AGENDA

Extraordinary Council Meeting

Membership:

Kahika - Mayor Moko Tepania - Chairperson

Kōwhai - Deputy Mayor Kelly Stratford

Cr Ann Court

Cr Felicity Foy

Cr Hilda Halkyard-Harawira

Cr Babe Kapa

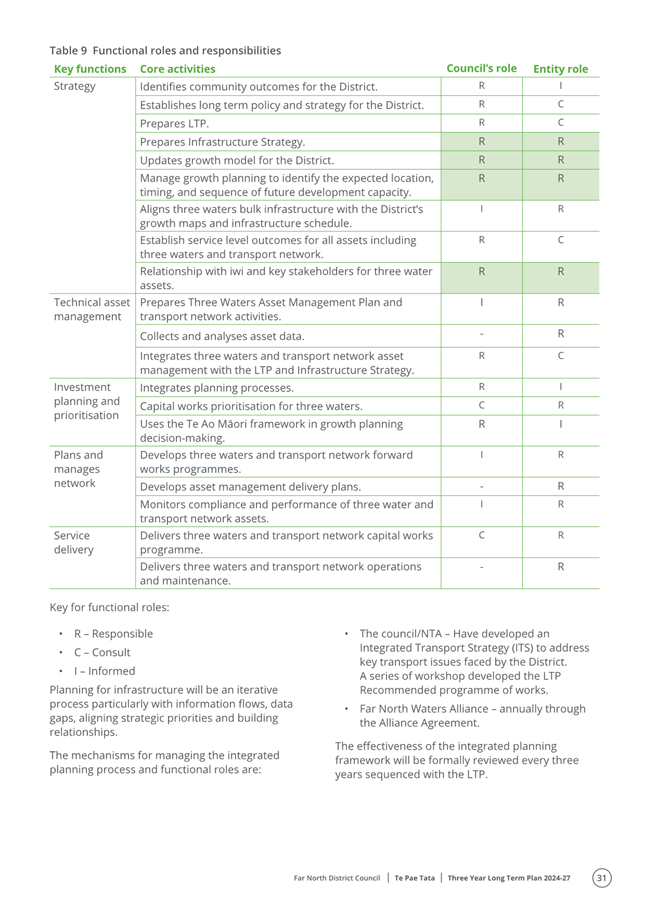

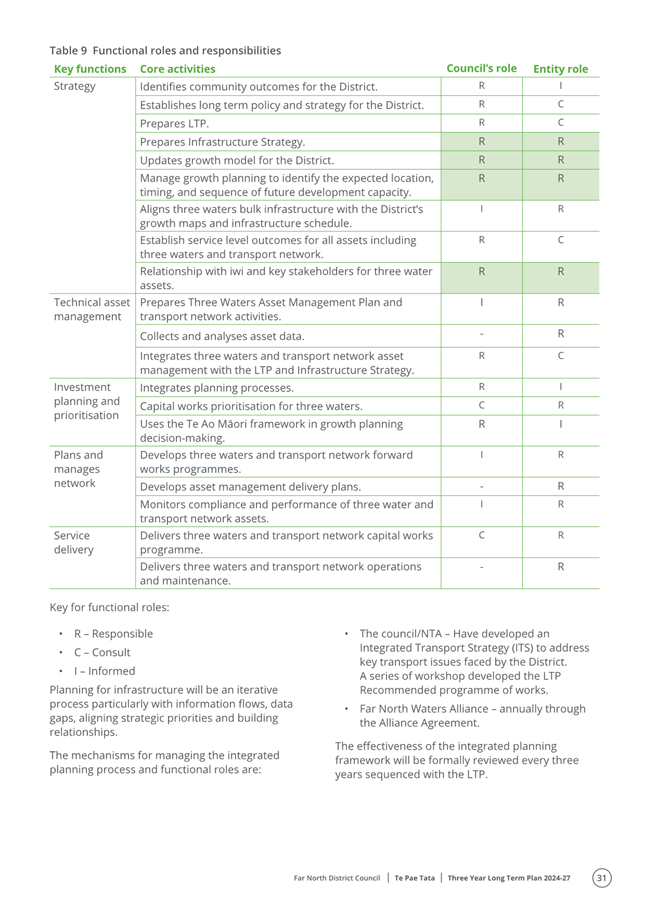

Cr Penetaui Kleskovic

Cr Steve McNally

Cr Mate Radich

Cr Tāmati Rākena

Cr John Vujcich

Wednesday, 26 June 2024

Time: 8:30am

Council Chambers

Council Chambers

Memorial Ave Kaikohe

1 Karakia

Timatanga / Opening Prayer

Ka tuku mātou kia kaha mai ngā māngai kua

whiriwhirihia mō Te Kaunihera o Te Hiku o te Ika ki te mahi me te

ngākau auaha me te whakamahi i ngā pūkenga me te mātauranga

i roto i ngā wānanga me ngā whakataunga kia whakatūria ai

tētahi Hapori e matatika ana, e tū kotahi ana ka mutu ka whakapiki

anō i te oranga o tō tātou rohe, ka whakatau anō i ngā

take o te rohe i runga i te tika me te pono.

We ask that through Council discussions and decisions the

representatives we have elected may govern the Far North District with

imagination, skill and wisdom to achieve a fairer and more united Community

that enhances the wellbeing of our district and solves the District’s

problems efficiently and effectively.

2 Ngā

Whakapāha Me Ngā Pānga Mema / Apologies and Declarations of

Interest

Members need to

stand aside from decision-making when a conflict arises between their role as a

Member of the Council and any private or other external interest they might

have. This note is provided as a reminder to Members to review the matters on

the agenda and assess and identify where they may have a pecuniary or other

conflict of interest, or where there may be a perception of a conflict of

interest.

If a Member

feels they do have a conflict of interest, they should publicly declare that at

the start of the meeting or of the relevant item of business and refrain from

participating in the discussion or voting on that item. If a Member thinks they

may have a conflict of interest, they can seek advice from the Chief Executive

Officer or the Manager - Democracy Services (preferably before the meeting).

It is noted that while members can seek advice the final

decision as to whether a conflict exists rests with the member.

3 Ngā

Tono Kōrero / Deputations

No requests for deputations were received at the time of the

Agenda going to print.

4 Ngā

Kōrero A Te Kahika / Mayoral Announcements

5 Te

Whakaaetanga o Ngā Meneti o Mua / Confirmation of Previous Minutes

5.1 Confirmation

of Previous Extraordinary Minutes

File

Number: A4757241

Author: Imrie

Dunn, Democracy Advisor

Authoriser: Casey

Gannon, Manager - Democracy Services

Take Pūrongo / Purpose of the Report

The minutes are attached to allow Council to confirm that

the minutes are a true and correct record of previous meetings.

|

tŪtohunga / Recommendation

That Council confirm the minutes of the Extraordinary

Council meeting held 6 June 2024 as a true and correct record.

|

1) TĀhuhu kŌrero / Background

Local Government Act 2002 Schedule 7 Section 28 states that

a local authority must keep minutes of its proceedings. The minutes of these

proceedings duly entered and authenticated as prescribed by a local authority

are prima facie evidence of those meetings.

2) matapaki me NgĀ KŌwhiringa

/ Discussion and Options

The minutes of the meetings are attached.

Far North District Council Standing Orders Section 27.3

states that no discussion shall arise on the substance of the minutes in any

succeeding meeting, except as to their correctness.

TAKE TŪTOHUNGA

/ REASON FOR THE RECOMMENDATION

The reason for the recommendation is to confirm the minutes

are a true and correct record of the previous meetings.

3) PĀnga PŪtea me ngĀ

wĀhanga tahua / Financial Implications and Budgetary Provision

There are no financial implications or the need for

budgetary provision as a result of this report.

Attachments

1. 2024-06-06

Council Minutes - A4735382 ⇩

Compliance schedule:

Full consideration has been given to the provisions of the

Local Government Act 2002 S77 in relation to decision making, in particular:

1. A

Local authority must, in the course of the decision-making process,

a) Seek

to identify all reasonably practicable options for the achievement of the

objective of a decision; and

b) Assess

the options in terms of their advantages and disadvantages; and

c) If

any of the options identified under paragraph (a) involves a significant

decision in relation to land or a body of water, take into account the

relationship of Māori and their culture and traditions with their

ancestral land, water sites, waahi tapu, valued flora and fauna and other

taonga.

2. This

section is subject to Section 79 - Compliance with procedures in relation to

decisions.

|

Compliance

requirement

|

Staff

assessment

|

|

State the level of significance

(high or low) of the issue or proposal as determined by the Council’s

Significance and Engagement Policy

|

This is a matter of low

significance.

|

|

State the relevant Council

policies (external or internal), legislation, and/or community outcomes (as

stated in the LTP) that relate to this decision.

|

This report complies with the

Local Government Act 2002 Schedule 7 Section 28.

|

|

State whether this issue or

proposal has a District wide relevance and, if not, the ways in which the

appropriate Community Board’s views have been sought.

|

It is the responsibility of each

meeting to confirm their minutes therefore the views of another meeting are

not relevant.

|

|

State the possible implications for Māori

and how Māori have been provided with an opportunity to contribute to

decision making if this decision is significant and relates to land and/or

any body of water.

|

There are no implications for Māori in confirming minutes

from a previous meeting. Any implications on Māori arising from matters

included in meeting minutes should be considered as part of the relevant

report.

|

|

Identify persons likely to be

affected by or have an interest in the matter, and how you have given

consideration to their views or preferences (for example,

youth, the aged and those with disabilities).

|

This report is asking for minutes

to be confirmed as true and correct record, any interests that affect other

people should be considered as part of the individual reports.

|

|

State the financial implications

and where budgetary provisions have been made to support this decision.

|

There are no financial

implications or the need for budgetary provision arising from this report.

|

|

Chief Financial Officer review.

|

The Chief Financial Officer has

not reviewed this report.

|

|

Extraordinary

Council Meeting Agenda

|

26 June 2024

|

6 Ngā

Pūrongo / Reports

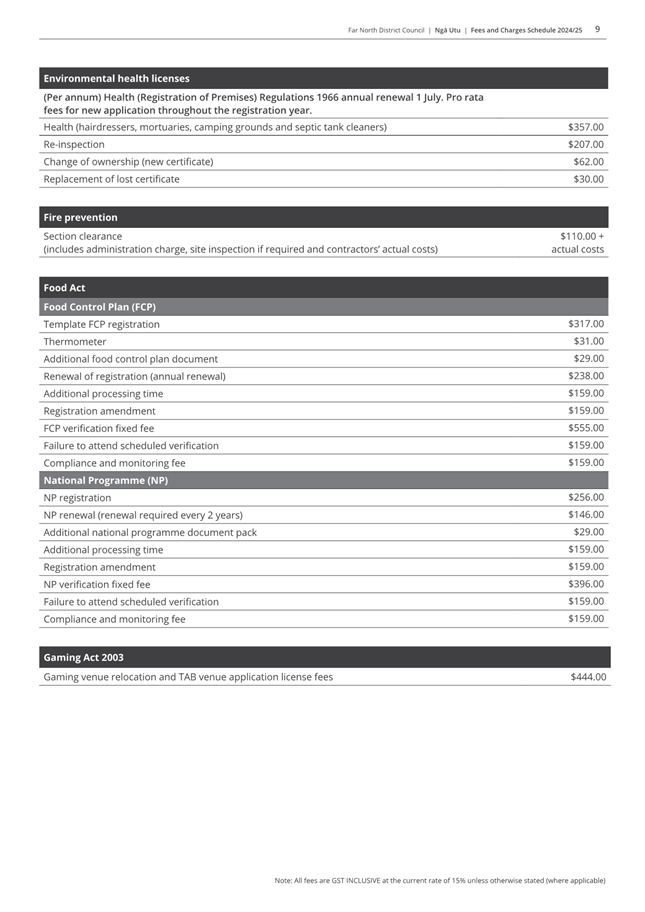

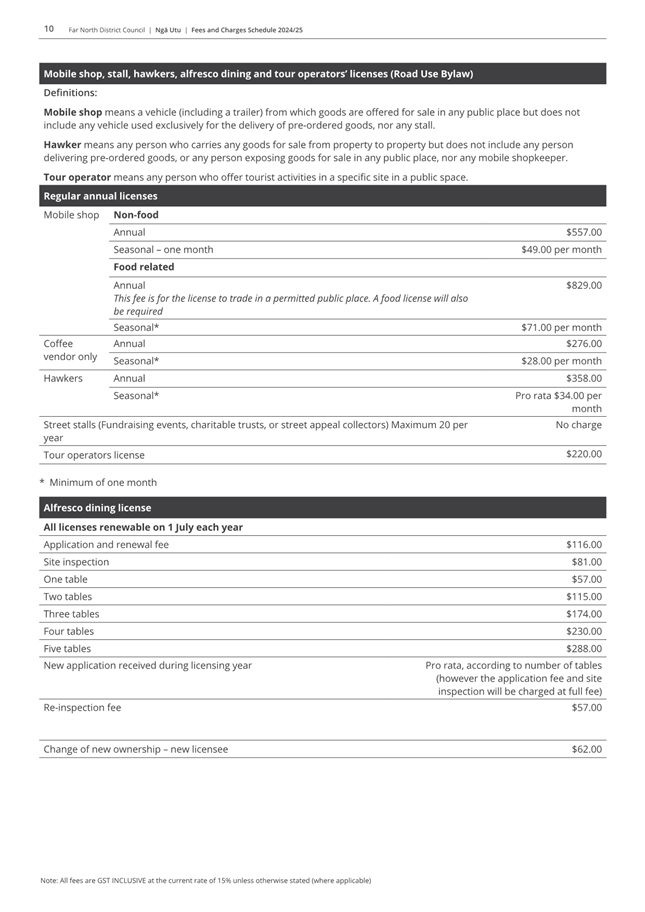

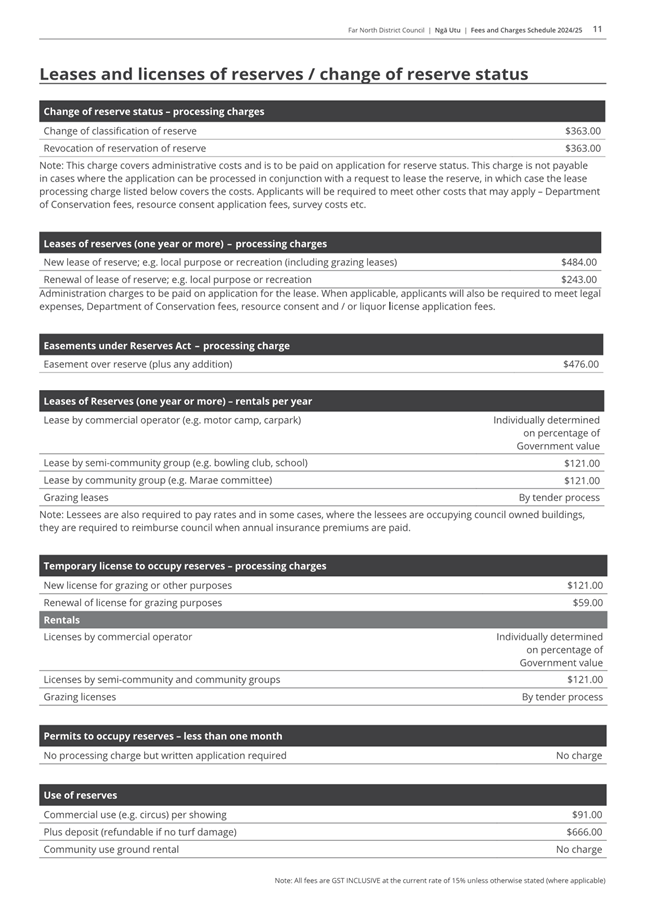

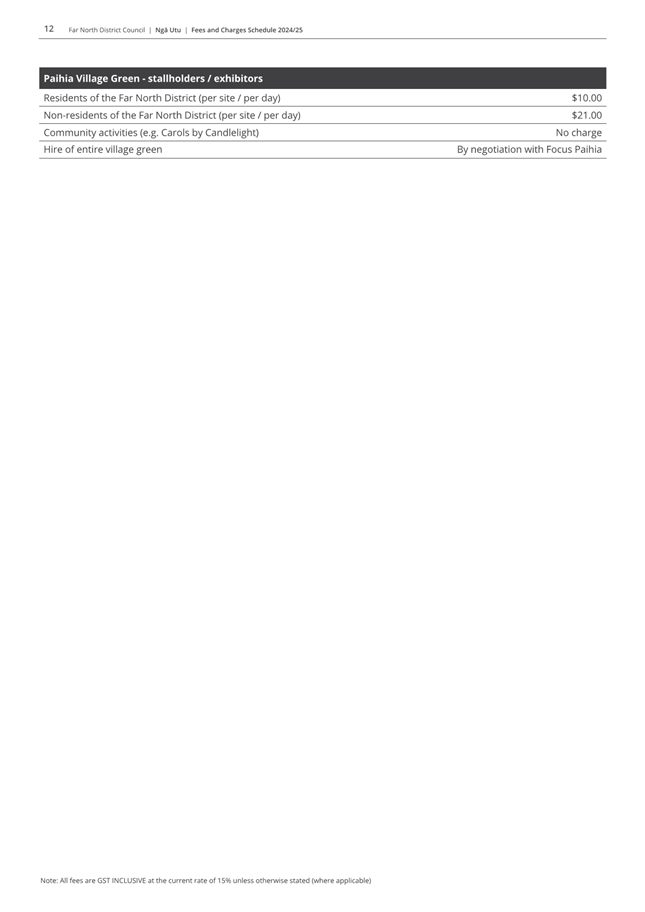

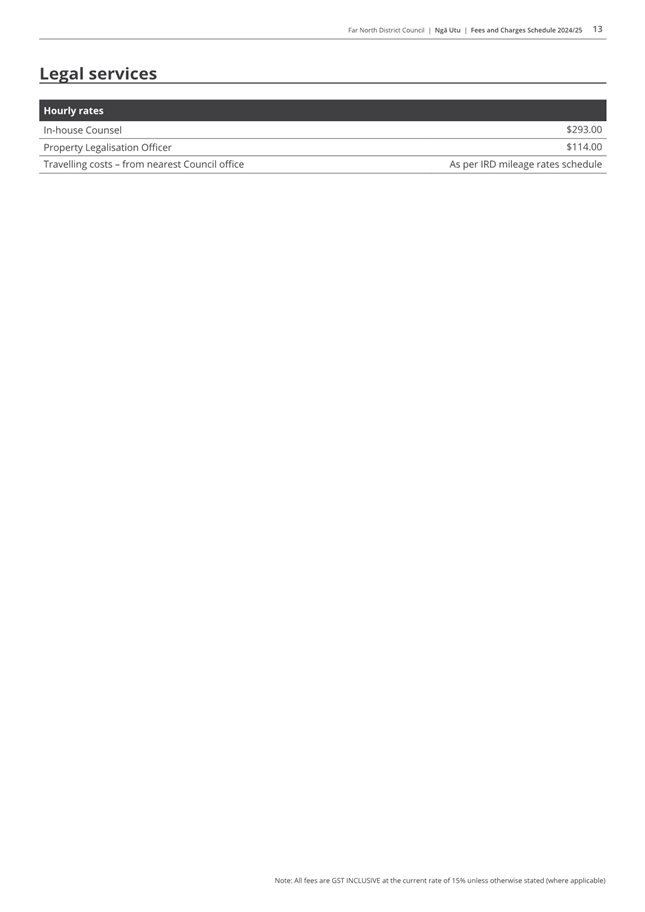

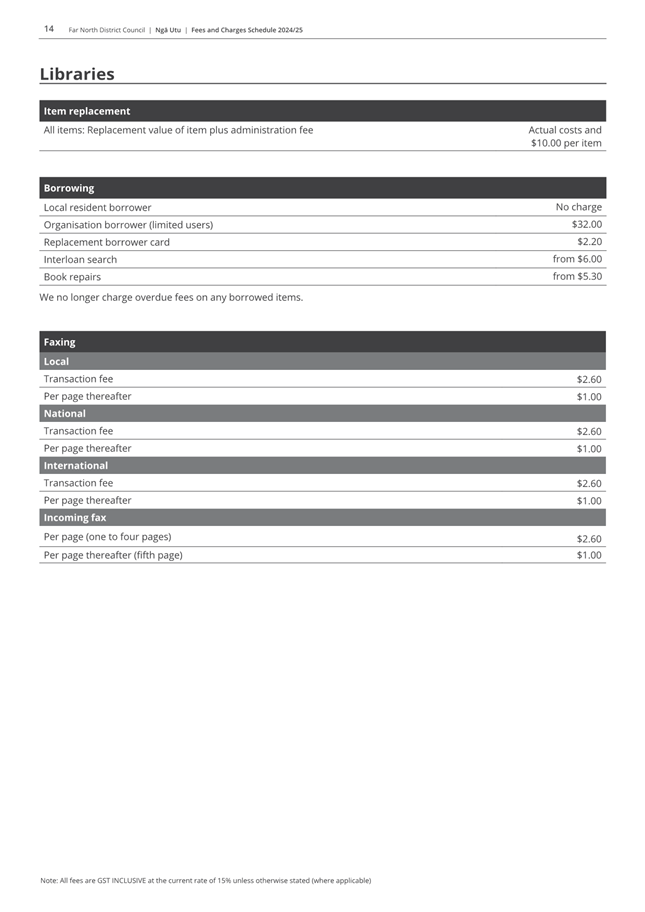

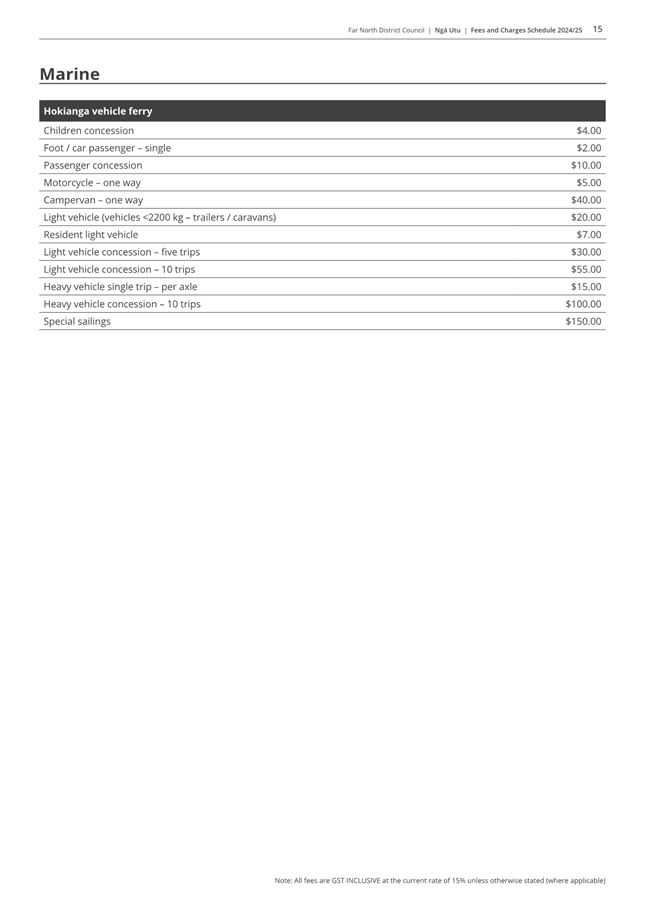

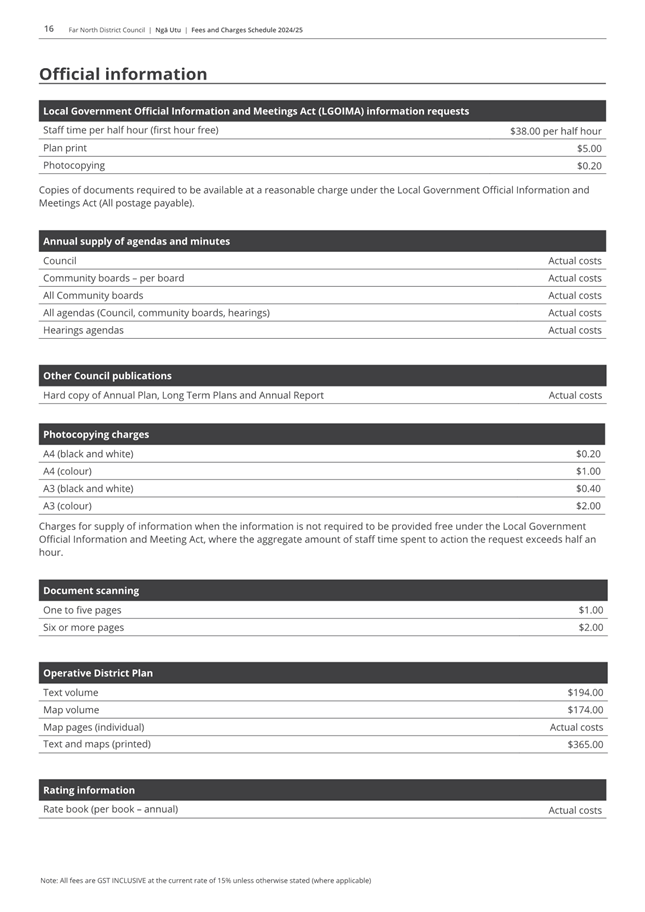

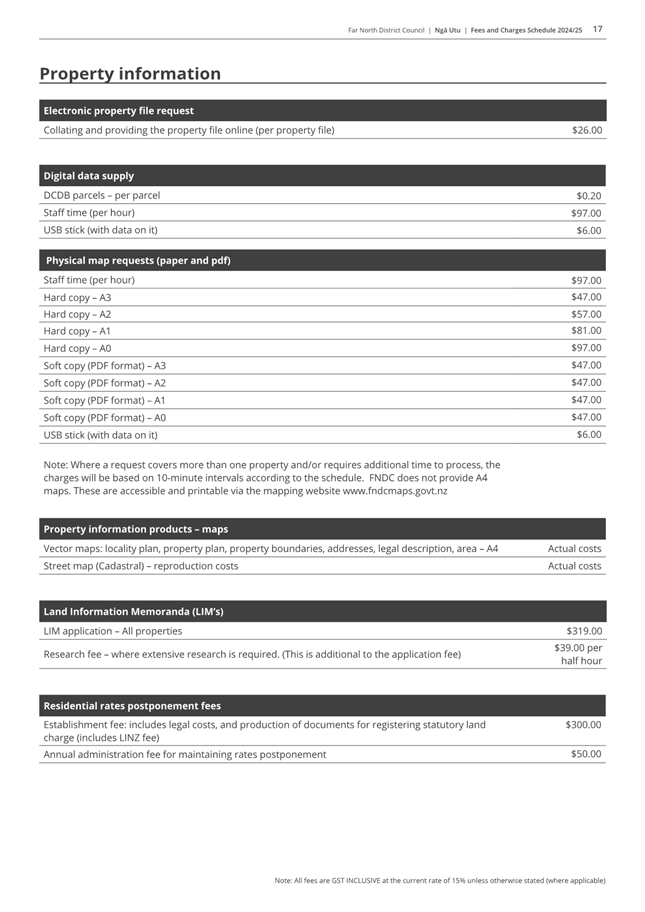

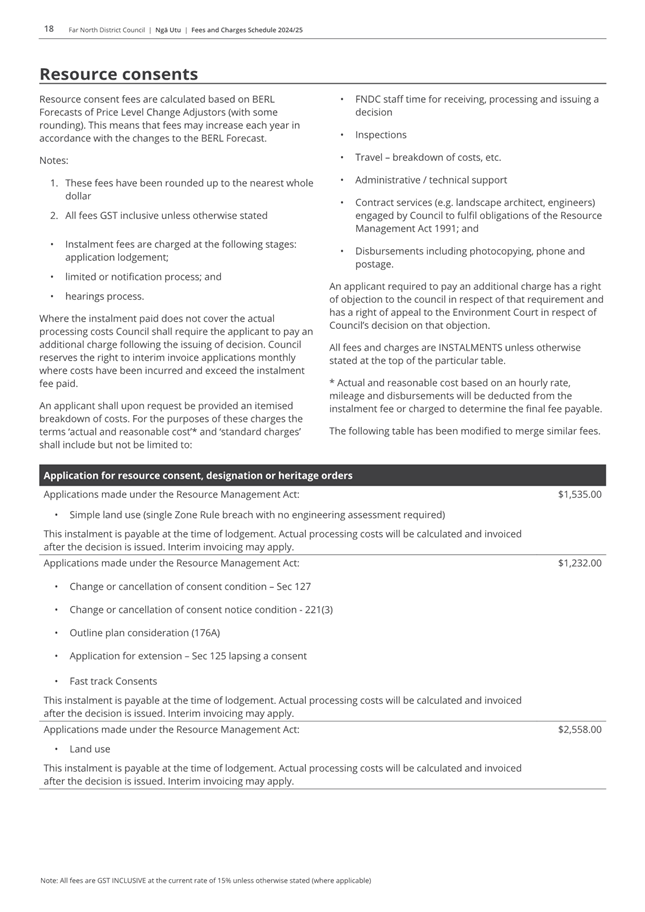

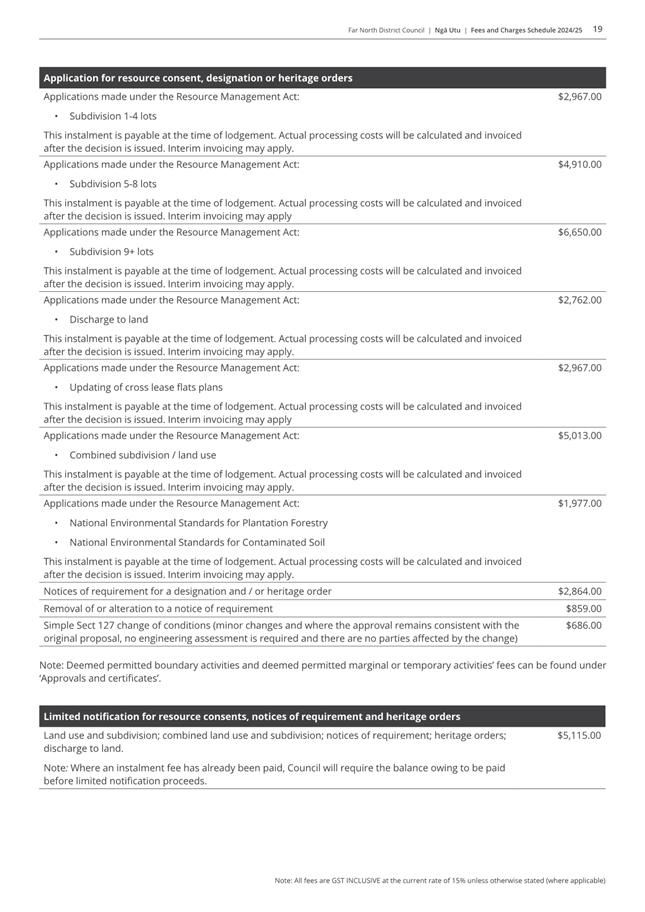

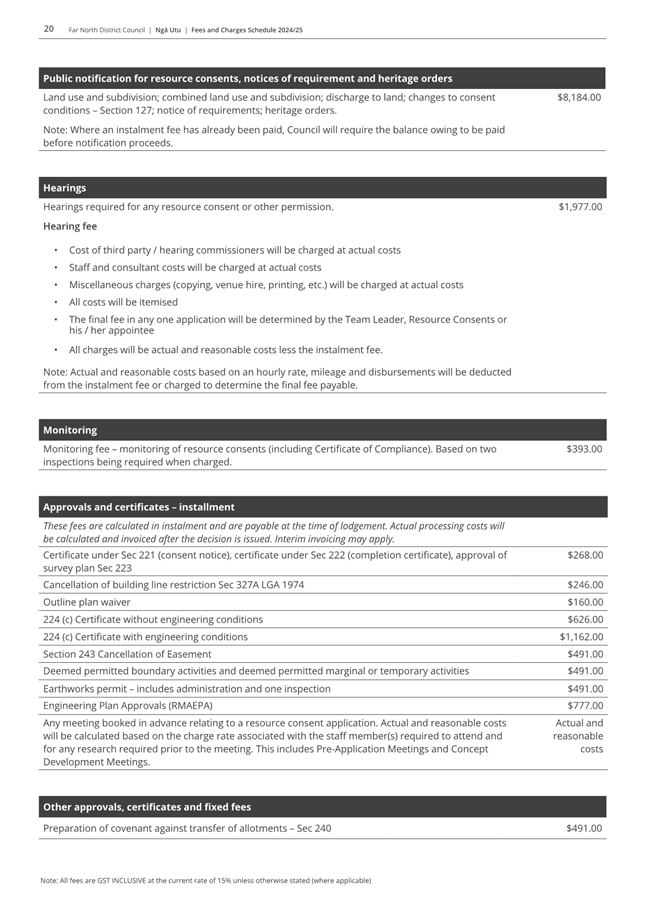

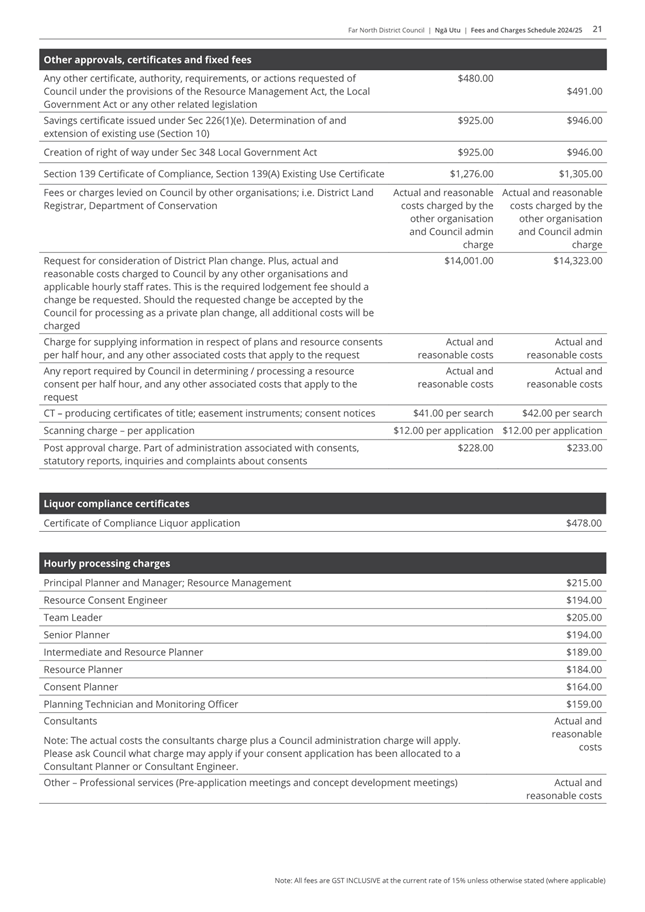

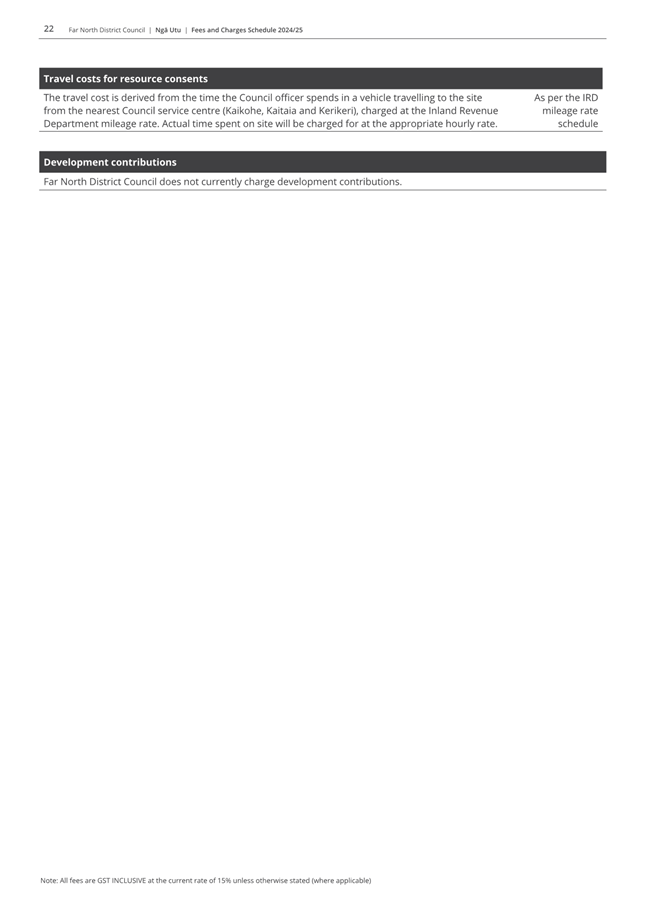

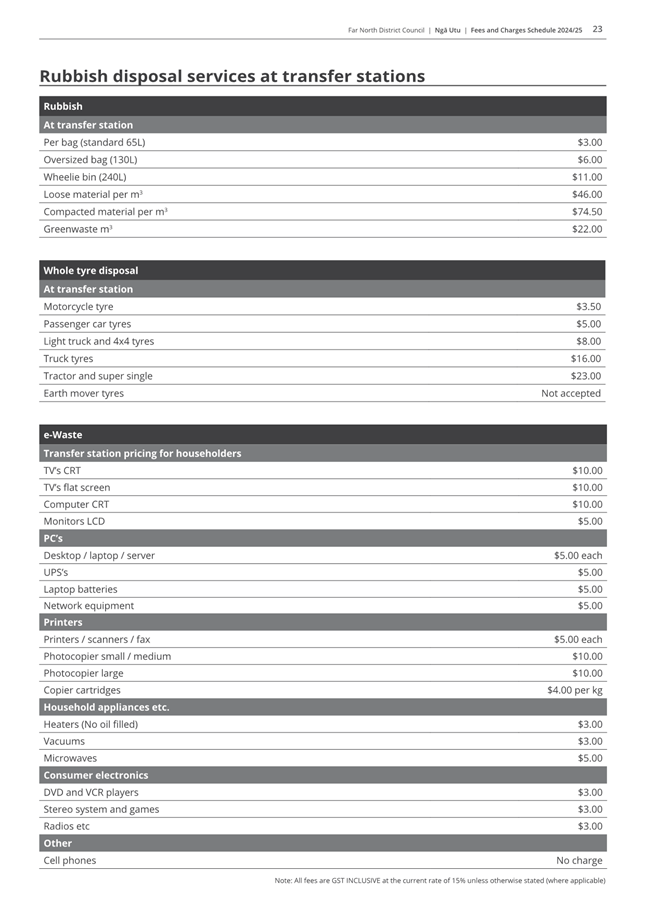

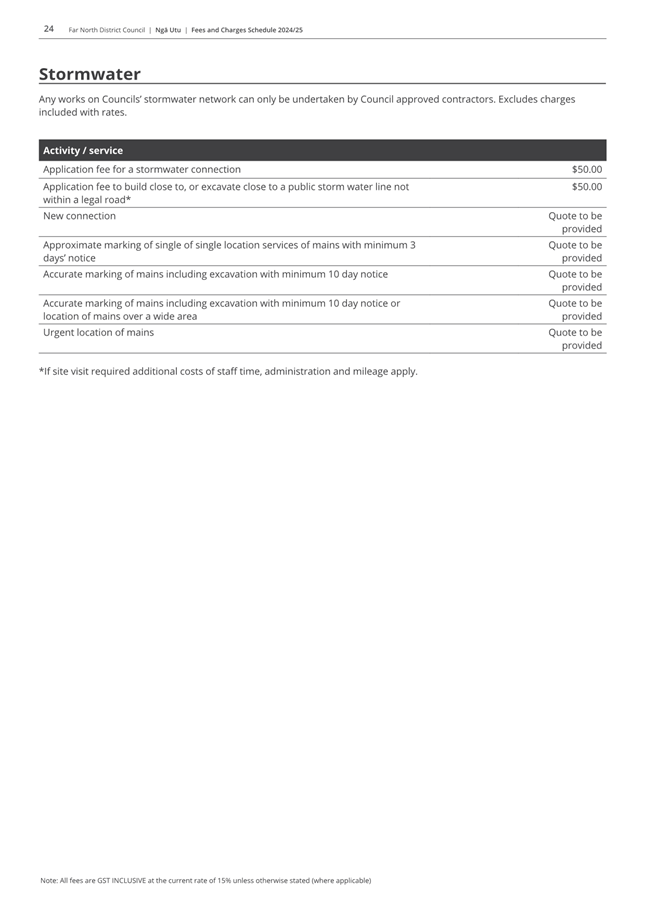

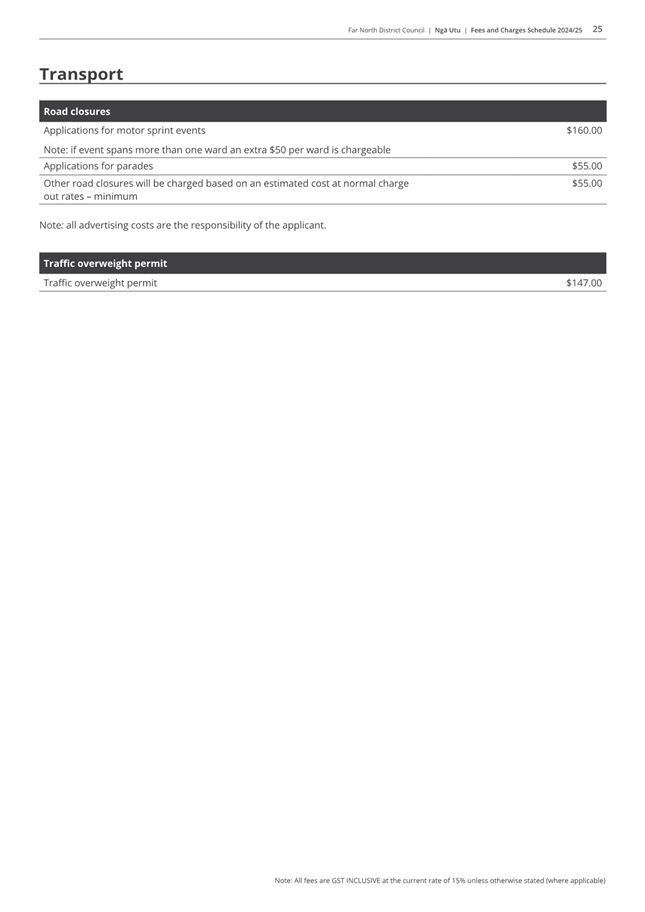

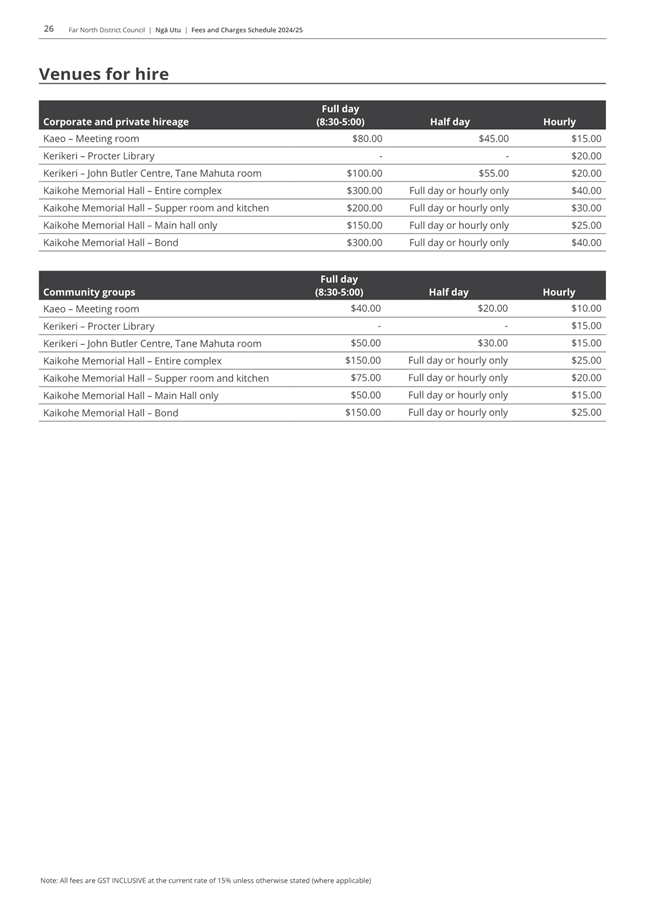

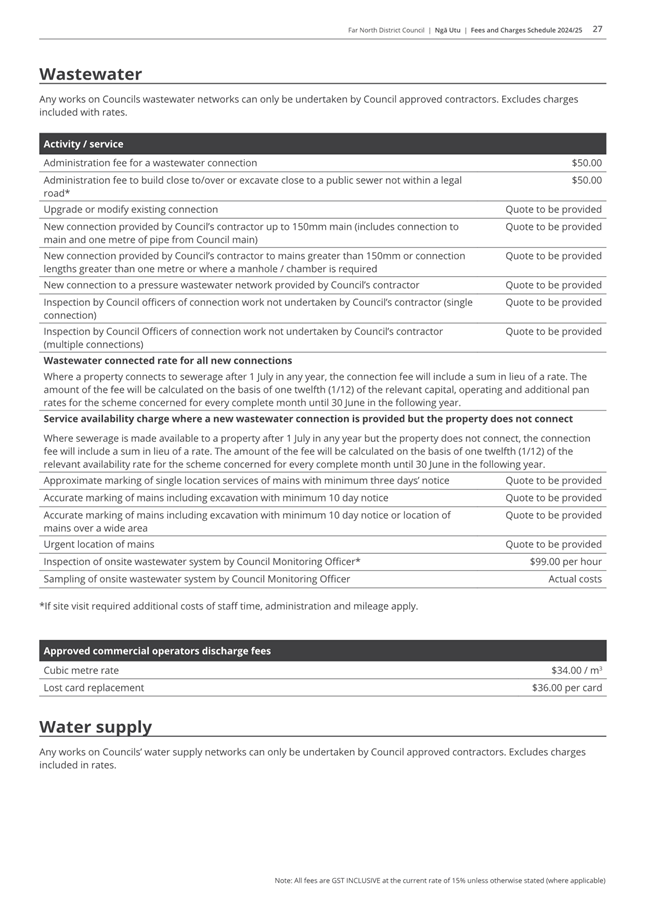

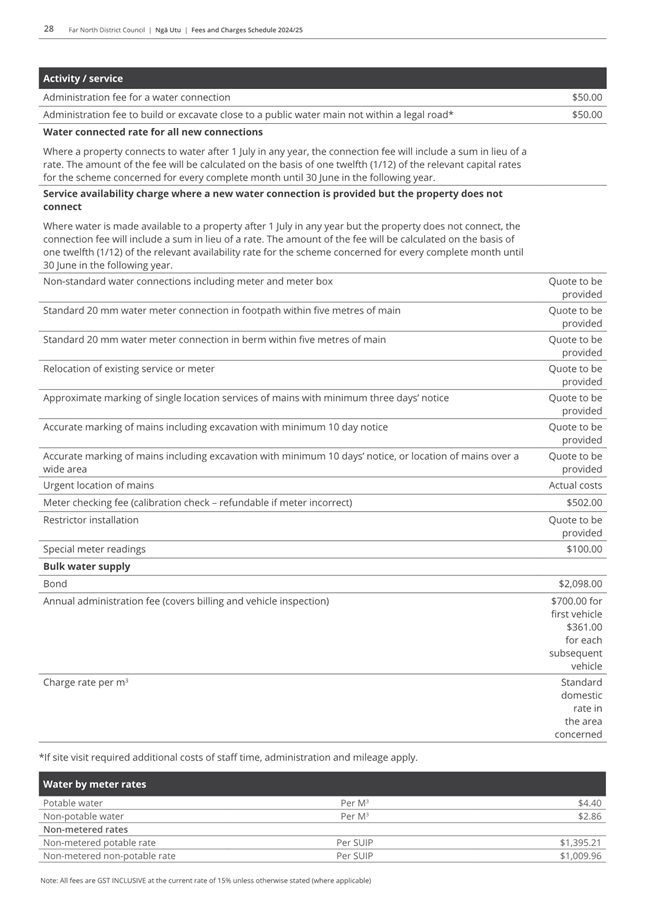

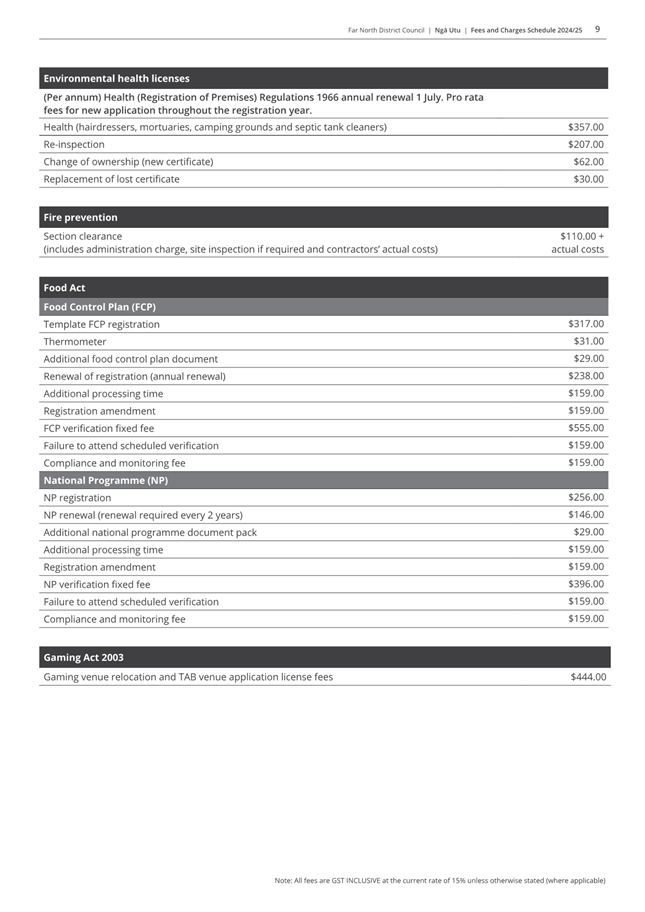

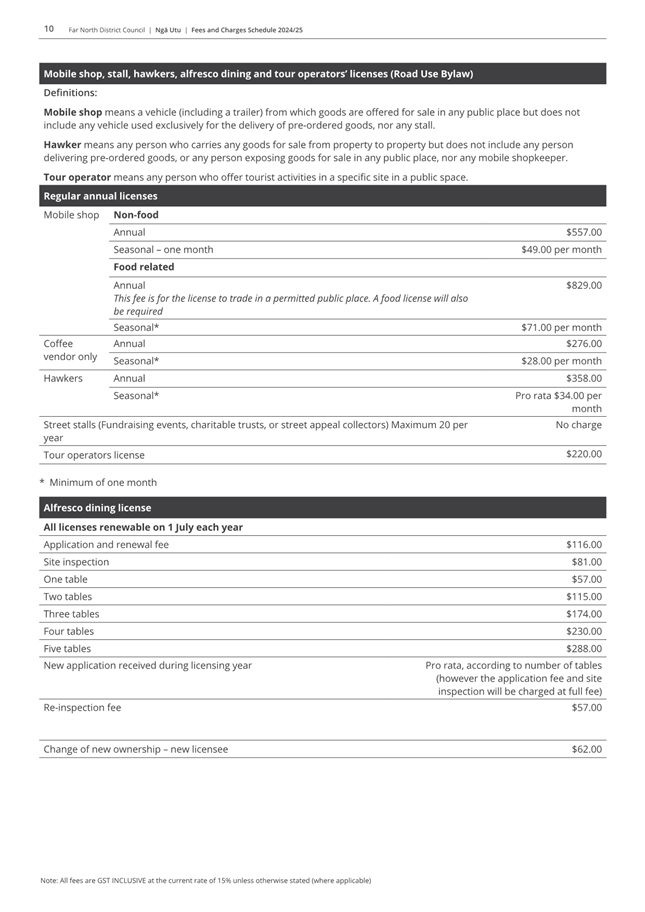

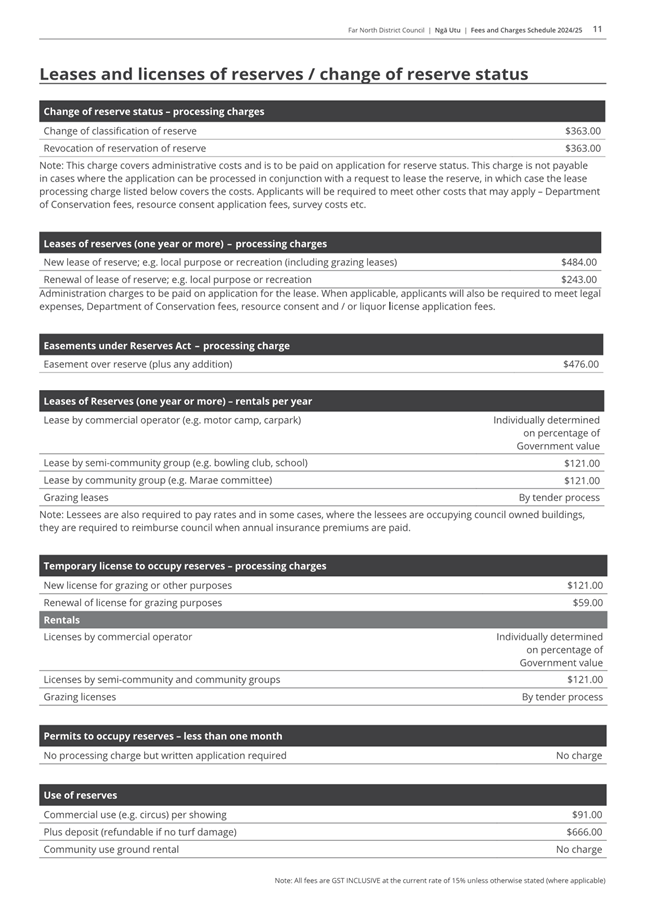

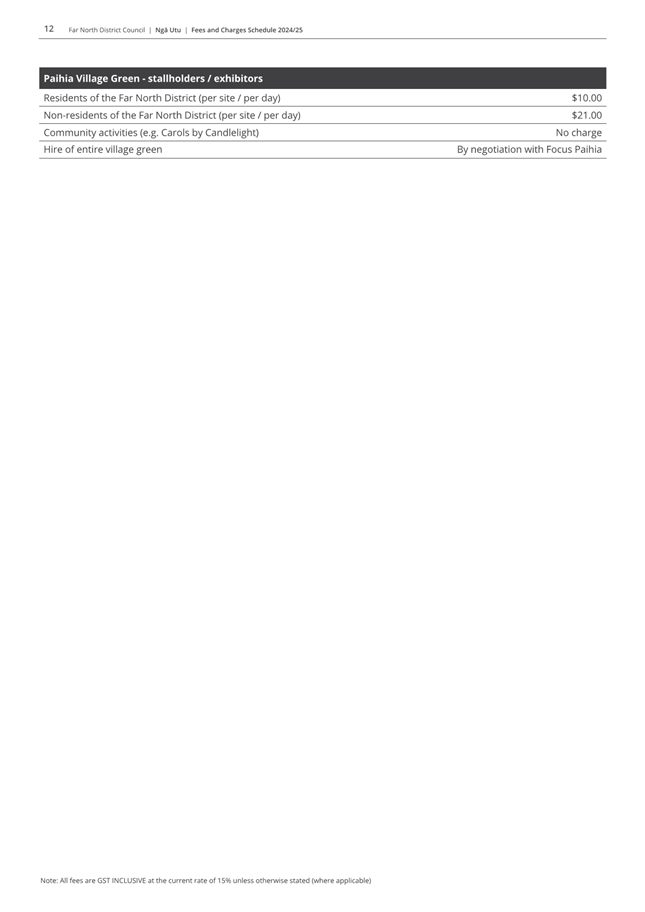

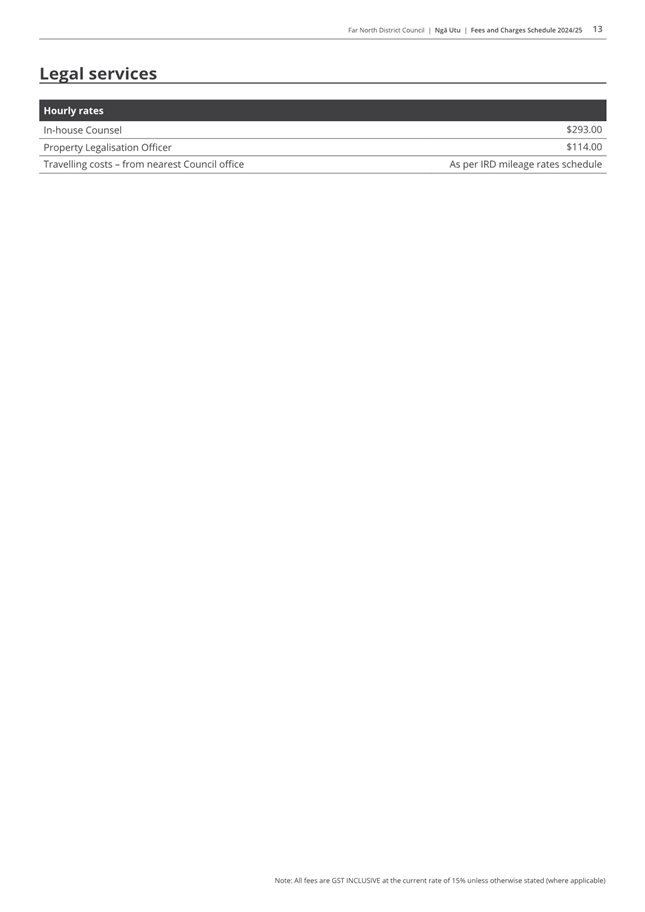

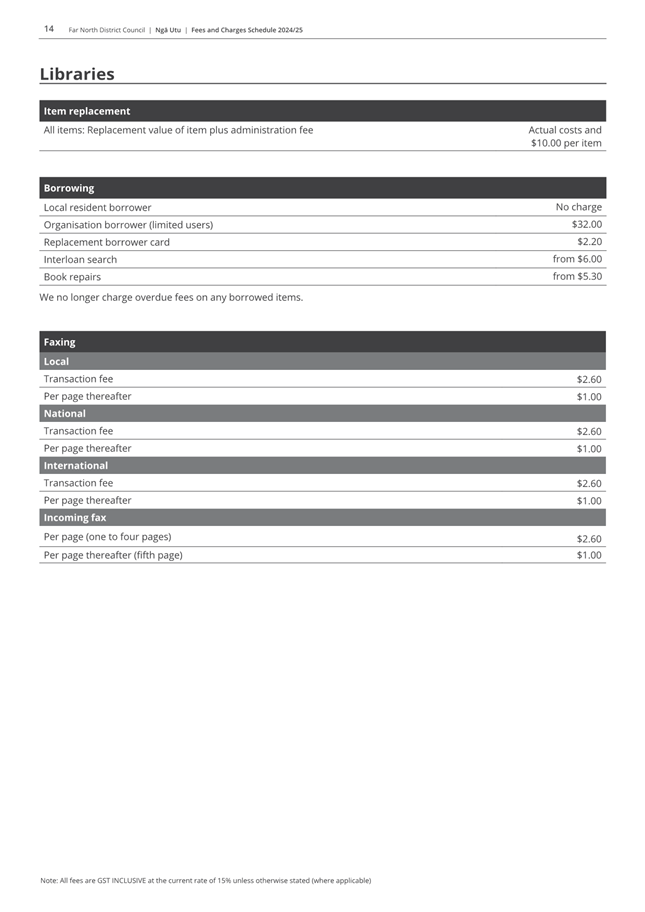

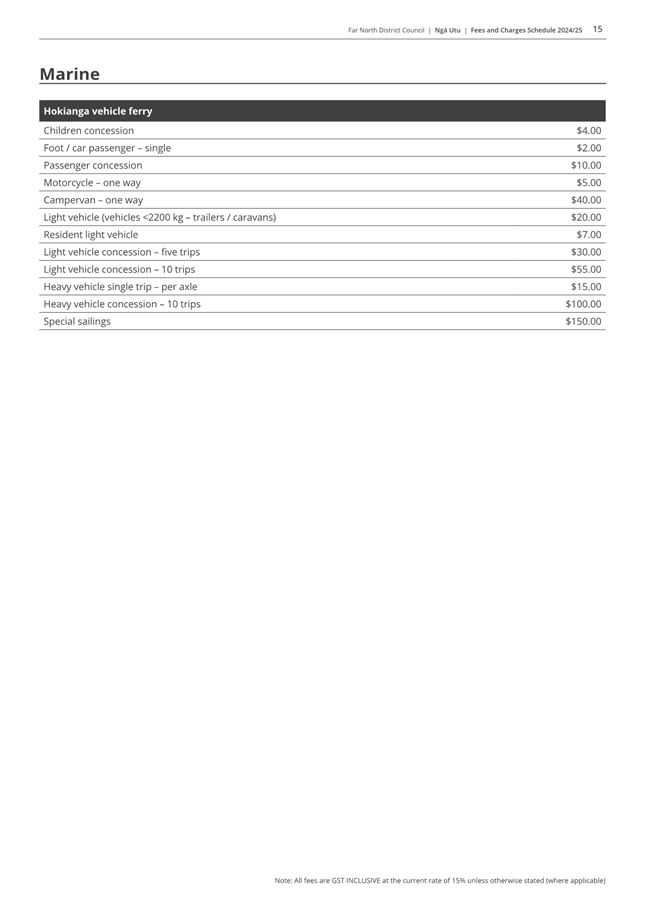

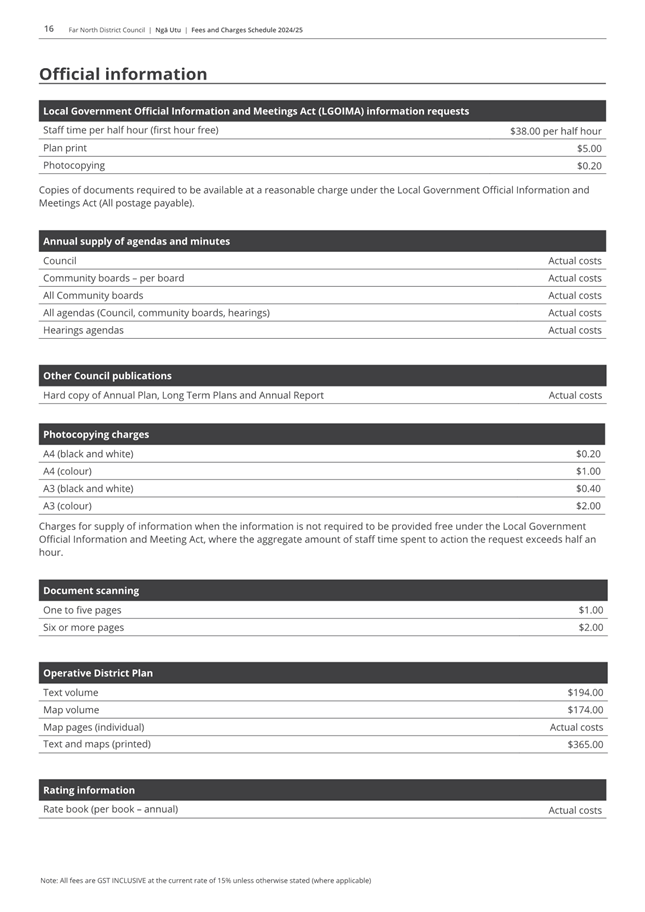

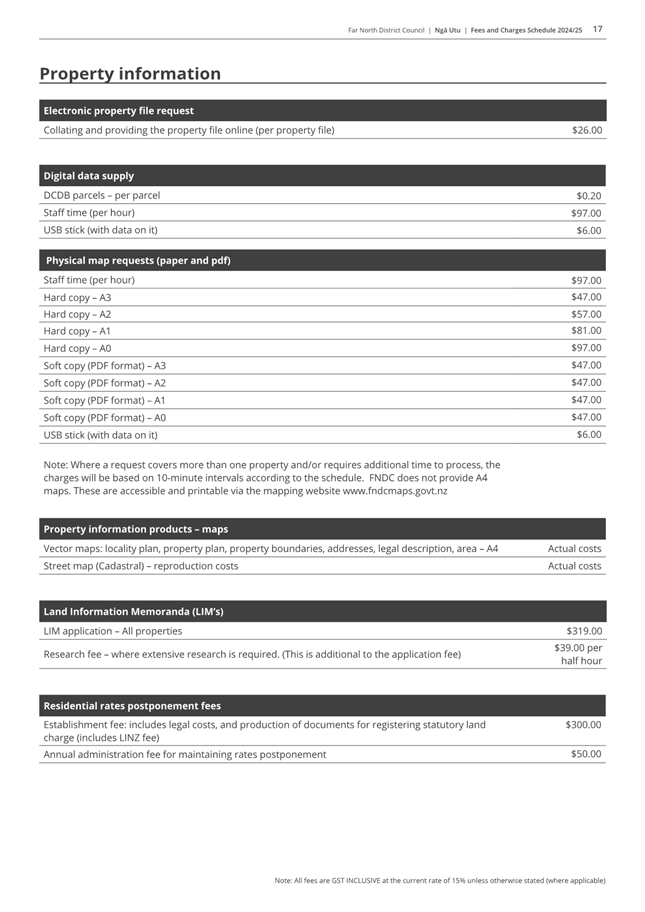

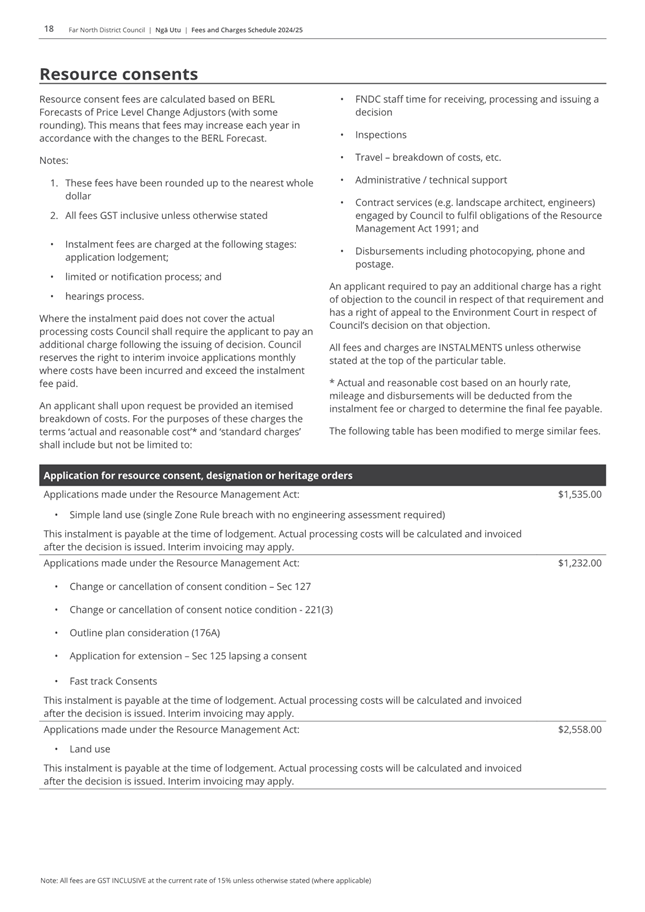

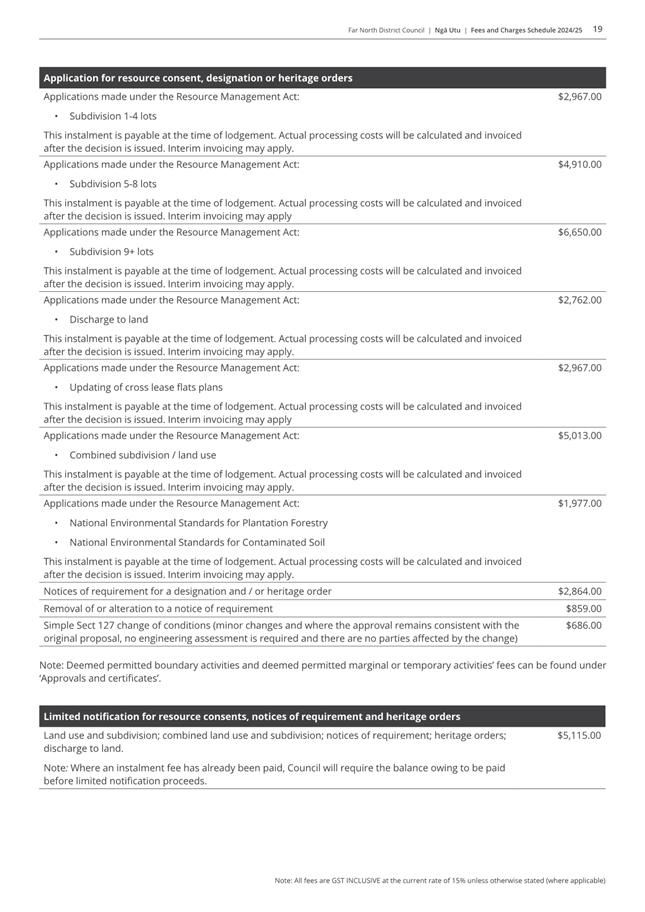

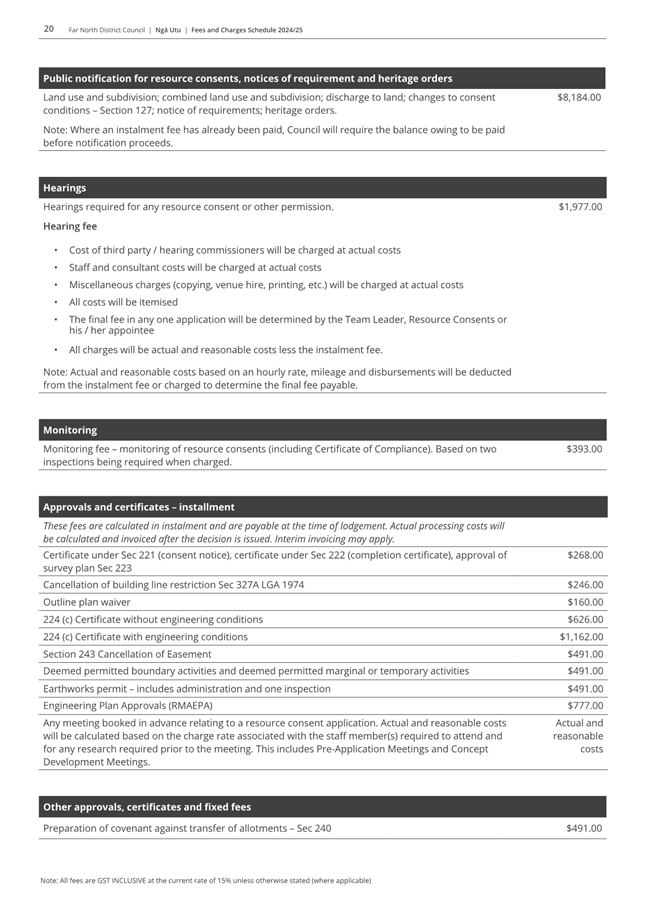

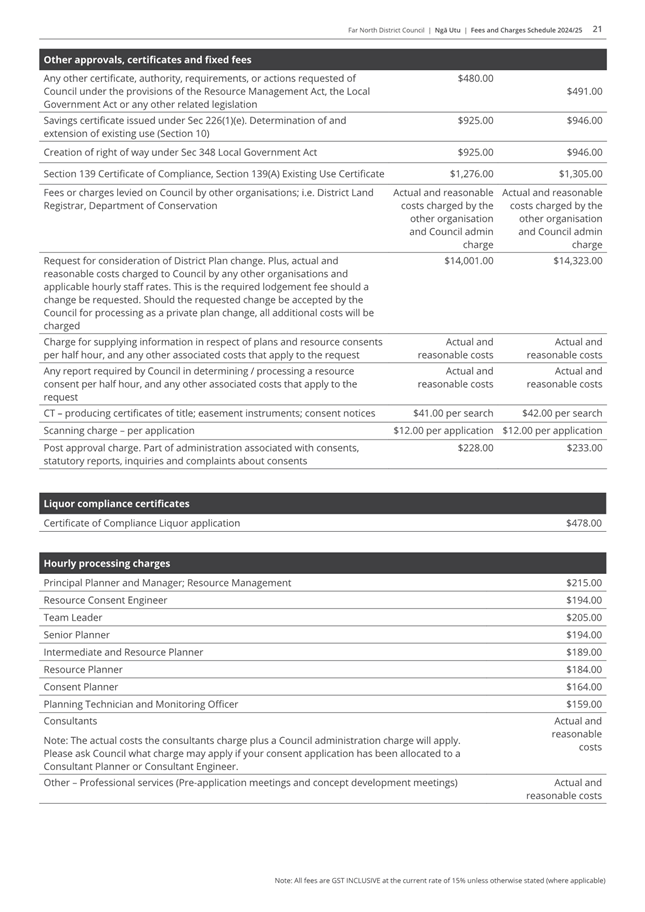

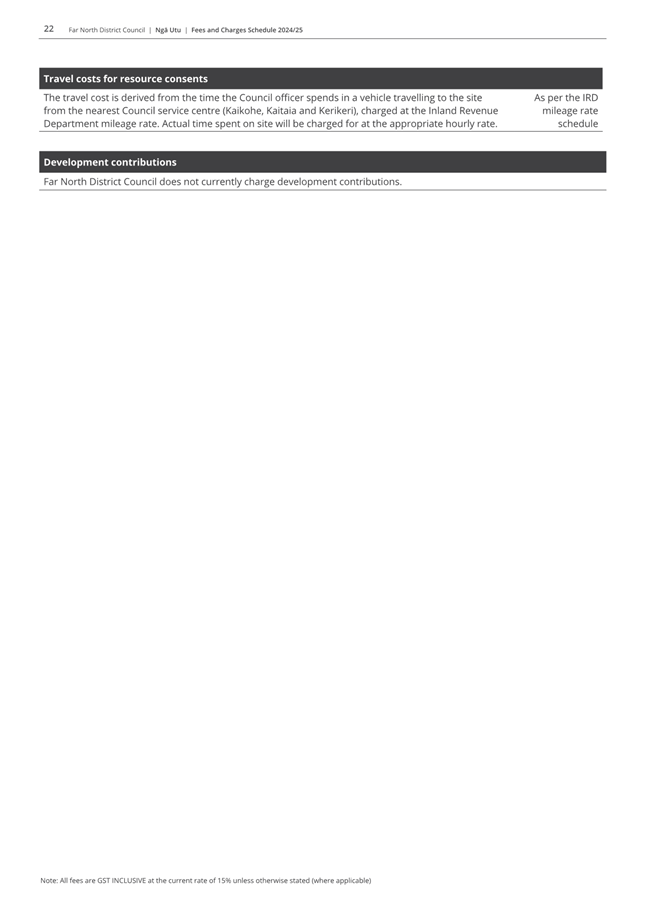

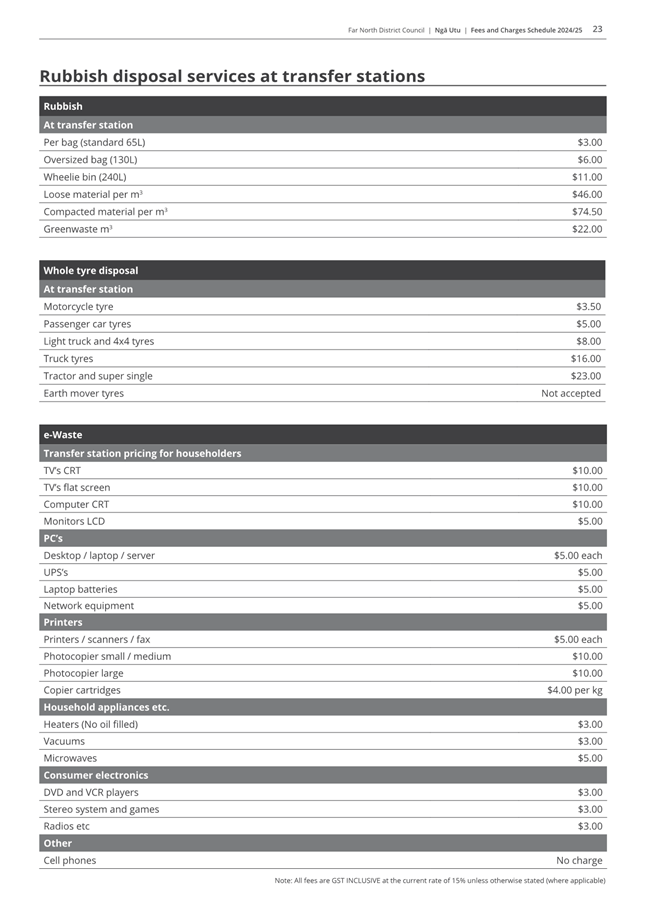

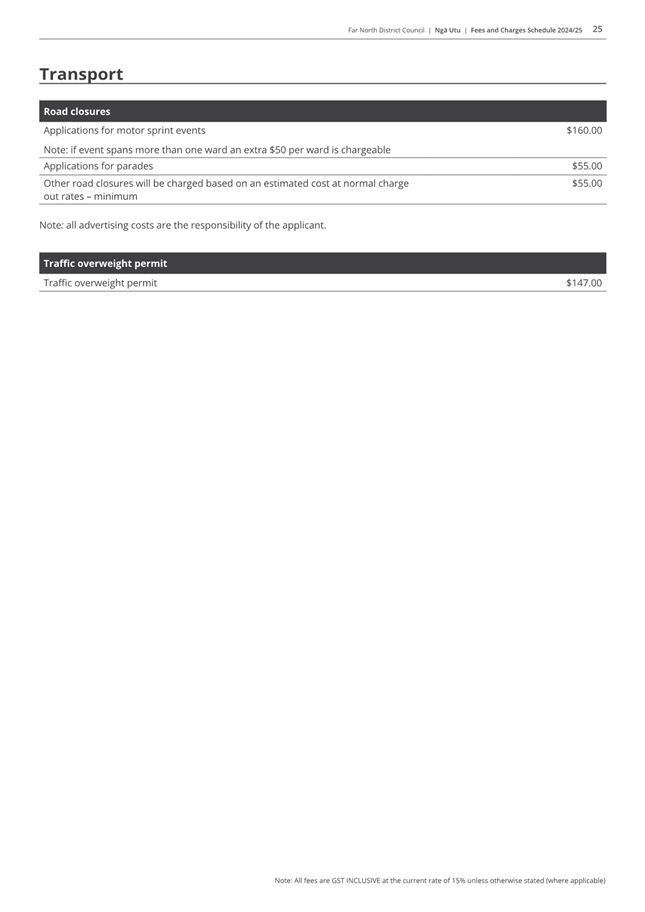

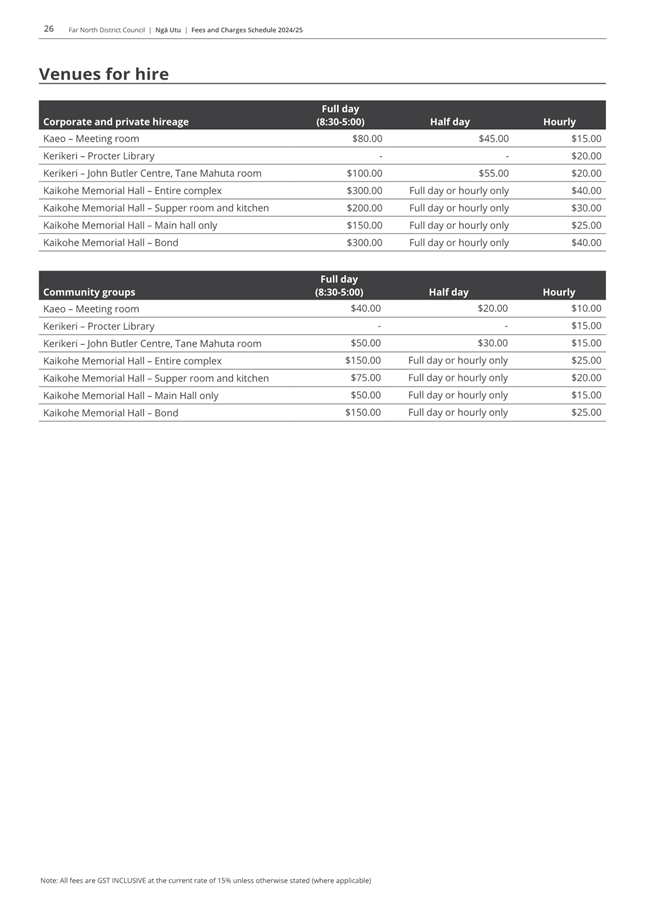

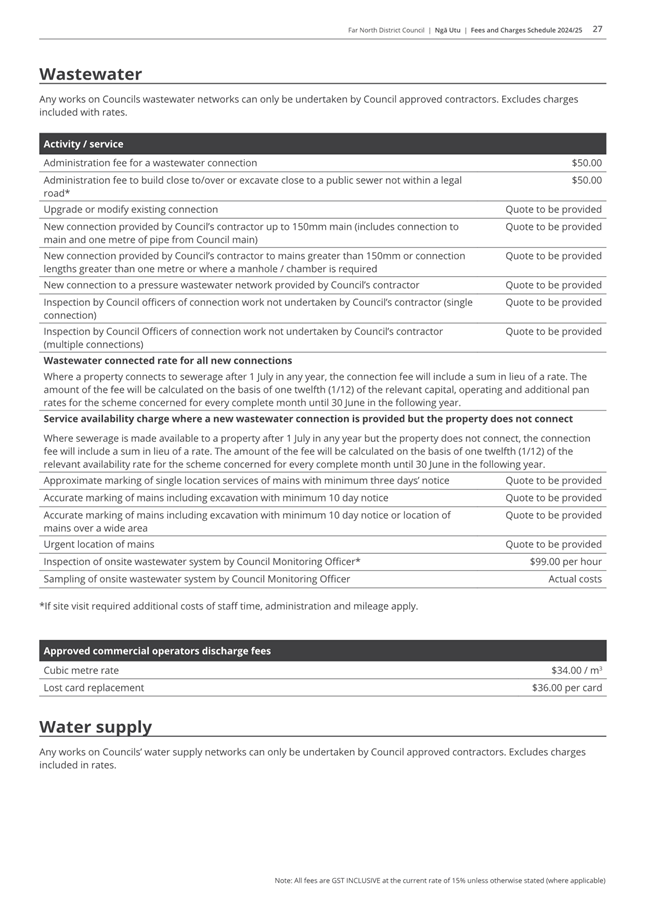

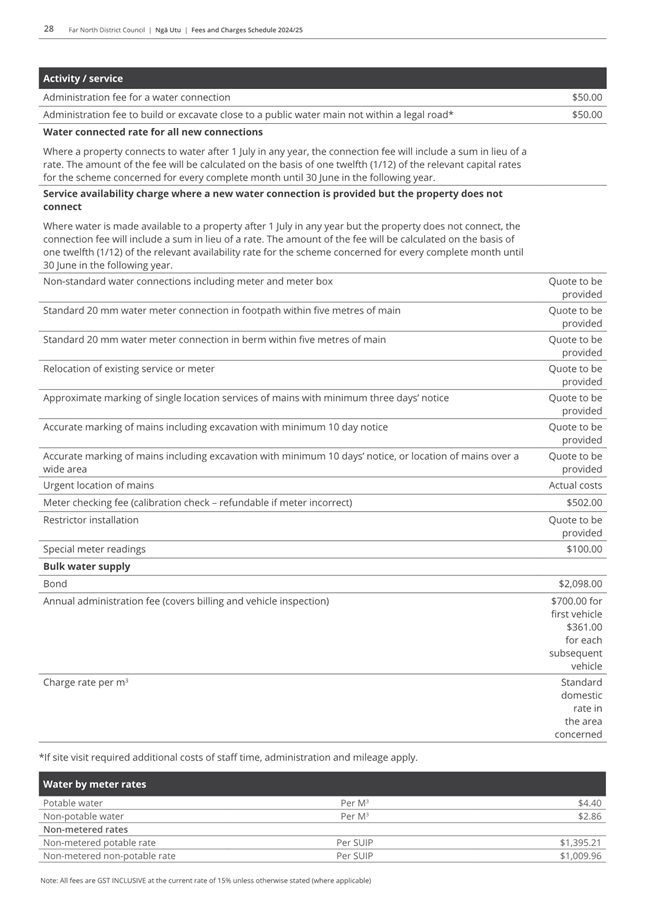

6.1 Adoption

of Fees and Charges for 2024/25

File

Number: A4756754

Author: Angie

Thomas, Team Leader - Accounting Services

Authoriser: Charlie

Billington, Group Manager - Corporate Services

Take Pūrongo / Purpose of the Report

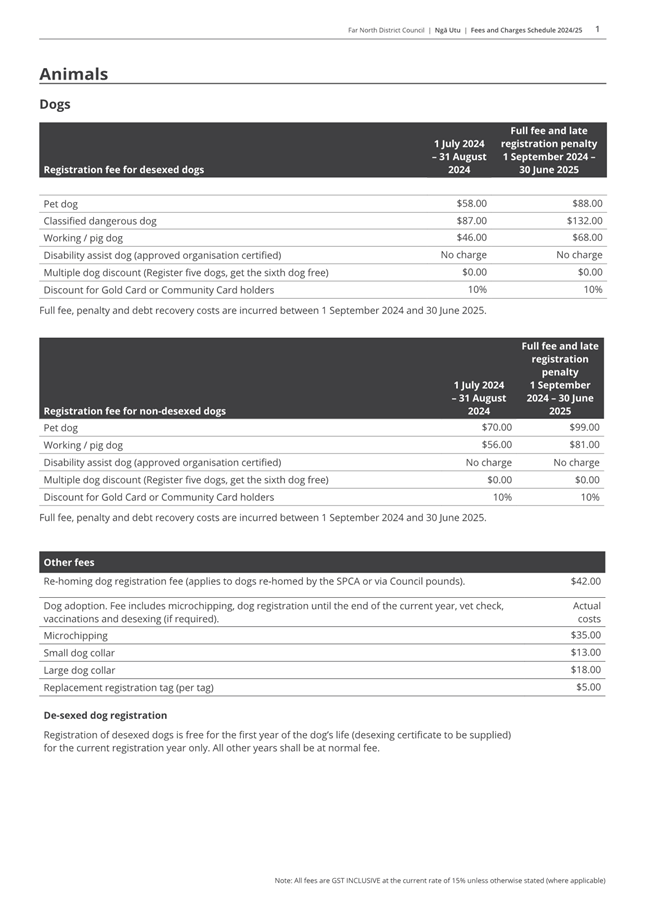

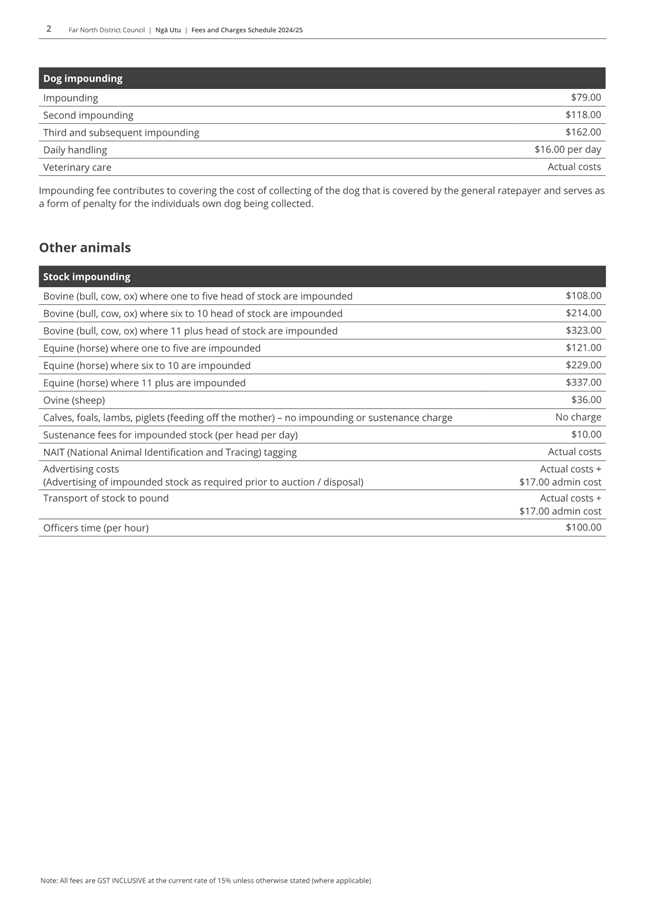

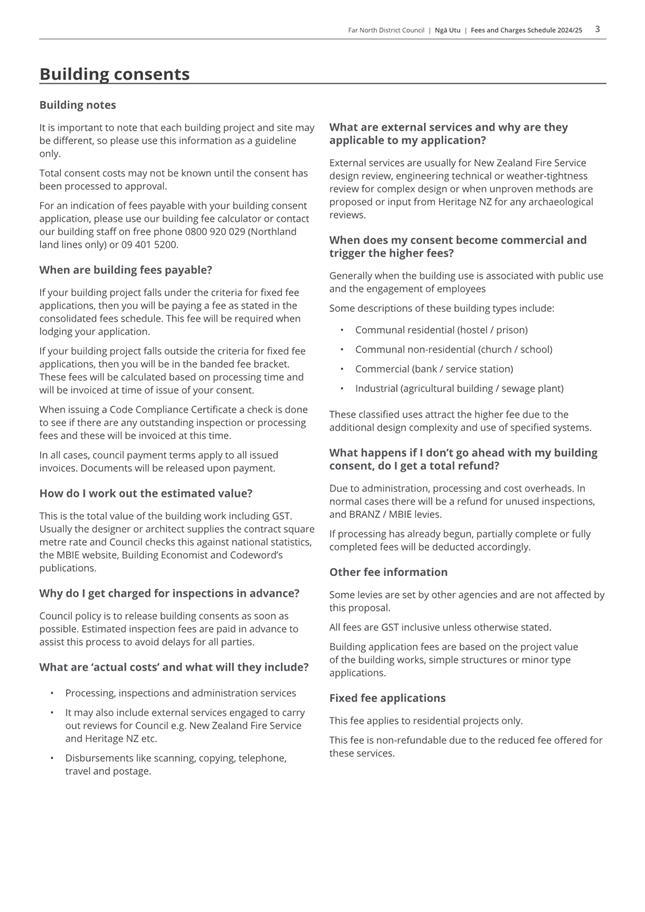

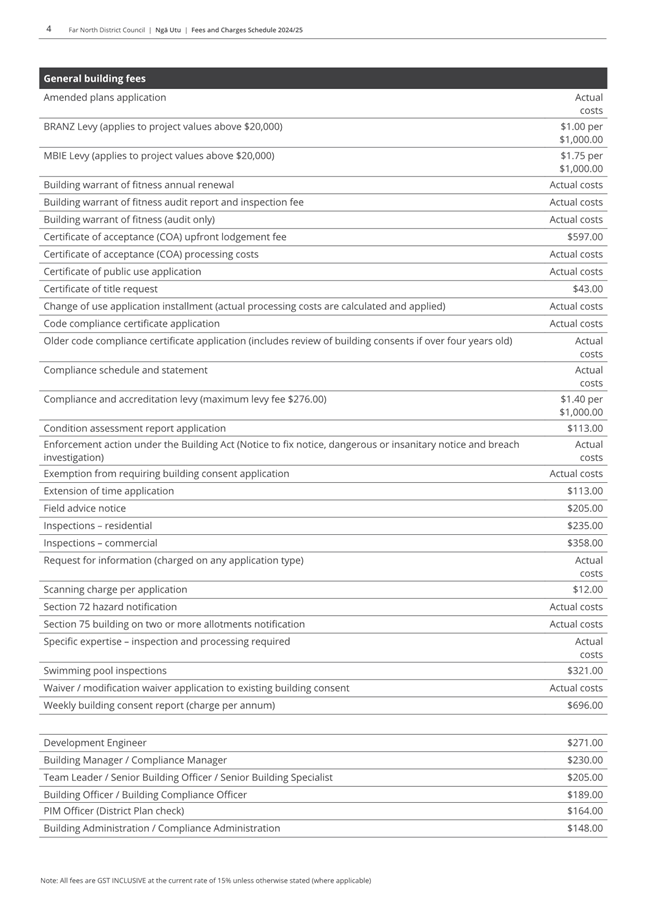

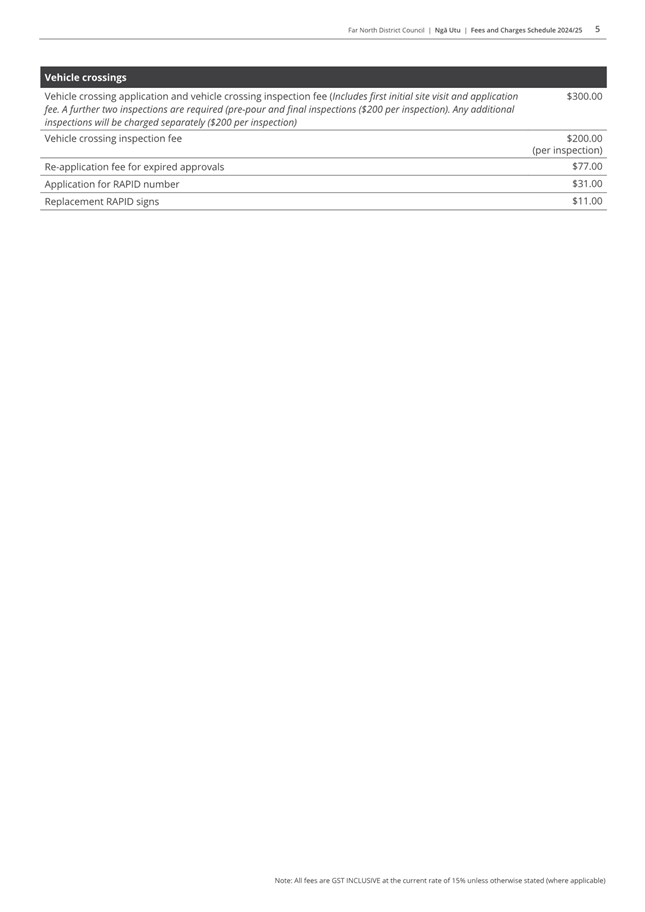

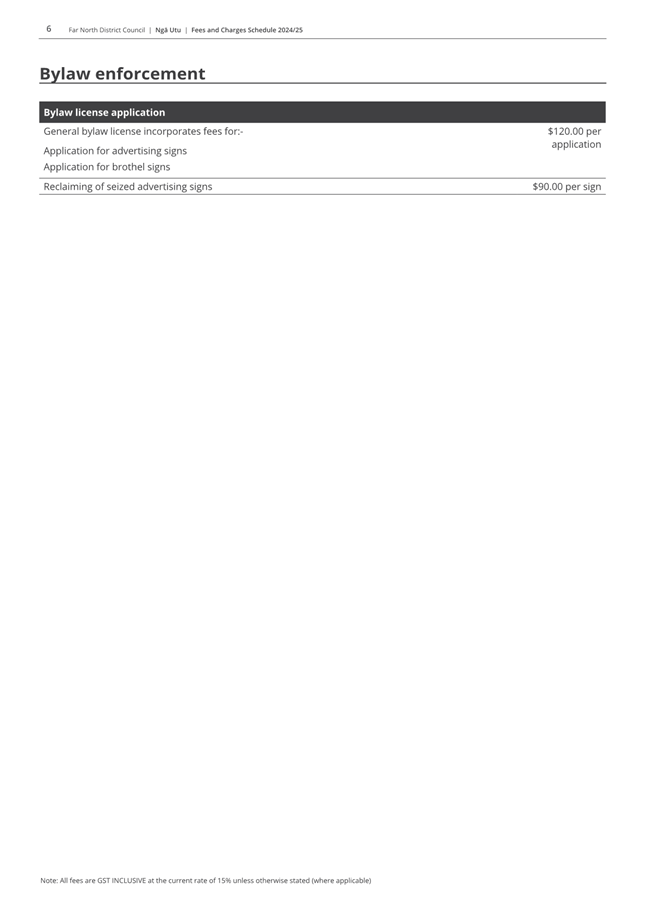

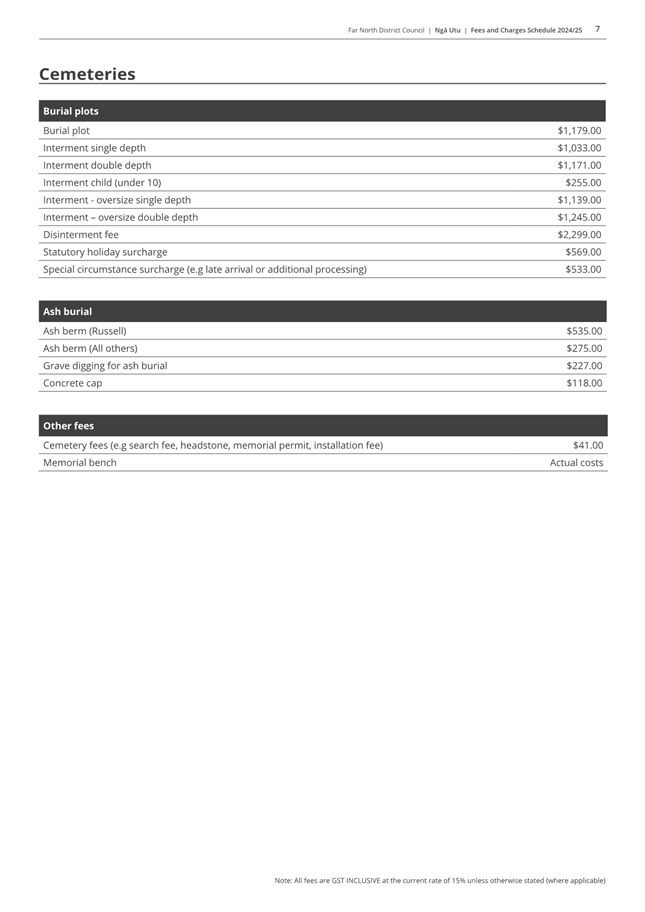

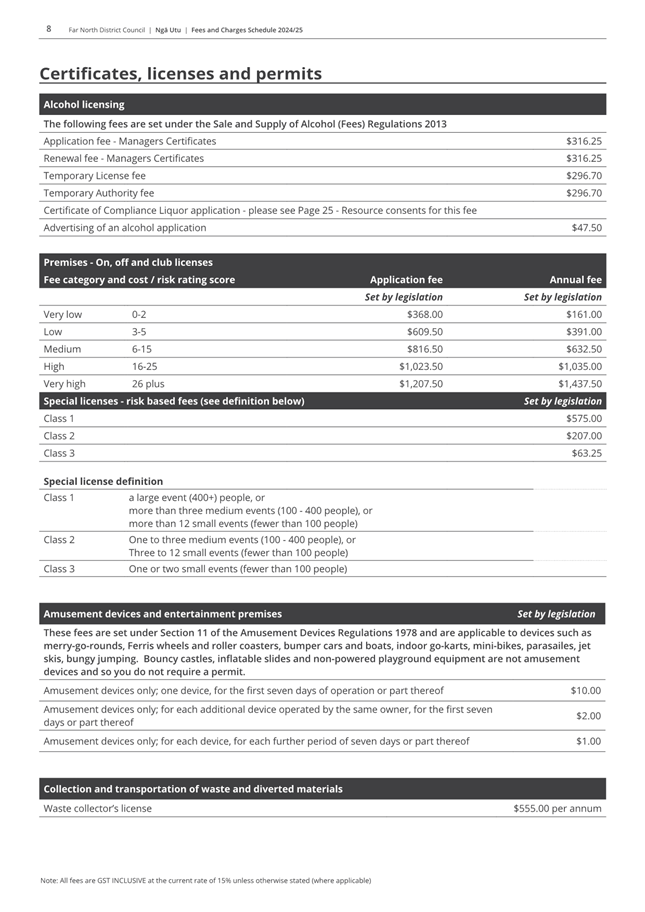

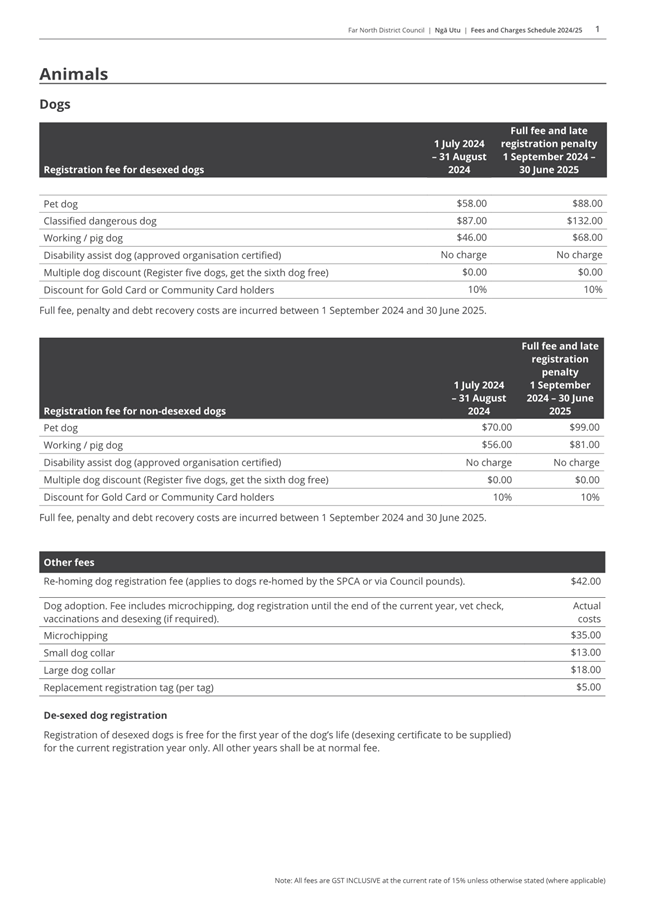

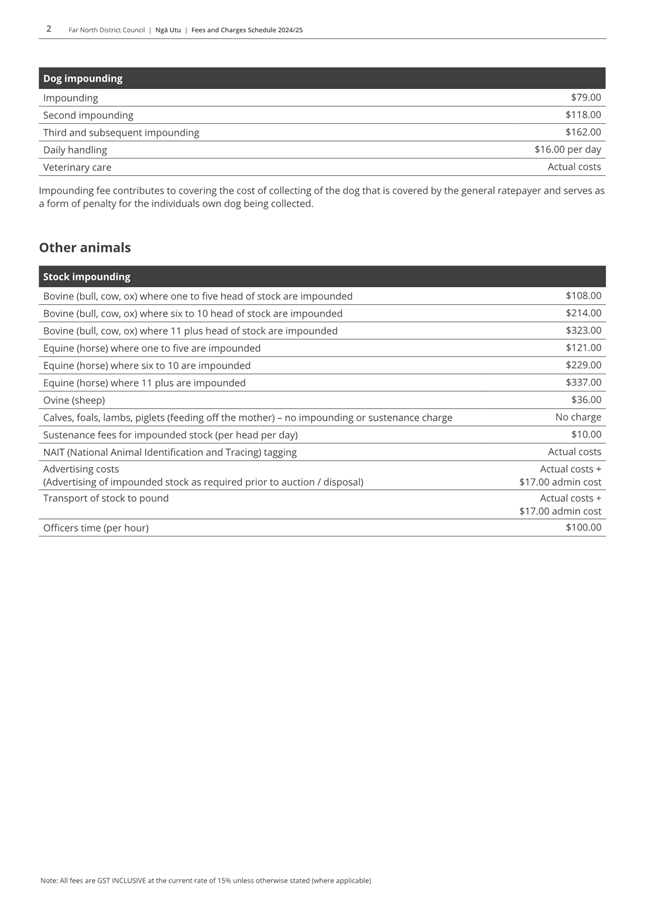

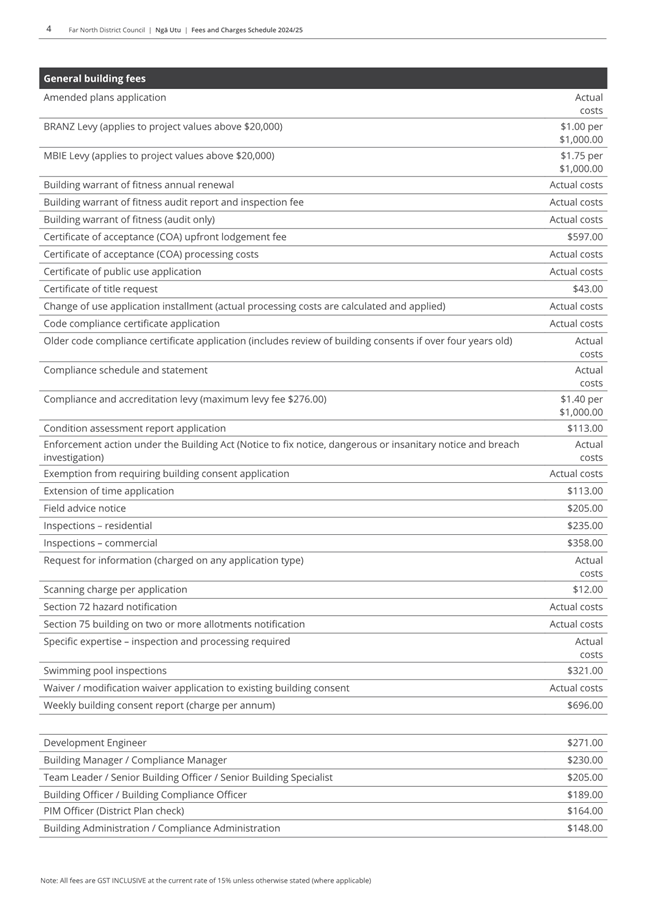

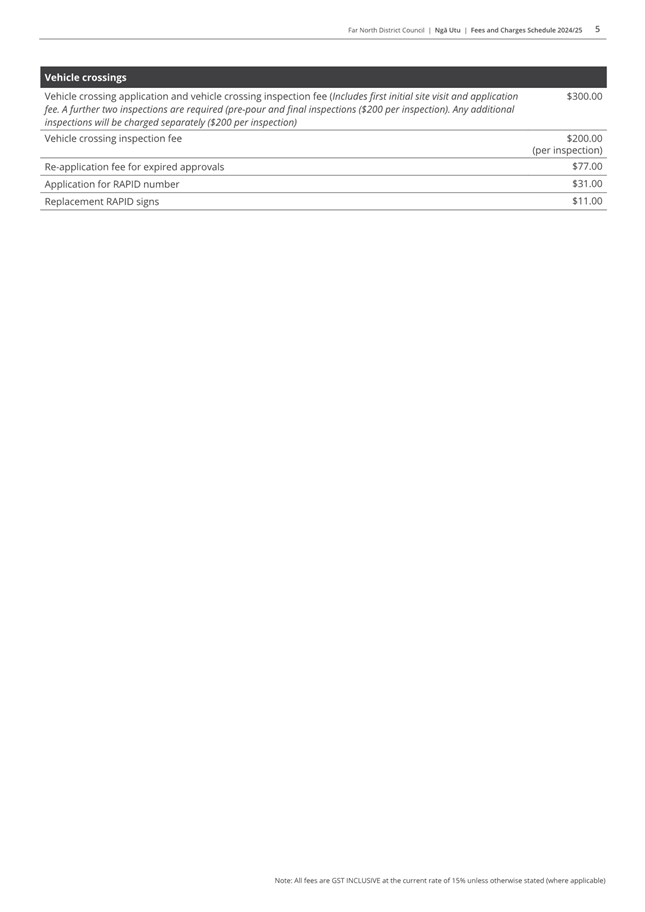

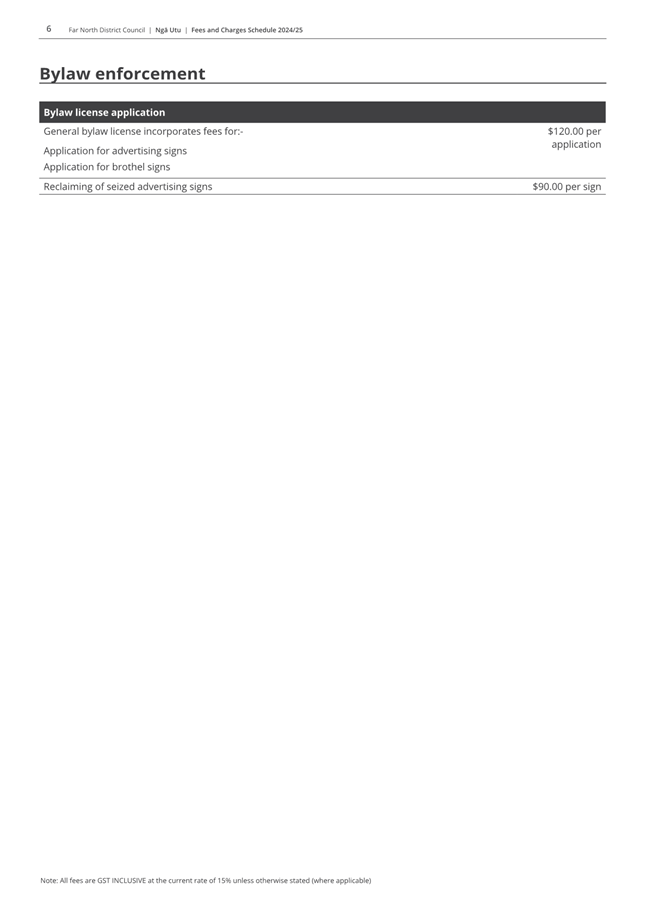

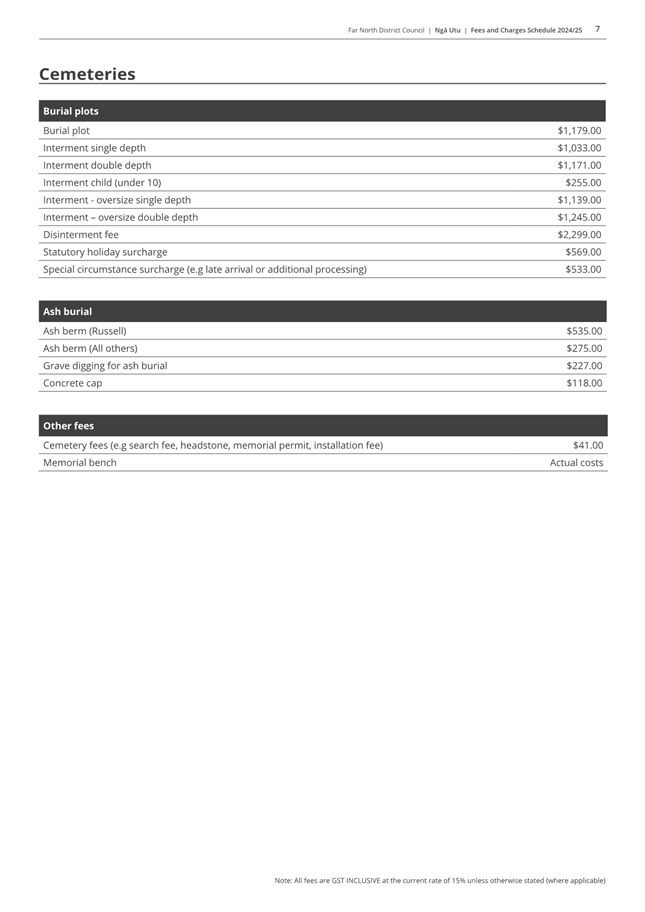

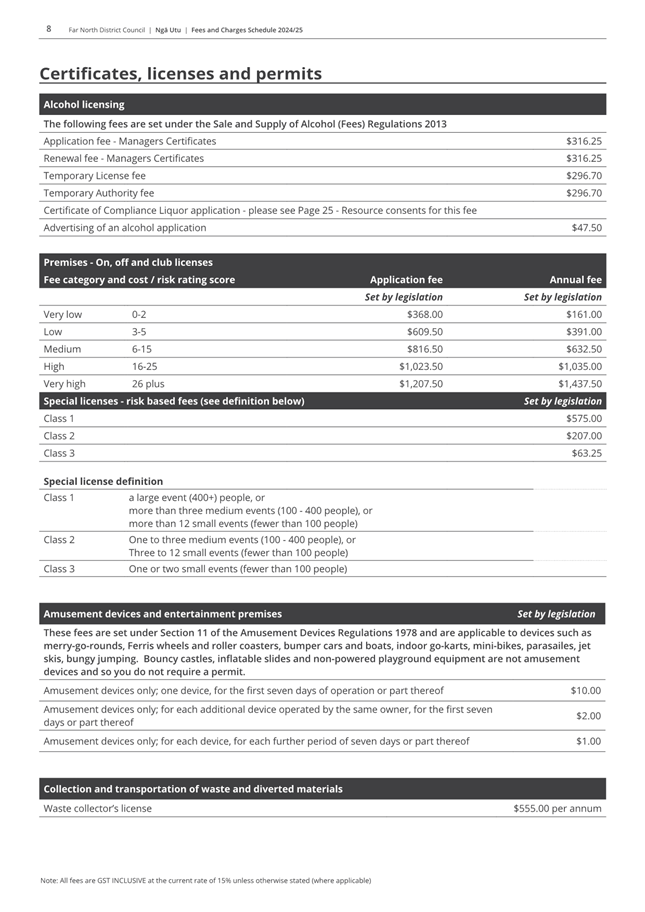

To adopt the schedule of fees and charges for the 2024/25 financial

year.

WhakarĀpopoto matua / Executive Summary

· Under

the Local Government Act 2002 (the LGA) Council is required to adopt an annual

schedule of fees and charges before the start of the financial year to which

they apply.

· For the

2024/25 financial year increases are limited to the Local Government Cost Index

(LGCI) inflation factor.

|

tŪtohunga

/ Recommendation

That Council:

a)

adopt the Schedule of Fees and Charges for 2024/25, and

b)

delegate the Chief Executive Officer authority to make any

final minor edits to the fees and charges prior to publication.

|

1) TĀhuhu kŌrero / Background

Council reviews and adjusts its fees and charges annually.

Although many fees and charges may be set by Council resolution, without

community consultation, under sections 12 and 150 of the LGA, some must follow

a formal process that includes public consultation in accordance with section

83 (the Special Consultative Procedure or SCP) of the LGA.

In the review of fees and charges for the 2024/25 financial

year, there were no new fees introduced, therefore only the Local Government

Cost Index (LGCI) inflation factor applies.

In March 2024, Council adopted

the Consultation Document and Supporting Information for the 2024–27 Long

Term Plan (LTP). All items were made publicly available on 27 March 2024.

Consultation continued until 29 April 2024. 506 submissions were received, and

more than 35 submitters spoke at hearings on 30 April to 3 May in Kaitāia

and Kaikohe. With public feedback in mind, Council formally deliberated changes

for inclusion in the final LTP on 06 June 2024 and 13 June 2024.

Although there were no changes

made to the fees and charges during deliberations, a SCP for Resource Consents

will occur during the 2024 calendar year. This will also allow staff to

look at any other revenue opportunities.

2) matapaki me NgĀ KŌwhiringa /

Discussion and Options

In general, fees have been adjusted by inflation (LGCI)

which is forecast at 2.4% for the 2024/25 financial year.

The Schedule of Fees and Charges for 2024/25 were part of

the supporting documentation during the consultation period for the Long term

plan 2024-27.

Take

Tūtohunga / Reason for the recommendation

The reason for the recommendation is to ensure an adopted

Schedule of Fees and Charges is in place prior to the start of the 2024/25

financial year.

3) PĀnga PŪtea me ngĀ

wĀhanga tahua / Financial Implications and Budgetary Provision

Forecast revenue from the Schedule of Fees and Charges for

2024/25 is recognised in the budget that will be adopted as part of the 2024-27

LTP.

If the Schedule of Fees and Charges is not adopted this will

have far reaching implications across all the 2024-27 LTP financials and rating

calculations for which the fee increases have been factored. There are also

specific legislative implications for Animal Management under the Dog Control

Act 1996 section 37 (6). The territorial authority shall, at least once

during the month preceding the start of registration year, publicly notify in a

newspaper circulating its district, the dog control fixed fees for the

registration year.

Āpitihanga

/ Attachments

1. Fees

and Charges Schedule 2024-25 - A4757340 ⇩

Hōtaka Take Ōkawa / Compliance Schedule:

Full consideration has been given to the provisions of the

Local Government Act 2002 S77 in relation to decision making, in particular:

1. A

Local authority must, in the course of the decision-making process,

a) Seek

to identify all reasonably practicable options for the achievement of the

objective of a decision; and

b) Assess

the options in terms of their advantages and disadvantages; and

c) If

any of the options identified under paragraph (a) involves a significant

decision in relation to land or a body of water, take into account the

relationship of Māori and their culture and traditions with their

ancestral land, water sites, waahi tapu, valued flora and fauna and other

taonga.

2. This

section is subject to Section 79 - Compliance with procedures in relation to

decisions.

|

He

Take Ōkawa / Compliance Requirement

|

Aromatawai

Kaimahi / Staff Assessment

|

|

State the level of significance

(high or low) of the issue or proposal as determined by the Council’s

Significance and Engagement Policy

|

Significance of the proposed

changes to the schedule of fees and charges is assessed as low.

|

|

State the relevant Council

policies (external or internal), legislation, and/or community outcomes (as

stated in the LTP) that relate to this decision.

|

The proposed schedule of Fees and

Charges links to the 2024–27 Long Term Plan.

|

|

State whether this issue or

proposal has a District wide relevance and, if not, the ways in which the

appropriate Community Board’s views have been sought.

|

Fees and charges hold

district-wide relevance. Community Boards provided input to the LTP in which

the Financial Strategy (and the limit on annual fee / charge adjustments)

were adopted.

|

|

State the possible implications for Māori

and how Māori have been provided with an opportunity to contribute to

decision making if this decision is significant and relates to land and/or

any body of water.

State the possible implications and how this

report aligns with Te Tiriti o Waitangi / The Treaty of Waitangi.

|

Consultation was carried out in

accordance with section 83 of the LGA.

|

|

Identify persons likely to be

affected by or have an interest in the matter, and how you have given

consideration to their views or preferences (for example – youth, the

aged and those with disabilities).

|

Resource consent fees relate

mostly to property developers and those who subdivide their land. Direct

communications with known practitioners occurred. All other proposals were

considered to be of general interest to all demographics.

|

|

State the financial implications

and where budgetary provisions have been made to support this decision.

|

No specific budgetary provisions

are required for adjusting fees and charges.

|

|

Chief Financial Officer review.

|

The Chief Financial Officer has

reviewed this report

|

|

Extraordinary

Council Meeting Agenda

|

26 June 2024

|

6.2 Adoption

of the 2024-27 Long Term Plan

File

Number: A4749755

Author: Angie

Thomas, Team Leader - Accounting Services

Authoriser: Charlie

Billington, Group Manager - Corporate Services

Take Pūrongo / Purpose of the Report

To adopt the Long Term Plan

(LTP) for 2024 – 2027.

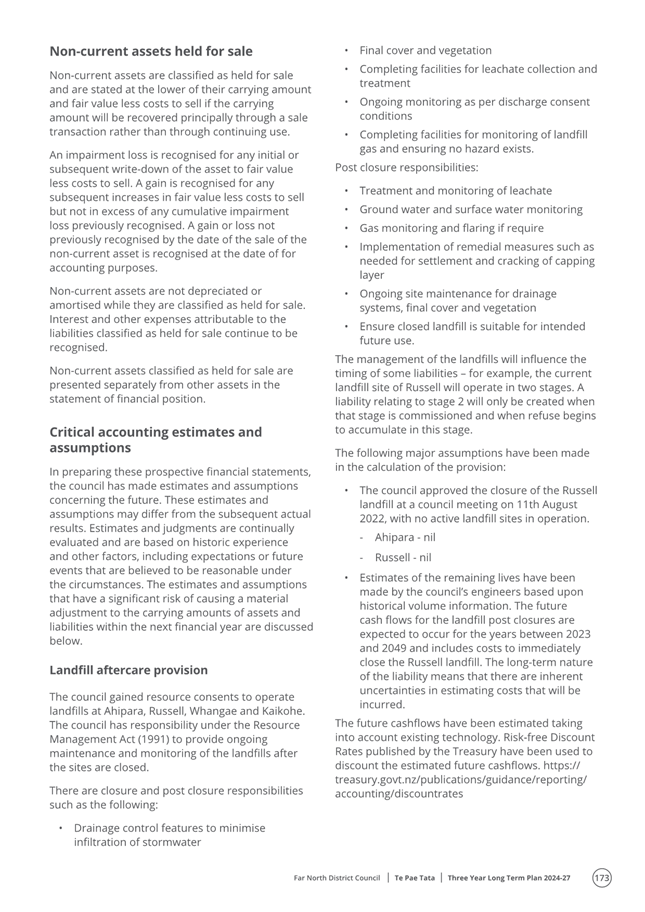

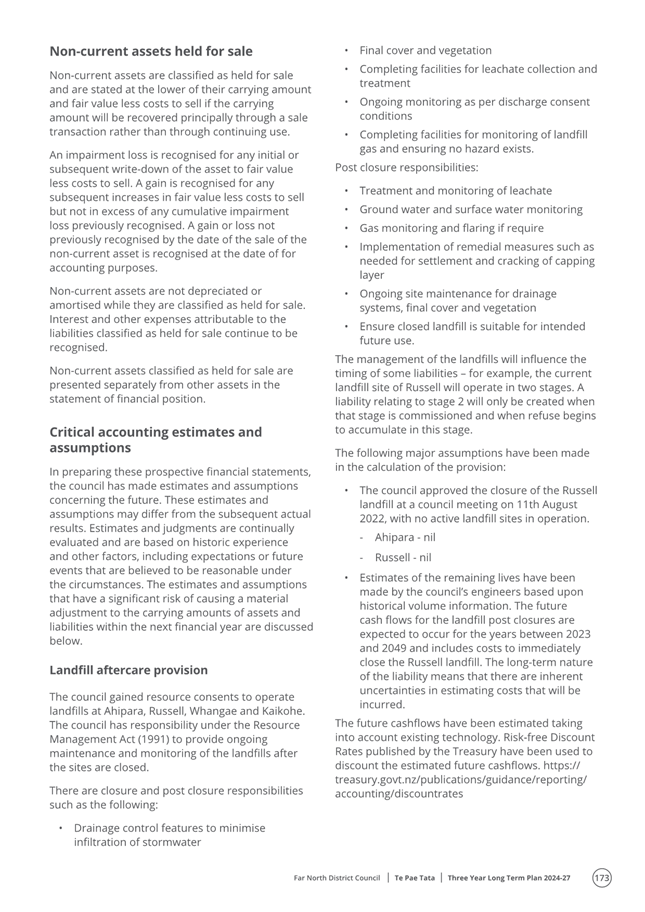

WhakarĀpopoto matua / Executive Summary

· The Local Government Act 2002 (the Act) requires a Council to have,

at all times, a LTP. The LTP must be adopted before commencement of the first

financial year to which it relates.

· Council adopted its Consultation Document for the 2024-27 LTP, along

with supporting information including strategies, policies, forecast financial

statements and work programmes, in March 2024, and consulted from 27 March 2024

until to 29 April 2024 in accordance with the Special Consultative Procedure.

· 506 submissions were received. Over 35 people spoke to their

submissions at public hearings on 30 April to 3 May in Kaitāia and Kaikohe. Kahika, Councillors,

Community Board Members, the Chief Executive Officer and senior managers

attended these hearings.

· The LTP presented for adoption was developed from the supporting

information that was previously adopted with the Consultation Document in March

(Council’s “we need to talk” with the community) and amended

in accordance with the decisions made by Council at the Deliberations meeting

on 06 June 2024 and Council meeting 13 June 2024.

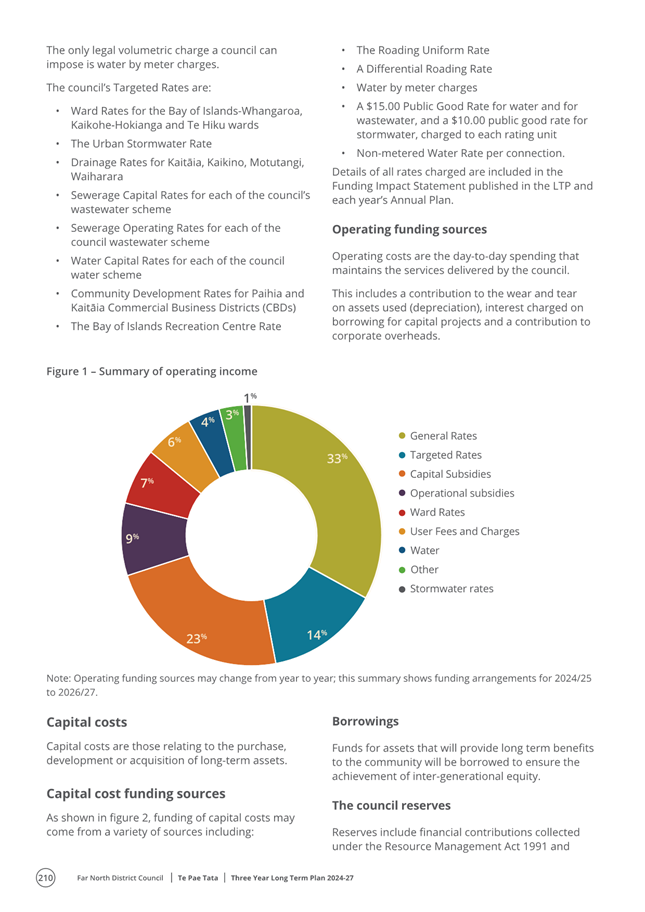

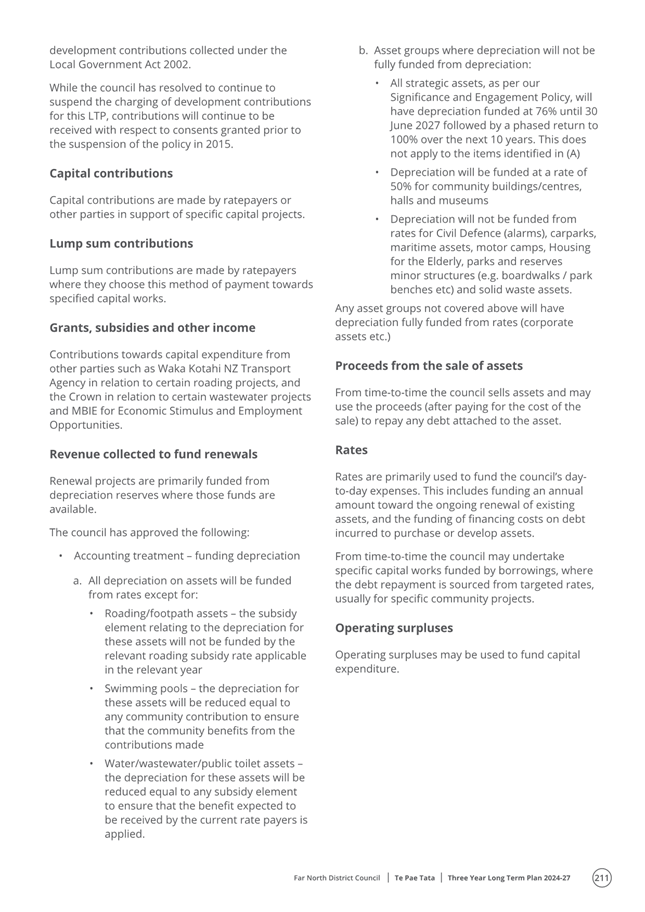

· The Revenue and Financing Policy, which shows how Council proposes

to fund its operating and capital expenditures, must be adopted for inclusion

in the LTP.

· The Treasury, Liability and Investment Policies which outline the

policies and procedures in respect to treasury activity undertaken by the

council, must also be adopted. These were included in the Consultation Document

supporting information and have undergone no material changes.

· The LTP must then be adopted to enable the setting of rates for the

2024/2025 financial year.

|

tŪtohunga

/ Recommendation

That Council:

a) adopt

the Revenue and Financing Policy contained in the final 2024-27 Long Term

Plan and the Treasury, Liability and Investment Policies; and,

b) adopt

the 2024–27 Long Term Plan as amended in accordance with the decisions

made at the Deliberations meeting held on 06 June 2024 and the Council

meeting held on 13 June 2024, and

c) authorise

the Chief Executive Officer to approve any minor accuracy, grammatical or

formatting amendments prior to the 2024-27 Long Term Plan and associated

documents being published or uploaded onto the Far North District Council

website.

|

1) TĀhuhu kŌrero / Background

The adoption of an LTP is a

requirement of Section 93 of the Local Government Act 2002. The process to be

followed and / or matters to be taken into account are contained in Part 6 of

the Act which encompasses Council’s decision making (sections 76 –

81), consultation processes (sections 82 – 90), and planning (sections 93

– 94). Council then follows the necessary Special Consultative Procedure

prescribed by the legislation.

However, 8 Councils were

approved to apply the Severe Weather Emergency (Local Government Act 2002 -

Long-term Plan) Order 2023 to address the impact of the severe weather related

events. Instead of producing an audited long-term plan covering 10 consecutive

years, a minimum of 3 years was required to enable Councils to focus on

recovery which is less resource intensive but still provides a strategic

direction in the medium term.

In March 2024, Council adopted

the Consultation Document and Supporting Information for the 2024–27 LTP.

All items were made publicly available on 27 March 2024. Consultation continued

until 29 April 2024. 506 submissions were received, and more than 35 submitters

spoke at hearings on 30 April to 3 May in Kaitāia and Kaikohe. With public

feedback in mind, Council formally deliberated changes for inclusion in the

final LTP on 06 June 2024 and 13 June 2024.

2) matapaki me NgĀ KŌwhiringa /

Discussion and Options

The 2024-27 LTP presented for

adoption was compiled from the supporting information that was previously

adopted with the Consultation Document in March (Council’s “we need

to talk” with the community) and was amended in accordance with the

decisions made by Council at the Deliberations meeting held on 06 June 2024 and

13 June 2024. These decisions were guided by community input gathered through

consultation and engagement, the submissions process, and public hearings.

Changes agreed at deliberations

are summarised in The Right Debate section of the LTP. Other changes relating

to a range of operational issues have also been incorporated into the final LTP

as a result of additional or updated information that became available after

the adoption of the Consultation Document and its supporting information.

While Councillors have already

received the majority of the material presented in the LTP (i.e. the supporting

information including strategies, policies, forecast financial statements, work

programmes and other material), the front section of the document is new. This

section serves to provide structure and includes:

· A message from the

Mayor and Chief Executive Officer

· Council, Community

Boards and committees and delegations

· Strategic linkages

including community outcomes and strategic priorities

· An overview of

Council’s approach to working in partnership with Māori

· A summary of what

we consulted on and the changes that were made as a result of consultation.

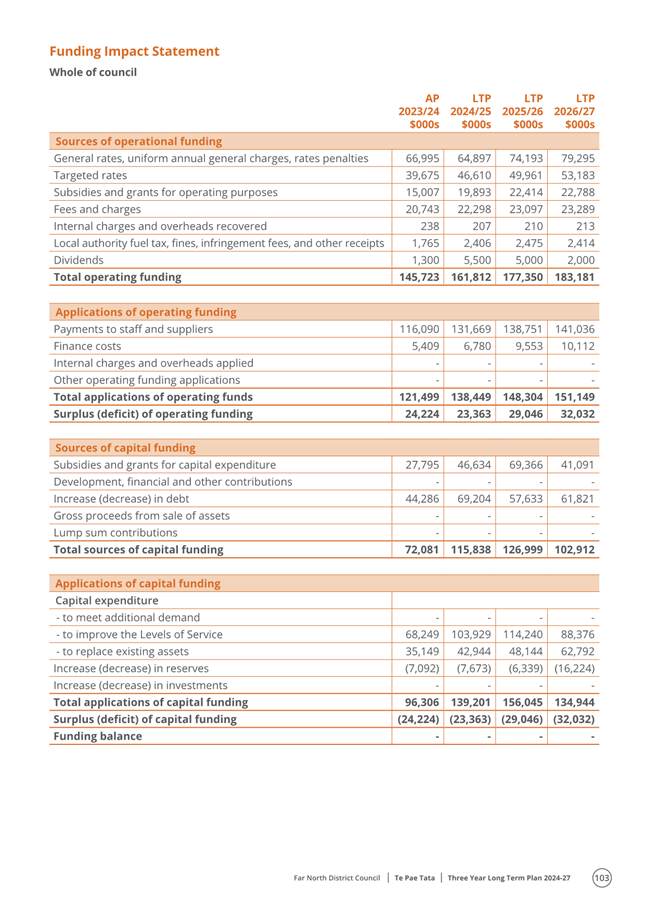

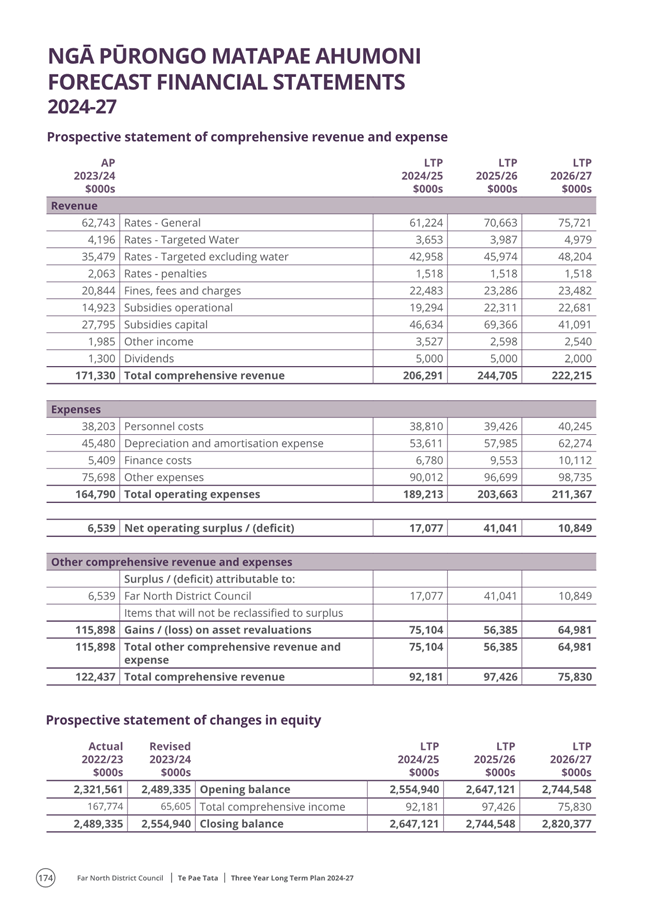

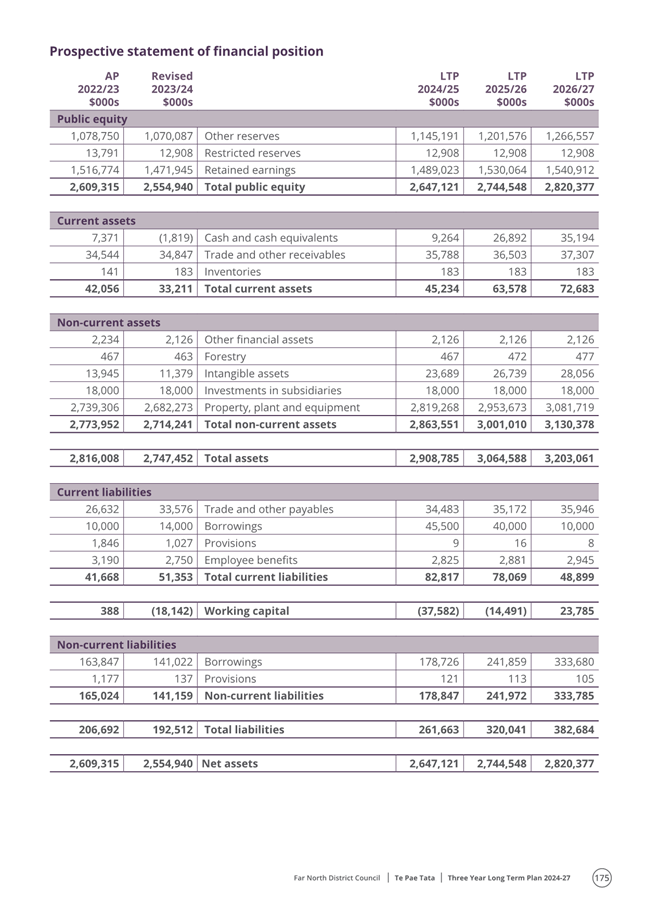

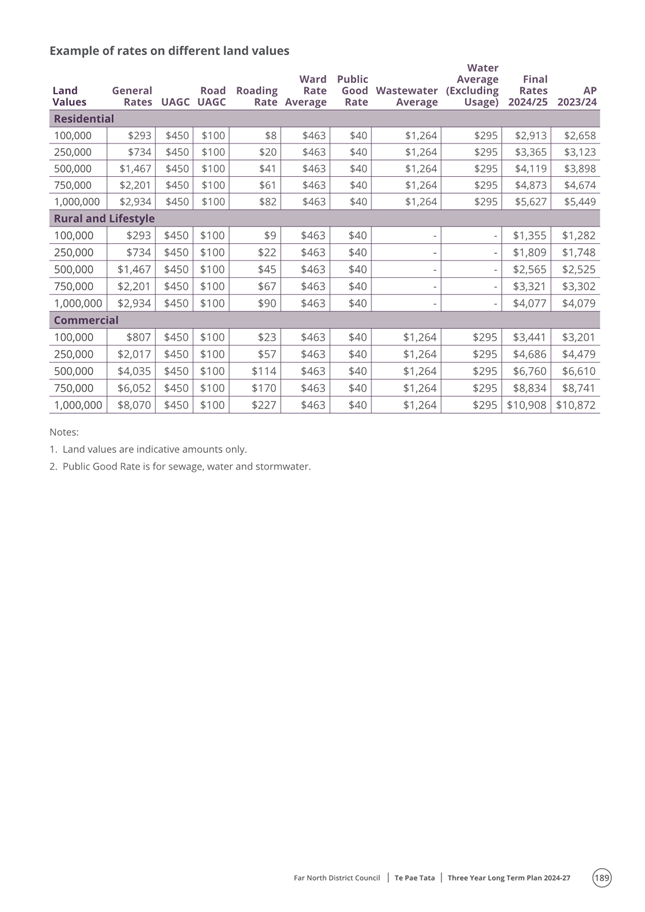

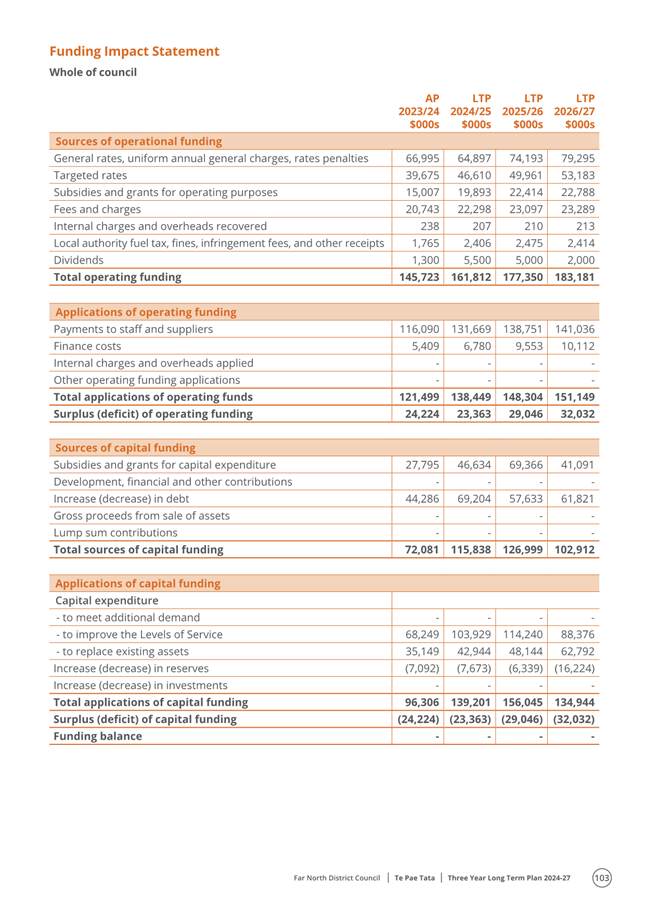

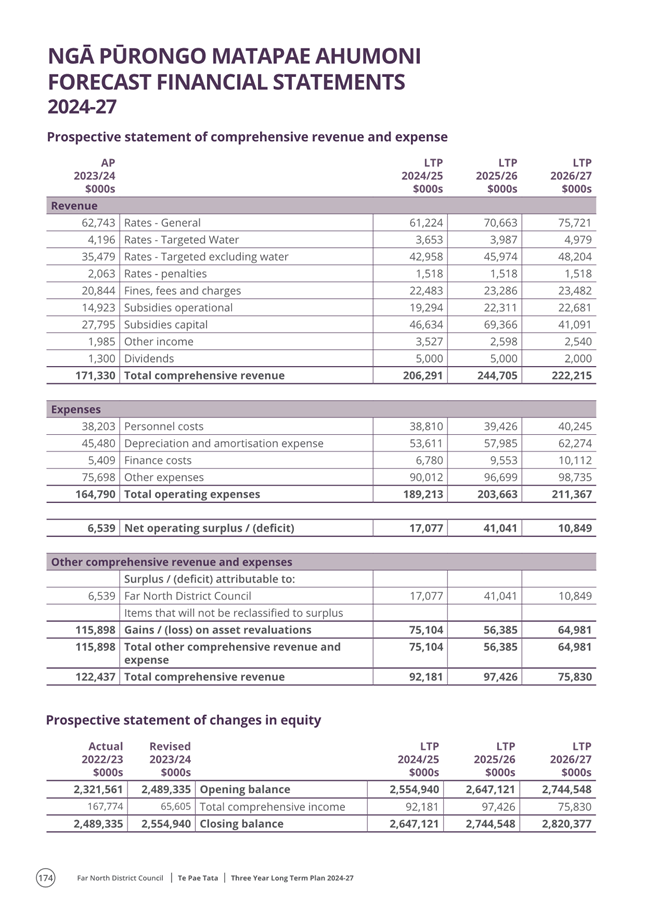

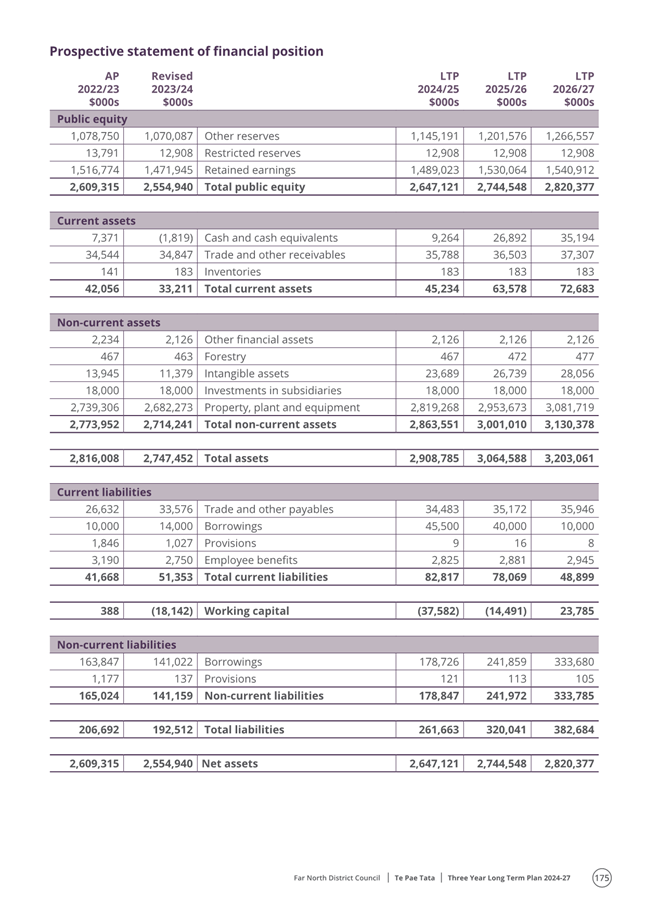

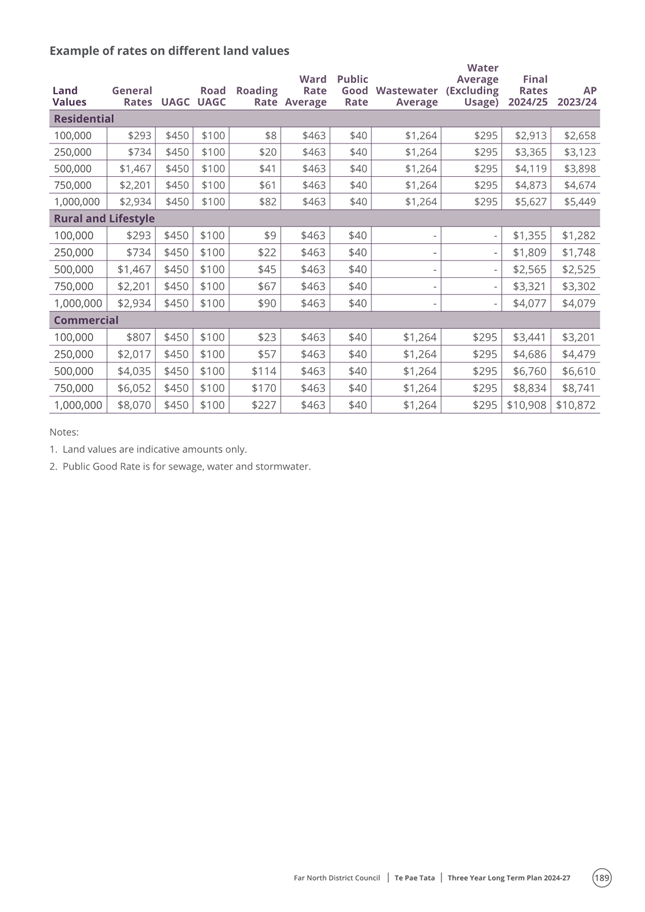

Key elements of the LTP for the 2024-27 years are:

· A balanced budget

in each year, where revenue exceeds expenditure (including depreciation)

· A rate to rate

increase of 4.5% in 2024/25. Total range of rates revenue ranging from

$112 million to $132 million.

· Net debt forecast

from $224 million to $291 million.

· Total annual

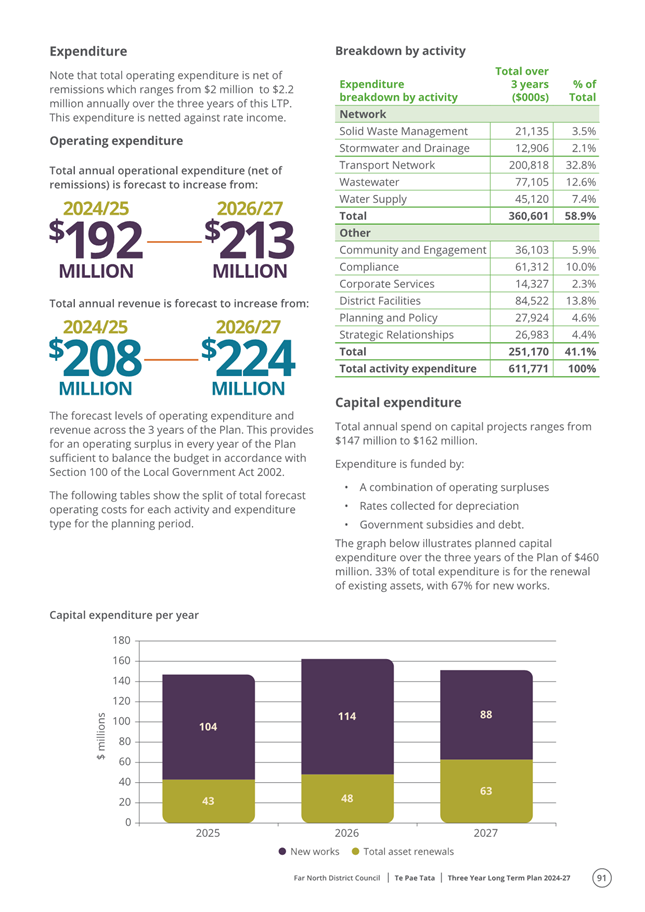

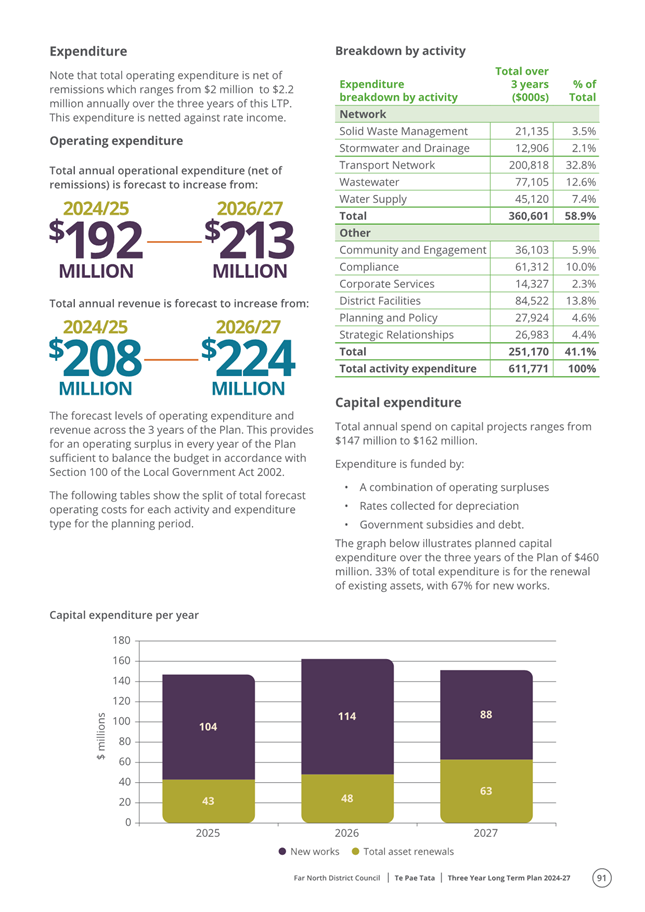

operating expenditure ranging from $192 million to $213 million.

· Total annual spend

on capital projects ranging from $147 million to $162 million.

The process from here:

The Local Government Act 2002 requires Council to adopt its

LTP by 30 June 2024.

Adoption of the LTP must

follow adoption of the Revenue and Financing Policy.

The LTP must then be adopted

to enable the setting of rates for the 2024/2025 financial year.

Take

Tūtohunga / Reason for the recommendation

Section 93 of the

Local Government Act 2002 requires a Council to have, at all times, a Long Term

Plan. The section prescribes the purpose and the procedure for adopting an LTP

as well as specifying that an LTP must be adopted before the commencement of the

first year to which it relates, and that an LTP adopted under this section must

cover a period of not less than 10 consecutive financial years.

The 2024-27 LTP

meets the statutory requirements of the Act and must be adopted by Council

prior to 1 July 2024.

3) PĀnga PŪtea me ngĀ

wĀhanga tahua / Financial Implications and Budgetary Provision

The 2024-27 LTP sets in place the Council programme for the

next three years along with the funding required. This document sets the

budgets for the three year period.

If the 2024-27 LTP is not adopted, the Council would not be

adhering to the Severe Weather Emergency (Local Government Act 2002 - Long-term

Plan) Order 2023 which we prescribed to. Additionally, Council would only be

able to rate for the 2024/25 year based on 25% of the rates that are payable in

the previous year being 2023/24 as per Section 50 of the Local Government

(Rating) Act 2002. This would have implications across all departments

within the organisation.

Āpitihanga

/ Attachments

1. Treasury,

Liability and Investment Policies - A4757338 ⇩

2. FNDC

LTP 2024-27 - A4759775 ⇩

Hōtaka Take Ōkawa / Compliance Schedule:

Full consideration has been given to the provisions of the

Local Government Act 2002 S77 in relation to decision making, in particular:

1. A

Local authority must, in the course of the decision-making process,

a) Seek

to identify all reasonably practicable options for the achievement of the

objective of a decision; and

b) Assess

the options in terms of their advantages and disadvantages; and

c) If

any of the options identified under paragraph (a) involves a significant

decision in relation to land or a body of water, take into account the

relationship of Māori and their culture and traditions with their

ancestral land, water sites, waahi tapu, valued flora and fauna and other

taonga.

2. This

section is subject to Section 79 - Compliance with procedures in relation to

decisions.

|

He

Take Ōkawa / Compliance Requirement

|

Aromatawai

Kaimahi / Staff Assessment

|

|

State the level of significance

(high or low) of the issue or proposal as determined by the Council’s

Significance and Engagement Policy

|

This decision involves a high

degree of significance.

|

|

State the relevant Council

policies (external or internal), legislation, and/or community outcomes (as

stated in the LTP) that relate to this decision.

|

The Local Government Act 2002.

Sever Weather Emergency Recovery

(Local Government Act 2002 – Long-term Plan) Order 2023

|

|

State whether this issue or

proposal has a District wide relevance and, if not, the ways in which the

appropriate Community Board’s views have been sought.

|

District-wide relevance. Community

Boards were represented at all workshops and public meetings. Community Board

submissions were considered.

|

|

State the possible implications for Māori

and how Māori have been provided with an opportunity to contribute to

decision making if this decision is significant and relates to land and/or

any body of water.

State the possible implications and how this

report aligns with Te Tiriti o Waitangi / The Treaty of Waitangi.

|

Implications were considered

within the development process of the LTP.

|

|

Identify persons likely to be

affected by or have an interest in the matter, and how you have given

consideration to their views or preferences (for example – youth, the

aged and those with disabilities).

|

The LTP applies to all ratepayers

and residents of the District. Feedback received from the public was

considered through the decision-making process.

|

|

State the financial implications

and where budgetary provisions have been made to support this decision.

|

The LTP sets the budgets for the

next 3 years.

|

|

Chief Financial Officer review.

|

The Chief Financial Officer has

reviewed this report.

|

|

Extraordinary

Council Meeting Agenda

|

26 June 2024

|

|

Extraordinary Council

Meeting Agenda

|

26 June 2024

|

6.3 Setting

of Rates, Due Dates and Penalties for 2024-2025

File

Number: A4736936

Author: Zakeeda

Khan, Senior Corporate Financial Planner

Authoriser: Jonathan

Slavich, Chief Financial Officer

Purpose of the Report

The purpose of the report is to allow

Council to set the rates, due dates, and penalties for the 2024-2025 rating

year in accordance with the provisions of the Local Government (Rating) Act

2002.

Executive Summary

Now that

Council has adopted the Long-Term Plan 2024-2027 it must set the rates for the

2024-2025 rating year.

· Set

General Rates

· Set

Targeted Rates

· Penalty

Dates

· Setting

of the Fees in respect to Postponed Rates

|

Recommendation

That, pursuant to Section 23 of the Local Government

(Rating) Act 2002 (the Act), Council

sets the rates as described below for the year

commencing 1st July 2024 and concluding 30th June 2025;

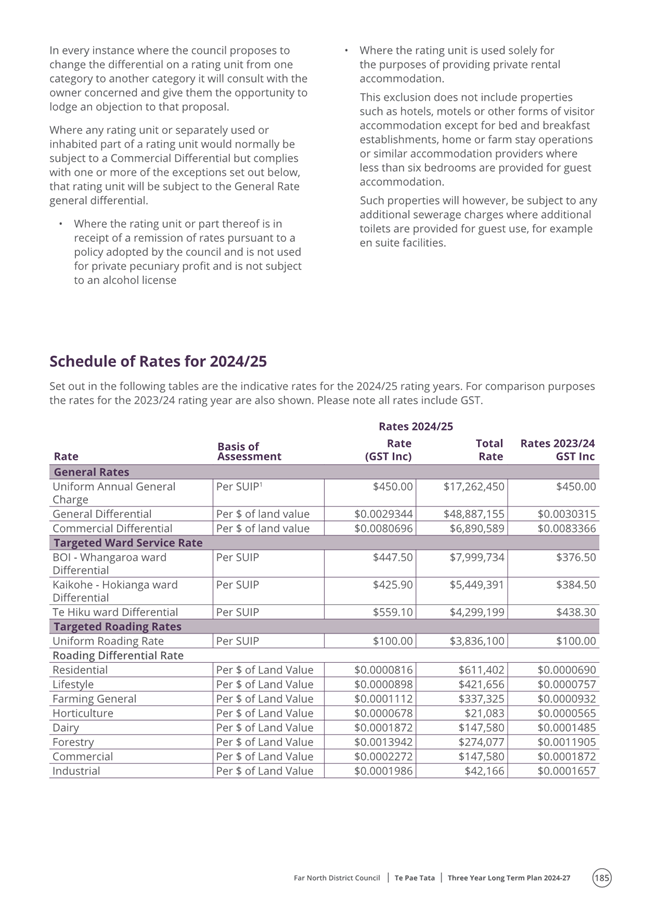

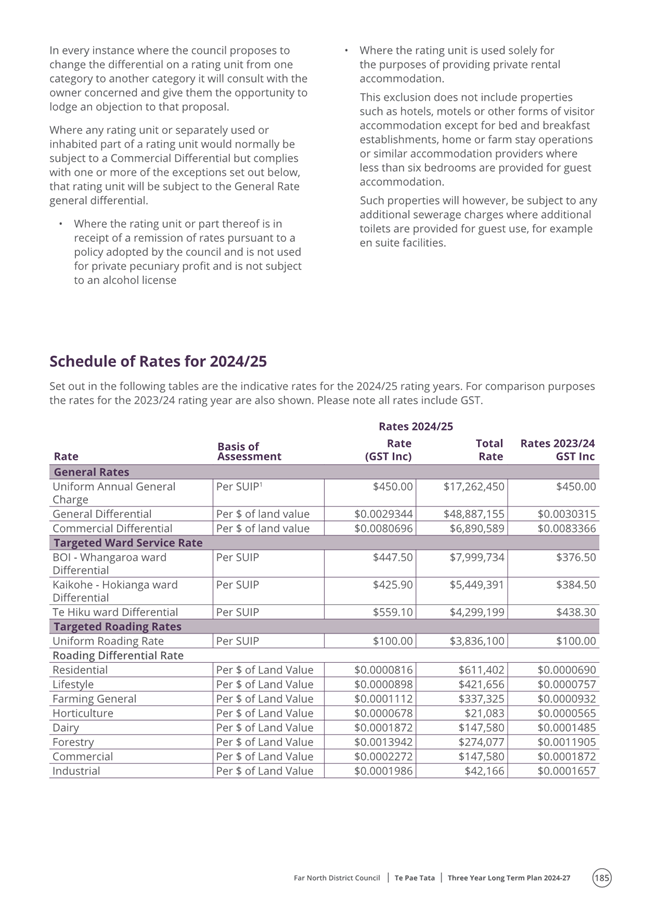

All rates are shown inclusive of GST

GENERAL RATE

General Rate

Differentiated on the basis of land use set on all rateable

land

|

Differential

|

Basis

|

Rate

|

|

General Differential

|

Per $ of Land Value

|

$0.0029344

|

|

Commercial Differential

|

Per $ of Land Value

|

$0.0080696

|

Uniform Annual General Charge (UAGC):

A UAGC of $450.00 per SUIP on every rateable Rating Unit

Definition of a SUIP:

· Any

part of a rating unit that is used or occupied by any person, other than the

ratepayer, having a right to use or inhabit that part by virtue of a tenancy,

lease, licence, or other agreement

· Any

part or parts of a rating unit that is used or occupied by the ratepayer for

more than one single use.

The following are considered to be separately used parts of

a rating unit:

· individual

flats or apartments

· separately

leased commercial areas which are leased on a rating unit basis

· vacant

rating units

TARGETED RATES

ROADING RATES

Uniform Roading Rate

A Uniform Targeted Rate of $100 per SUIP on every rateable

Rating Unit

Differential Roading Rate

Differentiated on the basis of land use set on all rateable

land

|

Differential

|

Basis

|

Rate

|

|

Residential

|

Per $ of Land Value

|

$0.0000816

|

|

Lifestyle

|

Per $ of Land Value

|

$0.0000898

|

|

Farming General

|

Per $ of Land Value

|

$0.0001112

|

|

Horticulture

|

Per $ of Land Value

|

$0.0000678

|

|

Dairy

|

Per $ of Land Value

|

$0.0001872

|

|

Forestry

|

Per $ of Land Value

|

$0.0013942

|

|

Commercial

|

Per $ of Land Value

|

$0.0002272

|

|

Industrial

|

Per $ of Land Value

|

$0.0001986

|

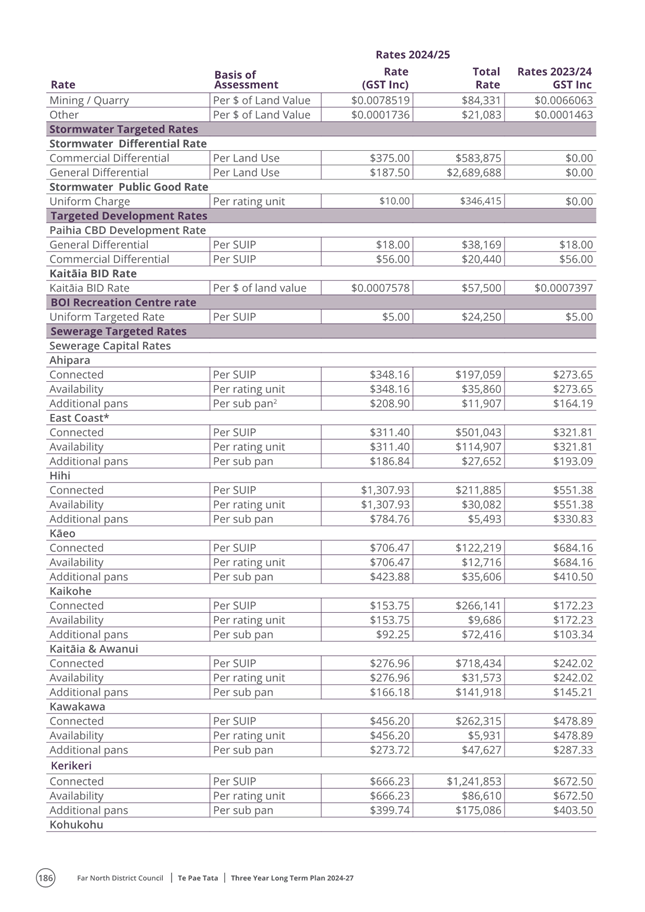

Mining/Quarry

|

Per $ of Land Value

|

$0.0078519

|

|

Other

|

Per $ of Land Value

|

$0.0001736

|

Ward Services Rate

Differentiated on the basis of location set on all rateable

land in the identified wards

|

Differential

|

Basis

|

Rate

|

|

BOI - Whangaroa Ward

|

Per SUIP

|

$447.50

|

|

Te Hiku Ward

|

Per SUIP

|

$425.90

|

|

Kaikohe - Hokianga Ward

|

Per SUIP

|

$559.10

|

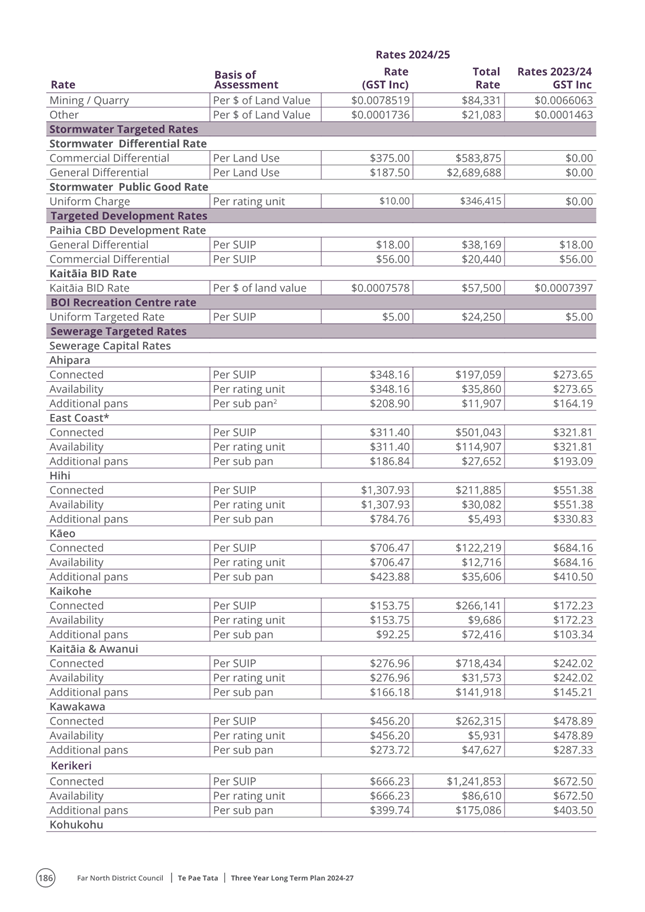

STORMWATE RATES

Stormwater Public Good Rate is set on every

rating unit in the district

Fixed rate set on differential categories on all rateable

land identified in the rating area maps for the listed urban communities;

|

Ahipara

|

Haruru Falls

|

Kaikohe

|

Kawakawa

|

|

Awanui

|

Hihi

|

Kaimaumau

|

Karikari

|

|

East Coast

|

Houhora/Pukenui

|

Kaitāia

|

Kerikeri/Waipapa

|

|

Kohukohu

|

Ōkaihau

|

Paihia/Te Haumi

|

Taupo Bay

|

|

Moerewa

|

Ōpononi/Ōmāpere

|

Rāwene

|

Tauranga Bay

|

|

Ngāwhā

|

Ōpua/Ōkiato

|

Russell

|

Whangaroa/Kāeo

|

|

Differential

|

Basis

|

Rate

|

|

General

|

50%

|

$187.50

|

|

Commercial

|

100%

|

$375.00

|

DEVELOPMENT RATES

Paihia CBD Development Rate

Differentiated on the basis of land use set on all rateable

land identified in the rating area maps

|

Differential

|

Basis

|

Rate

|

|

General Differential

|

Per SUIP

|

$18.00

|

|

Commercial Differential

|

Per SUIP

|

$56.00

|

Kaitāia BID Rate

|

Commercial

rating units defined in the rating area map

|

Basis

|

Rate

|

|

Per $ of Land Value

|

$0.0007578

|

BOI Recreation Centre Rate

|

Rating Units defined in the rating area map

|

Basis

|

Rate

|

|

Per SUIP

|

$5.00

|

SEWERAGE RATES

Separate sewerage rates are set for each sewerage scheme on

every rating unit that is connected to each scheme or to which the scheme is

“available”, that is where a rating unit is capable of being

connected to a public reticulated wastewater disposal system.

The additional pan rate is set on the basis of the third

and every subsequent water closet or urinal within the SUIP. A rating unit

used primarily as a residence for a single household must not be treated as

having more than a single pan.

Ahipara Sewerage Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$348.16

|

|

Available

|

Per Rating Unit

|

$348.16

|

|

Additional Pan Rate

|

Per additional pan

|

$208.90

|

East Coast* Sewerage Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$311.40

|

|

Available

|

Per Rating Unit

|

$311.40

|

|

Additional Pan Rate

|

Per additional pan

|

$186.84

|

Hihi Sewerage Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$1,307.93

|

|

Available

|

Per Rating Unit

|

$1,307.93

|

|

Additional Pan Rate

|

Per additional pan

|

$784.76

|

Kāeo Sewerage Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$706.47

|

|

Available

|

Per Rating Unit

|

$706.47

|

|

Additional Pan Rate

|

Per additional pan

|

$423.88

|

Kaikohe Sewerage Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$153.75

|

|

Available

|

Per Rating Unit

|

$153.75

|

|

Additional Pan Rate

|

Per additional pan

|

$92.25

|

Kaitāia and Awanui Sewerage Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$276.96

|

|

Available

|

Per Rating Unit

|

$276.96

|

|

Additional Pan Rate

|

Per additional pan

|

$166.18

|

Kawakawa Sewerage Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$456.20

|

|

Available

|

Per Rating Unit

|

$456.20

|

|

Additional Pan Rate

|

Per additional pan

|

$273.72

|

Kerikeri Sewerage Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$666.23

|

|

Available

|

Per Rating Unit

|

$666.23

|

|

Additional Pan Rate

|

Per additional pan

|

$399.74

|

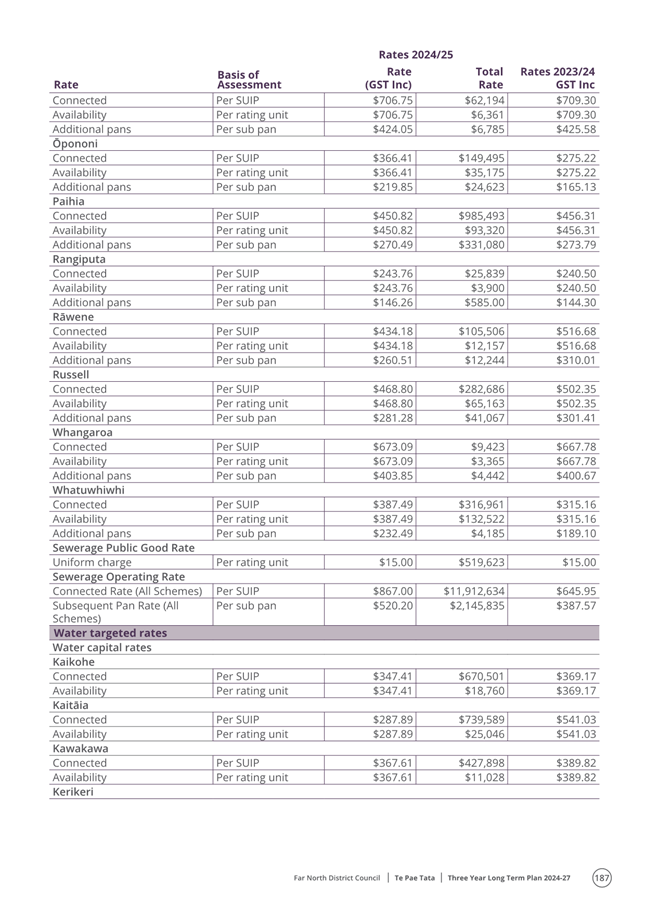

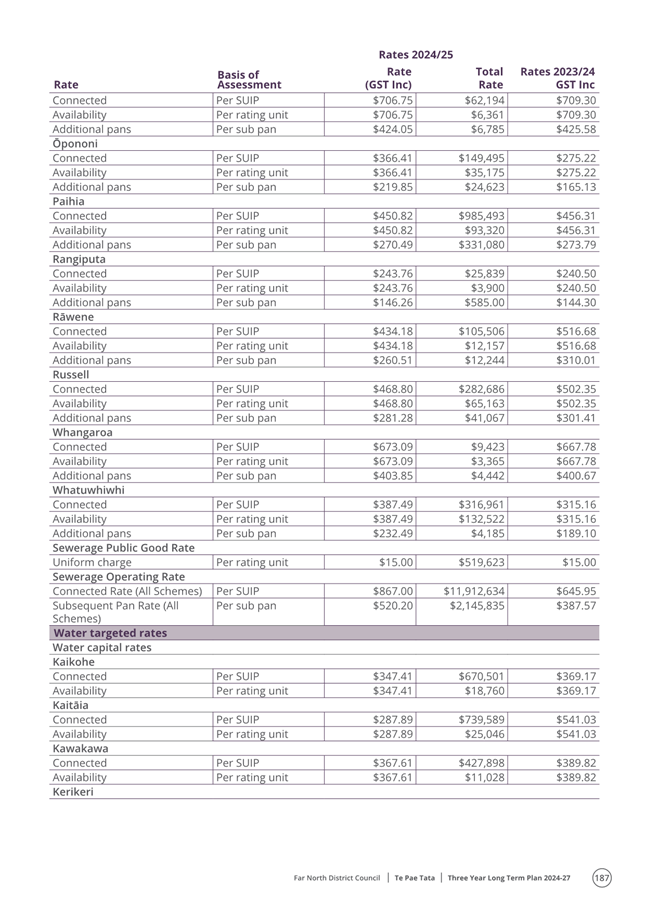

Kohukohu Sewerage Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$706.75

|

|

Available

|

Per Rating Unit

|

$706.75

|

|

Additional Pan Rate

|

Per additional pan

|

$424.05

|

Ōpononi Sewerage Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$366.41

|

|

Available

|

Per Rating Unit

|

$366.41

|

|

Additional Pan Rate

|

Per additional pan

|

$219.85

|

Paihia Sewerage Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$450.82

|

|

Available

|

Per Rating Unit

|

$450.82

|

|

Additional Pan Rate

|

Per additional pan

|

$270.49

|

Rangiputa Sewerage Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$243.76

|

|

Available

|

Per Rating Unit

|

$243.76

|

|

Additional Pan Rate

|

Per additional pan

|

$146.26

|

Rāwene Sewerage Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$434.18

|

|

Available

|

Per Rating Unit

|

$434.18

|

|

Additional Pan Rate

|

Per additional pan

|

$260.51

|

Russell Sewerage Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$468.80

|

|

Available

|

Per Rating Unit

|

$468.80

|

|

Additional Pan Rate

|

Per additional pan

|

$281.28

|

Whangaroa Sewerage Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$673.09

|

|

Available

|

Per Rating Unit

|

$673.09

|

|

Additional Pan Rate

|

Per additional pan

|

$403.85

|

Whatuwhiwhi Sewerage Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$387.49

|

|

Available

|

Per Rating Unit

|

$387.49

|

|

Additional Pan Rate

|

Per additional pan

|

$232.49

|

*East

Coast includes Taipa, Cable Bay, Coopers Beach, Mangonui

Sewerage Public Good Rate is set on every

rating unit in the district

District Wide Sewerage Operating Rate is set on every rating unit connected to a sewerage

scheme

|

Operating Rate

|

Basis

|

Rate

|

|

Connected (All schemes)

|

Per SUIP

|

$867.00

|

|

Additional Pan Rate

|

Per additional pan

|

$520.20

|

WATER RATES

Separate water rates are set for each water supply scheme

differentiated on the basis of supply or availability of supply to each

scheme, that is, capable of being connected to a public reticulated water

supply system.

Kaikohe Water Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$347.41

|

|

Available

|

Per Rating Unit

|

$347.41

|

Kaitāia Water Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$287.89

|

|

Available

|

Per Rating Unit

|

$287.89

|

Kawakawa Water Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$367.61

|

|

Available

|

Per Rating Unit

|

$367.61

|

Kerikeri Water Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$229.14

|

|

Available

|

Per Rating Unit

|

$229.14

|

Ōkaihau Water Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$407.92

|

|

Available

|

Per Rating Unit

|

$407.92

|

Ōmāpere/Ōpononi Water Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$613.16

|

|

Available

|

Per Rating Unit

|

$613.16

|

Paihia Water Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$239.40

|

|

Available

|

Per Rating Unit

|

$239.40

|

Rāwene Water Capital Rate

|

Differential

|

Basis

|

Rate

|

|

Connected

|

Per SUIP

|

$290.51

|

|

Available

|

Per Rating Unit

|

$290.51

|

Water Public Good Rate is set on every rating

unit in the district

District Wide Water Operating Rates

The District wide operating rates are assessed on the basis

of the quantity of water supplied as recorded by meter, or for a non-metered

supply, per SUIP.

Metered Supply rate (all schemes)

|

Operating Rate

|

Basis

|

Rate

|

|

Potable Water

|

Per m3 Supplied

|

$4.40

|

|

Non-potable Water

|

Per m3 Supplied

|

$2.86

|

Non-Metered Water Supply Rate (Includes 250 M3 Supply)

|

Operating Rate

|

Basis

|

Rate

|

|

Potable Water

|

Per SUIP

|

$1,395.21

|

|

Non-potable Water

|

Per SUIP

|

$1,009.96

|

DRAINAGE RATES are set on all rateable land in the

relevant drainage area

|

Kaitāia Drainage Area

|

Basis

|

Rate

|

|

Area of land within the defined rating area

|

Per hectare

|

$12.47

|

|

Kaikino Drainage Area (as defined in the FIS)

|

|

Differential

|

Basis

|

Rate

|

|

Differential A

|

Per hectare

|

$11.46

|

|

Differential B

|

Per hectare

|

$5.73

|

|

Differential C

|

Per hectare

|

$1.91

|

|

Motutangi Drainage Area (as defined in the FIS)

|

|

Differential

|

Basis

|

Rate

|

|

Differential A

|

Per hectare

|

$0.00

|

|

Differential B

|

Per hectare

|

$0.00

|

|

Differential C

|

Per hectare

|

$0.00

|

|

Waiharara Drainage Area (as defined in the FIS)

|

|

Differential

|

Basis

|

Rate

|

|

Differential A

|

Per hectare

|

$20.96

|

|

Differential B

|

Per hectare

|

$10.48

|

|

Differential C

|

Per hectare

|

$3.50

|

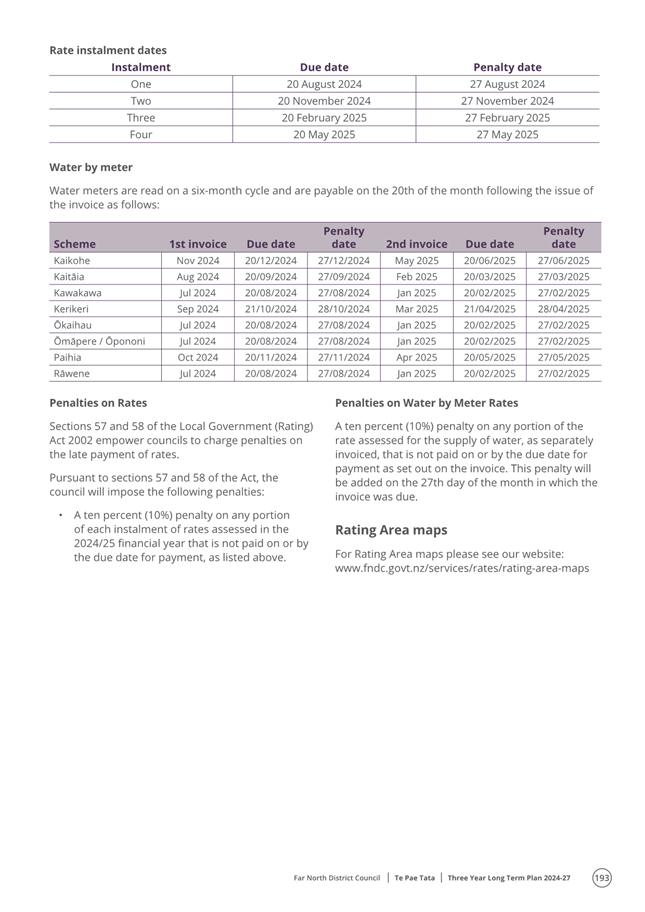

And that, pursuant to Section 24 of the Act and with the

exception of the targeted rates set for the supply of water pursuant to

Section 19 of the Act, Council charges the rates for the 2024-2025 rating

year by way of four equal instalments. Each instalment to be paid on or

before the due dates set out below;

|

Rate Instalment

|

Due Date

|

Penalty Date

|

|

First Instalment

|

20 August 2024

|

27 August 2024

|

|

Second Instalment

|

20 November 2024

|

27 November 2024

|

|

Third Instalment

|

20 February 2025

|

27 February 2025

|

|

Fourth Instalment

|

20 May 2025

|

27 May 2025

|

And that, pursuant to Sections 57 and 58 of the Act and

with the exception of the targeted rates set for the supply of water pursuant

to Section 19 of the Act, Council imposes the following penalties:

A ten percent (10%) penalty on any portion of any

instalment of rates assessed in the 2024-2025 financial year that is not paid

on or by the due date for payment as detailed above. This penalty will be

added on the penalty dates detailed above;

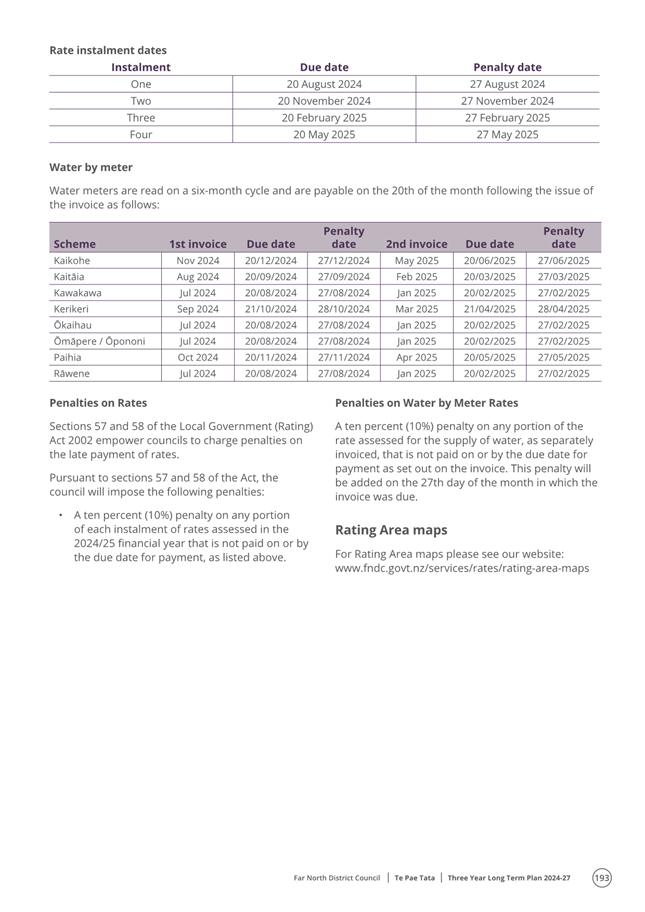

And that the water meters be read and invoiced on a

six-month cycle, or more often if required, and the subsequent invoices

become due for payment on the dates in the table below.

And that, pursuant to Sections 57 and 58 of the Act,

Council imposes the following penalties in respect of targeted rates set for

the supply of water pursuant to Section 19 of the Act:

A ten percent (10%) penalty on any portion of the rate for

the supply of water charged pursuant to Section 19 of the Act, as separately

invoiced, that is not paid on or by the due date for payment as set out

below;

|

Scheme

|

1st Invoice

|

Due Date

|

Penalty Date

|

2nd Invoice

|

Due Date

|

Penalty Date

|

|

Kaikohe

|

Nov 2024

|

20/12/2024

|

27/12/2024

|

May 2025

|

20/06/2025

|

27/06/2025

|

|

Kaitāia

|

Aug 2024

|

20/09/2024

|

27/09/2024

|

Feb 2025

|

20/03/2025

|

27/03/2025

|

|

Kawakawa

|

Jul 2024

|

20/08/2024

|

27/08/2024

|

Jan 2025

|

20/02/2025

|

27/02/2025

|

|

Kerikeri

|

Sep 2024

|

21/10/2024

|

28/10/2024

|

Mar 2025

|

21/04/2025

|

28/04/2025

|

|

Ōkaihau

|

Jul 2024

|

20/08/2024

|

27/08/2024

|

Jan 2025

|

20/02/2025

|

27/02/2025

|

|

Ōmāpere/

Ōpononi

|

Jul 2024

|

20/08/2024

|

27/08/2024

|

Jan 2025

|

20/02/2025

|

27/02/2025

|

|

Paihia

|

Oct 2024

|

20/11/2024

|

27/11/2024

|

Apr 2025

|

20/05/2025

|

27/05/2025

|

|

Rāwene

|

Jul 2024

|

20/08/2024

|

27/08/2024

|

Jan 2025

|

20/02/2025

|

27/02/2025

|

And that, pursuant to Section 88 of the Act, Council sets

Postponement Fees as provided for in the relevant Rates Postponement

Policies;

FEES IN RESPECT OF POSTPONED RATES

Pursuant to Section 88 of the Local Government (Rating) Act

2002, Council will charge a postponement fee on all rates that are postponed

under any of its postponement policies.

The Postponement fees are as follows:

· Application Fee:

$300

· Administration

Fee: $50 per year

· Financing Fee on

all Postponements: Currently set at 4.83% pa but may vary to match

Council’s average cost of funds. At Council’s discretion all

these fees may be added to the total postponement balance.

|

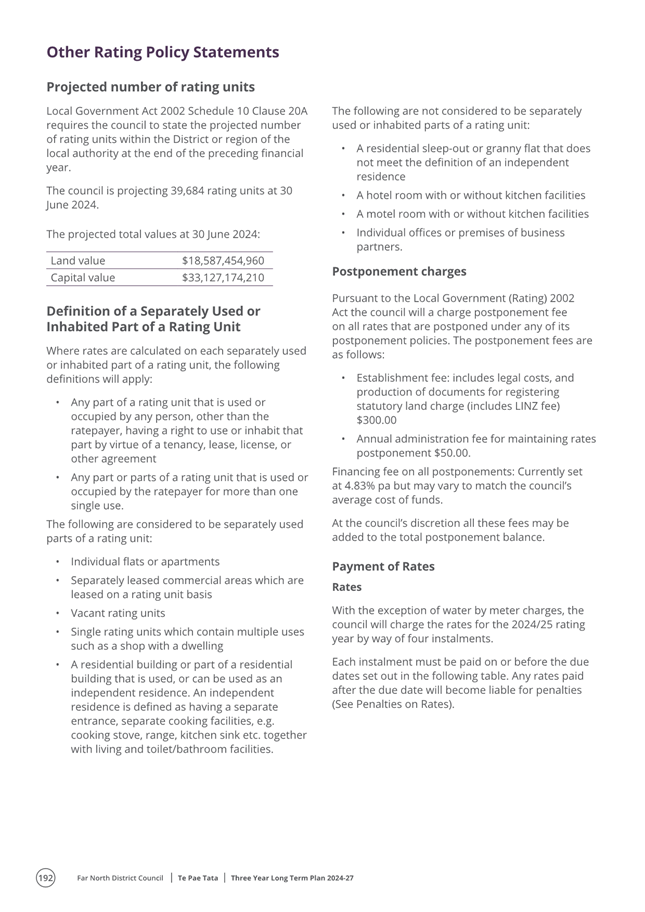

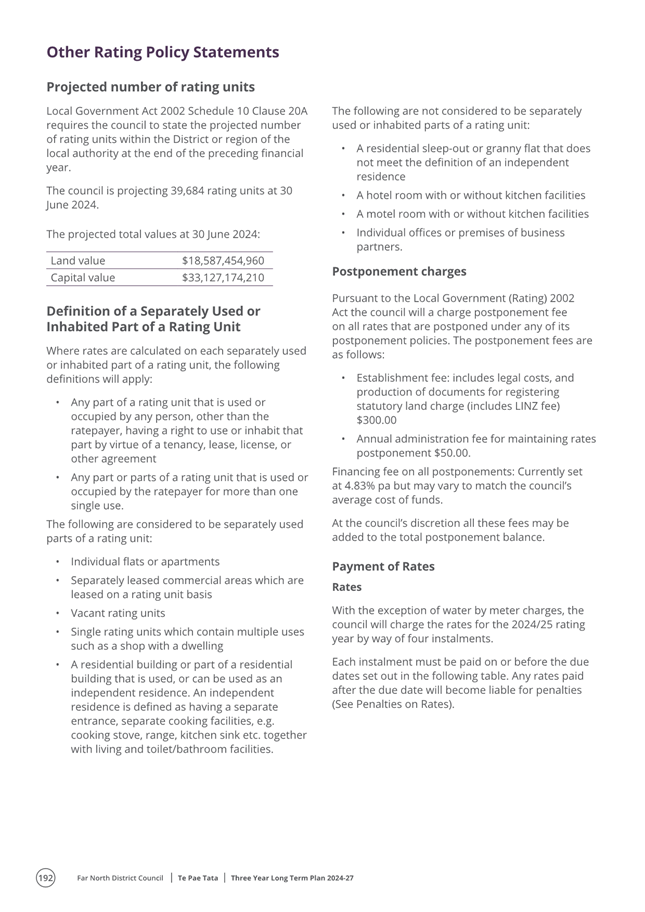

1) Background

Council has adopted the Long Term Plan 2024-2027 and

therefore, pursuant to Section 23 of the Local Government (Rating) Act 2002

(the Act), must now formally resolve to set the rates for the year commencing

01 July 2024 and concluding 30 June 2025.

2) Discussion and Options

The Act requires Council to formally set the rates for each

year after it has adopted the appropriate Annual Plan or Long-Term Plan. It is

this resolution which gives Council the power to set and charge rates for the

year.

Reason

for the recommendation

It is by setting the rates that Council obtains the funding

for the forthcoming year. This resolution provides for funding as set out in

the Long Term Plan 2024-2027 for the 2024-2025 rating year.

3) Financial Implications and Budgetary

Provision

It is by setting the rates that Council obtains the funding

for the forthcoming year. This resolution provides funding as is set out in the

Long Term Plan 2024–2027 for the 2024-2025 rating year.

Attachments

Nil

Compliance schedule:

Full consideration has been given to the provisions of the

Local Government Act 2002 S77 in relation to decision making, in particular:

1. A

Local authority must, in the course of the decision-making process,

a) Seek

to identify all reasonably practicable options for the achievement of the

objective of a decision; and

b) Assess

the options in terms of their advantages and disadvantages; and

c) If

any of the options identified under paragraph (a) involves a significant

decision in relation to land or a body of water, take into account the

relationship of Māori and their culture and traditions with their

ancestral land, water sites, waahi tapu, valued flora and fauna and other

taonga.

2. This

section is subject to Section 79 - Compliance with procedures in relation to

decisions.

|

Compliance

requirement

|

Staff

assessment

|

|

State the level of significance

(high or low) of the issue or proposal as determined by the Council’s

Significance and Engagement Policy

|

Low

|

|

State the relevant Council

policies (external or internal), legislation, and/or community outcomes (as

stated in the LTP) that relate to this decision.

|

Local Government Act 2002, Local

Government Rating Act 2002

|

|

State whether this issue or

proposal has a District wide relevance and, if not, the ways in which the

appropriate Community Board’s views have been sought.

|

N/A

|

|

State the possible implications for Māori

and how Māori have been provided with an opportunity to contribute to

decision making if this decision is significant and relates to land and/or

any body of water.

|

N/A

|

|

Identify persons likely to be

affected by or have an interest in the matter, and how you have given

consideration to their views or preferences.

|

N/A

|

|

State the financial implications

and where budgetary provisions have been made to support this decision.

|

As detailed in the Financial

Implications and Budgetary Provision section of this report.

|

|

Chief Financial Officer review.

|

The Chief Financial Officer has

reviewed this report

|

Council Chambers

Council Chambers