AGENDA

Ordinary Council Meeting

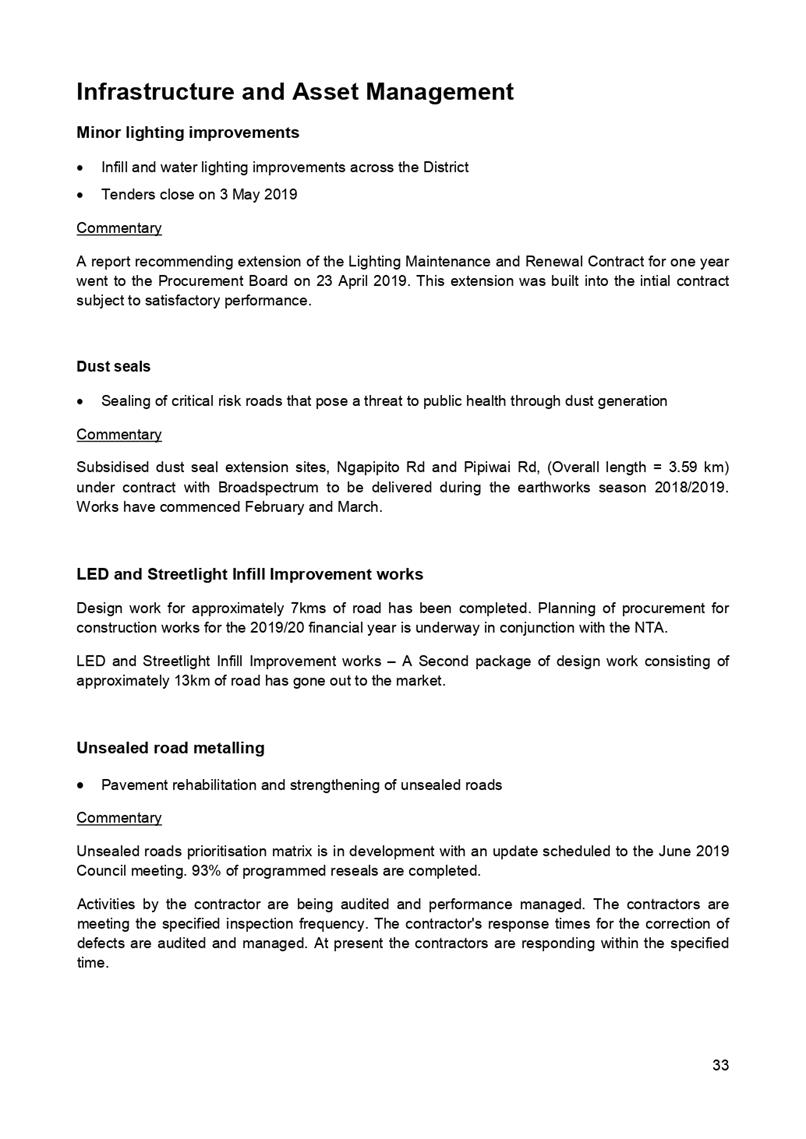

Thursday, 27 June 2019

|

Time:

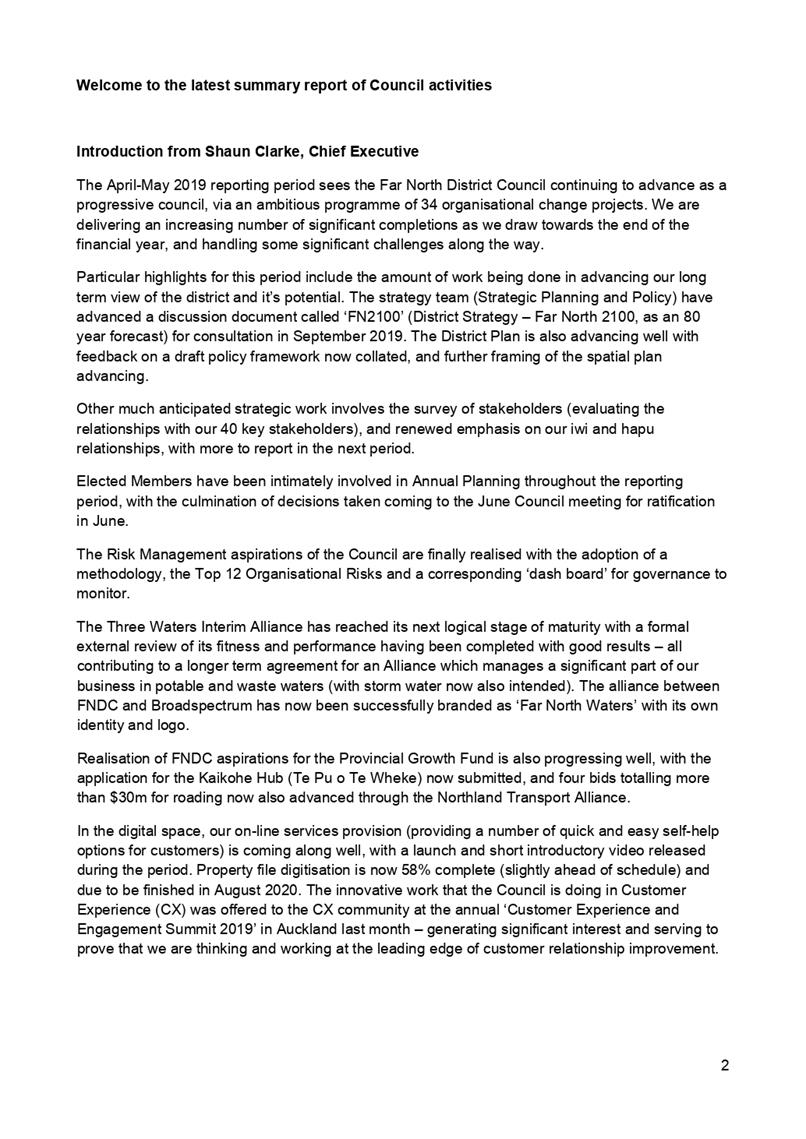

|

10.00 am

|

|

Location:

|

Far North Reap, Kauri Room

33 Puckey Avenue

Kaitaia

|

Membership:

Mayor John

Carter - Chairperson

Cr Tania

McInnes

Cr Ann Court

Cr Felicity

Foy

Cr Dave

Hookway

Cr Colin

(Toss) Kitchen

Cr Sally

Macauley

Cr Mate

Radich

Cr John

Vujcich

Cr Kelly

Stratford

|

Ordinary Council Meeting Agenda

|

27 June 2019

|

COUNCIL MEMBERS

REGISTER OF INTERESTS

|

Name

|

Responsibility

(i.e. Chairperson etc)

|

Declaration

of Interests

|

Nature

of Potential Interest

|

Member's

Proposed Management Plan

|

|

Hon John Carter QSO

|

Board Member of the

Local Government Protection Programme

|

Board Member of the

Local Government Protection Programme

|

|

|

|

Carter Family Trust

|

|

|

|

|

Felicity Foy

|

Director - Northland

Planning & Development

|

I am the director of a

planning and development consultancy that is based in the Far North and have

two employees.

|

|

I will abstain from any

debate and voting on proposed plan change items for the Far North District

Plan.

|

|

I will declare a

conflict of interest with any planning matters that relate to resource

consent processing, and the management of the resource consents planning

team.

|

|

I will not enter into

any contracts with Council for over $25,000 per year. I have previously

contracted to Council to process resource consents as consultant planner.

|

|

Flick Trustee Ltd

|

I am the director of

this company that is the company trustee of Flick Family Trust that owns

properties on Weber Place, Seaview Road and Allen Bell Drive.

|

|

|

|

Elbury Holdings Limited

|

This company is

directed by my parents Fiona and Kevin King.

|

This company owns

several dairy and beef farms, and also dwellings on these farms. The Farms

and dwellings are located in the Far North at Kaimaumau, Bird Road/Sandhills

Rd, Wireless Road/ Puckey Road/Bell Road, the Awanui Straight, Allen Bell

Drive.

|

|

|

Foy Farms partnership

|

Owner and partner in

Foy Farms - a farm in three titles on Church Road, Kaingaroa

|

|

|

|

Foy Farms Rentals

|

Owner and rental

manager of Foy Farms Rentals for 6 dwellings on Church Road, Kaingaroa and 1

dwelling at 64 Allen Bell Drive, Kaitaia, and one property at 96 North Road,

Kaitaia

|

|

|

|

King Family Trust

|

This trust owns several

titles/properties at Cable Bay, Seaview Rd/State Highway 10 and Ahipara -

Panorama Lane.

|

These trusts own

properties in the Far North.

|

|

|

Previous employment at

FNDC 2007-16

|

I consider the staff

members at FNDC to be my friends

|

|

|

|

Partner Felicity Foy

|

Employed by

Justaplumber Taipa

|

|

|

|

|

Friends with some FNDC

employees

|

|

|

|

|

Dave Hookway

|

Resident shareholder in

Kerikeri Irrigation

|

|

|

Declare if issues

arise.

|

|

Shareholder in

Farmlands.

|

|

|

Declare if issues

arise.

|

|

Employee – Northland

District Health Board – Public Health Unit – Health Improvement

Advisor

|

|

Am employee have no

personal gain.

|

Declare employment

should issues concerning the Northland DHB arises.

|

|

On property in Waipapa

West Rd.

|

|

Possible issues

relating to the street or zoning.

|

Declare when

appropriate.

|

|

Colin Kitchen

|

No form received

|

|

|

|

|

Tania McInnes

|

Director – GBT

Ventures Ltd

|

Company not currently

operational

|

|

Will notify Council if

company becomes operational.

|

|

Member of Northland

Conservation Board

|

|

Conservation matters

not aligned with Council policy.

|

Will notify Council

should a perceived conflict arise.

|

|

Trustee –

Northland Youth Education Trust

|

|

No perceived conflicts

|

Will notify Council

should a perceived conflict arise.

|

|

Founder – Bay of Islands

Women’s Nexus

|

No perceived conflicts.

An informal organisation

|

|

|

|

Own a section on

Seaview Road, Paihia 0200

|

|

|

|

|

Having worked within

the organisation in the early 2000’s, I know a number of staff, none of

which I am close with.

|

|

|

|

|

Mate Radich

|

No form received

|

|

|

|

|

Ann Court

|

Waipapa Business

Association

|

Member

|

|

|

|

Warren Pattinson

Limited

|

Shareholder

|

Building company. FNDC

is a regulator and enforcer

|

No FNDC Controls

|

|

Kerikeri Irrigation

|

Supplies my water

|

|

No EM intervention in

disputes

|

|

Top Energy

|

Supplies my power

|

|

No other interest

greater than the publics

|

|

District Licensing

|

N/A

|

N/A

|

N/A

|

|

Top Energy Consumer

Trust

|

Trustee

|

crossover in regulatory

functions, consenting economic development and contracts such as street

lighting.

|

Declare interest and

abstain from voting.

|

|

Ann Court Trust

|

Private

|

Private

|

N/A

|

|

Waipapa Rotary

|

Honorary member

|

Potential community

funding submitter

|

Declare interest and

abstain from voting.

|

|

Properties on Onekura

Road, Waipapa

|

Owner Shareholder

|

Any proposed FNDC

Capital works or policy change which may have a direct impact (positive/adverse)

|

Declare interest and

abstain from voting.

|

|

Property on Daroux Dr,

Waipapa

|

Financial interest

|

|

|

|

Flowers (I get flowers

occasionally)

|

Ratepayer 'Thankyou'

|

Bias/ Pre-determination?

|

Declare to Governance

|

|

Coffee and food

|

Ratepayers sometimes

'shout' food and beverage

|

Bias or

pre-determination

|

Case by case

|

|

Consider all staff my

friends

|

N/A

|

Suggestion of not being

impartial or pre-determined!

|

Be professional, due

diligence, weigh the evidence. Be thorough, thoughtful, considered impartial

and balanced. Be fair.

|

|

|

My husband is a builder

and may do work for Council staff

|

|

|

|

Warren Pattinson

(Husband)

|

Warren Pattinson

Limited

|

Director

|

Building Company. FNDC

is a regulator

|

Remain at arm’s

length

|

|

Air NZ

|

Shareholder

|

None

|

None

|

|

Warren Pattinson

Limited

|

Builder

|

FNDC is the consent

authority, regulator and enforcer.

|

Apply arm’s

length rules

|

|

Kurbside Rod and Custom

Club (unlikely)

|

President NZ Hot Rod

Association

|

Potential to be linked

to a funding applicant and my wife is on the decision making committee.

|

unlikely to materialise

but would absent myself from any process as would Ann.

|

|

Property on Onekura

Road, Waipapa

|

Owner

|

any proposed FNDC

capital work in the vicinity or rural plan change. Maybe a link to policy

development.

|

Would not submit.

Rest on a case by case basis.

|

|

Worked with or for Mike

Colebrook and Kelvin Goode

|

Paid employment

|

N/A

|

N/A

|

|

Sally Macauley

|

Chairman

|

Northland District

Health Board

|

Matters pertaining to

health issues re Fluoride and freshwater as an example.

|

Declare a perceived

conflict.

|

|

Chairman

|

Oranga Tamaraki -

Ministry of Vulnerable Children- Northland Community Response Forum

|

Matters pertaining to

this ministry

|

Declare a perceived

conflict.

|

|

Judicial Justice of the

Peace

|

Visitations to Ngawha

Prison

|

Matters pertaining to

Judicial Issues re Ngawha Prison

|

Declare a perceived

Interest

|

|

The Turner Centre

|

FNDC Representative

|

Observer, acknowledging

FNDC financial contribution.

|

Note FNDC partnership

|

|

Trustee

|

Kaikohe Education Trust

|

Providing students

laptops - possible request for written support to funders

|

Declare a conflict

|

|

Executive member

|

Kaikohe Business

Association

|

Matters pertaining to

request for written support to funders.

|

|

|

Chairman

|

Bay of Islands Arts

Festival Trust

|

Issues pertaining to

the application of support funds

|

Declare a conflict of interests

|

|

Trustee

|

Bay of Islands Radio

Marine

|

Issues pertaining to

the application of support funds

|

Declare a conflict of

interets

|

|

Secretary/Trustee

|

Kerkeri International

Piano Competition

|

Issues pertaining to

the application of support funds

|

Declare a conflict of

interests

|

|

Trustee/Director

|

Kaikohe Community and

Youth Trust

|

Possible application of

support funding

|

Declare a conflict of

interests

|

|

Commercial

|

Palmer Macauley

Offices- Kerikeri and Kaikohe

|

Infrastructural matters

with FNDC

|

Declare a conflict

|

|

Private property of

which there would not be any conflict.

|

|

|

|

|

Paihia, Kerikeri,

Kaikohe

|

|

|

|

|

Peter Macauley

(Husband)

|

Senior Partner

|

Palmer Macauley

|

|

|

|

Peter Macualey

|

Barristers and

Solicitors- Kerikeri, Kaikohe and Mangonui

|

Legal matters with FNDC

|

|

|

Director/Trustee

|

|

|

|

|

St John NZ Priory

Chapter

|

St John Priory Chapter

|

Legal matters with FNDC

|

Declare a conflict

|

|

Senior Partner

|

Peter Macauley- Palmer

Macauley Barristers and Solicitors Kaikohe, Kerikeri AND Mangonui

|

Legal matters with FNDC

|

Declare a conflict

|

|

St John NZ

|

Priory Trust Board

|

Writing of policies and

legal matters as an example

|

Note Interests

|

|

Lions Club of Kaikohe

|

Director

|

Legal matters etc

|

Note Interests

|

|

Kaikohe Rugby Club

|

Patron

|

Legal Matters

|

|

|

Viking Rugby Club,

Whangarei

|

Life Member

|

Legal Matters

|

|

|

Private Property

|

|

|

|

|

Kerkeri, Paihia - no

contents.

|

|

|

|

|

John Vujcich

|

Board Member

|

Ngati Hine Health Trust

|

Matters pertaining to

property or decisions that may impact of their health services

|

Declare interest and

abstain

|

|

Board Member

|

Pioneer Village

|

Matters relating to

funding and assets

|

Declare interest and

abstain

|

|

Director

|

Waitukupata Forest Ltd

|

Potential for council

activity to directly affect its assets

|

Declare interest and

abstain

|

|

Director

|

Rural Service Solutions

Ltd

|

Matters where council

regulatory function impact of company services

|

Declare interest and

abstain

|

|

Director

|

Kaikohe (Rau Marama)

Community Trust

|

Potential funder

|

Declare interest and

abstain

|

|

Partner

|

MJ & EMJ Vujcich

|

Matters where council

regulatory function impacts on partnership owned assets

|

Declare interest and

abstain

|

|

Member

|

Kaikohe Rotary Club

|

Potential funder, or

impact on Rotary projects

|

Declare interest and

abstain

|

|

Member

|

New Zealand Institute

of Directors

|

Potential provider of

training to Council

|

Declare a Conflict of

Interest

|

|

Member

|

Institute of IT

Professionals

|

Unlikely, but possible

provider of services to Council

|

Declare a Conflict of

Interest

|

|

Member

|

Kaikohe Business

Association

|

Possible funding provider

|

Declare a Conflict of

Interest

|

|

Mike Edmonds

|

Chair

|

Kaikohe Mechanical and

Historic Trust

|

Council Funding

|

Decide at the

time

|

|

Committee member

|

Kaikohe Rugby Football

and Sports Club

|

Council Funding

|

Withdraw and abstain

|

|

Adele Gardner

|

N/A - FNDC Honorarium

|

|

|

|

|

The Far North 20/20 ,

ICT Trust

|

Trustee

|

|

|

|

Te Ahu Charitable Trust

|

Trustee

|

|

|

|

ST Johns Kaitaia Branch

|

Trustee/ Committee

Member

|

|

|

|

I know many FNDC staff

members as I was an FNDC staff member from 1994-2008.

|

|

|

|

|

Partner of Adele

Gardner

|

N/A as Retired

|

|

|

|

|

Terry Greening

|

Greening Family Trust

|

Beneficiary

|

|

Highly unlikely to

interface with FNDC

|

|

Bay of Islands Walking

Weekend Trust

|

|

Potential of seeking

funds

|

Step aside from any

requests or decisions regarding requests

|

|

Russell 2000 Trust

(Chairman)

|

|

|

Trust is about to wind

up.

|

|

Russell Centennial

Trust (Chairman)

|

Manages Russell Museum

|

Seeks funds from

council

|

Step aside from any

requests or decisions regarding requests

|

|

Residence at Kaha

Place, Russell

|

Nil

|

Nil

|

N/A

|

|

Terry Greening (Wife)

|

Greening Family Trust

|

Beneficiary

|

N/A

|

N/A

|

|

Residence at Kaha

Place, Russell

|

|

|

|

|

Cr Kelly Stratford

|

Office manager at

Kinghans.

|

|

|

|

|

Denture assistant at

Kawakawa denture Services

self-employed as book keeper Kelly@ksbookkeeoing.net

|

None

|

None

|

|

|

KS Bookkeeping and

Administration

|

Business owner,

bookkeeping and development of environment management plans for clients.

|

None perceived

|

I’d step aside

from decisions that arise, that may have conflicts.

|

|

Kinghans Accounting

|

Office Administration

|

None perceived

|

I’d step aside

from decisions that arise, that may have conflicts.

|

|

Waikare Marae Trustees

|

Trustee

|

May be perceived

conflicts

|

Case by case basis

|

|

Kawakawa Business &

Community Association

|

Committee member/newsletter

editor and printer

|

None perceived

|

If there was a

perceived conflict, I will step aside from decision making

|

|

Bay of Islands College

|

Parent elected trustee

|

None perceived

|

If there was a

perceived conflict, I will step aside from decision making

|

|

Karetu School

Bay Cosmos Soccer

|

Parent elected trustee.

Committee member and coach

|

None perceived

|

If there was a

perceived conflict, I will step aside from decision making

|

|

Property in Waikare and

Moerewa

|

|

|

If there was a

perceived conflict, I will step aside from decision making

|

|

Coffee and food

|

Ratepayers sometimes

'shout' food and beverage

|

Bias or

pre-determination

|

Case by case

|

|

Kelly Stratford

(Husband)

|

Property in Moerewa

|

|

N/A

|

N/A

|

1 Prayer

2 Apologies

and Declarations of Interest

Members need to

stand aside from decision-making when a conflict arises between their role as a

Member of the Council and any private or other external interest they might

have. This note is provided as a reminder to Members to review the matters on

the agenda and assess and identify where they may have a pecuniary or other

conflict of interest, or where there may be a perception of a conflict of

interest.

If a Member

feels they do have a conflict of interest, they should publicly declare that at

the start of the meeting or of the relevant item of business and refrain from

participating in the discussion or voting on that item. If a Member thinks they

may have a conflict of interest, they can seek advice from the Chief Executive

Officer or the Team Leader Governance Support (preferably before the meeting).

It is noted that while members can seek advice the final

decision as to whether a conflict exists rests with the member.

3 MAYORAL

ANNOUNCEMENTS

4 DeputationS

11:15 Our

Kerikeri

11:30 Food

& Plant Research

5 Confirmation

of Previous Minutes

5.1 Confirmation

of Previous Minutes

File

Number: A2495294

Author: Melissa

Wood, Meetings Administrator

Authoriser: Aisha

Huriwai, Team Leader Governance Support

Purpose of the Report

The minutes are attached to allow Council to confirm that

the minutes are a true and correct record of previous meetings.

|

Recommendation

That Council confirms the minutes of the Council

meeting held 17 April 2019 as a true and correct record

|

1) Background

Local Government Act 2002 Schedule 7 Section 28 states that

a local authority must keep minutes of its proceedings. The minutes of

these proceedings duly entered and authenticated as prescribed by a local authority

are prima facie evidence of those meetings.

2) Discussion and Options

The minutes of the meetings are attached.

Far North District Council Standing Orders Section 27.3

states that no discussion shall arise on the substance of the minutes in any succeeding

meeting, except as to their correctness.

Reason

for the recommendation

The reason for the recommendation is to confirm the minutes

are a true and correct record of the previous meetings.

3) Financial Implications and Budgetary

Provision

There are no financial implications or the need for

budgetary provision as a result of this report.

Attachments

1. Unconfirmed

Minutes - Council meeting 17 April 2019 - A2448248 ⇩

Compliance schedule:

Full consideration has been given to the provisions of the Local

Government Act 2002 S77 in relation to decision making, in particular:

1. A

Local authority must, in the course of the decision-making process,

a) Seek

to identify all reasonably practicable options for the achievement of the

objective of a decision; and

b) Assess

the options in terms of their advantages and disadvantages; and

c) If

any of the options identified under paragraph (a) involves a significant

decision in relation to land or a body of water, take into account the

relationship of Māori and their culture and traditions with their

ancestral land, water sites, waahi tapu, valued flora and fauna and other

taonga.

2. This

section is subject to Section 79 - Compliance with procedures in relation to

decisions.

|

Compliance

requirement

|

Staff

assessment

|

|

State the level of significance

(high or low) of the issue or proposal as determined by the Council’s

Significance and Engagement Policy

|

Not applicable

|

|

State the relevant Council

policies (external or internal), legislation, and/or community outcomes (as

stated in the LTP) that relate to this decision.

|

Not applicable

|

|

State whether this issue or

proposal has a District wide relevance and, if not, the ways in which the

appropriate Community Board’s views have been sought.

|

Not applicable

|

|

State the possible implications for Māori

and how Māori have been provided with an opportunity to contribute to

decision making if this decision is significant and relates to land and/or

any body of water.

|

None

|

|

Identify persons likely to be

affected by or have an interest in the matter, and how you have given

consideration to their views or preferences.

|

Yes

|

|

State the financial implications

and where budgetary provisions have been made to support this decision.

|

There are no financial

implications or the need for budgetary provision arising from this report

|

|

Chief Financial Officer review.

|

The Chief Financial Officer has

not reviewed this report

|

|

Ordinary Council Meeting Agenda

|

27 June 2019

|

MINUTES OF Far North District Council MEETING

HELD AT THE COUNCIL CHAMBER, MEMORIAL AVENUE, KAIKOHE

ON WEDNESDAY 17 APRIL 2019 AT 10:00 AM

PRESENT: Mayor

John Carter (HWTM), Cr Tania McInnes (Deputy Mayor), Cr Ann Court, Cr Felicity

Foy, Cr Dave Hookway, Cr Colin (Toss) Kitchen, Cr Sally Macauley, Cr Mate

Radich, Cr John Vujcich

IN

ATTENDANCE:Mike Edmonds (Kaikohe-Hokianga Community Board Chairperson),

Terry Greening (Bay of Islands-Whangaroa Community Board Chairperson), Adele

Gardner (Te Hiku Community Board Chairperson), Shaun Baker - Northland

Transport Alliance, Shaun Reilly - Kaikohe-Hokianga Community Board Member

STAFF

PRESENT: Shaun Clarke - Chief Executive Officer, Janice Smith - General

Manager Corporate Services (Acting), Andy Finch - General Manager -

Infrastructure and Asset Management, Dean Myburgh - General Manager - District

Services, Darrell Sargent - General Manager - Strategic Planning and Policy,

Jaime Dyhrberg - Executive Officer, Glenn Rainham - Manager Alliances, Sheryl

Gavin - Manager Corporate Planning and Engagement, Jill Coyle - Manager People

and Capability, Tanya Proctor - Team Leader Infrastructure Programmes,Gayle

Anderson - Executive Assistant to GM SPP, Aisha Huriwai - Team Leader

Governance Support, Melissa Wood - Meetings Administrator, Marlema Baker -

Meetings Administrator, Michelle Sharp - Manager Project Management, Roger

Ackers - Manager Strategy Development, George Swanepoel - InHouse Counsel,

Richard Edmondson - Manager Communications

1 Prayer

His Worship the Mayor commenced the meeting with a prayer.

2 Apologies

and Declarations of Interest

Moved:

Mayor John Carter

Seconded: Deputy Mayor McInnes

That the apology from

Councillor Stratford be accepted and leave of absence granted

CARRIED

3 DeputationS

Bart Van der Meer representative from Volunteering Northland

provided a report to Council on their activies.

4 MAYORAL

ANNOUNCEMENTS

Provincial Growth Fund updates

5 Confirmation of Previous

Minutes

|

5.1 Confirmation

of Previous Minutes

|

Recommendation

Moved:

Mayor John Carter

Seconded: Cr Tania McInnes

That Council confirm the

minutes of the:

a) Council meeting held 28

February 2019 as a true and correct record

b) Extraordinary Council meeting

held 4 April 2019 as a true and correct record

CARRIED

6 Bay

of Islands-Whangaroa Community Board

|

6.1 Lease Russell Town Hall Shop

|

Recommendation

Moved:

Mayor John Carter

Seconded: Cr Colin Kitchen

That

Council

a) enters

into a 3x3x3 year commercial lease of the Russell Town Hall Shop with Bay of

Islands Kayak Tours Ltd.

b) approves that the

General Manager Infrastructure and Asset Management is authorised to negotiate

and agree to the terms and conditions of the lease on the premises on

commercial terms and subject to relevant Council policies and legislation.

c) agrees that in

accordance with Section 94 of the Reserves Act 1977, Council authorizes the use

of the Local Purpose (Public Hall) Reserve in front of the premises by Bay of

Islands Kayak Tours Ltd to park and display kayaks during business hours.

d) agrees that the General

Manager Infrastructure and Asset Management is authorised to negotiate and

agree to the terms and conditions of the permit to use the reserve, subject to

relevant Council policies and legislation.

CARRIED

deputations (CONTINUED)

Myles Taylor representative from Fire Emergency New Zealand

(FENZ) spoke regarding the local community profiling project.

7 Audit,

Risk, and Finance Committee

|

7.1 Amendments to Rating Relief Policies

|

Councillor Court declared an interest and withdrew from the

table

Recommendation

Moved:

Cr John Vujcich

Seconded: Mayor John Carter

That Council

approves the following amendments to the Rating Relief Polices prior to

consultation:

a) The

Transitional Farmland policy is re-instated

b) The

Treaty Settlement Lands policy is amended to include settlements approved prior

to 1 July 2018

c) The

Common Use Properties policy is amended to include commercial enterprises and residential

properties

d) The

Landlocked Land policy is amended to refer Maori land issues to the Maori Land Court

for decision

e) The

Land Subject to Protection for Outstanding Natural Landscape, Cultural, Historic

or Ecological Purposes policy is amended to include

covenants approved under the Heritage New

Zealand Pouhere Taonga Act 2014 (or Historic Places Act 1993)

f) The

Residential Rates for Senior Citizens policy is amended to provide clarity for conditions

1 and 4 to allow staff to apply the conditions fairly to all applicants.

CARRIED

Councillor

Court returned to the table

DEPUTATIONS

(CONTINUED)

Representatives from Far North Youth Mentoring Programme, accompanied by

Council staff, Bay of Islands-Whangaroa Community Board Member Rachel Smith,

and Councillor Kelly Stratford introduced themselves to Mayor and Councillors.

Attendance: Councillor Hookway left the meeting at 10:55 am

and returned to the meeting at 10:57 am.

8 Infrastructure

and Asset Management Group

|

8.1 Maromaku Domain Netball Courts

|

Recommendation

Moved:

Mayor John Carter

seconded: Cr Felicity Foy

That the Council:

a) uplift

the report Maromaku Domain Netball Courts from the table

b) note

the report Maromaku Domain Netball Courts

c) approve

the use of the existing budget of $371,370 less expenditure previously incurred,

to progress the project having the following scope:

i. Demolish

the existing three netball courts.

ii. Provide

two full size netball courts, two tennis courts, and a hockey training facility.

iii. Playing

surfaces finished with artificial turf.

d) continue

to seek a contribution from the community, comprising funding, materials or labour.

CARRIED

Councillors

Foy and McInnes requested their votes against the motion be recorded

8.2 Inclusion

of te rangi cross road iN the schedule of the far north DISTRICT COUNCIL

MAINTAINED ROADS

This item was withdrawn at the request of the Chief

Executive

8.3 PROGRESS

UPDATE ON THE DEVELOPMENT OF A DISTRICT WIDE PRIORITISATION MATRIX TO ENABLE

FORWARD WORK PROGRAMME FOR 2019-2020 FY

This item was withdrawn at the request of the Chief

Executive

9 District

Services Group

|

9.1 Resource Management Act Delegations

|

Councillor Foy declared an interest and withdrew from the discussion

in regard to this item

Recommendation

Moved:

Mayor John Carter

Seconded: Cr Ann Court

That Council approve the

delegations set out in the Resource Management Act Delegations Schedule 2019

with effect from 19 April 2019.

CARRIED

10 Strategic

Planning and Policy Group

|

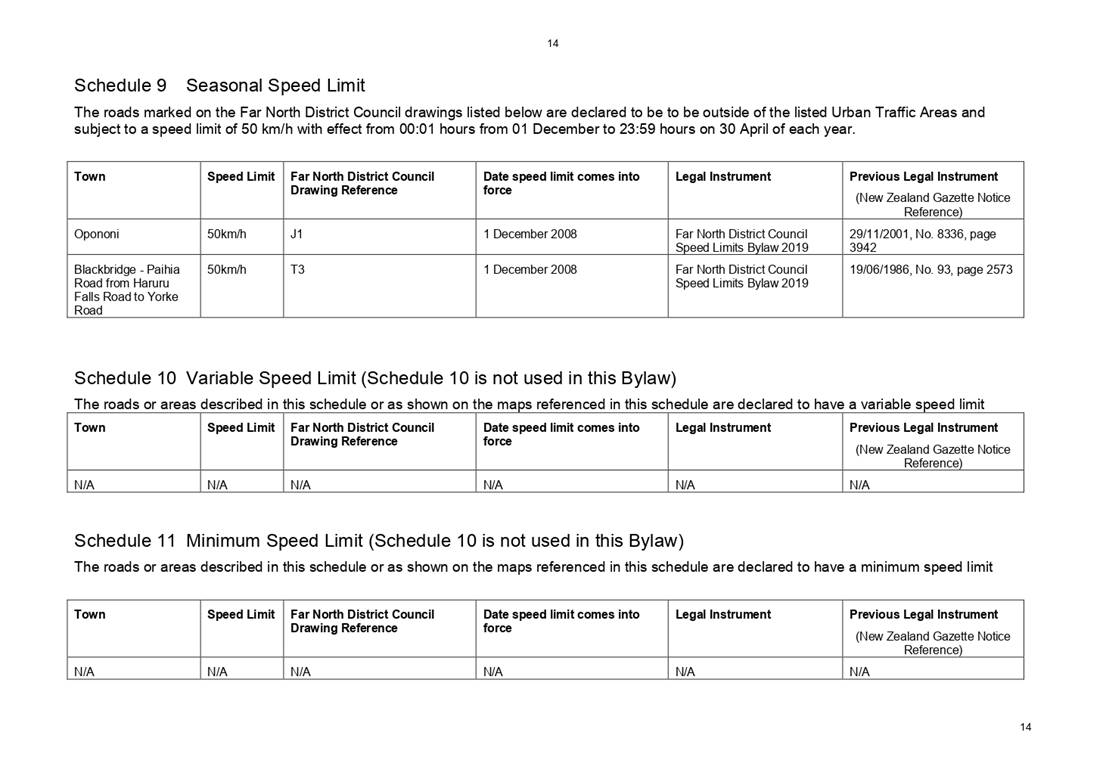

10.1 Speed Limits Bylaw Review

|

Recommendation

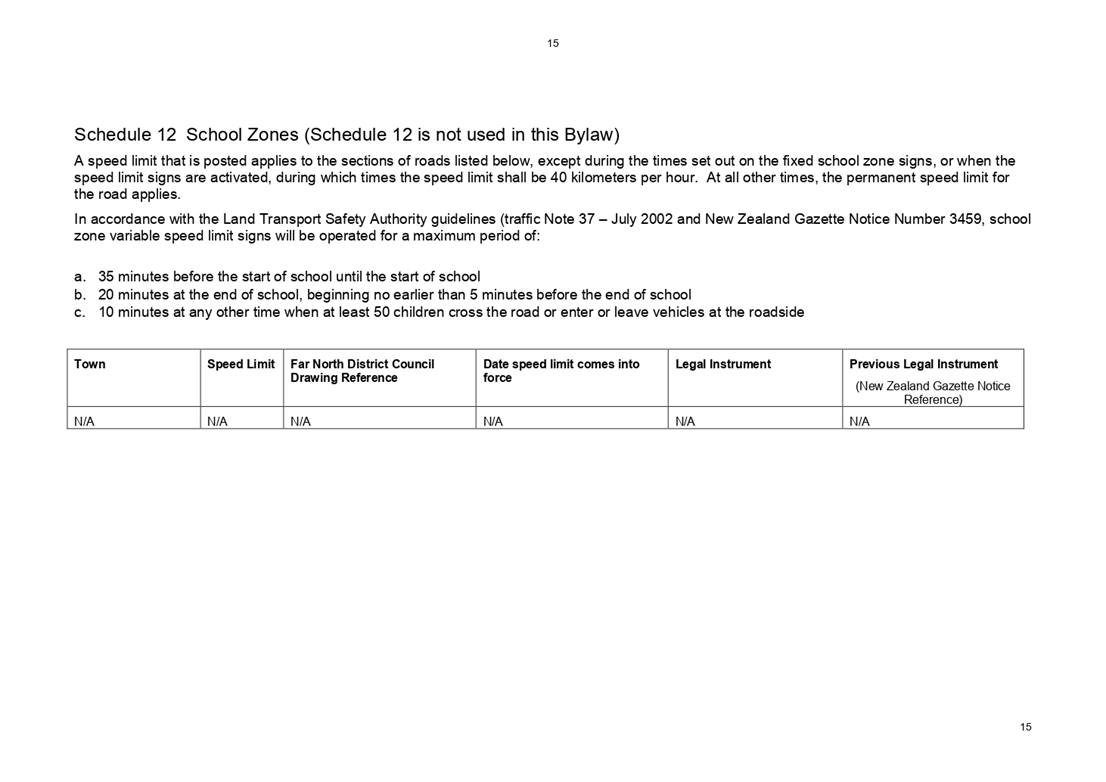

Moved:

Mayor John Carter

Seconded: Cr Mate Radich

That the Council:

a) adopt

the Proposed Speed Limits Bylaw 2019 for consultation (Attachment 1).

b) authorises the Chief Executive

Officer to make any necessary minor edits or amendments to the attached

Proposed Speed Limits Bylaw 2019 prior to consultation to correct any spelling

or typographical errors.

CARRIED

11 corporate

services group

|

11.1 Lease Council building 11 Parnell Street,

Rawene

|

Recommendation

Moved:

Cr John Vujcich

Seconded: Cr Felicity Foy

That the matter be

referred back to staff and returned to the table with the appropriate community

board recommendation.

CARRIED

|

11.2 Local Bill amending the Electricity Industry

Act 2010

|

Councillor Court declared an interest and withdrew from the

table

Recommendation

Moved:

Mayor John Carter

Seconded: Cr Tania McInnes

That the Far North District Council supports and adopts an

amended local bill that will:

a) Have the effect of

removing the application of the Electricity Industry Act 2010 insofar as it

relates to prohibitions on common management of distributors with interests in

generation in the Far North District; and

b) In substitution empower

the Council to set requirements relating to common management of such

distributors; and

c) Approve the principles

set out in the attached Schedule upon which an application which is made by a

distributor under the terms of the bill will be considered.

CARRIED

Councillor Court returned to the table

|

11.3 Elected Member Report - Inclusive Growth

Summit 19 March 2019 and Road Controlling Authorities Forum 29 March 2019

|

Recommendation

Moved:

Cr John Vujcich

Seconded: Cr Tania McInnes

That Council note the

report entitled “Elected Member Report - Inclusive Growth Summit, 19

March 2019 and Road Controlling Authorities Forum, 29 March 2019”.

CARRIED

|

11.4 CEO Report to Council 01 February 2019 - 31

March 2019 - SUPPLEMENTARY AGENDA

|

Recommendation

Moved:

Cr John Vujcich

Seconded: Mayor John Carter

That the Council receive

the report “CEO Report to Council 01 February 2019 - 31 March

2019”.

CARRIED

Attendance: Mayor Carter left the meeting at 11:43 am and

returned at 11:45 am.

Attendance: Councillor Kitchen left the meeting at 12:23 pm

and returned at 12:26 pm.

The meeting was adjourned at 12:14 pm and resumed at 1:50 pm

12 Public

Excluded

RESOLUTION TO

EXCLUDE THE PUBLIC

|

Recommendation

Moved: Mayor John

Carter

Seconded: Cr Colin Kitchen

That the public be excluded from the following parts of

the proceedings of this meeting.

The general subject matter of each matter to be considered

while the public is excluded, the reason for passing this resolution in

relation to each matter, and the specific grounds under section 48 of the

Local Government Official Information and Meetings Act 1987 for the passing

of this resolution are as follows:

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to

each matter

|

Ground(s) under section 48 for the passing of this

resolution

|

|

12.1 – Confirmation of Previous

Minutes – Public Excluded

|

s7(2)(i) - the withholding of the information is

necessary to enable Council to carry on, without prejudice or disadvantage,

negotiations (including commercial and industrial negotiations)

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

12.2 - Te Pu o Te Wheke project

|

s7(2)(f)(i) - free and frank expression of

opinions by or between or to members or officers or employees of any local

authority

s7(2)(h) - the withholding of the information is

necessary to enable Council to carry out, without prejudice or

disadvantage, commercial activities

s7(2)(i) - the withholding of the information is

necessary to enable Council to carry on, without prejudice or disadvantage,

negotiations (including commercial and industrial negotiations)

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

CARRIED

|

13 Meeting

Close

The meeting closed at 2:41 pm.

The minutes of this meeting were confirmed at the meeting

held on 27 June 2019

...................................................

CHAIRPERSON

6 Bay

of Islands-Whangaroa Community Board

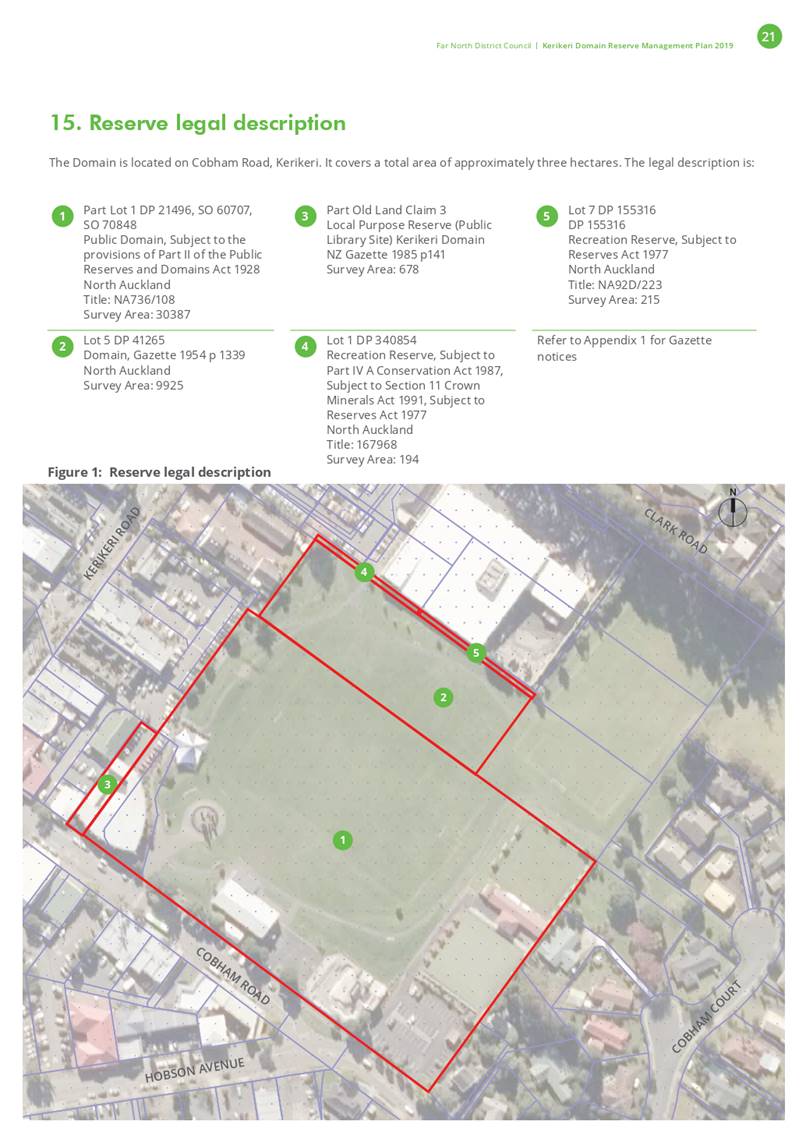

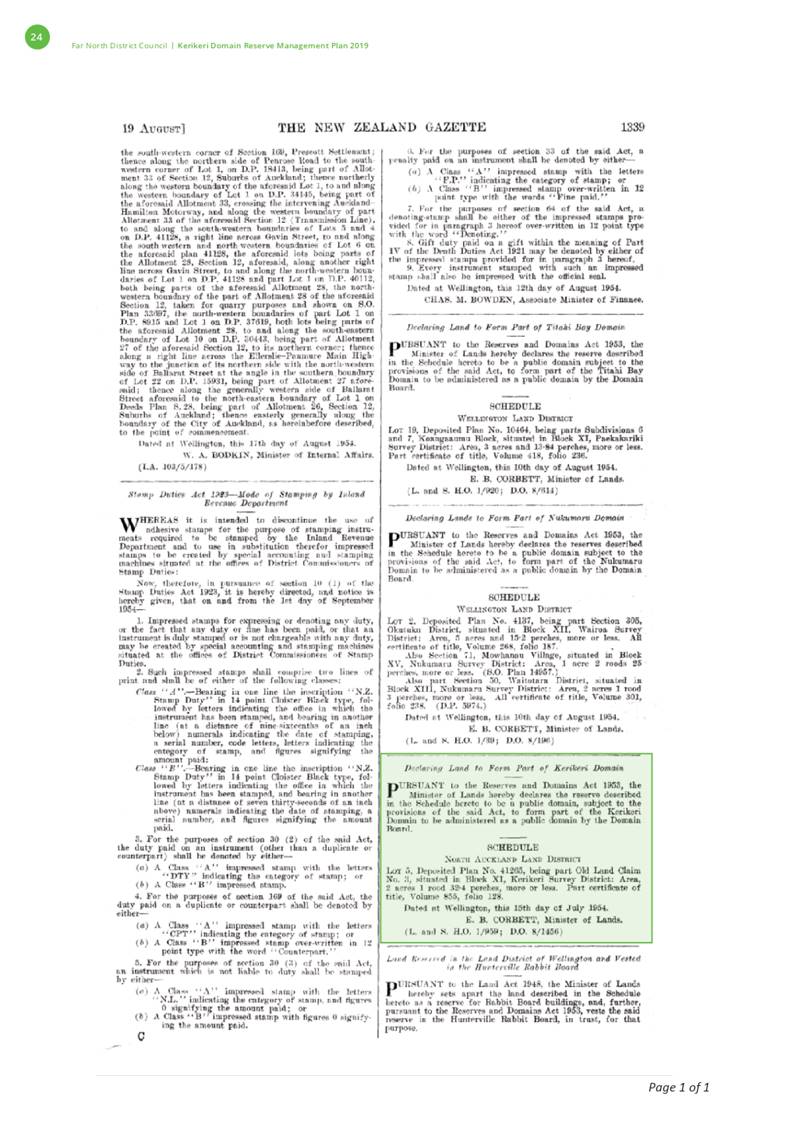

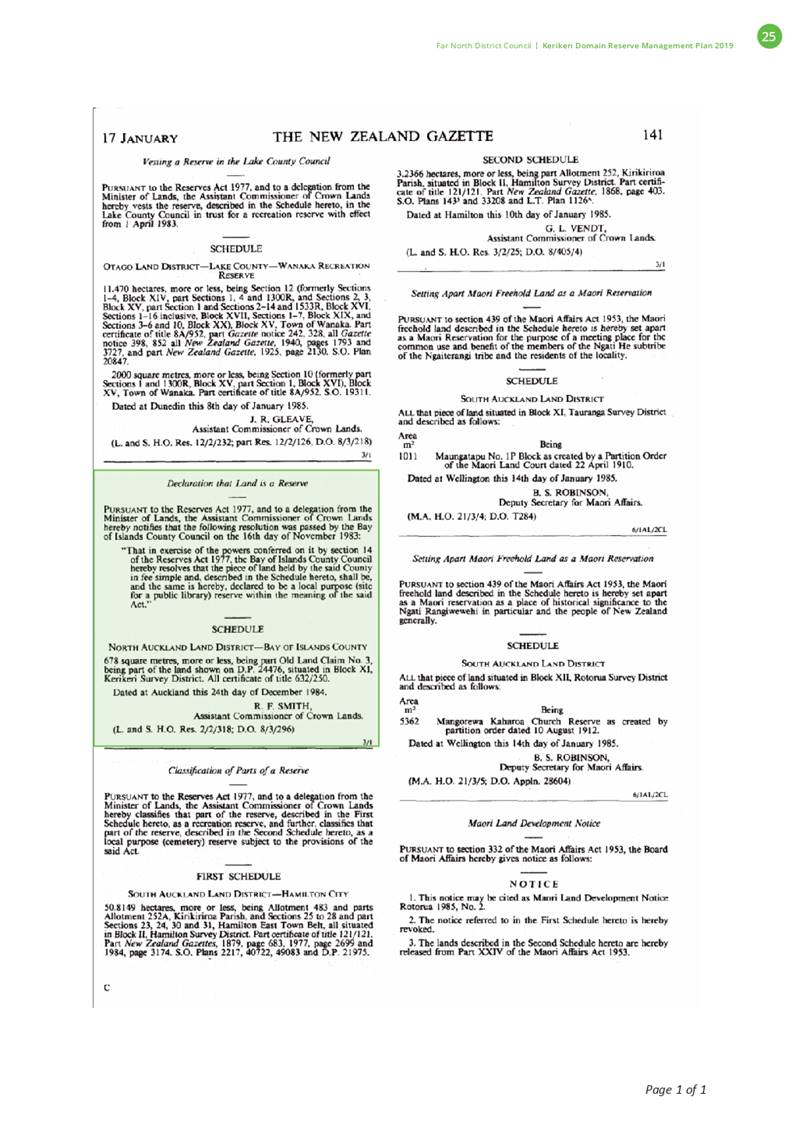

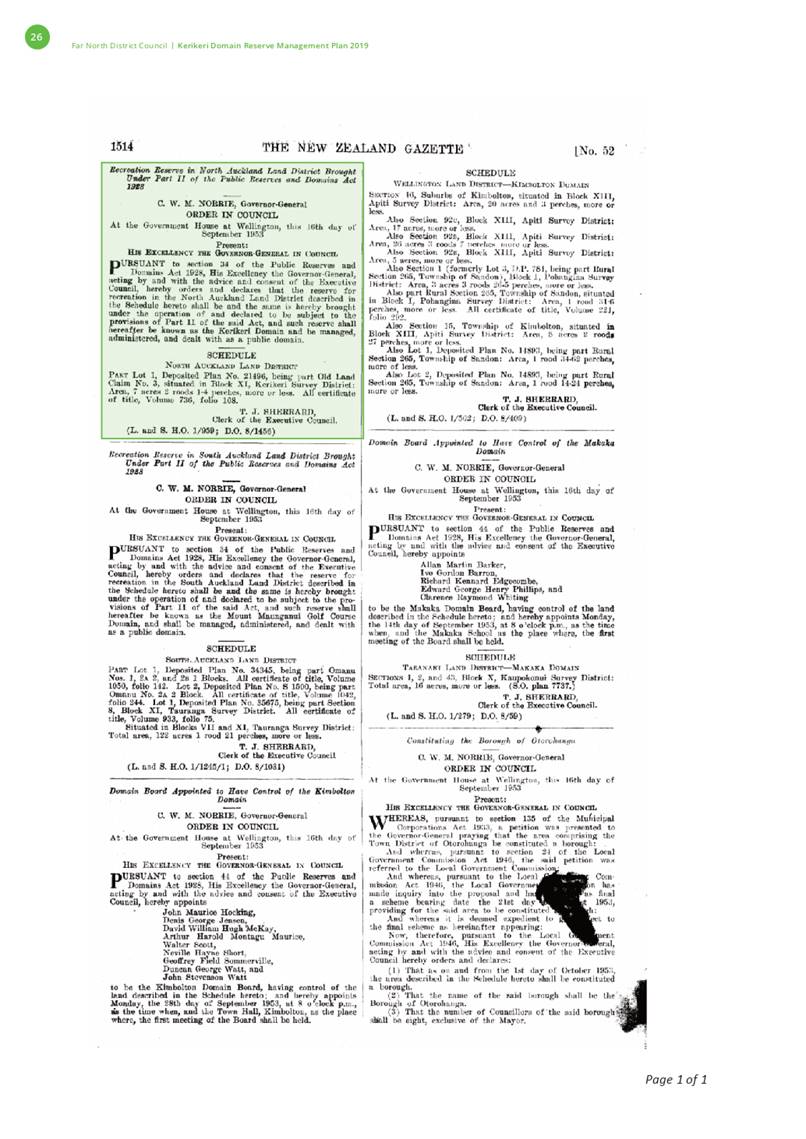

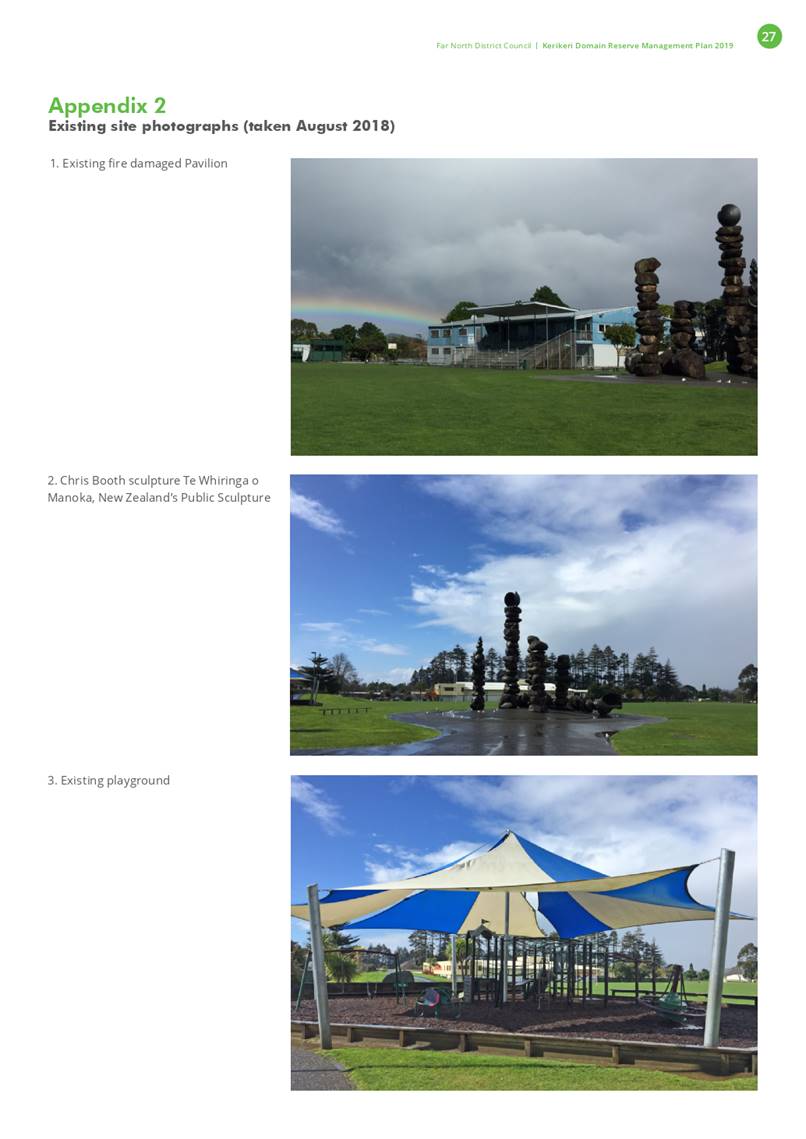

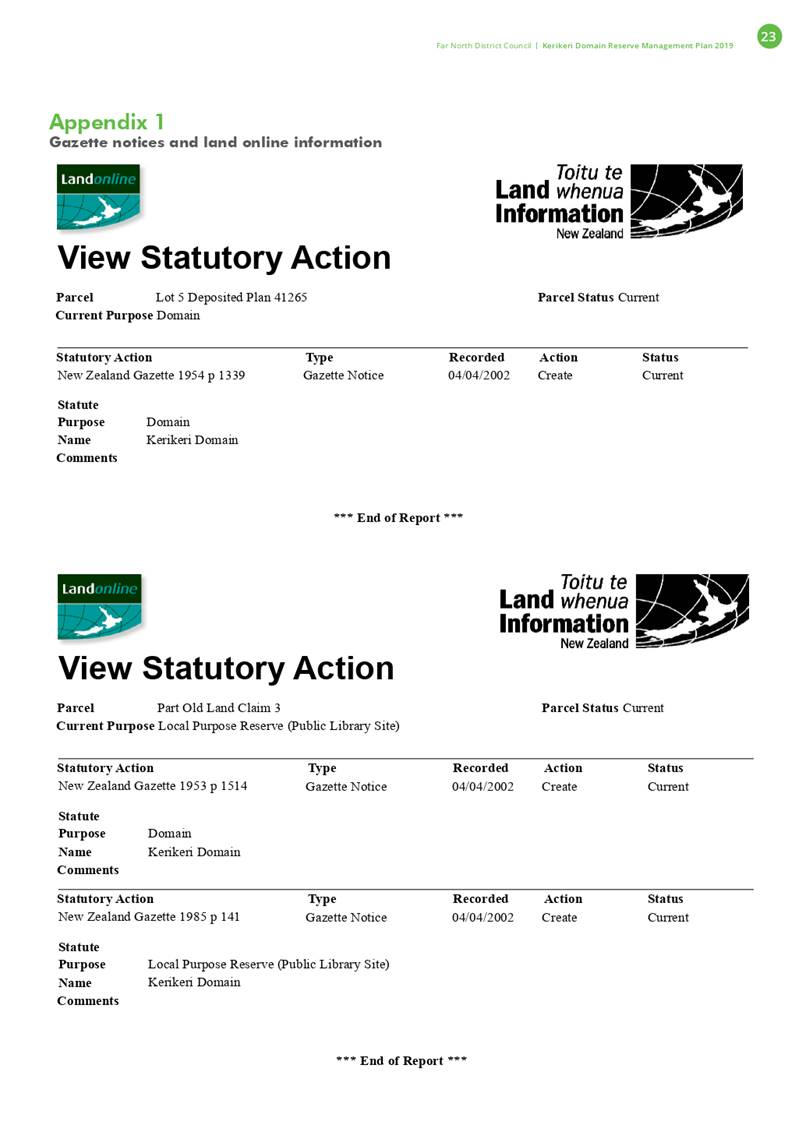

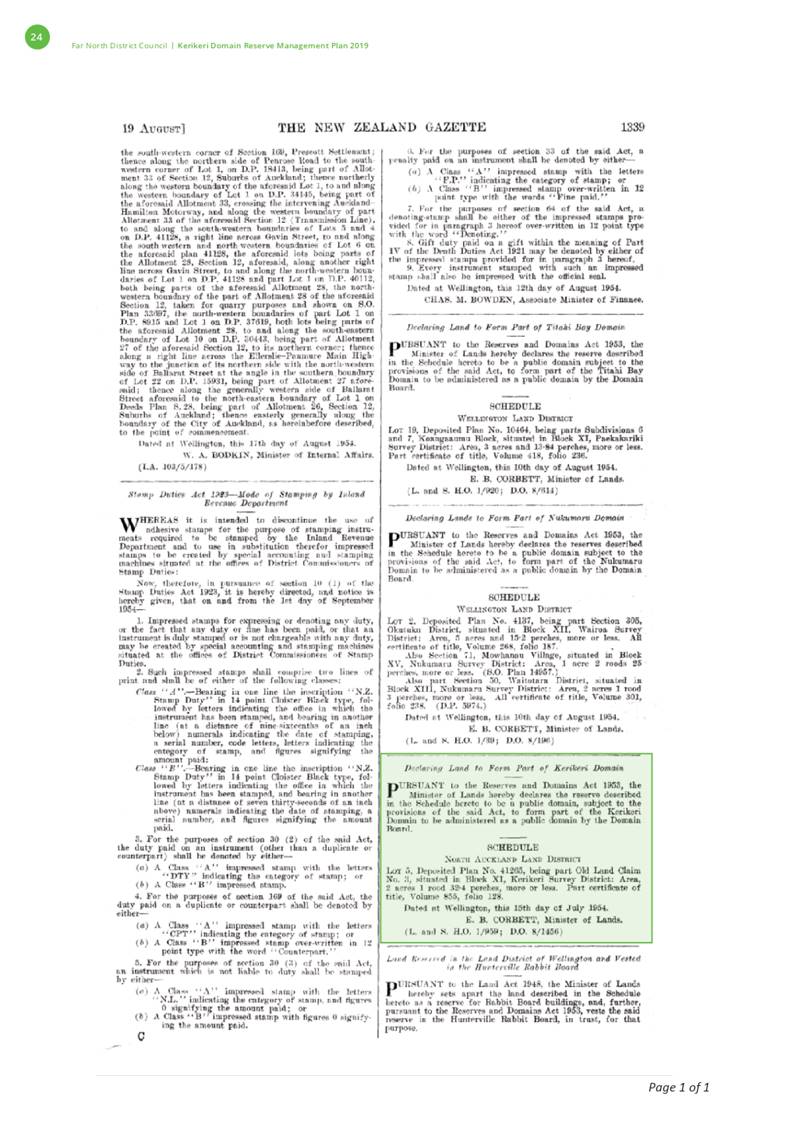

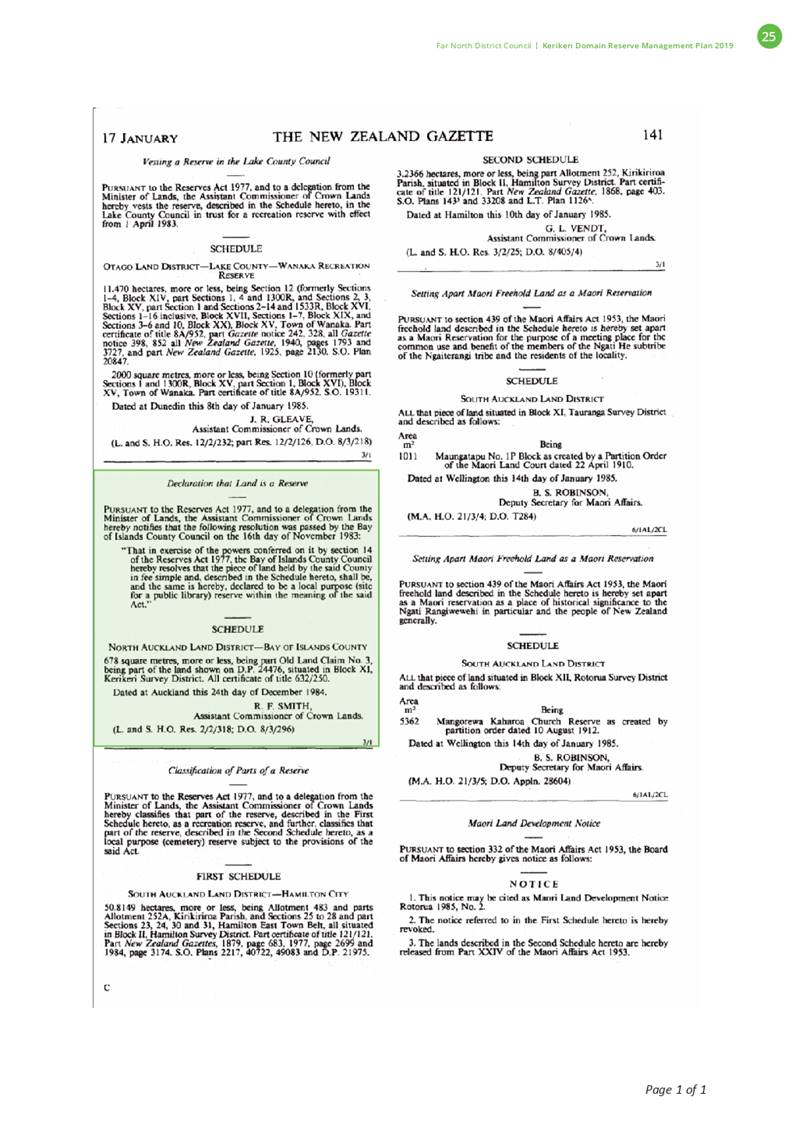

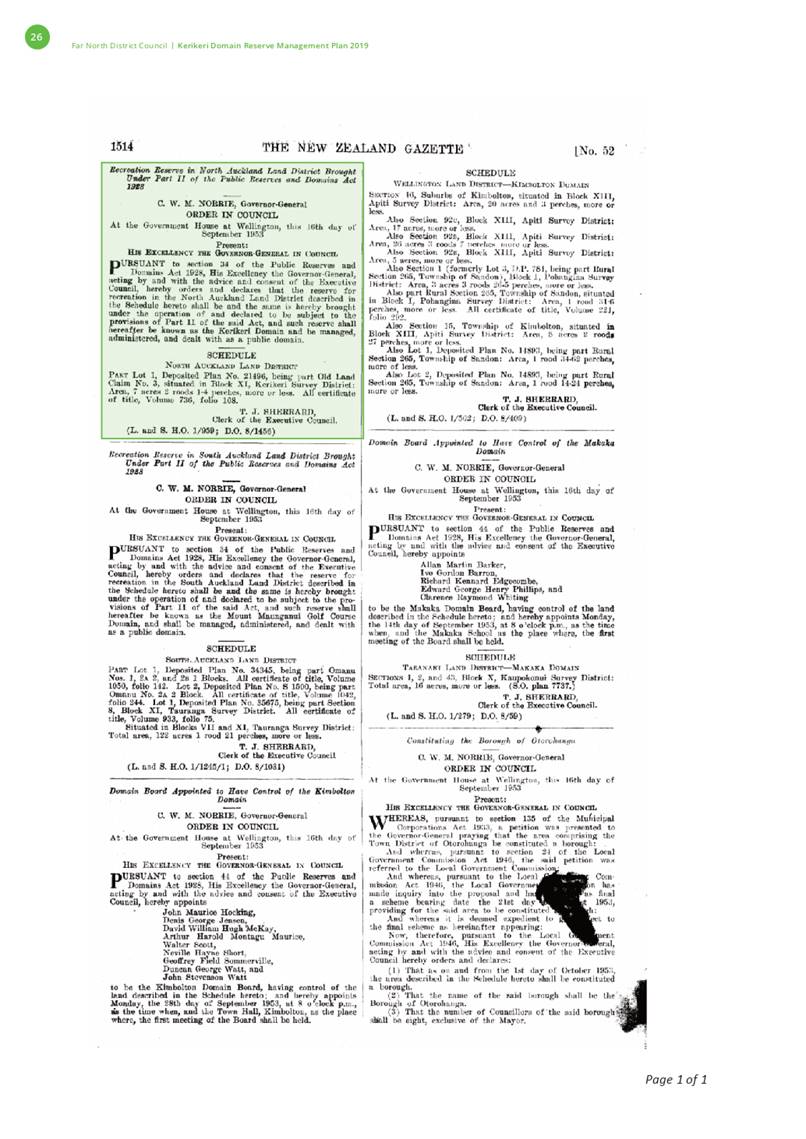

6.1 Adoption

of the Kerikeri Domain Reserve Management Plan

File

Number: A2478426

Author: Rachael

Pull, Specialist Planner - Urban Design

Authoriser: Darrell

Sargent, General Manager - Strategic Planning and Policy

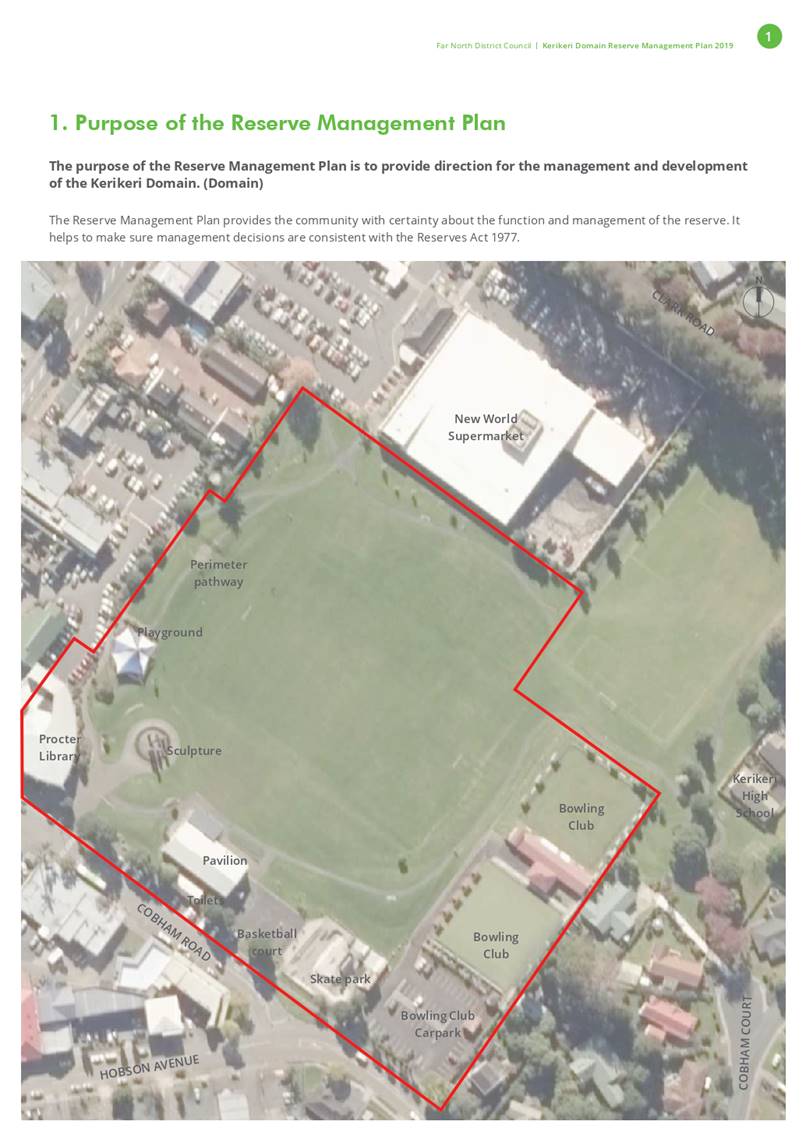

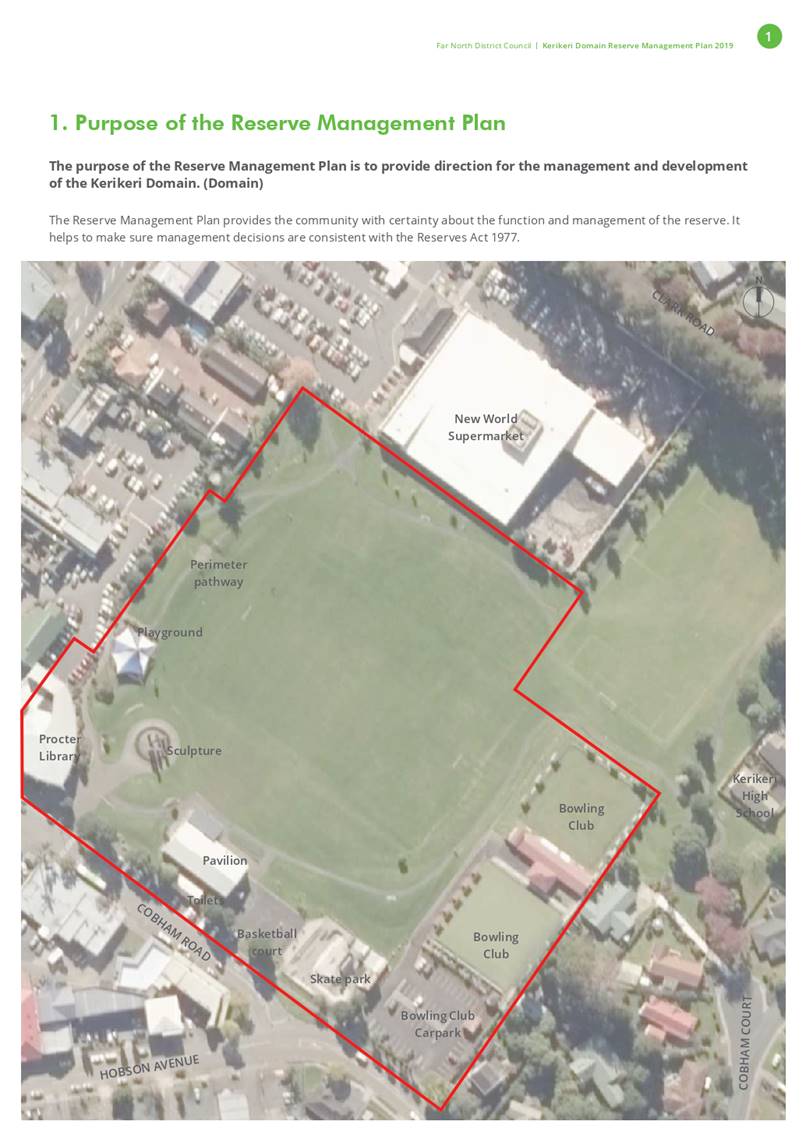

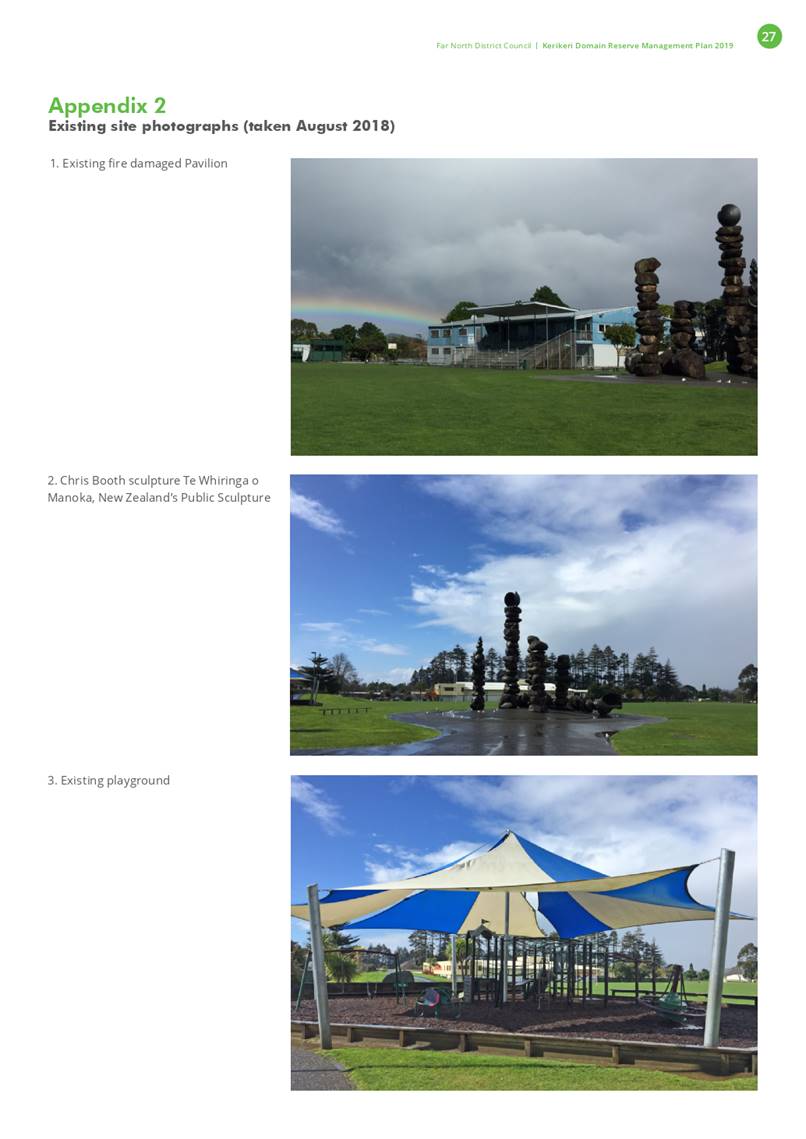

Purpose of the Report

· To seek adoption

of the Kerikeri Domain Reserve Management Plan.

Executive Summary

Administration,

with the support of the Bay of Islands-Whangaroa Community Board (Community

Board), consultants, key stakeholders, iwi and the public have created a

Reserve Management Plan for the Kerikeri Domain to meet obligations under

Section 41 of the Reserves Act 1977. The Kerikeri Domain Reserve

Management Plan (Management Plan) has been through a public notification

process and submissions were heard at a hearing on 9 April 2019.

The Community Board was presented the Kerikeri Domain

Reserve Management Plan at their meeting on 20 May 2019. The Community Board

made some changes to the Management Plan which have been incorporated in the

attached version for Council to adopt.

The Community Board also recommended that the reserve

management plan be adopted and that a governing body for the Kerikeri Domain be

established.

|

Recommendation

That Council:

a) adopts

the Draft Kerikeri Domain Reserve Management Plan 2019 pursuant to its powers

under section 41 of the Reserves Act 1977

b) Requests that Council urgently establish a reserve management

committee for the Kerikeri Domain, to manage the domain and its use, and that

the committee seek to be an incorporated society.

|

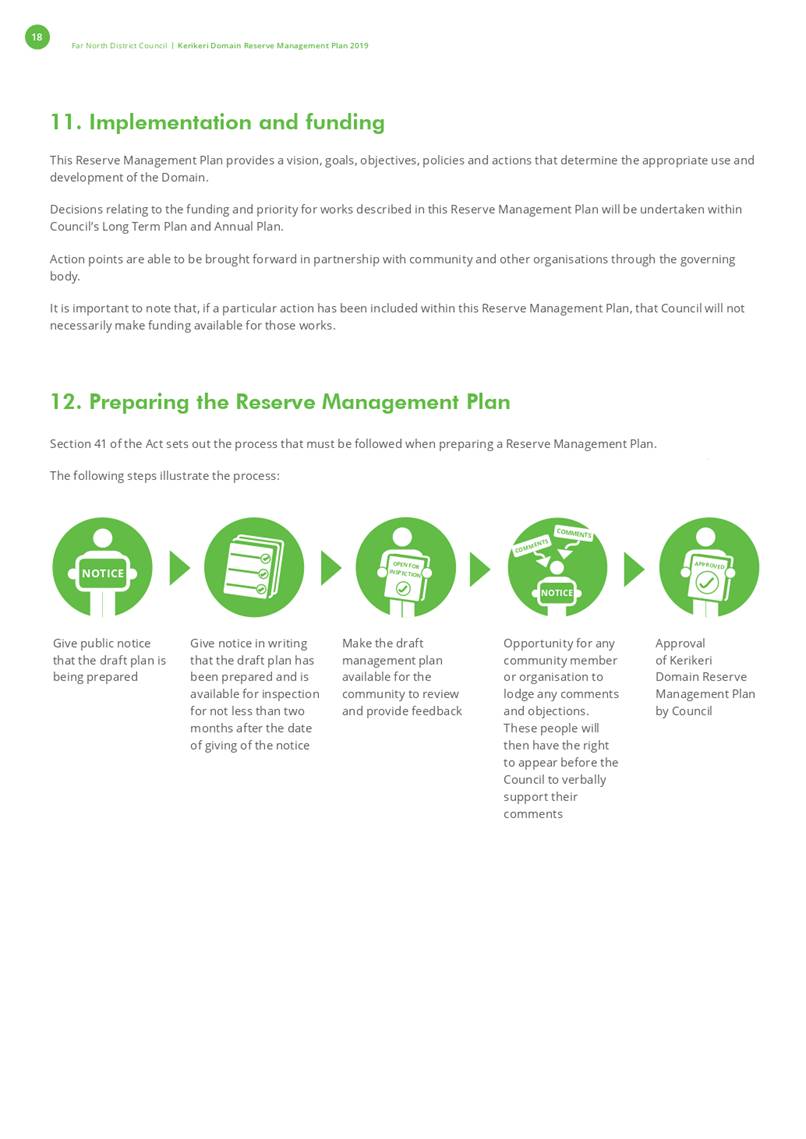

1) Background

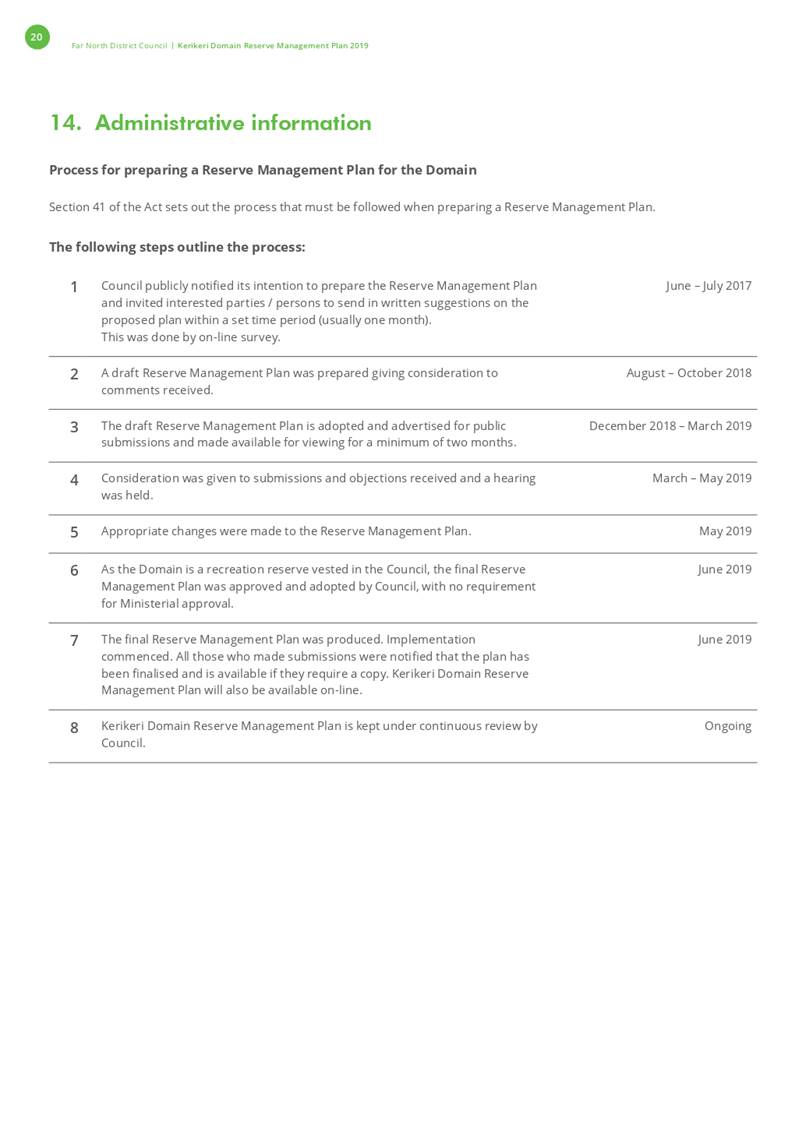

In June 2017, Council gave public notice of its intention to

create a Management Plan for the Kerikeri Domain. One of Council's

responsibilities under the Reserves Act 1977 is to prepare Management Plans for

all of its gazetted reserves. A Management Plan sets out how Council

intends to provide for the use, enjoyment, maintenance, protection,

preservation and, when appropriate, development of a reserve.

The Management Plan was written by Administration, with

support from the Community Board and consultants, following consultation with

key stakeholders, iwi and the public.

The Management Plan was publicly notified on 17 December

2018, with submissions closing on 15 March 2019. A total of 151

submissions were received, with 32 submitters requesting to be heard. The

submissions were in general support of having a Management Plan, with the

majority requesting changes to the Management Plan as they wanted to have

additional facilities and references to certain groups and activities provided

at the Kerikeri Domain. Some of the submissions also related to matters

out of scope, which can’t be controlled by the Management Plan and are

better managed by Council’s Bylaws and the Long Term Plan.

At the 13 December 2018 Council meeting it was resolved that

the Community Board would hear the submissions received on the Management Plan,

and that they would deliberate on whether to make any changes to the Management

Plan before recommending adoption by Council.

The public hearing was held by the Community Board on 9

April 2019, with deliberations held on 20 May 2019 at which time the Management

Plan was amended.

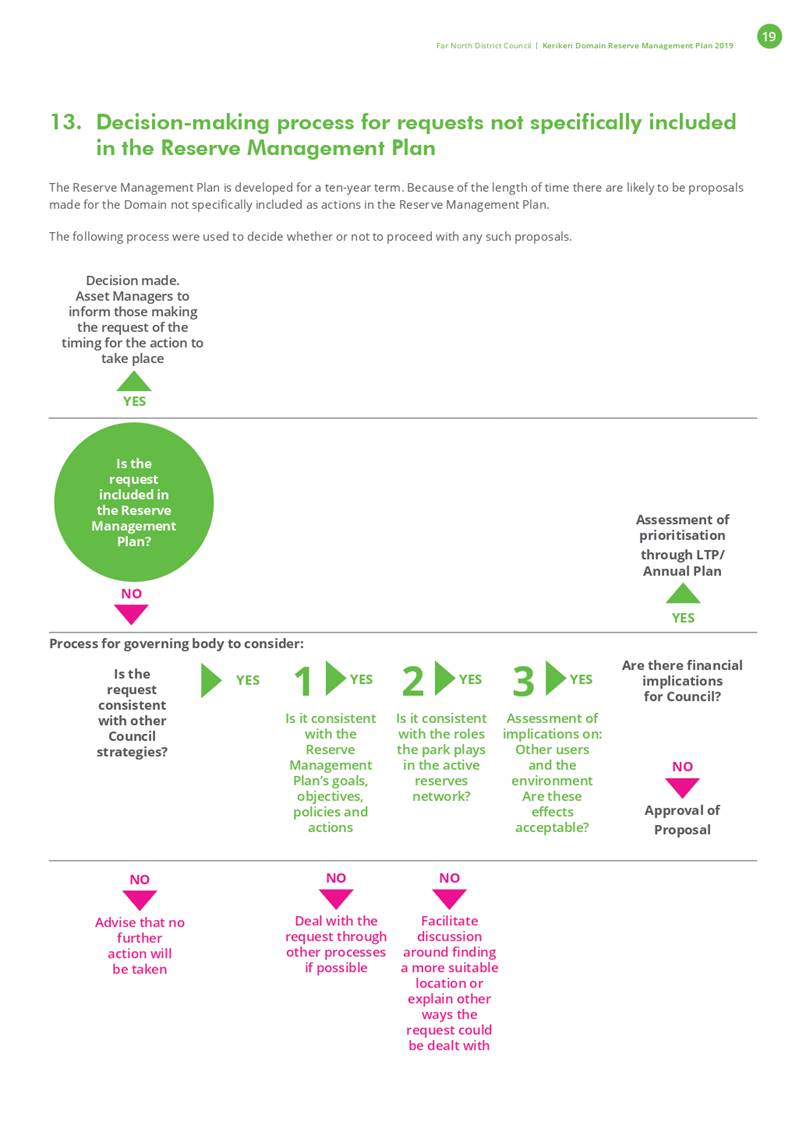

2) Discussion and Options

The Community Board recommends that Council adopt the

amended Kerikeri Domain Reserve Management Plan.

Options

The available options include

Council either adopting the amended Management Plan or resolving to prepare a

new Management Plan.

Option 1

The

Community Board has reviewed the submissions made by the public and considers

that there should be some minor changes made to the Management Plan to achieve

a more integrated document, which also addresses concerns raised by the

community. The following changes were made:

a) Amended/additional

action points to improve/increase how the Kerikeri Domain is developed

Submissions were received suggesting expanding the actions

in the Management Plan to provide more facilities and to more specifically

address concerns about implementation. It is considered that the

following action points be amended:

|

Action Point

|

Amendment

|

|

Short Term

|

|

Council develop a maintenance and management plan for the

Domain

|

Expand action point to include the following within the

maintenance plan:

- community planting/weeding days.

- recognition of additional maintenance requirements for

sports (e.g. turf management).

- the ethics of ako (teaching and learning), manaakitanga

(hospitality/teamwork), whānaungatanga (relationships) and Kotahitanga

(unity).

|

|

Action items to be designed, costed and approved by

Council

|

Expand the design criteria to include the Crime Prevention

Through Environmental Design principles.

Add landscaping and an interactive water play area to the

list.

|

|

|

New short term action point:

Within six month Council design a horticultural landscape

plan for the Kerikeri Domain in accordance with this document and undertake

the first stage of plantings to provide shade opportunities.

|

|

|

New short term action point:

Council to develop a shared use arrangement with Kerikeri

High School regarding shared infrastructure and the use of the Kerikeri Domain

and adjoining Ministry of Education owned land.

|

|

|

New short term action point:

Within six months Council in partnership with the

Community Board and community consider the establishment of an incorporated

society representing the community to manage and oversee the Domain.

|

|

Medium Term

|

|

Water fountains and rubbish bins

|

Move from medium term action point to short term action

point and expand to specifically reference human and dog water fountains and

rubbish bins and recycling.

|

|

Lighting

|

Expand reference to lighting to include feature and

security lighting. Remove reference to excluding sport lighting.

|

|

Upgrade footpaths

|

Amend to consider new footpath connections and be a

minimum width of 2.2 metres.

|

|

Locations of key amenities

|

Hitching posts added as an example.

|

|

|

New Medium term action point:

Provide CCTV cameras in appropriate locations to enhance

safety.

|

|

|

New Medium term action point:

Establish barbeque areas around the domain outside the

perimeter pathway.

|

|

|

New Medium term action point:

Establish safe and accessible play areas for children.

|

|

|

New Medium term action point:

Upgrade the parking next to the library to provide space

for people with accessibility concerns and parents.

|

|

|

New Medium term action point:

Provide access onto the Domain for heavy vehicles for

permitted activities.

|

|

|

Move from medium term action point to short term action

point:

Upgrade existing basketball court to enable opportunities

for all ball sports.

|

A general amendment to remove reference to

‘FNDC’ by each action point (except those specific to Council) will

mean that any group can fundraise or develop these facilities as long as they

are in accordance with the Management Plan. This is backed up by an

additional statement in the ‘Implementation and Funding’ section of

the Management Plan.

It is considered that amending/adding these action points

will meet the vision and objectives of the plan and provide more clarity to

Council and groups using and developing the Kerikeri Domain.

b) Amend

Concept Plan to be more flexible

Several submitters provided alternative concept plans.

All are based on a similar theme of infrastructure and planting surrounding a

green space. Where they differ is regarding the amount of green space,

activities outside the scope of the Management Plan and some specific

activities within the Kerikeri Domain. It is considered that adopting

elements from each of these plans will create a more comprehensive plan that

reflects the vision for the Kerikeri Domain and the submissions.

c) Changes

to improve clarity

Submissions were received to make minor changes to the

document to better reflect users, facilities onsite, cultural history,

policies, action points, the concept plan and the different outcomes for the

pavilion. As these changes enhance the usability of the management plan

it is considered that these changes will enhance the outcomes of the document.

d) Changes

to governance

22 submissions were received for a governance structure to

manage the Kerikeri Domain. An action point for Council to consider

having the Kerikeri Domain managed by an incorporated society has been created

as a short term action point (1-3 years).

Option 2

The Council may consider that they do not agree with all or

some of the recommendations made in Option 1. Therefore the Council has

the option of recommending starting the Management Plan process again.

Reason

for the recommendation

Option 1 is recommended to the Council. It is

considered that the recommended amendments will address the majority of

concerns raised in the submissions, and create a more integrated Management

Plan. Council is required to have a Management Plan for Kerikeri

Domain.

3) Financial Implications and Budgetary

Provision

Associated administrative tasks and costs. These costs will

be met through the existing 2018/19 operational budget for the development of

the management plan.

None of the actions included in Option 1 are guaranteed and

are subject to either community funding or inclusion in a future Long Term

Plan.

There are no financial implications for the Council in

relation to the resolution.

Attachments

1. Kerikeri Domain Reserve

Management Plan - A2494927 ⇩

Compliance schedule:

Full consideration has been

given to the provisions of the Local Government Act 2002 S77 in relation to

decision making, in particular:

1. A Local

authority must, in the course of the decision-making process,

a) Seek to

identify all reasonably practicable options for the achievement of the

objective of a decision; and

b) Assess

the options in terms of their advantages and disadvantages; and

c) If

any of the options identified under paragraph (a) involves a significant

decision in relation to land or a body of water, take into account the

relationship of Māori and their culture and traditions with their

ancestral land, water sites, waahi tapu, valued flora and fauna and other

taonga.

2. This

section is subject to Section 79 - Compliance with procedures in relation to

decisions.

|

Compliance

requirement

|

Staff assessment

|

|

State the level of significance

(high or low) of the issue or proposal as determined by the Council’s

Significance and Engagement Policy

|

This report will have low level of significance as it

is a legislative requirement and has already been consulted on. The Management

Plan will facilitate the development and enhancement of a large recreational

area to the benefit of the local community and wider district residents and

be consistent with existing plans and policies.

|

|

State the relevant Council

policies (external or internal), legislation, and/or community outcomes (as

stated in the LTP) that relate to this decision.

|

Reserves Act 1977 – outlines process for writing

and adopting reserve management plans.

|

|

State whether this issue or

proposal has a District wide relevance and, if not, the ways in which the

appropriate Community Board’s views have been sought.

|

The Community Board’s views have been considered

through the establishment of the Community Reference Group to determine who

the stakeholders were and the workshop that the Community Board members were

invited to on 17 September 2018.

The Community Board’s views were further

considered through the delegation given to hear and deliberate on submissions

and make a recommendation to Council.

|

|

State the possible implications for Māori

and how Māori have been provided with an opportunity to contribute to

decision making if this decision is significant and relates to land and/or

any body of water.

|

Māori have been, and will continue to be,

consulted on the issues outlined in the Management Plan.

|

|

Identify persons likely to be

affected by or have an interest in the matter, and how you have given

consideration to their views or preferences.

|

As part of the legislative

process, the Management Plan was open to the public for three months for

submissions, which were heard by the Community Board.

|

|

State the financial implications

and where budgetary provisions have been made to support this decision.

|

There are no immediate financial implications

associated with the recommended resolutions, as outlined in Section 3 of this

report.

|

|

Chief Financial Officer review.

|

The CFO has reviewed this report.

|

|

Ordinary Council Meeting Agenda

|

27 June 2019

|

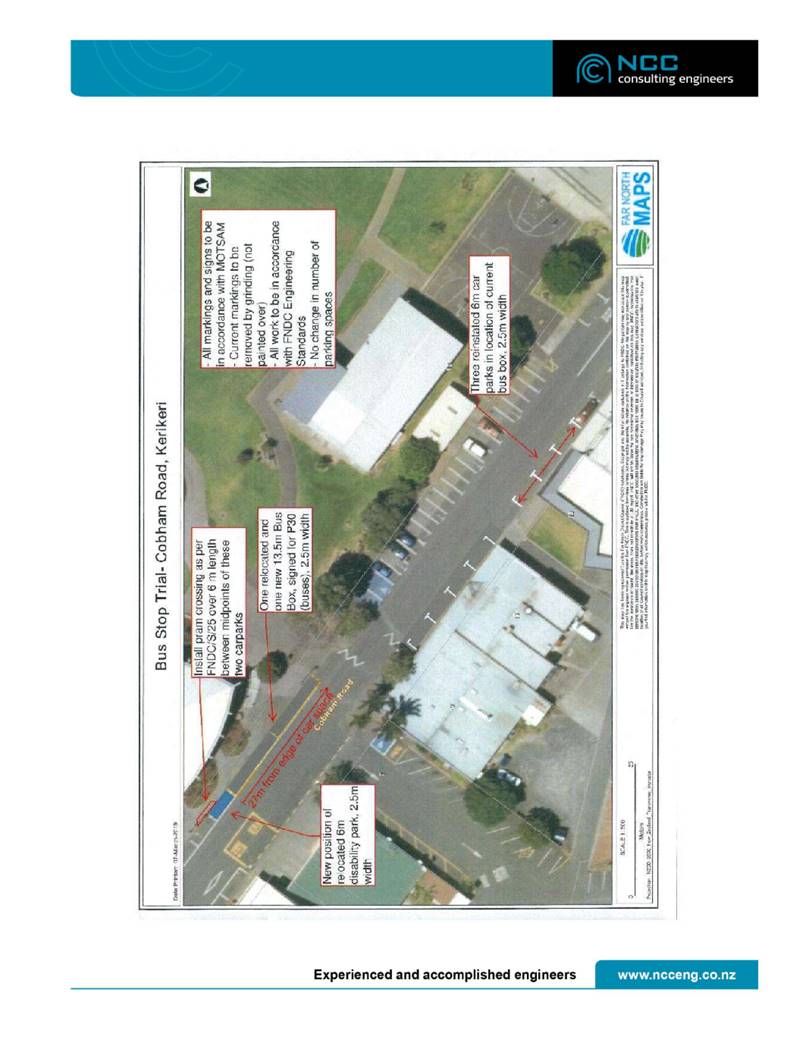

6.2 Cobham

Road Bus Stop

File Number: A2497323

Author: Mike

Fox, Project Manager - Transport and Roading

Authoriser: Andy Finch, General Manager - Infrastructure and Asset Management

Purpose of the Report

This report is to confirm the Bay of Islands-Whangaroa Community

Board’s decision to adopt the current layout of the bus stop and to amend

the Traffic and Parking Bylaw to ensure that the bus stop is legally

enforceable, as well as request that the Commercial Operators provide a

suitable bus shelter for patrons.

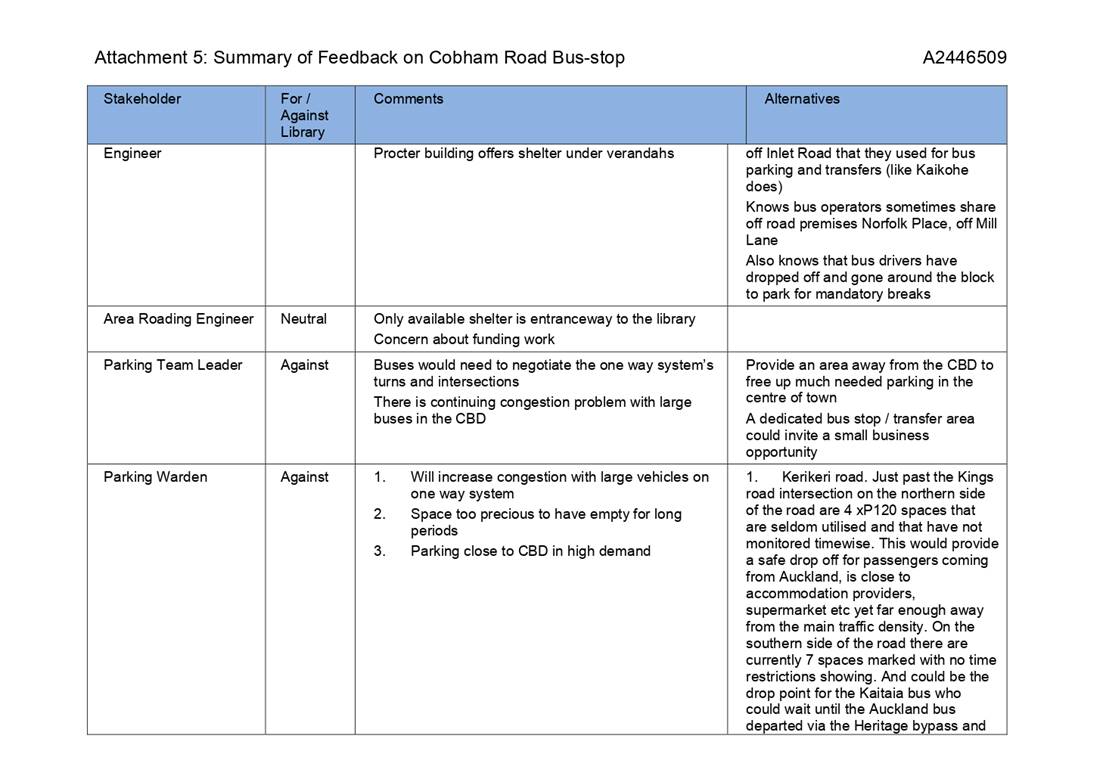

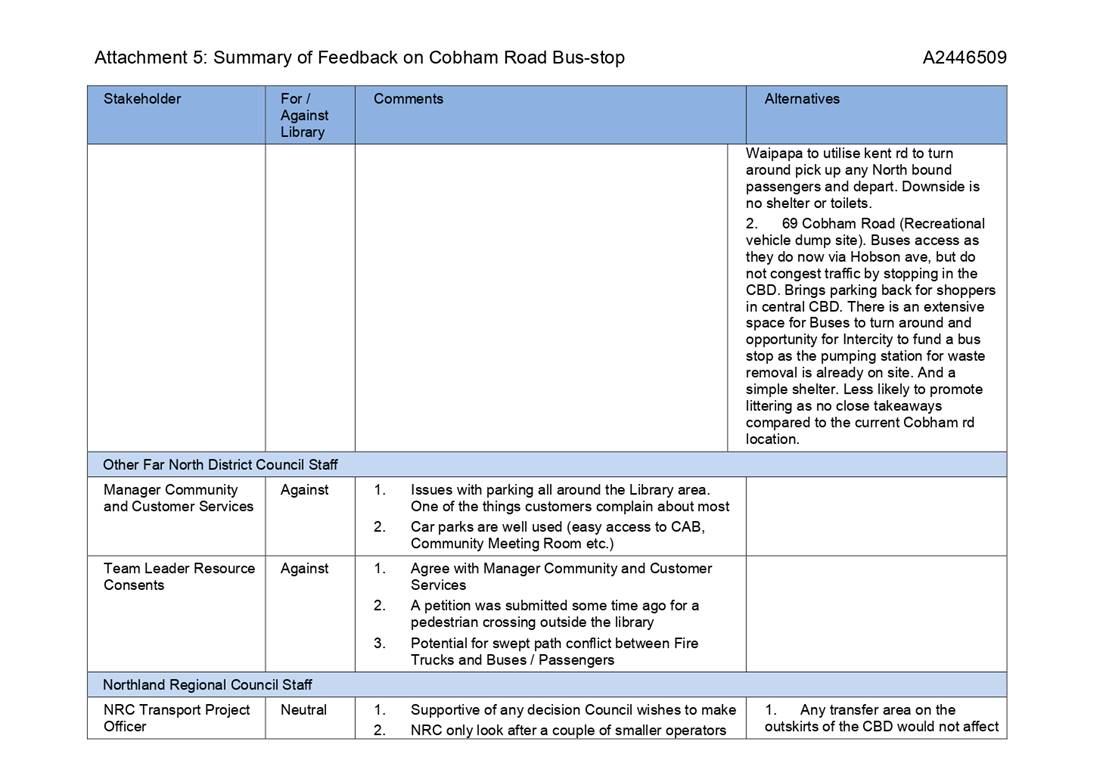

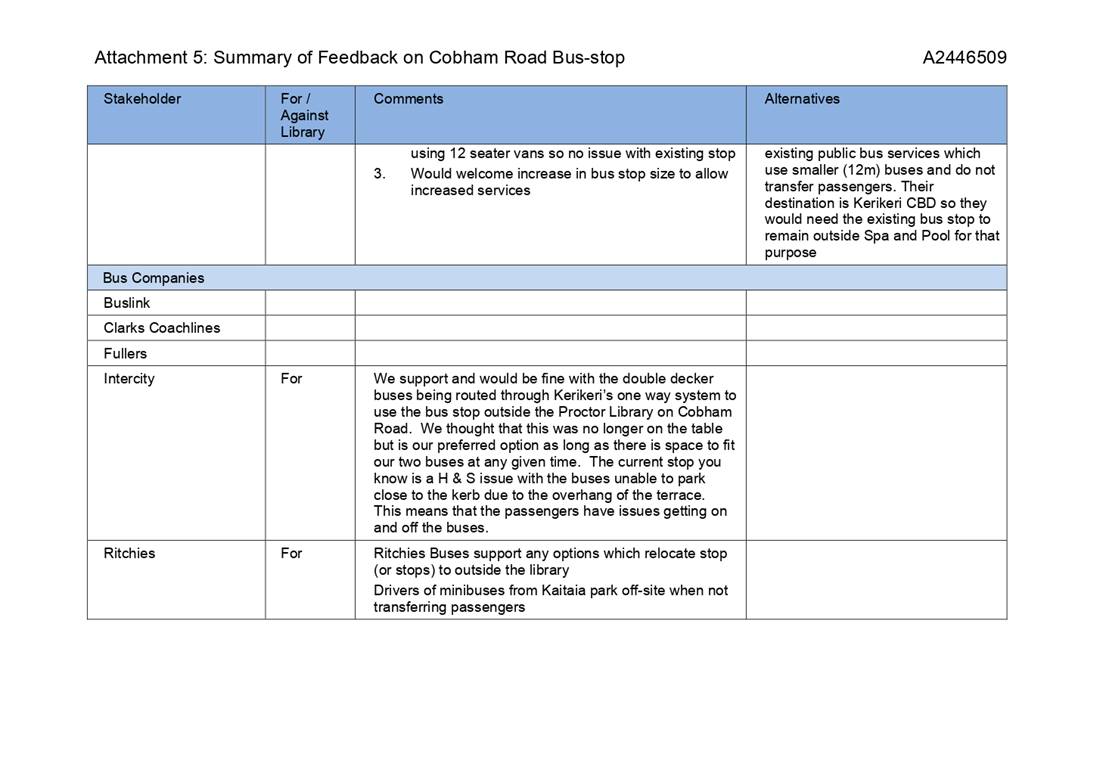

Executive Summary

· After a fire in May 2016, the Cobham Road bus stop was temporarily

relocated to outside 13 and 15 Cobham Road

· There have been complaints about the location of the bus stop and

reports of unsafe use of the bus stop by the bus companies (double parking)

· In response to the above, community feedback has been sought for a

trial layout consisting of a double bus park outside the Proctor library.

Mixed results have been received

· The Community Board was asked to consider this feedback and

determine what layout they support

· The Bay of Islands-Whangaroa Community Board considered this report

at their meeting on 20 May 2019 and makes the following recommendation to

Council.

|

Recommendation

That Council

a) adopt

the current layout and amend the Traffic and Parking Bylaw to ensure that the

bus stop is legally enforceable

b) request that staff ask the

Commercial Operators to provide a suitable bus shelter for patrons

|

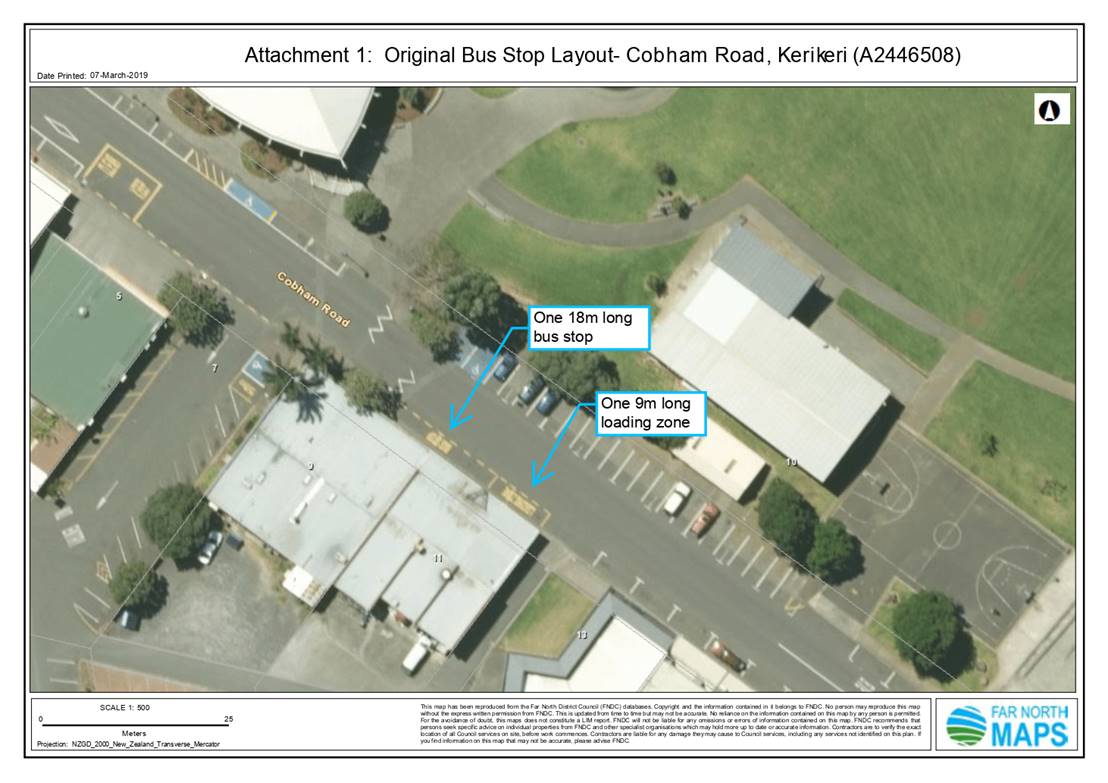

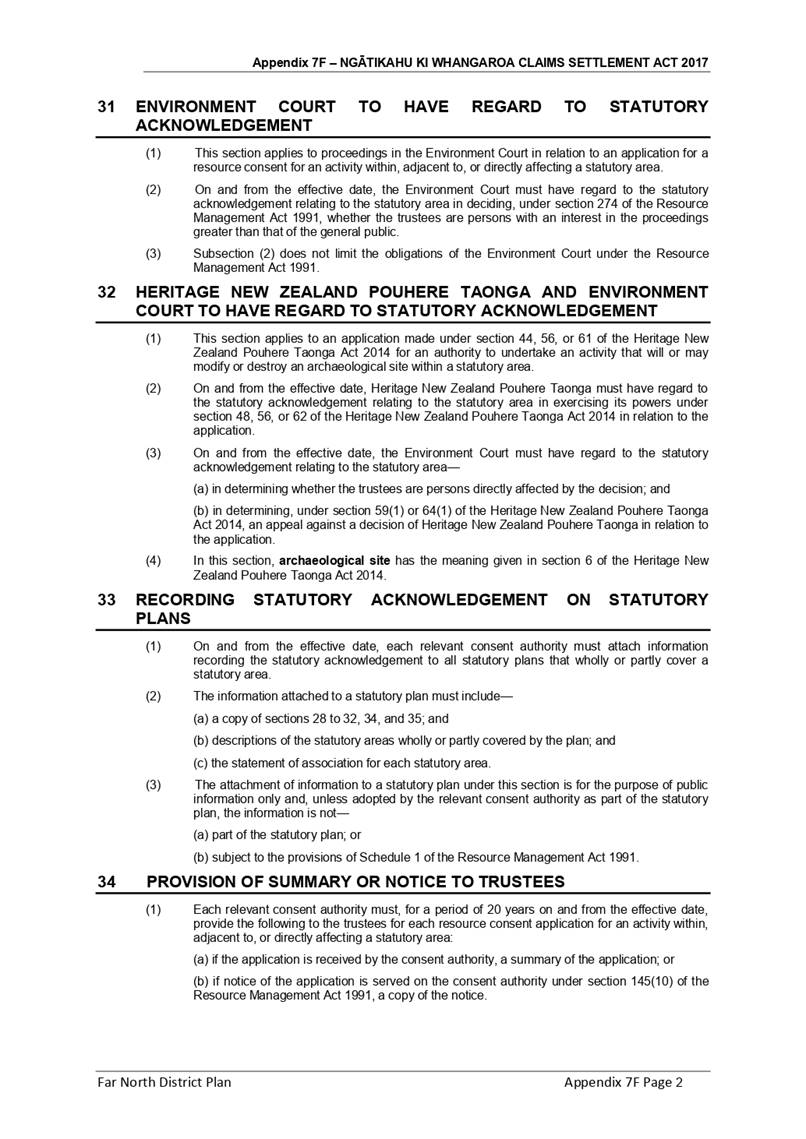

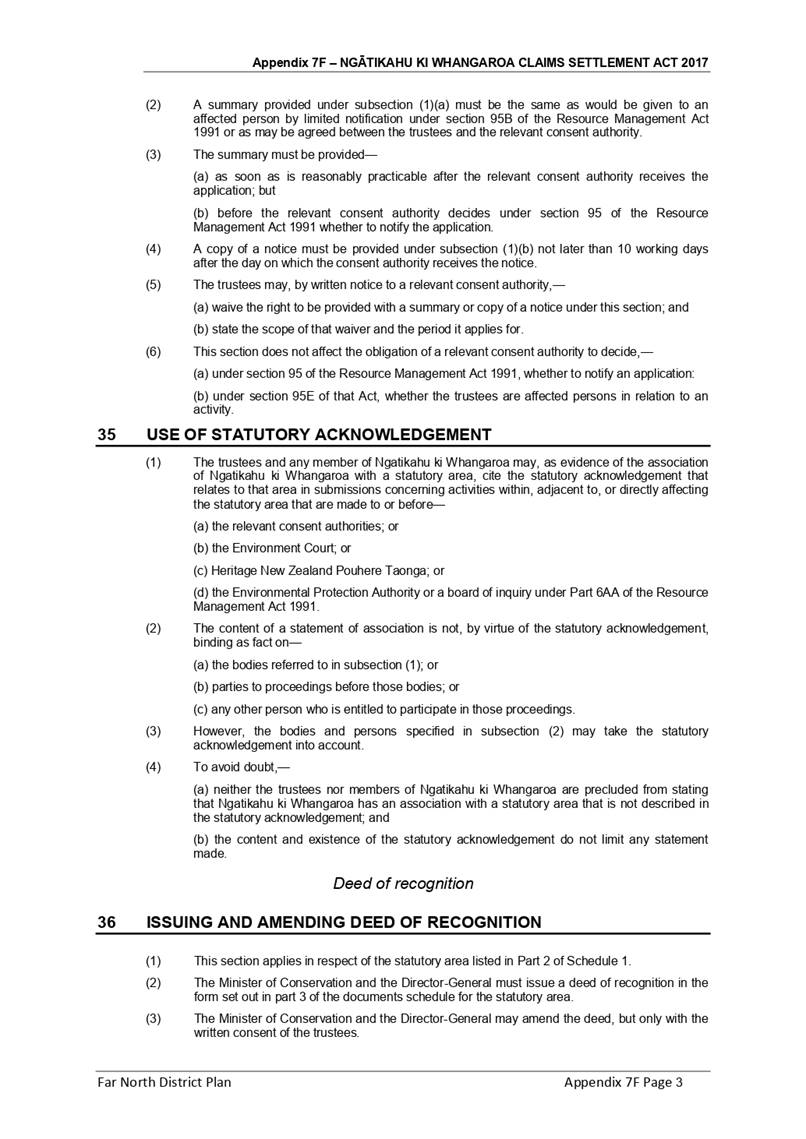

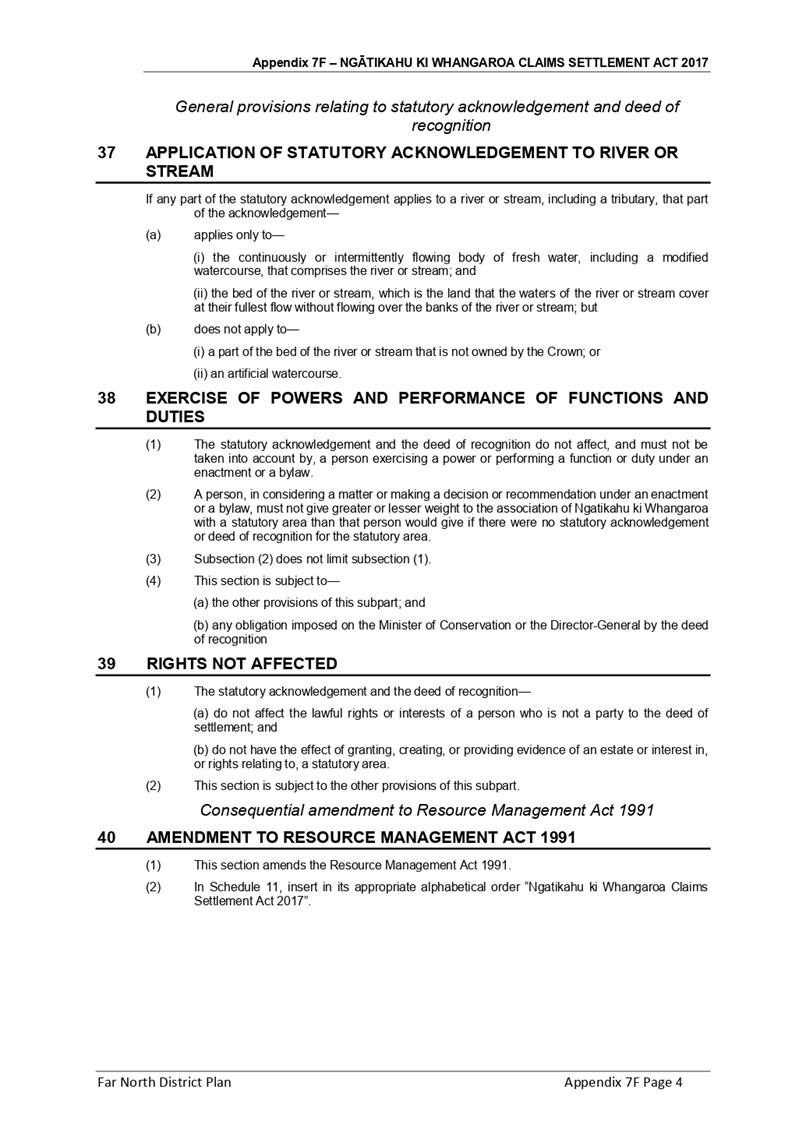

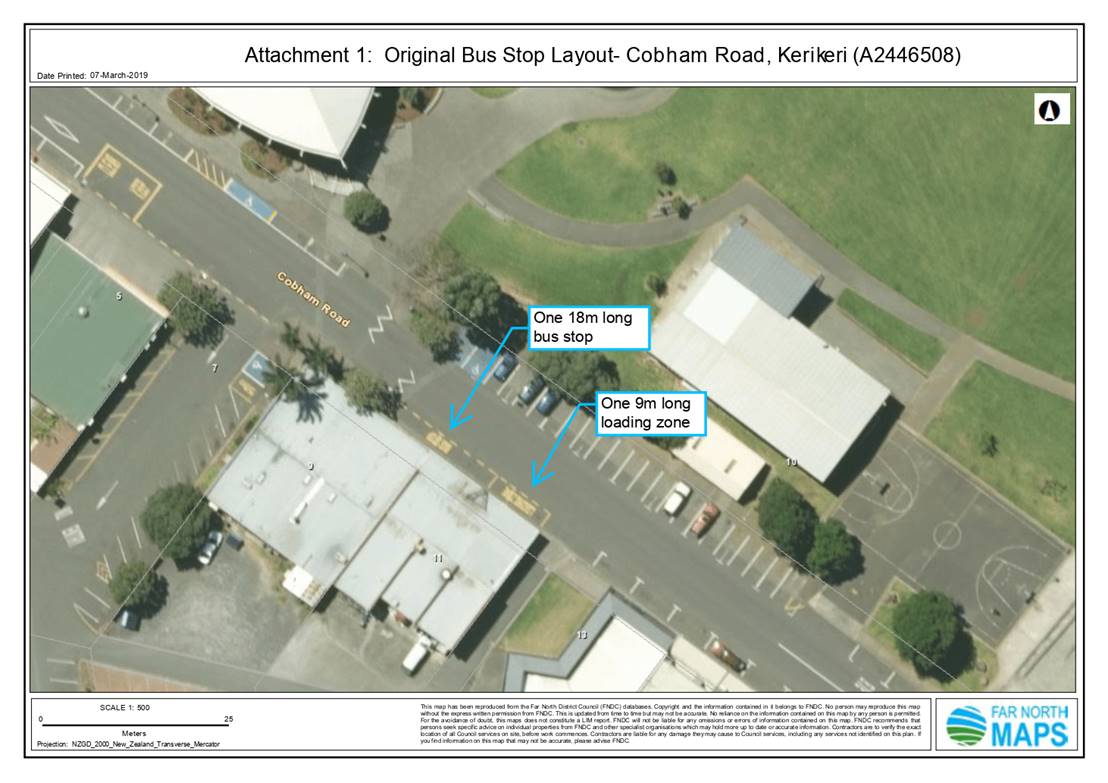

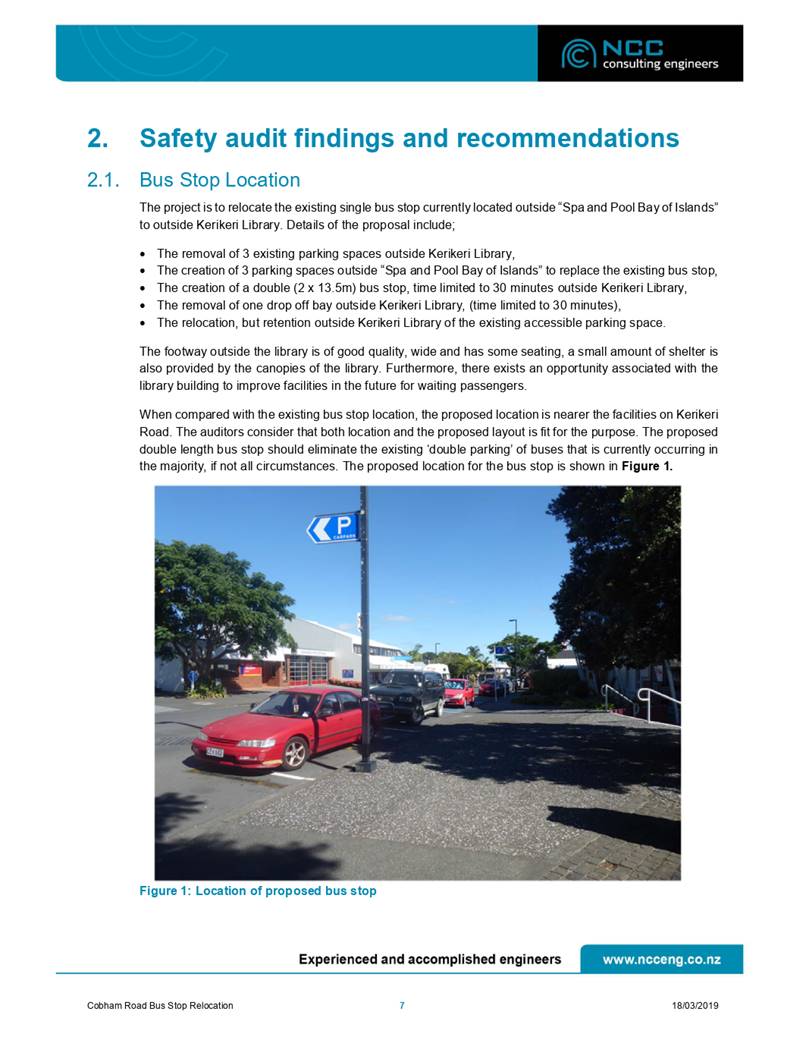

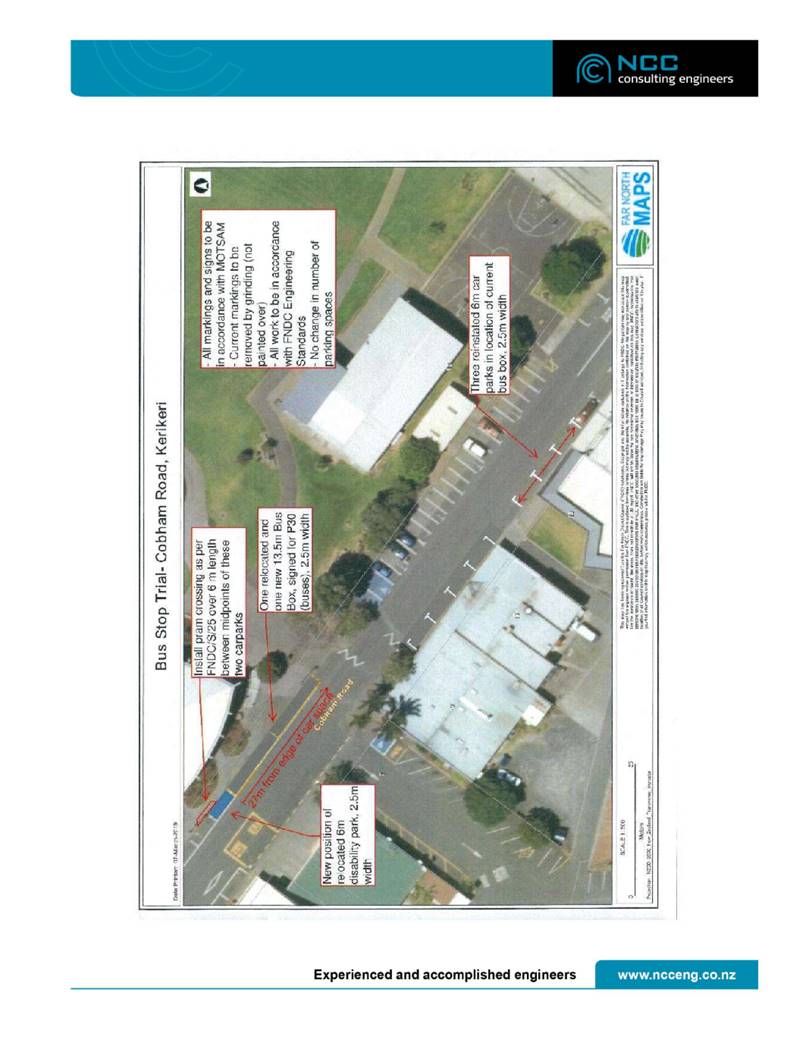

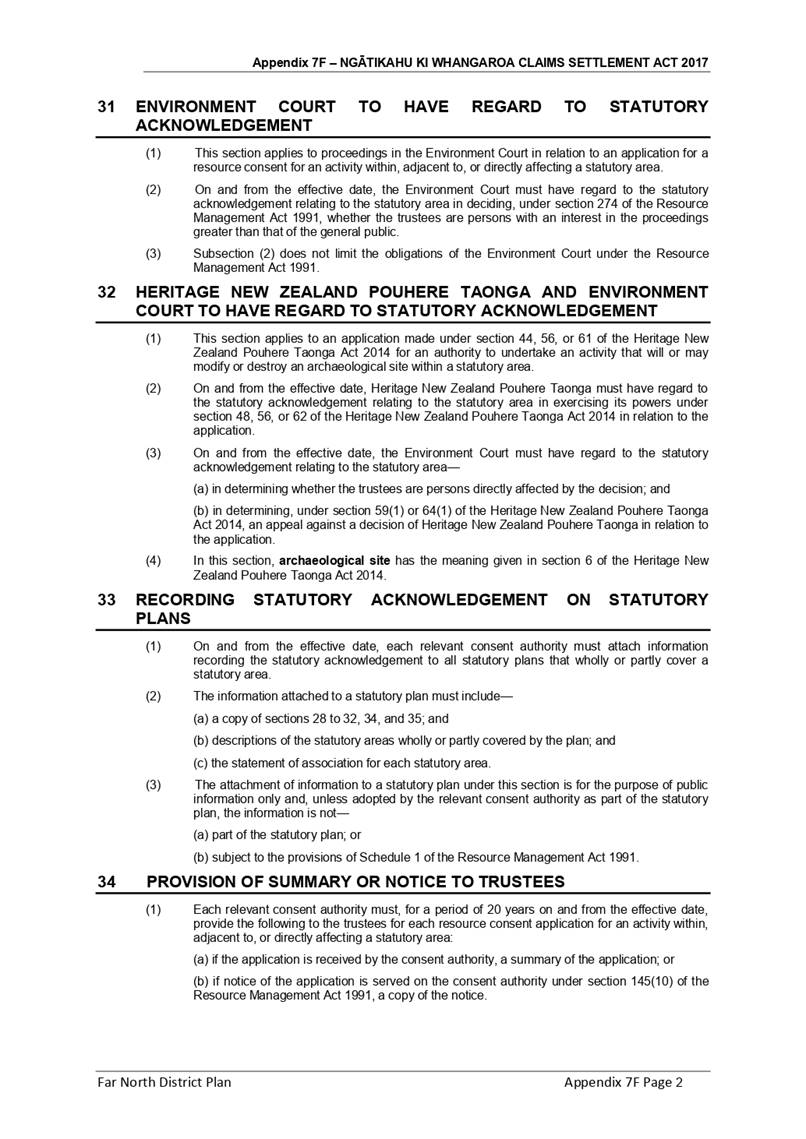

1) Background

The Cobham Road bus stop historically was located outside numbers 9

and 11 Cobham Road, Kerikeri. This layout was formally adopted under the

Parking and Traffic Control bylaw, so is enforceable. This layout is

shown on Attachment 1.

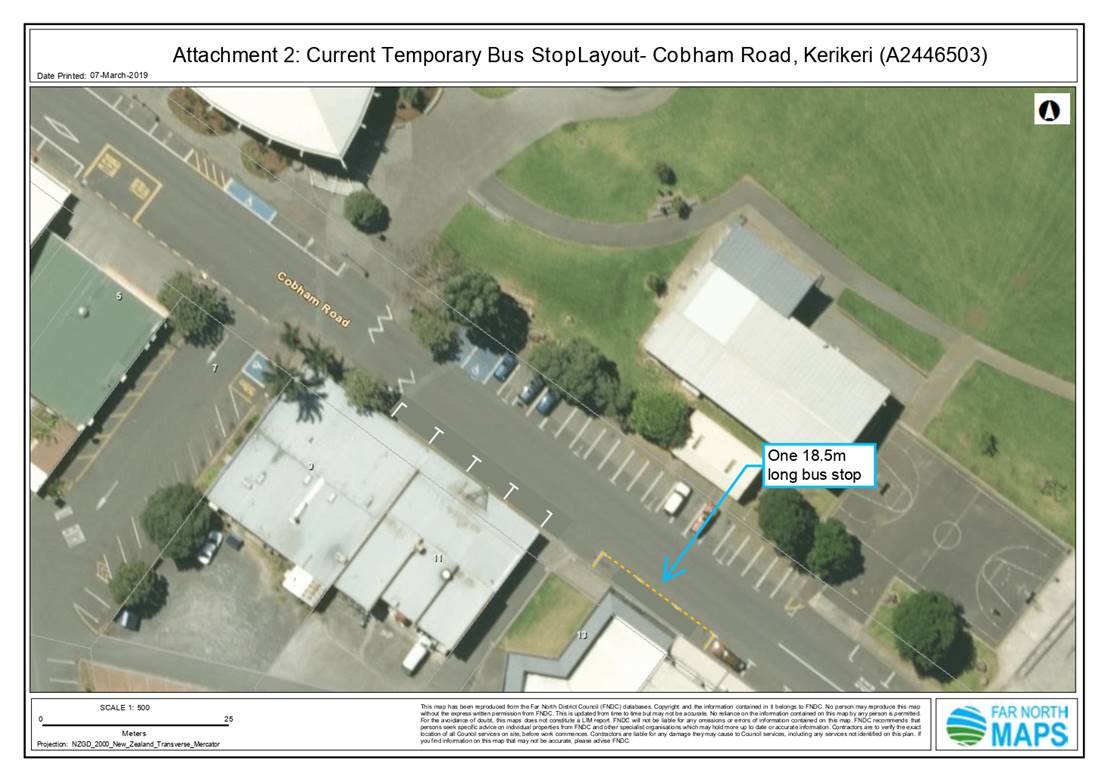

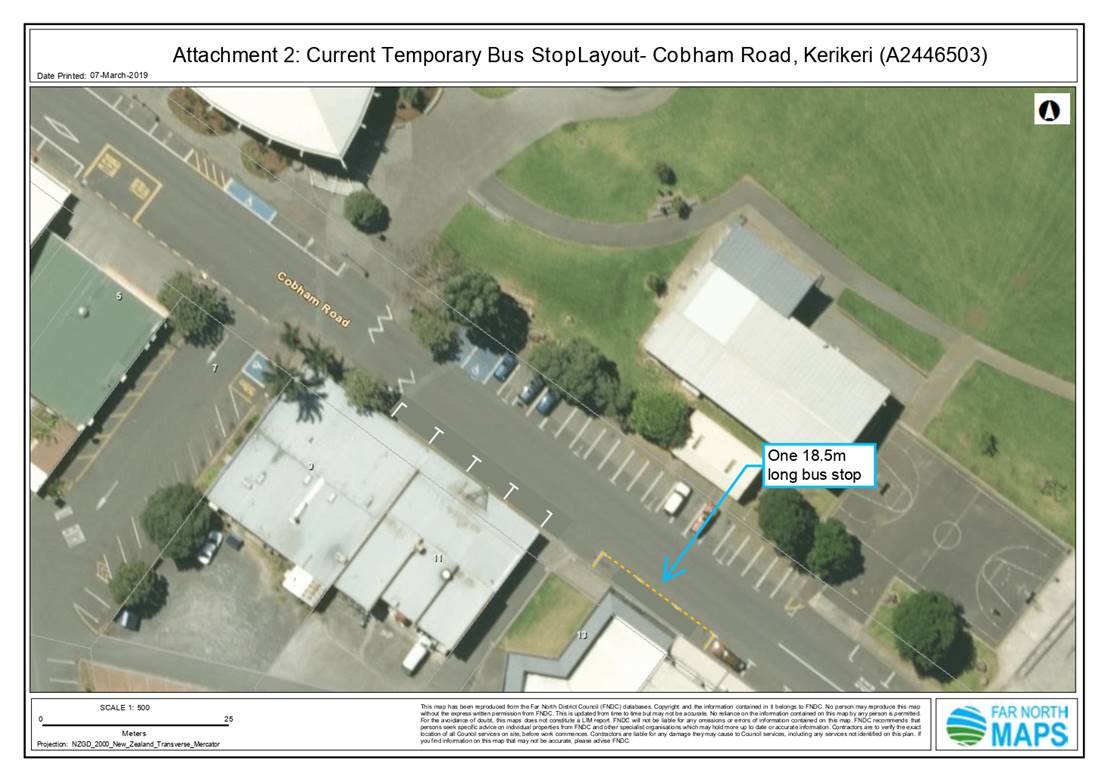

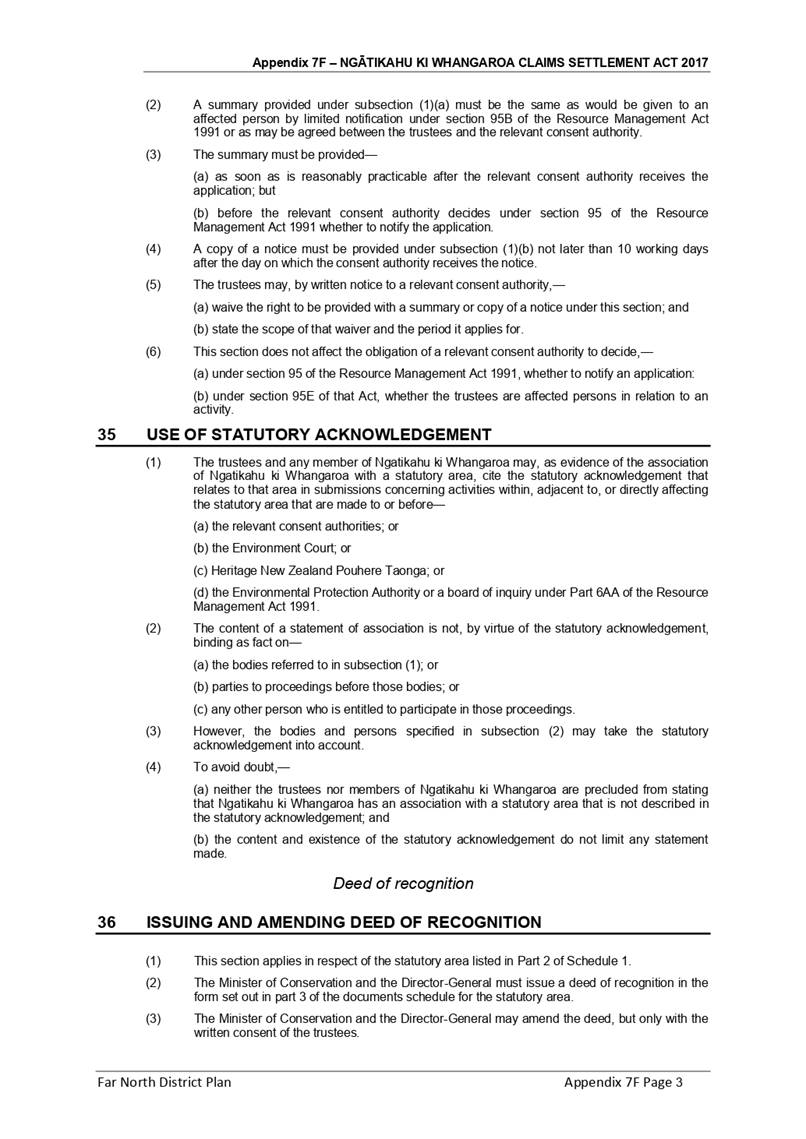

After a fire in May 2016, the bus stop was temporarily re-located to

its current location outside numbers 13 and 15 Cobham Road. This was to

avoid bus passengers being exposed to construction hazards during repair of the

buildings. This layout was not formally adopted under the Parking and

Traffic Control bylaw, and is therefore not enforceable. This layout is

shown on Attachment 2.

Since then, complaints by businesses relating to the loss of car

parking spaces outside their premises have been received and safety concerns have

been raised regarding the manner in which some bus companies are using the

bus-stop, particularly the practice of double parking buses. Some bus

companies have also advised that at both this and the original layout, their

vehicles are unable to park close enough to the kerb to use disabled access

ramps because of the shop awnings.

Far North District Council has written to bus companies to reinforce

that they are responsible for safe use of the bus stop. The companies

were reminded that double parking of vehicles is not permitted in the Road

Code, and were asked to review their procedures to ensure that their operations

are safe, legal and appropriate at the Cobham Road bus stop.

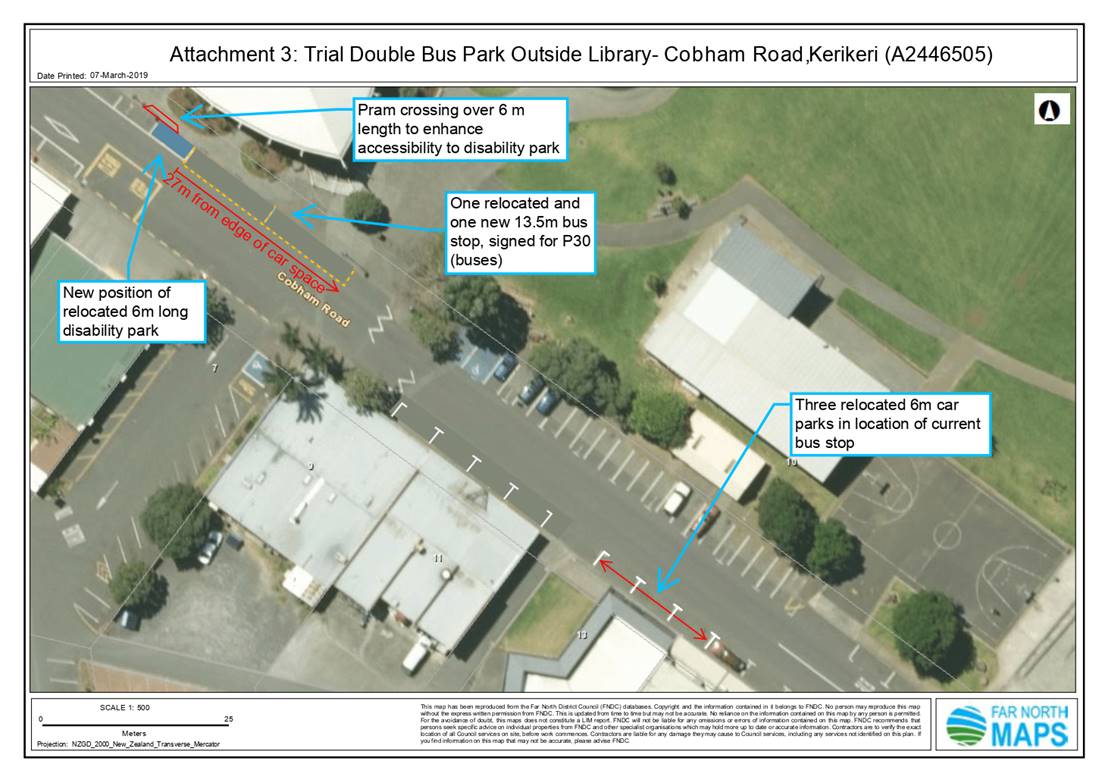

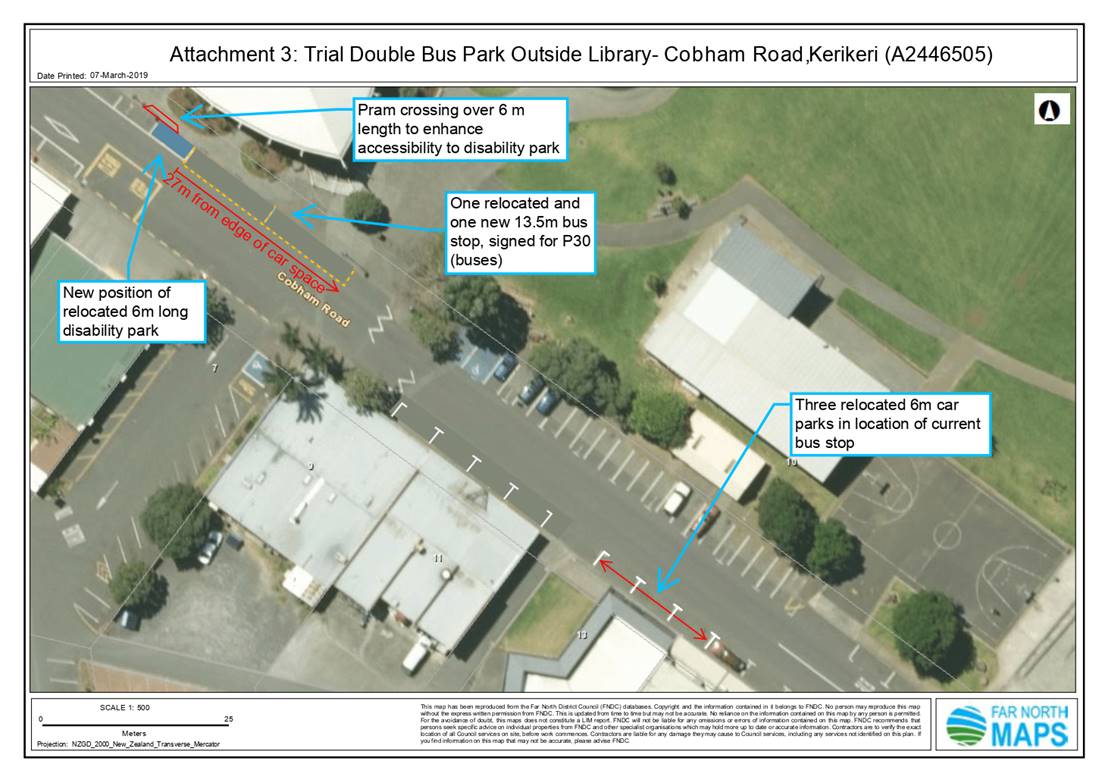

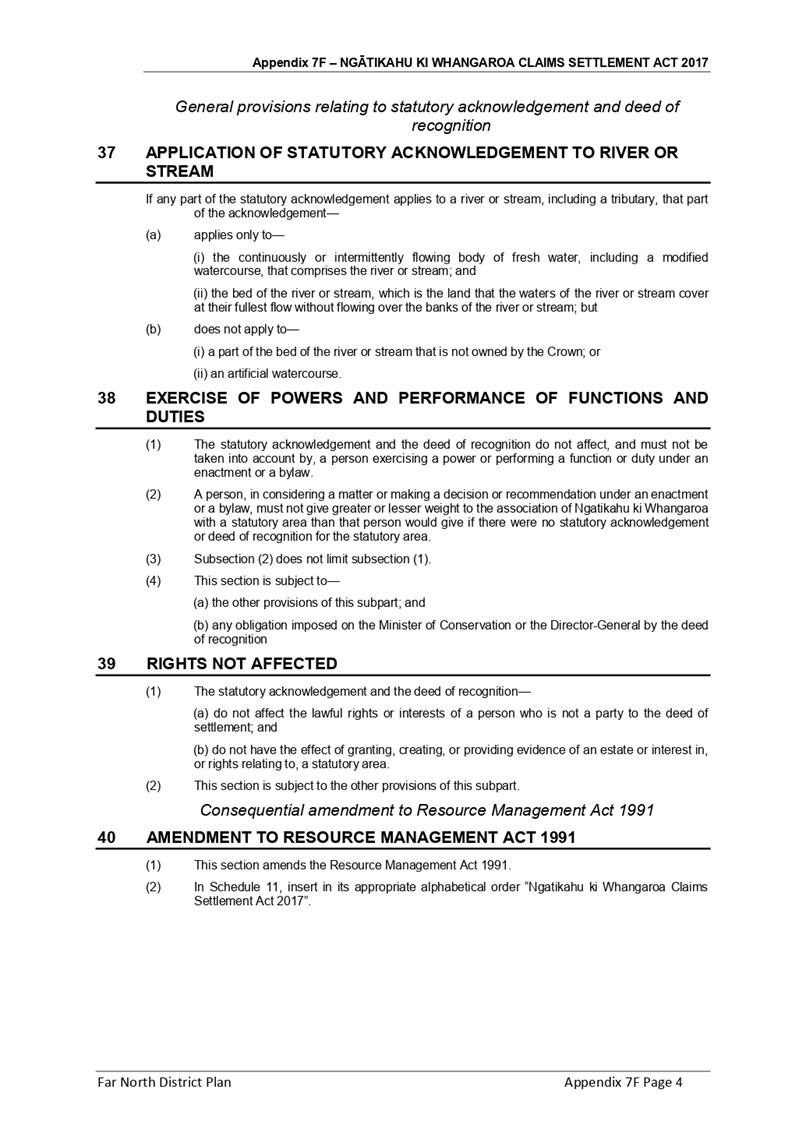

Council representatives also met with some of the parties involved

at the site, and mapped out a trial layout consisting of a double bus park

outside the Proctor library. This layout is shown on Attachment 3.

The trial layout was subject to a Road Safety Audit, and directly affected

parties were asked for feedback.

Facilities for public transport in Kerikeri

will be reviewed as part of the District Transport Strategy, so the bus

facilities on Cobham Road may be changed or relocated when the strategy is

adopted.

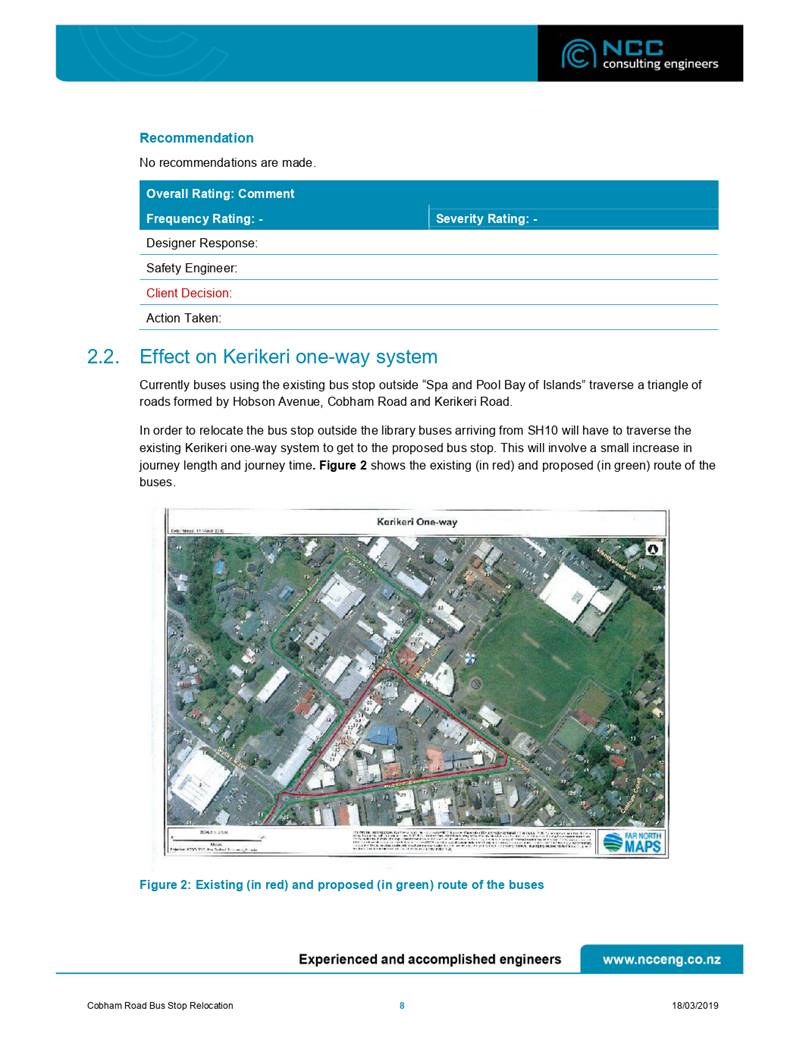

2) Discussion and Options

Original and Current Layouts

The components of the original and current

layouts as shown in Attachments 1 and 2 are relatively straight forward.

Changes that would be required to revert to the original layout would include:

a) Reinstatement of

the original bus stop and loading zone outside numbers 9 and 11 Cobham Road.

b) The reinstated

bus stop and loading zone would be in place of four parking spaces, though

three parking spaces would be reinstated outside 13 and 15 Cobham Road.

There would therefore be a one less car parking space provided than currently.

c) As the original

layout is the current enforceable layout, no bylaw change would be necessary.

No road safety audit has been completed for

either of these layouts, nor has feedback been sought from the community.

Trial

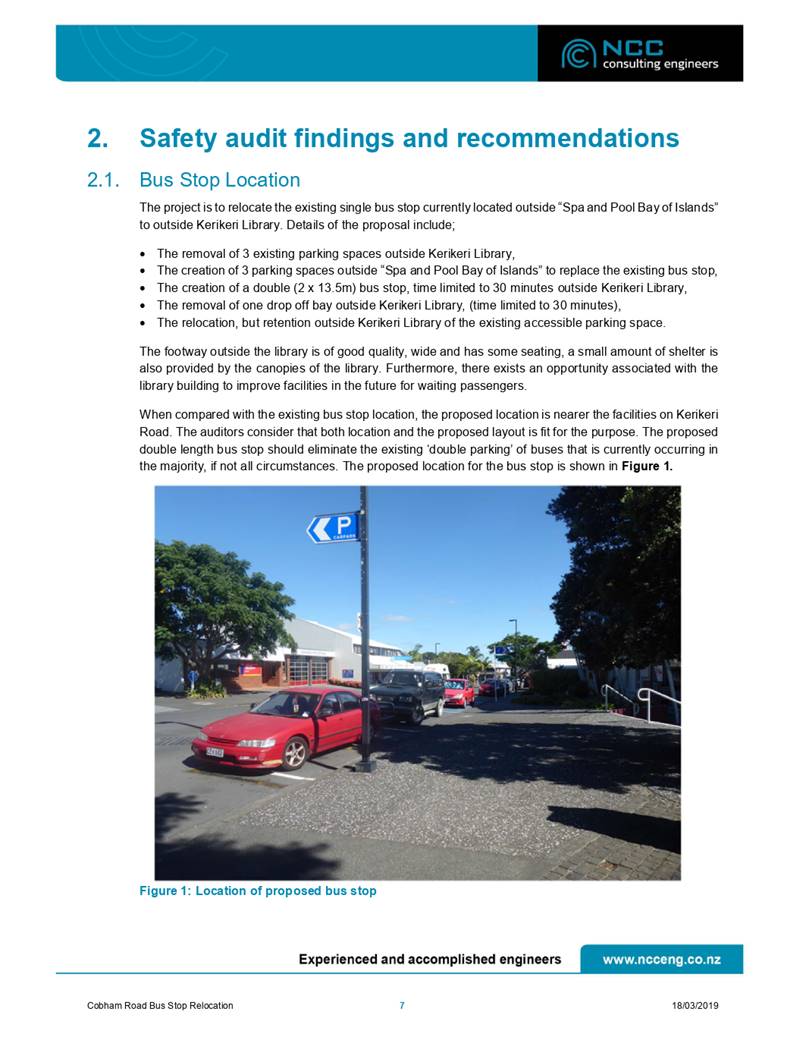

Double Bus Park outside the Library

As shown in

Attachment 3, this layout involves the following changes:

a) A new double bus

park is provided outside the library. The provision of a double bus park with a

P30 time limit is in response to the current issue of double parking by coaches

transferring passengers on Cobham Road.

b) The new double

bus park is in place of one disability parking space, two other parking spaces,

and one loading zone.

c) A replacement

disability parking space is located on the Kerikeri-centre side of the current

loading zone, with a lowered kerb to facilitate better accessibility.

d) Three parking

spaces are provided in the current location of the bus stop outside numbers 13

and 15 Cobham Road. These replace the two parking spaces taken up by the

new double bus park and the parking place taken up by the relocated disability

parking space. There is therefore no reduction in the number of parking

spaces provided.

e) The loading zone

will not be replaced.

It was proposed that this layout could be

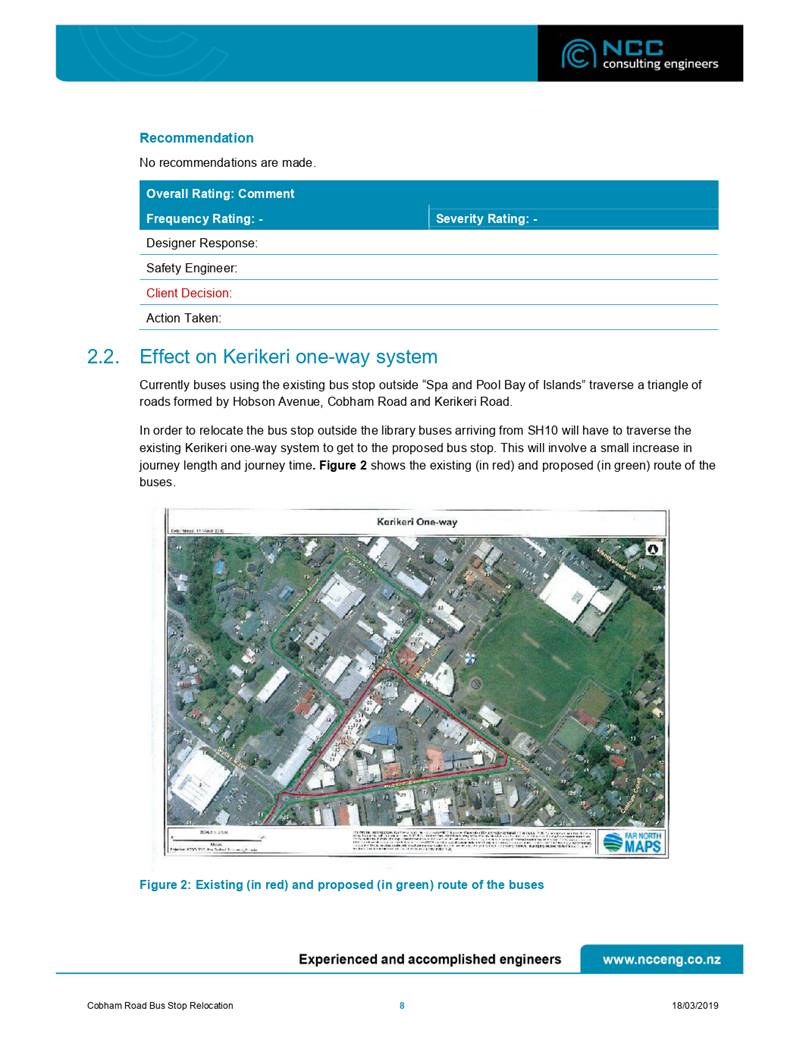

trialled for twelve months, and if successful adopted as part of the District

Transport Strategy.

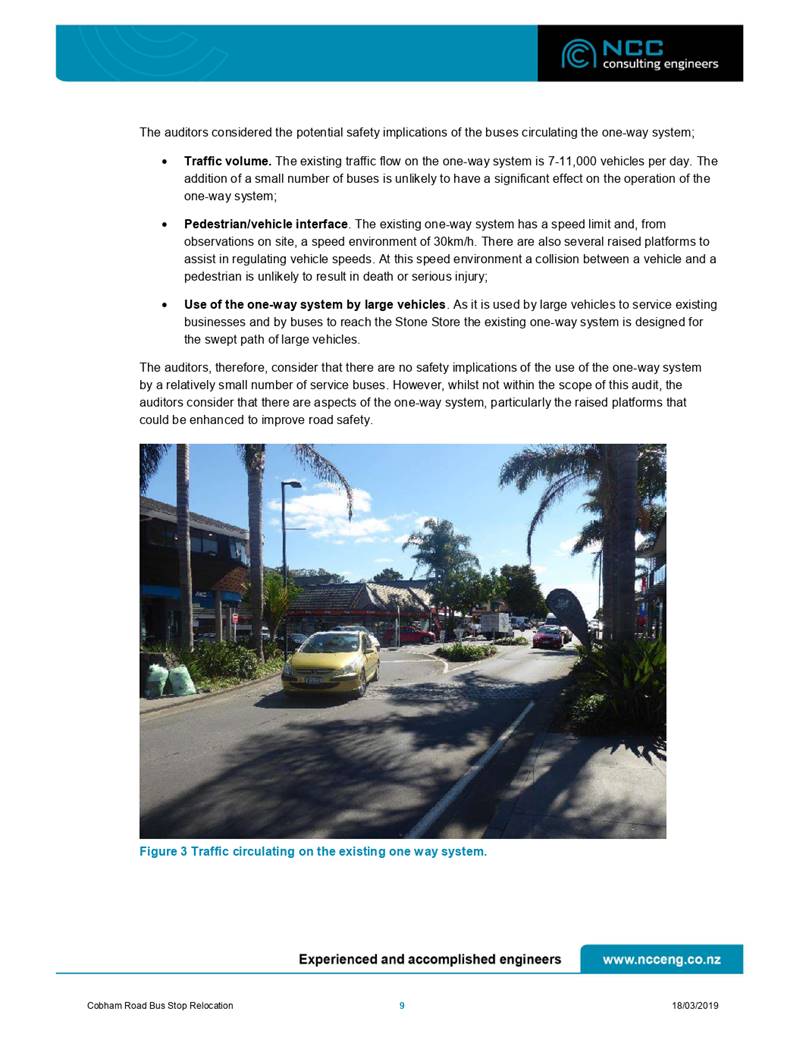

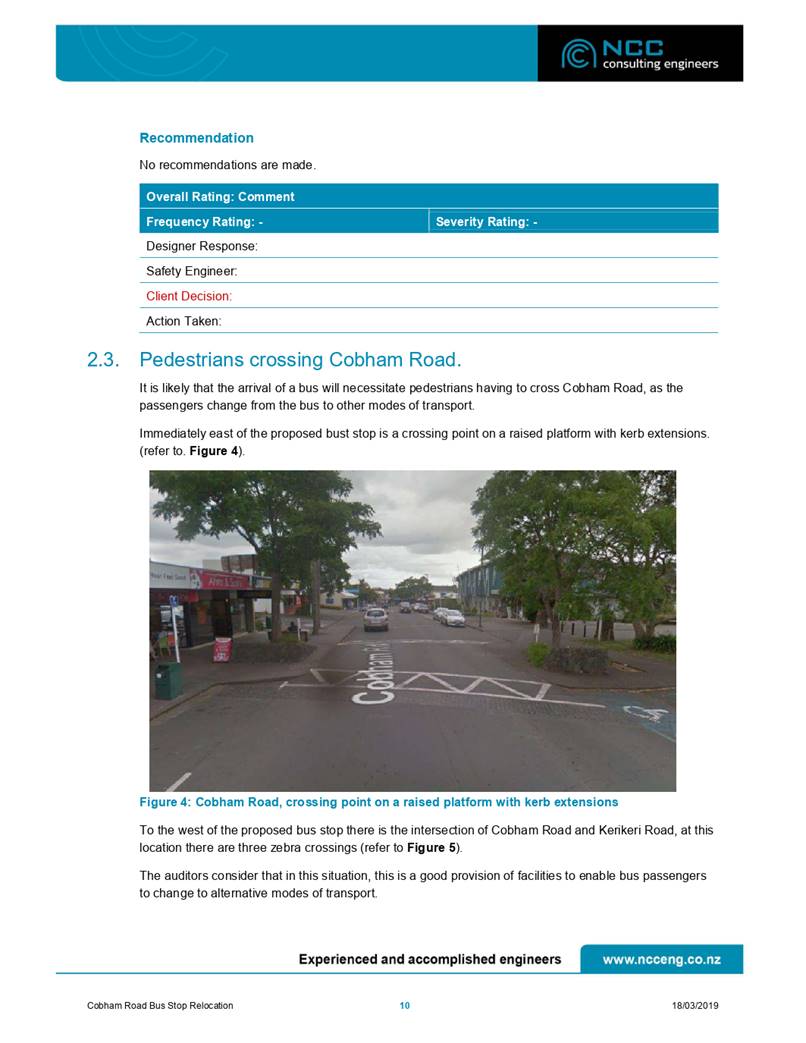

The double bus park layout has been subject

to an independent road safety audit by Northern Civil Consulting (Attachment

4). The audit found that:

• both

the location and the proposed layout are fit for purpose

• the

proposed double length bus park should eliminate the existing ‘double

parking’ of buses that is currently occurring in the majority, if not all

circumstances

• there

are no significant safety implications of the use of the one-way system by a

relatively small number of buses

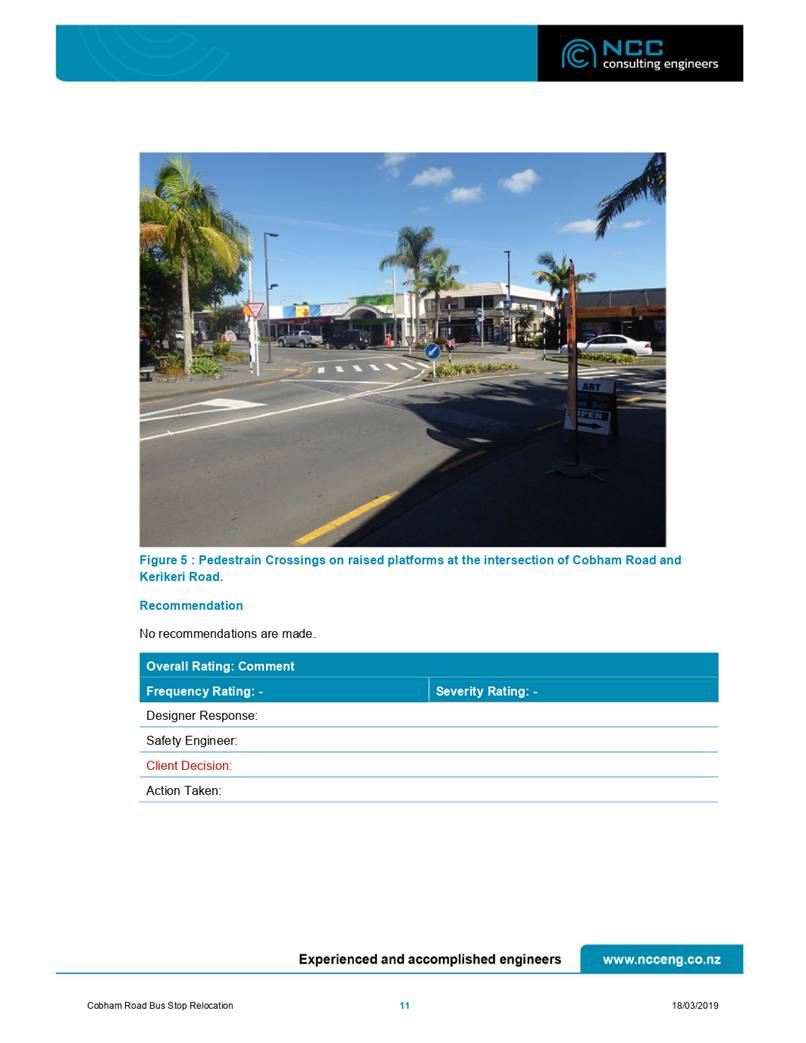

• the

raised crossing point immediately east of the proposed bus park and the zebra

crossings at the intersection of Cobham Road and Kerikeri Road make good

provision for bus passengers to cross the road and change to alternative modes

of transport.

The audit did not recommend any changes to

the layout.

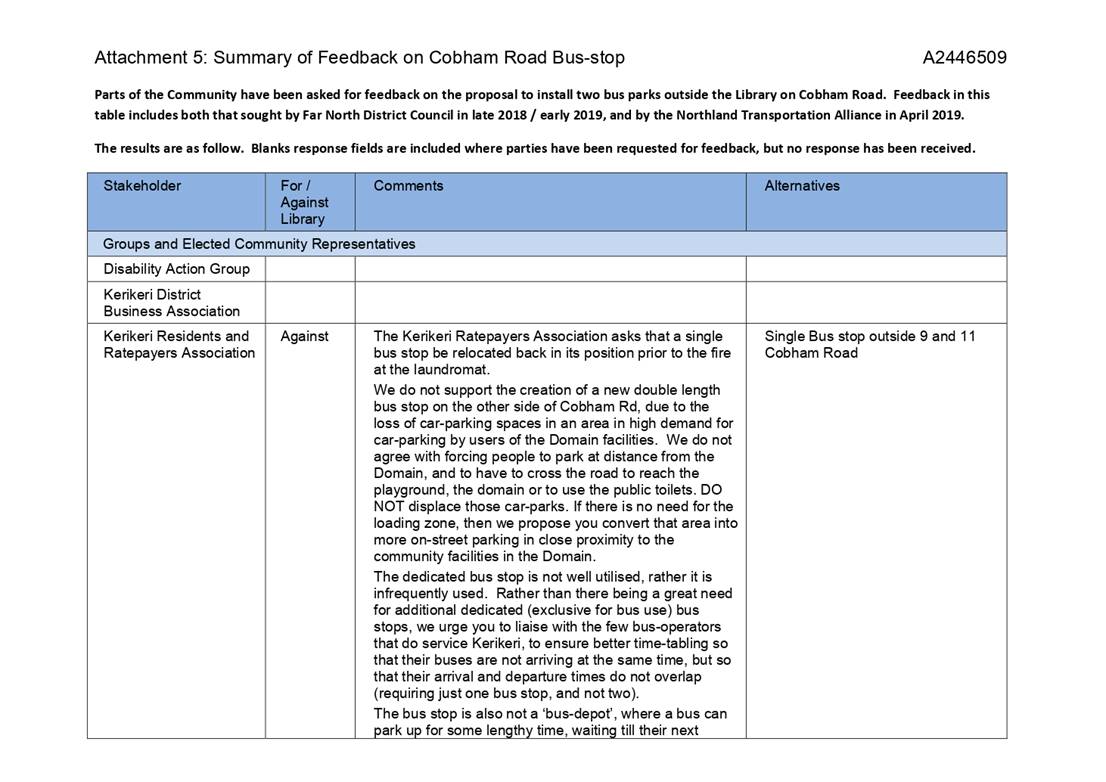

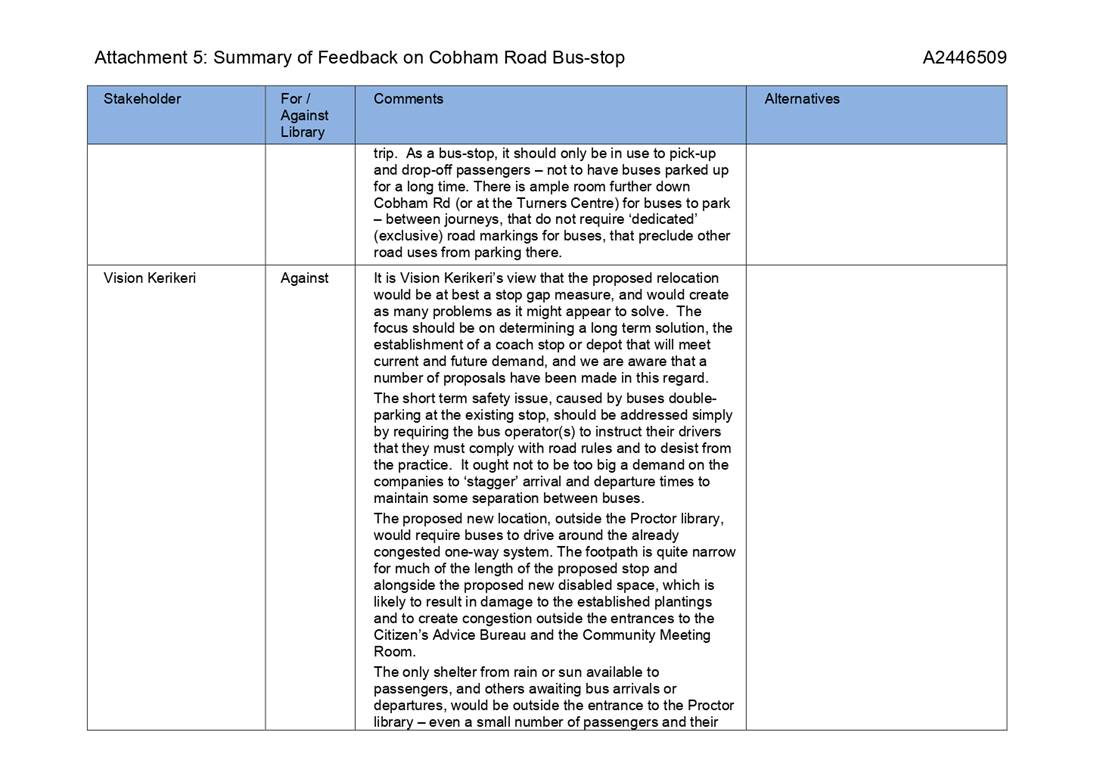

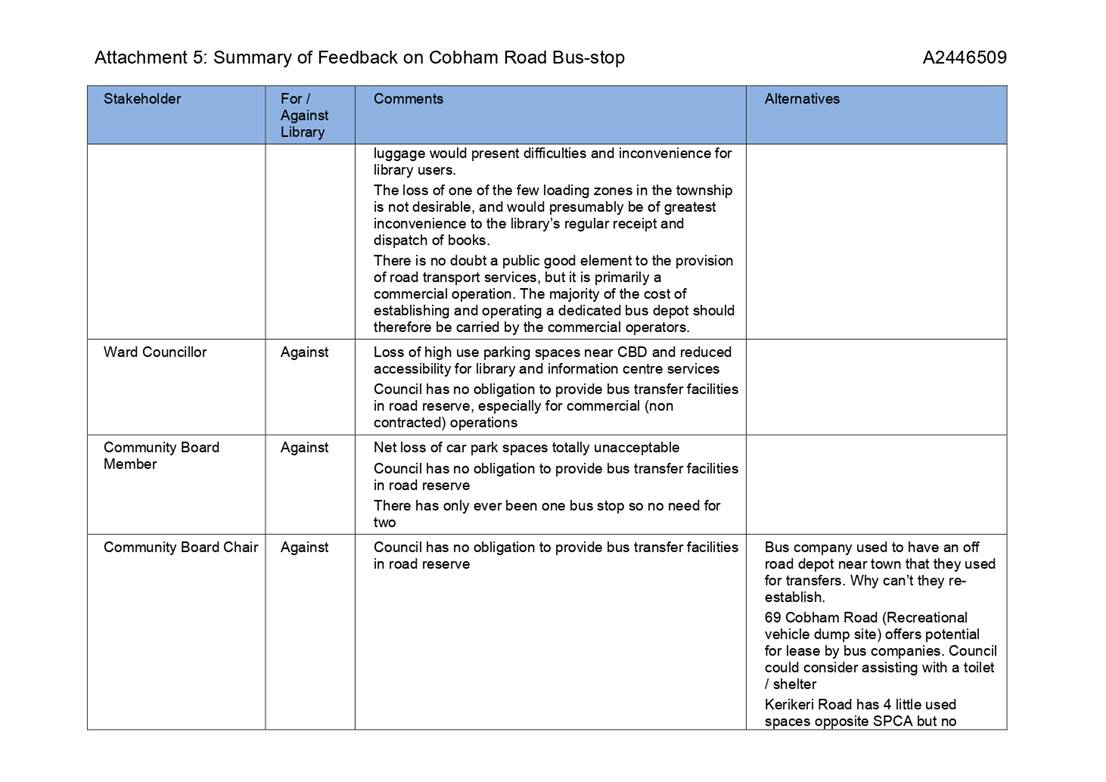

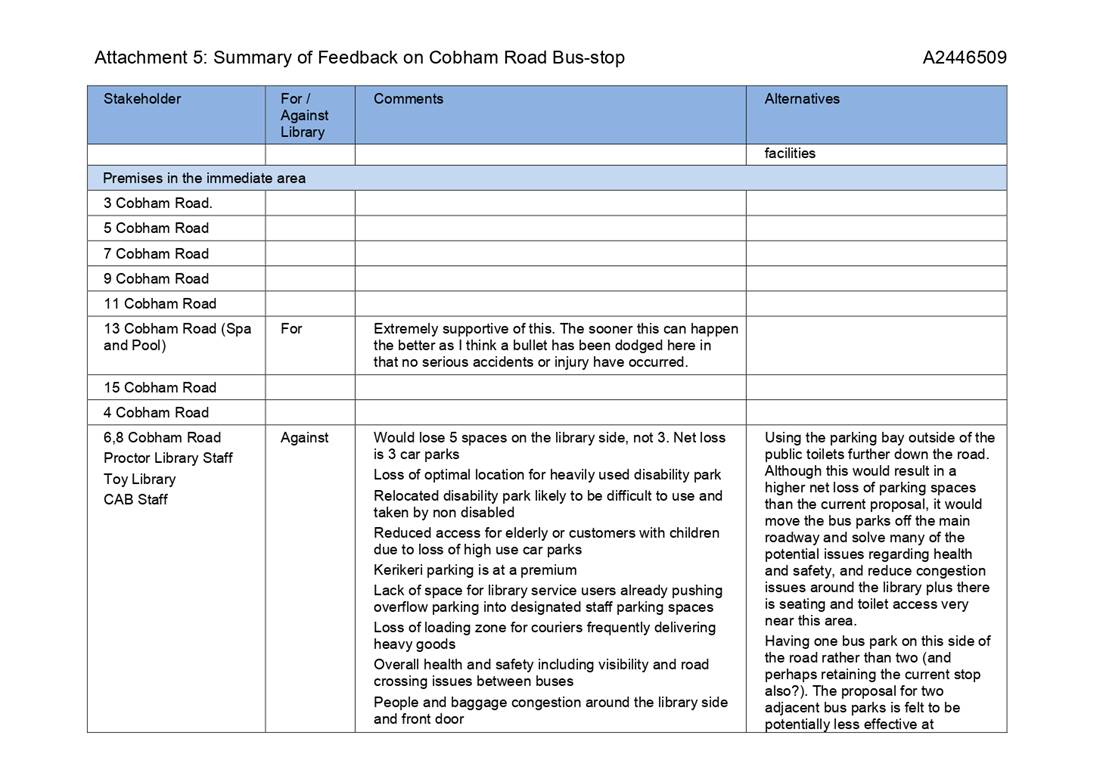

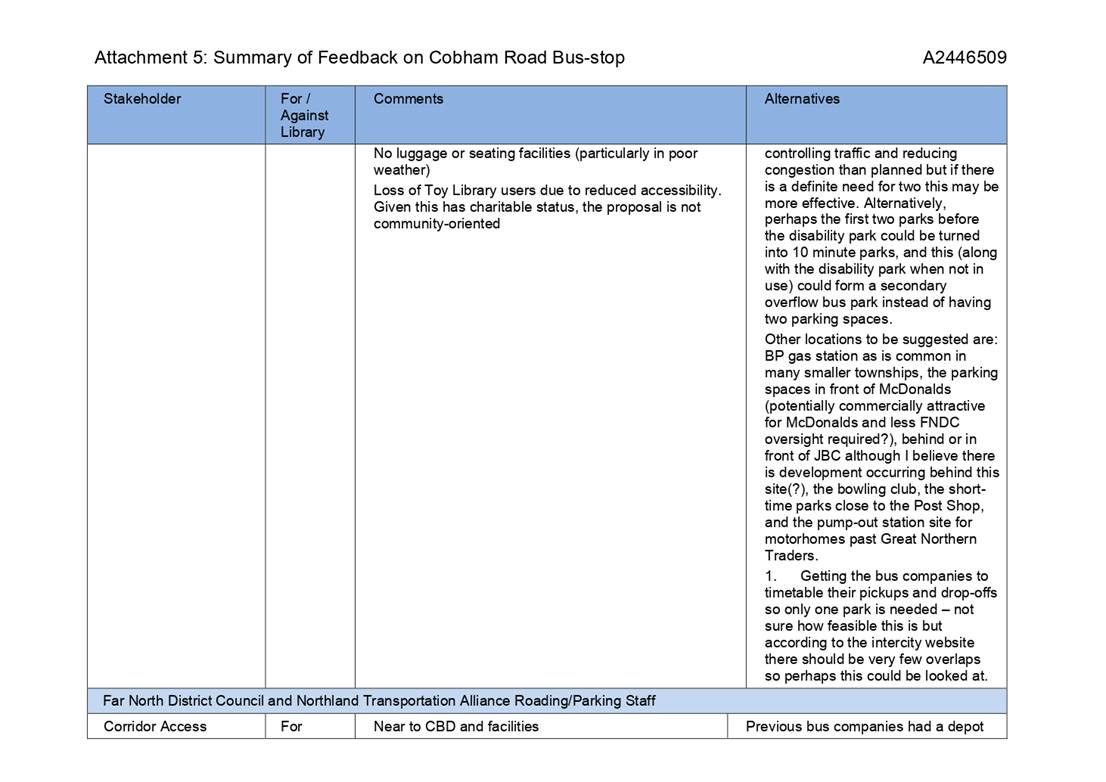

There has been a considerable amount of

local interest in the Cobham Road bus stop. A range of interested parties

were therefore asked for written feedback on the trial double bus park layout.

A total of sixteen feedback responses were

received. Ten of these were against this proposal, four supported this

proposal and two were neutral. However, a simple majority count to determine

support is not appropriate. This is because feedback has been obtained

from a mix of individuals and representative organisations, and the various

parties have or represent differing interests which must be interpreted.

A table with all of the responses is

included as Attachment 5.

Options

Taking into account the trial double bus

park layout concept, the road safety audit and the feedback received, the

Community Board was asked to deliberate on the three options:

Option 1 No changes are made to the current

layout (do nothing, but recommend that the Parking and Traffic Control bylaw be

changed); or

Option 2 The layout is changed back to the

original layout (complete works, no Parking and Traffic Control bylaw change

necessary); or

Option 3 The trial layout consisting of a

double bus park outside the library is adopted for twelve months (complete

works and recommend that the Parking and Traffic Control bylaw be changed).

The Community Board resolved to recommend

Option 1- that Council adopt the current layout and amend the Traffic and

Parking Bylaw, and also resolved to request that staff ask the Commercial

Operators to provide a suitable bus shelter for patrons. In making the

second part of this resolution, it was recognised by the Community Board that

provision of a suitable bus shelter cannot be required (i.e. the resolution is

to ask only).

Changing the Parking and Traffic Bylaw

Administration consider the

proposed changes to the Parking and Traffic Bylaw as meeting the threshold for

the criteria of level of public interest as per Councils Significance and

Engagement Policy. This is because the proposed change will generate

considerable interest and community views that may render the community deeply

divided.

Therefore as per the requirements

of 156 (1) (a) (i) of the Local Government Act, Council must use the special

consultative procedure when amending or revoking a bylaw that meets a threshold

within a Councils Significance and Engagement Policy.

Section 83 of the Local Government

Act, sets out the requirements of the special consultative procedure.

These include the adoption of a statement of proposal by Council, one month of

consultation and the provision of a reasonable opportunity for persons to

present their views to the Council in a spoken manner before any amendment to

the bylaw can be put to Council for adoption.

If the recommendation of the Community

Board is adopted, the current situation (i.e. the bus-stop not being covered by

the bylaw) will therefore persist during the time this takes.

Reason for the recommendation

The Community Board was asked to

recommend a layout for Council to adopt because:

a) whilst the trial

double bus park layout is technically sound and safe, mixed feedback was

received; and

a. the trial double bus park layout is a change in the

level of service provided by Council that will advantage a particular group

(provision of a double bus space with 30 minute parking, which will benefit bus

companies and their passengers); and

b) the trial double

bus park layout is a change in the level of service provided by Council that

will dis-advantage a particular group (removal of a loading zone outside the

library, which may require changes to library operations);

c) the choice

between layouts involves consideration of public interests better represented

by the board than by staff.

The Community Board was also asked to

recommend that Council make any necessary change to the Traffic Control and

Parking bylaw as this is required to make any selected layout

enforceable. No bylaw change is required if the recommendation is to

return to the original layout, as this is already included in the bylaw.

3) Financial Implications and

Budgetary Provision

The work involves placement of signs, line

marking and minor civil engineering works, so the financial implications of

this work are not significant. The work will be

funded as minor safety works under the Low Cost Low Risk category.

No physical works will be required by

Council if the Community Board resolution is adopted, as their recommendation

is to adopt the currently marked and signposted layout.

Attachments

1. Original

Bus Stop Layout - A2446508 ⇩

2. Current

Temporary Bus Stop Layout - A2446503 ⇩

3. Trial

Double Bus Park Layout - A2446505 ⇩

4. Road

Safety Audit - A2446502 ⇩

5. Summary

of Feedback - A2446509 ⇩

Compliance schedule:

Full consideration has been given to the

provisions of the Local Government Act 2002 S77 in relation to decision making,

in particular:

1. A Local authority must, in the

course of the decision-making process,

a) Seek to identify all reasonably

practicable options for the achievement of the objective of a decision; and

b) Assess the options in terms of

their advantages and disadvantages; and

c) If any of the options

identified under paragraph (a) involves a significant decision in relation to

land or a body of water, take into account the relationship of Māori and

their culture and traditions with their ancestral land, water sites, waahi

tapu, valued flora and fauna and other taonga.

2. This section is subject to Section

79 - Compliance with procedures in relation to decisions.

|

Compliance requirement

|

Staff assessment

|

|

State the level

of significance (high or low) of the issue or proposal as determined by the Council’s Significance and Engagement Policy

|

This report has

the potential to trigger high significance depending on the preferred option

of Council. Any changes to bylaws would require consultation before they

could be enforced.

|

|

State the

relevant Council policies (external or internal), legislation, and/or

community outcomes (as stated in the LTP) that relate to this decision.

|

Parking and

Traffic Control bylaw must be changed if necessary to make the selected

layout enforceable.

|

|

State whether

this issue or proposal has a District wide relevance and, if not, the ways in

which the appropriate Community Board’s views have been sought.

|

The Bay of

Islands-Whangaroa Community Board’s views have been sought and included

in this report.

|

|

State the possible implications for Māori

and how Māori have been provided with an opportunity to contribute to decision

making if this decision is significant and relates to land and/or any body of

water.

|

There are no

special implications for Māori.

|

|

Identify persons

likely to be affected by or have an interest in the matter, and how you have

given consideration to their views or preferences.

|

Local groups,

businesses and bus companies have been asked for feedback. Bus

passengers are considered to be represented by the bus companies and the

wider public by the Kerikeri Residents and Ratepayers Association, Vision Kerikeri

and the Community Board itself.

|

|

State the

financial implications and where budgetary provisions have been made to

support this decision.

|

If required,

there is capacity in the Low Cost Low Risk funding category.

|

|

Chief Financial

Officer review.

|

The Chief

Financial Officer has reviewed this report

|

|

Ordinary Council Meeting Agenda

|

27 June 2019

|

|

Ordinary Council Meeting Agenda

|

27 June 2019

|

|

Ordinary Council Meeting Agenda

|

27 June 2019

|

|

Ordinary Council Meeting Agenda

|

27 June 2019

|

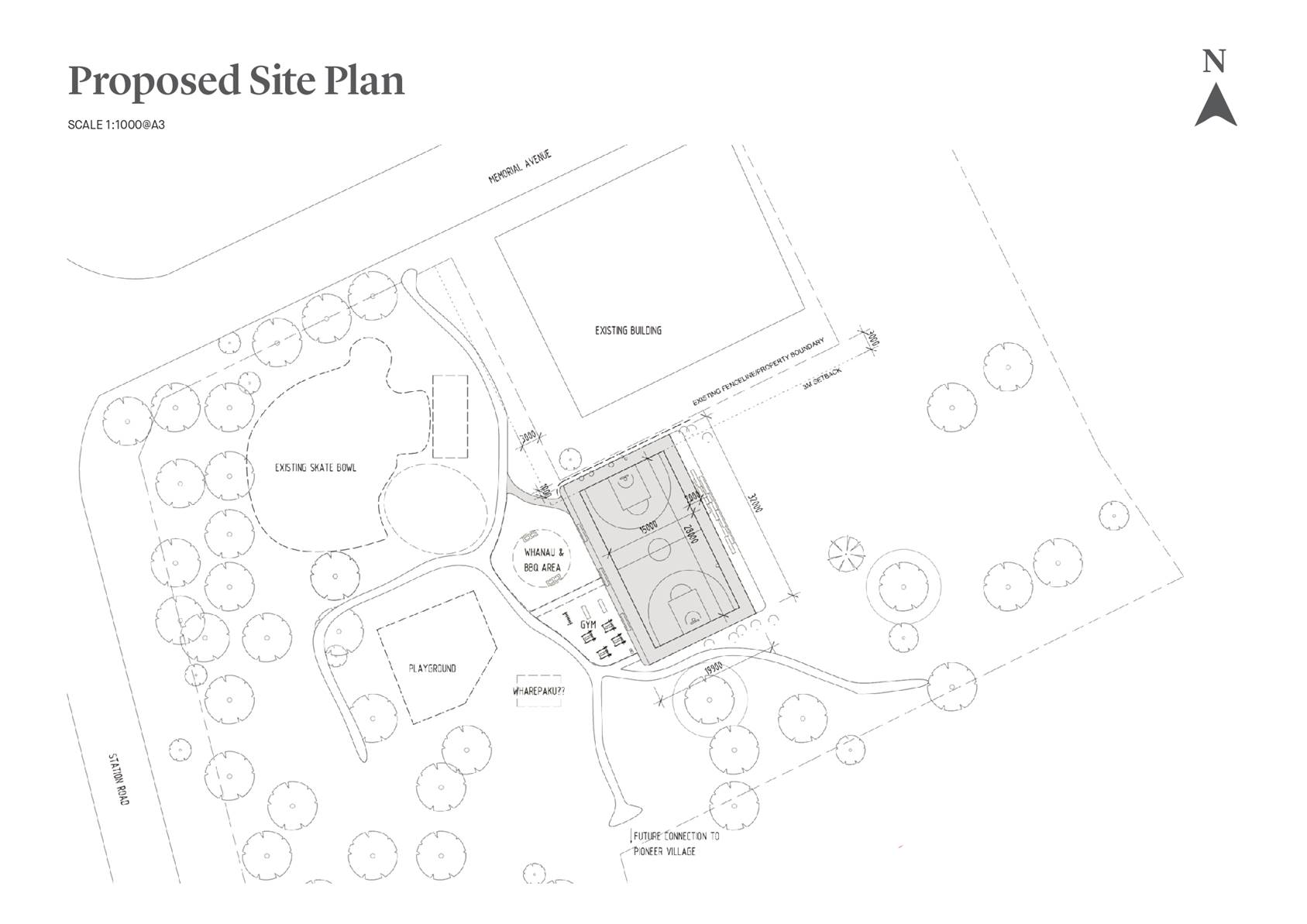

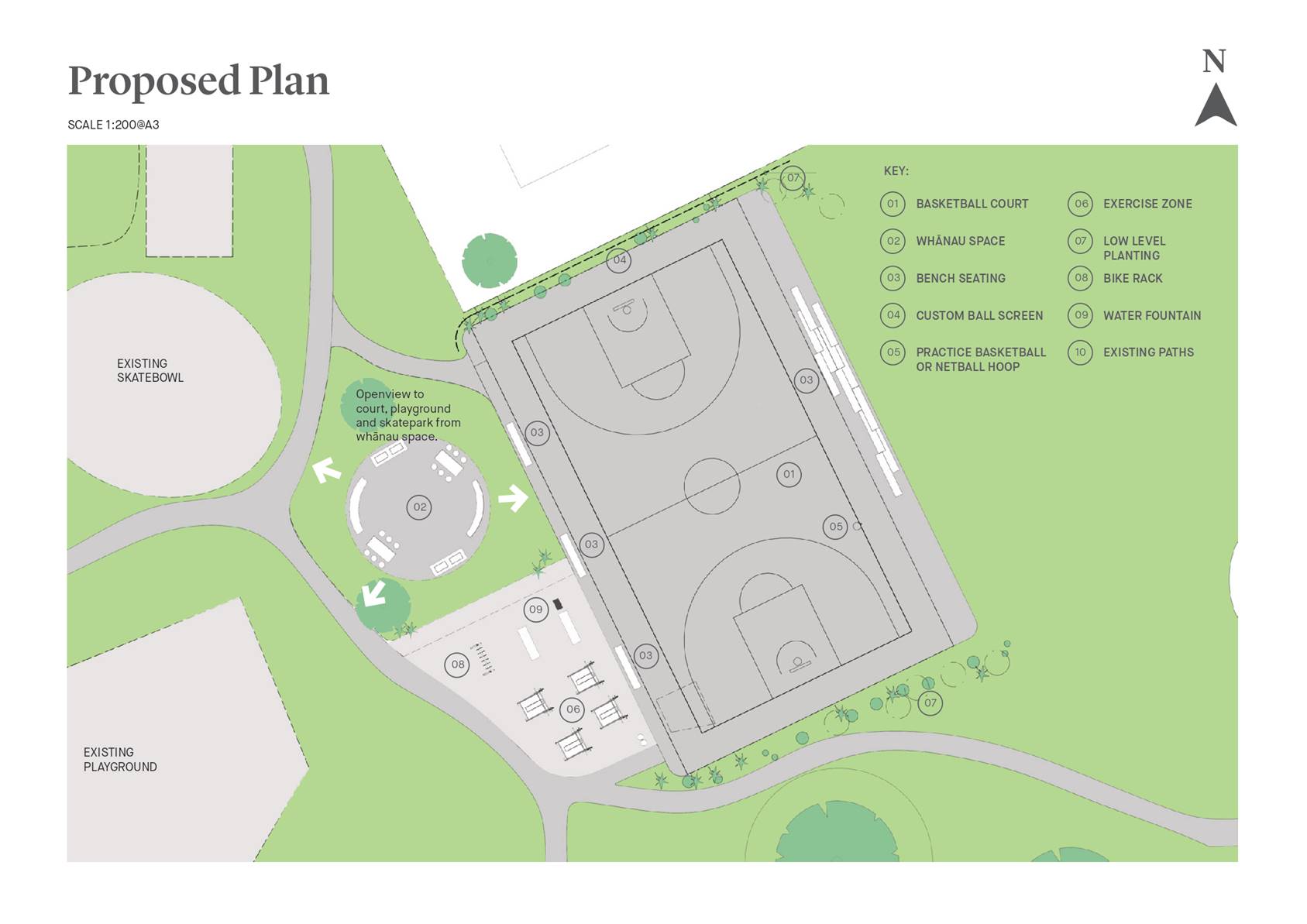

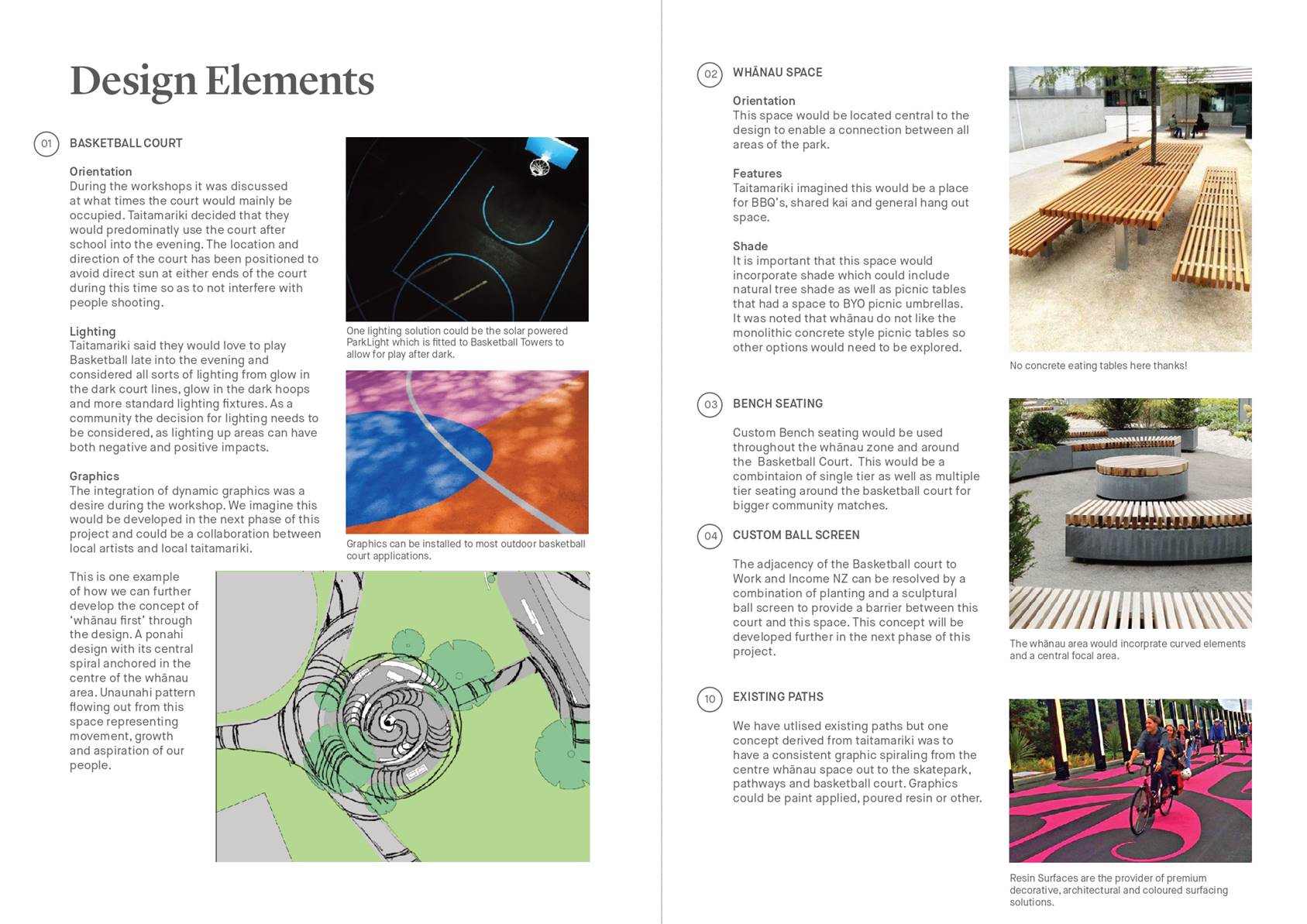

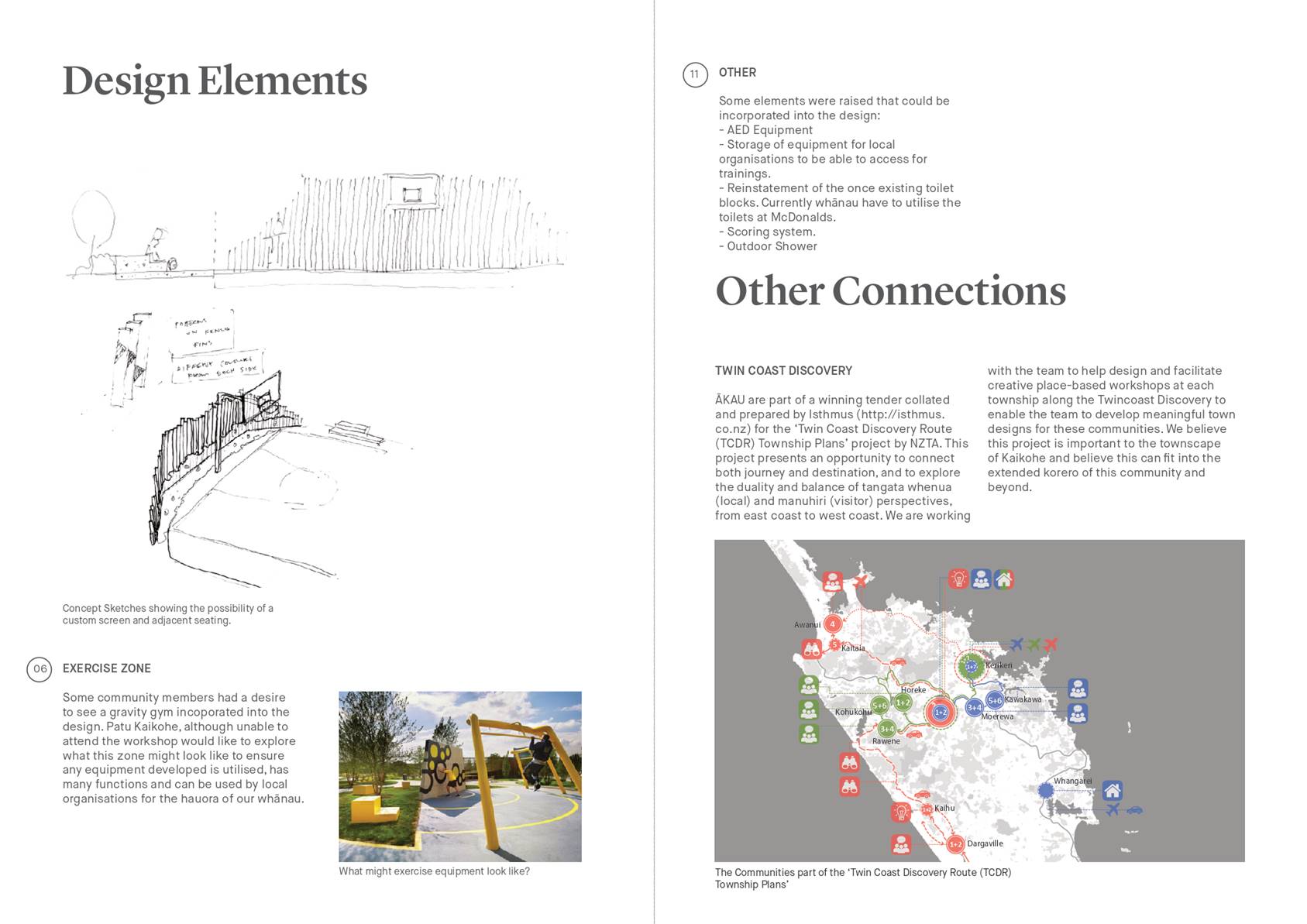

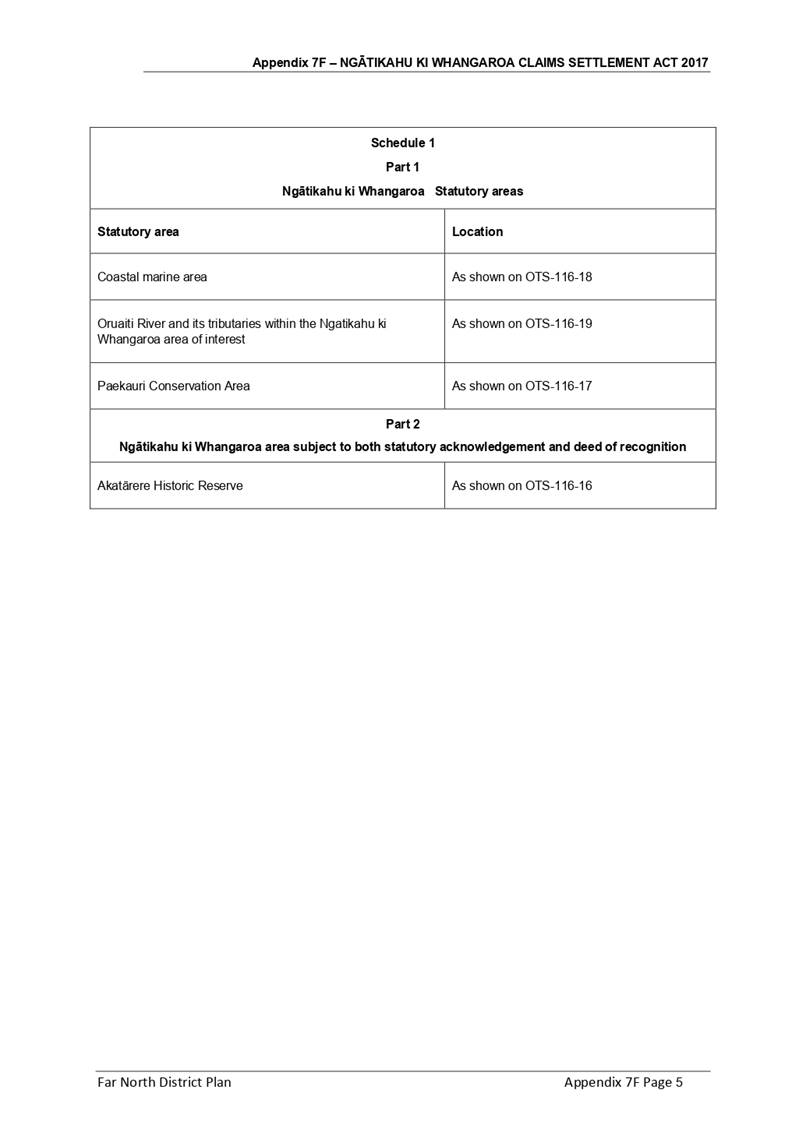

7.1 Basketball

Court Project - Memorial Park, Kaikohe

File

Number: A2515853

Author: Robert

Willoughby, Community Development Advisor

Authoriser: Darrell

Sargent, General Manager - Strategic Planning and Policy

Purpose of the Report

To seek approval from Council to build the asset when

sufficient funding has been secured.

Executive Summary

A proposal by residents requesting a basketball court on

Memorial Park in Kaikohe was received in 2018. The Kaikohe Community Youth Charitable

Trust (KCYCT) was formed to raise funds to build the Basketball Court. Quotes

from two parties have been obtained. The estimated cost of the project is

$100,000. To date the Trust has raised $72,000, a shortfall of $28,000.

A preferred location for the asset has been agreed and

Council confirms there are no consenting requirements. The Trust has asked

Council to manage the project, and the Trust would like Council to maintain the

asset in perpetuity.

Legal opinion confirms that the asset will automatically

vest in Council by virtue of being on the reserve.

This report recommends that Council build the asset when

sufficient funding has been secured.

The Kaikohe-Hokianga Community Board considered this report

at their meeting on 5 June 2019 and makes the following recommendation to

Council.

|

Recommendation

That

a) approval

be given to construct a basketball court on Memorial Park reserve once the

Kaikohe Community Youth Charitable Trust has secured sufficient funding.

b) Council

staff manage the project using funds received from the Kaikohe Community

Youth Charitable Trust.

c) sufficient

operational funding be allocated in the 2020/21 Annual Plan and subsequent

Long Term Plans to maintain, insure and depreciate the asset.

|

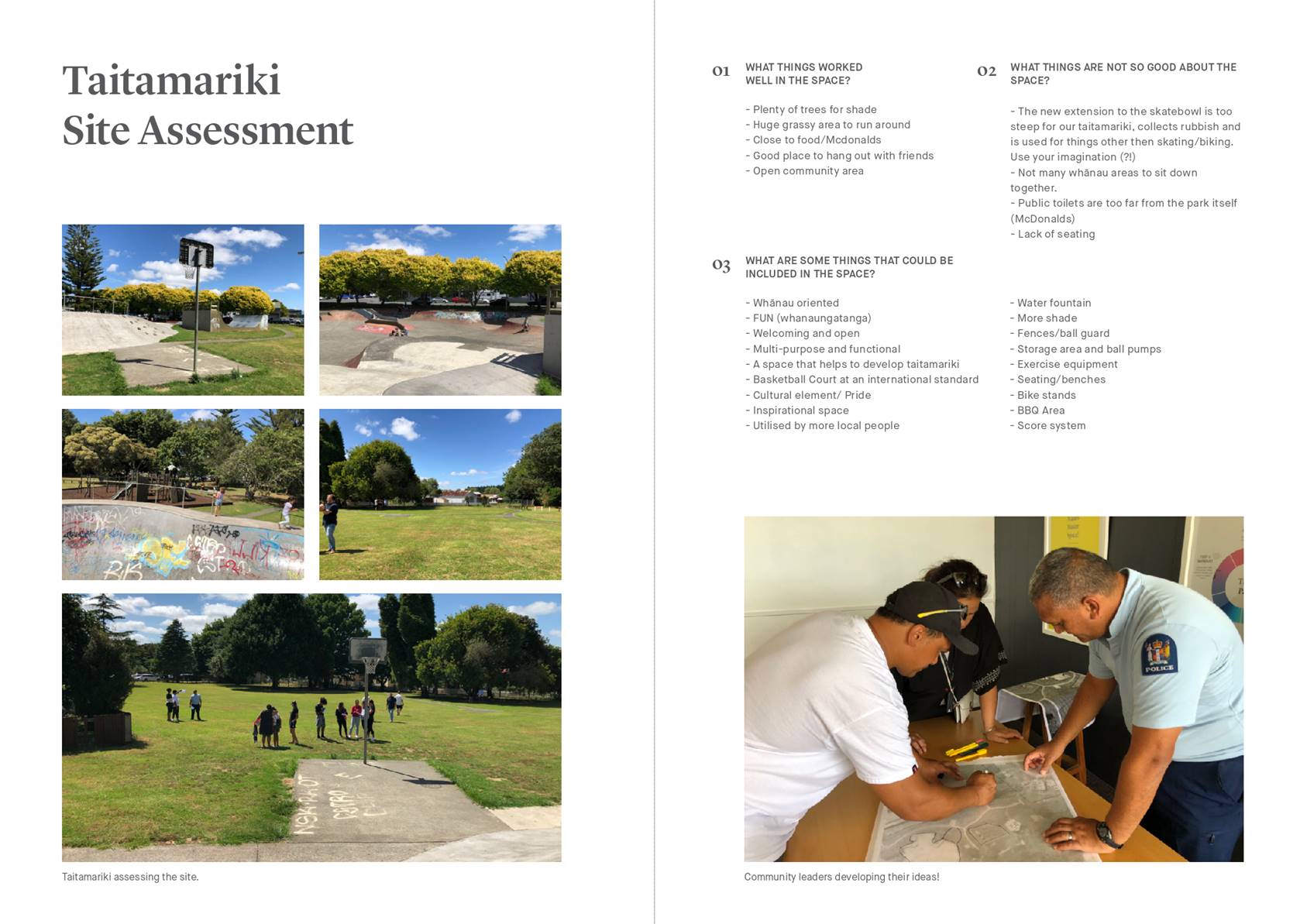

1) Background

A public petition of 1500 signatures to the Far North

District Council requesting a basketball court on Memorial Park in Kaikohe was

received in 2018. The cost of the project has been quoted at $100,000. The

Kaikohe Community Youth Charitable Trust was formed to raise funds to build the

asset. To date the Trust has raised $72,000 from the following donors:

|

Oxford

Trust

|

30,000

|

|

Pub

Charity

|

10,000

|

|

Kaikohe-Hokianga

Community Board

|

20,000

|

|

Northland

District Health Board

|

5,000

|

|

Te

Kotahitanga e Mahi Kaha Trust

|

5,000

|

|

Ngapuhi

Runanga

|

1,500

|

|

New World

Kaikohe

|

500

|

|

Total

Raised

|

72,000

|

There is a short-fall of funding.

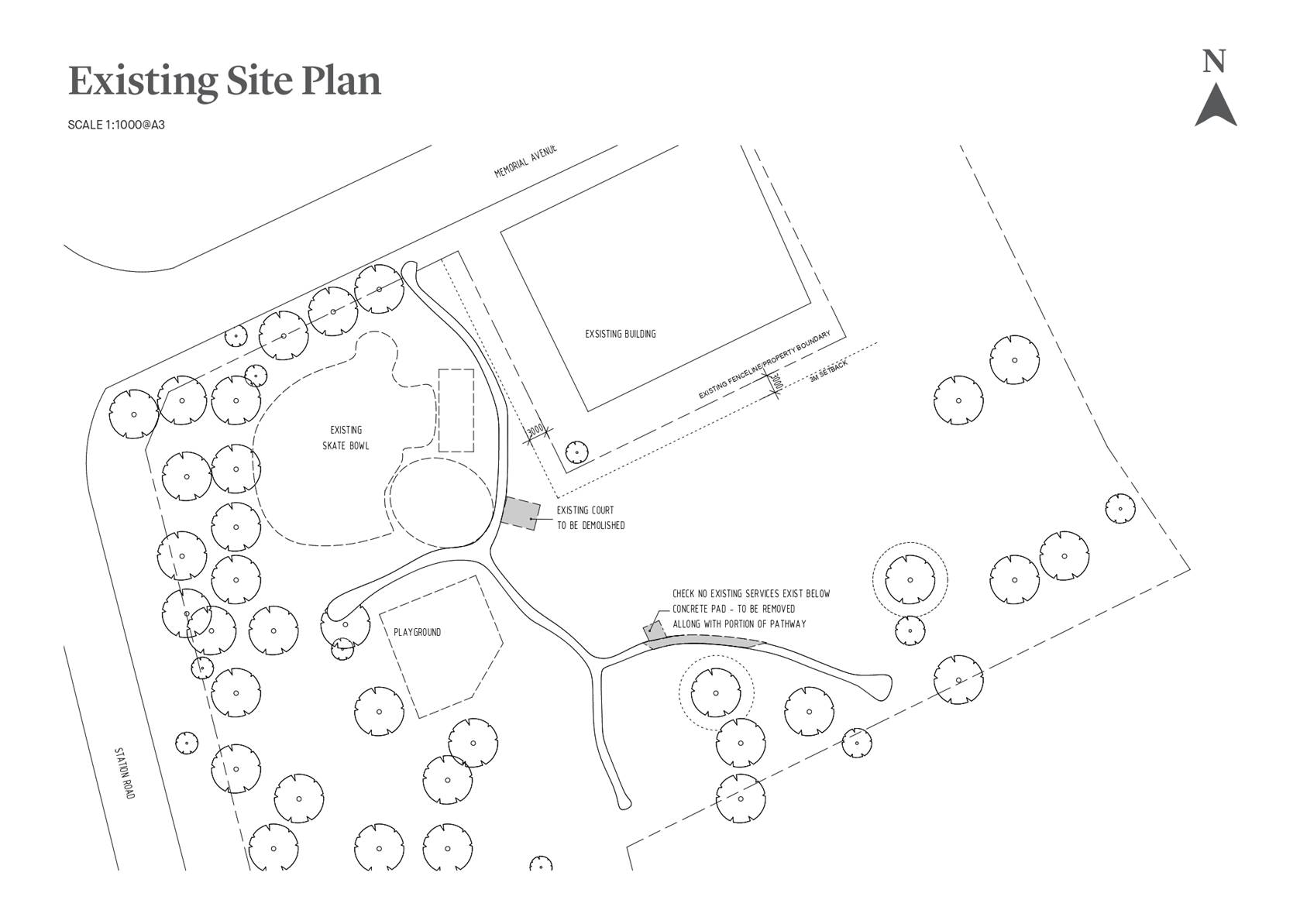

Council and KCYCT have agreed a

preferred location for the court and Council staff confirm that there are no

consenting requirements. Memorial Park does not have a reserve management plan

in place. There is therefore no restriction on the placement of an asset such

as this.

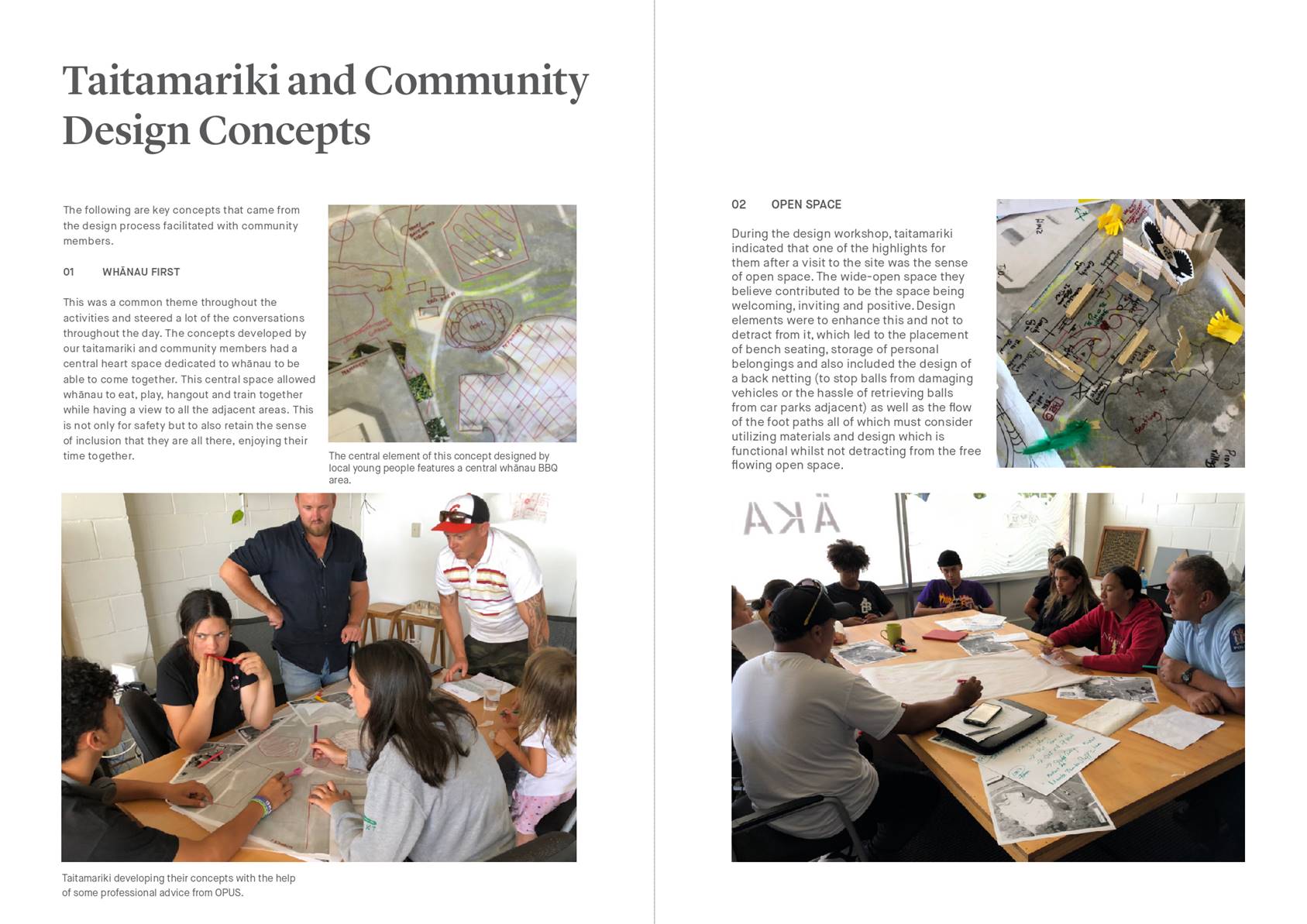

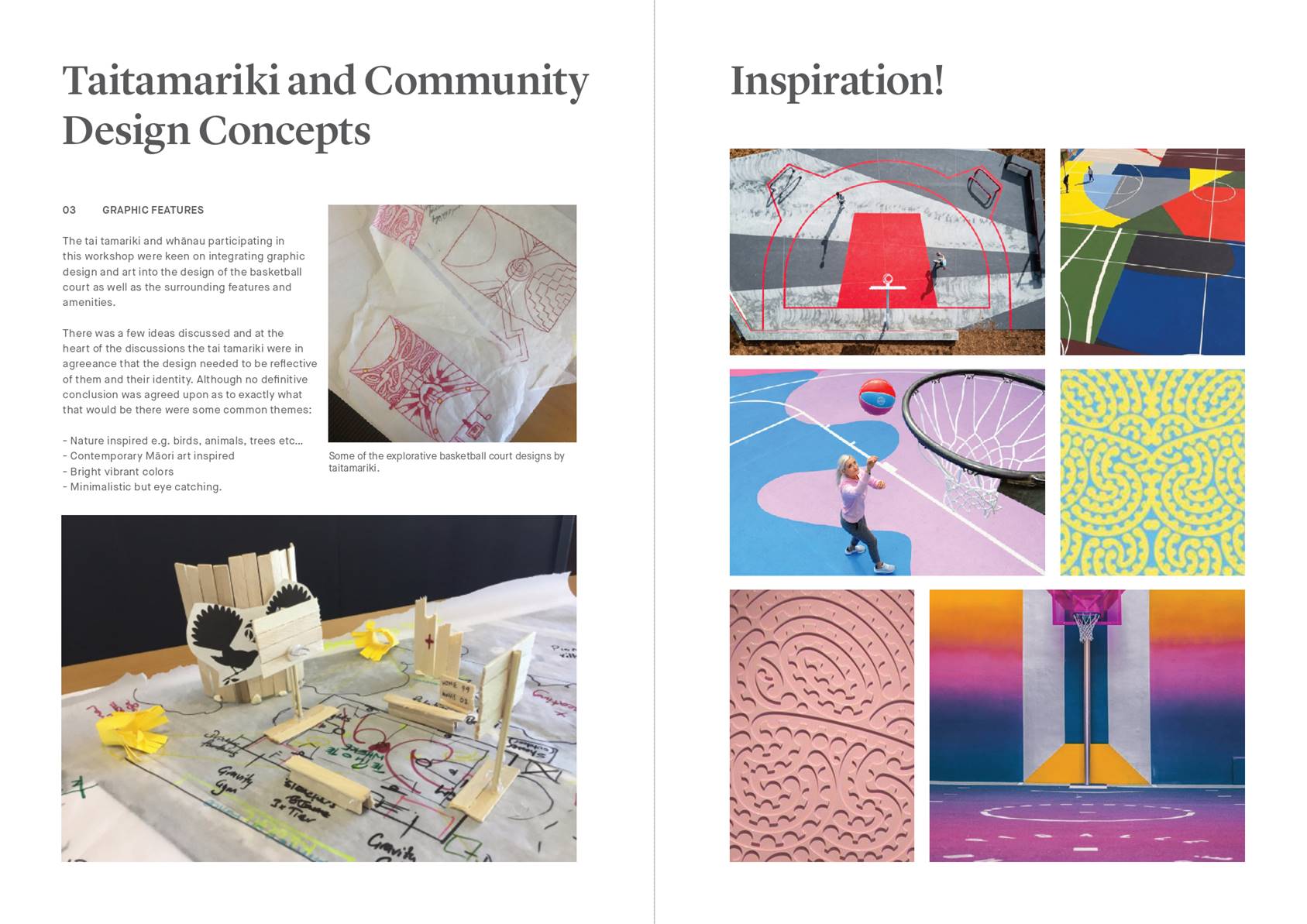

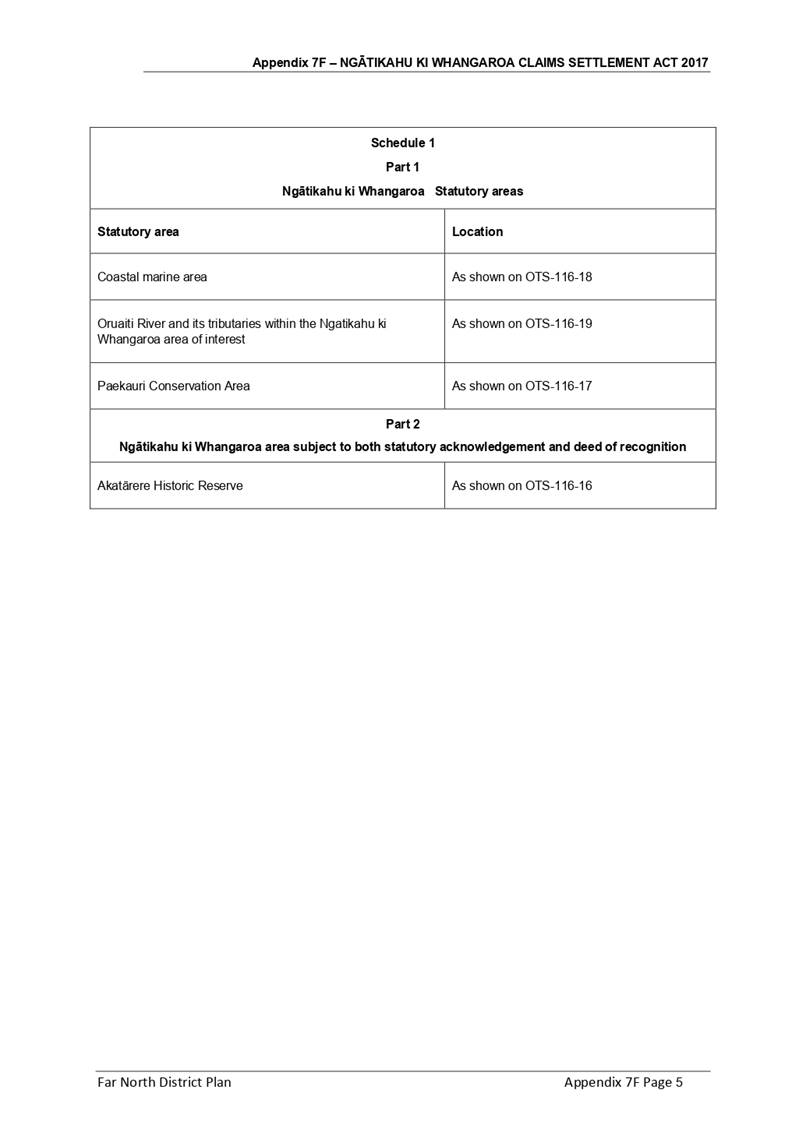

A concept plan has been developed by the community, led by

AKAU, to articulate the design, size and structure of the court and the

surrounding area.

KCYCT wants Council to manage the project and own and

maintain the court once it is completed.

2) Discussion and Options

Project management, ownership

and responsibility for maintenance

Council

automatically becomes the owner of the asset once it has been constructed on a

Council reserve. Operating costs have been estimated at $5,000 per year

including maintenance, insurance and depreciation.

Assuming

that the asset will be constructed in 2019/20, operating costs will not arise

until 2020/21. These costs will therefore be included in the 2020/21 Annual

Plan and subsequent LTP.

Should the

project go ahead, Council will need to manage the construction of the asset to

ensure it is fit for purpose, constructed to the required standard and safe for

users.

Funding

shortfall

KCYCT are $28,000 short of the quoted

cost. The Trust itself has sought the quotes the funding target is based on.

Since Council will project manage and own the resulting asset, it is necessary

for Council’s procurement process to be followed and therefore more work

done on securing quotes to lay the foundation. Two quotes have also been

received for the astro-turf and court fitout element. Foundation costs seem to

vary depending upon the locality of the contractor. It is possible that the

cost for foundation could be reduced.

Options are:

Option 1 (preferred): Work with KCYCT to review the

quoted cost using Council contractors. The Trust has received two quotes. Given

the cost variances between them a third quote is being sought. Staff recommend

the asset should not be built until the funding streams have been secured.

Option 2: KCYCT continues its fundraising efforts and

works with Council to phase the project so that funds already raised can be put

to use. Although this mitigates the risk of having to repay donor funds,

Council faces the possibility that the Trust is unsuccessful in raising the

rest of the money, leaving Council with the cost of completing the build.

Approval to construct the asset on Memorial Park Reserve

The Community Board does not have the delegated authority to

approve construction of the asset on a reserve. Therefore, Council approval

needs to be sought.

Reason

for the recommendation

The project is recognised by Council as an excellent

place-making initiative that will attract substantial use by the youth of

Kaikohe and visitors. The community has done a good job of raising a

significant amount of funding and is close to target but requires more time to

get to their goal.

Since the asset will be owned and maintained by Council it

is important that Council’s procurement and construction processes be

adhered to. For this reason the recommendation is to proceed only when

Council-approved quotes have been received and sufficient funding has been

confirmed.

3) Financial Implications and Budgetary

Provision

Assuming that the asset will be constructed in 2019/20,

operating costs will not arise until 2020/21. These costs are estimated at

$5,000 annually to cover maintenance, insurance and depreciation will therefore

be included in the 2020/21 Annual Plan and subsequent LTP.

The capital to build the asset will be provided to Council

from KCYCT.

Attachments

1. AKAU Kaikohe Basketball

Report - A2515837 ⇩

Compliance schedule:

Full consideration has been given to the provisions of the

Local Government Act 2002 S77 in relation to decision making, in particular:

1. A

Local authority must, in the course of the decision-making process,

a) Seek

to identify all reasonably practicable options for the achievement of the

objective of a decision; and

b) Assess

the options in terms of their advantages and disadvantages; and

c) If

any of the options identified under paragraph (a) involves a significant

decision in relation to land or a body of water, take into account the

relationship of Māori and their culture and traditions with their

ancestral land, water sites, waahi tapu, valued flora and fauna and other

taonga.

2. This

section is subject to Section 79 - Compliance with procedures in relation to

decisions.

|

Compliance

requirement

|

Staff

assessment

|

|

State the level of significance

(high or low) of the issue or proposal as determined by the Council’s

Significance and Engagement Policy

|

The project holds a high level of significance for the

youth of Kaikohe to engage in positive recreational activity. Urban

basketball is a growing sport with increasing participation rates.

|

|

State the relevant Council

policies (external or internal), legislation, and/or community outcomes (as

stated in the LTP) that relate to this decision.

|

The projects sits well as a place

making activity for Kaikohe and fits within the social development goals of

the Kaikohe Community Plan to engage youth in developing programs and

activities for their community.

|

|

State whether this issue or

proposal has a District wide relevance and, if not, the ways in which the

appropriate Community Board’s views have been sought.

|

The Kaikohe-Hokianga Community Board supports, in

principle, the proposal to install a basketball court to Memorial Park,

Kaikohe at no cost to Council (excepting potential funding grants), subject

to

i) All funds for the project being secured by 1 December

2018 (subsequently reviewed to 1st April 2019.

ii) The final location and design being approved by the

board and subject matter Council staff

iii) Funds for maintaining the court until the next Long

Term Plan budget (2021-31) is set are provided by the petitioner

b) The Board notes that the petitioner will work with

Council staff to meet legal and safety requirements regarding this project.

|

|

State the possible implications for Māori

and how Māori have been provided with an opportunity to contribute to

decision making if this decision is significant and relates to land and/or

any body of water.

|

There are no foreseen implications for Maori. The project

is supported by Ngapuhi Runanga who have contributed to the project

|

|

Identify persons likely to be

affected by or have an interest in the matter, and how you have given

consideration to their views or preferences.

|

The basketball court will be constructed at the

recreational end of Memorial Park. No encumbrances to access are foreseen.

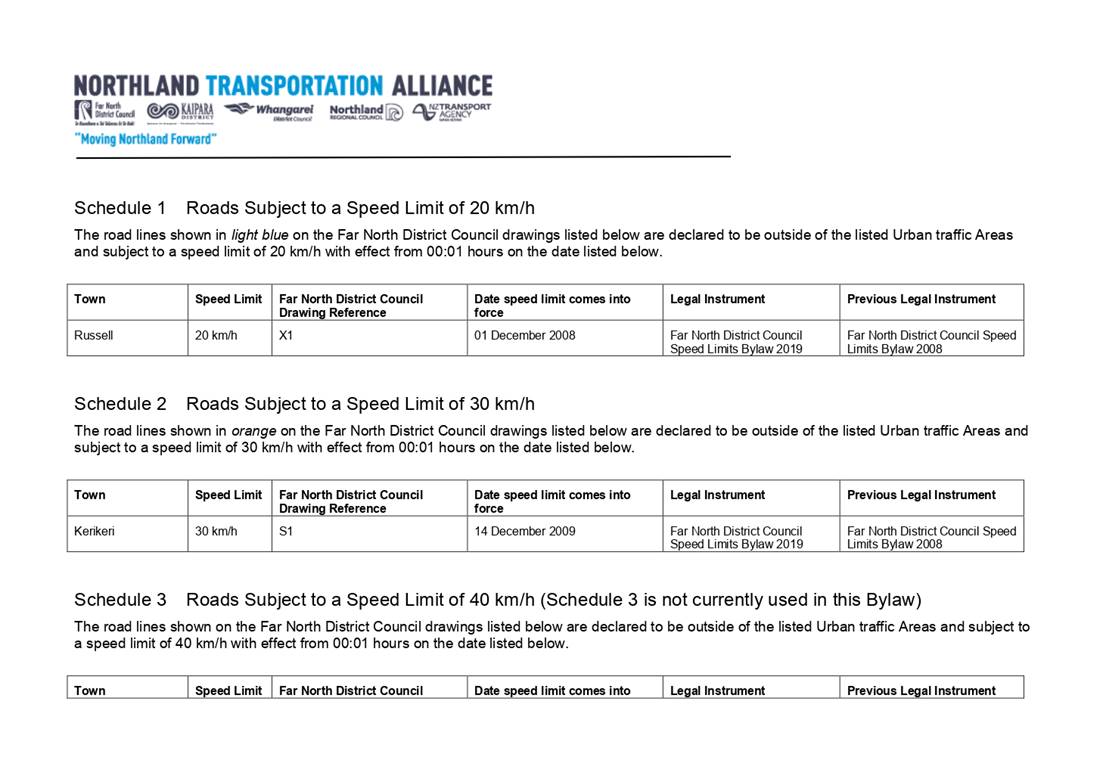

Kaikohe Police have been engaged in the project and support its purpose and