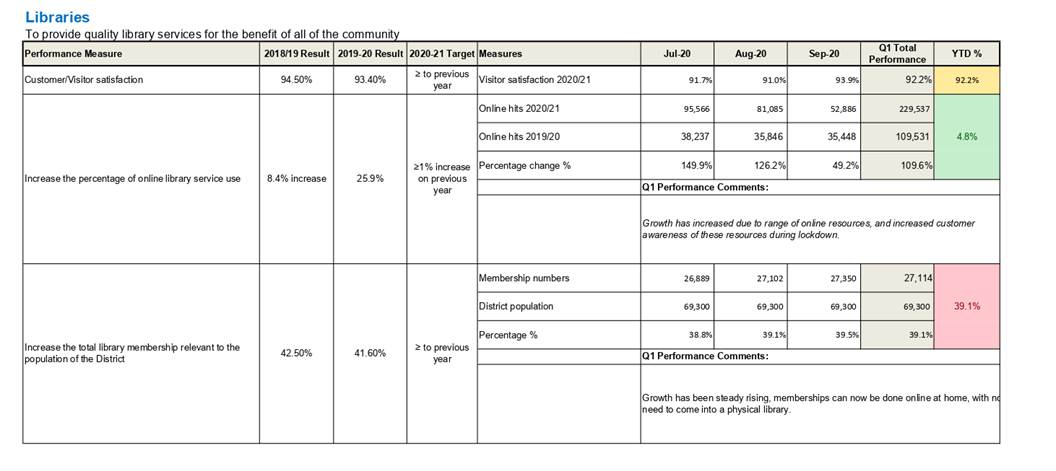

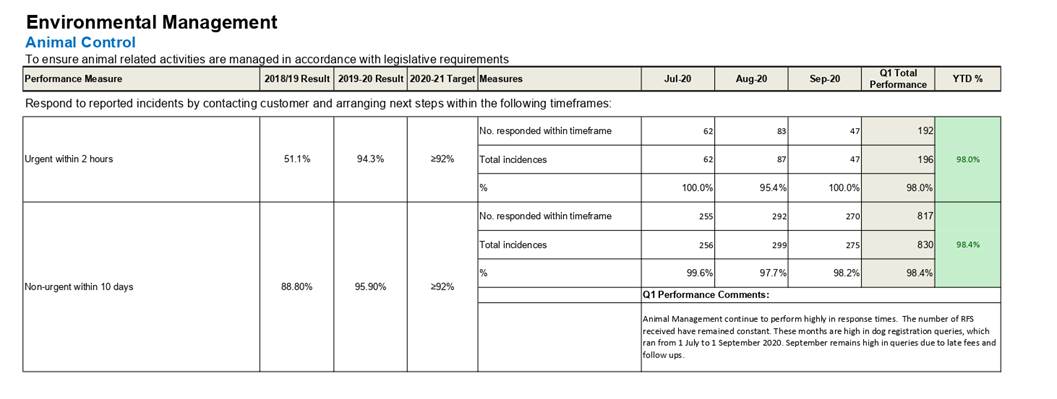

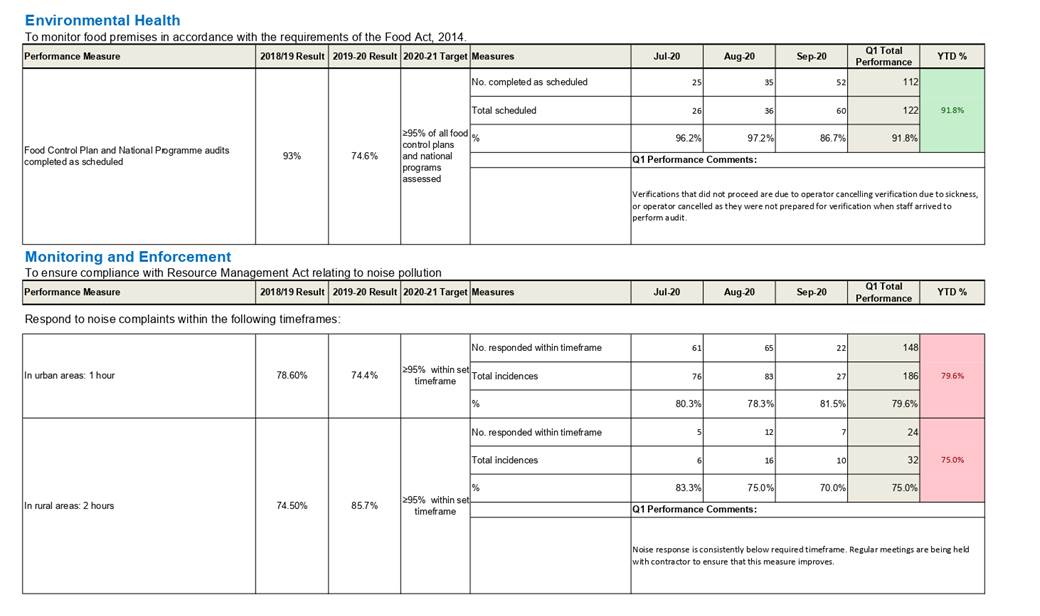

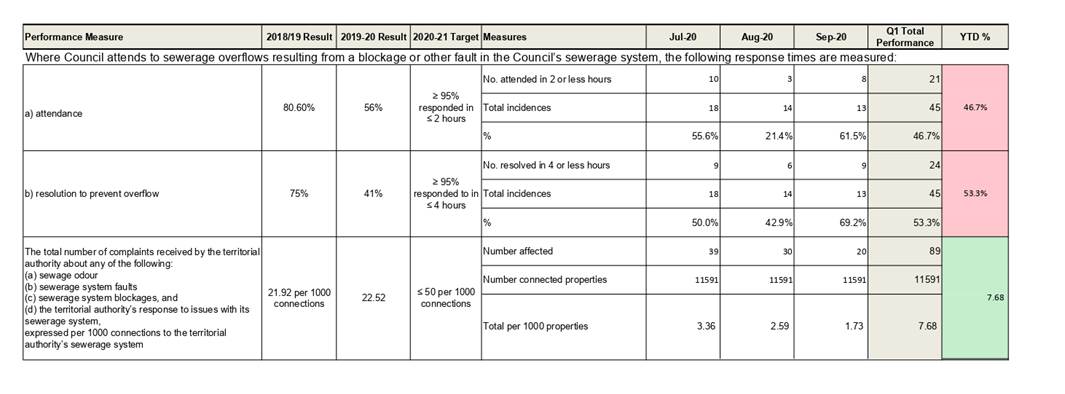

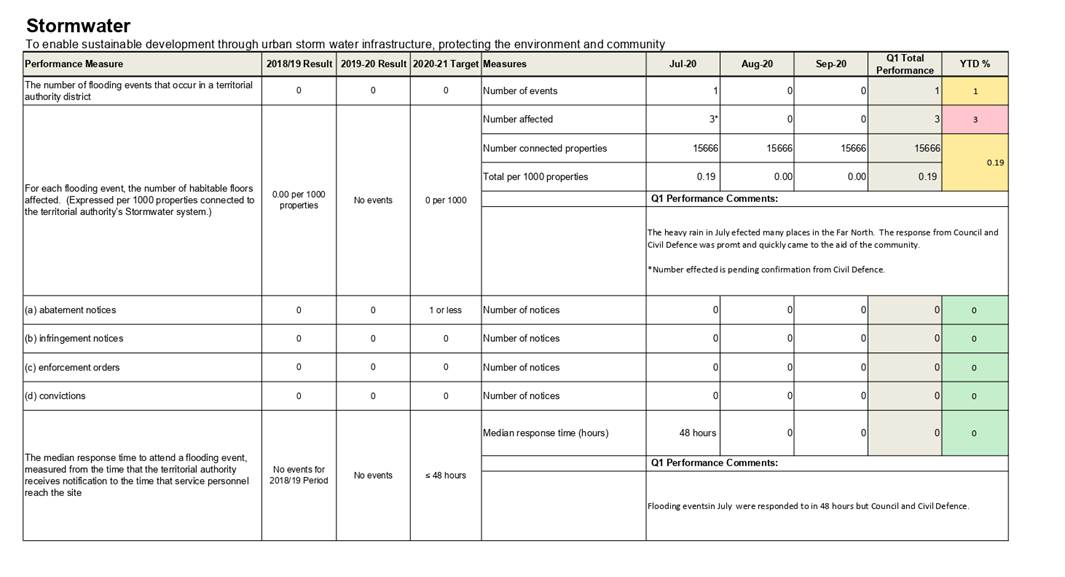

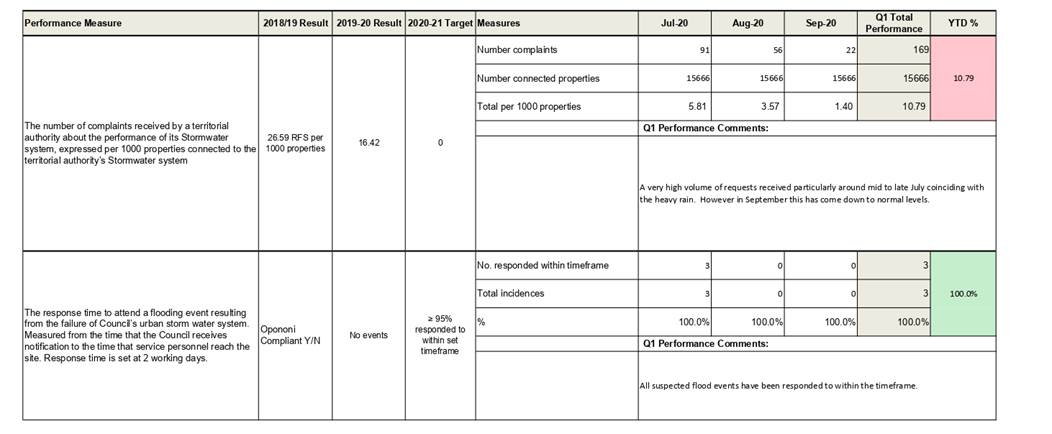

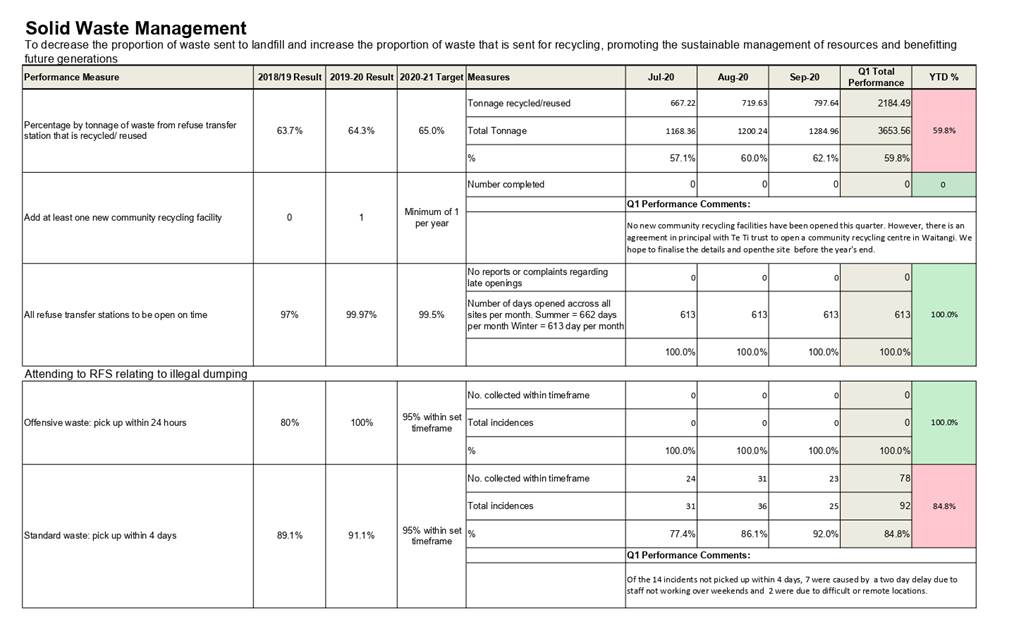

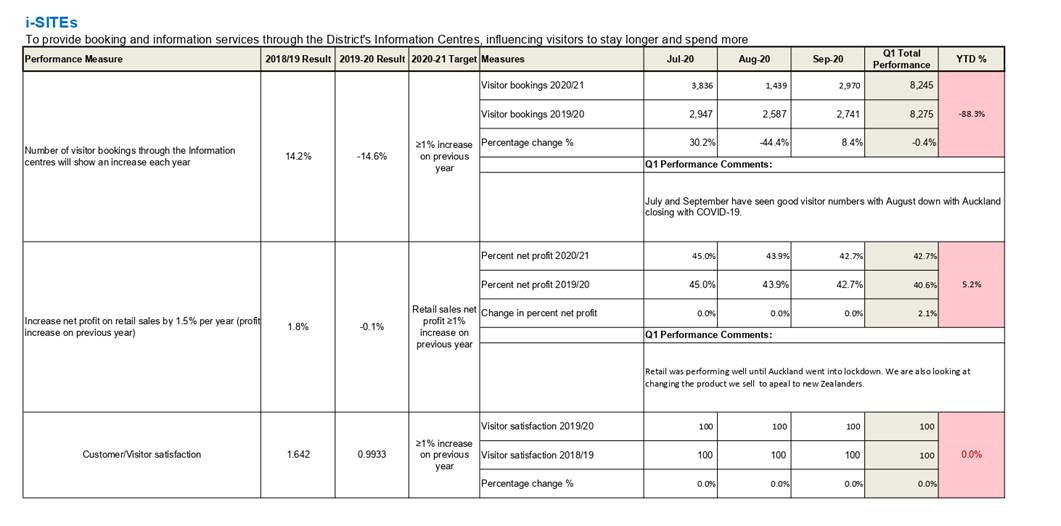

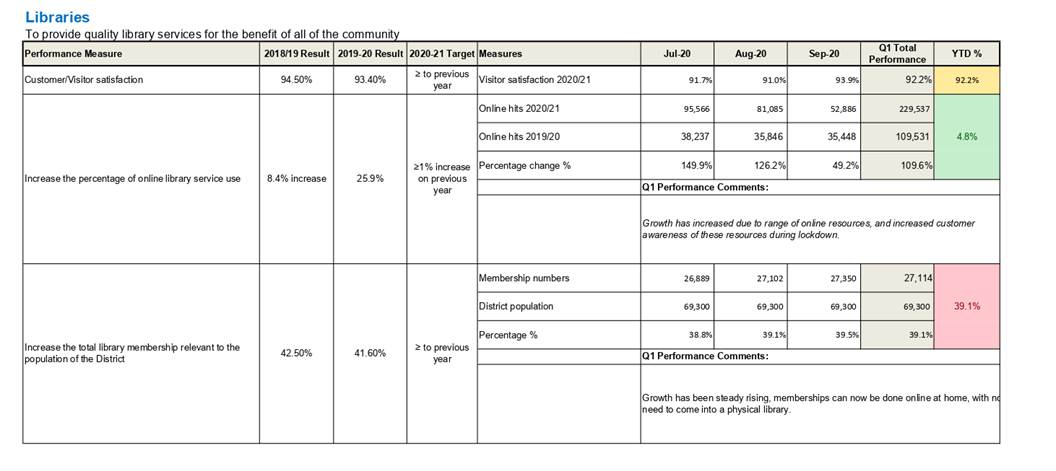

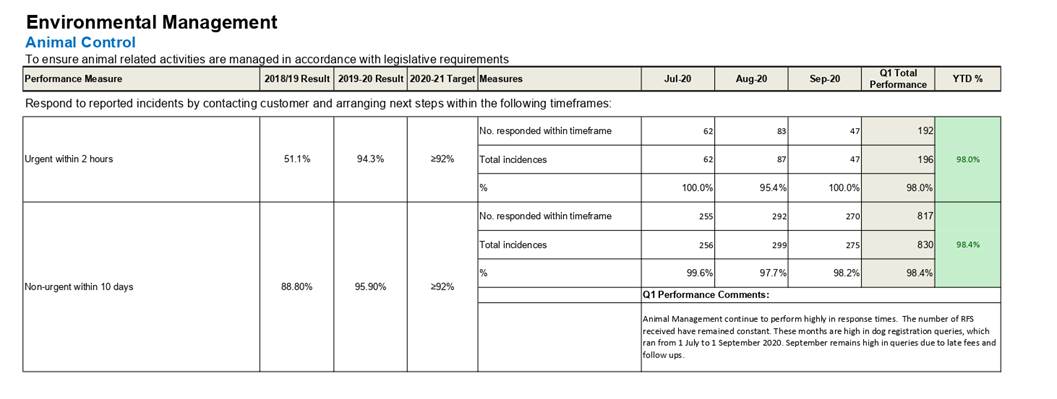

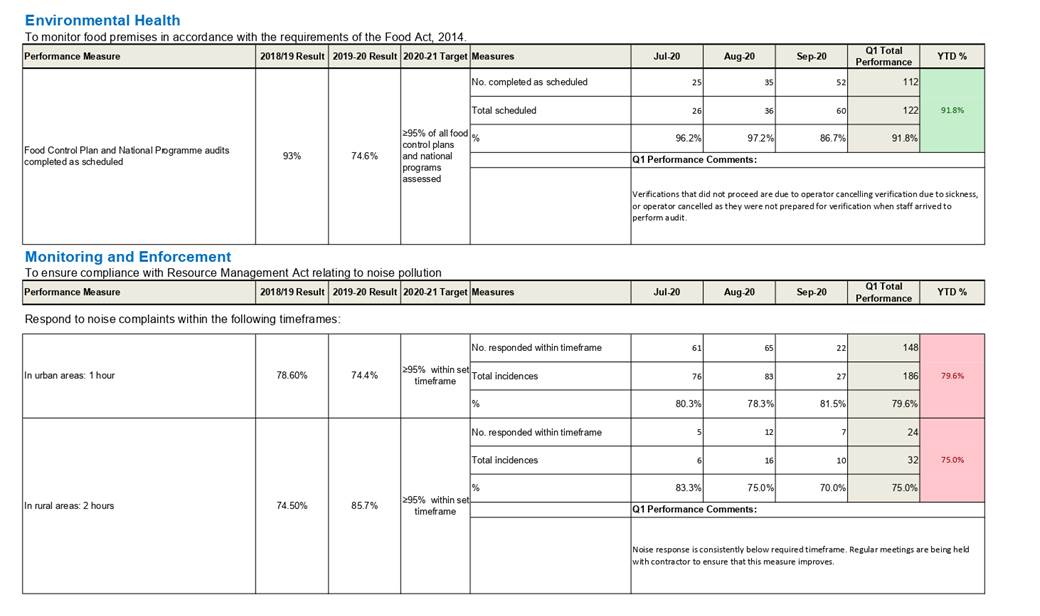

of Service KPI Quarter 1 Performance Report

File

Number: A2998583

Author: Mia

Haywood, Accounting Support Officer

Authoriser: William

J Taylor MBE, General Manager - Corporate Services

Purpose of the Report

The purpose of this

report is to present the Level of Service KPI Performance Report for the

Assurance, Risk and Finance Committee’s consideration.

Executive Summary

This report is to present the level of serviceKey

Performance Indicators (KPI) performance report for the Assurance, Risk and

Finance committee’s consideration.

|

Recommendation

That the Assurance, Risk and Finance Committee receive

the report Level of Service KPI Quarter 1 Performance Report .

|

Background

An overview of

staffing and financial data is included to give an overall picture of the

activity groups, and what factors may have an influence on performance.

Discussion and Next Steps

This report is for information

only.

Financial Implications and Budgetary Provision

There are no financial

implications or budgetary provision needed as a result of this report.

Attachments

1. Q1 - Level of

Service Quarterly Performance Report - A2998576 ⇩

|

Assurance, Risk and Finance Committee Meeting Agenda

|

2 December 2020

|

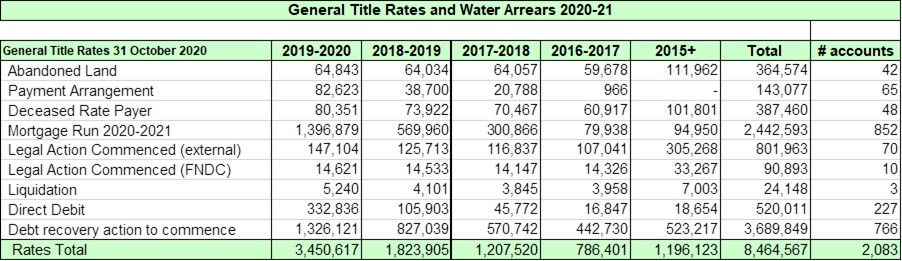

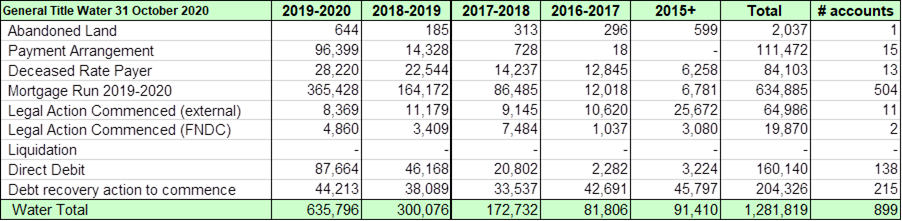

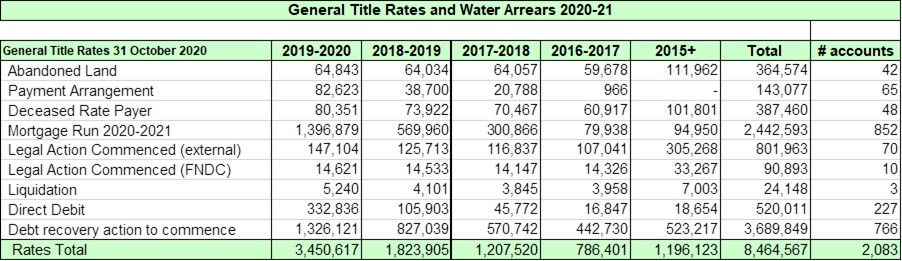

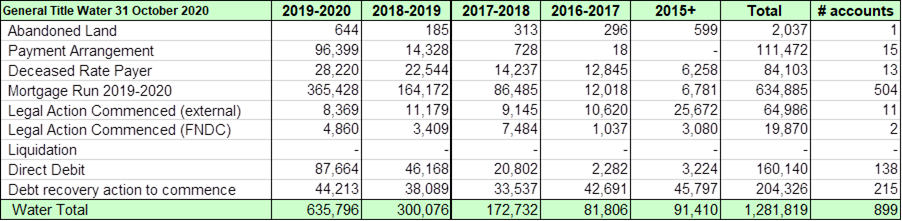

6.5 Revenue

Recovery Report - 31 October 2020.

File

Number: A3008875

Author: Margriet

Veenstra, Manager - Transaction Services

Authoriser: William

J Taylor MBE, General Manager - Corporate Services

Purpose of the Report

The

purpose of this report is to provide reporting to the Far North District

Council Assurance, Risk, and Finance Committee.

Executive Summary

This is the third report for the financial

year 2020/21 and provides information on action taken to collect the current

and arrears balances for rates, water and sundry debt so far this year, and to

provide information on how collection is tracking against targets.

|

Recommendation

That the Assurance, Risk and Finance Committee

receive the report “Revenue Recovery Report - 31 October 2020.”

|

1) Background

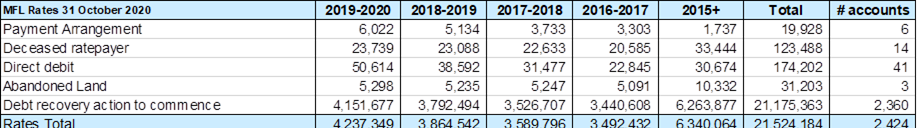

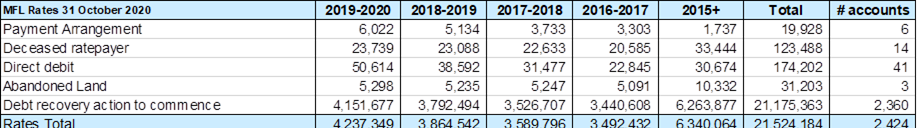

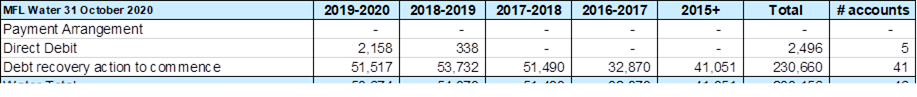

This document has been prepared to outline current and

arrears balances for rates, water and Sundry debt as at 31 October 2020 and the

actions taken by the debt management team for the collection of the General

Title rates and water and sundry debt.

This

information is part of the standing items reported to the Committee on a

regular basis.

Discussion and Next Steps

The data

provided is for General Title and Maori Freehold Land rates and water accounts

with sundry debtors shown in a separate table.

General

Title rates and water debt

Key

actions since the last report:

· Between the 1st of October and the 20th

of October, debt management proactively called owners of properties with

mortgages who are in arrears to offer payment plans to avoid mortgage demand.

· On 21 October, 327 mortgage demand letters were sent to the

owners of properties with arrears debt of more than $3,000 and several calls

were received by the team from owners after their banks contacted them.

· Instruction was given to external law firm to proceed with

legal action for those properties on hold since early this year. So far,

default judgement has been received for a further 4 properties with a debt of

$80,833.35 for which charging orders will be registered against the properties.

A further three are to be applied for and one is with the court for judgment.

· Council Legal team have started preparing files for legal

proceedings for 10 properties passed to them.

Next actions:

· Prepare policy for approval by Council of next actions post

default judgment from the courts.

· Proactive calling between 23 November and 27 November, to

rate payers who missed the 2nd instalment due date to offer

assistance or payment plans.

· Proactive calling of owners of properties with mortgages

with arrears debt of less than $3,000 to offer payment plans to avoid mortgage

demand in February.

· Commence final demand letters to owners without a mortgage

with an arrears debt, focussing on those properties where statute barred will

apply in the near future.

For the total number of General

Title rates and water accounts marked as ‘Debt recovery action to

commence’:

· These are properties where there is no mortgage, no

payments have been received and the owner has not contacted Council to discuss

payment options.

· 70% of these accounts have arrears of more than two rating

years.

o 70% of these accounts have received final demand letters

from council but a review will take place and a final letter will be sent prior

to commencing filing for debt recovery through the courts due to the time lag

since the last letter.

o Debt management will send the first final demand letters to

the remaining 30%.

· 30% is for accounts with up to two years rates arrears.

o Debt management to commence calling.

o If no contact is made, first demand letters will be sent.

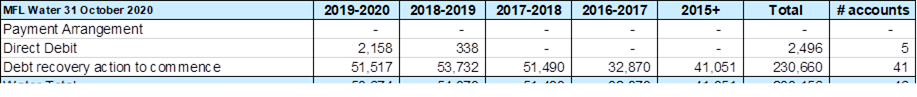

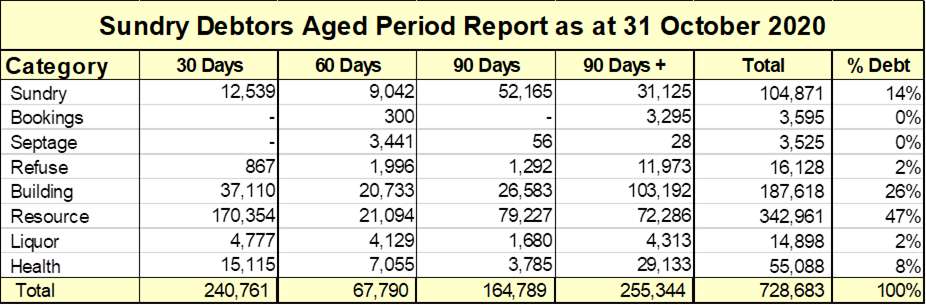

Sundry debtors debt

The total sundry debtors aged debt balance has increased

since the last report, mainly driven by $170,000 resource consent invoices

becoming overdue. The 90+ days debt for resource

consents has halved since the last report. Of the total debt, 47% is attributed

to invoices raised for Resource Consents and 26% for Building Consents.

The following actions agreed to

reduce the resource consent debt are now in place or completed:

· The legal opinion from RMA specialist lawyer for council

regarding requesting payment prior to issuing consent has been received.

Outcome is that council may not withhold the resource consent decision

from the applicant for incomplete payment.

· A workshop was held on the 14th October with Debt Management,

Resource Consent Team and District Services Administration to agree actions,

inter-departmental communications and processes.

· Fee review tracker is now in place in objective, where all

team members register fee reviews that have been requested by customers and

updated by the resource consent team as they process the review. All

communications to customers as to the outcome of the review will be saved to

the same folder.

Further

actions to be implemented for resource consent and building consent debt: