AGENDA

Audit, Risk, and Finance Committee Meeting

Thursday, 28 March 2019

|

Time:

|

12:45 pm

|

|

Location:

|

Council Chamber

Memorial Avenue

Kaikohe

|

Membership:

Cr John

Vujcich - Chairperson

Mayor John

Carter

Cr Tania

McInnes

Cr Ann Court

Cr Felicity

Foy

Cr Colin

(Toss) Kitchen

Cr Sally

Macauley

Cr Kelly

Stratford

Member Bruce

Robertson

Member Adele

Gardner

Member Mike

Edmonds

Member Terry

Greening

|

Audit, Risk, and Finance Committee

Meeting Agenda

|

28 March 2019

|

AUDIT, RISK AND FINANCE

COMMITTEE - MEMBERS REGISTER OF INTERESTS

|

Name

|

Responsibility (i.e.

Chairperson etc)

|

Declaration of

Interests

|

Nature of Potential

Interest

|

Member's Proposed

Management Plan

|

|

Hon John Carter QSO

|

Board Member of the

Local Government Protection Programme

|

Board Member of the

Local Government Protection Program

|

|

|

|

Carter Family Trust

|

|

|

|

|

Felicity Foy

|

Director - Northland

Planning & Development

|

I am the director of a

planning and development consultancy that is based in the Far North and have

two employees.

|

|

I will abstain from any

debate and voting on proposed plan change items for the Far North District

Plan.

|

|

I will declare a

conflict of interest with any planning matters that relate to resource

consent processing, and the management of the resource consents planning

team.

|

|

I will not enter into

any contracts with Council for over $25,000 per year. I have previously

contracted to Council to process resource consents as consultant planner.

|

|

Flick Trustee Ltd

|

I am the director of

this company that is the company trustee of Flick Family Trust that owns

properties on Weber Place, Seaview Road, and Allen Bell Drive.

|

|

|

|

Elbury Holdings Limited

|

This company is

directed by my parents Fiona and Kevin King.

|

This company owns

several dairy and beef farms, and also dwellings on these farms. The Farms

and dwellings are located in the Far North at Kaimaumau, Bird Road/Sandhills

Rd, Wireless Road/ Puckey Road/Bell Road, the Awanui Straight and Allen Bell

Drive.

|

|

|

Foy Farms partnership

|

Owner and partner in

Foy Farms - a farm in three titles on Church Road, Kaingaroa

|

|

|

|

Foy Farms Rentals

|

Owner and rental

manager of Foy Farms Rentals for 6 dwellings on Church Road, Kaingaroa and 1

dwelling on Allen Bell Drive, Kaitaia

|

|

|

|

King Family Trust

|

This trust owns several

titles/properties at Cable Bay, Seaview Rd/State Highway 10 and Ahipara -

Panorama Lane.

|

These trusts own

properties in the Far North.

|

|

|

Previous employment at

FNDC 2007-16

|

I consider the staff

members at FNDC to be my friends

|

|

|

|

Partner Felicity Foy

|

Employed by

Justaplumber Taipa

|

|

|

|

|

Friends with some FNDC

employees

|

|

|

|

|

Colin Kitchen

|

No form received

|

|

|

|

|

Tania McInnes

|

Director – GBT

Ventures Ltd

|

Company not

currently operational

|

|

Will notify

Council if company becomes operational.

|

|

Member of Northland

Conservation Board

|

|

Conservation matters

not aligned with Council policy.

|

Will notify Council

should a perceived conflict arise.

|

|

Trustee –

Northland Youth Education Trust

|

|

No perceived conflicts

|

Will notify Council

should a perceived conflict arise.

|

|

Founder – Bay of

Islands Women’s Nexus

|

No perceived conflicts.

An informal organisation

|

|

|

|

Own a section on

Seaview Road, Paihia 0200

|

|

|

|

|

Having worked within

the organisation in the early 2000’s, I know a number of staff, none of

which I am close with.

|

|

|

|

|

John Vujcich

|

Board Member

|

Ngati Hine Health Trust

|

Matters pertaining to

property or decisions that may impact of their health services

|

Declare interest and

abstain

|

|

Board Member

|

Pioneer Village

|

Matters relating to

funding and assets

|

Declare interest and

abstain

|

|

Director

|

Waitukupata Forest Ltd

|

Potential for council

activity to directly affect its assets

|

Declare interest and

abstain

|

|

Director

|

Rural Service Solutions

Ltd

|

Matters where council

regulatory function impact of company services

|

Declare interest and

abstain

|

|

Director

|

Kaikohe (Rau Marama)

Community Trust

|

Potential funder

|

Declare interest and

abstain

|

|

Partner

|

MJ & EMJ Vujcich

|

Matters where council

regulatory function impacts on partnership owned assets

|

Declare interest and

abstain

|

|

Member

|

Kaikohe Rotary Club

|

Potential funder, or

impact on Rotary projects

|

Declare interest and

abstain

|

|

Member

|

New Zealand Institute

of Directors

|

Potential provider of

training to Council

|

Declare a Conflict of

Interest

|

|

Member

|

Institute of IT

Professionals

|

Unlikely, but possible

provider of services to Council

|

Declare a Conflict of

Interest

|

|

Member

|

Kaikohe Business

Association

|

Possible funding provider

|

Declare a Conflict of

Interest

|

|

Ann Court

|

Waipapa Business

Association

|

Member

|

|

|

|

Warren Pattinson

Limited

|

Shareholder

|

Building company. FNDC

is a regulator and enforcer

|

No FNDC Controls

|

|

Kerikeri Irrigation

|

Supplies my water

|

|

No EM intervention in

disputes

|

|

Top Energy

|

Supplies my power

|

|

No other interest

greater than the publics

|

|

District Licensing

|

N/A

|

N/A

|

N/A

|

|

Top Energy Consumer

Trust

|

Trustee

|

Crossover in regulatory

functions, consenting economic development and contracts such as street lighting.

|

Declare interest and

abstain from voting.

|

|

Ann Court Trust

|

Private

|

Private

|

N/A

|

|

Waipapa Rotary

|

Honorary member

|

Potential community

funding submitter

|

Declare interest and

abstain from voting.

|

|

Properties on Onekura

Road, Waipapa

|

Owner Shareholder

|

Any proposed FNDC

Capital works or policy change which may have a direct impact (positive/adverse)

|

Declare interest and

abstain from voting.

|

|

Property on Daroux Dr,

Waipapa

|

Financial interest

|

|

|

|

Flowers (I get flowers

occasionally)

|

Ratepayer 'Thankyou'

|

Bias/

Pre-determination?

|

Declare to Governance

|

|

Coffee and food

|

Ratepayers sometimes

'shout' food and beverage

|

Bias or

pre-determination

|

Case by case

|

|

Consider all staff my

friends

|

N/A

|

Suggestion of not being

impartial or pre-determined!

|

Be professional, due

diligence, weigh the evidence. Be thorough, thoughtful, considered impartial

and balanced. Be fair.

|

|

|

My husband is a builder

and may do work for Council staff

|

|

|

|

Warren Pattinson

(Husband)

|

Warren Pattinson

Limited

|

Director

|

Building Company. FNDC

is a regulator

|

Remain at arm’s

length

|

|

Air NZ

|

shareholder

|

None

|

None

|

|

Warren Pattinson

Limited

|

Builder

|

FNDC is the consent

authority, regulator and enforcer.

|

Apply arm’s

length rules

|

|

Kurbside Rod and Custom

Club (unlikely)

|

President NZ Hot Rod

Association

|

Potential to be linked

to a funding applicant and my wife is on the decision making committee.

|

unlikely to materialise

but would absent myself from any process as would Ann.

|

|

Property on Onekura

Road, Waipapa

|

Owner

|

Any proposed FNDC capital

work in the vicinity or rural plan change. Maybe a link to policy

development.

|

Would not submit.

Rest on a case by case basis.

|

|

Sally Macauley

|

Chairman

|

Northland District Health

Board

|

Matters pertaining to

health issues re Fluoride and freshwater as an example.

|

Declare a perceived

conflict.

|

|

Chairman

|

Oranga Tamaraki -

Ministry of Vulnerable Children- Northland Community Response Forum

|

Matters pertaining to

this ministry

|

Declare a perceived

conflict.

|

|

Judicial Justice of the

Peace

|

Visitations to Ngawha

Prison

|

Matters pertaining to

Judicial Issues re Ngawha Prison

|

Declare a perceived

Interest

|

|

The Turner Centre

|

FNDC Representative

|

Observer, acknowledging

FNDC financial contribution.

|

Note FNDC partnership

|

|

Trustee

|

Kaikohe Education Trust

|

Providing students

laptops - possible request for written support to funders

|

Declare a conflict

|

|

Executive member

|

Kaikohe Business

Association

|

Matters pertaining to

request for written support to funders.

|

|

|

Chairman

|

Bay of Islands Arts

Festival Trust

|

Issues pertaining to

the application of support funds

|

Declare a conflict of

interests

|

|

Trustee

|

Bay of Islands Radio

Marine

|

Issues pertaining to

the application of support funds

|

Declare a conflict of

interests

|

|

Secretary/Trustee

|

Kerikeri International

Piano Competition

|

Issues pertaining to

the application of support funds

|

Declare a conflict of

interests

|

|

Trustee/Director

|

Kaikohe Community and

Youth Trust

|

Possible application of

support funding

|

Declare a conflict of

interests

|

|

Commercial

|

Palmer Macauley

Offices- Kerikeri and Kaikohe

|

Infrastructural matters

with FNDC

|

Declare a conflict

|

|

Private property of

which there would not be any conflict.

|

|

|

|

|

Paihia, Kerikeri,

Kaikohe

|

|

|

|

|

Peter Macauley

(Husband)

|

Senior Partner

|

Palmer Macauley

|

|

|

|

Peter Macualey

|

Barristers and

Solicitors- Kerikeri, Kaikohe and Mangonui

|

Legal matters with FNDC

|

|

|

Director/Trustee

|

|

|

|

|

St John NZ Priory

Chapter

|

St John Priory Chapter

|

Legal matters with FNDC

|

Declare a conflict

|

|

Senior Partner

|

Peter Macauley- Palmer

Macauley Barristers and Solicitors Kaikohe, Kerikeri AND Mangonui

|

Legal matters with FNDC

|

Declare a conflict

|

|

St John NZ

|

Priory Trust Board

|

Writing of policies and

legal matters as an example

|

Note Interests

|

|

Lions Club of Kaikohe

|

Director

|

Legal matters etc

|

Note Interests

|

|

Kaikohe Rugby Club

|

Patron

|

Legal Matters

|

|

|

Viking Rugby Club,

Whangarei

|

Life Member

|

Legal Matters

|

|

|

Private Property

|

|

|

|

|

Kerikeri, Paihia - no

contents.

|

|

|

|

|

Bruce Robertson

|

No interests to declare

|

|

|

|

|

Mike Edmonds

|

Chair

|

Kaikohe Mechanical and

Historic Trust

|

Council Funding

|

Decide at the

time

|

|

Committee member

|

Kaikohe Rugby Football

and Sports Club

|

Council Funding

|

Withdraw and abstain

|

|

Adele Gardner

|

N/A - FNDC Honorarium

|

|

|

|

|

The Far North 20/20,

ICT Trust

|

Trustee

|

|

|

|

Te Ahu Charitable Trust

|

Trustee

|

|

|

|

ST Johns Kaitaia Branch

|

Trustee/ Committee

Member

|

|

|

|

I know many FNDC staff

members as I was an FNDC staff member from 1994-2008.

|

|

|

|

|

Partner of Adele

Gardner

|

N/A as Retired

|

|

|

|

|

Terry Greening

|

Greening Family Trust

|

Beneficiary

|

|

Highly unlikely to

interface with FNDC

|

|

Bay of Islands Walking

Weekend Trust

|

|

Potential of seeking

funds

|

Step aside from any

requests or decisions regarding requests

|

|

Russell 2000 Trust

(Chairman)

|

|

|

Trust is about to wind

up.

|

|

Russell Centennial

Trust (Chairman)

|

Manages Russell Museum

|

Seeks funds from

council

|

Step aside from any

requests or decisions regarding requests

|

|

Residence at Kaha

Place, Russell

|

Nil

|

Nil

|

N/A

|

|

Terry Greening (Wife)

|

Greening Family Trust

|

Beneficiary

|

N/A

|

N/A

|

|

Residence at Kaha

Place, Russell

|

|

|

|

|

Cr Kelly Stratford

|

Office manager at

Kinghans.

|

|

|

|

|

Denture assistant at

Kawakawa denture Services

self-employed as book keeper Kelly@ksbookkeeoing.net

|

None

|

None

|

|

|

KS Bookkeeping and

Administration

|

Business owner,

bookkeeping and development of environment management plans for clients.

|

None perceived

|

I’d step aside

from decisions that arise, that may have conflicts.

|

|

Kinghans Accounting

|

Office Administration

|

None perceived

|

Step aside from

decisions that arise, that may have conflicts.

|

|

Waikare Marae Trustees

|

Trustee

|

May be perceived

conflicts

|

Case by case basis

|

|

Kawakawa Business &

Community Association

|

Committee

member/newsletter editor and printer

|

None perceived

|

If there was a

perceived conflict, I will step aside from decision making

|

|

Bay of Islands College

|

Parent elected trustee

|

None perceived

|

If there was a

perceived conflict, I will step aside from decision making

|

|

Karetu School

Bay Cosmos Soccer

|

Parent elected trustee.

Committee member and coach

|

None perceived

|

If there was a

perceived conflict, I will step aside from decision making

|

|

Property in Waikare and

Moerewa

|

|

|

If there was a

perceived conflict, I will step aside from decision making

|

|

Coffee and food

|

Ratepayers sometimes

'shout' food and beverage

|

Bias or

pre-determination

|

Case by case

|

|

Kelly Stratford

(Husband)

|

Puketona Junction

Café

39 Gillies Café

|

Barista & Chef

Barista

|

N/A

|

N/A

|

|

|

Property in Moerewa

|

|

N/A

|

N/A

|

Members need to

stand aside from decision-making when a conflict arises between their role as a

Member of the Community Board and any private or other external interest they

might have. This note is provided as a reminder to Members to review the

matters on the agenda and assess and identify where they may have a pecuniary

or other conflict of interest, or where there may be a perception of a conflict

of interest.

If a Member

feels they do have a conflict of interest, they should publicly declare that at

the start of the meeting or of the relevant item of business and refrain from

participating in the discussion or voting on that item. If a Member thinks they

may have a conflict of interest, they can seek advice from the Chief Executive

Officer or the Team Leader Governance Support (preferably before the meeting).

It is noted

that while members can seek advice the final decision as to whether a conflict

exists rests with the member.

2 Deputation

No requests for deputations were

received at the time of the Agenda going to print.

3 Confirmation

of Previous Minutes

3.1 Confirmation

of Previous Minutes

File

Number: A2339435

Author: Melissa

Wood, Meetings Administrator

Authoriser: Kate

Barnes, Governance Support Team Leader

Purpose of the Report

The minutes of the previous Audit, Risk, and Finance Committee

meeting are attached to allow the Committee to confirm that the minutes are a

true and correct record

|

Recommendation

That the Audit, Risk, and Finance Committee confirm

that the minutes of the meeting of the Committee held 29 November 2018 are a true

and correct record.

|

1) Background

Local

Government Act 2002 Schedule 7 clause 28 states that a local authority must

keep minutes of its proceedings. The minutes of these proceedings duly

entered and authenticated as prescribed by a local authority are prima facie

evidence of those meetings.

2) Discussion and Options

The minutes of the meeting are attached. Far North District

Council Standing Orders Section 27.3 states that no discussion shall arise on

the substance of the minutes in any succeeding meeting, except as to their

correctness.

Reason

for the recommendation

The reason for the recommendation is to confirm the minutes

are a true and correct record of the previous meeting

3) Financial Implications and Budgetary

Provision

There are no financial

implications or the need for budgetary provision as a result of this report.

Attachments

1. Unconfirmed

Minutes - Audit, Risk, and Finance Committee 29 November 2018 - A2283847 ⇩

Compliance schedule:

Full consideration has been given to the provisions of the

Local Government Act 2002 S77 in relation to decision making, in particular:

1. A

Local authority must, in the course of the decision-making process,

a) Seek

to identify all reasonably practicable options for the achievement of the

objective of a decision; and

b) Assess

the options in terms of their advantages and disadvantages; and

c) If

any of the options identified under paragraph (a) involves a significant

decision in relation to land or a body of water, take into account the

relationship of Māori and their culture and traditions with their

ancestral land, water sites, waahi tapu, valued flora and fauna and other

taonga.

2. This

section is subject to Section 79 - Compliance with procedures in relation to

decisions.

|

Compliance

requirement

|

Staff

assessment

|

|

State the level of significance

(high or low) of the issue or proposal as determined by the Council’s

Significance and Engagement Policy

|

Not applicable

|

|

State the relevant Council

policies (external or internal), legislation, and/or community outcomes (as

stated in the LTP) that relate to this decision.

|

Not applicable

|

|

State whether this issue or

proposal has a District wide relevance and, if not, the ways in which the

appropriate Community Board’s views have been sought.

|

Not applicable

|

|

State the possible implications for Māori

and how Māori have been provided with an opportunity to contribute to

decision making if this decision is significant and relates to land and/or

any body of water.

|

None

|

|

Identify persons likely to be

affected by or have an interest in the matter, and how you have given

consideration to their views or preferences.

|

Not applicable

|

|

State the financial implications

and where budgetary provisions have been made to support this decision.

|

There are no financial

implications or the need for budgetary provision arising from this report.

|

|

Chief Financial Officer review.

|

The Chief Financial Officer has

not reviewed this report.

|

|

Audit, Risk, and Finance Committee Meeting Agenda

|

28 March 2019

|

MINUTES OF Far North District Council

Audit, Risk, and

Finance Committee Meeting

HELD AT THE Council

Chamber, Memorial Avenue, Kaikohe

ON Thursday, 29

November 2018 AT 10:00 am

PRESENT: Cr

John Vujcich, Mayor John Carter (HWTM), Cr Tania McInnes (Deputy Mayor), Cr Ann

Court, Cr Colin (Toss) Kitchen, Cr Sally Macauley, Cr Kelly Stratford, Member Bruce

Robertson, Member Adele Gardner, Member Mike Edmonds, Member Terry Greening

APOLOGIES: Cr

Felicity Foy

IN

ATTENDANCE: Shaun Reilly – Kaikohe-Hokianga Community Board Member

STAFF

PRESENT: Shaun Clarke - Chief Executive Officer, Samantha

Edmonds - General Manager

Corporate Services, Andy Finch - General Manager Infrastructure & Asset

Management, Darrell Sargent - General Manager Strategic Planning &

Policy, Jaime Dyhrberg - Executive Officer, Janice Smith - Chief Financial Officer,

George Swanepoel - In-House Counsel, Matt Bell - Manger Risk & Improvement,

Glenn Rainham - Manager Alliances, Tanya Reid - Business Improvement

Advisor, Leanna Ransom - Internal Auditor, Tanya Nowell - Team

Leader Infrastructure Programmes, Alastair Wiseman - Manager Health Safety

& Wellbeing

1 Apologies

and Declarations of Interest

|

Apology

|

|

Committee Resolution 2018/7

Moved: Cr Kelly

Stratford

Seconded: Cr Ann

Court

That the apology received from Cr Foy be accepted and

leave of absence granted.

Carried

|

3 Corporate

Services Group

|

3.1 Confirmation

of Previous Minutes

|

|

Committee Resolution 2018/8

Moved: Member Adele

Gardner

Seconded: Member

Terry Greening

That the Audit, Risk, and Finance Committee confirm

that the minutes of the meeting of the Committee held 27 September 2018 are a

true and correct record.

Carried

|

3.2A Deputation

Matthew Wilson from Aon New Zealand (Insurance Company)

Deputy Mayor

McInnes left the meeting at 10:25 am and rejoined the meeting at 10:57 am.

Mayor Carter

left the meeting at 10:30 am and rejoined the meeting at 10:31 am

Councillor

Kitchen left the meeting at 10:37 am and rejoined the meeting at 10:39 am

|

3.2 Insurance

renewal considerations

|

|

Committee Resolution 2018/9

Moved: Cr Kelly

Stratford

Seconded: Member

Bruce Robertson

That the Audit, Risk, and Finance Committee

a) approve

the additional funding required in future years to provide for public

liability and professional indemnity insurance quoted by Aon Insurance of

$115,000

CARRIED

b) approve

the additional funding required in 2019/20 and 2022/23 for the Riskpool

additional calls of approximately $104,000 in each year

CARRIED

c) consider

the requirement for insurance cover for underground assets based on the

possible loss information provided and if necessary, approve an additional

$65,000 in the budget from 2019/20 onwards

Amendment

Moved: Member Bruce

Robertson

Seconded: Mayor

John Carter

c) Confirms that Council do not

insure underground assets, for 2019/20, but consider the impacts

on the financial strategy with respect to self-funding and asset management.

Carried

Councillor Stratford requested a vote by division

|

For

|

Against

|

|

Mayor Carter

|

Cr Stratford

|

|

Cr Macauley

|

Member Greening

|

|

Member Robertson

|

Member Gardner

|

|

Cr Court

|

Member Edmonds

|

|

Cr Kitchen

|

|

|

Deputy Mayor McInnes

|

|

|

Cr Vujcich

|

|

The amendment became the

substantive motion

That the Audit, Risk, and Finance Committee

a) approve

the additional funding required in future years to provide for public

liability and professional indemnity insurance quoted by Aon Insurance of

$115,000

b) approve

the additional funding required in 2019/20 and 2022/23 for the Riskpool

additional calls of approximately $104,000 in each year

c) Confirms

that Council do not insure underground assets, for 2019/20, but consider the

impacts on the financial strategy with respect to self-funding and asset

management.

Carried

Councillor Stratford abstained from voting

|

|

3.3 Council

Financial Report October 2018

|

|

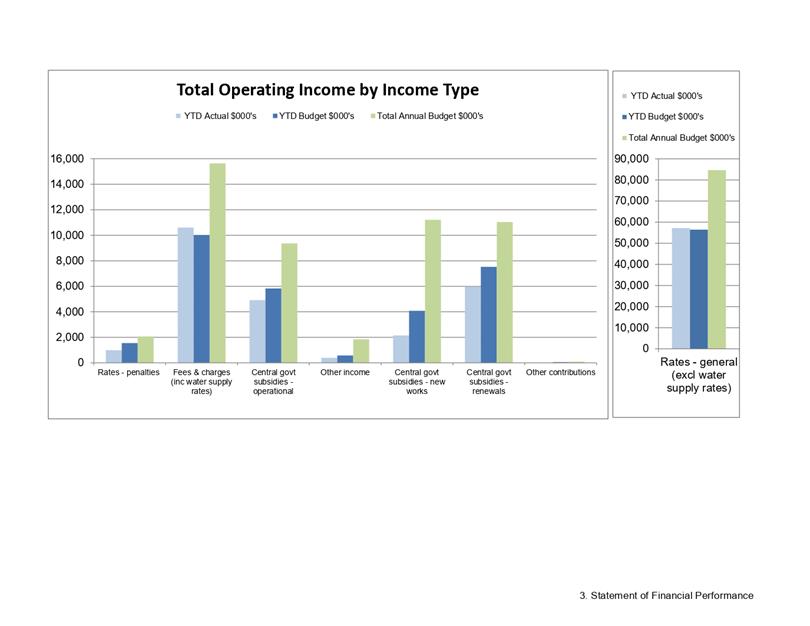

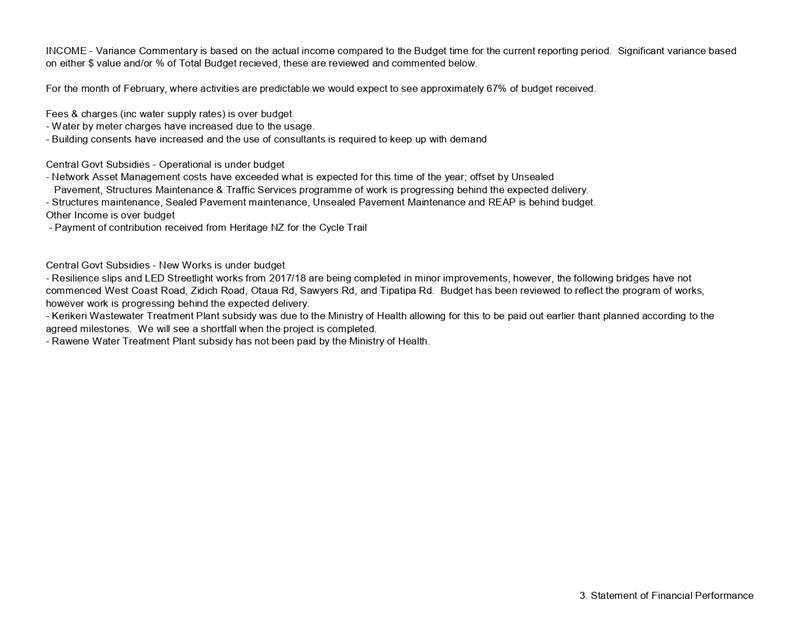

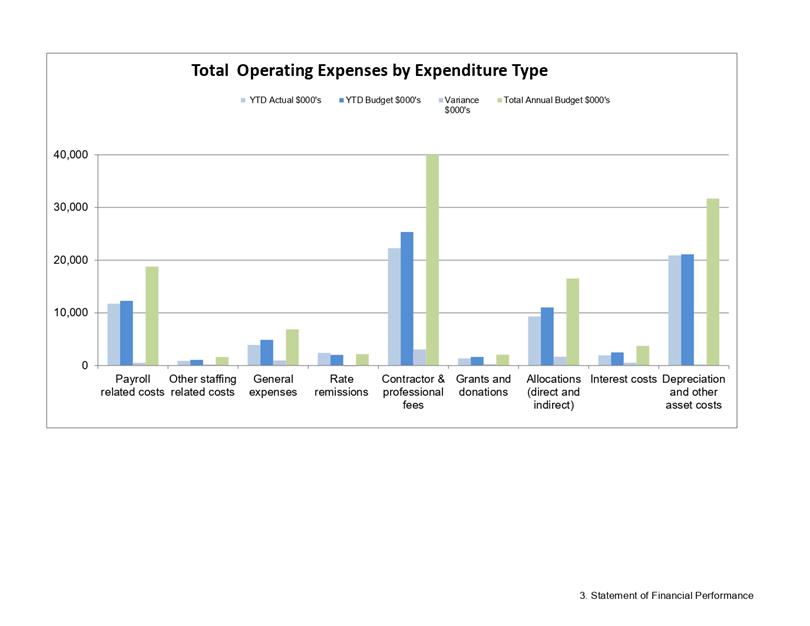

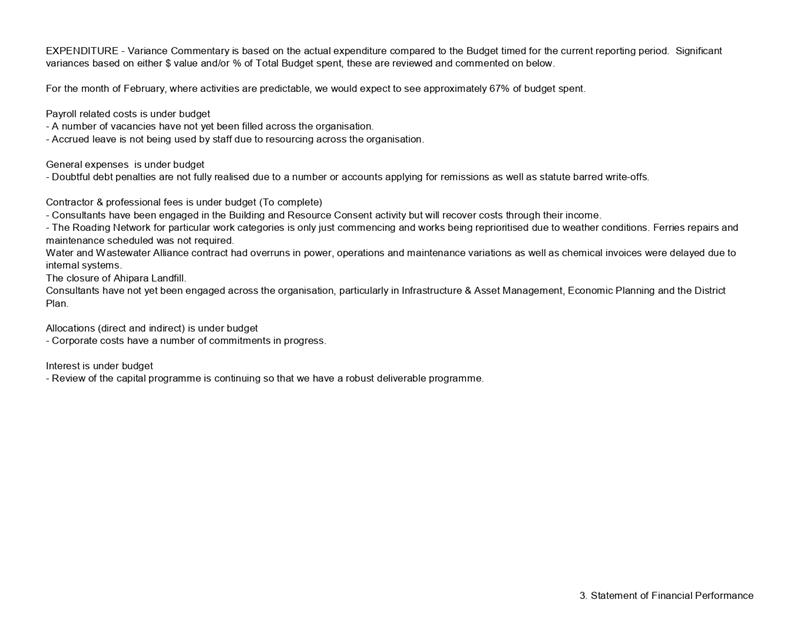

Committee Resolution 2018/10

Moved: Cr Ann Court

Seconded: Member

Adele Gardner

That the Audit, Risk, and Finance Committee receive the

report entitled “Council Financial Report 31 October 2018”

Carried

|

4 Information

Reports

|

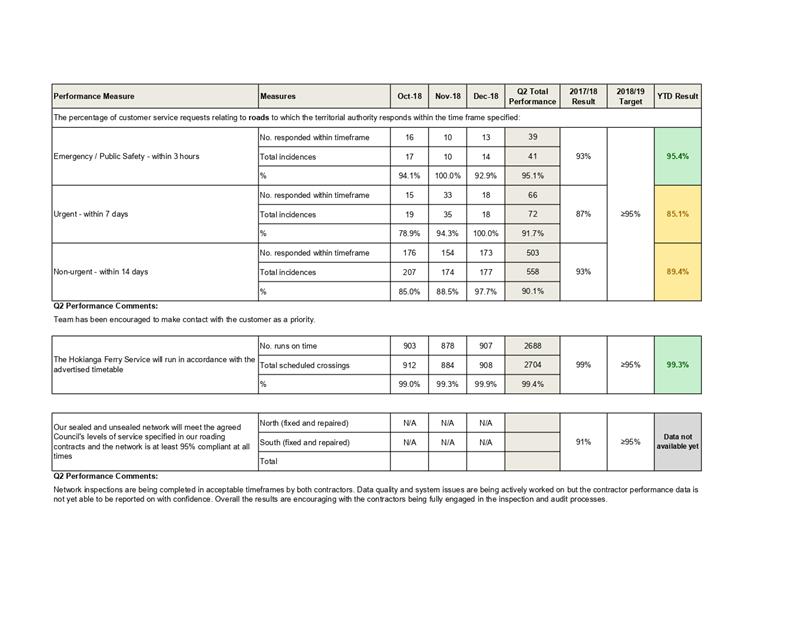

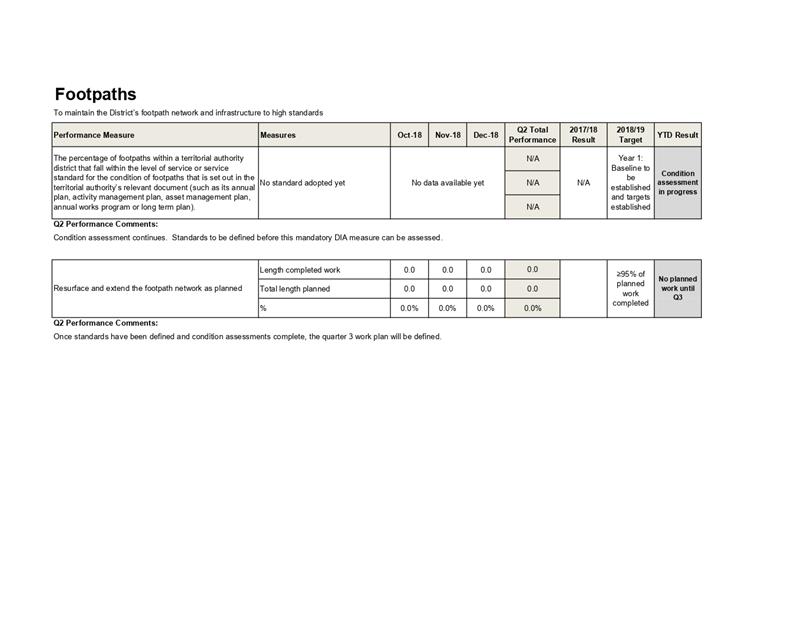

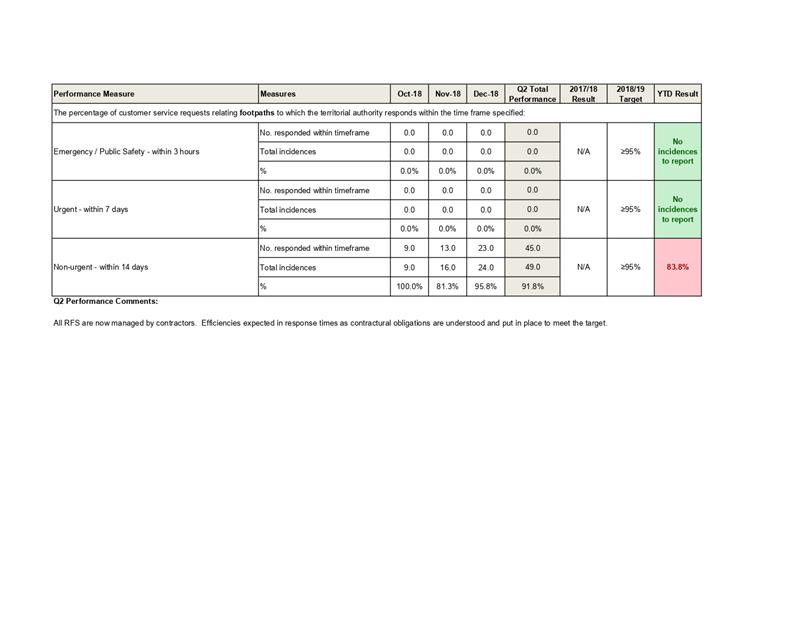

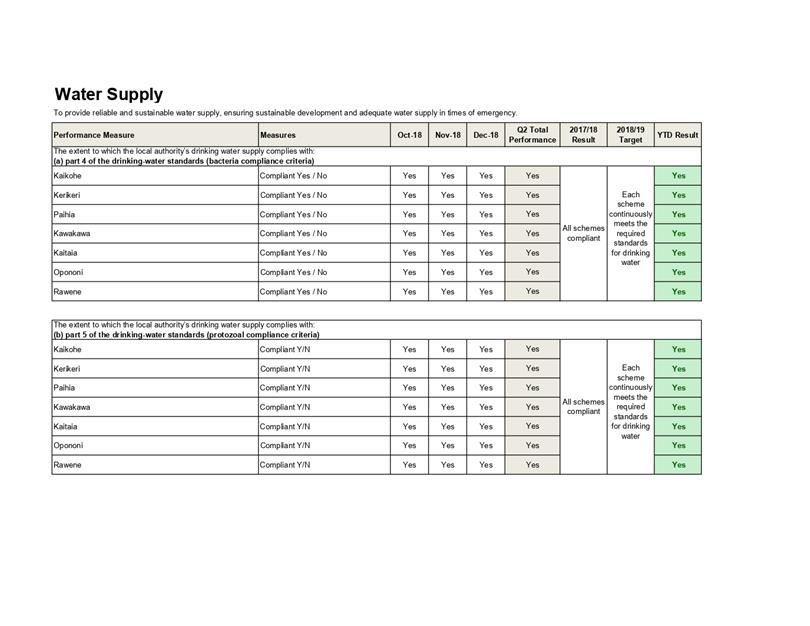

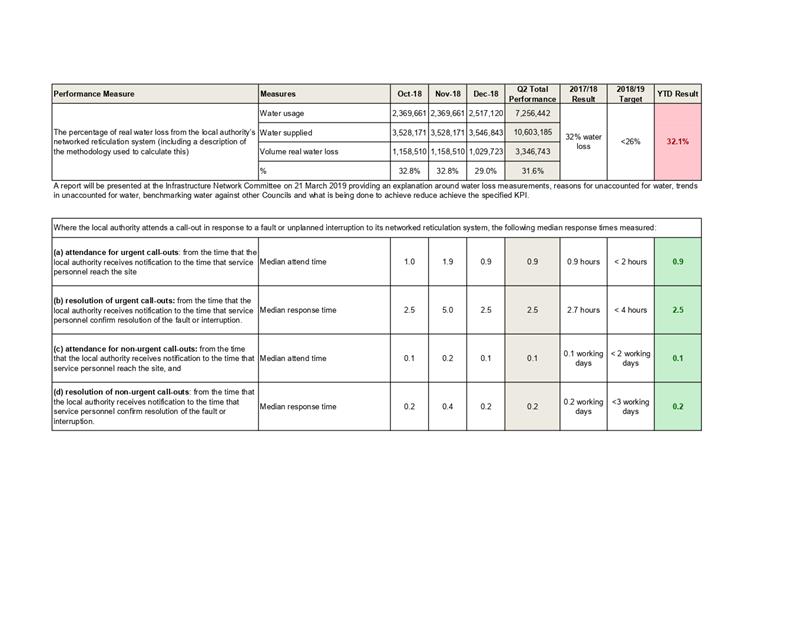

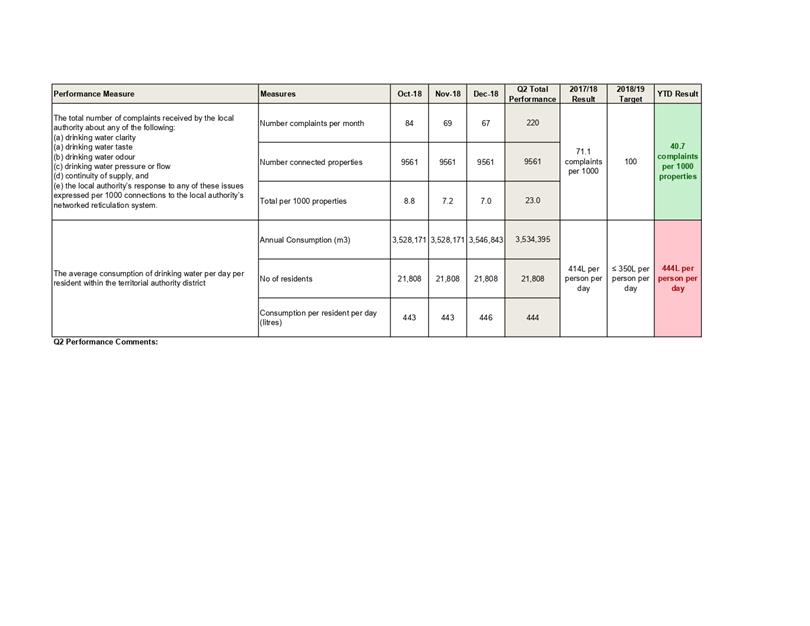

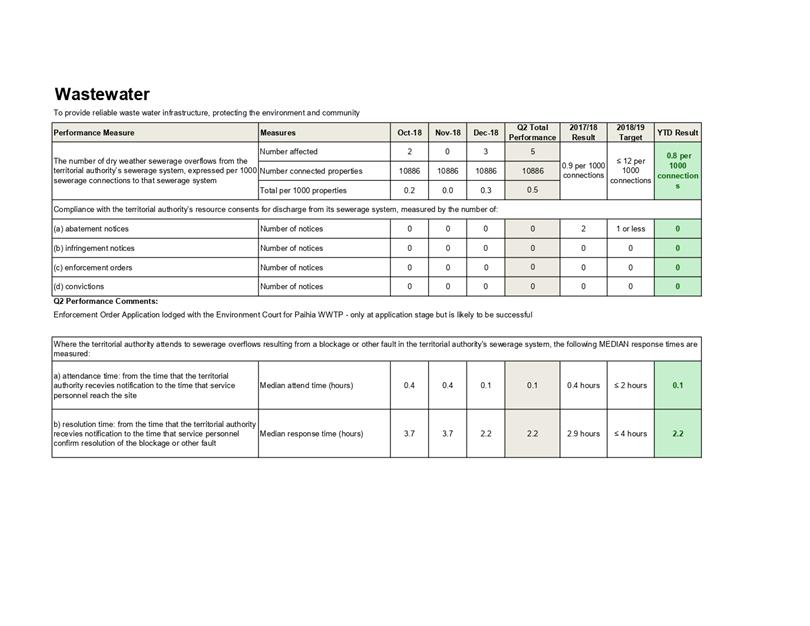

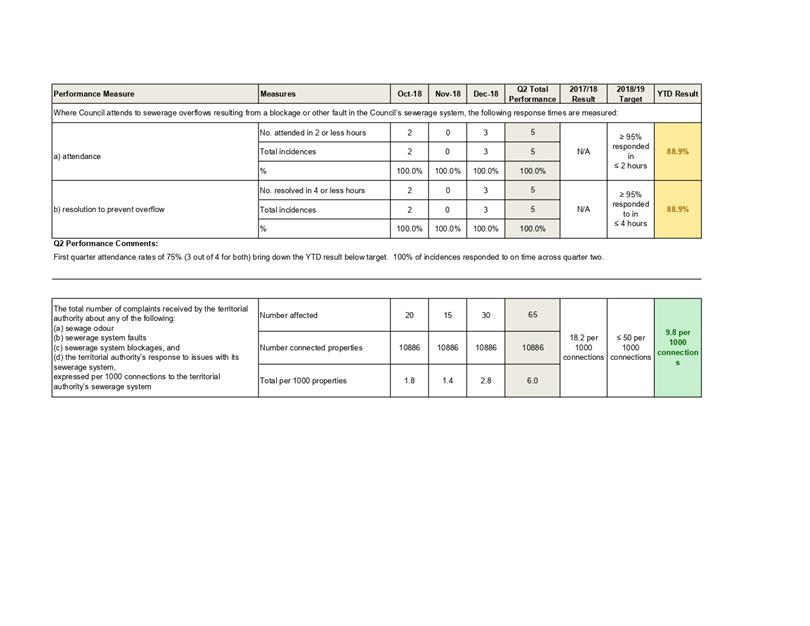

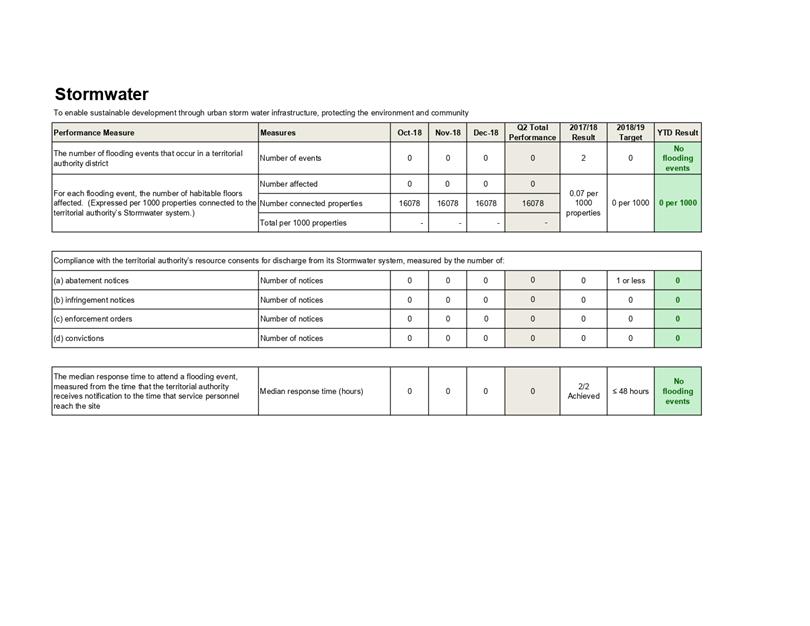

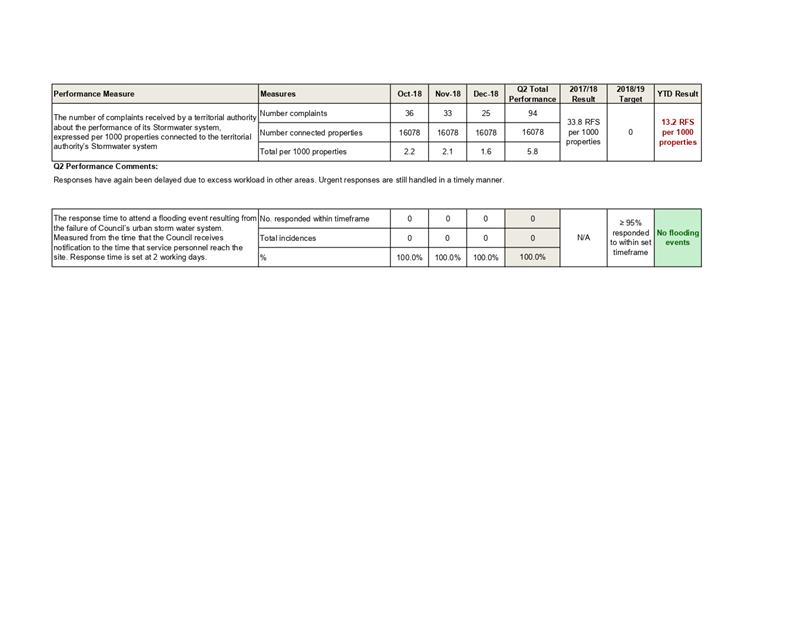

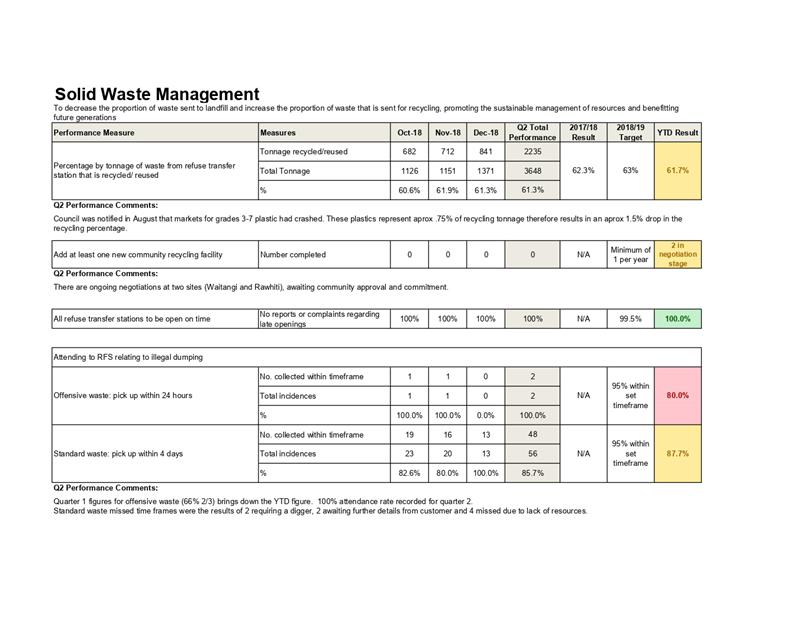

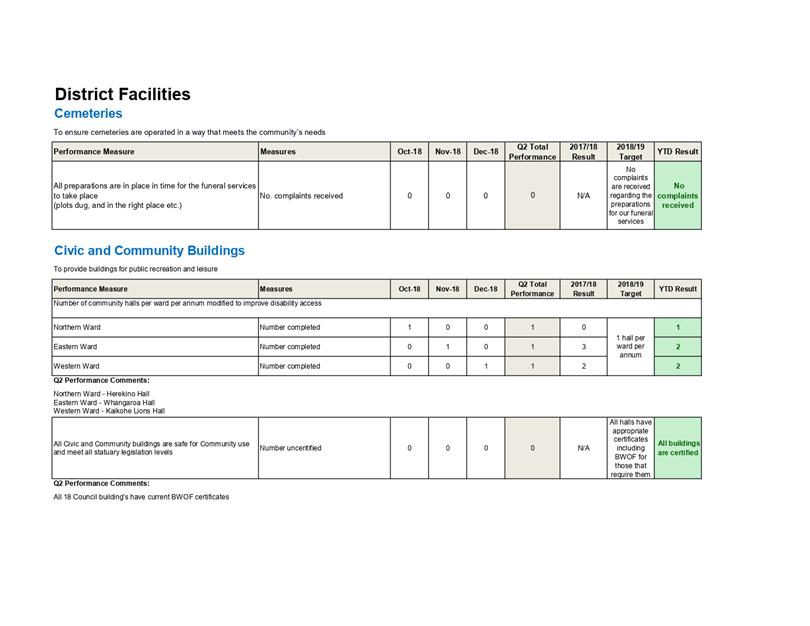

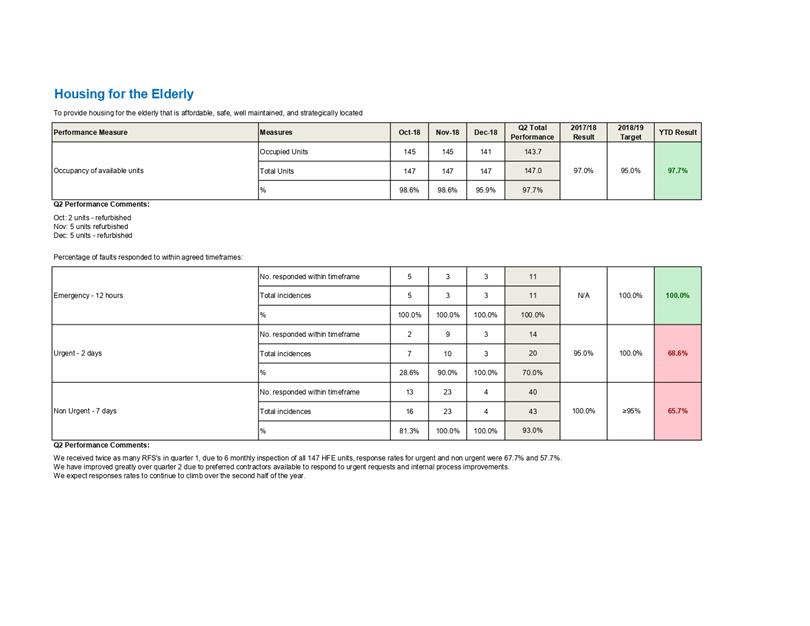

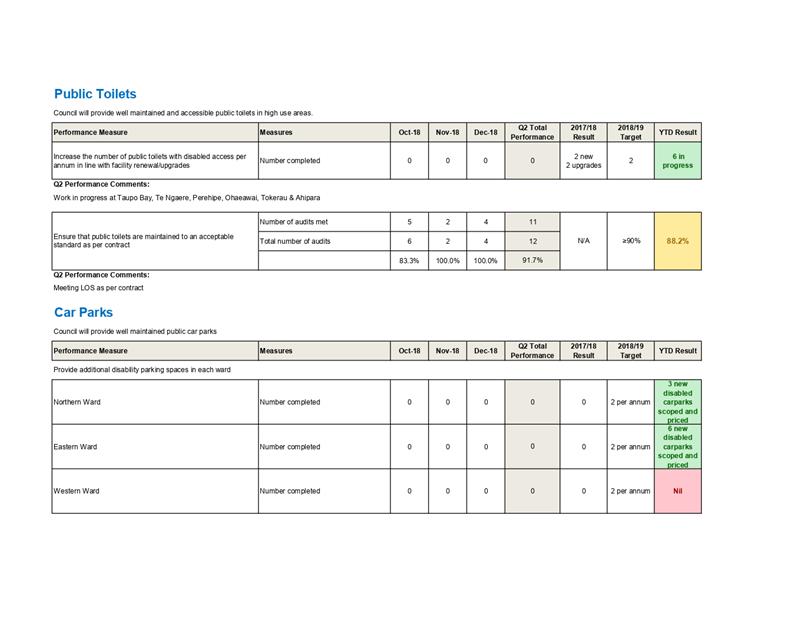

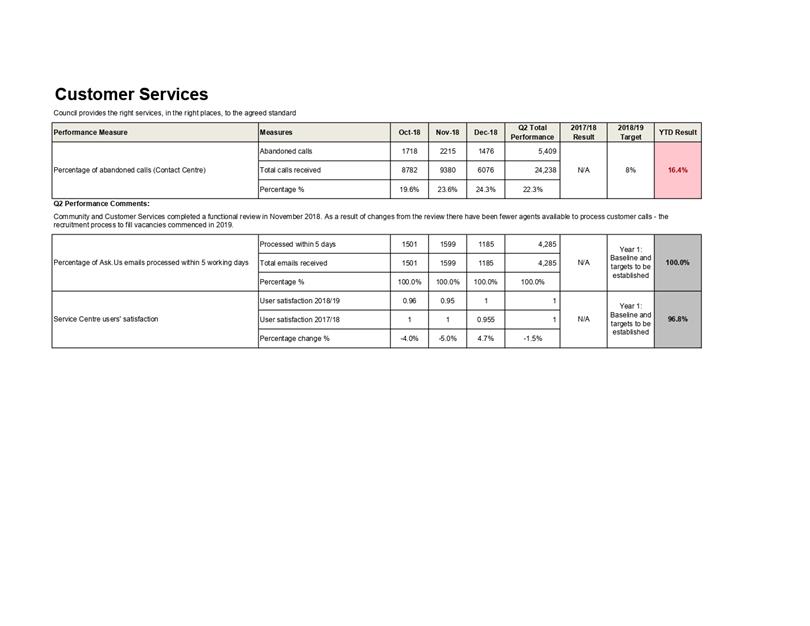

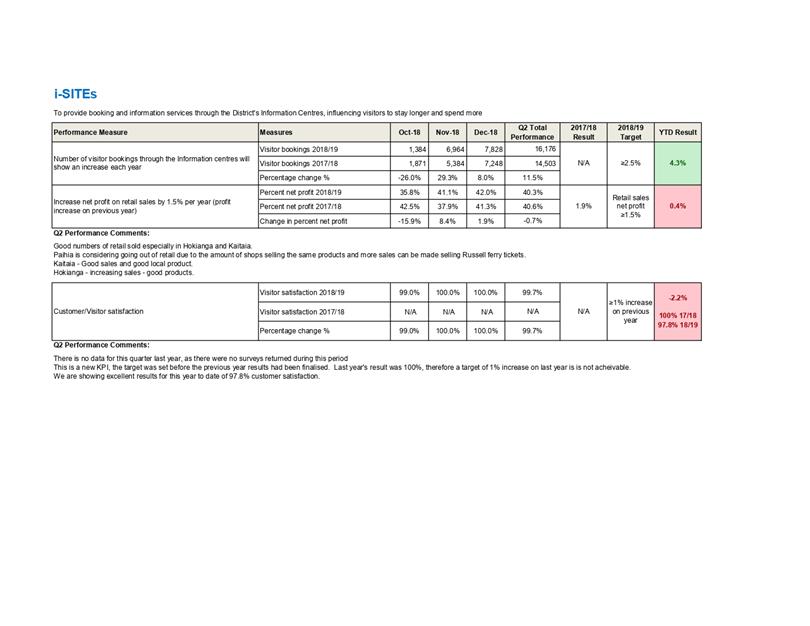

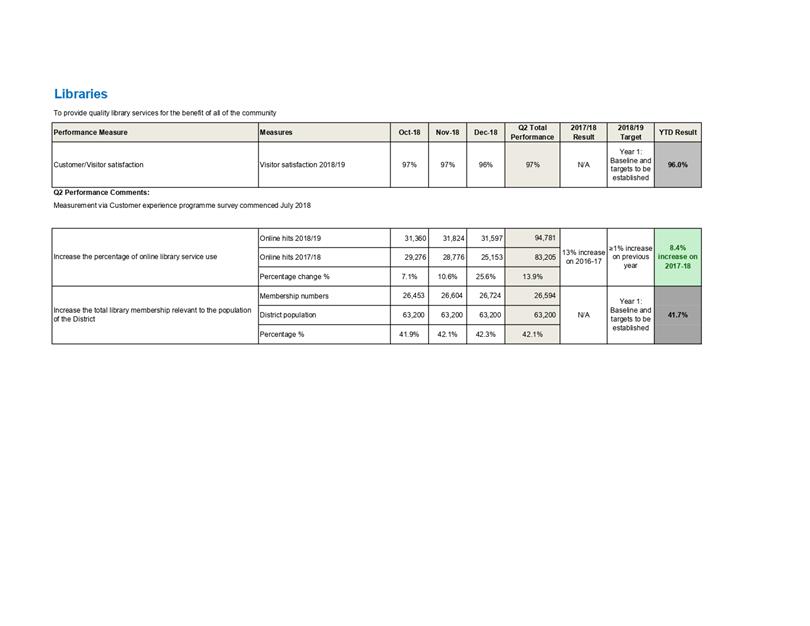

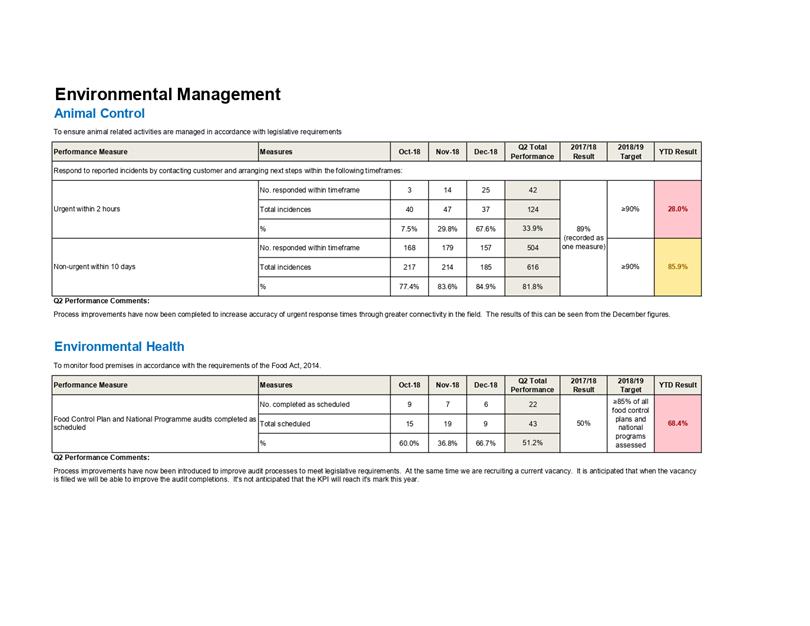

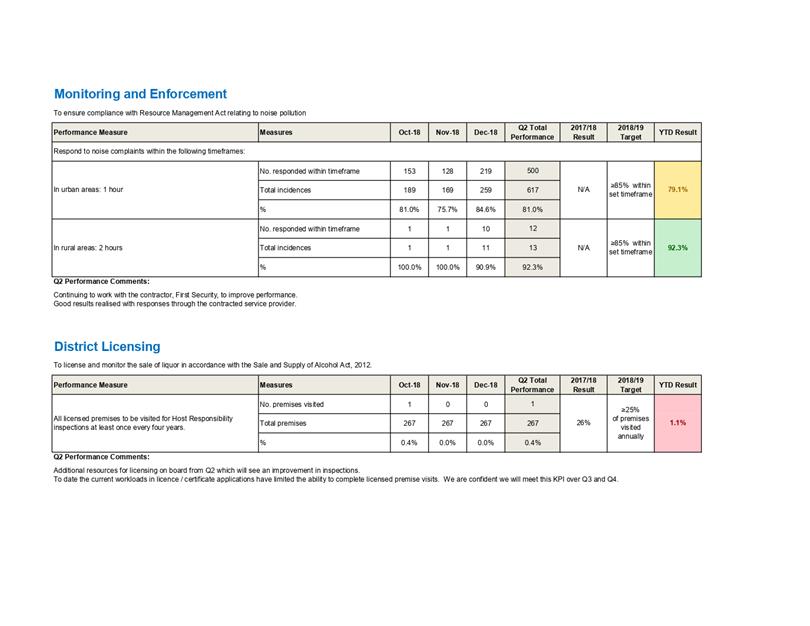

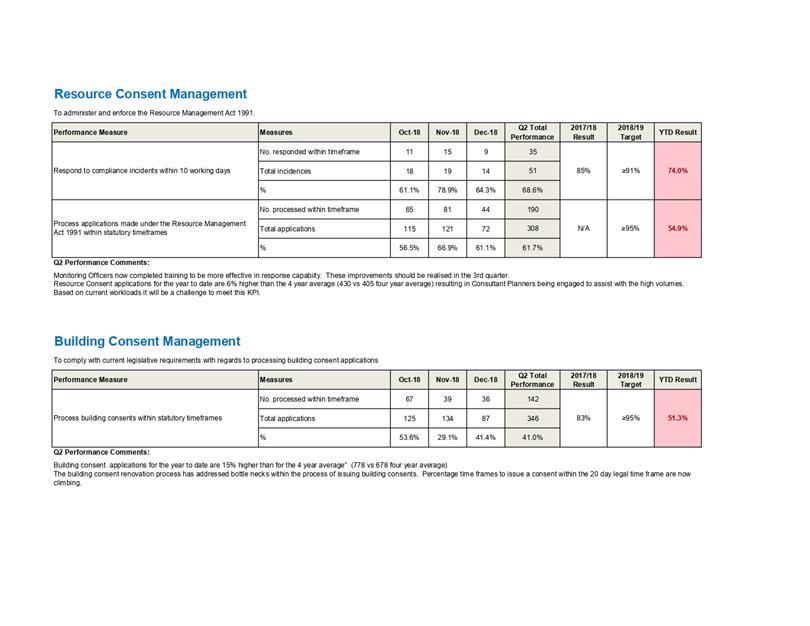

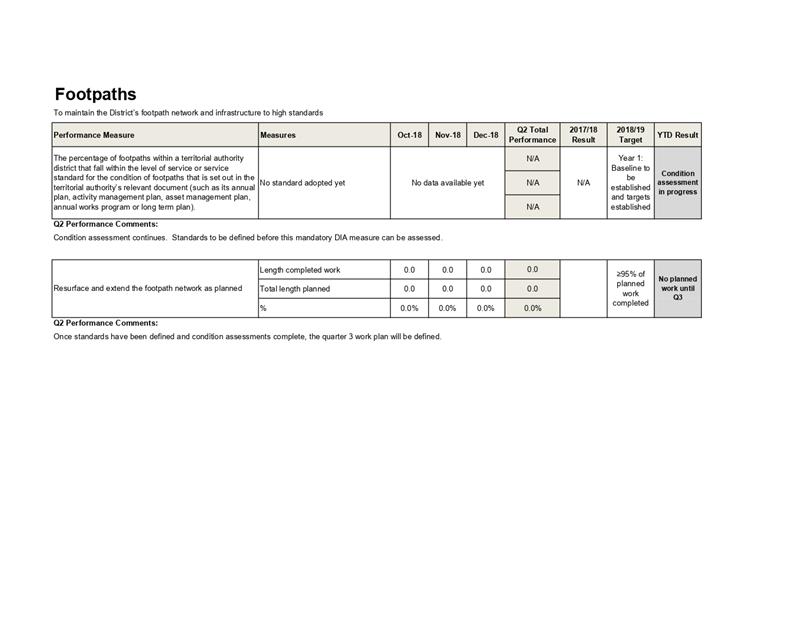

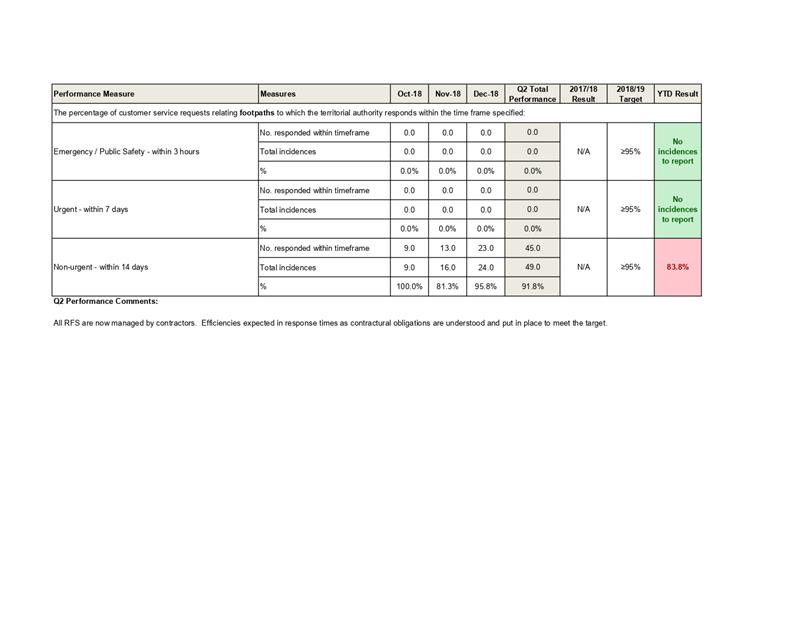

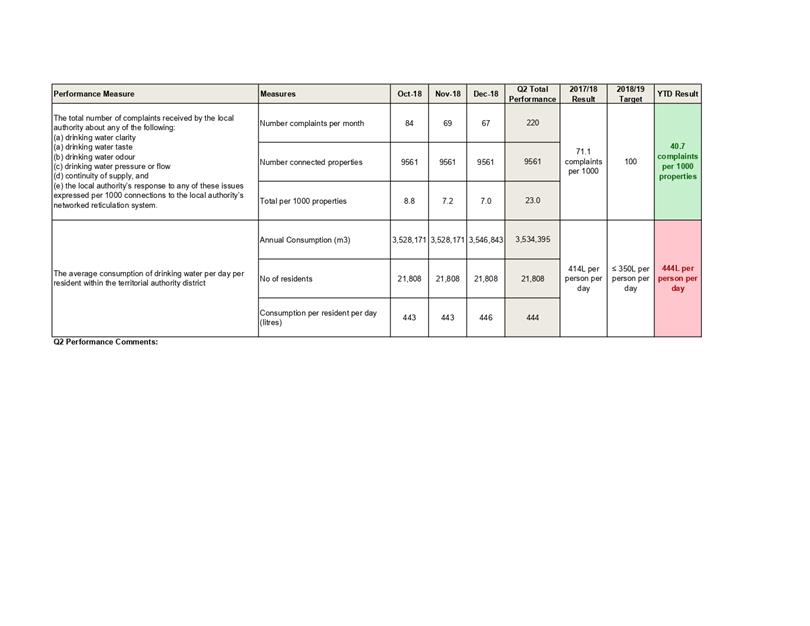

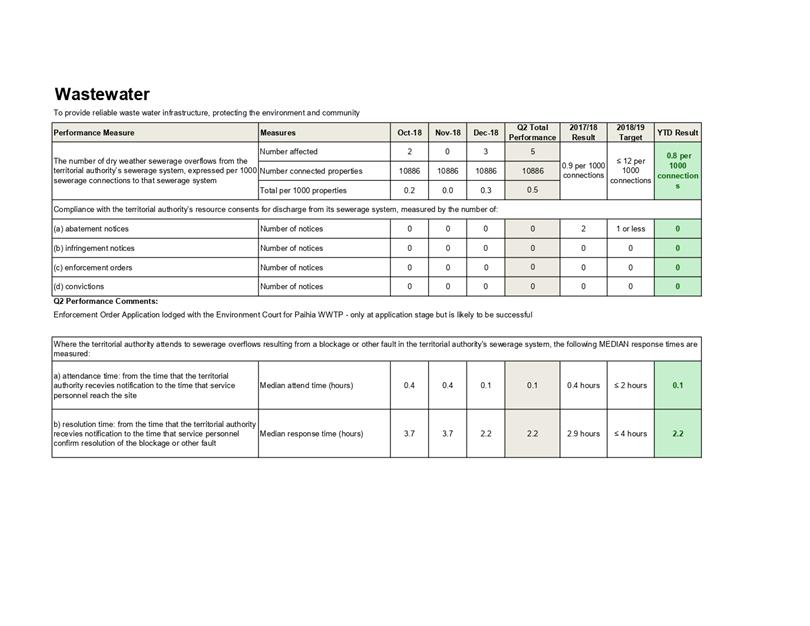

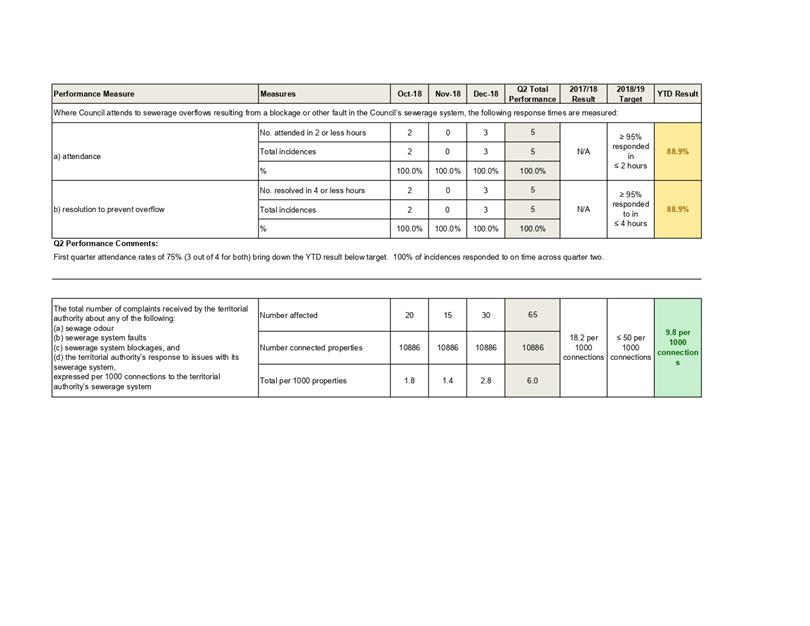

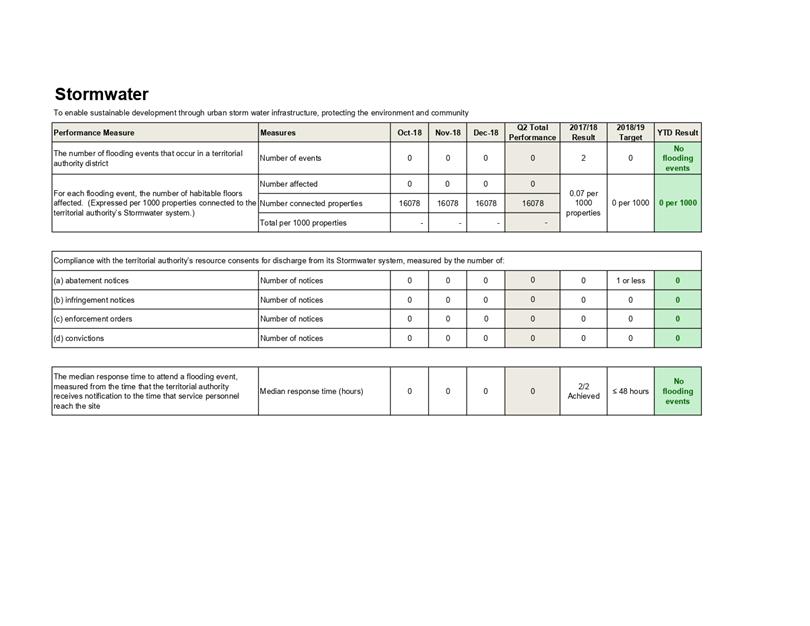

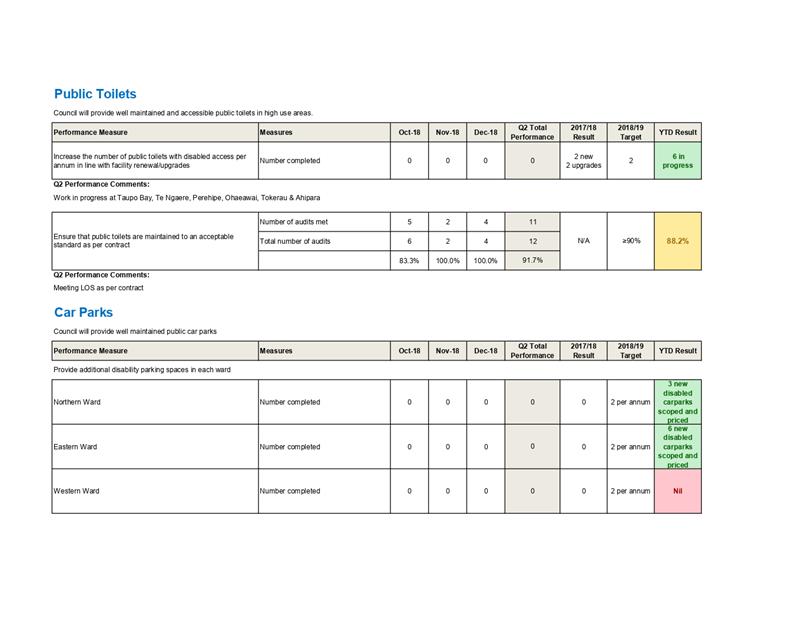

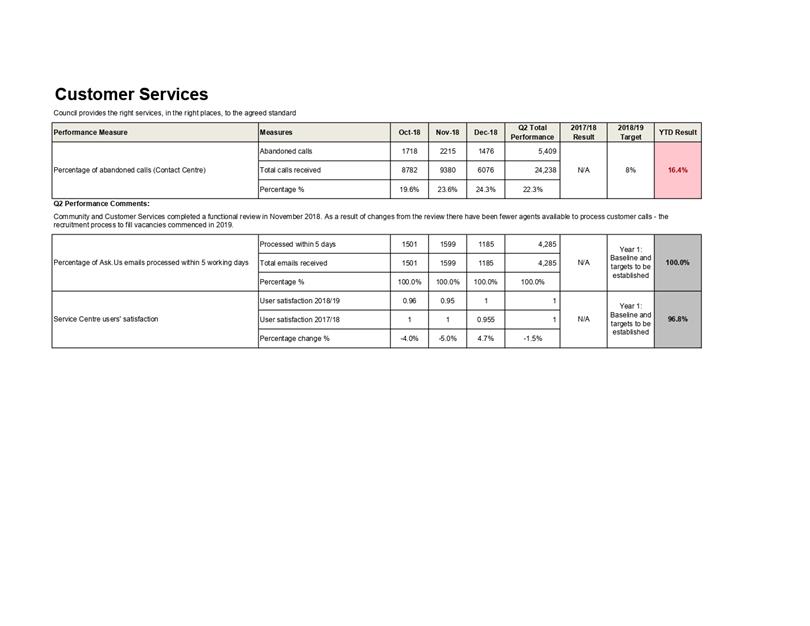

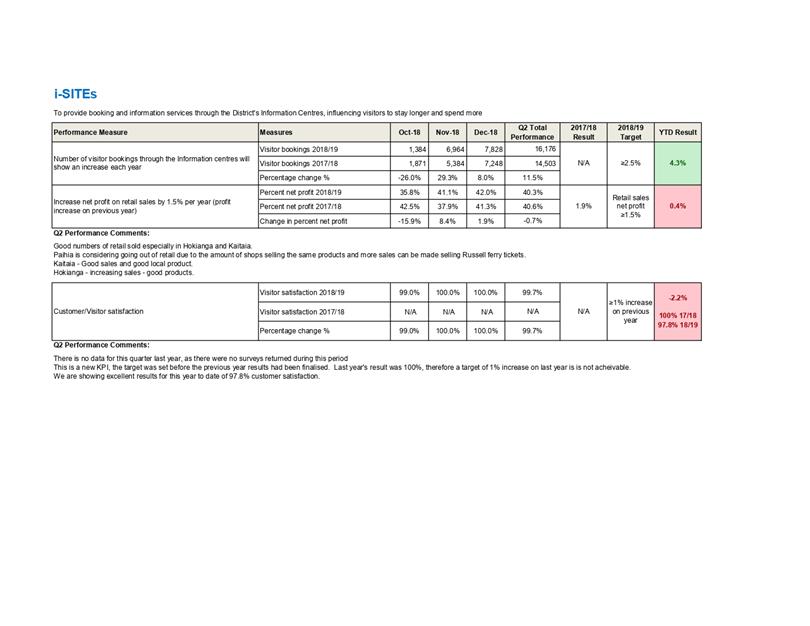

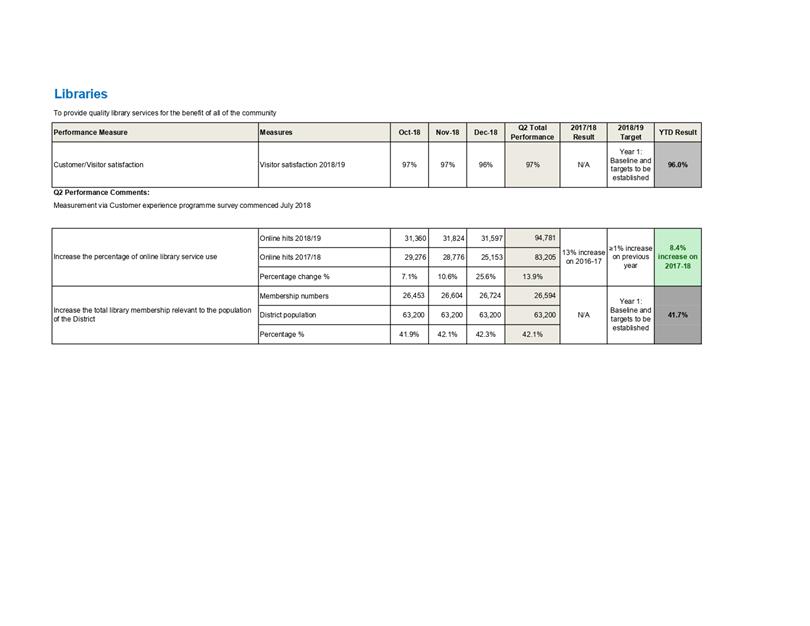

4.1 Level

of Service KPI Performance Report - Quarter 1

|

|

Committee Resolution 2018/11

Moved: Cr Colin (Toss)

Kitchen

Seconded: Mayor

John Carter

That the Audit, Risk, and Finance Committee receive the

report ”Level of Service KPI Performance Report - Quarter 1.”

Carried

|

5 Public

Excluded

RESOLUTION TO

EXCLUDE THE PUBLIC

|

Committee Resolution 2018/12

Moved: Cr Tania McInnes

Seconded: Cr

Kelly Stratford

That the public be excluded from the following parts of

the proceedings of this meeting.

The general subject matter of each matter to be considered

while the public is excluded, the reason for passing this resolution in

relation to each matter, and the specific grounds under section 48 of the

Local Government Official Information and Meetings Act 1987 for the passing

of this resolution are as follows:

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to

each matter

|

Ground(s) under section 48 for the passing of this

resolution

|

|

5.1 - Confirmation of Previous Minutes

(Public Excluded)

|

s7(2)(b)(ii) - the withholding of the information

is necessary to protect information where the making available of the

information would be likely unreasonably to prejudice the commercial

position of the person who supplied or who is the subject of the

information

s7(2)(c)(i) - the withholding of the information

is necessary to protect information which is subject to an obligation of

confidence or which any person has been or could be compelled to provide

under the authority of any enactment, where the making available of the

information would be likely to prejudice the supply of similar information,

or information from the same source, and it is in the public interest that

such information should continue to be supplied

s7(2)(g) - the withholding of the information is necessary

to maintain legal professional privilege

s7(2)(h) - the withholding of the information is

necessary to enable Council to carry out, without prejudice or

disadvantage, commercial activities

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

5.2 - Internal Audit Update - November

|

s7(2)(b)(ii) - the withholding of the information

is necessary to protect information where the making available of the

information would be likely unreasonably to prejudice the commercial

position of the person who supplied or who is the subject of the

information

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

5.3 - FNDC Current Legal Action

Potential Liability Claims

|

s7(2)(g) - the withholding of the information is

necessary to maintain legal professional privilege

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

Carried

|

|

6 CONFIRMATION OF INFORMATION AND DECISIONS IN

OPEN MEETING

|

|

Committee Resolution 2018/13

Moved: Cr Tania McInnes

Seconded: Cr

Kelly Stratford

That the Audit, Risk, and Finance Committee confirms

that the information and decisions contained in the part of the meeting held

with the public excluded are not to be restated in public meeting.

Carried

|

6 Meeting

Close

The Meeting closed at 11:56 am.

The minutes of this meeting will be confirmed at the Audit, Risk, and Finance Committee Meeting held on 28 March 2019

...................................................

CHAIRPERSON

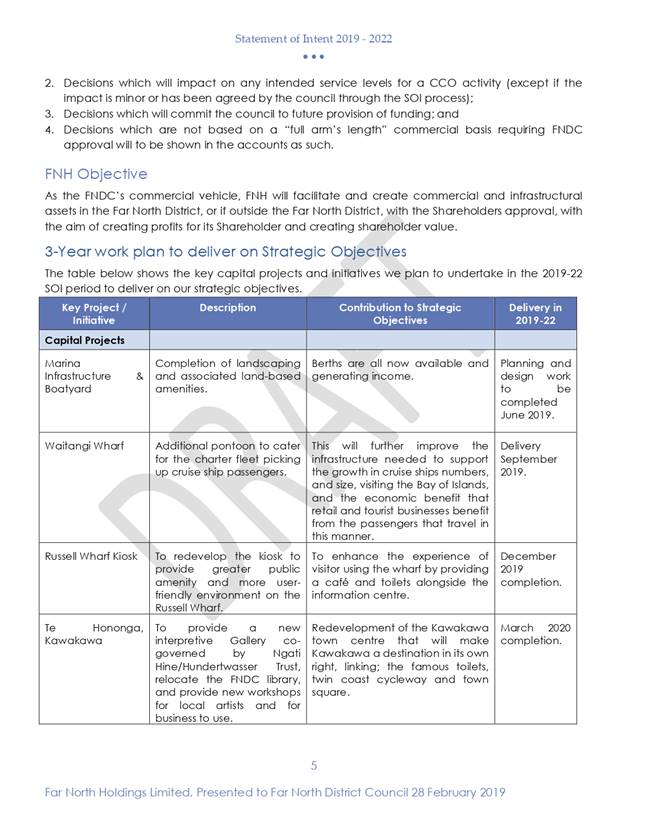

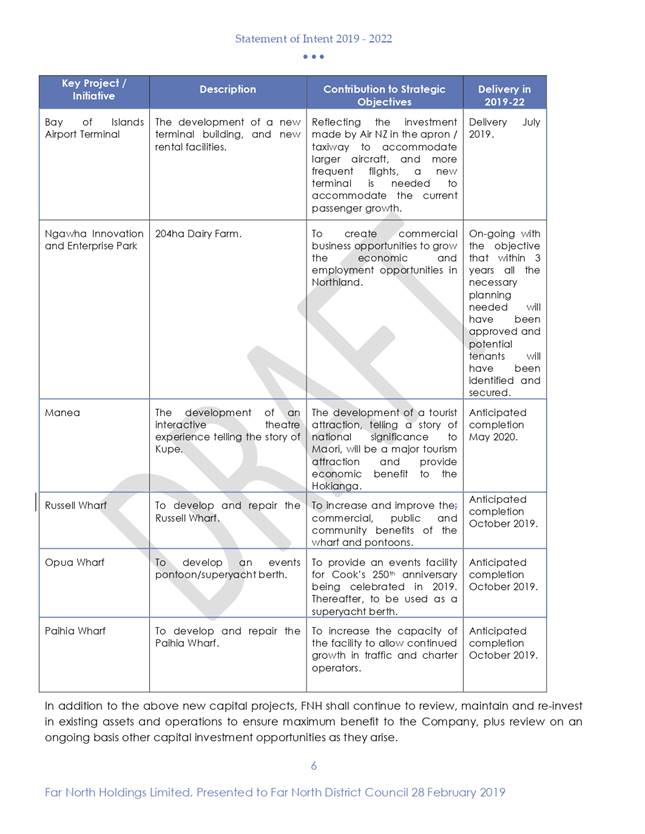

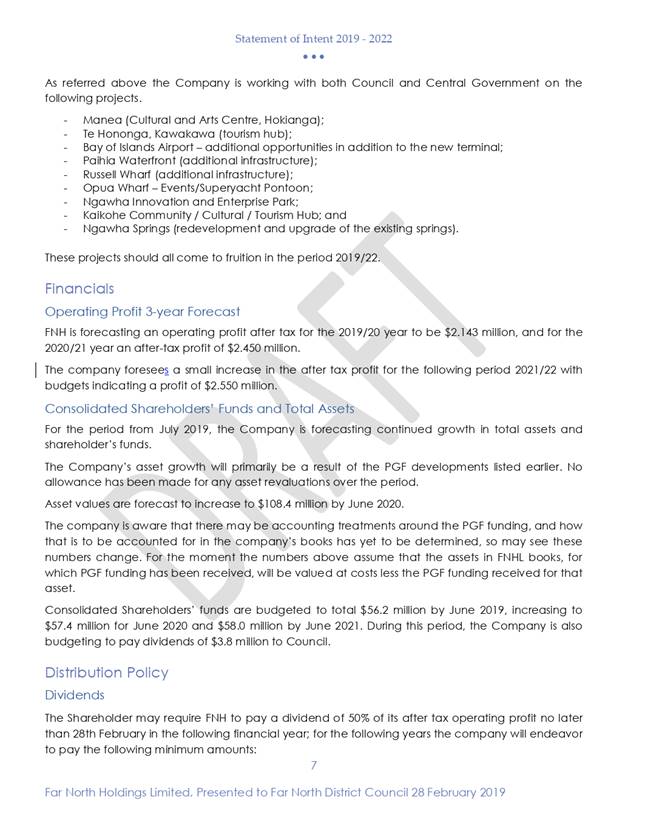

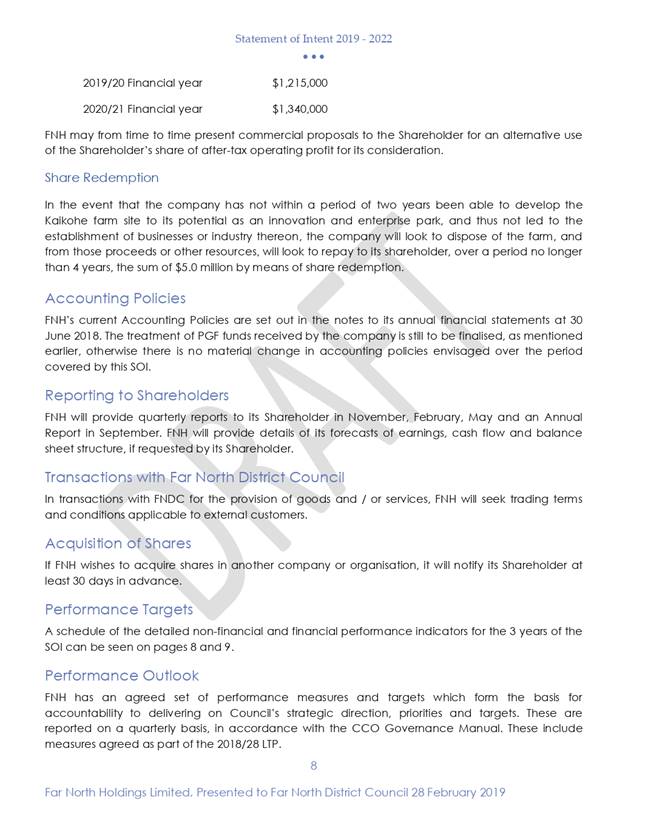

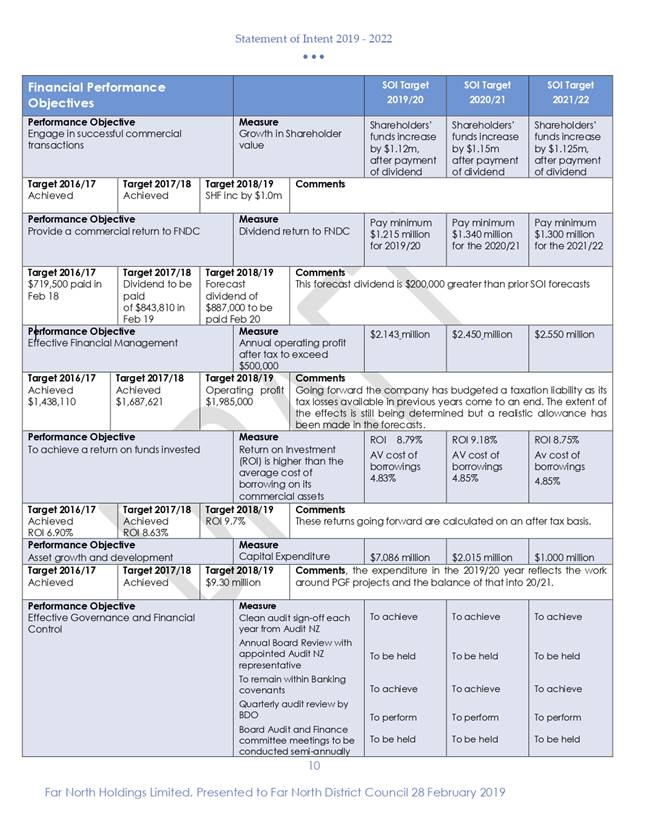

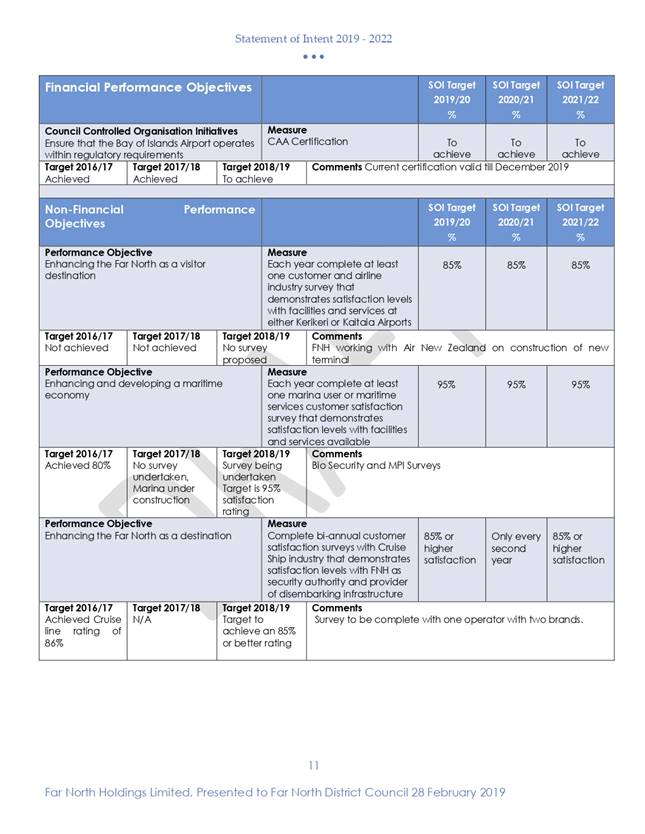

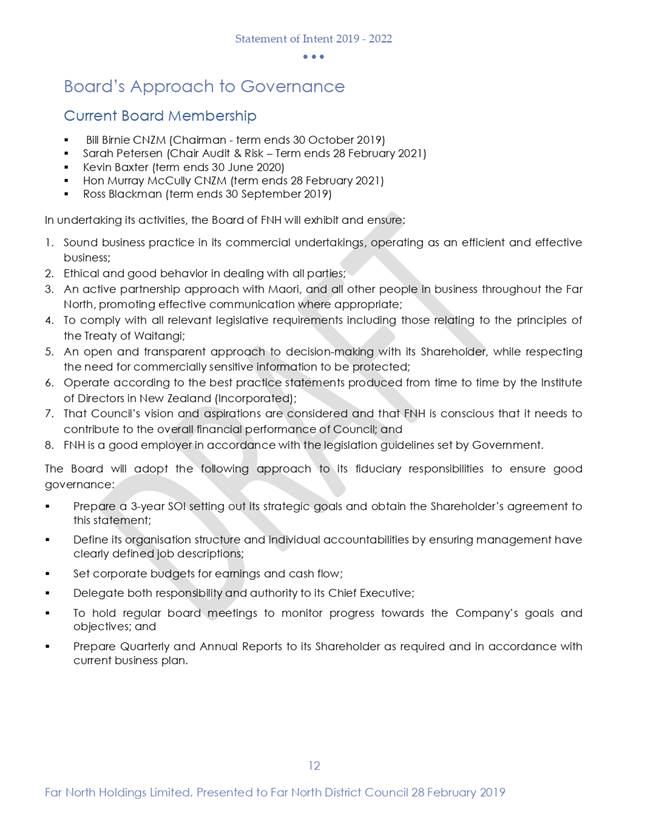

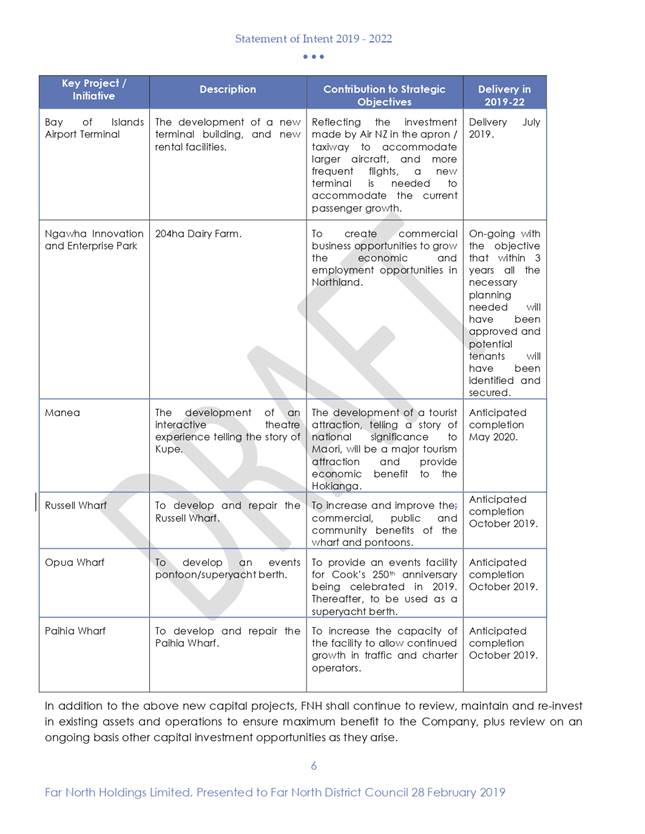

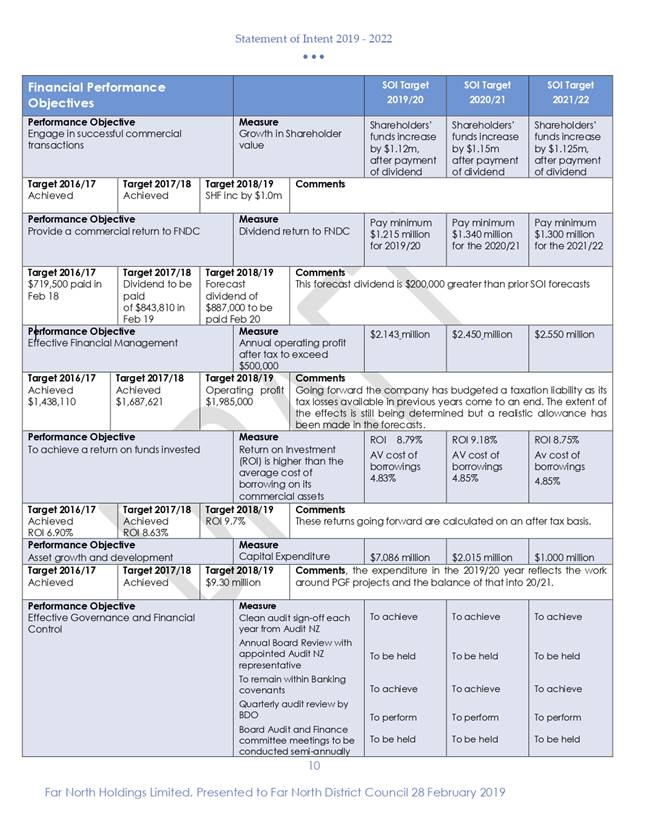

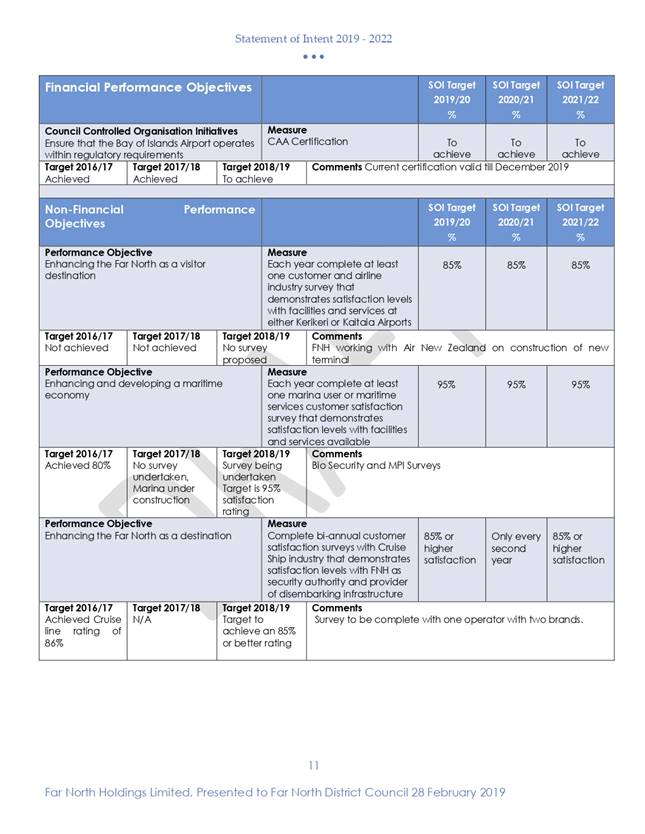

4 Strategic

Planning and Policy Group

4.1 Draft

Far North Holdings Limited Statement of Intent 2019-2022

File

Number: A2395737

Author: Sheryl

Gavin, General Manager Corporate Services (Acting)

Authoriser: Shaun

Clarke, Chief Executive Officer

Purpose of the Report

This

report presents the draft Statement of Intent of Far North Holdings Limited for

the three years from 1 July 2018 to 30 June 2021.

Executive Summary

· The Statement of Intent presented complies with the requirements of

the Local Government Act.

· This report was submitted via email to Shaun Clarke, Chief Executive

Officer, Sheryl Gavin, General Manager Corporate Services (Acting) and Janice

Smith, Chief Financial Officer on 28 February 2018.

|

Recommendation

That the Audit, Risk, and Finance Committee

recommend Council confirm the Far North Holdings Statement of Intent 2019-2022.

|

1) Background

The

requirements for the governance and accountability of council-controlled

organisations (CCO) and council organisations are set out in Part 5, Sections

55-74, of the Local Government Act 2002 (LGA) and Schedule 8, Clauses 1-10, of

the LGA sets out specific provisions regarding Statements of Intent (SOI).

The

purposes of a SOI are to:

a. Provide

transparency to the community about the proposed activities and intentions of

the CCO for the forthcoming year

b. Enable

Council, as the shareholder in the CCO to influence the direction of the

company

c. Create

a basis for accountability of the Directors of the CCO to Council as the

shareholder.

Section

64, LGA requires every CCO to have a SOI that complies with clauses 9 and 10 of

Schedule 8 of the LGA. These clauses outline the statutory content of a SOI.

The

statutory provisions of Schedule 8 require the Board to deliver to its

shareholders a draft SOI on or before 1 March each year then consider any

comments on the draft SOI made to it within 2 months of 1 March before

delivering the completed SOI on or before 30 June each year.

The

shareholder, Council, can either agree with the draft SOI or require the Board

to modify the SOI on any matter included in Clause 9 (1)( a) to (i). Modification

must be by way of resolution and the shareholder is first required to consult

the Board as to the matters to be modified.

The

effect of the timing provisions is that the shareholder, Council, has until 30

April to make any comments back to the company on changes it would like to see

made to the draft SOI. The CCO must then consider these comments and

submit its final SOI to the shareholder by 30 June.

Far North Holdings Limited (FNHL)

has met its statutory obligations by submitting a draft SOI by the statutory

deadline. A copy of the draft SOI is attached.

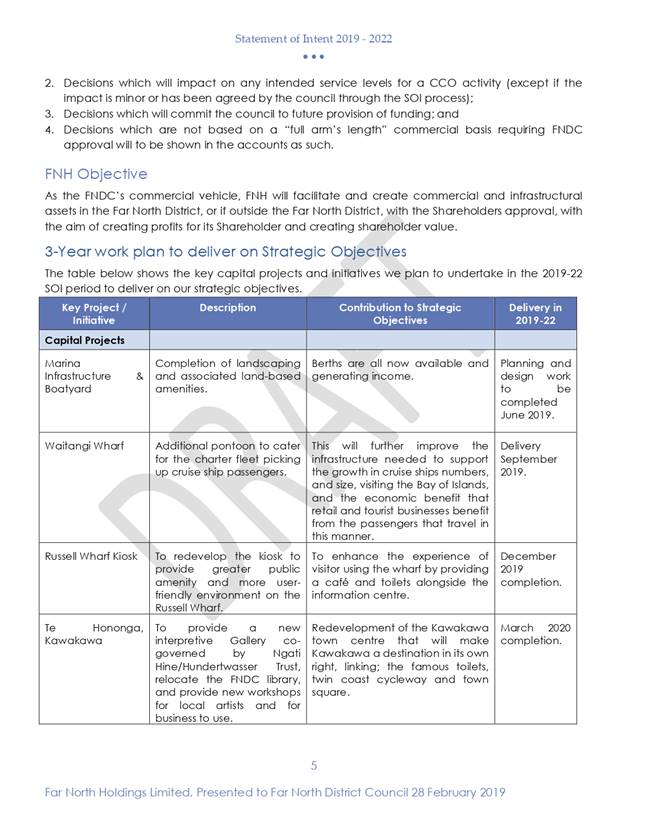

2) Discussion and Options

The draft

SOI contains information specified in Clause 9, Schedule 8, LGA. The SOI

is consistent with previous SOIs that have been submitted by FNHL.

Reason

for the recommendation

The receipt of the draft Statement

of Intent from the Council CCTO, Far North Holdings Limited, is part of the

compliance requirements of a statutory process. The reason for the

recommendation is to confirm the draft SOI and recommend the report be received

by Council at a meeting prior to 30 June 2019.

3) Financial Implications and Budgetary

Provision

There are no financial implications or the need for

budgetary provision.

Attachments

1. DRAFT Statement

of Intent 2019 to 2022 - A2400587 ⇩

Compliance schedule:

Full consideration has been given to the provisions of the

Local Government Act 2002 S77 in relation to decision making, in particular:

1. A

Local authority must, in the course of the decision-making process,

a) Seek

to identify all reasonably practicable options for the achievement of the

objective of a decision; and

b) Assess

the options in terms of their advantages and disadvantages; and

c) If

any of the options identified under paragraph (a) involves a significant

decision in relation to land or a body of water, take into account the

relationship of Māori and their culture and traditions with their

ancestral land, water sites, waahi tapu, valued flora and fauna and other

taonga.

2. This

section is subject to Section 79 - Compliance with procedures in relation to

decisions.

|

Compliance

requirement

|

Staff

assessment

|

|

State the level of significance

(high or low) of the issue or proposal as determined by the Council’s

Significance and Engagement Policy

|

As this

is a report for Audit, Risk & Finance Committee to recommend to Council

and requires no decisions to be made by the Audit, Risk, and Finance

Committee it is deemed to have a low to medium level of significance.

|

|

State the relevant Council

policies (external or internal), legislation, and/or community outcomes (as

stated in the LTP) that relate to this decision.

|

Part 5, Sections 55-74, of the

Local Government Act 2002 (LGA)

Schedule 8, Clauses 1-10, of the

Local Government Act 2002 (LGA)

|

|

State whether this issue or

proposal has a District wide relevance and, if not, the ways in which the

appropriate Community Board’s views have been sought.

|

The matter has District wide

relevance.

|

|

State the possible implications for Māori

and how Māori have been provided with an opportunity to contribute to

decision making if this decision is significant and relates to land and/or

any body of water.

|

Considered in relation to

proposed performance objectives of FNHL.

|

|

Identify persons likely to be

affected by or have an interest in the matter, and how you have given

consideration to their views or preferences.

|

Not applicable.

|

|

State the financial implications

and where budgetary provisions have been made to support this decision.

|

There are no financial

implications or the need for budgetary provision arising from this report.

|

|

Chief Financial Officer review.

|

The Chief Financial Officer has

reviewed this report

|

|

Audit, Risk, and Finance Committee Meeting Agenda

|

28 March 2019

|

5 Corporate

Services Group

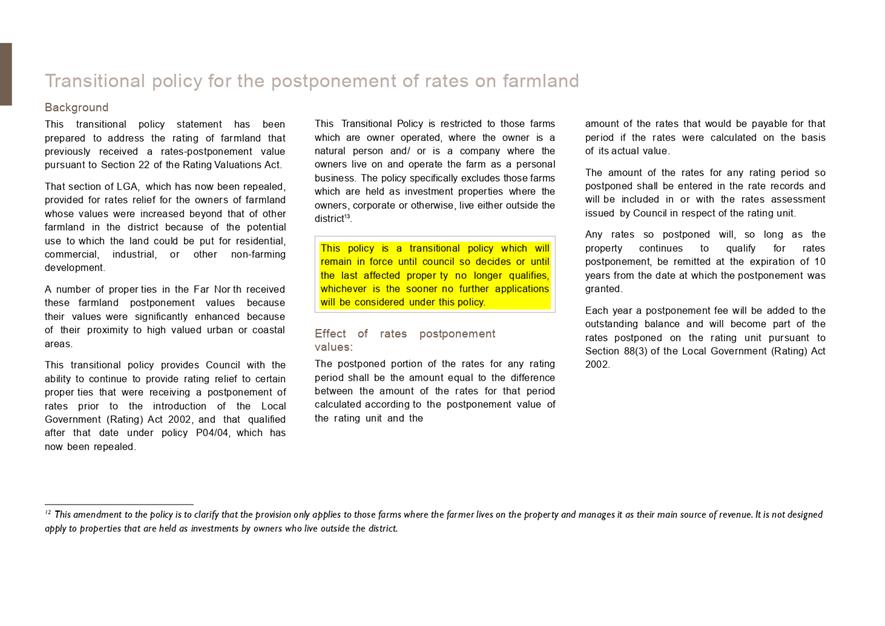

5.1 Amendments

to Rating Relief Policies

File

Number: A2386461

Author: Janice

Smith, Chief Financial Officer

Authoriser: Sheryl

Gavin, General Manager Corporate Services (Acting)

Purpose of the Report

To seek a recommendation to amend the rating relief polices

adopted as part of the 2018/28 LTP process where issues around interpretation

and application have been identified.

Executive Summary

· The document Rating Relief Policies was adopted by Council in June

2018 as part of the 2018/28 LTP process.

· Staff have been working with the revised polices and have identified

some minor issues that need to be amended to allow the policies to be applied

as intended.

· Once the amendments have been approved it will be necessary to

conduct a short consultation with the public.

|

Recommendation

That the Audit, Risk, and Finance Committee

recommend to Council that the following amendments to the Rating Relief

Polices are approved prior to consultation:

i) The

Transitional Farmland policy is re-instated

ii) The

Treaty Settlement Lands policy is amended to include settlements approved prior

to 1 July 2018

iii) The

Common Use Properties policy is amended to include commercial enterprises and

residential properties

iv) The

Landlocked Land policy is amended to refer Maori land issues to the Maori

Land Court for decision

v) The

Land Subject to Protection for Outstanding Natural Landscape, Cultural,

Historic or Ecological Purposes policy is amended to include covenants

approved under the Heritage New Zealand

Pouhere Taonga Act 2014 (or Historic Places Act 1993)

vi) The

Residential Rates for Senior Citizens policy is amended to provide clarity

for conditions 1 and 4 to allow staff to apply the conditions fairly to all

applicants.

|

1) Background

As part of the 2018/28 LTP process the Rating Relief

Policies were re-drafted into plain English and those thought to no longer be

necessary were rescinded.

Since adoption of the revised policies, staff have

identified some issues of interpretation that appear to be at odds with the

intention of the policies.

Approval is now sought to make some small amendments to

these policies so that they can be effectively applied in a consistent manner.

2) Discussion and Options

Since 1 July 2018, staff have been working with the revised

Rating Relief Policies and have noted that the following issues require amendment:

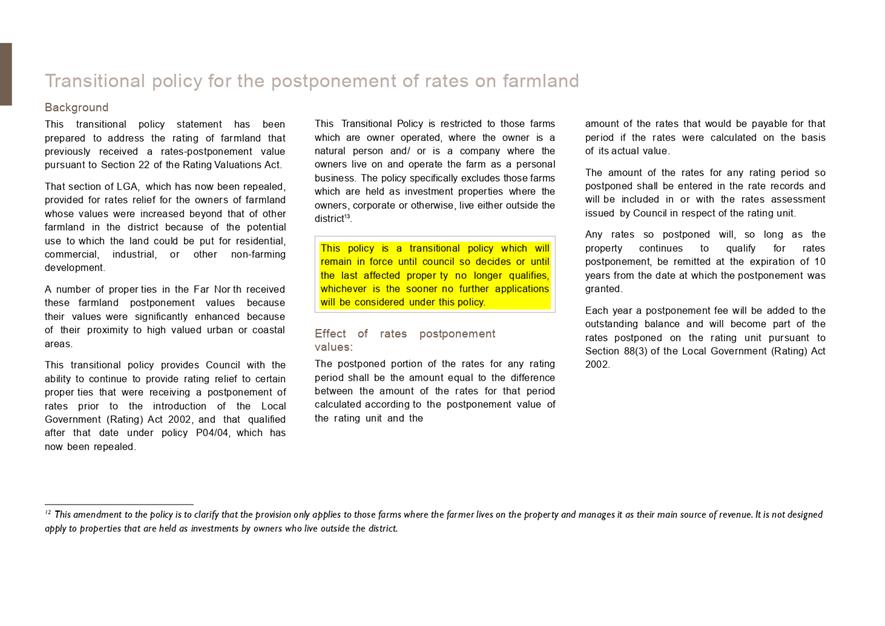

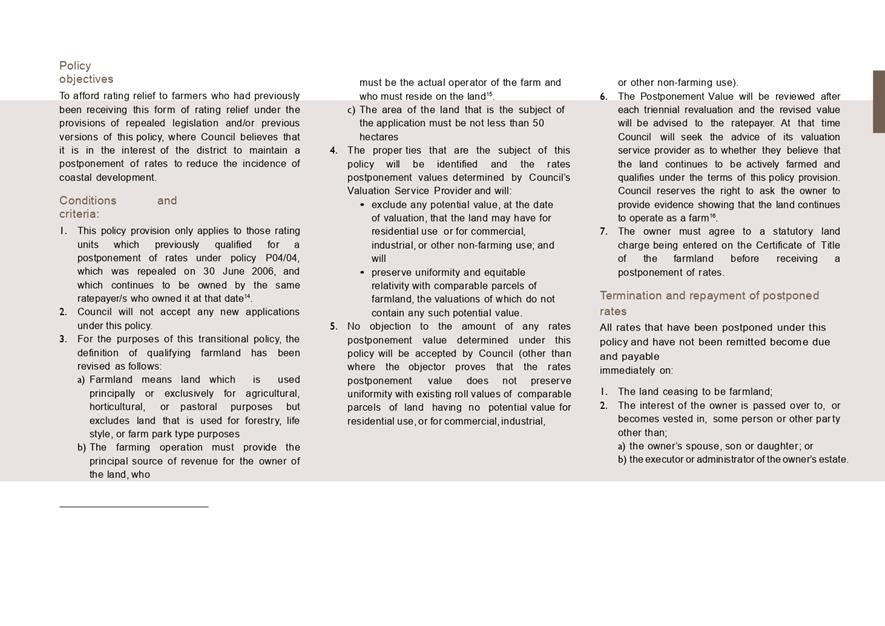

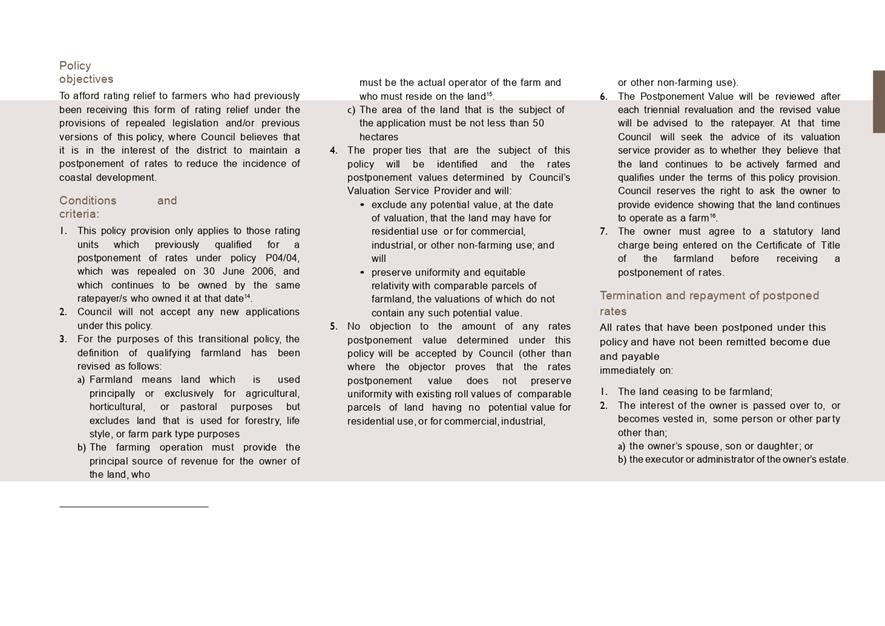

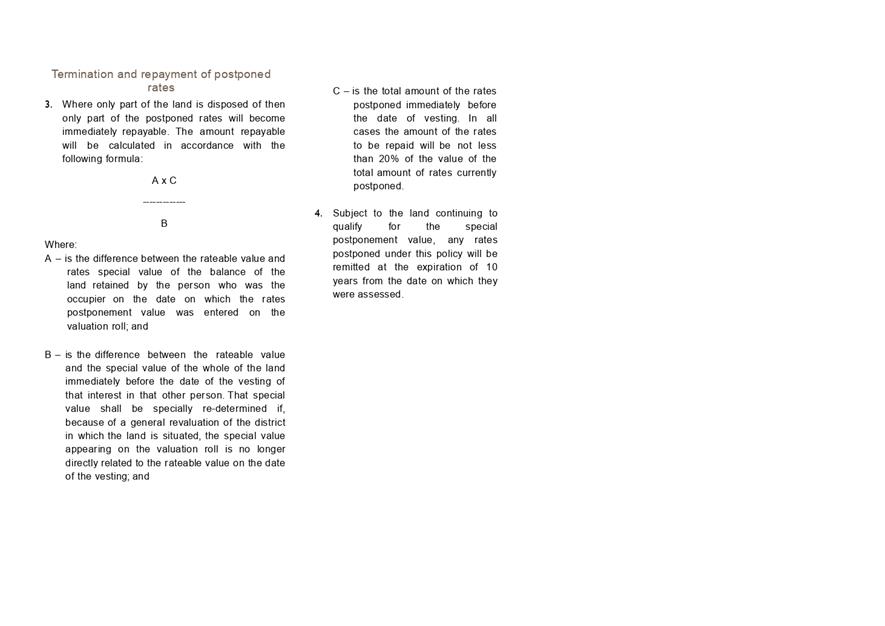

a) Transitional

Farmland Policy

This policy was always

intended to be a transitional policy and stated that:

“This policy is

a transitional policy which will remain in force until council so decides or

until the last affected property no longer qualifies, whichever is the sooner.

No further applications will be considered under this policy”

There are 11 active

postponements under this policy and when Council made the decision to rescind

the policy, technically the postponement on all 11 accounts ceased. Staff do

not think that this was the intention and permission is sought to re-instate

the policy with the same clause as stated above.

b) Treaty

Settlement Lands

This policy was

introduced to provide some relief where lands were returned under treaty

settlements as General Title Land and therefore not eligible for relief under

the Maori Freehold Land policies.

The policy became

effective from 1 July 2018 but did not provide for the conditions and criteria

to apply to lands that had settled prior to that date

It is recommended that

the policy be applied retrospectively to any lands settled prior to 1 July 2018

under the Treaty of Waitangi settlement processes.

c) Common

Use Properties

This policy is

intended to provide some relief to owners that do not strictly meet the

requirements of S20 of the Local Government (Rating) Act 2002 for contiguous

properties. It would typically be applied to farms, commercial enterprises and

residential properties which span more than one rating unit.

The policy as

currently written can only be applied to farm land or commercial developments

which are vacant.

When the policy was

re-written it was not the intention to create the above limitation and it is

recommended that the following amendments be included:

Condition and criteria

4.

That this should be

amended to include “or commercial enterprise” after the word

“farm”

Condition and criteria

5.

A new condition is

included as follows:

In the case of residential rating units where two or more separately

owned rating units are owned by an

individual and/or trust and are contiguous but the ownership is not an exact

match, the rating units will be considered as one. For this to apply one unit

must have a dwelling and the other unit(s) considerable development which

proves that the rating units are being used as one. E.g. House/dwelling

on one rating unit and or garden and garage on the other rating unit.

Existing conditions

and criteria 5 and 6 be re-numbered 6 and 7

d) Land

Locked Land

This policy applies to

both General Title and Maori Freehold Land.

However, the policy

requires the applicant to apply to the High Court under the Property Law Act

2007 to have the land declared “land locked”.

A legal opinion has

been received that advises that only the Maori Land Court can make this

declaration in relation to Maori Freehold Land.

It is therefore

recommended that condition and criteria 1 be amended to add

“or, in the case

of Maori Freehold Land, as determined by the Maori Land Court”.

e) Land

Subject to Protection for Outstanding Natural Landscape, Cultural, Historic or

Ecological Purposes

Under condition 2 of

this policy a series of sections of relevant Acts are referred to under which

this policy can be applied.

It has been identified

that there are some covenants that are legally applied under the Heritage New Zealand Pouhere Taonga Act 2014 (or Historic

Places Act 1993) and that this reference has been omitted.

Whilst it can be

assumed that it would be Council’s intent to include such covenants, they

cannot be included without the specific Act being added to the policy

It is recommended that

the Heritage New Zealand Pouhere Taonga Act 2014 (or

Historic Places Act 1993) be added to condition 2.

f) Residential

Rates for Senior Citizens

There are 2 conditions

within this policy that are not clear or easy to apply.

Condition and criteria

1 (b) refers to an applicant being “on a fixed income” but does not

include a definition of what this might mean. It is recommended that the

following definition be added:

“an income from a pension or investment that is set

at a particular figure and does not vary like a dividend or rise with the rate

of inflation”

Condition and criteria 4 requires staff to make an

assessment of an applicant’s income in order to determine if they have

insufficient funds remaining to pay their rates. Staff are not trained to make

such assessments therefore it is suggested that the following be added:

“if the applicant qualified for the Rates Rebate then

their income has already been tested and they therefore qualify for the Rates

Postponement”.

All amendments to the policies are identified in green in

the attached document.

Legislative process

to amend remission and postponement policies

Remission and

postponement policies are made under section 102(2)(e) of the Local Government

Act (LGA). Amendments to these policies are subject to consultation that gives

effect to section 82 of the LGA. In practical terms, this means that those who

are affected by the amendments must be consulted in any way Council sees fit as

long as the requirements of section 82 are fulfilled and consultation is

aligned with Council’s policy on Significance and Engagement. Note that

the required consultation is not a Special Consultative Procedure, and

therefore does not require notification, a statement of proposal or formal

hearings.

Following adoption of

the draft amendments by Council an appropriate consultation period will take

place, followed by formal adoption prior to the end of June 2019. A

consultation plan will be developed should this Committee recommend approval of

the proposed amendments to Council.

Reason

for the recommendation

The above anomalies have been identified in the Rating

Relief Policies and staff are recommending amendments so that the policies can

be effectively and fairly applied.

3) Financial Implications and Budgetary

Provision

There are no financial implications arising from this report

Attachments

1. Rating Relief

Policies - A2391572 ⇩

2. Transitional

policy for the postponement of rates on farmland - A2391574 ⇩

Compliance schedule:

Full consideration has been given to the provisions of the

Local Government Act 2002 S77 in relation to decision making, in particular:

1. A

Local authority must, in the course of the decision-making process,

a) Seek

to identify all reasonably practicable options for the achievement of the

objective of a decision; and

b) Assess

the options in terms of their advantages and disadvantages; and

c) If

any of the options identified under paragraph (a) involves a significant

decision in relation to land or a body of water, take into account the

relationship of Māori and their culture and traditions with their

ancestral land, water sites, waahi tapu, valued flora and fauna and other

taonga.

2. This

section is subject to Section 79 - Compliance with procedures in relation to

decisions.

|

Compliance

requirement

|

Staff

assessment

|

|

State the level of significance

(high or low) of the issue or proposal as determined by the Council’s

Significance and Engagement Policy

|

Low

|

|

State the relevant Council

policies (external or internal), legislation, and/or community outcomes (as

stated in the LTP) that relate to this decision.

|

This is an amendment to existing

Council Rating Relief Policies

|

|

State whether this issue or

proposal has a District wide relevance and, if not, the ways in which the

appropriate Community Board’s views have been sought.

|

N/A

|

|

State the possible implications for Māori

and how Māori have been provided with an opportunity to contribute to

decision making if this decision is significant and relates to land and/or

any body of water.

|

N/A

|

|

Identify persons likely to be

affected by or have an interest in the matter, and how you have given

consideration to their views or preferences.

|

N/A

|

|

State the financial implications

and where budgetary provisions have been made to support this decision.

|

None

|

|

Chief Financial Officer review.

|

The Chief Financial Officer

prepared this report

|

|

Audit, Risk, and Finance Committee Meeting Agenda

|

28 March 2019

|

Section 102(3) of the

Local Government Act 2002 (LGA 02) provides that a council may adopt a rates

remission policy and a postponement policy. This policy addresses both the

remission and postponement of rates.

Sections 102(1) and

101(2) of the LGA 02 require councils to adopt a policy for the remission and

postponement of rates on Māori Freehold Land. In the development of these

policies, Council has considered Schedule 11 of the LGA 02 and recognises that

the nature of Māori land is different to General Title Land.

The objectives of

Council’s rating relief policies are to:

1.

1. Provide

an equitable system of rating remission and postponement for all sectors of the

community;

2. Provide ratepayers with

financial assistance where they might otherwise have difficulty meeting their

obligations to pay rates;

3. Align with Council’s

community outcomes and strategic priorities;

4. Recognise that certain

unoccupied Māori Freehold Land not used may have particular conditions,

ownership structures, or other circumstances which make it appropriate to remit

or postpone rates for defined periods of time; and

5. Ensure

consideration of Schedule 11 of the LGA 02 (matters relating to rates relief on

Māori Freehold Land).

1. All applications under these policies must be

made in writing, signed by the owner/ratepayer, and accompanied by any required

supporting documentation. After an application has been submitted, further

documentation may be requested. In that event, the applicant will be notified

accordingly.

2. As provided

for in section 88 of the Local Government (Rating) Act 2002 (LGRA 02), a

postponement fee may be calculated and added to the postponed rates.

3. The basis of

calculating the postponement fee is included in each year’s Funding

Impact Statement, which can be found in the Long Term or Annual Plan for that

year.

4. The owner(s)

of the property must provide proof of eligibility which will be confirmed with

relevant Council information.

5. Where land

is in multiple ownership, a written statement authorising an individual to act

for one or more owners must be submitted with all applications.

6. Where a

property or part of that property is sold within the period of remission or

postponement, Council has the right to recover the rates remitted or postponed

for the applicable period. This may apply to the whole property or only to that

portion of the portion that has been sold.

7. Council may

require further information from the applicant if deemed necessary to process

the application.

8. Council

reserves the right to inspect the use of a property, where appropriate, for

application assessment and to confirm compliance with policy criteria from time

to time.

9. Any decision

made by Council under this policy is final.

10. Remissions or postponements granted under

previous policies will remain in force as per those policies.

11. Applications

may be made for a remission or postponement of rates in circumstances which are

not included in the separate policy category sections set out below. These are

known as “outside of policy” applications. Council’s

authority is restricted by the provisions of the LGRA 02. For that reason, all

such applications “outside of policy” must be in writing, and

accompanied by sufficient detail and documentation to support a decision by

Council.

12. Council is

under no obligation to approve any applications that do not comply with the

established policies and Council’s decision on the matter is final.

13. Council’s

decision whether to grant or deny an application for remission or postponement

of rates will be based upon:

a. The application itself; and,

b. All supporting documents

submitted by the applicant; and,

c. Any relevant information and/or documentation

held in Council’s records.

14. Except where

otherwise indicated, Council reserves the right to grant or deny any and all

applications for remission or postponement of rates under these policies.

Introduction. 1

Making an application? This is what you need to know: 1

Table of Contents. 3

Definitions. 4

Common-Use Properties. 5

Community, Sports and Not-for-profit Organisations. 6

Excess Water Charges. 7

Incentivising Māori Economic Development 8

Landlocked Land. 9

Land Subject to Protection for Outstanding Natural

Landscape, Cultural, Historic or Ecological Purposes. 10

Māori Freehold Land Not Used. 12

New Users of Māori Freehold Land. 13

Papakāinga on Māori Freehold Land. 14

Penalties. 15

Properties Spanning Multiple Districts. 16

Residential Rates for Senior Citizens. 17

School Sewerage Charges. 19

Treaty Settlement Lands. 20

Unusable Land. 21

Wastewater Charges on Government Funded Subsidy Schemes. 22

Proposed Policies for Revocation. 23

For

the purpose of these policies, words used in the singular include the plural,

and words used in the plural include the singular.

ARREAR means unpaid rates as

at 30 June of the rating year prior to application.

COUNCIL means the Far North

District Council and includes any person or agent authorised by the Far North

District Council.

LANDLOCKED has the same meaning

as defined in the Property Law Act 2007.

MĀORI FREEHOLD LAND has the same meaning

as defined in

Te

Ture Whenua Māori Act 1993 Part VI section 129(2)(a).

NATURAL DISASTER has the same meaning as

in the Earthquake Commission Act 1993.

NEW USER is a person that has

not been previously identified in Council’s Rates Information Database as

being responsible for the rates on the land.

OCCUPIED means a formal right by

occupation order or informal right by licence to occupy Māori

Freehold Land,

or other arrangements are in place and are exercised.

OCCUPIER

means a person, persons,

organisation, or business entity that is using a rating unit or portion of a

rating unit under a lease, license or other formal agreement for a specified

period of time.

OUTSTANDING NATURAL

LANDSCAPE

refers to

any largely unmodified landscape with characteristics and qualities that amount

to being conspicuous, eminent or remarkable. These landscapes are afforded

protection through the Resource Management Act 1991 as a matter of national

importance.

PAPAKĀINGA has the same meaning as in the operative

version of the Far North District Plan.

POSTPONEMENT means an agreed delay

in the payment of rates for a certain time, or until certain defined events

occur.

RATEPAYER includes, under the Local

Government (Rating) Act 2002, either the owner of the rating unit or a lessee

under a registered lease of not less than 10 years, which provides that the

lessee is required to be entered into the Rating Information Database as the

ratepayer.

REASONABLE ACCESS has the same meaning

as the Property Law Act 2007.

REMISSION means that the requirement to pay

the rate levied for a particular financial year is forgiven in whole or in

part.

STATUTORY LAND CHARGE means a charge

registered against a Certificate of Title of a property by someone who has a

financial interest in the property, such as debt or part ownership.

TREATY SETTLEMENT LANDS means any land which

has been returned to Māori ownership in a Treaty Claims Settlement, or

land which may have been purchased from Treaty settlement monies to replace

land which could not be returned because it is in private ownership.

UNIFORM ANNUAL GENERAL

CHARGE (UAGC) is a type of rate levied by Council. It is a fixed

charge, or an amount that stays the same regardless of the value of the

property. The UAGC is the same amount for all ratepayers across the District.

USED includes use for the

purposes of any residential occupation of the land, or any activity for

business or commercial purposes, including lease agreements, or storage of

equipment, stock or livestock.

Background

Section 20 of the LGRA

02 requires that multiple rating units be treated as one rating unit if they

are:

1. Owned by the same person or persons; and,

2. Used jointly as a single unit; and,

3. Contiguous or separated only by a road,

railway, drain, water race, river or stream.

This policy expands on

the provisions of the Act, and provides for commercial operations to be treated

as one rating unit to assist economic development in the district.

Policy Objectives

1. To provide for farming

by treating multiple rating units as one rating unit if they are physically

separated but used jointly as one farming operation.

2. To assist development

in the District by treating multiple rating units of a development as a single

rating unit for a maximum of three years.

Scope

This policy applies to

both General Title and Māori Freehold Land.

Policy Statements

In addition to the

provisions of section 20 of the LGRA 02, Council will treat the following

separate rating units as a single rating unit if they are owned by the same

person or entity:

a. A farm that consists of multiple

rating units but functions as one commercial operation;

b. Rating units of a residential or

commercial development which are vacant and owned by the original developer,

pending their sale or lease to subsequent purchasers or lessees.

Conditions and Criteria

1. Applicants must provide

sufficient evidence that the multiple rating units in question are being

jointly used as a single farming operation, or are part of the same subdivision

or commercial development.

2. In the case of a

residential or commercial development, multiple rating units will be treated as

a single rating unit for a maximum term of three years. This term is calculated

from 1 July in the year that this provision first applies.

3. Residential or

commercial developments that have already received this remission under a

previous policy are not eligible for remission under this policy.

4. In the case of a farm or commercial

enterprise,

the separate multiple rating units must be owned or leased by the same person

or entity. If any of the separate rating units are leased, the term of the

lease must be 10 years or more, including rights of renewal. The owners of each

of the separate rating units must confirm in writing that their unit is being

jointly used as a single farming operation.

5. In the case of

residential rating units where two or more separately owned rating units

are owned by an individual and/or trust and are contiguous but the

ownership is not an exact match, the rating units will be considered as one.

For this to apply one unit must have a dwelling and the other unit(s)

considerable development which proves that the rating units are being used as

one. E.g. House/dwelling on one rating unit and or garden and garage on

the other rating unit.

6. In the case of a farm,

the rating units must be situated within a radius of two kilometres from the

boundary of the primary property.

7. Council reserves the

right to exclude any specific targeted charge from this policy.

8.

Background

Community and voluntary

groups provide facilities to enhance and contribute to the wellbeing of the

residents of the Far North. This policy provides rating relief for those

organisations that operate for the benefit of the community.

Policy Objectives

1. To assist in the

ongoing provision of community services and recreational opportunities that

benefit Far North residents.

2. To facilitate and support access to drug,

alcohol and mental health facilities for Far North residents.

Scope

This

policy applies to both General Title and Māori Freehold Land.

Policy Statements

1. Council may remit up to

100% of the rates payable on land owned or used by:

a. Registered

Charitable Organisations or IRD approved donee organisations; or

b. Any

entity which has, as its principal purpose and function, the provision of free access to family

counselling, or, assessment, counselling and in-patient treatment for people

with alcohol, drug and mental health related problems.

2. Council may remit 50% of the rates payable on

land owned or used by an entity for the purpose of providing benefit to Far North

residents through:

a. the promotion of recreation,

health, education, or instruction; or

b. the

running of a campground on land for the purposes listed in section 2(a) above.

3. Council may remit service charges, which may be

sewerage only or any or all service charges at the sole discretion of Council.

Conditions and Criteria

1. Relevant financial

information must accompany all applications. This includes:

a. statement of

organisation objectives

b. full financial accounts

c. information on

activities and programmes

d. details

of membership or clients.

2. No remission will be

given on land on which a licence under the Sale of Liquor Act is held.

3. No remission will be

given on land where any person or entity receives private financial profit from

the activities carried out on the land. All income earned by ratepayers and

entities receiving a remission under this policy must be spent on reasonable

salaries, wages and other costs reasonably related to its community, sports, or

not-for-profit purposes.

4. Land used for an

activity which is commercial in nature does not qualify for rates remission.

For example an “op-shop” does not qualify for rating relief under

this policy.

5.

Background

Individual consumers

are responsible for:

a. the maintenance of their own

internal reticulation system from the water meter to the house; and

b. payment

for all water supplied through the meter.

Some

consumers may experience an occasional water leak in their internal

reticulation, and not be aware of the problem. This policy seeks to assist the

ratepayer to cover excess water charges.

Policy Objectives

1. To assist ratepayers

with excessive water charges due to a water leak.

2. To incentivise ratepayers to regularly check

their water meter and maintain their internal water reticulation.

Scope

This

policy applies to both General Title and Māori Freehold Land.

Policy Statements

1. Council may provide a

full remission of excess water charges to the ratepayer once every 10 years

where a leak in the internal reticulation of that property has resulted in

water loss.

2. Council may provide a 50% remission of excess

water charges to the ratepayer in the case of a separate leak on that property within 10

years following the grant of a first application.

Conditions and Criteria

1. Applications made under

this policy must be received by Council within six months of the first

notification to the ratepayer by Council of a possible leak.

2. Proof of repairs to the

internal reticulation must accompany the application. This may be in the form

of a detailed written report or an invoice for repairs from a registered

plumber.

3. No remission will be

given where the repairs have not been completed by a registered plumber.

4. Excess water charges

resulting from any other leaks within the 10 year period are not eligible for

remission.

5. The maximum relief that

will be provided will be the difference between the normal consumption and the

actual water consumption for that period.

Background

Council recognises that

there is a need to incentivise economic development on Māori Freehold

Land. Enabling and incentivising Māori economic development through the

remission of rates may see direct economic and social benefits to landowners

generating a return on the land, as well as to Council from future rates

contributions, as the venture grows and becomes sustainable.

Policy Objectives

1. To provide incentives

for Māori land owners to develop Māori Freehold Land for economic

use.

2. To enable owners to develop an economic base

and to assist with the subsequent payment of rates.

Scope

This

policy applies to Māori Freehold Land.

Policy Statement

Council

will remit rates on Māori Freehold Land for the purposes of incentivising

economic development.

Conditions and Criteria

1. Council will remit

rates under this policy on an eight-year sliding scale as follows:

• Years 1-3

- 100% remitted

• Year 4 -

90% remitted

• Year 5 -

80% remitted

• Year 6 -

60% remitted

• Year 7 -

40% remitted

• Year 8 -

20% remitted; and

• Year 9 - 0% remitted

2. The land, or portion of

the land, for which relief is sought must be considered suitable for

development, and confirmed as currently not used.

3. Applications must be accompanied

by a business case, and a meeting with Council staff will be required to

determine any other necessary documentation.

4. Key considerations by

Council may include:

a. professional advice

has been obtained;

b. there is a suitable

management structure in place;

c. appropriate

financial arrangements for the development of the land have been made;

d. suitable monitoring and

reporting systems have or will be established; and

e. realistic

financial projections and cash flows have been provided.

5. Upon approval, a

regular annual report and financial statements on the development must be

submitted to Council each year.

Background

The

Property Law Act 2007 enables owners of landlocked properties to take legal

action in order to gain reasonable access to their property. Ratepayers may be

unable to take action under these provisions of the Property Law Act due to

their financial circumstances.

Policy Objectives

To

provide rating relief to ratepayers where their land has no reasonable access

and the ratepayer cannot afford to take action through the Property Law Act

2007.

Scope

This

policy applies to both General Title and Māori Freehold Land.

Policy Statement

Council

may postpone rates on landlocked land where there is no reasonable access as

defined in the Property Law Act 2007, or, in the case of Maori

Freehold Land, as determined by the Maori Land Court

Conditions and Criteria

1. The land must be

landlocked as defined in Section 326 of the Property Law Act 2007, or, in the case of Maori

Freehold Land, as determined by the Maori Land Court

2. The application must

state why access cannot be obtained through procedures set forth in Part 6,

Subpart 3, of the Property Law Act.

3. The application must

include a statutory declaration that there is no practical access across adjoining

land and that the land is not in use by any person, Fencing to prevent

trespassing does not constitute use of the land.

4. The maximum term for

the postponement of rates for landlocked property is three years. If the land

remains landlocked at the end of that period, postponed rates will be remitted.

5. The owner must advise

Council if the status of the land changes, if access is obtained, or if any

person commences to use the land. If the land ceases to be landlocked during

the period of the postponement, any rates postponed and not remitted under this

policy will not be repayable unless the owner fails to keep the current and

future rates up to date.

6. The repayment of

postponed rates will not be required merely because of a change of ownership of

the land, provided that the land continues to comply with the criteria of this

policy.

1.

7.

Background

The Far North District Council recognises that

certain rateable land within the District is protected for outstanding natural

landscape, cultural, heritage, or ecological purposes.

Policy Objectives

To

provide rating relief to landowners who have reserved lands that have

particular outstanding natural landscape, cultural, historic or ecological

values for future generations.

Scope

This

policy applies to both General Title and Māori Freehold Land.

Policy Statements

1. Council may remit

rates on land subject to protection for outstanding natural landscape,

cultural, historic or ecological purposes under the formal protection

agreements listed in 2 a) through 2 g) of the conditions and criteria of this

policy.

2. Council may postpone

rates on land subject to protection for outstanding natural landscape,

cultural, historic or ecological purposes under the formal protection listed in

2 h) of the conditions and criteria of this policy.

Conditions and Criteria

1. Applications must be supported

by a copy of the formal protection agreement and a Management Plan detailing

how the values of the land are to be maintained, restored, and/or enhanced.

2. The land must be

subject to a formal protection agreement as set out below:

a. An open space

covenant under section 22 of the Queen Elizabeth the Second National Trust Act

1977; or

b. A conservation covenant

under section 77 of the Reserves Act 1977; or

c. A Nga Whenua Rahui

kawenata under section 77A of the Reserves Act 1977; or

d. A declaration of protected

private land under section 76 of the Reserves Act 1977; or

e. A management

agreement for conservation purposes under section 38 of the Reserves Act 1977;

or

f. A management agreement for conservation purposes

under section 29 of the Conservation Act 1987; or

g. A Māori reservation

for natural, historic, or cultural conservation purposes under sections 338 to

341 of the Te Ture Whenua Māori Act 1993 (Māori Land Act 1993); or

h. A

covenant for conservation purposes under section 27 of the Conservation Act

1987.

i. A covenant for

conservation purposes approved under the Heritage New Zealand Pouhere Taonga

Act 2014 (or Historic Places Act 1993)

3. The rating unit or

portion of the rating unit that is the subject of the application must not be

in use.

4. Where the entire rating

unit is the subject of the application, the remission or postponement of rates

will apply to all rates levied on the property.

5. The protected and

unprotected portions of the rating unit will be separately valued and assessed

as separate parts pursuant to Section 45 (3) of the Local Government (Rating)

Act 2002. In these instances, the remission or postponement of rates will only

apply to the protected portion of the rating unit.

6. The following

activities will not constitute use of the land:

a. Work undertaken to

preserve or enhance the features covenanted on the land, including but not

limited to weed control, planting to counteract erosion, or erection of a fence

to prevent trespassing.

b. The

removal of material by Māori for cultural purposes.

7. Any remission or

postponement granted under this policy will become effective on 1 July in the

rating year following the submission of the application.

8. Any remission or postponement of rates on the

land will be cancelled immediately in the event that the land ceases to be

protected under a formal protection agreement. Postponed rates that have not

been remitted will be repayable in the event that the covenant conditions and

the Management Plan objectives are breached in the sole opinion of the Council,

whose decision is final.

Specific Conditions

and Criteria for Postponement of Rates

1. After a term of six

years, the postponed rates for the first year of the covenant period will be

remitted. After this, one additional year of the postponed rates will be