Te

Kaunihera o Tai Tokerau ki te Raki

AGENDA

Ordinary Te Miromiro - Assurance, Risk and Finance

Committee Meeting

Wednesday, 22 February 2023

|

Time:

|

9:30 am

|

|

Location:

|

Council Chambers

Memorial Avenue

Kaikohe

|

Membership:

Kahika - Mayor Moko Tepania

Kōwhai – Deputy Mayor

Kelly Stratford

Deputy Chairperson John Vujcich

Cr Ann Court

Cr Hilda Halkyard-Harawira

Cr Steve McNally

Cr Penetaui Kleskovic

Cr Tāmati Rākena

Cr Felicity Foy

Cr Babe Kapa

Cr Mate Radich

1 Karakia

Timatanga / Opening Prayer

2 Ngā

Whakapāha Me Ngā Pānga Mema / Apologies and Declarations of

Interest

Members need to

stand aside from decision-making when a conflict arises between their role as a

Member of the Council and any private or other external interest they might

have. This note is provided as a reminder to Members to review the matters on

the agenda and assess and identify where they may have a pecuniary or other

conflict of interest, or where there may be a perception of a conflict of

interest.

If a Member

feels they do have a conflict of interest, they should publicly declare that at

the start of the meeting or of the relevant item of business and refrain from

participating in the discussion or voting on that item. If a Member thinks they

may have a conflict of interest, they can seek advice from the Chief Executive

Officer or the Team Leader Democracy Support (preferably before the meeting).

It is noted that while members can seek advice the final

decision as to whether a conflict exists rests with the member.

3 Ngā

tono kōrero / Deputations

No requests for deputations were received at the time of the

Agenda going to print.

4 Ngā

Kōrero A Te Kahika / Mayoral Announcements

5 Reports

5.1 Council

Financial Report for the Period Ending 31 December 2022

File

Number: A4062275

Author: Ajay

Kumar, Acting Manager Accounting Services

Authoriser: Janice

Smith, General Manager - Corporate Services

TE TAKE PŪRONGO / Purpose of the Report

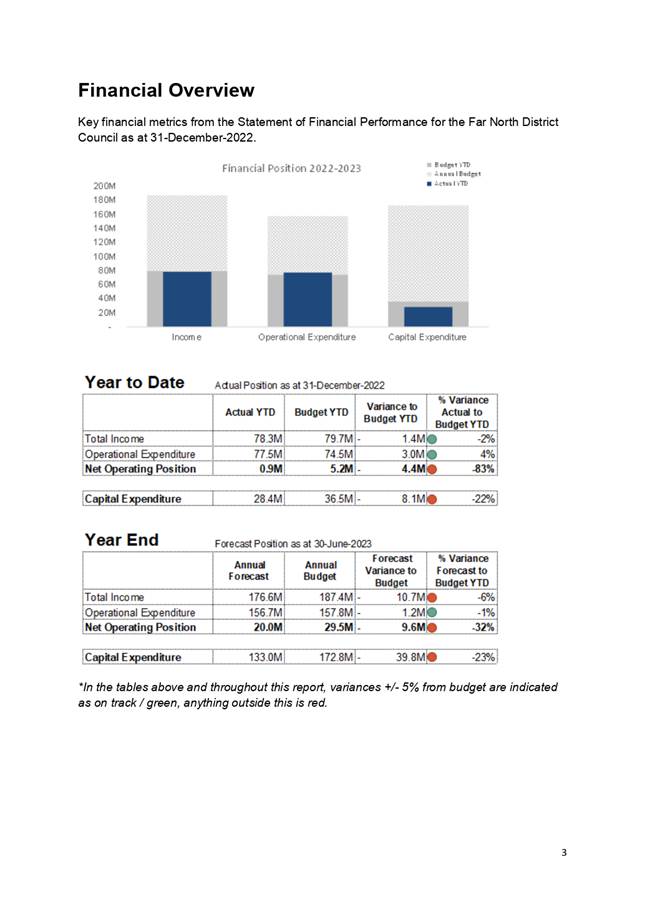

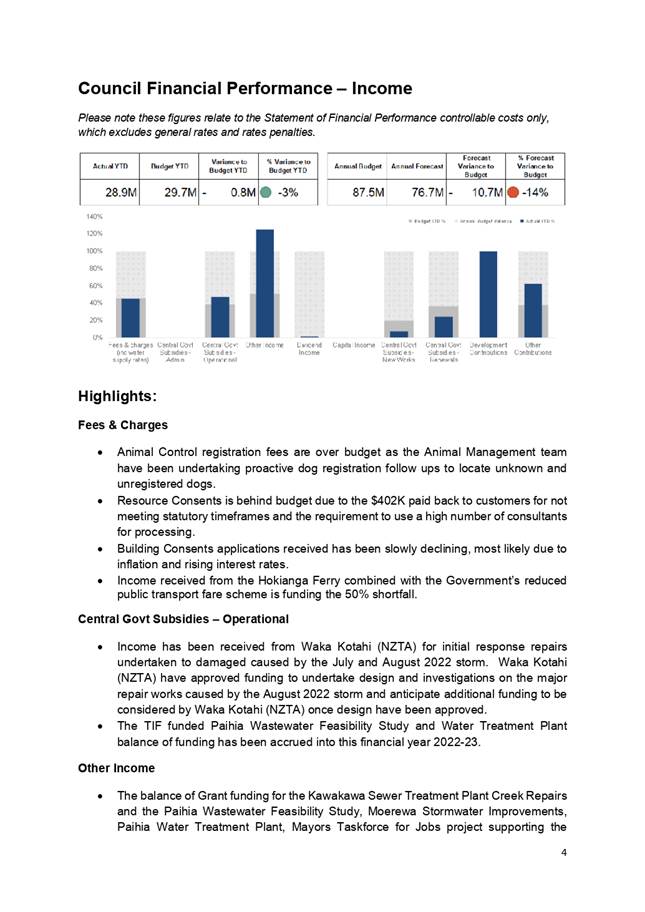

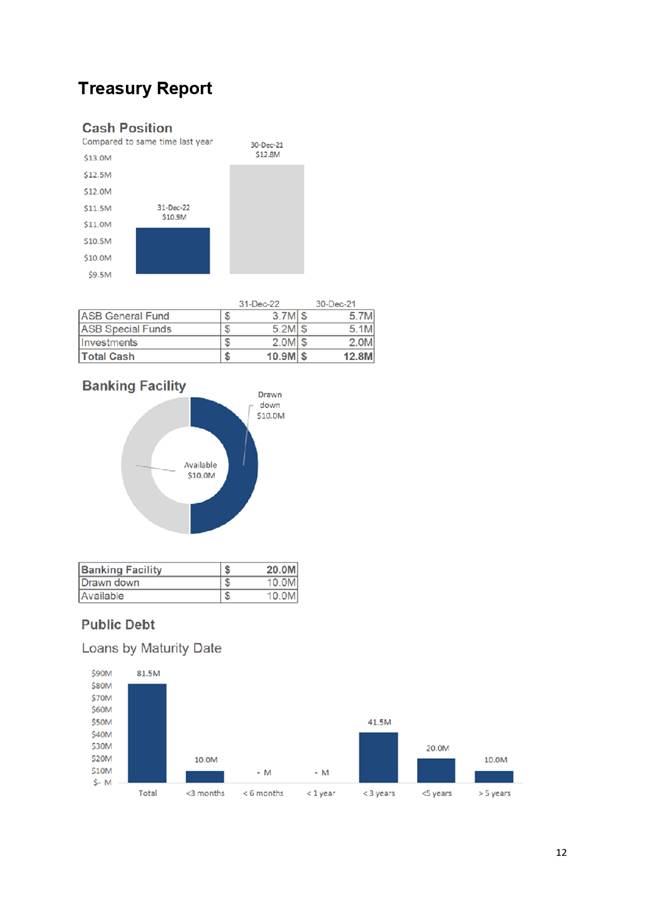

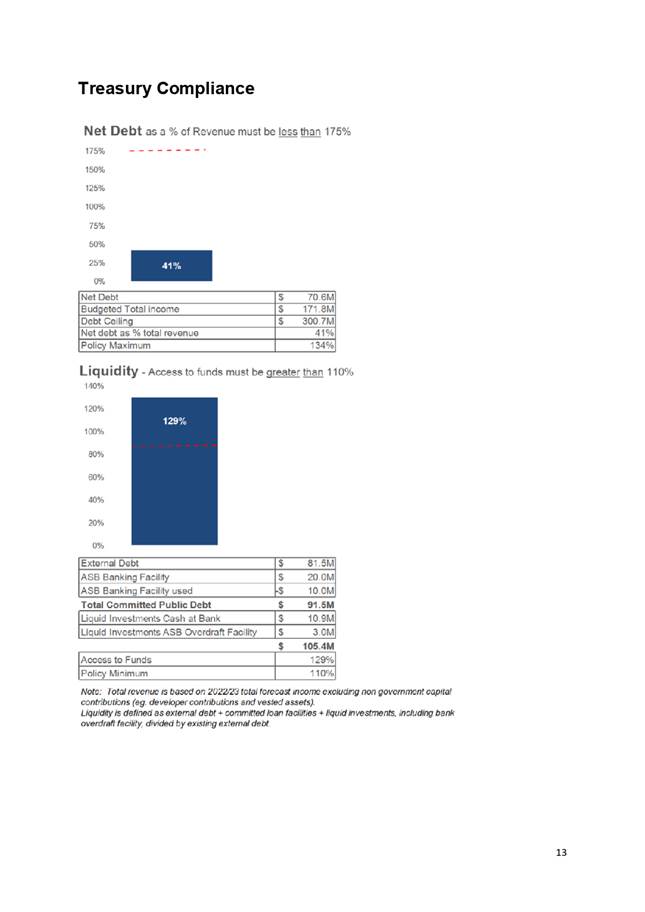

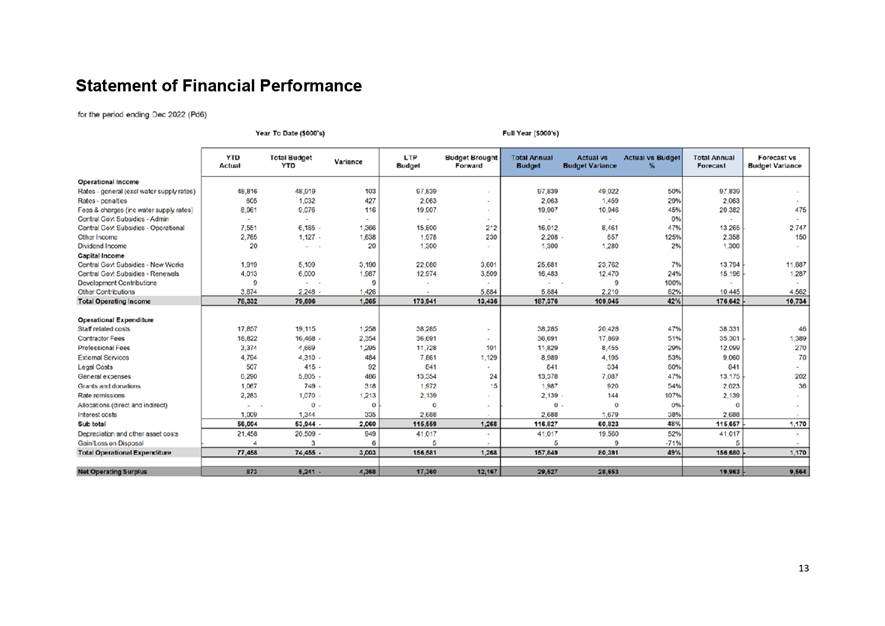

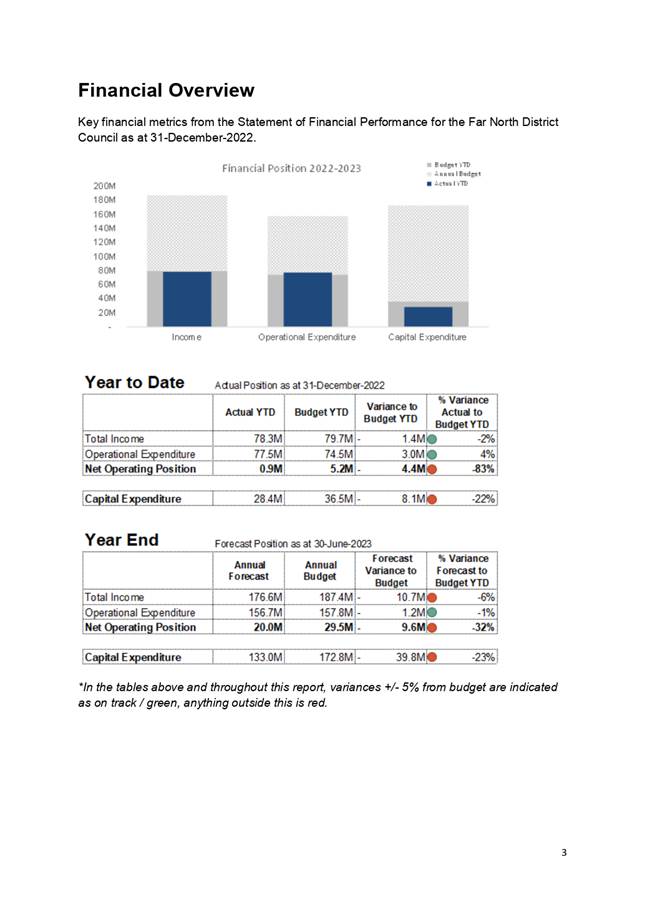

To provide an overview

and information on the current financial position and performance of the Far

North District Council as at 31 December 2022.

TE WHAKARĀPOPOTO MATUA / Executive

SummarY

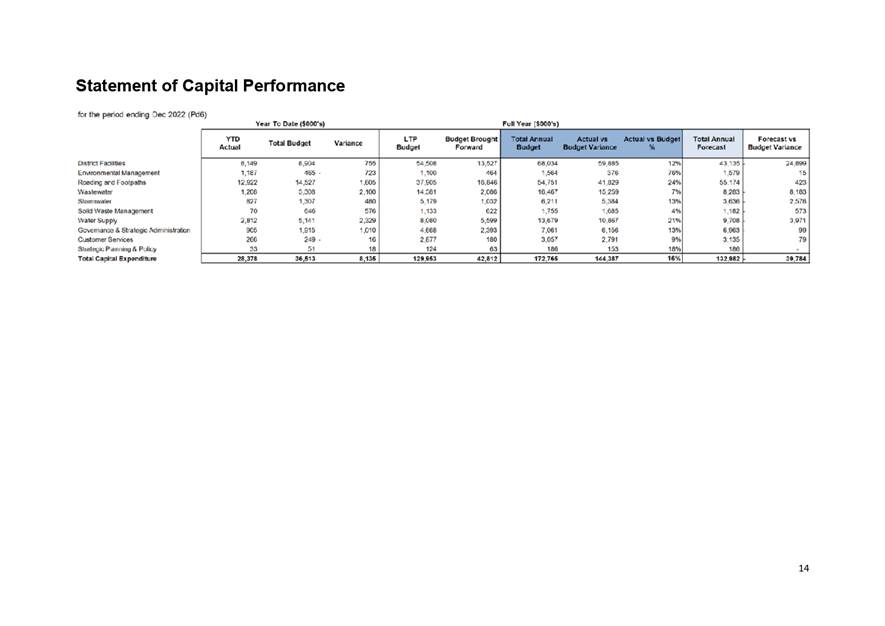

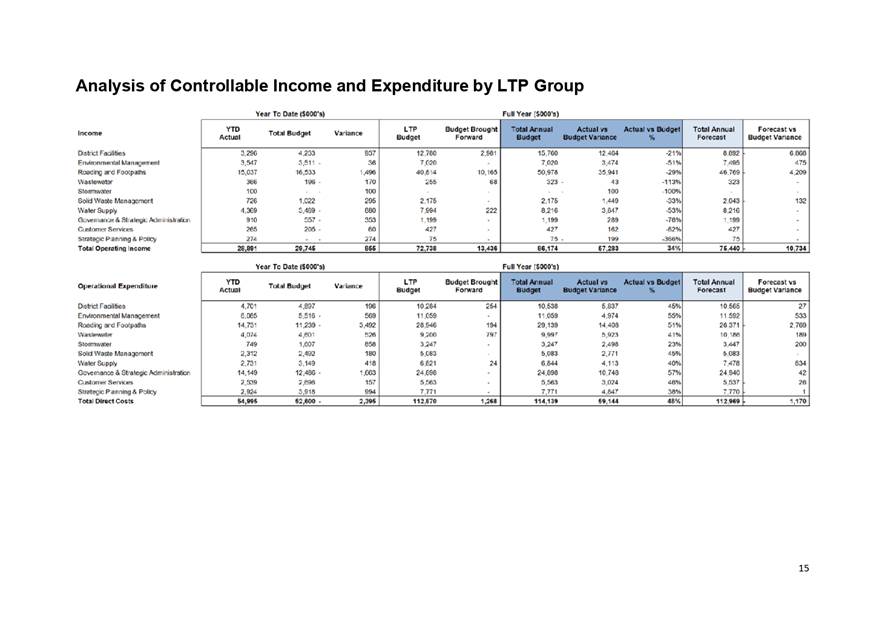

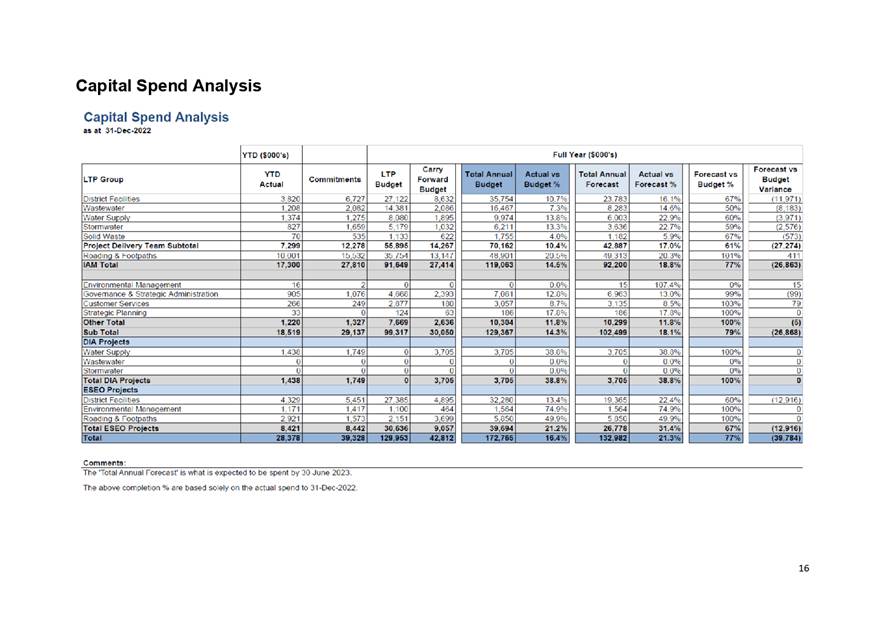

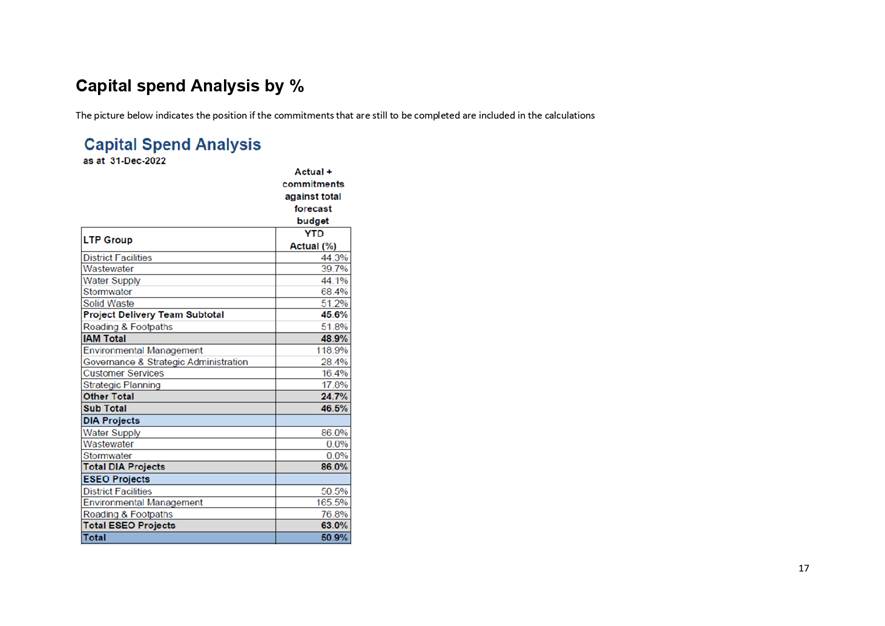

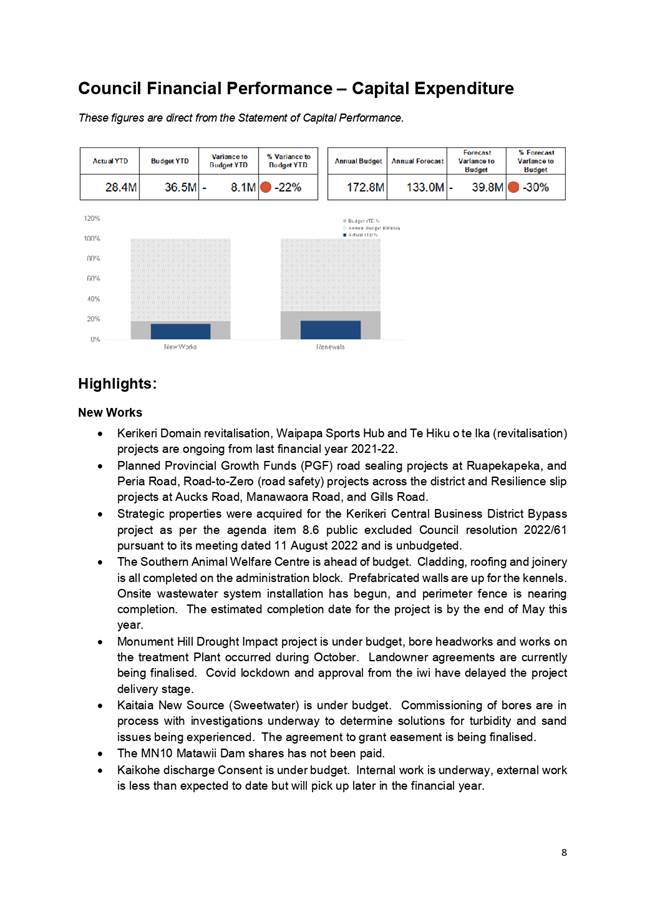

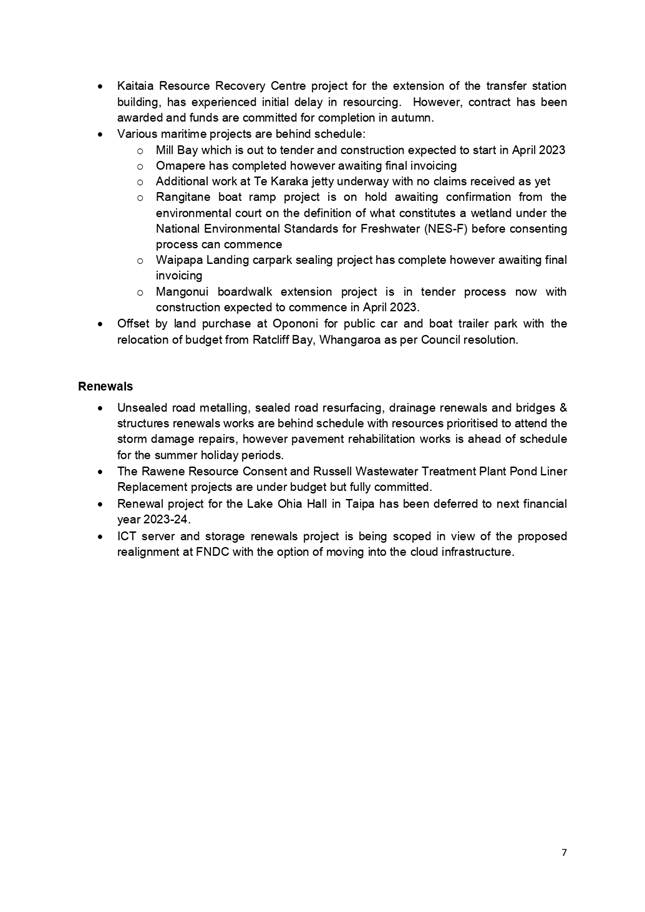

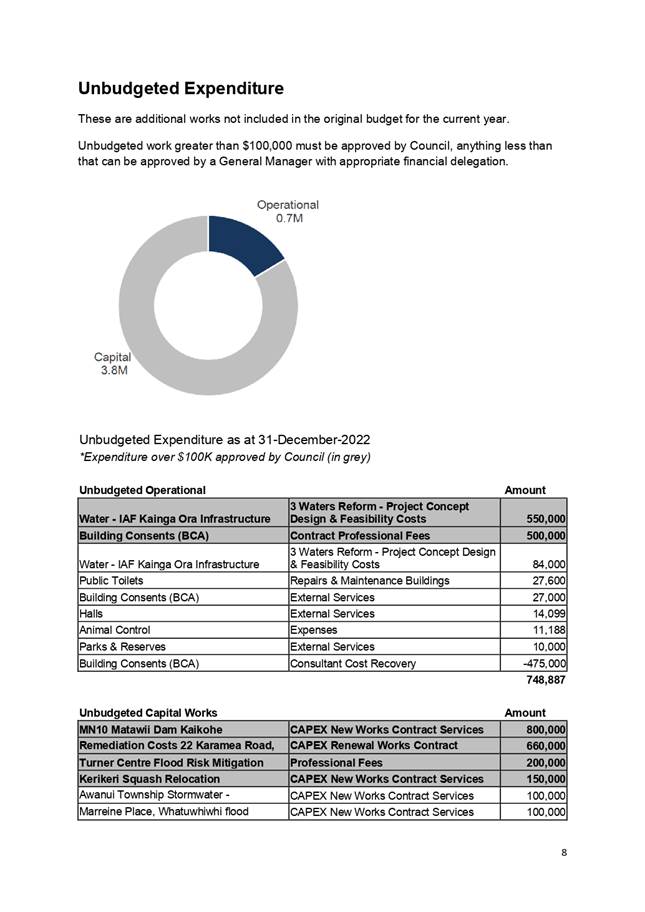

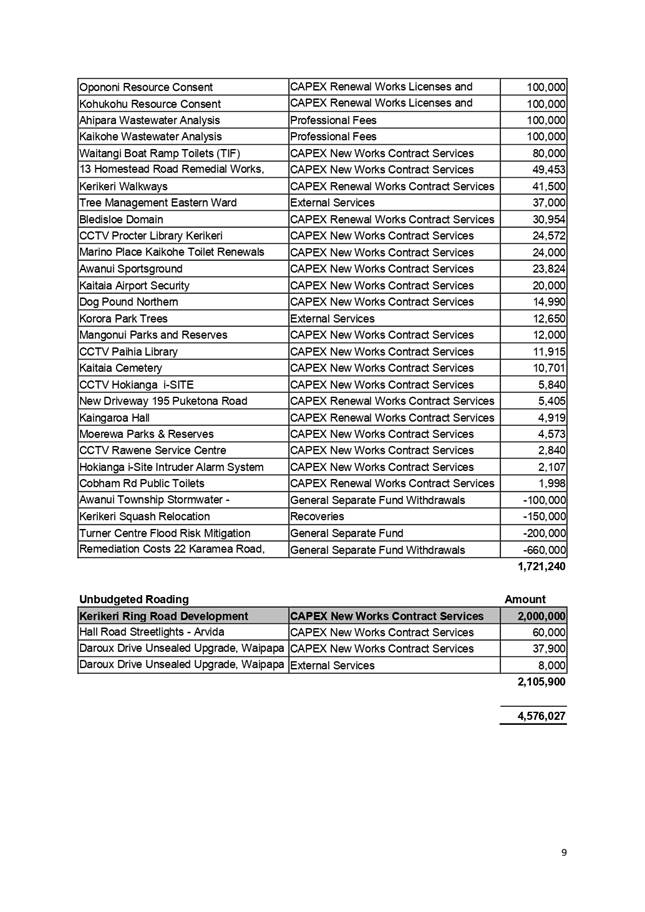

This report provides a summary overview, Statement of Financial

Performance, Capital Performance and Borrowing and Investment reports.

|

NGĀ TŪTOHUNGA /

Recommendation

That the Te Miromiro - Assurance, Risk and Finance

Committee

a) receive

the report Council Financial Report for the Period Ending 31 December 2022.

b) authorise

to receive a quarterly financial report going forward as per the formal

calendar.

c) authorise

to receive a monthly financial report through a briefing paper outside the

quarterly report.

|

TE tĀHUHU KŌRERO / Background

This report provides

financial information as at quarter ending 31 December 2022.

TE MATAPAKI ME NGĀ KŌWHIRINGA /

Discussion and Next Steps

The report is for

information only.

NGĀ PĀNGA PŪTEA ME NGĀ WĀHANGA

TAHUA / Financial Implications and Budgetary Provision

There are no financial

implications or budgetary provisions required as a result of this report.

ngĀ Āpitihanga / Attachments

1. Council

Financial Report Dec 2022 (Pd6) FINAL - A4065410 ⇩

|

Ordinary Te

Miromiro - Assurance, Risk and Finance Committee Meeting Agenda

|

22 February

2023

|

6 Information

Reports

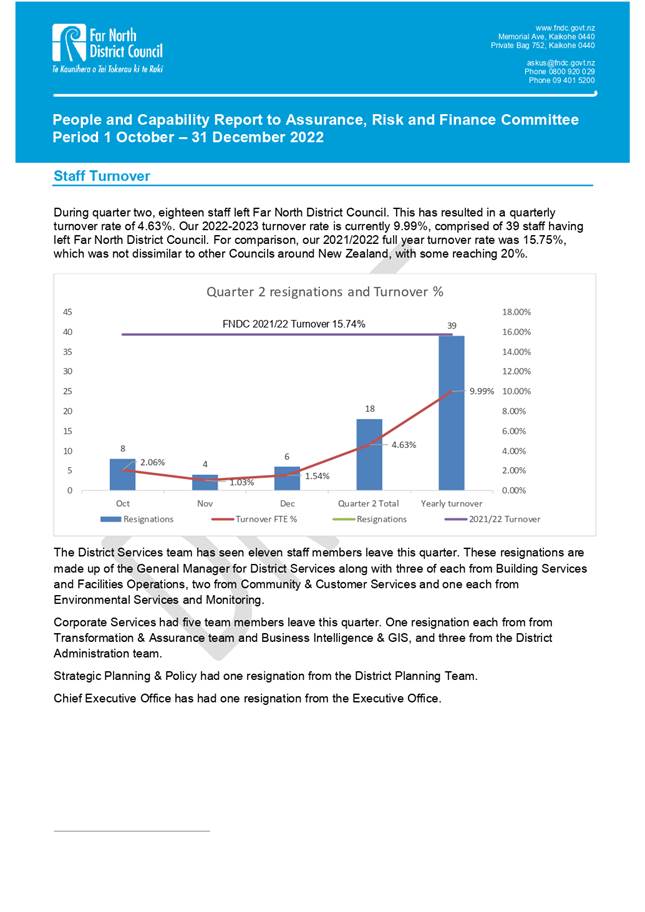

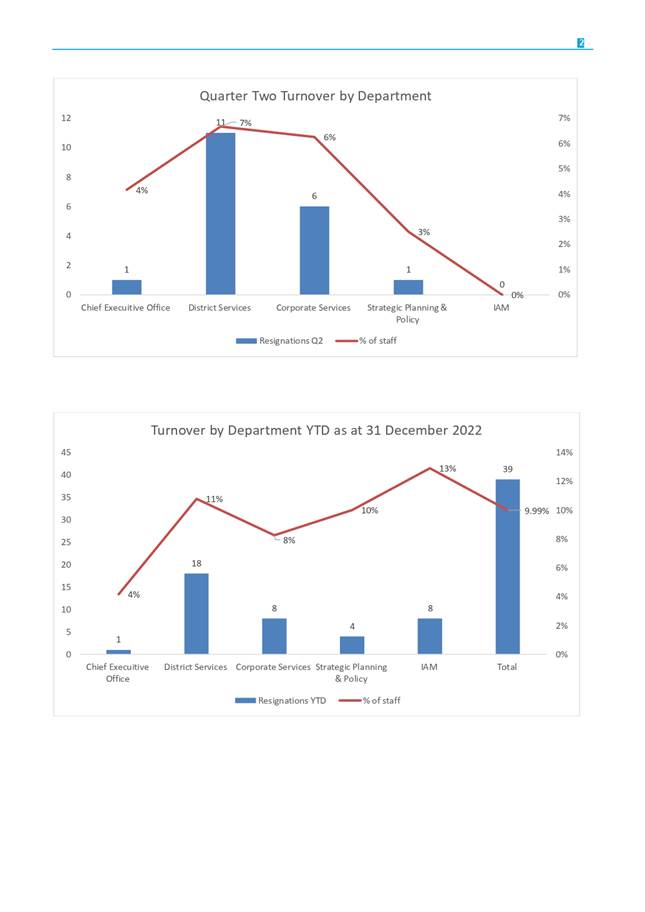

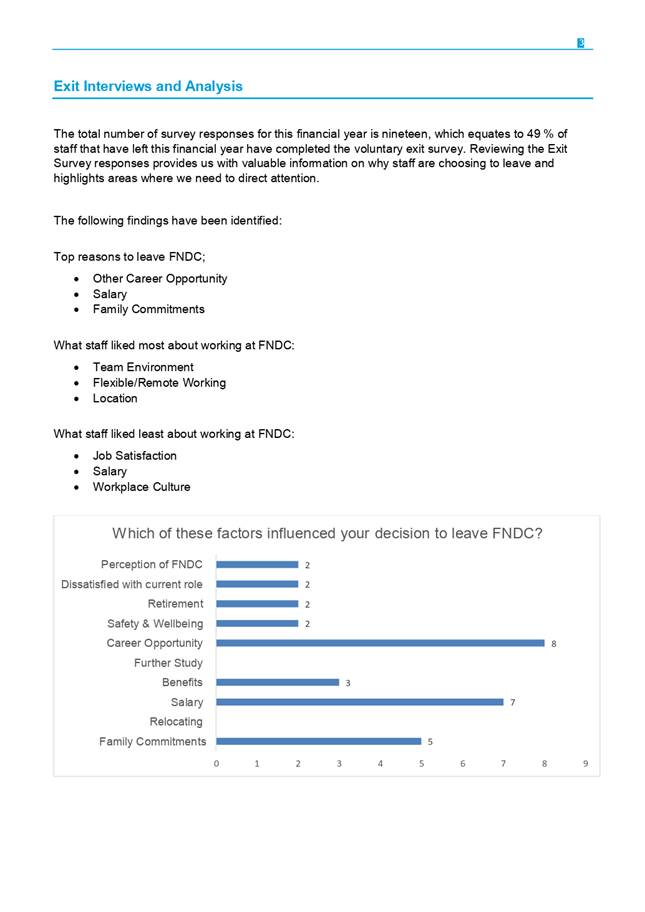

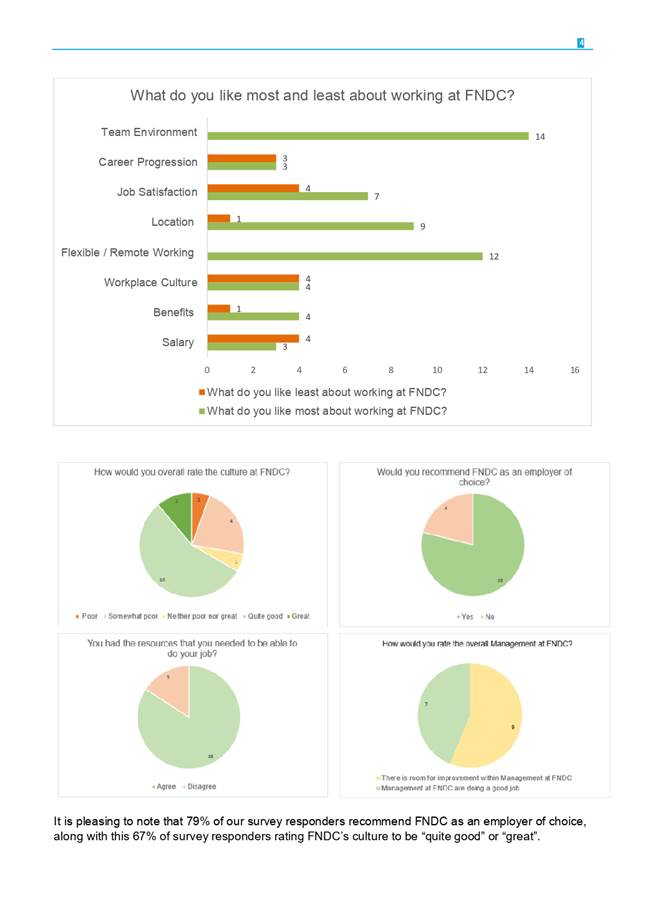

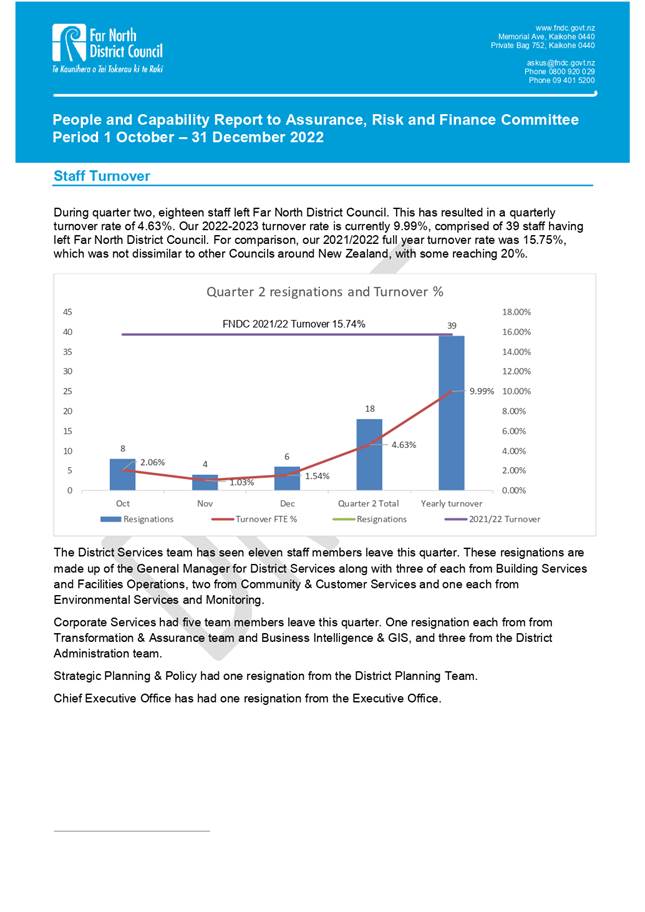

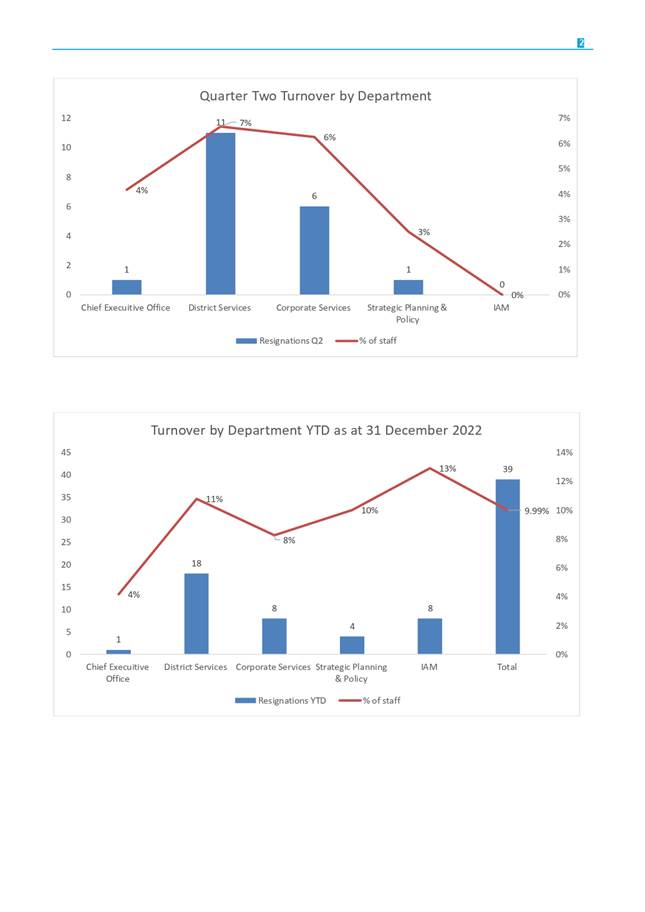

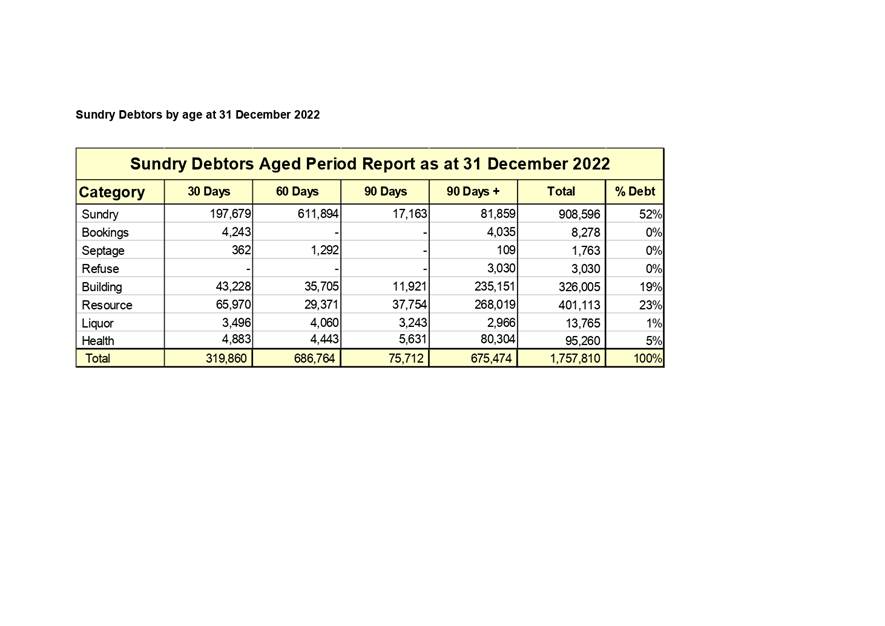

6.1 People

and Capability Quarterly Update: 1 October - 31 December 2022

File

Number: A4064275

Author: Mia

Haywood, People and Capability Data and Systems Specialist

Authoriser: Jill

Coyle, Chief People Officer

TAKE PŪRONGO / Purpose of the Report

The purpose of this report is to present the Audit, Risk and

Finance Committee with the quarterly update for People and Capability.

WHAKARĀPOPOTO MATUA / Executive SummarY

Included in the report is information on:

- Staff

Turnover.

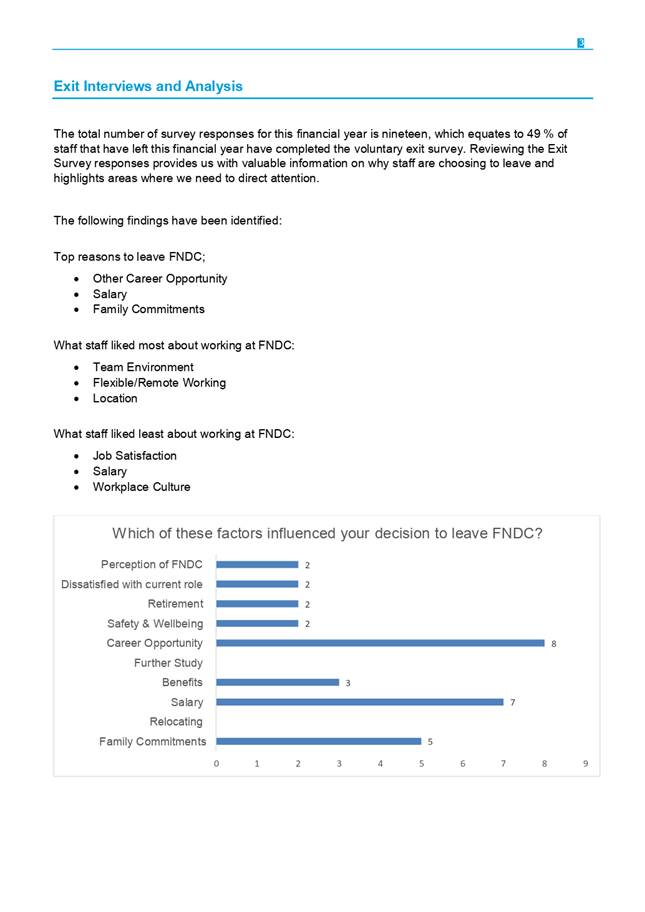

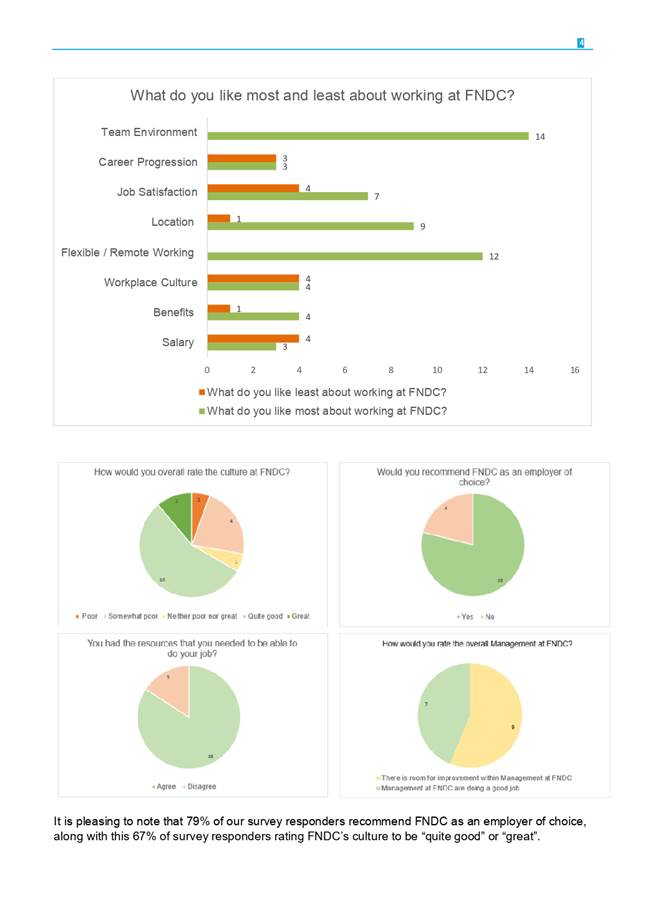

- Exit

Interviews and Analysis.

- Personal

Grievances; and

- Disciplinary

Actions and Costs.

|

TŪTOHUNGA

/ Recommendation

That the Te Miromiro - Assurance, Risk and Finance

Committee receive the report People and Capability Quarterly Update: 1

October - 31 December 2022

|

tĀHUHU KŌRERO / Background

This report will be

presented to the Audit, Risk and Finance Committee on a quarterly basis.

MATAPAKI ME NGĀ KŌWHIRINGA /

Discussion and Next Steps

This report is

Information only.

Āpitihanga

/ Attachments

1. People

Capability Turnover Report 1 October - 31 December 2022 - A4064269 ⇩

|

Ordinary Te

Miromiro - Assurance, Risk and Finance Committee Meeting Agenda

|

22 February

2023

|

6.2 Revenue

recovery report

File

Number: A4070190

Author: Margriet

Veenstra, Manager - Transaction Services

Authoriser: Janice

Smith, General Manager - Corporate Services

TAKE PŪRONGO / Purpose of the Report

The

purpose of this report is to provide quarterly reporting to the Far North

District Council Assurance, Risk, and Finance Committee.

WHAKARĀPOPOTO MATUA / Executive SummarY

This is the

first report for the financial year 2022-23 and provides information on action

taken to collect the arrears balances for rates, water and sundry debt this

year, and to provide information on how collection is tracking against targets.

|

TŪTOHUNGA

/ Recommendation

That the Te Miromiro - Assurance, Risk and Finance

Committee receive the report Revenue recovery report.

|

tĀHUHU KŌRERO / Background

This document has been prepared to outline the arrears balances

for rates, water and Sundry debt as of 31 December 2022 and the actions taken

by the debt management team for the collection of the General Title rates and

water, and sundry debt.

This

information is part of the standing items reported to the Committee on a

regular basis.

MATAPAKI ME NGĀ KŌWHIRINGA /

Discussion and Next Steps

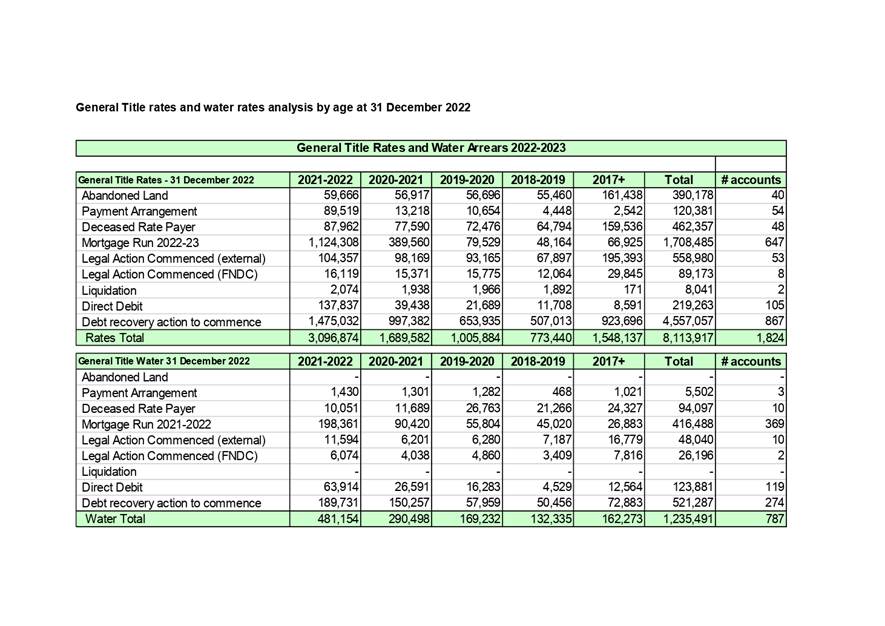

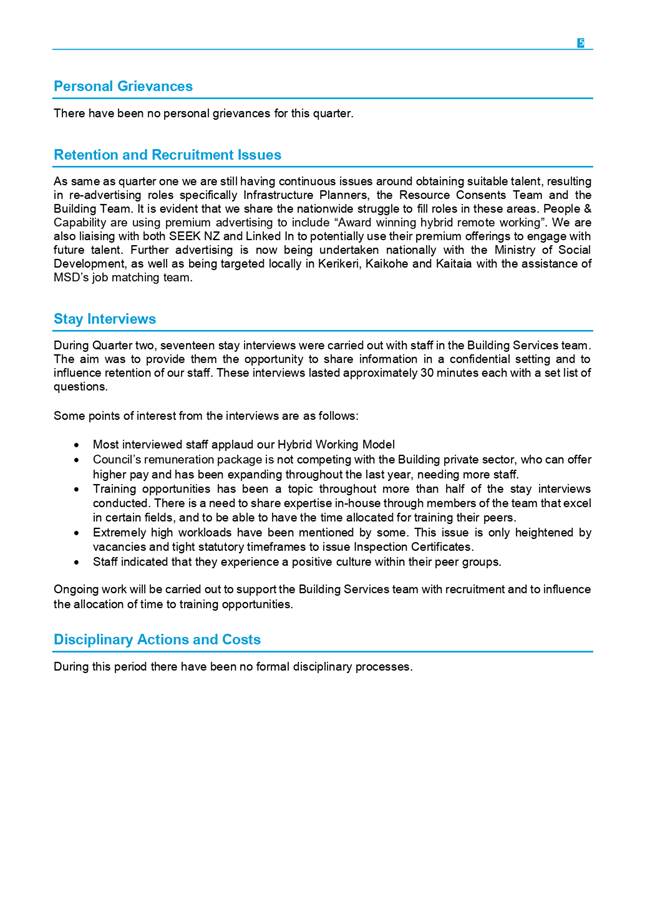

The data

provided is for General Title and Māori Freehold Land rates and water

accounts with sundry debtors shown in a separate table. Since the 1st

of July 2022, the General Title rates total arrears balance has been reduced by

21.4% and water rates by 39.7%.

General

Title rates and water debt

Key

actions since the last report:

· Legal services team sent application to the courts for

financial assessment for 10 properties where owners reside at the property, and

no payments have been received since council received judgment. One of the

properties has since been sold and another to be sold in February.

· Legal services team served statutory demand against one

business and owner of many properties for overdue rates totalling $211,312.70.

Payment arrangement now in place and debt to be cleared by end of March 2023. A

further business paid before statutory demand was served. A statutory demand

is notice demanding payment from a debtor where there is no reasonable dispute

about the amount of the debt, or the fact that it is due. The debtor can either

apply to set the demand aside, pay or come to an arrangement, if not the

company is presumed insolvent and liquidation proceedings may be filed by the

creditor.

· Mortgage demand reporting and reviews of accounts

completed. Pre-mortgage demand calling commenced for small financial

institutions.

· Recruitment to

replace two revenue recovery officers who moved to other positions in council

at the start of the rating year. One new officer started 9 January and

interviews for second officer to be completed by the end of January.

Next

actions:

· Prepare and pass a further list of businesses with rates

arrears to Legal Services team to serve statutory demand.

· Commence pre-mortgage demand calling 16 January 2023, one

bank per week over a 5-week period, finishing 17 February 2023. Mortgage demand

will be issued to the relevant bank at the end of each week.

For the total number of General Title rates accounts marked

as ‘Debt recovery action to commence’:

· These are properties where there is no mortgage, and we do

not have a payment arrangement or direct debit set up on the account.

· 46% of properties only have last year’s rates in

arrears and 22% have 2 years of arrears. Debt management will be contacting

these owners by phone, email, or letter. Any water arrears will be picked up at

the same time.

· 30% of these accounts have arrears of 3 or more rating

years. Debt management will start the final demand process for these which can

result in referral to Council’s legal services team to commence legal

proceedings.

Comparing Q2 last year to this year, arrears collection was

up this quarter compared to the previous year, but we have seen a drop of

current rates collected, similar to Q1 of this year. The number of properties

receiving penalty notices this quarter increased by 15% compared to last year.

Revenue recovery did make post instalment due date calls in November to owners

who had not paid Q1 and Q2 instalments and majority had forgotten and

subsequently paid. There appeared to be several businesses in the tourism

sector with unpaid rates and we successfully trialled issuing statutory demand

which we will continue with this year. We will continue to monitor rates

accounts for businesses within the tourism sector for the next couple

instalments, as it has been widely publicised that the industry is facing

challenges due to staff shortage and recent bad weather events.

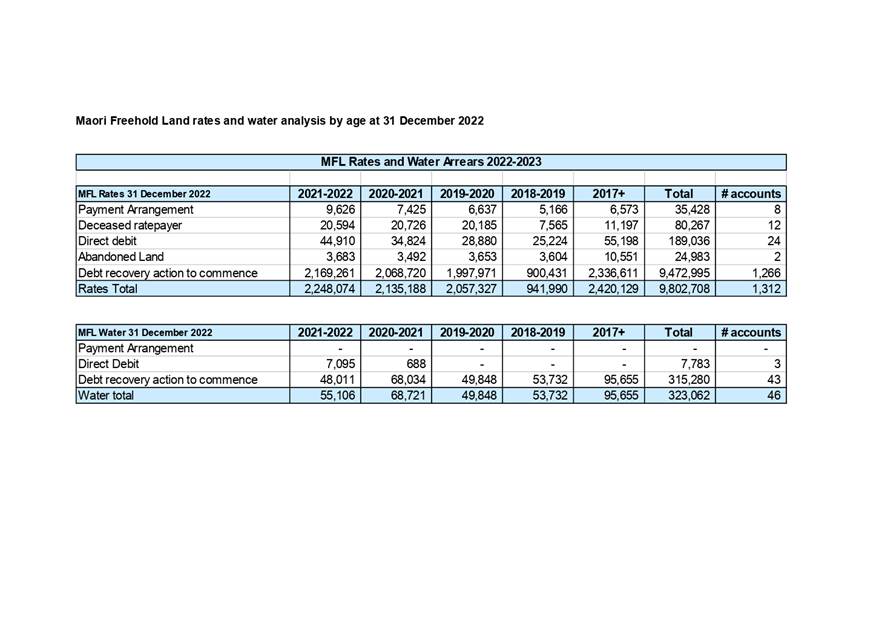

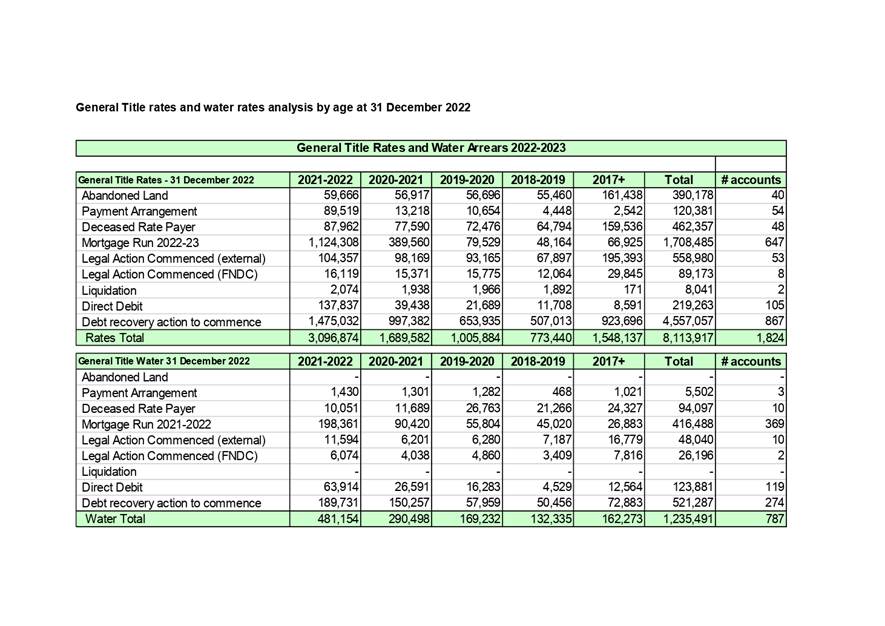

Maori

Freehold Land rates and water debt

The rates debt has reduced by 2.08% since the start of the

year of which 25% was for write-offs for properties which are non-rateable

since the introduction of the Whenua Māori rating amendment law came in to

affect. The water rates were reduced by 2.98% since the start of the year.

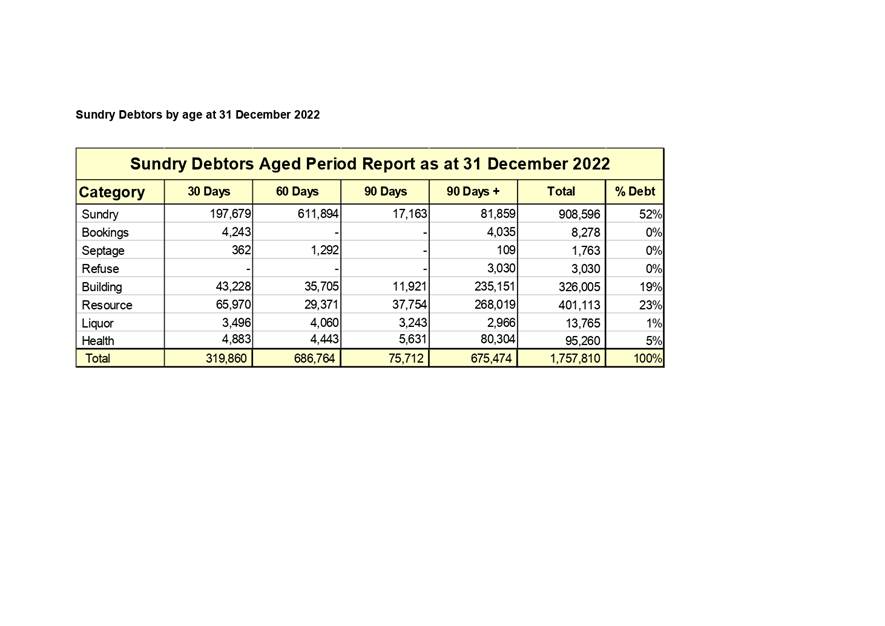

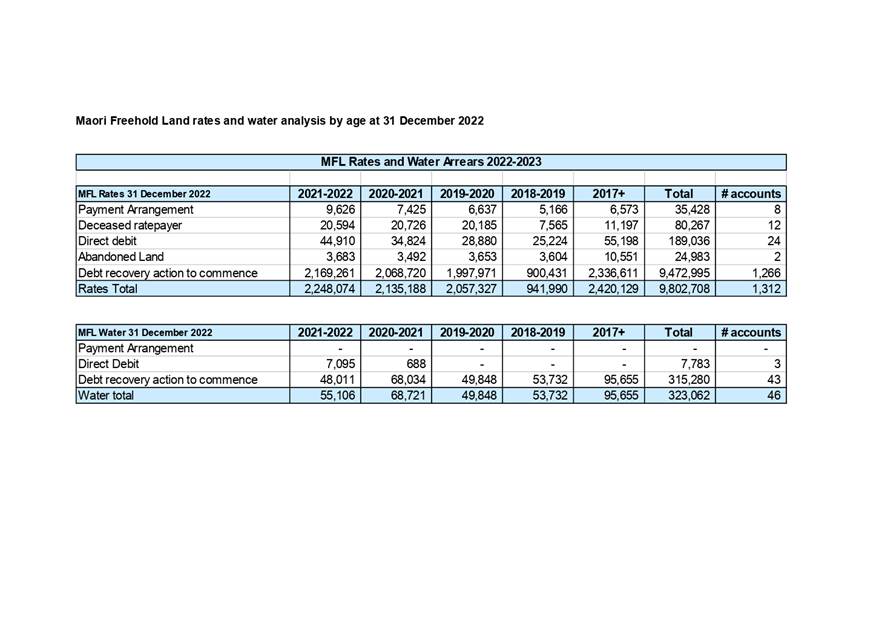

Sundry debtors debt

The total sundry debtors aged debt balance has increased

since the start of the year due to a delay in payment for Ministry of Business,

Innovation and Employment sundry invoices for which payment is expected by the

end of January 2023.

The resource consent and building debt have remained at the

same balance since 30 June 2022. The revenue recovery team continue to work

with both teams to reduce this.

PĀNGA PŪTEA ME NGĀ WĀHANGA

TAHUA / Financial Implications and Budgetary Provision

Provision is made annually for doubtful debts in relation

to the arrears owed to council. A higher provision for Maori Freehold land

rates and water is made in comparison to General Title rates and water due to

the difference in collection options available to Council.

Āpitihanga

/ Attachments

1. 31

December 2022 ARF Revenue recovery Report attachment - A4070132 ⇩

|

Ordinary Te

Miromiro - Assurance, Risk and Finance Committee Meeting Agenda

|

22 February

2023

|

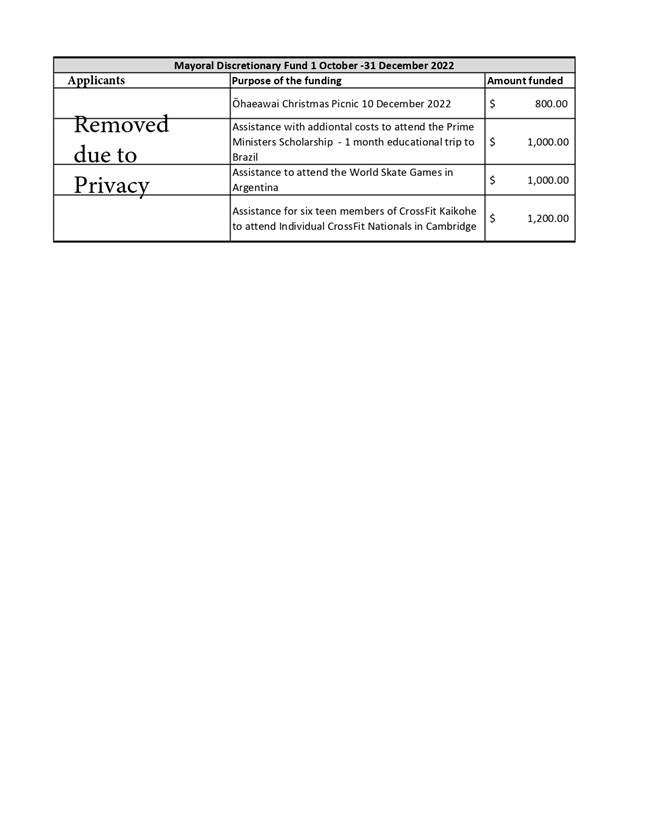

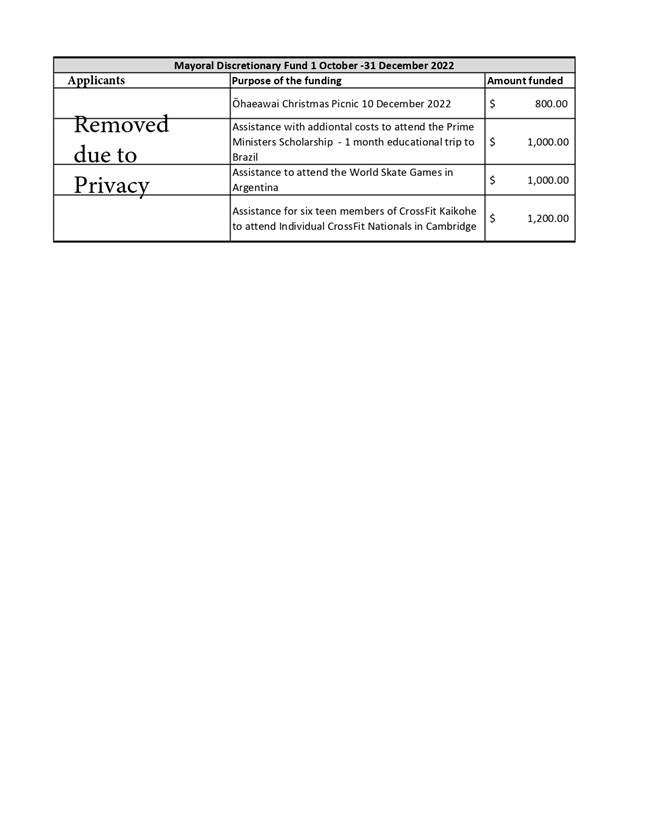

6.3 Mayoral

Discretionary Fund

File

Number: A4072810

Author: Rhonda-May

Whiu, Democracy Advisor

Authoriser: Jacine

Warmington, Manager - Community and Customer Services

TAKE PŪRONGO / Purpose of the Report

For Te Miromiro -

Assurance, Risk and Finance Committee to note the quarterly expenditure from

the Mayoral Discretionary Fund.

WHAKARĀPOPOTO MATUA / Executive SummarY

Council policy requires

the reporting from the Mayoral Discretionary Fund to the Committee. This report

covers the quarterly period of 1 October to 31 December 2022.

|

TŪTOHUNGA

/ Recommendation

That the Te Miromiro - Assurance, Risk and Finance

Committee receive the report Mayoral Discretionary Fund.

|

tĀHUHU KŌRERO / Background

The Mayoral Discretionary

Fund was established as a response to ongoing requests for financial assistance

that are not eligible under existing funding avenues within Council, or are of

an emergency assistance nature.

All decisions on funding

are at the discretion of the Mayor.

In the interests of

transparency for ratepayers, Council policy requires that the grants made are

reported publicly.

MATAPAKI ME NGĀ KŌWHIRINGA /

Discussion and Next Steps

This report is for

information only.

PĀNGA PŪTEA ME NGĀ WĀHANGA

TAHUA / Financial Implications and Budgetary Provision

The total fund is in the

amount of $20,000 excluding GST. The fund is to be included as a recurrent item

in Council’s annual operational budget.

Āpitihanga

/ Attachments

1. Mayoral

Discretionary Fund 1 October -31 December 2022 - A4077976 ⇩

|

Ordinary Te

Miromiro - Assurance, Risk and Finance Committee Meeting Agenda

|

22 February

2023

|

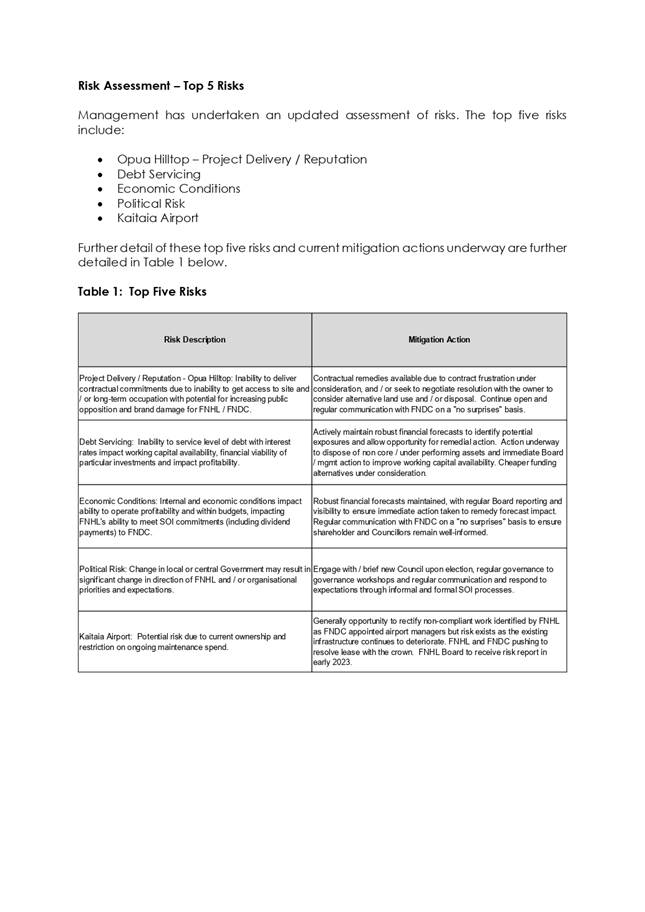

6.4 FNHL

Reports 2022 – Finance, Health & Safety and Risk

File

Number: A4087258

Author: Julia

Lee, Senior Financial Accountant

Authoriser: Janice

Smith, Group Manager - Corporate Services

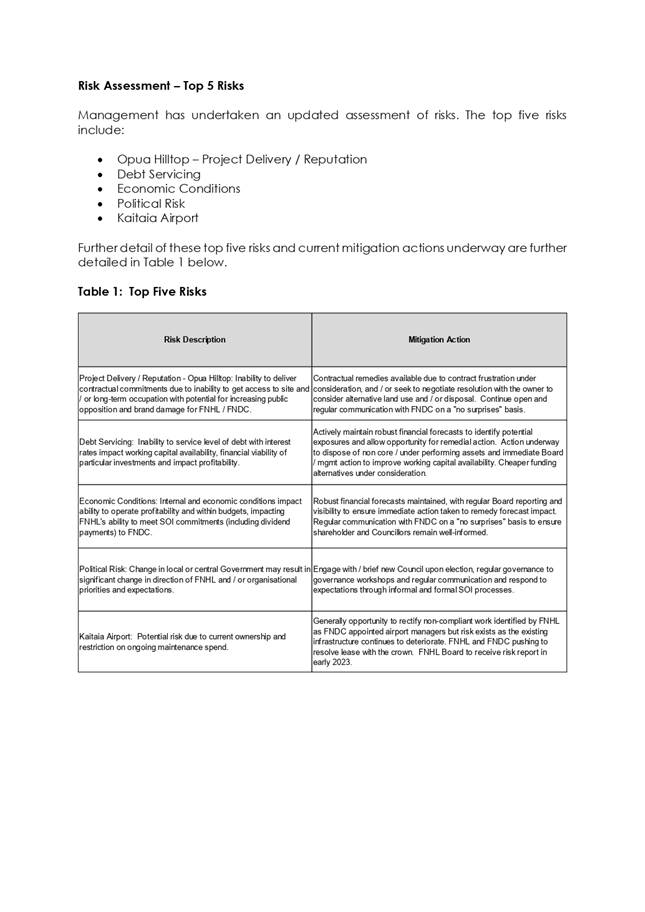

Take Pūrongo / Purpose of the Report

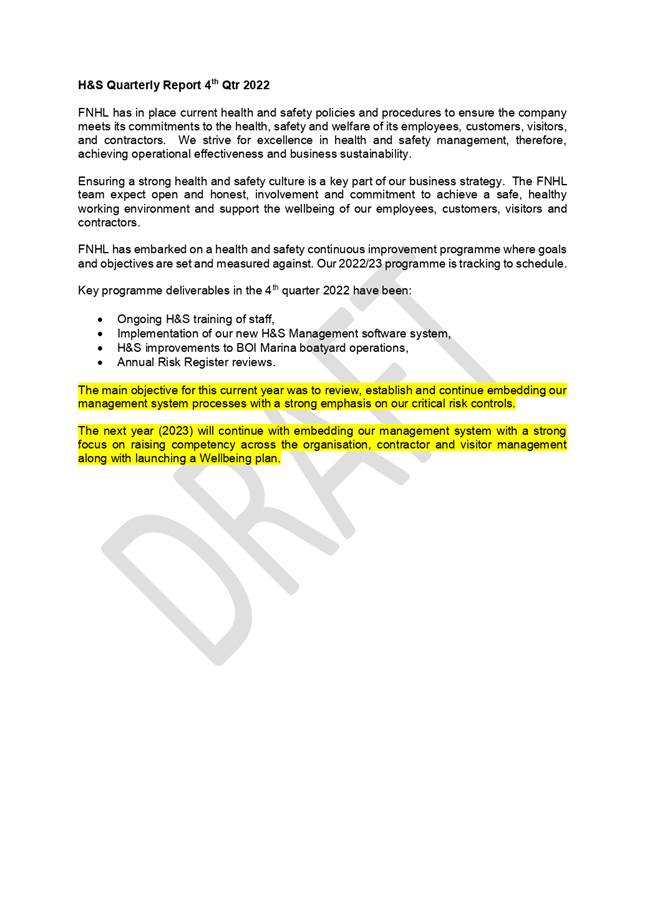

To present the Far North

Holdings Limited (FNHL) first quarter financial report, Risk Report Nov 2022

and H&S Quarterly Report 4th quarter 2022

WhakarĀpopoto matua / Executive Summary

· These reports are for the first quarter for the financial year

2022/23.

|

tŪtohunga

/ Recommendation

That the Te Miromiro - Assurance, Risk and

Finance Committee receive the reports for FNHL Reports 2022 – Finance,

Health & Safety and Risk.

i) Management

accounts.

ii) Risk

report.

iii) H&S

quarterly report.

|

1) TĀhuhu kŌrero / Background

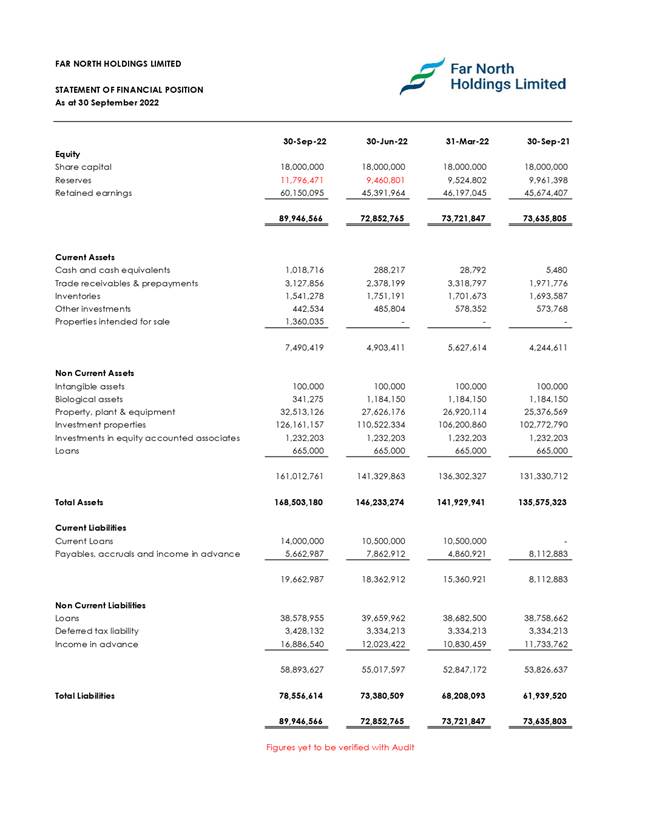

The September 2022 first quarter financial report is the

first report received for the current financial year.

The Risk and H&S quarterly reports are the first to be

received by Council, in line with Letter of Expectation dated Dec 2021 and

outlined in Statement of Intent 2022-25.

2) matapaki me NgĀ KŌwhiringa /

Discussion and Options

Commentary on first quarter management accounts:

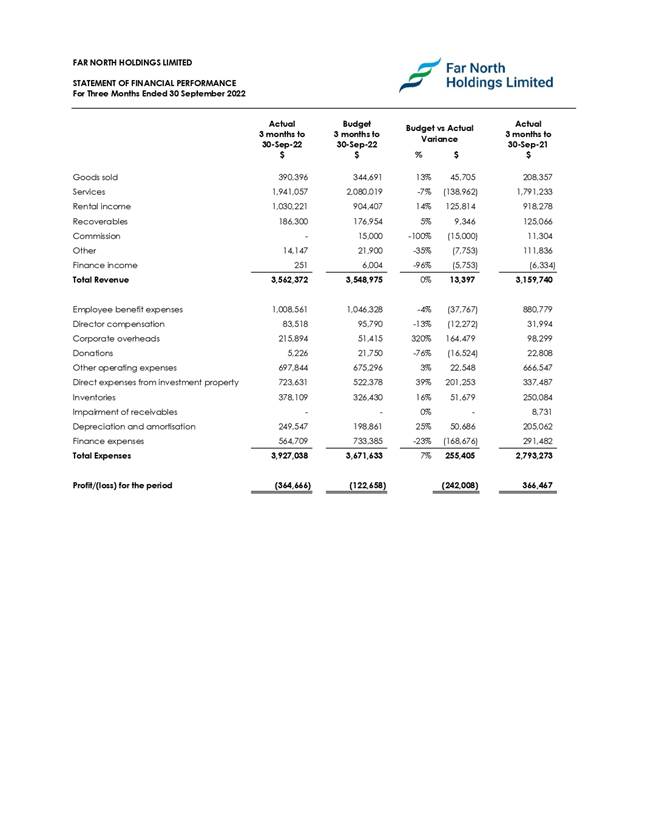

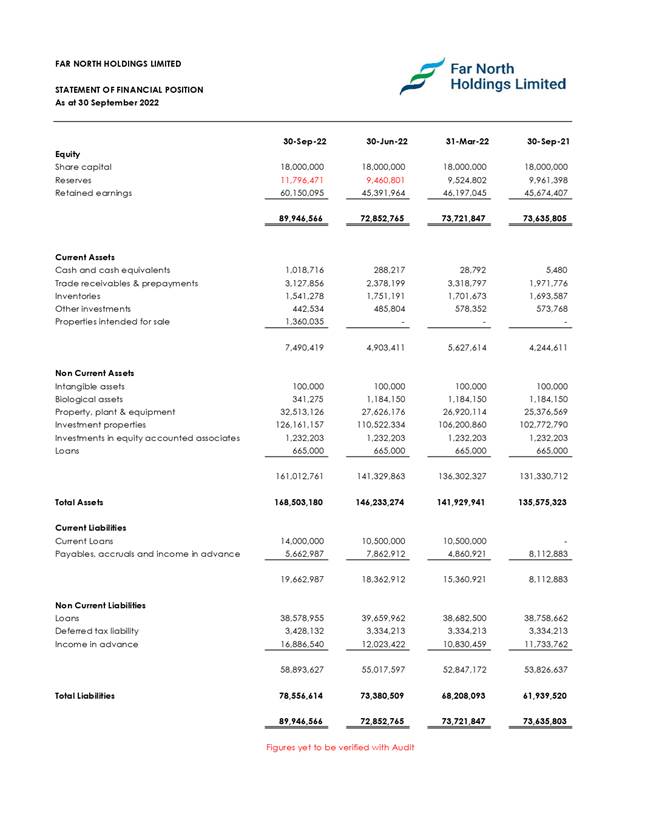

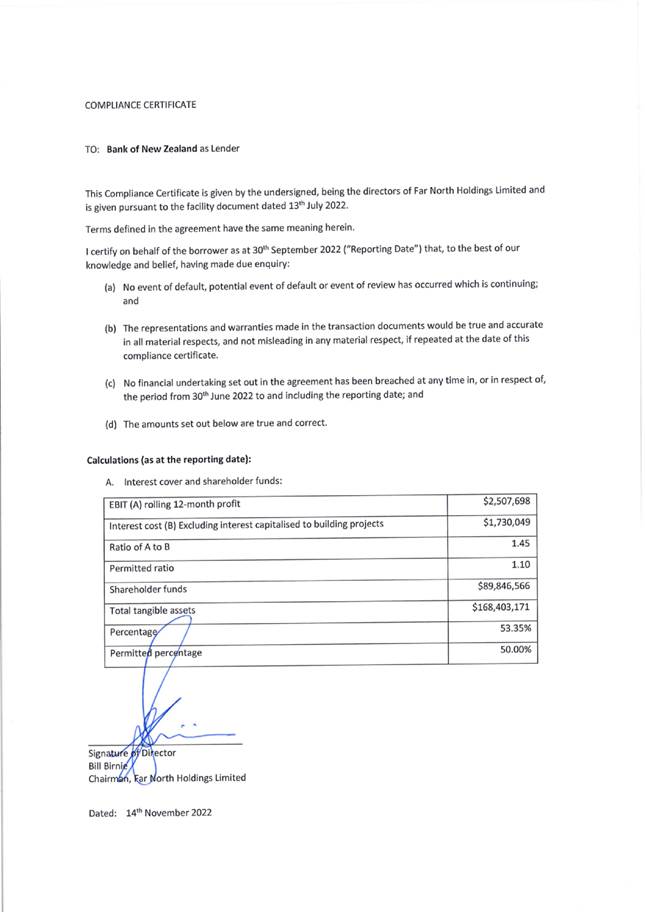

FNHL’s financial performance is below budget primarily

from the ongoing impacts of the global economy and resulting rapid rise of

inflation and interest rates.

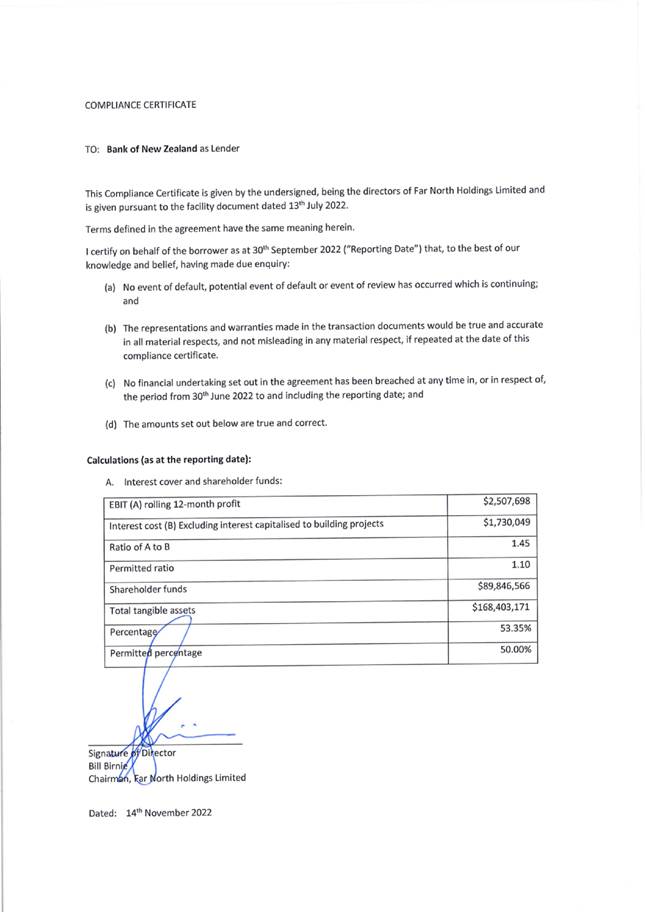

This is seen in the interest rate cover ratio. This

ratio represents how many times the company can pay its obligations using

earnings – it declined from 3.59 at 30 September 2021 to 1.45 at 30

September 2022, minimum ratio being 1.1.

Further, equity/asset ratio illustrates how the company pays

for its assets, so the lower it is, the more debt the company has used to pay

for them – it deteriorated slightly from 54.28% at 30 September 2021 to

53.4% as at 30 September 2022, permissible ratio of 50%.

Covid continues to hinder tourism in Northland, so rent

relief is still being provided to the effected tenants, and further support is

expected to be provided to those tenants that continue to be affected.

Building continues to progress well with the Ngawha

Innovation and Enterprise Park, with:

· NorthTec internal

linings currently at 75% complete, estimated completion is mid-December.

· Regent internal

fit-out is 95%, with the inside of the building due to be completed

mid-October, and external works expected end of September.

· Innovation Hub is

progressing well, and is currently on schedule, with some external works having

commenced.

· Corrections site

has two building platforms completed, with slab construction due to start early

October.

Community Housing Projects are progressing well, with three

units having been completed and delivered to site at Te Hau Ora a Ngapuhi

Kaikohe and framing for the next six units has commenced. At Ranfurly

Street, Dargaville, resource consent has been lodged for stage one.

The Kaitaia Masterplan is due to be finalised and presented

to Kaitaia Business Association and community Board in mid-November.

Other projects include the Merlin Labs Hangar at Kerikeri

Airport to provide a new facility for an aviation software company.

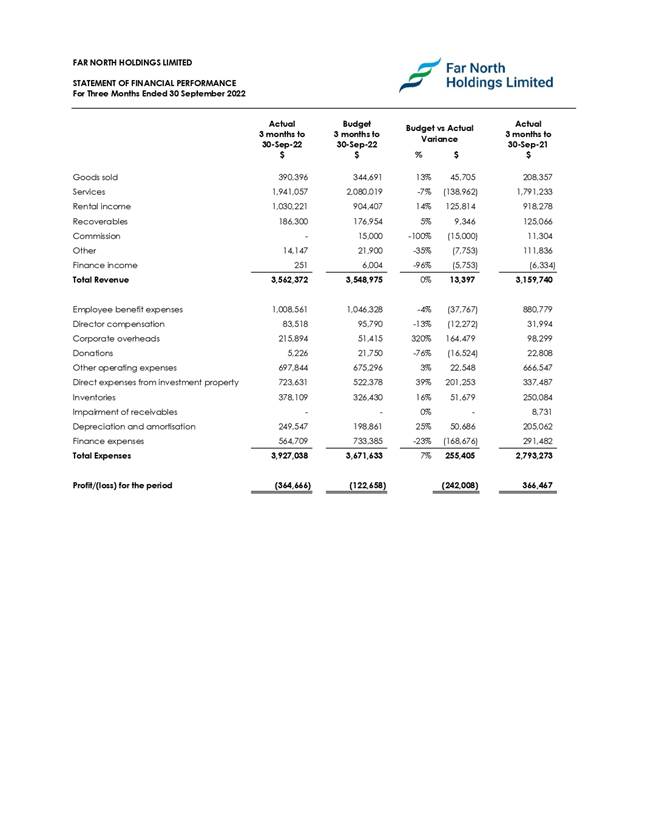

Operating loss is double what was originally budgeted for,

with $365k loss actual versus $123k budget. This is due to:

· Increase

in Goods Sold, $390k actual versus $345k budget, an increase in 13% - due to

higher-than-expected sales for fuel and boatyard operations.

· Increase

in Inventories, $378k actual versus $326k budget, 16% - due to increased fuel

costs, but this offsets the increase in Goods Sold above.

· Honey

income is lower than expected $14k actual versus $$22k, 35% decrease –

reflects the wind down of the business due to ongoing adverse performance.

· Rental

income is performing well against budget, $1,030k actual versus $904k budget,

14% increase – reflects increases in CPI adjustments to commercial

properties, together with the Kamo Road property which has exceeded budgeted

estimate.

· Employee

benefit expenses are lower than budgeted, $1,009k versus $1,046k, 4% decrease -

due to capitalisation of staff costs related to development projects, together

with the current tight employment market causing difficulty in securing staff.

· Corporate

overheads are significantly above budget, $216k versus $51k, 320% increase -

multiple expenses being incurred during the first quarter which should level

out throughout the year. These include Health & Safety, reflecting

ongoing commitment to improving the work environment for staff and the public,

Consulting and Computer costs due to structural and tax advice, and the pending

relocation to Ngawha Innovation Park.

· Direct

expenses from investment property, $724k versus $522k, 39% increase - primarily

due to recruiting a temporary airport manager and 30% increase in insurance

costs, and delays for repairs & maintenance from last year have now begun

to catch up.

· Finance

expenses, $565k versus $733k, 23% decrease – reflects delayed drawdown of

financing facilities related to the Corrections and RSA projects. These

will increase significantly as progress is made with these projects and the drawdown

facilities utilised.

3) PĀnga PŪtea me ngĀ

wĀhanga tahua / Financial Implications and Budgetary Provision

The are no financial

implications arising from these reports, they are information only reports.

Āpitihanga

/ Attachments

1. FNHL

First Quarter Report 22.23 - A4087240 ⇩

2. FNHL

HS Qtrly Report 4th qtr 2022 draft v01 - A4087292 ⇩

3. FNHL

Risk Report Nov 22 - A4087291 ⇩

Hōtaka Take Ōkawa / Compliance Schedule:

Full consideration has been given to the provisions of the

Local Government Act 2002 S77 in relation to decision making, in particular:

1. A

Local authority must, in the course of the decision-making process,

a) Seek

to identify all reasonably practicable options for the achievement of the objective

of a decision; and

b) Assess

the options in terms of their advantages and disadvantages; and

c) If

any of the options identified under paragraph (a) involves a significant

decision in relation to land or a body of water, take into account the relationship

of Māori and their culture and traditions with their ancestral land, water

sites, waahi tapu, valued flora and fauna and other taonga.

2. This

section is subject to Section 79 - Compliance with procedures in relation to

decisions.

|

He

Take Ōkawa / Compliance Requirement

|

Aromatawai

Kaimahi / Staff Assessment

|

|

State the level of significance

(high or low) of the issue or proposal as determined by the Council’s

Significance and Engagement Policy

|

Not significant

|

|

State the relevant Council

policies (external or internal), legislation, and/or community outcomes (as

stated in the LTP) that relate to this decision.

|

Schedule 8 (3) of Local

Government Act 2002

|

|

State whether this issue or

proposal has a District wide relevance and, if not, the ways in which the

appropriate Community Board’s views have been sought.

|

NA

|

|

State the possible implications for Māori

and how Māori have been provided with an opportunity to contribute to

decision making if this decision is significant and relates to land and/or

any body of water.

State the possible implications and how this

report aligns with Te Tiriti o Waitangi / The Treaty of Waitangi.

|

NA

|

|

Identify persons likely to be

affected by or have an interest in the matter, and how you have given

consideration to their views or preferences (for example – youth, the

aged and those with disabilities).

|

NA

|

|

State the financial implications

and where budgetary provisions have been made to support this decision.

|

NA

|

|

Chief Financial Officer review.

|

CFO has reviewed these reports.

|

|

Ordinary Te

Miromiro - Assurance, Risk and Finance Committee Meeting Agenda

|

22 February

2023

|

|

Ordinary Te Miromiro

- Assurance, Risk and Finance Committee Meeting Agenda

|

22 February

2023

|

|

Ordinary Te

Miromiro - Assurance, Risk and Finance Committee Meeting Agenda

|

22 February

2023

|

|

Ordinary Te

Miromiro - Assurance, Risk and Finance Committee Meeting Agenda

|

22 February

2023

|

7 TE

WĀHANGA TūMATAITI / Public Excluded

RESOLUTION TO

EXCLUDE THE PUBLIC

|

Recommendation

That the public be excluded from the following parts of

the proceedings of this meeting.

The general subject matter of each matter to be considered

while the public is excluded, the reason for passing this resolution in

relation to each matter, and the specific grounds under section 48 of the

Local Government Official Information and Meetings Act 1987 for the passing

of this resolution are as follows:

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Ground(s) under section 48 for the

passing of this resolution

|

|

7.1 - Current Legal Proceedings And

Potential Liability Claims

|

s7(2)(g) - the withholding of the information is

necessary to maintain legal professional privilege

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|