Te

Kaunihera o Tai Tokerau ki te Raki

AGENDA

Assurance, Risk and Finance Committee Meeting

Wednesday, 31 August 2022

|

Time:

|

11:00 am

|

|

Location:

|

Council Chamber

Memorial Avenue

Kaikohe

|

Membership:

Chairperson John Vujcich

Deputy Chairperson Bruce Robertson

Mayor John Carter

Deputy Mayor Ann Court

Cr Mate Radich

Cr Rachel Smith

Cr Kelly Stratford

Cr Moko Tepania

Member Mike Edmonds

Member Adele Gardner

Reina Penney

|

|

Authorising Body

|

Mayor/Council

|

|

Status

|

Standing Committee

|

|

COUNCIL

COMMITTEE

|

Title

|

Assurance, Risk and Finance

Committee Terms of Reference

|

|

Approval Date

|

19 December 2019

|

|

Responsible Officer

|

Chief Executive

|

Purpose

The purpose of the Assurance,

Risk and Finance Committee (the Committee) is to assist and advise the

Governing Body in discharging its responsibility and ownership of finance, risk

and internal control.

The Committee will review the

effectiveness of the following aspects:

·

The robustness of financial management

practices.

·

The integrity and appropriateness of

internal and external reports and accountability arrangements.

·

The robustness of the risk management

framework.

·

The robustness of internal controls and

the internal audit framework.

·

Compliance with applicable laws, regulations,

standards, and best practice guidelines.

·

The establishment and maintenance of

controls to safeguard the Council’s financial and non-financial assets.

·

Data governance framework

To perform his or her role

effectively, each Committee member must develop and maintain

his or her skills and knowledge,

including an understanding of the Committee’s responsibilities, and of

the Council’s business, operations, and risks.

Membership

The Council will determine the

membership of the Assurance, Risk and Finance Committee including at least one

independent appointment with suitable financial and risk management knowledge

and experience.

The Assurance, Risk and Finance

Committee will comprise of at least five elected members (one of which will be

the chairperson), and one independent appointed member.

|

Mayor

Carter

|

|

John

Vujcich – Chairperson

|

|

Bruce

Robertson – Deputy Chairperson and Independent Member of the Committee

|

|

Moko

Tepania

|

|

Mate

Radich

|

|

Rachel

Smith

|

|

Kelly

Stratford

|

|

Ann

Court

|

|

Mike

Edmonds

|

|

Adele

Gardner

|

|

Reina

Penney

|

Non-appointed

Councillors may attend meetings with speaking rights, but not voting rights.

Quorum

The quorum at a meeting of the Assurance, Risk and Finance Committee is 4

members.

Frequency of

Meetings

The Assurance, Risk and Finance

Committee shall meet every 6 weeks, but may be cancelled if there is no

business.

Power to

Delegate

The Assurance, Risk and

Finance Committee may not delegate any of its responsibilities, duties or

powers.

Committees

Responsibilities

The Committees responsibilities

are described below:

Financial

systems and performance of the Council

·

Review the Council’s financial

and non-financial performance against the Long-Term Plan and Annual Plan

·

Review Council quarterly financial

statements and draft Annual Report

Far

North Holdings Limited (FNHL)

·

Recommend to Council the approval of

statement of intent and Annual Report (s67 LGA)

·

Receive 6 monthly report on operations

(s66 LGA)

·

Receive quarterly financial statements

·

Recommend appointment of directors of

FNHL

Risk

Management

·

Review appropriateness of

Council’s risk management framework and associated procedures for

effective risk identification, evaluation, and treatment

·

Receive and review risk management

dashboard reports

·

Provide input, annually, into the

setting of the risk management programme of work

·

Receive updates on current litigation

and legal liabilities

Internal

Audit and Controls

·

Review whether management has in place

a current and comprehensive internal audit framework

·

Receive and review the internal audit

dashboard reports

·

Provide input, annually, into the setting

of the internal audit programme of work

·

Review whether there are appropriate

processes and systems in place to identify and investigate fraudulent behaviour

The

Committee will manage Council’s relationship with external auditor.

The

Committee will approve applications to declare land abandoned and any other

such matters under the Rating Act.

Rules and

Procedures

Council’s

Standing Orders and Code of Conduct apply to all the committee’s

meetings.

Annual reporting

The Chair of the Committee will submit

a written report to the Chief Executive on an annual basis. The review

will summarise the activities of the Committee and how

it has contributed to the Council’s governance and strategic objectives.

The Chief Executive will place the report on

the next available agenda of the governing body.

2 Nga Whakapāha Me Ngā Pānga Mema / Apologies

and Declarations of Interest

Members need to

stand aside from decision-making when a conflict arises between their role as a

Member of the Committee and any private or other external interest they might

have. This note is provided as a reminder to Members to review the matters on

the agenda and assess and identify where they may have a pecuniary or other

conflict of interest, or where there may be a perception of a conflict of

interest.

If a Member

feels they do have a conflict of interest, they should publicly declare that at

the start of the meeting or of the relevant item of business and refrain from

participating in the discussion or voting on that item. If a Member thinks they

may have a conflict of interest, they can seek advice from the Chief Executive

Officer or the Team Leader Democracy Support (preferably before the meeting).

It is noted

that while members can seek advice the final decision as to whether a conflict

exists rests with the member.

3 Ngā

Tono Kōrero / Deputation

No requests for deputations were received at the time of the

Agenda going to print.

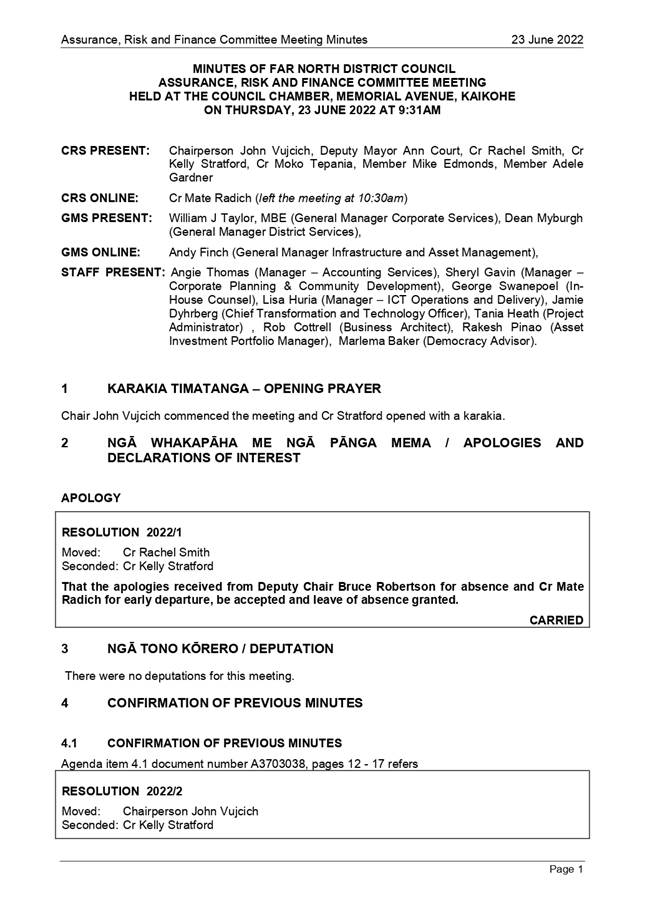

4 Confirmation

of Previous Minutes

4.1 Confirmation

of Previous Minutes

File

Number: A3793199

Author: Joshna

Panday, Democracy Advisor

Authoriser: Aisha

Huriwai, Team Leader Democracy Services

Purpose of the Report

The minutes are attached to allow the Committee to confirm

that the minutes are a true and correct record of previous meetings.

|

Recommendation

That the Assurance, Risk and Finance Committee confirms

the minutes of the Assurance, Risk and Finance Committee meeting held 23 June

2022 as a true and correct record.

|

1) Background

Local Government Act 2002 Schedule 7 Section 28 states that

a local authority must keep minutes of its proceedings. The minutes of these

proceedings duly entered and authenticated as prescribed by a local authority

are prima facie evidence of those meetings.

2) Discussion and Options

The minutes of the meetings are attached.

Far North District Council Standing Orders Section 27.3

states that no discussion shall arise on the substance of the minutes in any

succeeding meeting, except as to their correctness.

Reason

for the recommendation

The reason for the recommendation is to confirm the minutes

are a true and correct record of the previous meetings.

3) Financial Implications and Budgetary

Provision

There are no financial implications or the need for

budgetary provision as a result of this report.

Attachments

1. 2022-06-23

Assurance, Risk and Finance Committee Minutes [A3763713] - A3763713 ⇩

Compliance schedule:

Full consideration has been given to the provisions of the

Local Government Act 2002 S77 in relation to decision making, in particular:

1. A

Local authority must, in the course of the decision-making process,

a) Seek

to identify all reasonably practicable options for the achievement of the

objective of a decision; and

b) Assess

the options in terms of their advantages and disadvantages; and

c) If

any of the options identified under paragraph (a) involves a significant

decision in relation to land or a body of water, take into account the

relationship of Māori and their culture and traditions with their

ancestral land, water sites, waahi tapu, valued flora and fauna and other

taonga.

2. This

section is subject to Section 79 - Compliance with procedures in relation to

decisions.

|

Compliance

requirement

|

Staff

assessment

|

|

State the level of significance

(high or low) of the issue or proposal as determined by the Council’s

Significance and Engagement Policy

|

This is a matter of low

significance.

|

|

State the relevant Council

policies (external or internal), legislation, and/or community outcomes (as

stated in the LTP) that relate to this decision.

|

This report complies with the

Local Government Act 2002 Schedule 7 Section 28.

|

|

State whether this issue or

proposal has a District wide relevance and, if not, the ways in which the

appropriate Community Board’s views have been sought.

|

It is the responsibility of each

meeting to confirm their minutes therefore the views of another meeting are

not relevant.

|

|

State the possible implications for Māori

and how Māori have been provided with an opportunity to contribute to

decision making if this decision is significant and relates to land and/or

any body of water.

|

There are no implications for Māori in confirming minutes

from a previous meeting. Any implications on Māori arising from matters

included in meeting minutes should be considered as part of the relevant

report.

|

|

Identify persons likely to be

affected by or have an interest in the matter, and how you have given

consideration to their views or preferences (for example,

youth, the aged and those with disabilities).

|

This report is asking for minutes

to be confirmed as true and correct record, any interests that affect other

people should be considered as part of the individual reports.

|

|

State the financial implications

and where budgetary provisions have been made to support this decision.

|

There are no financial

implications or the need for budgetary provision arising from this report.

|

|

Chief Financial Officer review.

|

The Chief Financial Officer has

not reviewed this report.

|

|

Assurance, Risk

and Finance Committee Meeting Agenda

|

31 August 2022

|

5 Reports

5.1 Affordability

Risk Decision Report

File

Number: A3787804

Author: Tanya

Reid, Principal Advisor - Organisational Performance and Transformation

Authoriser: Janice

Smith, Acting General Manager - Corporate Services

Take Pūrongo / Purpose of the Report

1.

To seek approval to accept the Affordability Risk Reference Group

recommendation that our current risk position be categorised into four

affordability risk themes.

WhakarĀpopoto matua / Executive Summary

2.

Council has recognised affordability as one of our top organisational

risks as it poses significant risk:

· Affordability is acknowledged as one of Far North’s key

challenges

· Affordability is both complex and multi-faceted.

· The Far North district has high levels of people on low and fixed

incomes

· FNDC has a strong reliance on property rates as a revenue generating

mechanism

· Risk Management is one of the key pillars to manage affordability

· This report recommends separating the current affordability risk

(ARF005) into four grouped under an affordability banner on the top organisational

dashboard to maintain a whole of affordability risk view.

· This supports a whole of Council view while allowing for an

intentional strategic focus on treatments with clear outcomes and

accountability.

|

tŪtohunga

/ Recommendation

That the Assurance, Risk and

Finance Committee:

a) Remove

ARF005 Affordability risk from the top organisational dashboard

b) Adopt

four affordability risks onto the top organisational risk dashboard. The four

risks are:

i) ARF020

Ratepayer ability to pay

ii) ARF021

Provision of Services

iii) ARF022

Integrated planning

iv) ARF023

Form and function of Local Government

c) Establishes

regular risk progress reports, for each risk, to the Assurance, Risk and

Finance Committee.

d) Rescores

risks and reports, at least annually, an affordability risk management

overview to the Assurance, Risk and Finance Committee on the management and

progress to treat the affordability risks.

|

1) TĀhuhu kŌrero / Background

3.

Affordability is acknowledged as one of Far

North’s key challenges. With a small rating base, diverse socio-economic

factors and large distributed infrastructure base and service requirement, this

will get worse over time without intervention.

4.

FNDC has a strong reliance on property rates as a revenue generating

mechanism, and this may create some affordability issues particularly for

households with low or fixed incomes or high property values. As a district

with high levels of low and fixed incomes there are issues regarding

affordability. Changes to local government (including climate change, three

waters, and local government reform) and to the community we serve

(demographics, climate change) will have implications on affordability.

Affordability in the context of rates has two aspects:

· The cost relative

to income (and wealth to the extent that wealth can be converted into income)

· The ability of

ratepayers to earn greater income in the future from the spending of the rates,

e.g. investment in infrastructure that will allow an individual to earn higher

incomes in the future.

5.

Sustainability can be defined as the ability to meet present needs

without compromising the needs of future generations. Sustainability represents

an extended definition of affordability in the sense that sustainability

introduces a longer timeframe in which the issues of fairness and risk must be

considered.

6.

Affordability is a complex and multi-faceted

risk requiring a whole of Council view.

Council’s current affordability risk statement

7.

In November 2018 the Assurance, Risk and Finance Committee drafted and

scored their top organisational risks. These were adopted by Council in May

2019. Since adoption onto the top organisational risk dashboard this risk, described

as ARF005 Affordability risk has been subject to a number of deep dives and

risk progress reports.

The current risk statement, and risk scoring, is articulated

in table 1 below:

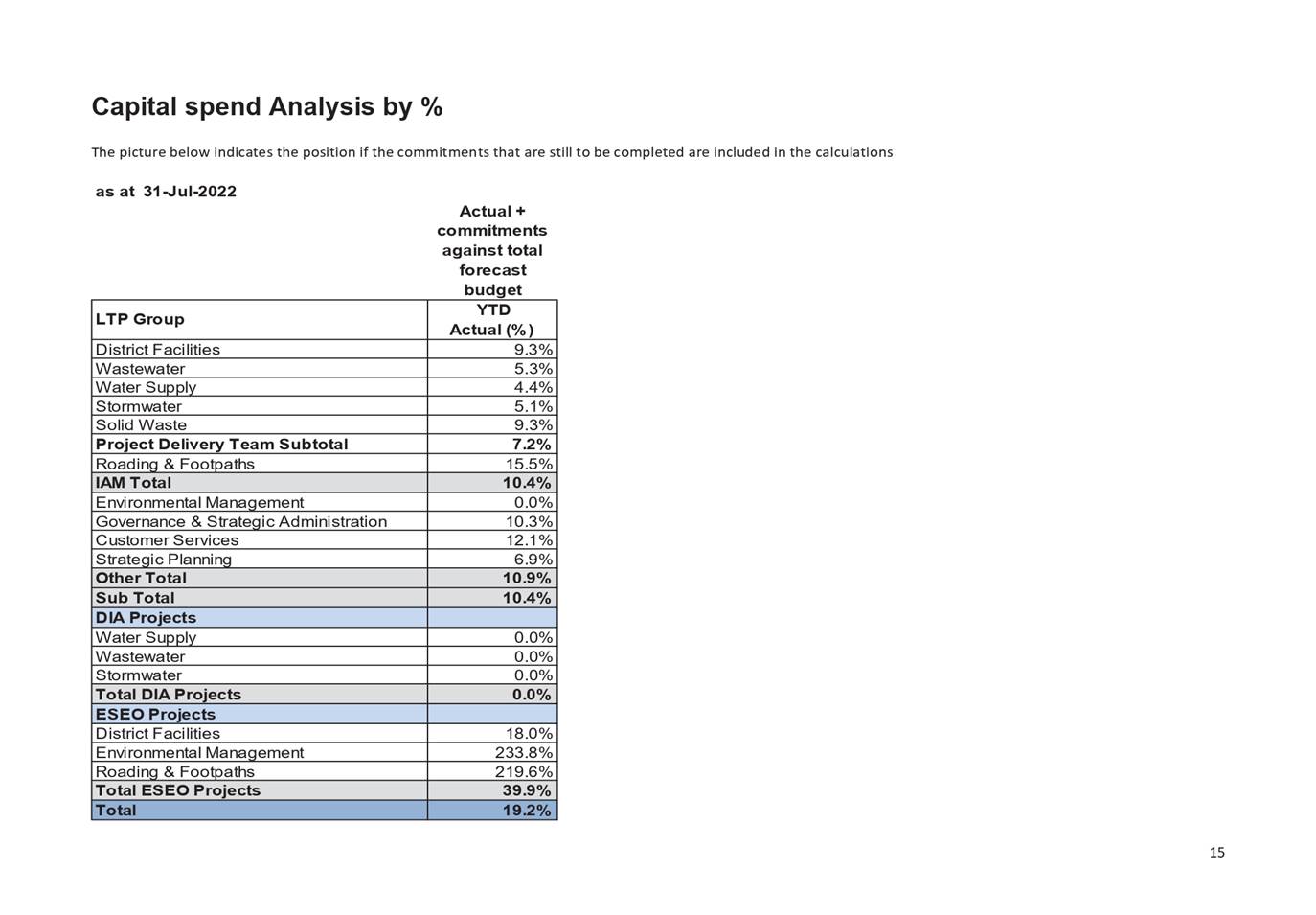

Table 1: ARF005 Affordability

risk statement and risk scoring.

|

Risk Score

|

Risk

description

|

Impacts

|

Treatments

|

|

Inherent

risk score=45

Residual

score = 26

|

Delivery of Services Risk (Affordability)

• Economic development

• Economic delivery (affordability)

• Alignment of financial & regional strategies

• Current and future cost picture

|

• Financial and remediation costs (large assets /

services)

• Future cost forecasting including climate change

modelling

• Rating implications

• Affordability pressures

• Political & reputational pressure

|

• Cost Blueprinting – big picture

• Revenue Review

• Cost and revenue forecasting (in addition to LTP

budgeting)

• Review financial processes and models (e.g.

depreciation)

• Existing & additional revenue streams

investigated

• Scale back discretionary projects / focus on

priorities

|

2) matapaki me NgĀ KŌwhiringa /

Discussion and Options

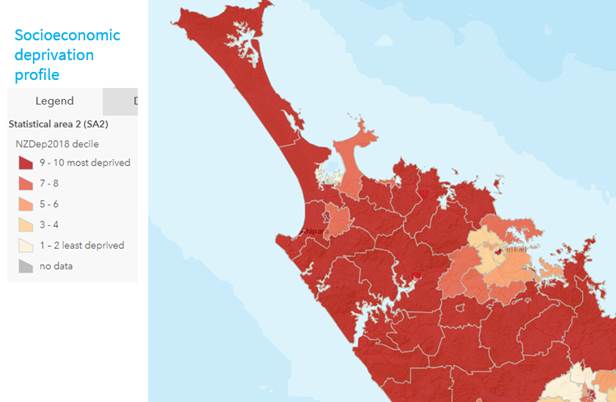

The Far North District has a number of attributes which

affect affordability. Firstly, who we are:

• We are

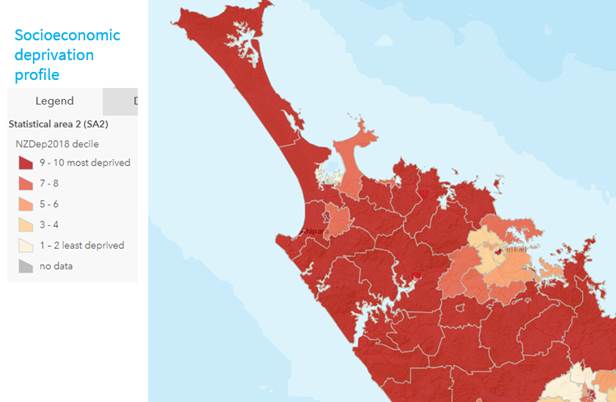

a growing district of 72,600 with a high level of deprivation (the illustration below, from StatsNZ, details our socioeconomic

deprivation profile by mesh area) and a high number of over 65’s.

• We are

a district lacking public transport - distance, affordability and connectivity

are all barriers.

• With 50.5% Māori descent we have a very different ethnic composition compared to the national

population:

• We are the 13th largest Council by area

• We do not have a large central hub

• We are one of seven Councils (Mackenzie, Clutha, Central Otago, Hurunui and Westland) with no townships with greater than 6,500

population.

Using the 2018

census data Council commissioned Business and Economic Research Limited (BERL)

to conduct data analysis of rates affordability across the Far North District

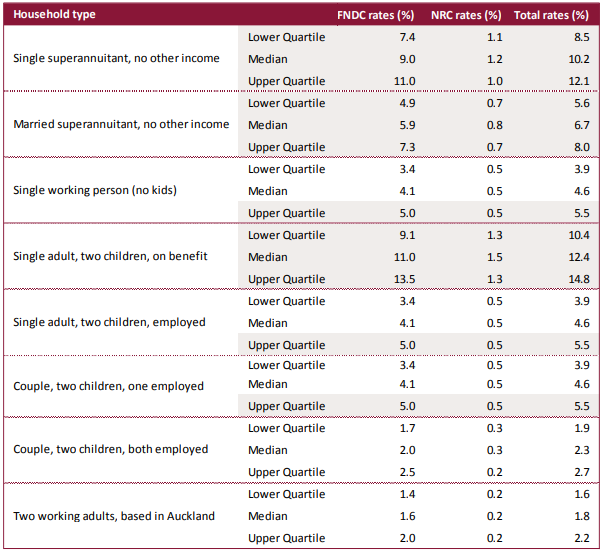

and prepare a report outlining rates affordability issues.

Concerns about

the impact of rates increases on low-income households led to the establishment

of The Local Government Rates Inquiry (the Inquiry) in 2007. The resulting

report, known as the Shand Report after the Chair David Shand, concluded that

rates affordability was the ability to pay rates without serious economic difficulty.

The inquiry noted that in 2004, the average rates paid by households

represented 2.51 percent for all groups and although there are likely to be

pockets of affordability in all types of household, they did not consider rates

affordability was a problem for the average household. As an approximate

benchmark, affordability concerns will arise where rates exceed five percent of

gross household income.

The report also

suggested that particular household types will demonstrate rates affordability

issues:

• Households

in the lowest 40 percent of incomes

• One

parent households with children

• One

person households

• Households

whose principal source of income is New Zealand Superannuation.

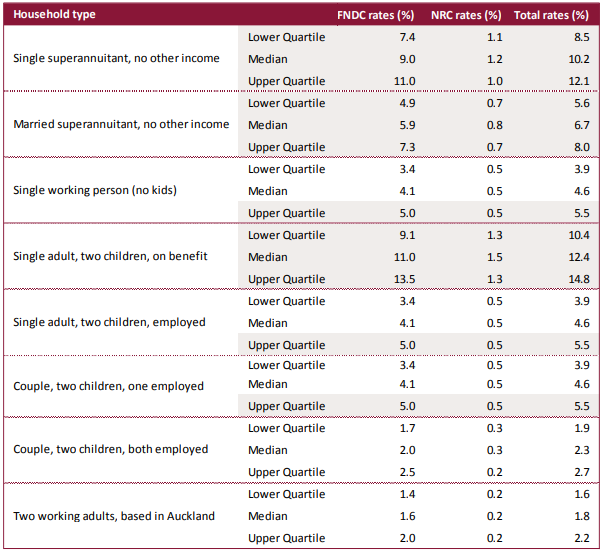

These

households predominantly have low or fixed incomes. Consequently, BERL used the

affordability benchmarks of:

• Rates

as a percentage of gross household income, where affordability issues are

likely to arise when rates exceed five percent.

BERL found that

within the Far North District there were a significant number of households

with rates affordability issues in the Far North District. These were:

• Single

superannuitant with no other income

• Married

superannuitants with no other income

• Single

adult with two children in receipt of Sole Parent Support households.

These

households had rates in excess of five percent of gross household income across

lower, median and high quartile total rates levels. A fuller view of household

rates affordability by household type / income level is provided in table 2

below.

Table 2: total rates as a

percentage of gross income by household type. Far North District

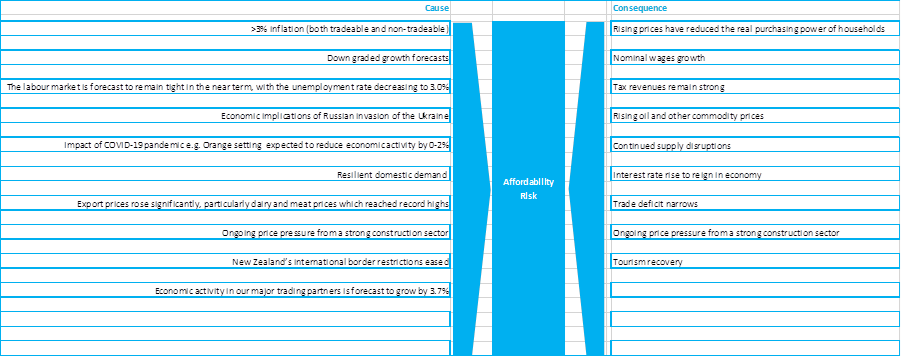

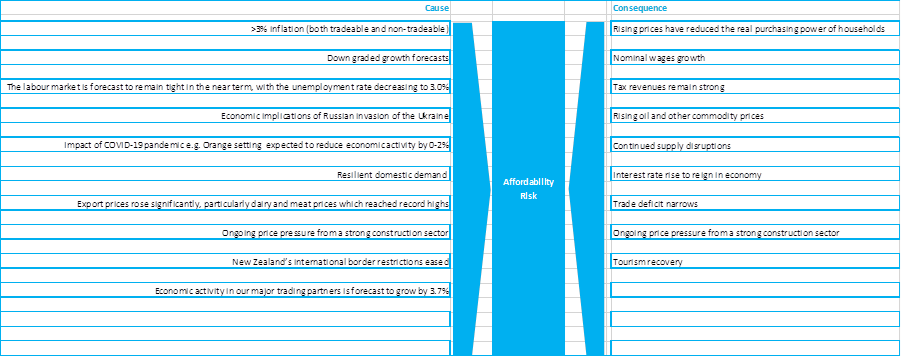

Nationally and

internationally economies are feeling the effects of the COVID pandemic, war

and climate change. Table three is a bow tie type analysis identifying current

external environment influences which are impacting affordability within the

Far North.

Table 3: Bow tie analysis

current economic issues and consequences.

|

Assurance, Risk

and Finance Committee Meeting Agenda

|

31 August 2022

|

8.

A root cause strategic analysis separated the affordability risk into

four clear themes. These themes were workshopped by the Affordability Risk

Reference group to provide strawman risk statements then further workshopped

with the Assurance, Risk and Finance Committee. These statements are captured

in table four. Risk and Finance Committee agreed and scored the inherent risk for

the four strategically themed affordability risk statements.

|

Table 4: Affordability

Risk statements

|

|

Cause

(Because

of…)

|

Risk

(there is a chance that…)

|

Effect

(leading

to…)

|

|

a)

Ratepayer

ability to pay

b)

We are a

district of high deprivation, geographically dispersed small communities with

no major hub and no public transport. We are an economically challenged

district with limited employment opportunities and a significant number of

households with low or fixed incomes.

c)

Berl’s

rule of thumb: *rates as a % of gross household income, where affordability

issues are likely to arise when rates exceed 5%

d)

*Rates =

cost of essential and social infrastructure and services usually provided by

Territorial Authorities.

|

That Territorial Authorities income requirement, to

fund essential and social infrastructure and services, will be outpaced by

our ratepayer’s ability to pay

|

If ratepayers' default on their rates payment

Council will not have the cashflow to continue operations without borrowing

or taking some other actions such as

reprioritising service delivery and reviewing the user pays components of

current fees and charges.

|

|

e)

Provision of

Services

f)

We are a district of

multiple small scale service schemes (with small number of ratepayers covering

the costs of these schemes) with aged infrastructure. We are also

experiencing the effects of higher engineering and quality standards, other

entities committing Council to ongoing maintenance of new assets and

increasing costs to manage / adapt to the effects of climate change.

|

There is a chance that we cannot continue the expected provision of

service to our communities into the future at an affordable level.

|

Not being able to deliver or provide new assets / amenities /

facilities at an acceptable level of service which sustain and promote

community wellbeing and resilience.

We may also not be legally compliant (statutory services) or be able

to continue offering the range of services currently being provided.

|

|

g)

Integrated

planning

h)

As a Council,

district, region, and inter-agency, we are not connected or resourced to plan

for the future in a coherent and integrated manner.

|

This leads to short term and/or adhoc decisions on development and

protection of the district (and region), missed opportunities and communities

that feel vulnerable and undeveloped.

|

This leaves us unable to put the right strategies/plans in place and

operate from a holistic perspective, i.e. building places rather than

individual assets.

We are not prioritising the best use of limited resources achieving

sub-optimal outcomes

|

|

i)

Form and function

of Local Government

j)

The form and

function of local Government is changing (and will continue to be subjected to reforms and changes), but this Council still only has rates

and user pays charges as its core revenue source. There is a lack of certainty around

Central Govt’s willingness to provide funding as part of current and

future devolved responsibilities at local govt. level. Additionally, our processes (10

year long term plan) do not align with the government cycle e.g. Waka Kotahi

|

There is a chance that we do not have the long-term operational

funding and resources to support the mandate; and that Council does not have

the instruments to implement policy changes.

|

We end up in a position where we are forced to take action using

existing resources, impeding the delivery of our current workload.

And we do not meet the expectations set by central government causing

damage to Council reputation

Example climate change.

|

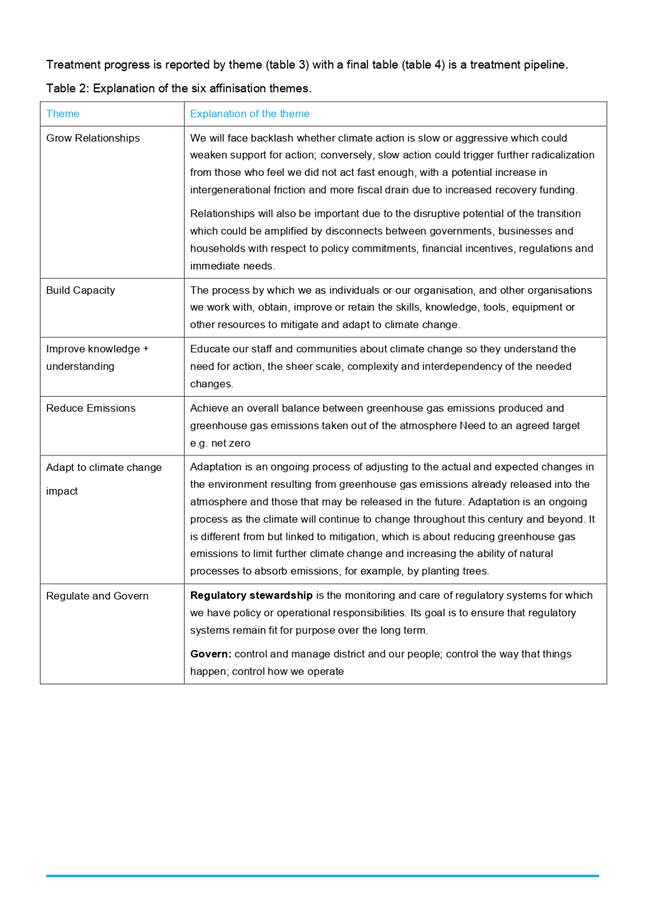

Scoring of affordability

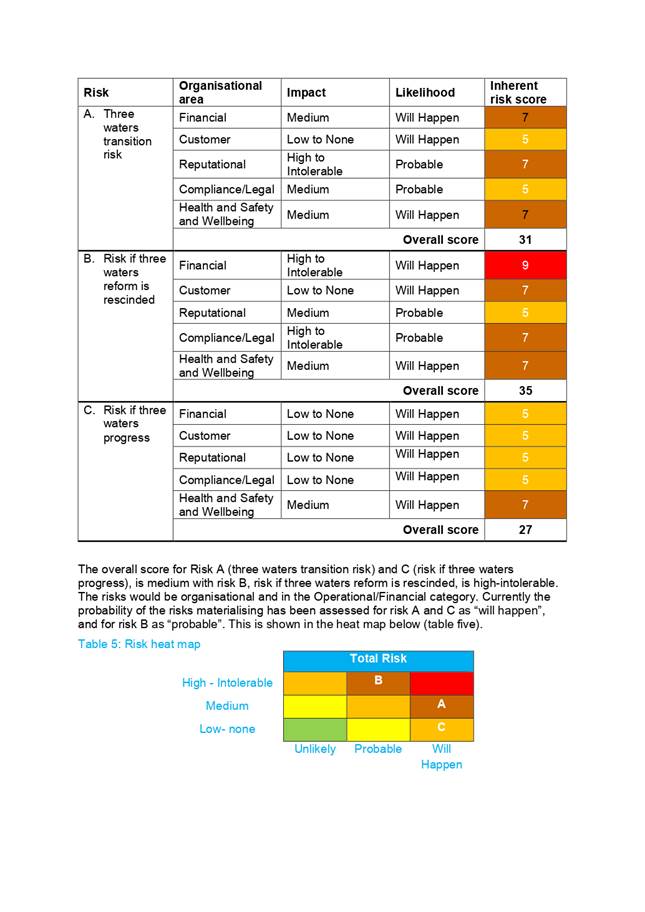

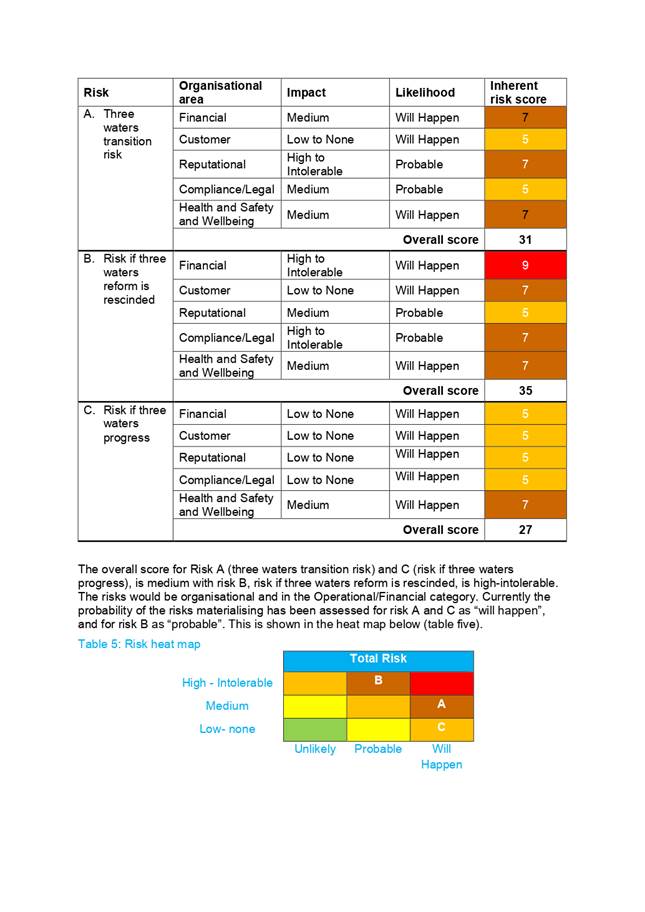

risks

9.

The Assurance, Risk and Finance Committee scored the inherent risk. The

risks were scored by identifying both the risk impact for five organisational

areas (see table five) and the likelihood of the risk occurring (see table

six). For each organisational area, the risk impact is given a score of

“High to Intolerable”, “Medium” or “Low to

None” and the likelihood is rated as either “Will happen”,

“Probable” or “Unlikely”. The impact and likelihood

matrix is used to determine the values for each affordability risk (see table

seven). The likelihood of all four risks materialising is assessed as

“will happen”.

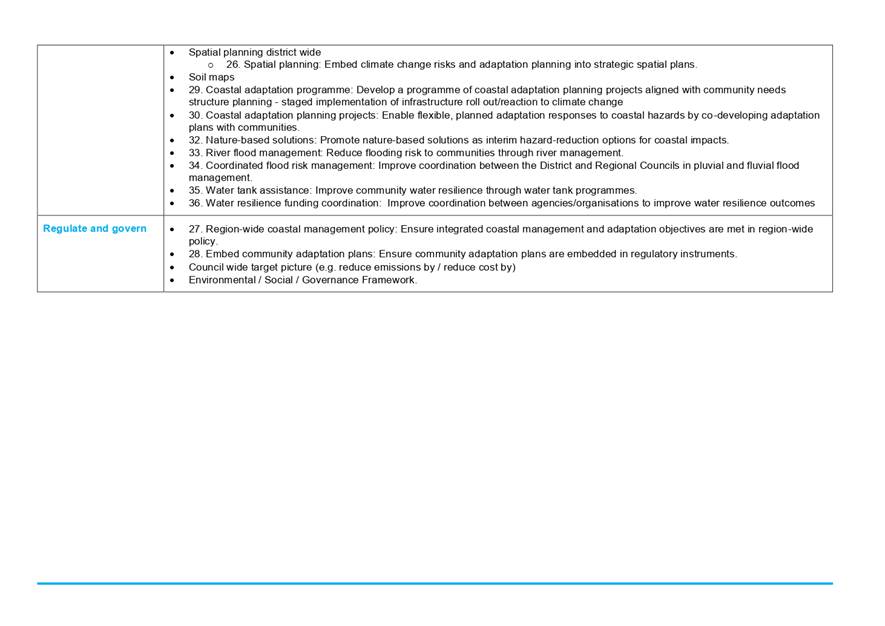

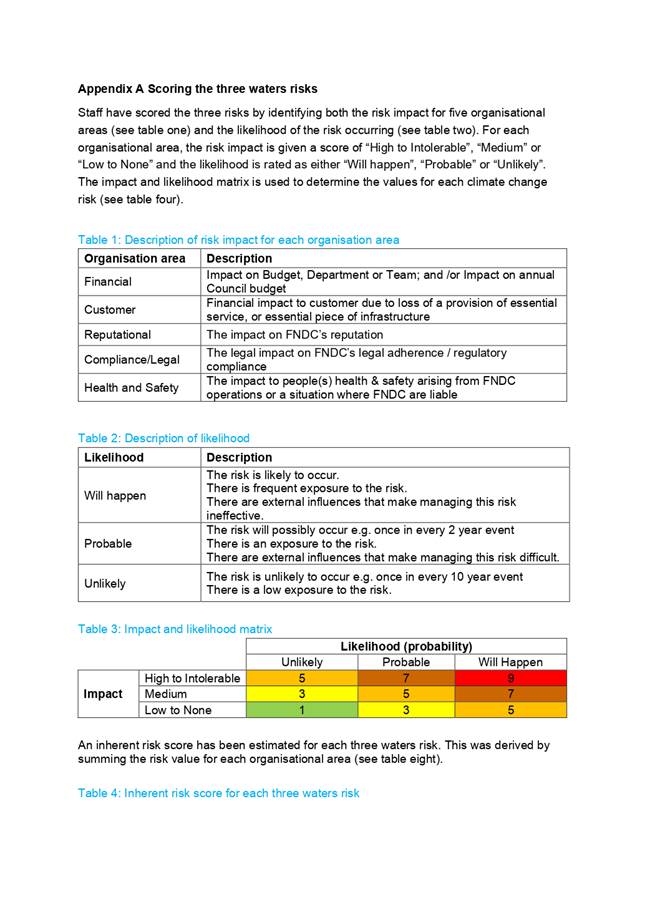

Table 5: Description of risk impact for each organisation area

|

k)

Organisation area

|

l)

Description

|

|

m)

Financial

|

n)

Impact on Budget, Department or Team; and /or Impact on annual

Council budget

|

|

o)

Customer

|

p)

Financial impact to customer due to loss of a provision of

essential service, or essential piece of infrastructure

|

|

q)

Reputational

|

r)

The impact on FNDC’s reputation

|

|

s)

Compliance/Legal

|

t)

The legal impact on FNDC’s legal adherence / regulatory

compliance

|

|

u)

Health and Safety

|

v)

The impact to people(s) health & safety arising from FNDC

operations or a situation where FNDC are liable

|

Table 6: Description of likelihood

|

w)

Likelihood

|

x)

Description

|

|

y)

Will happen

|

z)

The risk is likely to occur.

aa)

There is frequent exposure to the risk.

bb)

There are external influences that make managing this risk

ineffective.

|

|

cc)

Probable

|

dd)

The risk will possibly occur e.g. once in every 2 year event

ee)

There is an exposure to the risk.

ff)

There are external influences that make managing this risk

difficult.

|

|

gg)

Unlikely

|

hh)

The risk is unlikely to occur e.g. once in every 10 year event

ii)

There is a low exposure to the risk.

|

Table 7: Impact and likelihood matrix

|

|

Likelihood

(probability)

|

|

Unlikely

|

Probable

|

Will

Happen

|

|

Impact

|

High to Intolerable

|

5

|

7

|

9

|

|

Medium

|

3

|

5

|

7

|

|

Low to None

|

1

|

3

|

5

|

jj)

An inherent risk score has been estimated for each affordability

risk. This was derived by summing the risk value for each organisational area

(see table eight).

Table 8: Inherent risk score for

each affordability risk (inc. organisational area score and overall score)

|

kk)

Risk

|

ll)

Organisational area

|

mm)

Impact

|

nn)

Likelihood

|

oo)

Inherent risk score

|

|

pp)

Ratepayer ability to pay

qq)

|

rr)

Financial

|

ss)

High to Intolerable

|

tt)

Will Happen

|

9

|

|

uu)

Customer

|

vv)

High to Intolerable

|

ww)

Will Happen

|

9

|

|

xx)

Reputational

|

yy)

High to Intolerable

|

zz)

Will Happen

|

9

|

|

aaa)

Compliance/Legal

|

bbb)

High to Intolerable

|

ccc)

Will Happen

|

9

|

|

ddd)

Health and Safety

|

eee)

High to Intolerable

|

fff)

Will Happen

|

9

|

|

ggg)

Overall score

|

45

|

|

hhh)

Provision of Services

iii)

|

jjj)

Financial

|

kkk)

High to Intolerable

|

lll)

Will Happen

|

9

|

|

mmm)

Customer

|

nnn)

High to Intolerable

|

ooo)

Will Happen

|

9

|

|

ppp)

Reputational

|

qqq)

High to Intolerable

|

rrr)

Will Happen

|

9

|

|

sss)

Compliance/Legal

|

ttt)

High to Intolerable

|

uuu)

Will Happen

|

9

|

|

vvv)

Health and Safety

|

www)

High to Intolerable

|

xxx)

Will Happen

|

9

|

|

yyy)

Overall score

|

45

|

|

zzz)

Integrated planning

aaaa)

|

bbbb)

Financial

|

cccc)

High to Intolerable

|

dddd)

Will Happen

|

9

|

|

eeee)

Customer

|

ffff)

High to Intolerable

|

gggg)

Will Happen

|

9

|

|

hhhh)

Reputational

|

iiii)

Medium

|

jjjj)

Will Happen

|

7

|

|

kkkk)

Compliance/Legal

|

llll)

High to Intolerable

|

mmmm)

Will Happen

|

9

|

|

nnnn)

Health and Safety

|

oooo)

High to Intolerable

|

pppp)

Will Happen

|

9

|

|

qqqq)

Overall score

|

43

|

|

rrrr)

Form and function of Local Government

ssss)

|

tttt)

Financial

|

uuuu)

High to Intolerable

|

vvvv)

Will Happen

|

9

|

|

wwww)

Customer

|

xxxx)

High to Intolerable

|

yyyy)

Will Happen

|

9

|

|

zzzz)

Reputational

|

aaaaa)

High to Intolerable

|

bbbbb)

Will Happen

|

9

|

|

ccccc)

Compliance/Legal

|

ddddd)

High to Intolerable

|

eeeee)

Probable

|

7

|

|

fffff)

Health and Safety

|

ggggg)

High to Intolerable

|

hhhhh)

Will Happen

|

9

|

|

iiiii)

Overall score

|

43

|

Responsibilities

jjjjj)

All four affordability risks remain classified as both

organisational and strategic risks with the GM-SPP responsible for risk

governance. All affordability risks will be subject to regular risk progress

reports. The risks have been recorded on the Organisational Risk Register to

enable management at a Group level.

|

Table

9: Affordability risk summary.

|

|

Risk

ID:

|

Risk

title

|

Risk Level

|

Risk description

|

Inherent risk score

|

Residual risk score

|

Accountable

Risk Governance

|

Responsible

Risk Governance

|

Risk Progress Report

schedule

|

|

ARF020

|

kkkkk)

Ratepayer ability to pay

|

Organisational

|

Strategic

|

45

|

|

CEO

|

GMSPP

|

6 Monthly

|

|

ARF021

|

lllll)

Provision of Services

|

Organisational

|

Strategic

|

45

|

|

CEO

|

GMSPP

|

6 Monthly

|

|

ARF022

|

mmmmm)

Integrated planning

|

Organisational

|

Strategic

|

43

|

|

CEO

|

GMSPP

|

6 Monthly

|

|

ARF023

|

nnnnn)

Form and function of Local

Government

|

Organisational

|

Strategic

|

43

|

|

CEO

|

GMSPP

|

6 Monthly

|

Each of the affordability risks are high-intolerable and

will happen. The risks will be clustered on the organisational risk dashboard

under the heading “affordability”.

Connecting up the Council affordability risk treatment

response:

The terms of reference for the Affordability Risk Reference

Group were signed off in February 2022. The purpose of the Affordability Risk

Reference Group is to support the provision of a “joined up

connected” response. The objective of the Affordability Risk Reference group

is to support the organisation through the provision of:

· Advice and

guidance

· Explore

opportunities within Council

· Inform specific

elements of proposed work

· To champion the

work impacting Affordability

· Build an

organisational network

· To support risks

three lines of defence through systems of control (help to monitor the risk and

ensure right resources are allocated) and governance (effectively manage escalation

of the risk and define strategies to manage).

Take

Tūtohunga / Reason for the recommendation

The Affordability Risk Reference Group has recommended:

a) ARF005 Affordability risk

is removed from the top organisational dashboard – this is because we

propose to replace it with the recommendation in “b” below

b) To enable greater clarity

and ability to align work programmes and approaches, it is recommended that the

four affordability risks are adopted onto the top organisational risk

dashboard. The four risks are identified as:

ooooo)

ARF020 Ratepayer ability to pay

ppppp)

ARF021 Provision of Services

qqqqq)

ARF022 Integrated planning

rrrrr)

ARF023 Form and function of Local Government

c) To ensure that the

affordability risk is managed effectively it is recommended that each risk is

subject to a regular risk progress report to the Assurance, Risk and Finance

Committee

d) To enable FNDC to track

risk and risk management measure it is recommended that at least annually there

is a affordability risk progress report which provides an overview to the

Assurance, Risk and Finance Committee on the management and progress to treat

affordability risks

e) Recognising the dynamic

nature of environment affecting affordability, it is recommended that these

risks are regularly rescored due to the evolving environment including the

government’s reform programmes and regulatory changes.

3) PĀnga PŪtea me ngĀ

wĀhanga tahua / Financial Implications and Budgetary Provision

There is no budgetary provision required.

Āpitihanga

/ Attachments

Nil

Hōtaka Take Ōkawa / Compliance Schedule:

Full consideration has been given to the provisions of the

Local Government Act 2002 S77 in relation to decision making, in particular:

1. A

Local authority must, in the course of the decision-making process,

a) Seek

to identify all reasonably practicable options for the achievement of the

objective of a decision; and

b) Assess

the options in terms of their advantages and disadvantages; and

c) If

any of the options identified under paragraph (a) involves a significant

decision in relation to land or a body of water, take into account the

relationship of Māori and their culture and traditions with their

ancestral land, water sites, waahi tapu, valued flora and fauna and other

taonga.

2. This

section is subject to Section 79 - Compliance with procedures in relation to

decisions.

|

He

Take Ōkawa / Compliance Requirement

|

Aromatawai

Kaimahi / Staff Assessment

|

|

State the level of significance

(high or low) of the issue or proposal as determined by the Council’s

Significance and Engagement Policy

|

The recommendation in this report

does not meet the thresholds as per the Council’s significance and

engagement policy.

|

|

State the relevant Council

policies (external or internal), legislation, and/or community outcomes (as

stated in the LTP) that relate to this decision.

|

Risk Management Policy

|

|

State whether this issue or

proposal has a District wide relevance and, if not, the ways in which the

appropriate Community Board’s views have been sought.

|

None

|

|

State the possible implications for Māori

and how Māori have been provided with an opportunity to contribute to

decision making if this decision is significant and relates to land and/or

any body of water.

State the possible implications and how this

report aligns with Te Tiriti o Waitangi / The Treaty of Waitangi.

|

While the recommendation in this

report does not have any direct implications for Maori, given the disparity

in income levels between communities, affordability will be particularly

challenging.

|

|

Identify persons likely to be

affected by or have an interest in the matter, and how you have given

consideration to their views or preferences (for example – youth, the

aged and those with disabilities).

|

There are no affected or interested

parties to the recommendation.

|

|

State the financial implications

and where budgetary provisions have been made to support this decision.

|

There is no financial implication

or request for budgetary provision.

|

|

Chief Financial Officer review.

|

The Chief Financial Officer has

reviewed this report.

|

6 Information

Reports

6.1 Revenue

recovery report 30 June 2022

File Number: A3787760

Author: Margriet

Veenstra, Manager - Transaction Services

Authoriser: Janice

Smith, Acting General Manager - Corporate Services

TAKE PŪRONGO / Purpose of the Report

The

purpose of this report is to provide quarterly reporting to the Far North

District Council Assurance, Risk, and Finance Committee.

WHAKARĀPOPOTO MATUA / Executive SummarY

This is the

final report for the financial year 2021-22 and provides information on action

taken to collect the current and arrears balances for rates, water and sundry

debt so far this year, and to provide information on how collection is tracking

against targets.

|

TŪTOHUNGA

/ Recommendation

That the Assurance, Risk and Finance Committee receive

the report Revenue recovery report 30 June 2022.

|

tĀHUHU KŌRERO / Background

This document has been prepared to outline current and

arrears balances for rates, water and Sundry debt as of 30 June 2022 and the

actions taken by the debt management team for the collection of the General

Title rates and water, and sundry debt.

This

information is part of the standing items reported to the Committee on a

regular basis.

MATAPAKI ME NGĀ KŌWHIRINGA /

Discussion and Next Steps

Background

This

document has been prepared to outline current and arrears balances for rates,

water and Sundry debt as of 30 June 2022 and the actions taken by the debt

management team for the collection of the General Title rates and water, and

sundry debt.

This

information is part of the standing items reported to the Committee on a

regular basis.

Discussion and Next Steps

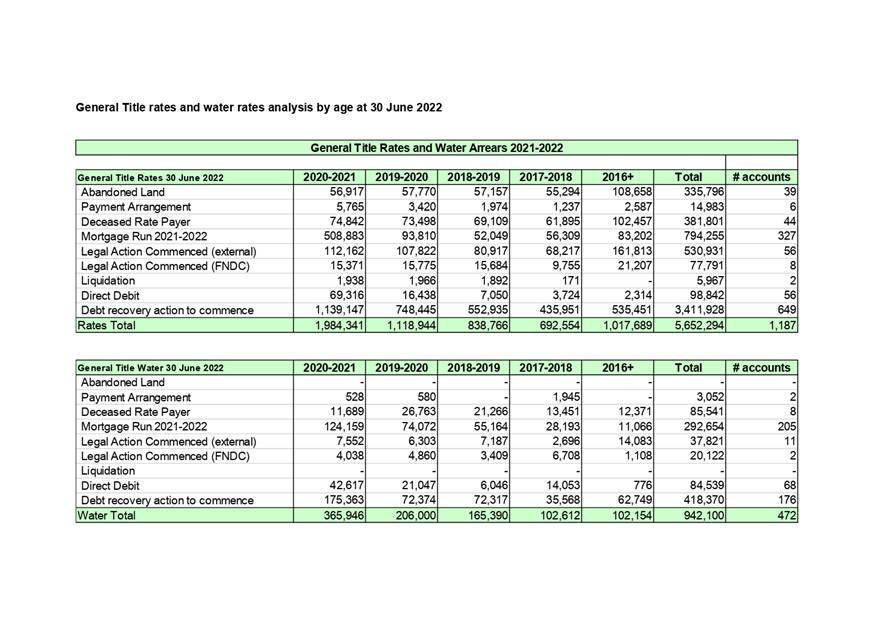

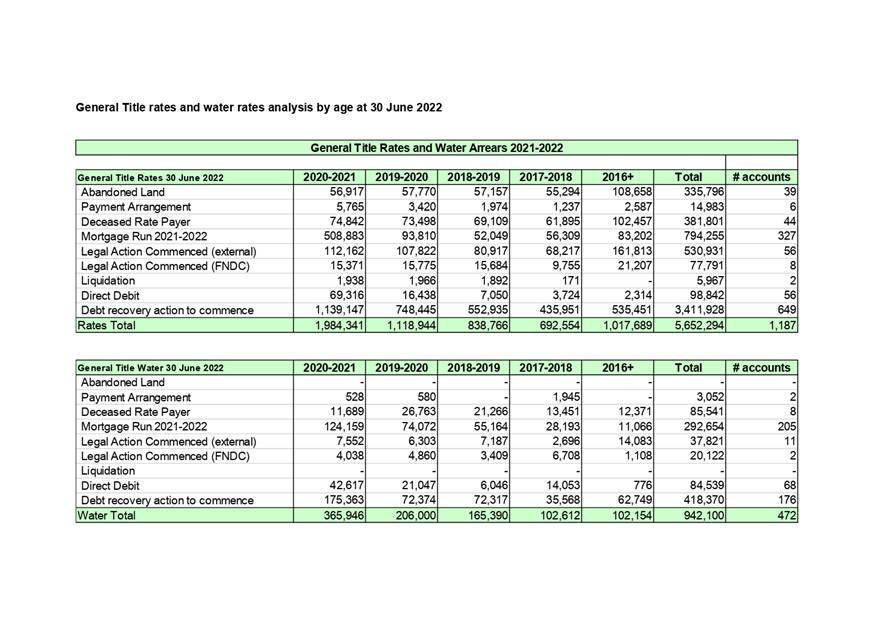

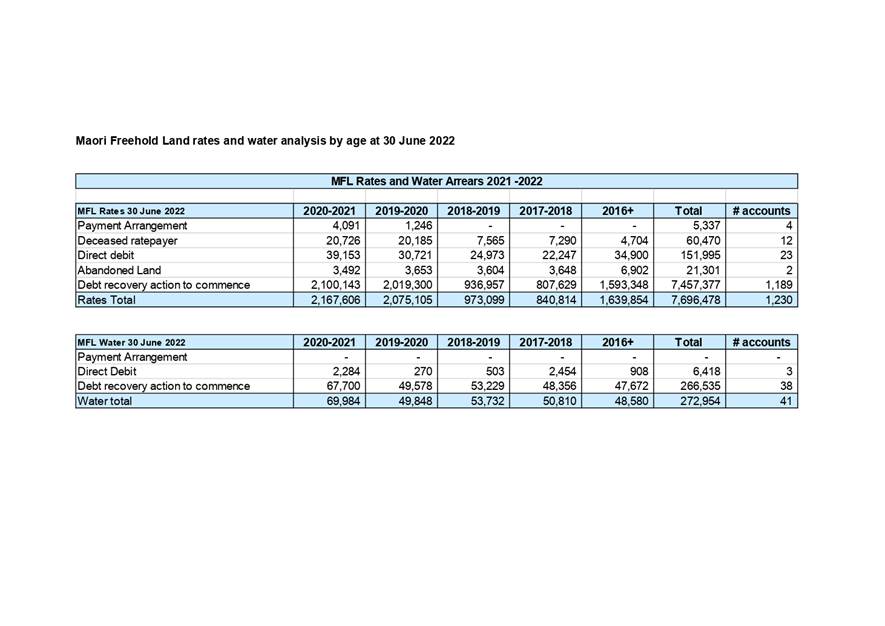

The data

provided is for General Title and Maori Freehold Land rates and water accounts

with sundry debtors shown in a separate table. Since the 1st of July

2021, the General Title rates total arrears balance has been reduced by 40% and

water rates by 45%.

General

Title rates and water debt

Key

actions since the last report:

· Revenue recovery team were unable to proceed with final

mortgage demand due to staff shortages. Where possible, contact was made with

owners and payment plans offered to avoid mortgage demand in the new year.

· Instructions sent to legal services team to commence

applications to the courts for financial assessment for properties where

judgment was received but no payments have been made.

Next

actions:

· Complete reporting for all properties with mortgages and

commence pre-mortgage demand calling.

· Prepare and issue mortgage demand to the 5 major banks

after the 1st of August 2022 once pre-mortgage demand has been

completed.

· Review properties without a mortgage and high arrears and

commence demand process in collaboration with Council’s Legal Services team.

For the total number of General Title rates accounts marked

as ‘Debt recovery action to commence’:

· These are properties where there is no mortgage, and we do

not have a payment arrangement or direct debit set up on the account.

· 32% of properties only have last year’s rates in

arrears and 13% have 2 years of arrears. Debt management will be contacting

these owners by phone, email, or letter. Any water arrears will be picked up at

the same time.

· 55% of these accounts have arrears of 3 or more rating

years. Debt management will start the final demand process for these which can

result in referral to Council’s legal services team to commence legal

proceedings.

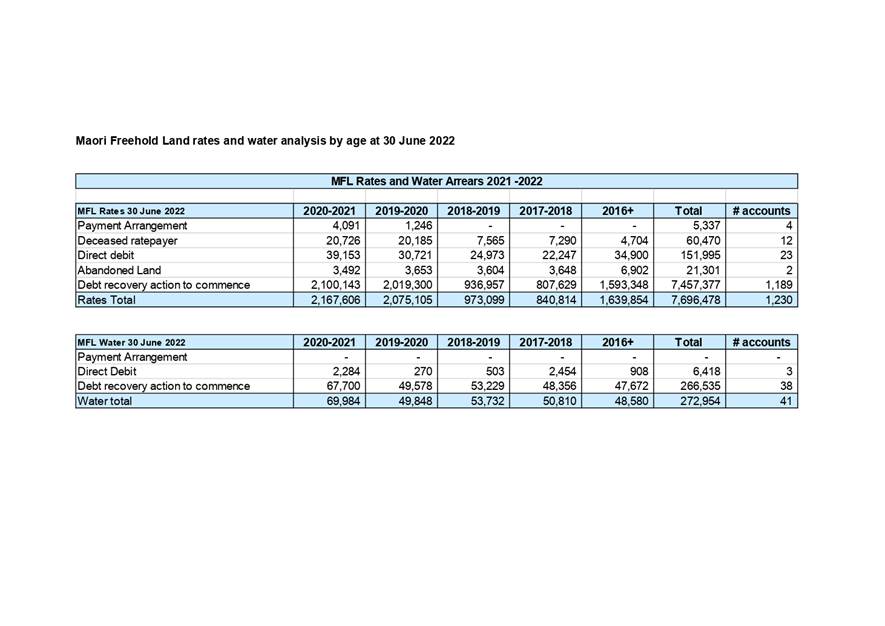

Maori

Freehold Land rates and water debt

The debt for Maori Freehold land has reduced since the

write-offs were completed in June as per the Local Government (Rating of Whenua

Maori) Amendment Act 2021. The rates debt has reduced by 11.54% since the start

of the year which was mainly due to write-off’s for non-rateable properties

and statute barred write off.

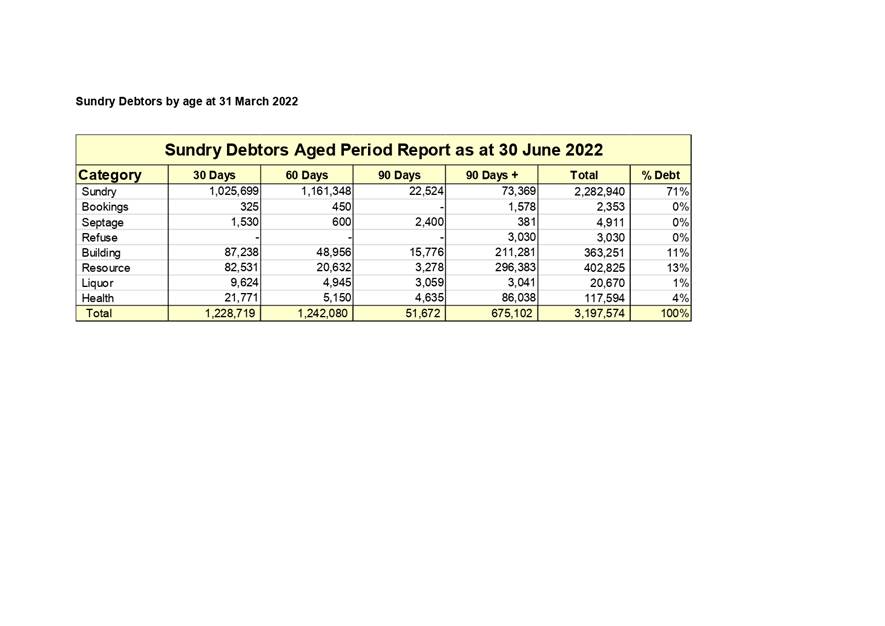

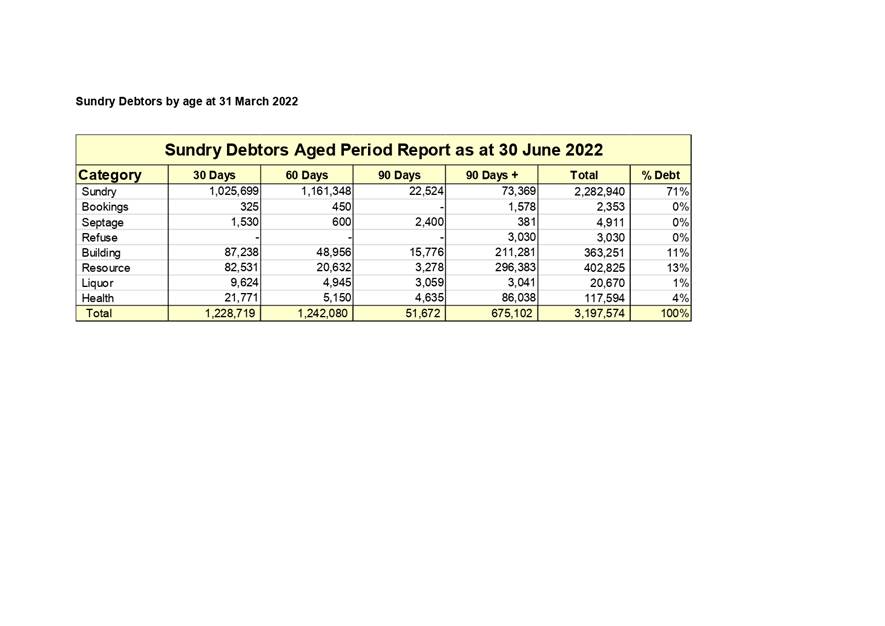

Sundry debtors debt

The total sundry debtors aged debt balance has increased

since the start of the year. However, two payments from the Ministry of

Business, Innovation and Employment, totalling $2,070,000 were received after financial

year end.

The 90 day+ resource consent debt has reduced by $77,774

since the last report, and the building consent debt has increased by $10,908.

The revenue recovery team continue to work with both teams to reduce this. The

30-to-60-day debt has seen an increase and we are in the process of completing

analysis to understand what is driving this increase.

PĀNGA PŪTEA ME NGĀ WĀHANGA

TAHUA / Financial Implications and Budgetary Provision

Provision is made annually for doubtful debts in relation

to the arrears owed to council. A higher provision for Maori Freehold land

rates and water is made in comparison to General Title rates and water due to

the difference in collection options available to Council.

Āpitihanga

/ Attachments

1. Revenue

recovery Report attachment 30 June 2022 - A3865504 ⇩

|

Assurance, Risk

and Finance Committee Meeting Agenda

|

31 August 2022

|

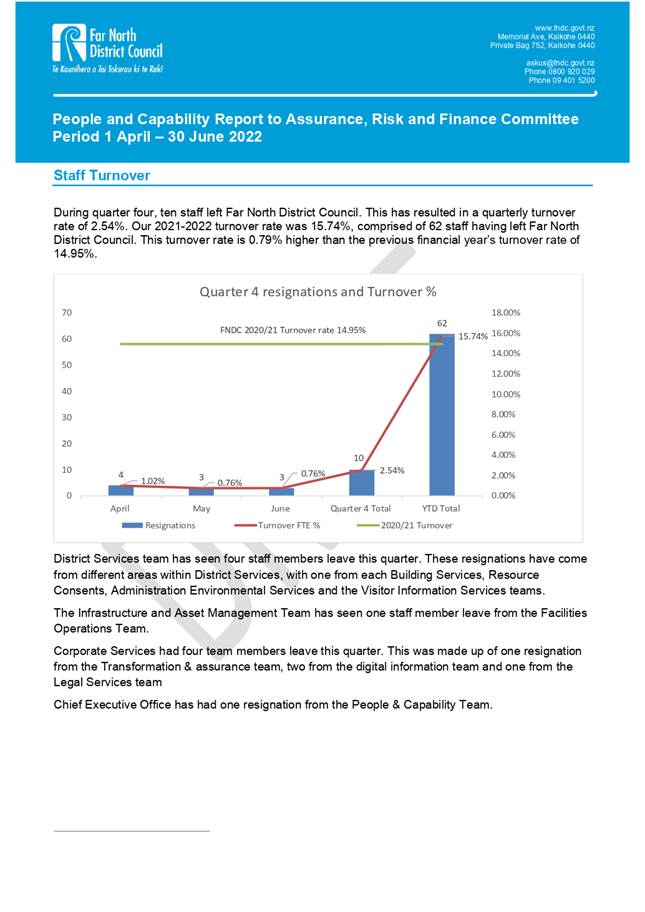

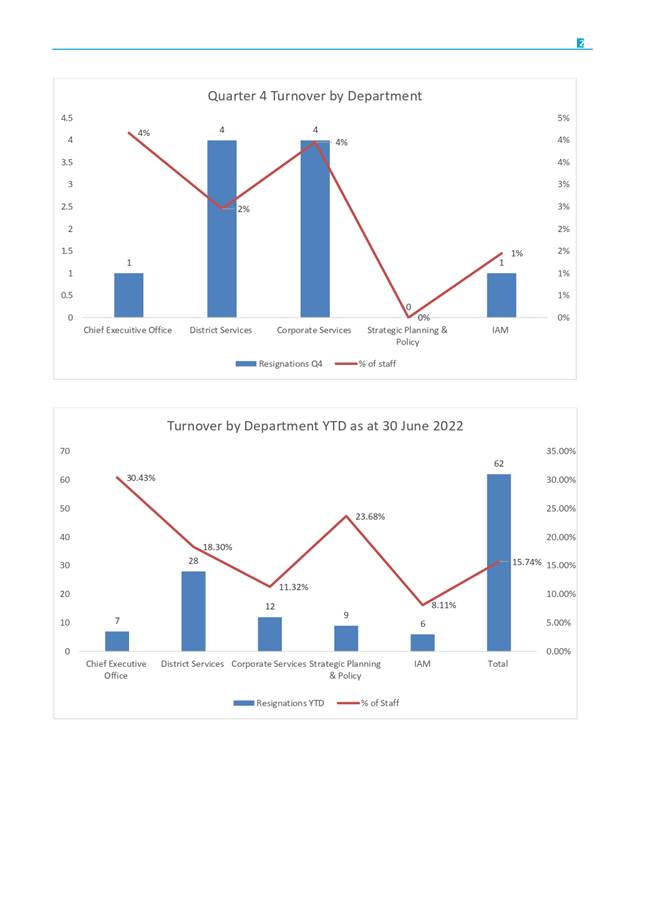

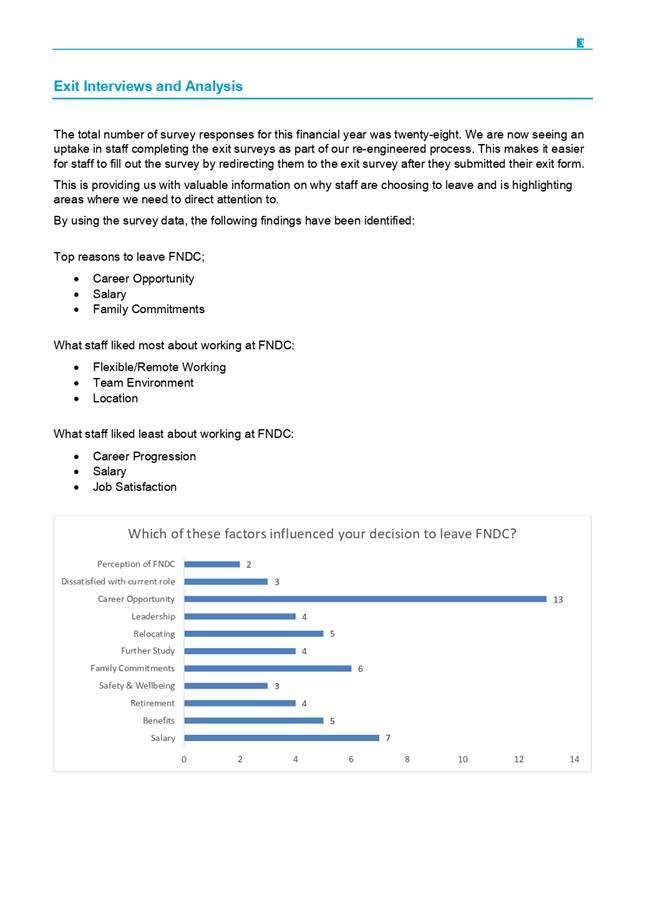

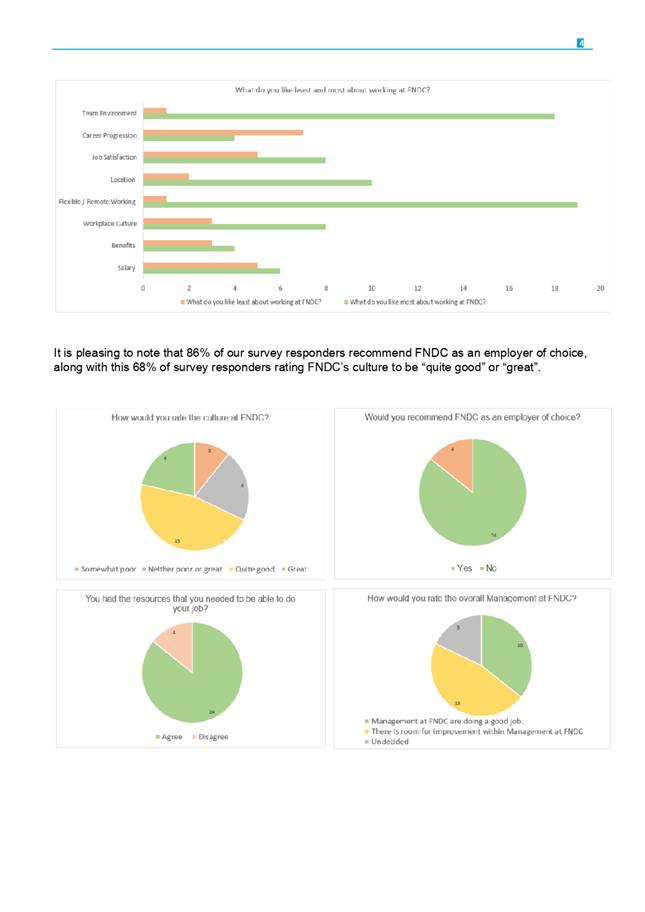

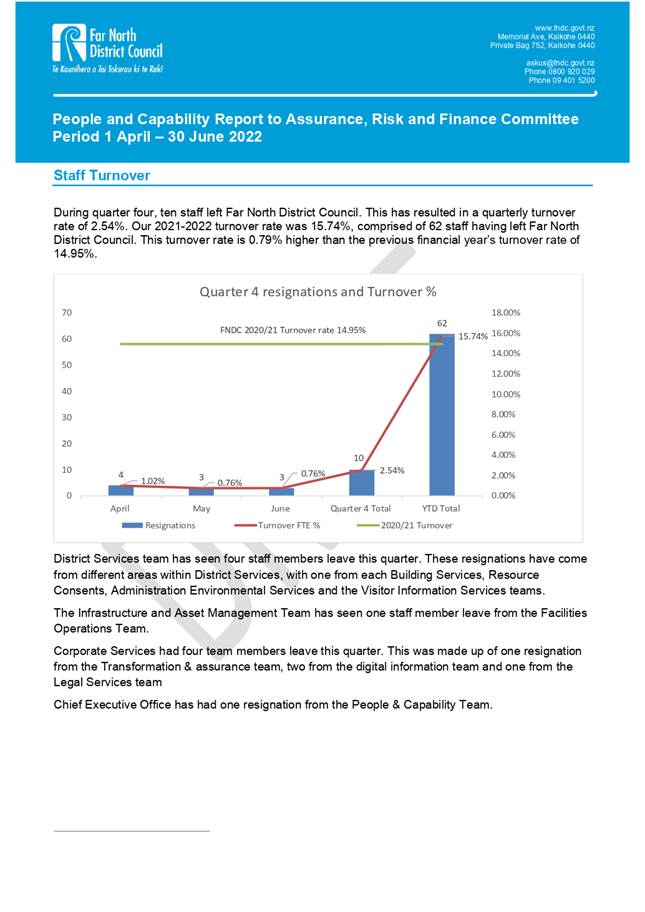

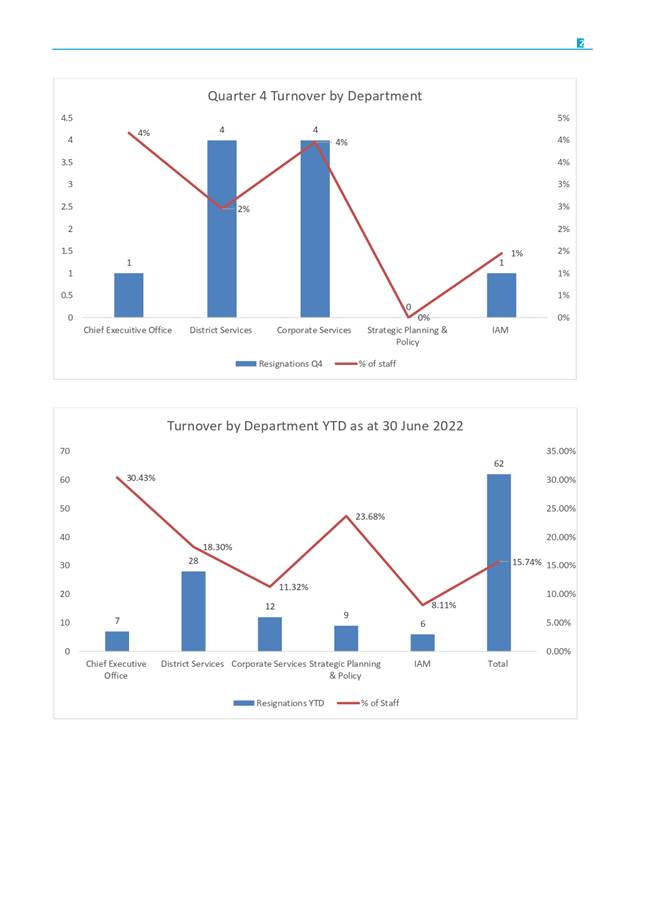

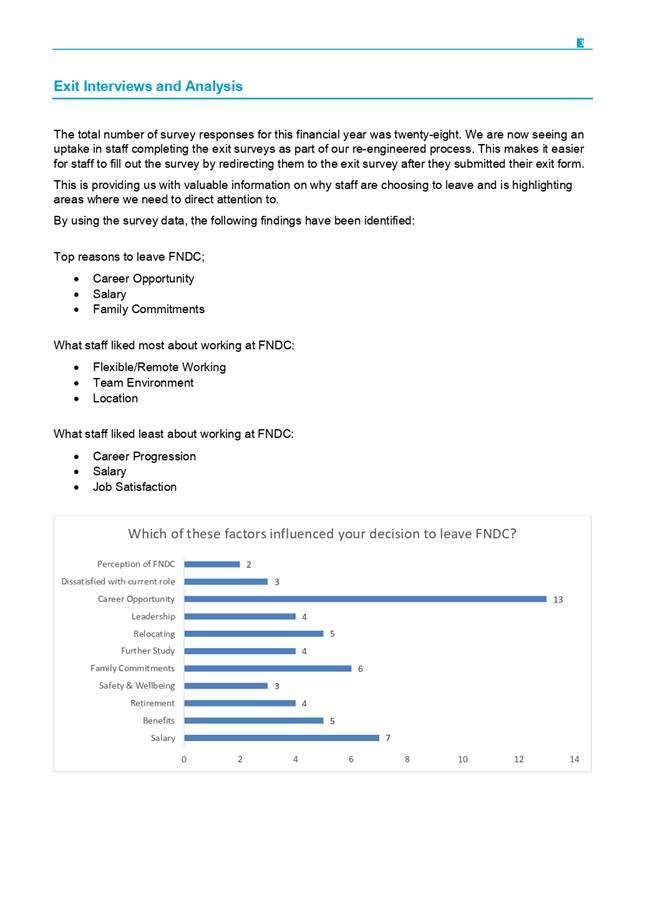

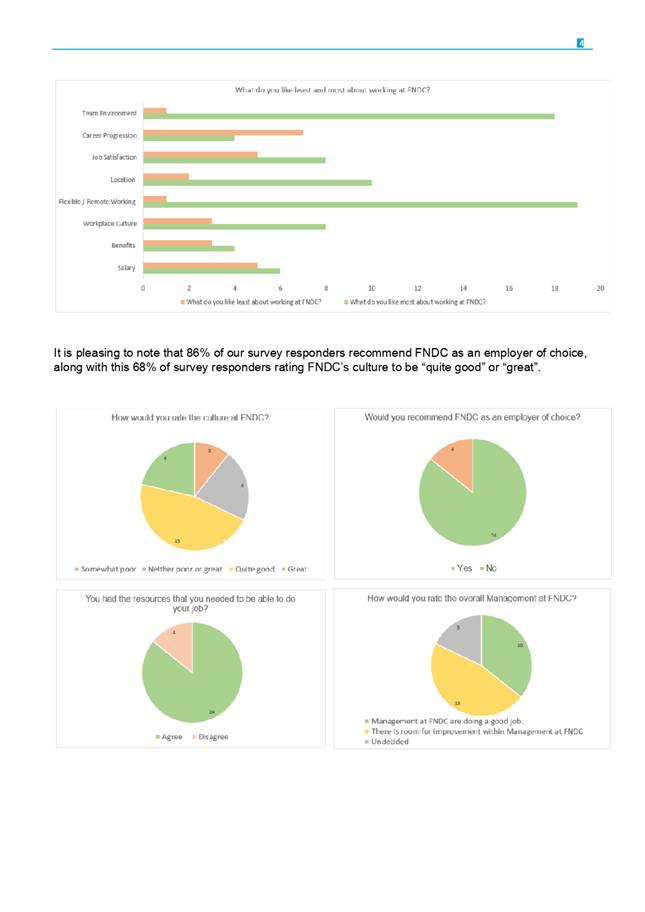

6.2 People

and Capability Quarterly Update: 1 April - 30 June 2022

File

Number: A3834250

Author: Mia

Haywood, People and Capability Data and Systems Specialist

Authoriser: Jill

Coyle, Chief People Officer

TAKE PŪRONGO / Purpose of the Report

The purpose of this

report is to present the Audit, Risk and Finance Committee with the quarterly

update for People and Capability.

WHAKARĀPOPOTO MATUA / Executive SummarY

Included in the report is

information on:

- Staff Turnover.

- Exit Interviews and Analysis.

- Personal Grievances; and

- Disciplinary Actions and Costs.

|

TŪTOHUNGA

/ Recommendation

That the Assurance, Risk and Finance Committee receive

the report People and Capability Quarterly Update: 1 April - 30 June 2022.

|

tĀHUHU KŌRERO / Background

This report will be

presented to the Audit, Risk and Finance Committee on a quarterly basis.

MATAPAKI ME NGĀ KŌWHIRINGA /

Discussion and Next Steps

This report is

Information only.

Āpitihanga

/ Attachments

1. People

Capability Report 1 April - 30 June 2022 - A3834210 ⇩

|

Assurance, Risk

and Finance Committee Meeting Agenda

|

31 August 2022

|

6.3 August

2022 Risk Management Report

File

Number: A3834819

Author: Tanya

Reid, Principal Advisor - Organisational Performance and Transformation

Authoriser: Janice

Smith, Acting General Manager - Corporate Services

TAKE PŪRONGO / Purpose of the Report

To provide an information report on:

· top

organisational risk dashboard and report schedule

· emergent

risk

· scheduled

risk progress reports for the organisation’s top risks

· organisational

risk update; and

· business

continuity planning.

No

decision is required.

WHAKARĀPOPOTO MATUA / Executive SummarY

Risk

progress updates are provided for eight of the nine scheduled top

organisational risks reports including the first risk progress report for

ARF019 Resource consents. The risk trend is stable for five of these

risks and increasing for four.

As we

continue to operate in dynamic environment a high-level national and

international environmental scan is provided.

An

emergent risk has been identified for inclusion in this report.

Two

additional reports are included on the Assurance, Risk and Finance Committee 31

August 2022 agenda:

· a decision report

seeking approval to accept the Affordability Risk Reference Group

recommendation that our current risk position be categorised into four

affordability risk themes; and

· an information

report on the impact of three waters reform on organisational risk management

and potential emergent risks.

|

TŪTOHUNGA / Recommendation

That the

Assurance, Risk and Finance Committee receive the report August 2022 Risk

Management Report.

|

tĀHUHU KŌRERO / Background

The top organisational risks are risks that may impact on

Council achieving its vision, mission and community outcomes and are regularly

reported to the Assurance, Risk and Finance Committee to ensure they are being

appropriately managed. The top organisational risks are owned by the CEO. A

number of these risks are subject to external influences which may affect

effective council operations.

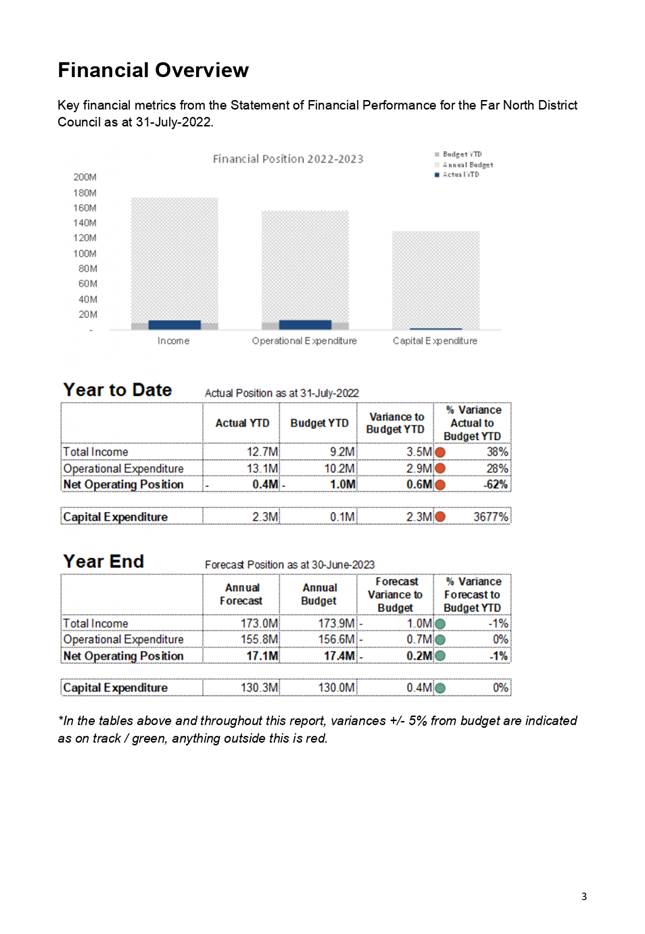

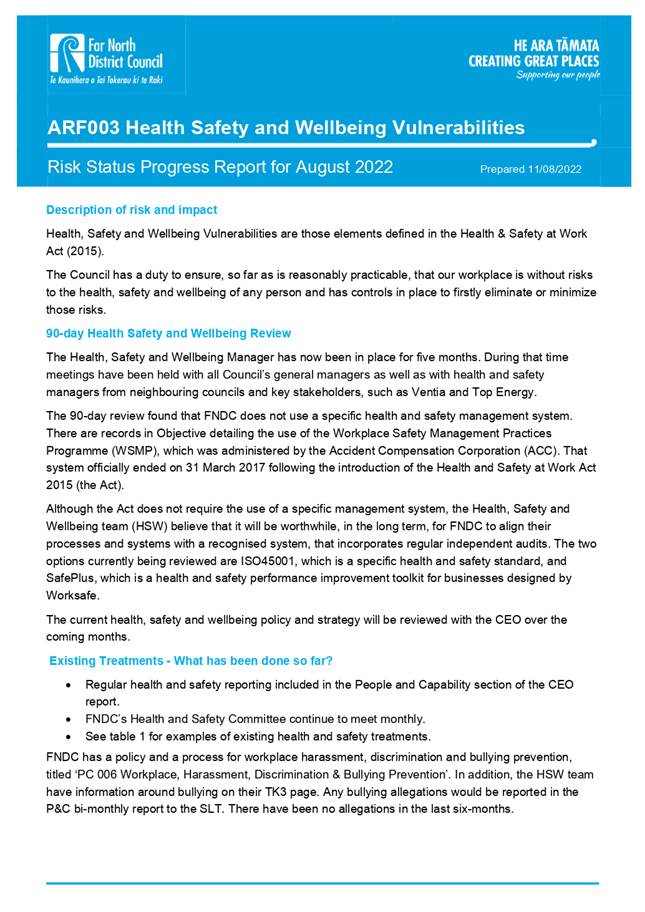

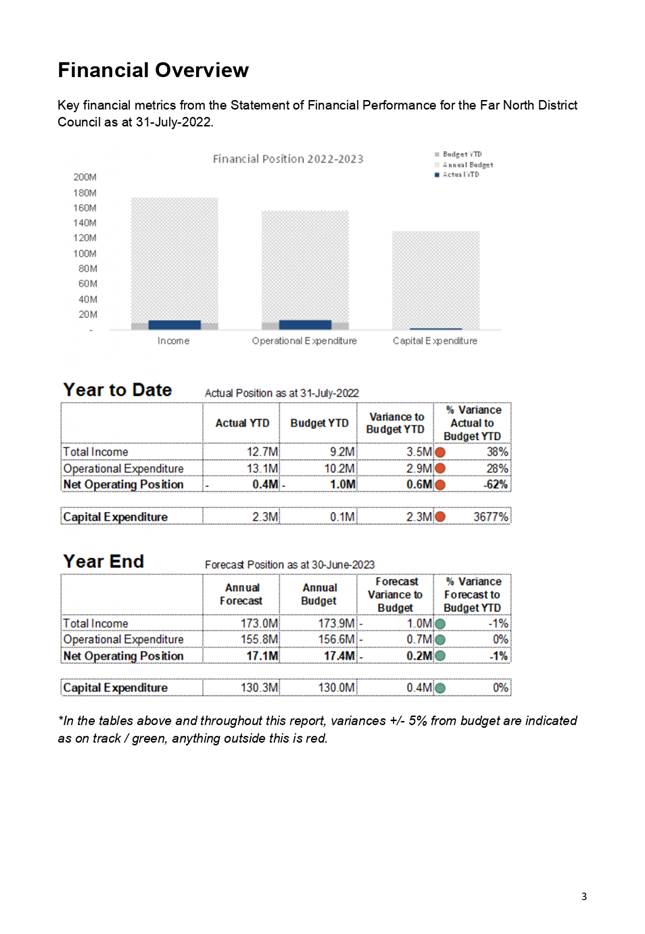

Table 1 provides a risk snapshot of the Assurance, Risk

and Finance Committee Organisational Risk Dashboard with inherent and residual

risk scores as accepted by this Committee, and the risk trend as assessed by

the risk subject matter experts. The risk trend is increasing for eight of the

13 top organisational risks and is stable for the remaining five risks. These risks

are categorised into three themes – Climate Change, Enterprise Governance

and Infrastructure and Asset Management Risks.

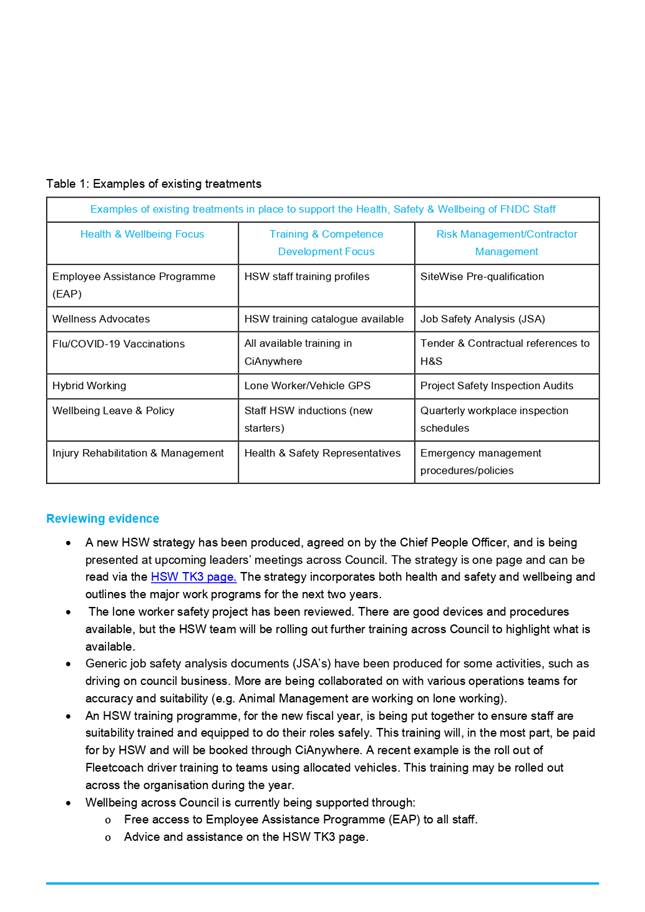

Table 2 provides details of the 2022 risk progress report

schedule, as agreed by Assurance, Risk and Finance Committee. The schedule has

synchronised risk progress reports to enable the Assurance, Risk and Finance

Committee to collectively review reports on interconnected risks.

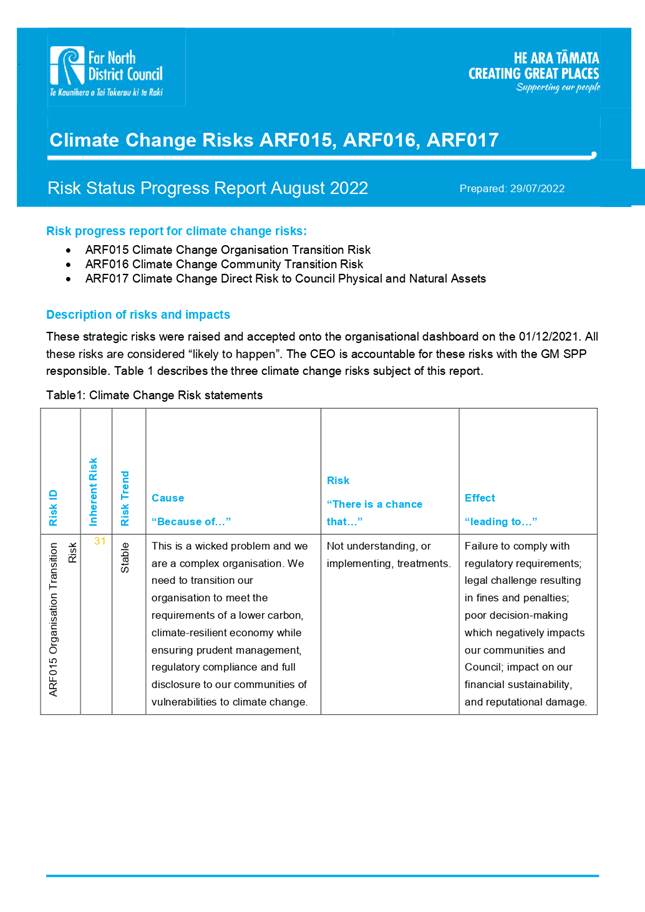

Table 1: Top organisational risk

dashboard

|

Risk ID:

|

Risk title

|

Date Risk adopted

|

Inherent risk score

|

Residual

risk

score

|

The risk

trend is:

|

Months

since

risk

trend

last

changed:

|

High level risk treatment

progress:

|

|

Climate Change

|

|

ARF015

|

Climate Change Organisation

Transition Risk

|

01/12/22

|

31

|

|

Stable

|

5

|

Climate Change

active treatment plan in place with treatment pipeline.

|

|

ARF016

|

Climate Change Community

Transition Risk

|

01/12/22

|

39

|

|

Stable

|

5

|

Climate Change

active treatment plan in place with treatment pipeline.

|

|

ARF017

|

Climate Change Direct Risk

to Council Physical and Natural Assets

|

01/12/22

|

37

|

|

Stable

|

6

|

Climate Change

active treatment plan in place with treatment pipeline.

|

|

ARF018

|

Failure to understand and

capture climate-related opportunities

|

01/12/22

|

29

|

|

Stable

|

0

|

Climate Change

active treatment plan in place with treatment pipeline.

|

|

Enterprise

Governance

|

|

ARF003

|

Health & Safety

Vulnerabilities

|

30/05/19

|

46

|

34

|

Stable

|

0

|

The risk trend

is stable because we have a strategy which identifies a course of action to

reduce this risk.

|

|

ARF005

|

Affordability Risk

|

30/05/19

|

45

|

26

|

Increa-

sing

|

20

|

Affordability Risk have been themed to

develop four targeted risks. A decision report, to split into the themed

risks, is on the August 2022 ARF agenda.

|

|

ARF010

|

Data Governance Risks

|

30/05/19

|

39

|

14

|

Increa-

sing

|

8

|

Cyber security risk, is intensifying with growing digital

dependency and increasing geopolitical disruptions.

|

|

ARF019

|

Resource Consent Risk

|

23/06/22

|

41

|

13

|

Increa-

sing

|

2

|

Council continues to receive an increasing number of

applications for resource consents while also needing to manage a significant

backlog.

|

|

Infrastructure and Asset

Management

|

|

ARF004

|

Asset Management Risks

|

30/05/19

|

45

|

18

|

Increasing

|

6

|

With the reset of Programme Darwin, a

significant treatment for this risk, the Infrastructure and Asset Management

Group want to revisit this stated risk to articulate the current risk.

|

|

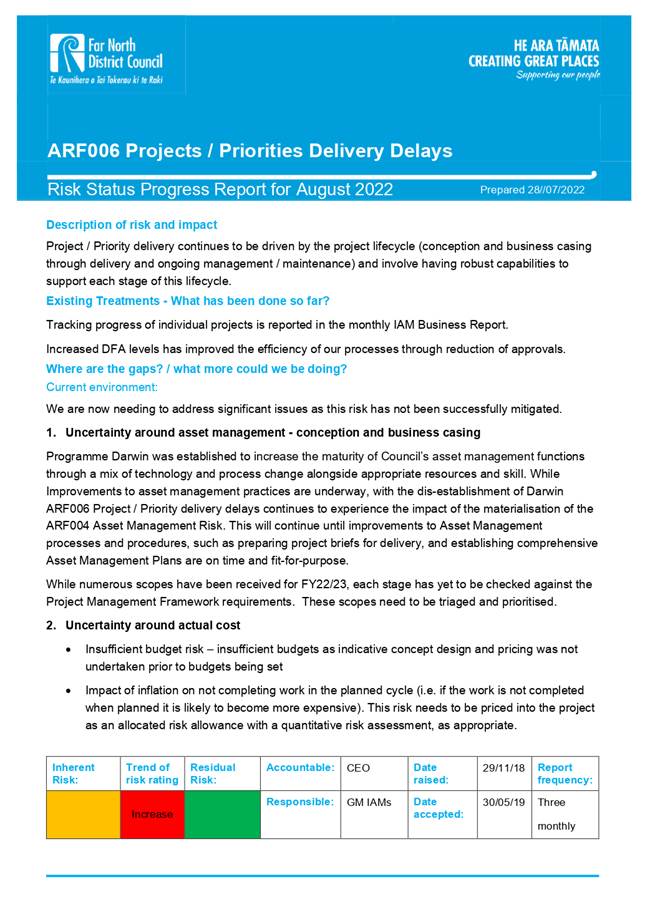

ARF006

|

Project Priorities

Deliveries Delays

|

30/05/19

|

45

|

14

|

Increasing

|

6

|

We are now needing to address significant

issues as this risk has not been successfully mitigated.

|

|

ARF007

|

Compliance NRC Abatements

|

30/05/19

|

45

|

18

|

Increasing

|

8

|

Council is not meeting all resource

consent conditions.

|

|

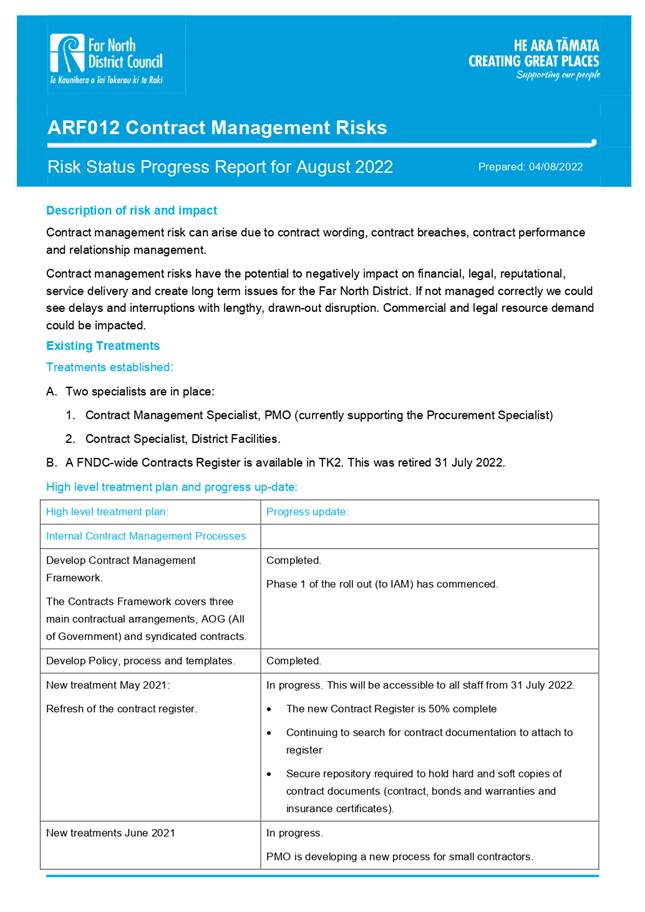

ARF012

|

Contract Management Risks

|

30/05/19

|

39

|

14

|

Increasing

|

0

|

Treatments such as the new contracts

register, and contract management framework are progressing.

|

|

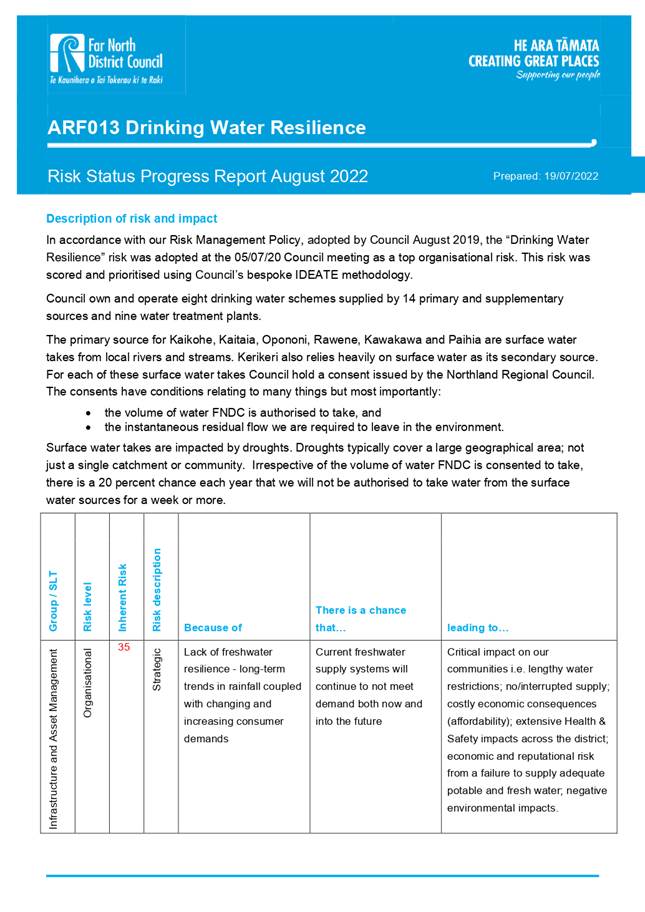

ARF013

|

Drinking Water Resilience

|

05/07/20

|

35

|

|

Stable

|

20

|

Updated Water

Safety Plans completed.

|

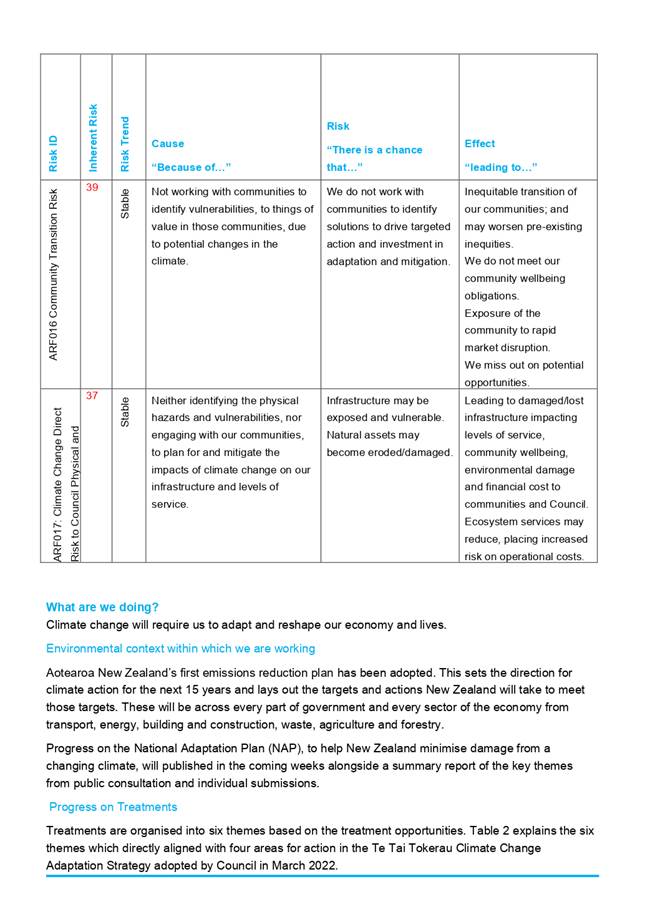

Table 2: 2022 risk

progress report schedule

|

|

2022

Assurance, Risk and Finance Committee meeting date:

|

02/02

|

16/03

|

27/04

|

22/06

|

31/08

|

|

Climate

Change risk progress reporting schedule

|

|

ARF015

|

Climate Change Organisation Transition Risk

|

|

ü

|

|

ü

|

ü

|

|

ARF016

|

Climate Change Community Transition Risk

|

|

ü

|

|

ü

|

ü

|

|

ARF017

|

Climate Change Direct Risk to Council Physical and Natural

Assets

|

ü

|

|

ü

|

|

ü

|

|

ARF018

|

Failure to understand and capture climate-related

opportunities

|

|

|

|

ü

|

|

|

Enterprise Governance risk progress reporting schedule

|

|

ARF003

|

Health

& safety vulnerabilities

|

ü

|

|

ü

|

|

ü

|

|

ARF005

|

Affordability

risk

|

|

|

|

ü

|

|

|

ARF010

|

Data

governance risks

|

|

|

|

ü

|

|

|

ARF019

|

Resource

consents

|

|

|

|

|

ü

|

|

Infrastructure

and Asset Management risk progress reporting schedule

|

|

ARF004

|

Asset

management risks

|

ü

|

|

|

|

ü

|

|

ARF006

|

Project

priorities deliveries delays

|

ü

|

|

ü

|

|

ü

|

|

ARF007

|

Compliance

nrc abatements

|

|

|

|

ü

|

|

|

ARF012

|

Contract

management risks

|

ü

|

|

ü

|

|

ü

|

|

ARF013

|

Drinking

water resilience

|

|

ü

|

|

ü

|

ü

|

|

|

Externally funded

shovel ready,

economic stimulus employment opportunity projects

|

|

ü

|

|

|

|

Discussion and Next Steps

We are operating in a very dynamic context

National trends

· Employment

remains above its maximum sustainable level

· Employers

are experiencing a significant shortage of candidates across all industry

sectors, and organisations

· Domestic

spending remains supported by high employment levels, resilient household balance

sheets in aggregate, continued fiscal support, and strong terms of trade

· Labour

and resource scarcity are contributing to upward price pressures which are

currently exacerbated by seasonal illness, a resurgence in COVID-19 cases, and

a net outflow of labour abroad

· The

level of global economic activity, combined with the ongoing supply disruptions

largely driven by both COVID-19 persistence and the Russian invasion of

Ukraine, continue to generate global inflation pressures

· The

Monetary Policy Committee (13/07/2022) agreed to continue to lift the OCR to a

level where it is confident consumer price inflation will settle within the

target range. The Committee is comfortable that the projected path of the OCR

outlined in the May Monetary Policy Statement remains broadly consistent

with achieving its primary inflation and employment objectives - without

causing unnecessary instability in output, interest rates and the exchange

rate.

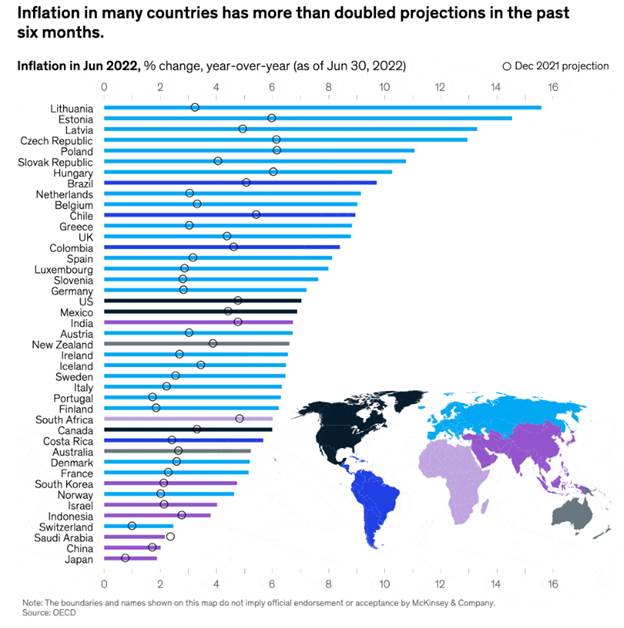

Global economy trends

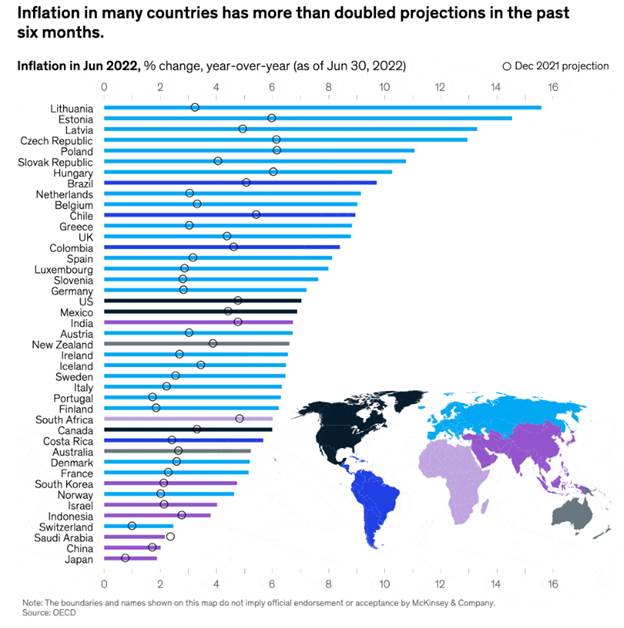

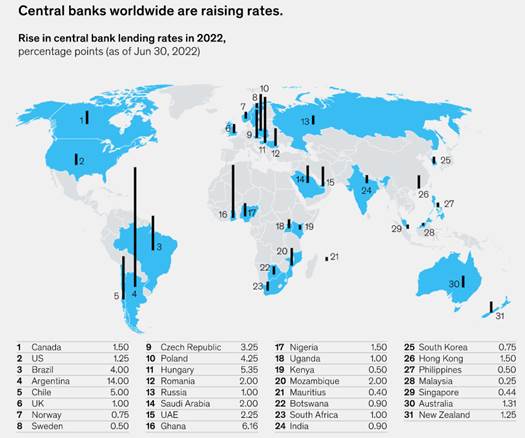

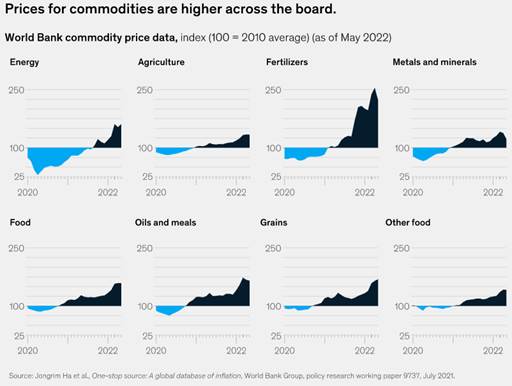

Inflation has altered the economic mood, and potentially

reset the path of global and national economies worldwide for years to

come. In the past six months, inflation has far exceeded December 2021

expectations. In many countries, actual rates have doubled projections

(illustration one). In response to

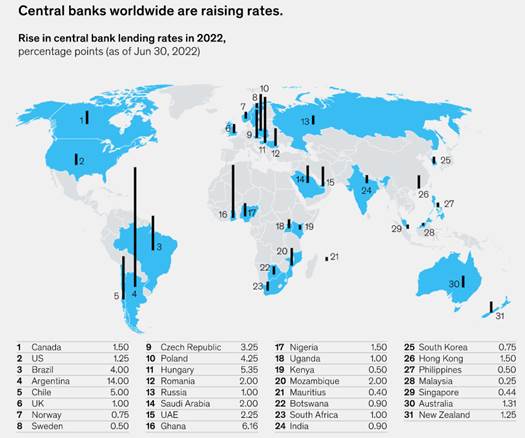

inflation’s alarming rise, central banks worldwide are raising their core

bank lending rates (illustration two). So

far, however, rate raises in most countries have not matched the pace of

inflation. Rising rates are expected to ease demand and lower prices for two

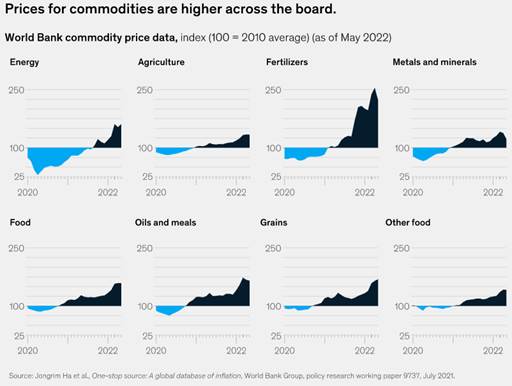

critical components of headline inflation: housing and commodities such as

energy and metals. As economic stimulus reflated the global economy that had

been punctured by the COVID-19 pandemic, prices took off (illustration three). Then Russia’s

invasion sent prices higher still. The biggest rise was in fertilizers. Spurred

by shortages of natural gas, a key component in making fertilizer, and by

rising demand from farmers, fertilizer prices have risen sharply.

Emergent risk:

Increasing

probability that one current risk may materialise:

Change management is a structured

approach to implementing change in an organization, a systematic approach to

dealing with changes to goals, processes and technologies. District Services

have identified this as a regulatory/compliance risk (DS018) - Because of

change management practice (or lack of); there is a chance that inconsistent

processing and service level; leading to not meeting statutory requirements,

creating legal liabilities and reputational damage. It is probable that we are

now seeing this risk materialise. District facilities have also identified an

operational/financial risk (DS023) focussed on the lack of an organisation-wide

imbedded compliance information flow.

The issue:

Historically, FNDC has issued one or

more resource consents with a specific consent condition which required the

developer to design, supply and install a reticulated wastewater system on the

basis that the area of the subdivision was designated as a ‘future area

of benefit’ for sewer connections.

It has been alleged that, where FNDC

has not provided the wastewater connection, FNDC is considered to be in breach

of our obligations to facilitate connecting the development. These

allegations have been accompanied by requests to re-imburse the cost of the

required wastewater reticulated system inclusive of interest on that

investment.

At this stage it is unclear how many

resource consents may have been issued with the above mentioned conditions and

work is underway to understand the scale and extent of any associated risks.

It is also important to note that when

testing the liability balance related to resource management deposits, in 2018,

Audit NZ found that some of the deposits in the listing were received 18 years

ago. A project has been underway to identify these bonds, and to then confirm

resource consent conditions have been met, to enable bonds to be returned.

There are 11 instances where remedial work needs to be completed. Six of these

are roading issues and are with the NTA to confirm work required; two are waiting

for assessment from engineers; two are with District Facilities Operations to

remediate; and one remains to be actioned.

Table 3 captures previously identified emergent risks. One

additional emergent risk, identified 21/06/2022 and verbally advised to the

Assurance, Risk and Finance Committee at the June 2022 meeting, has been

included in the table below as item number six.

Table 3: Table of identified emergent risk

|

Emergent risks

|

Presented to ARF:

|

Progress

|

|

1. The risk of externally funded shovel

ready, economic stimulus employment opportunity projects due to the impact of

the COVID-19 pandemic.

|

October 2020

|

The Assurance, Risk and Finance Committee received

a report at the March 2022 meeting.

|

|

2. The risk of not fit for purpose

business continuity arrangements.

|

October 2020

|

A progress up-date is provided under the group risk

section.

|

|

3. Government’s Three Waters

Reform programme.

|

December 2020

|

Subject to an information report August 2022

Assurance, Risk and Finance Committee agenda.

|

|

4. Potential impact of the Worksafe

decision, in December 2020, to charge 13 parties over the Whakaari/White

Island tragedy; and the government review of WorkSafe New

Zealand’s performance of its regulatory functions in relation to

activities on Whakaari White Island.

|

February 2021

|

Impact to be considered when further information is

to hand.

|

|

5. Ngapuhi Mana Whakahono ā Rohe.

|

Feb 2022

|

Workshop with Elected Members 09/08/22

|

|

6. Risk #IAM066, identified 21/06/2022,

of the implications to budgets of cost escalations to complete scheduled

maintenance work.

|

June 2022

|

Subject of a decision report (item 6.4) to Council 11/08/2022

The additional funding approval sought is budgeted

within the adopted 2021/2024 LTP and

does not result in any unbudgeted expenditure.

|

Organisational risk progress reports:

Nine of the

scheduled risk progress reports, including high level treatment plan progress,

are provided with highlights and analysis of risk progress below. More detail

is available in the attached risk progress reports.

The ARF004

Asset Management Risks progress report has not been tabled. This risk was established

in 2018. At this time the main focus for addressing, what is really an

issue, was the establishment of Programme Darwin to deliver technology and

process change, alongside appropriate resources and skill that would

dramatically increase the maturity of Council’s asset management

functions.

The

Infrastructure and Asset Management Group would like to revisit this stated

risk to articulate what the current risk is in this space. Then the

impacts and proposed treatments will better match that statement of risk.

Improvements to our asset management practices are underway, these are both

within the previous auspices of Programme Darwin, like the condition

assessments across Three Waters and District Facilities asset portfolios, and

also as improvements to processes and procedures such as preparing project

briefs for delivery and establishing the comprehensive Asset Management Plan

Council needs.

Additionally,

Council has not quantified climate risks to its assets, nor are these risks

addressed in asset management plans. Without quantifying the risks and the

impact of risk treatment options, it will be nearly impossible to maintain

effective oversight of the council’s assets.

Risk progress reports – highlights and analysis:

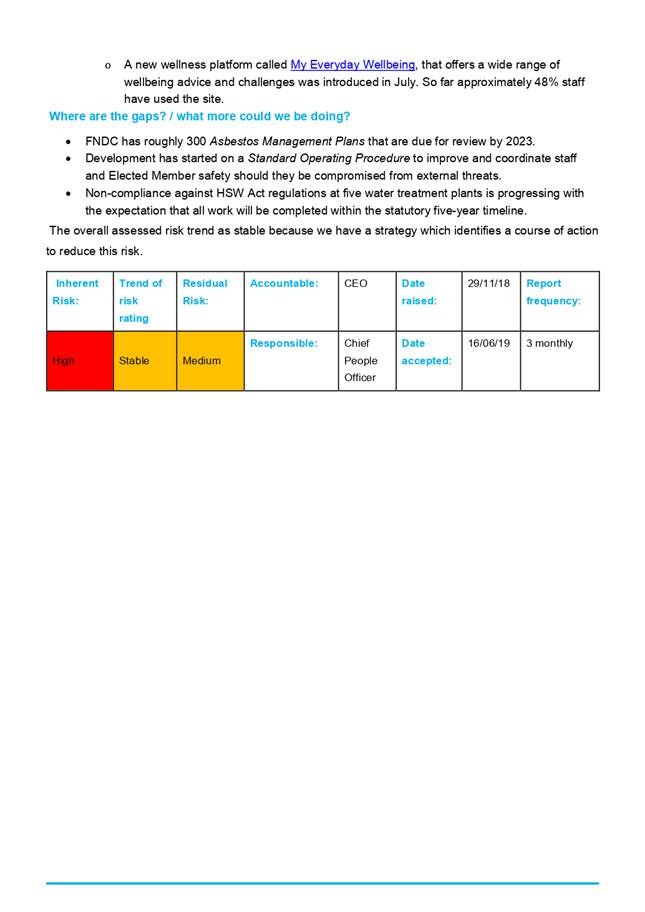

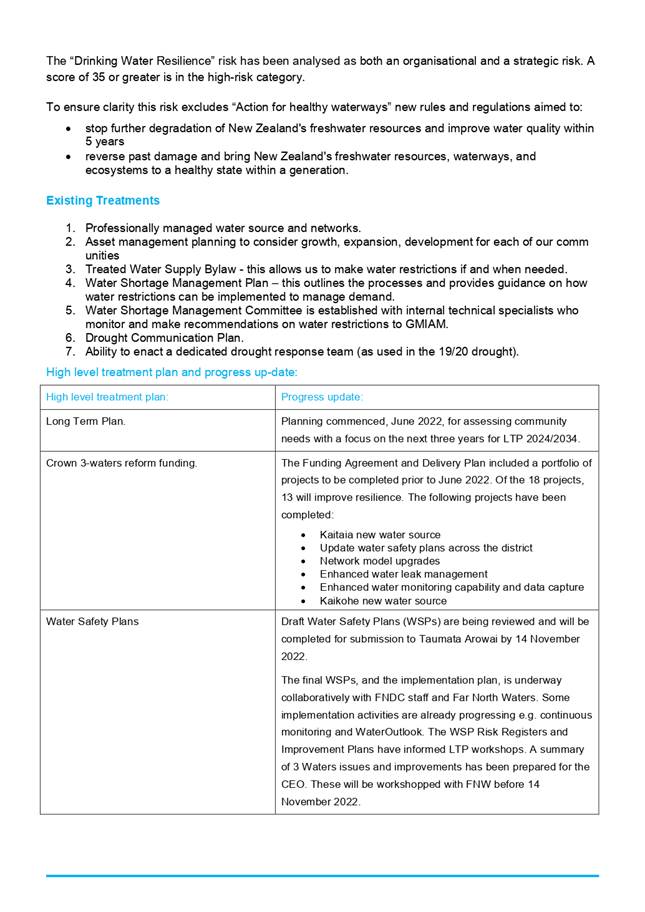

1. ARF003

Health & Safety Vulnerabilities risk progress report. The inherent risk

rating trend has been assessed as stable as we have a strategy which

identifies a course of action to reduce this risk.

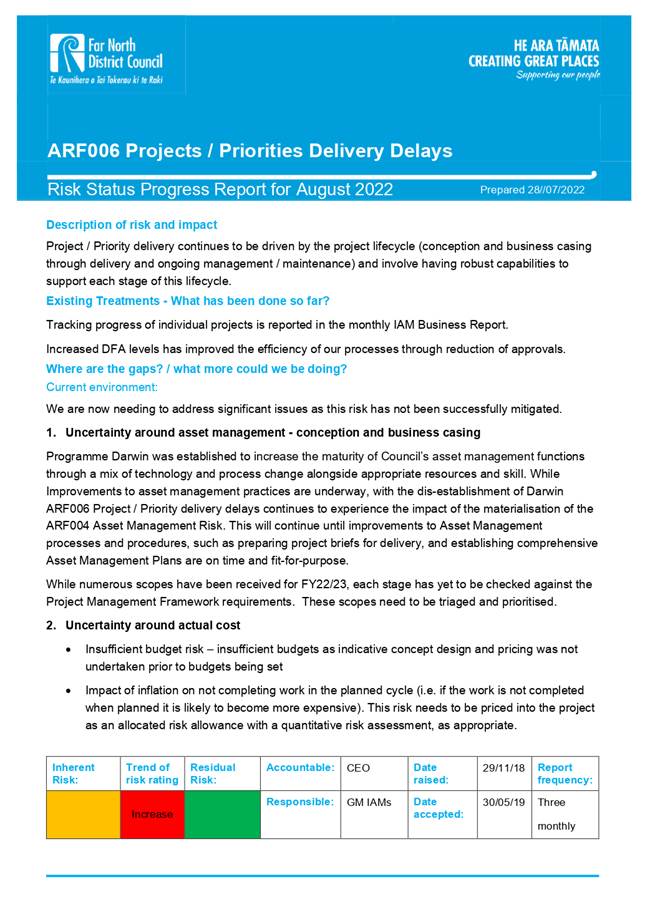

2. ARF006

Project Priorities Deliveries Delays risk progress report. The inherent risk

rating trend has been assessed as increasing as we are now needing to

address significant issues as this risk has not been successfully mitigated.

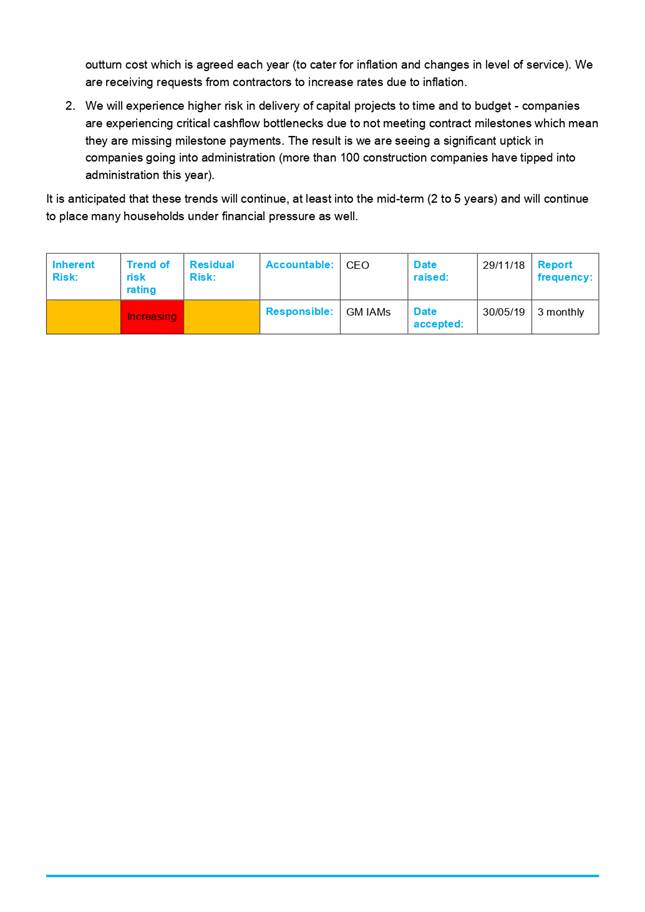

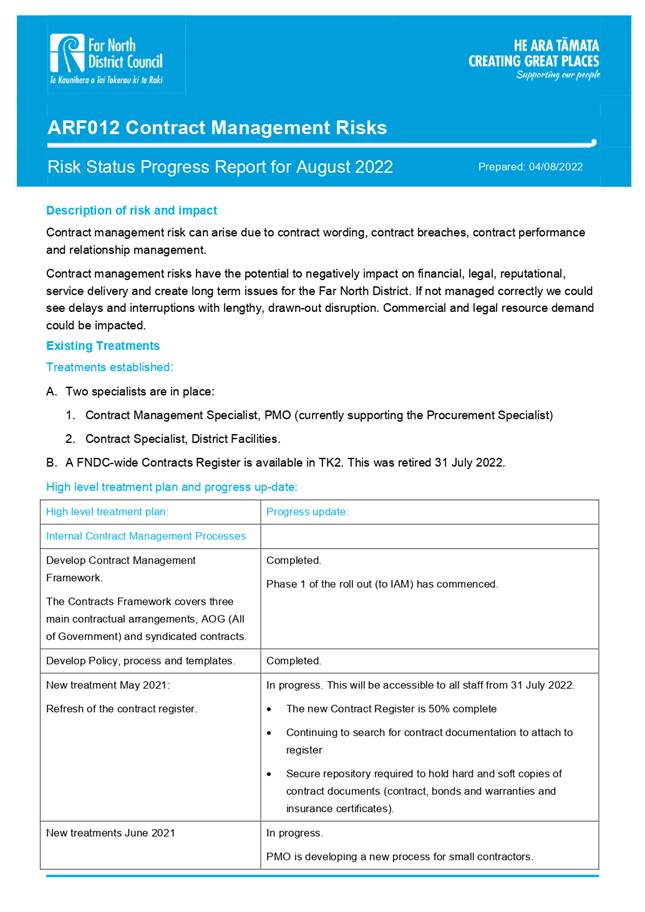

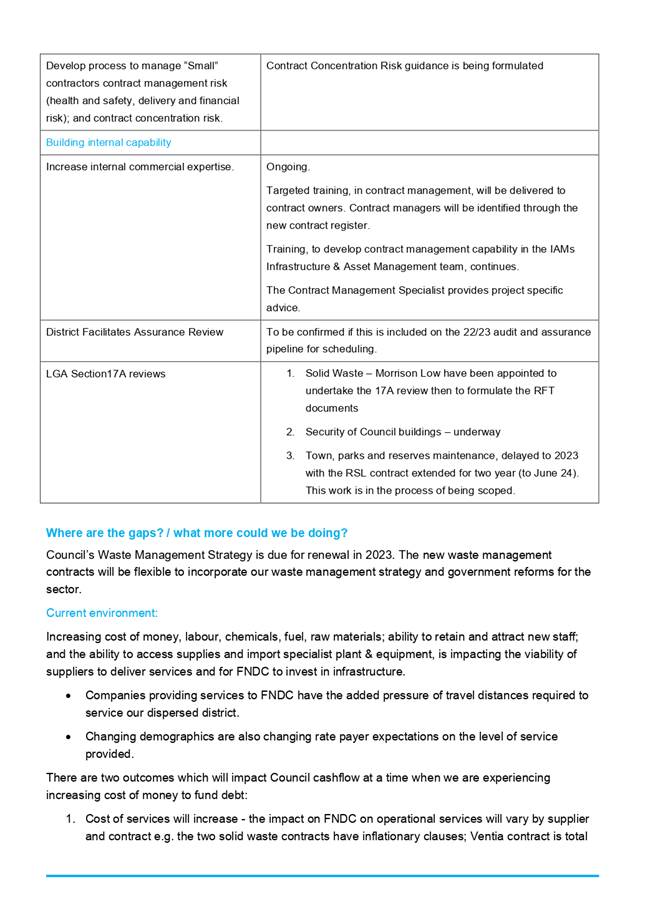

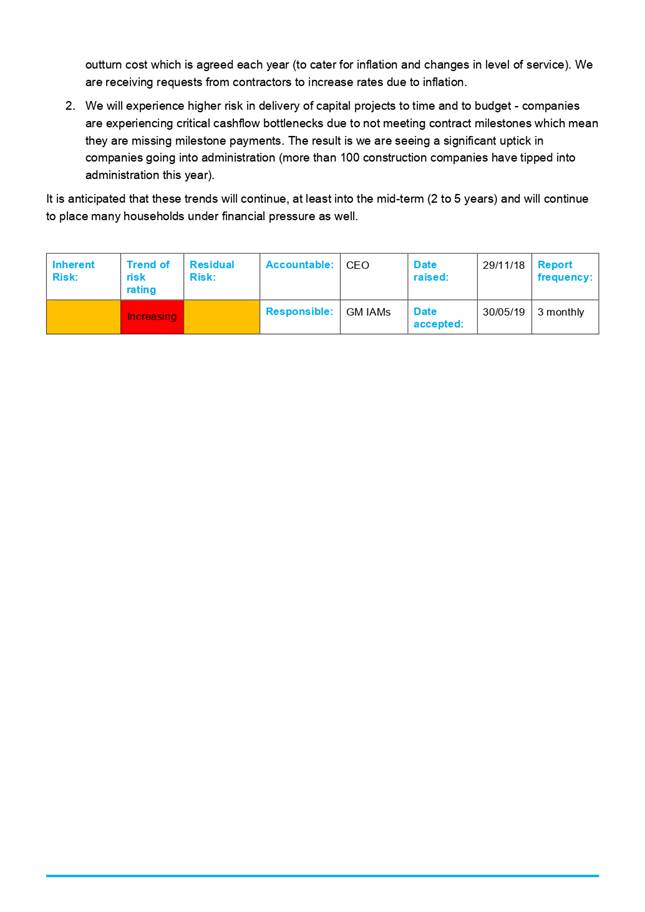

3. ARF012

Contract Management Risks risk progress report. The inherent risk rating trend

has been assessed as increasing due to the increasing

cost of money, labour, chemicals, fuel, raw materials; ability to retain and

attract new staff; and the ability to access supplies and import specialist

plant & equipment.

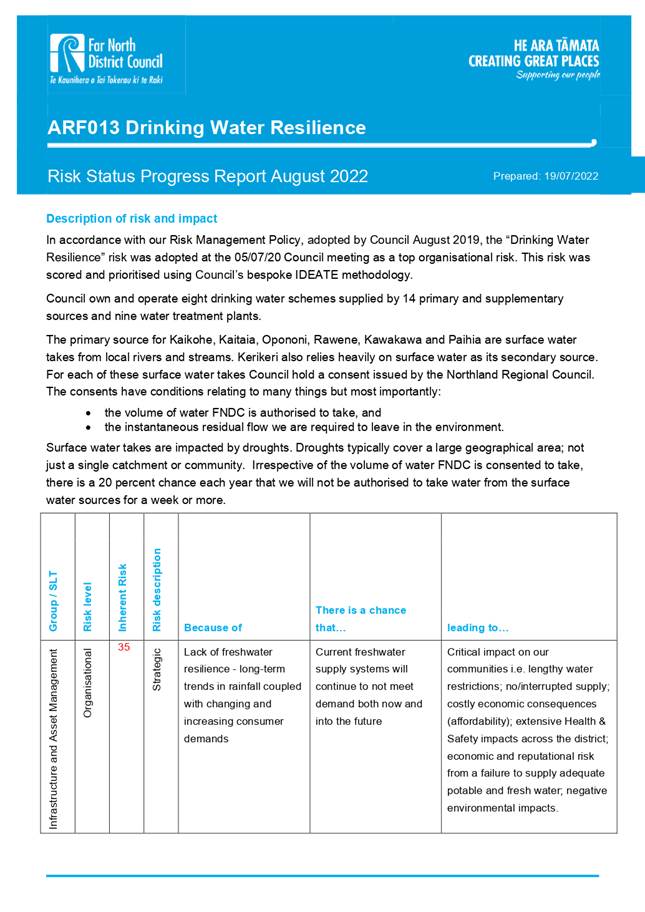

4. ARF013

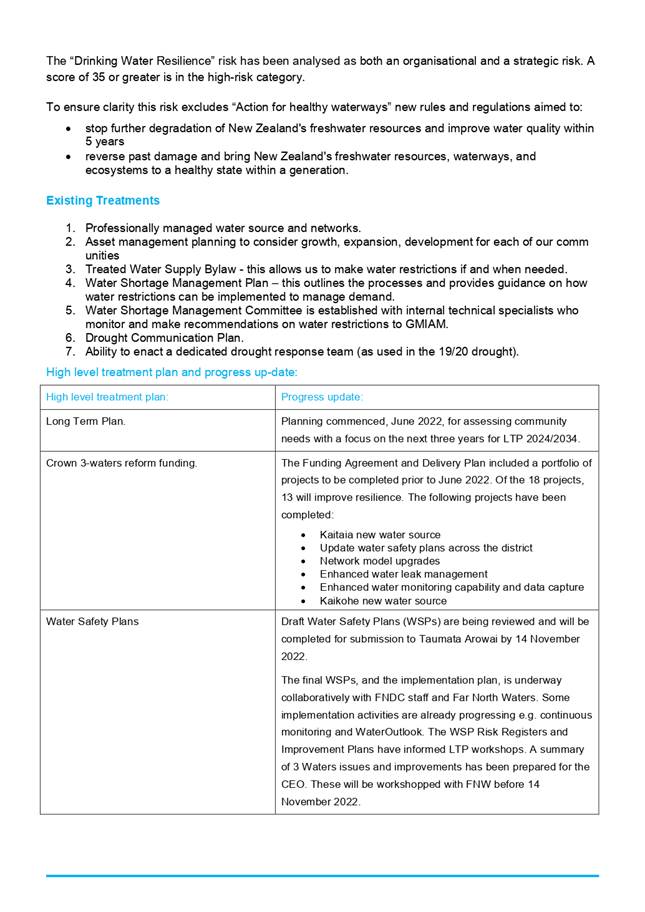

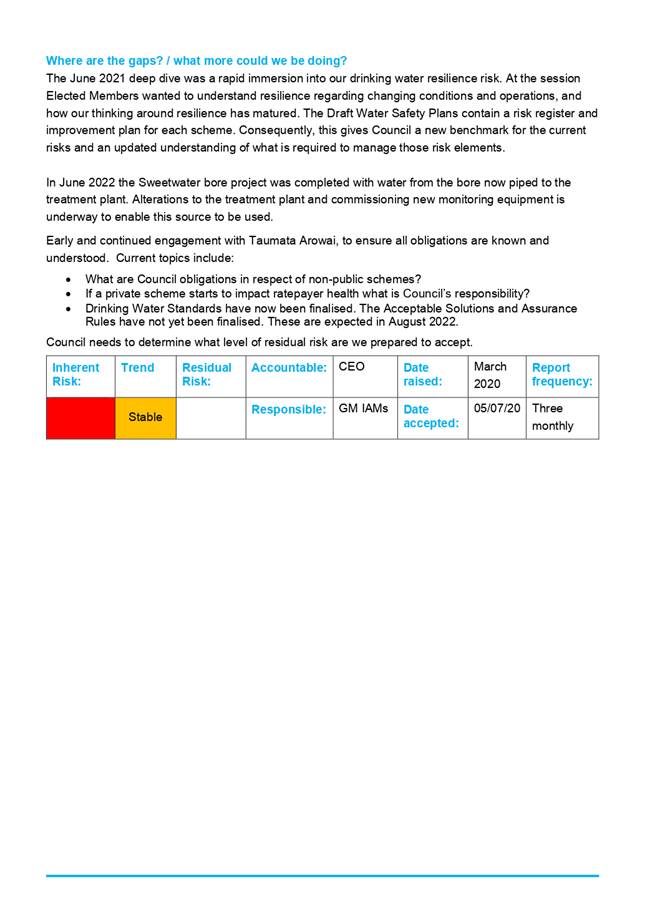

Drinking Water Resilience risk progress report. The inherent risk rating trend

has been assessed as stable. The Draft Water

Safety Plans contain a risk register and improvement plan for each scheme.

5. Consolidated

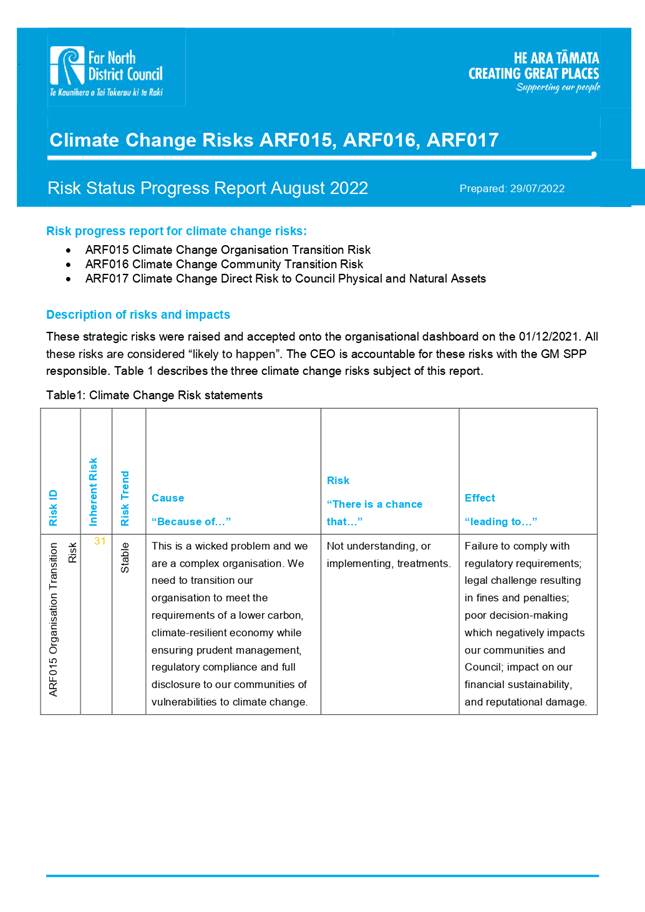

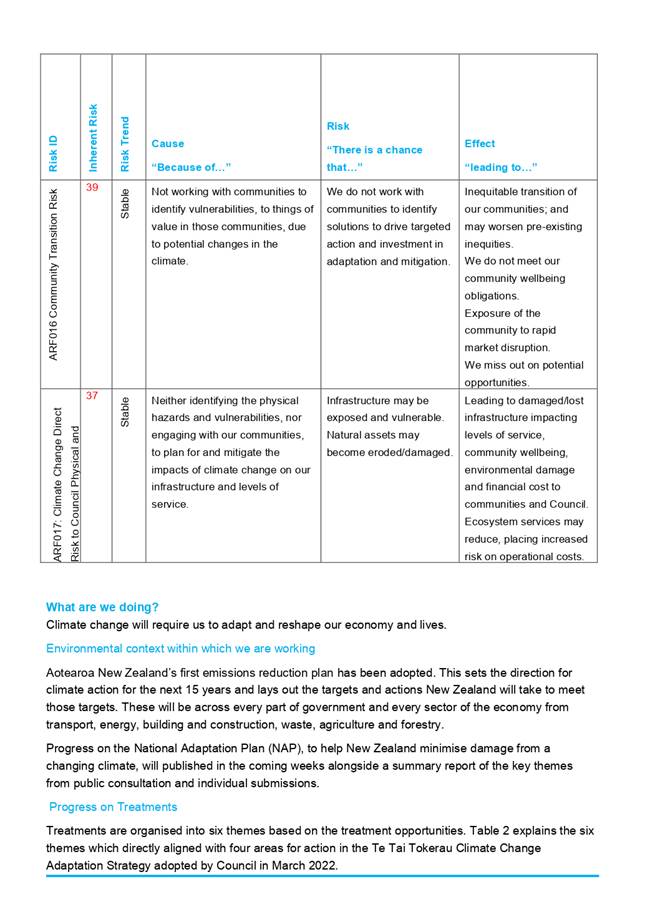

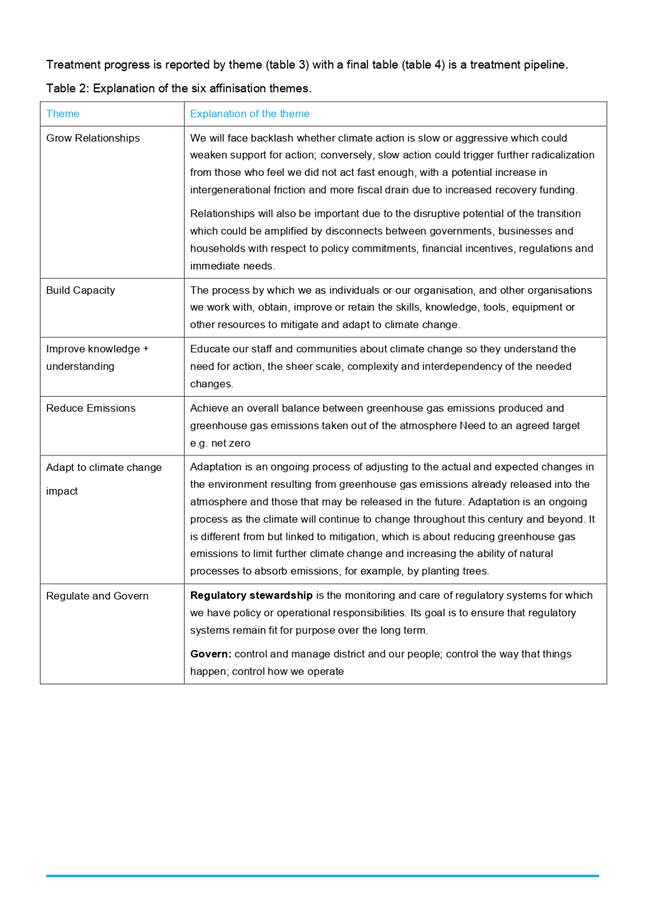

Climate Change Risks (ARF015, ARF016 and ARF017) progress report. The inherent

risk rating trend has been assessed as stable for these three Climate

Change risks. There is an active structured Climate Change treatment plan in

place:

· Treatments have

been analysed then clustered into one of six distinct themes to help synthesize

information and provide insights

· Treatments are

provided in two tables, those in progress and a pipeline of potential / planned

treatments

· The Climate Change

Risk Reference Group continues to progress actions working with WSP to develop

a science-based emissions reduction programme

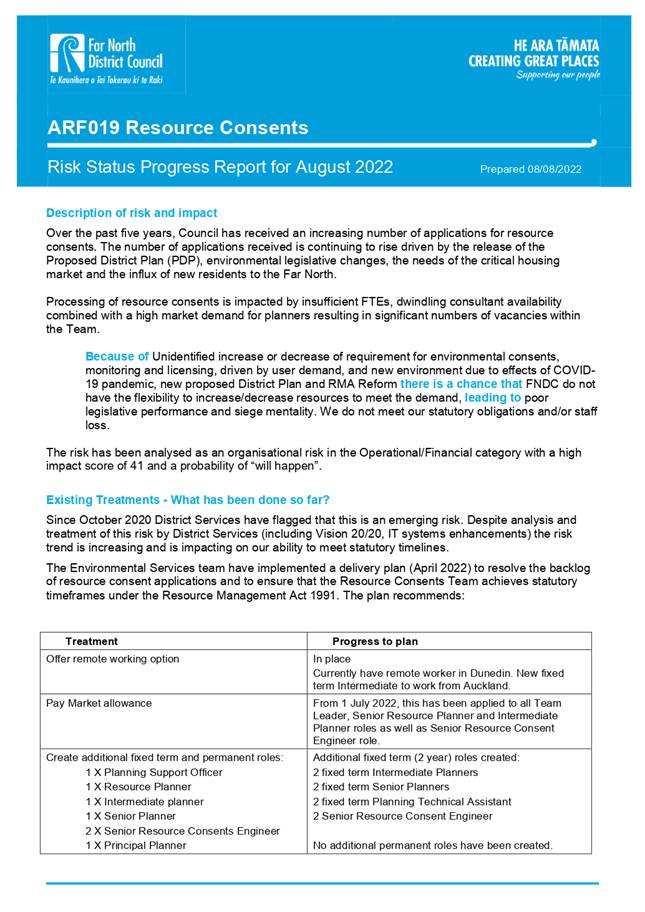

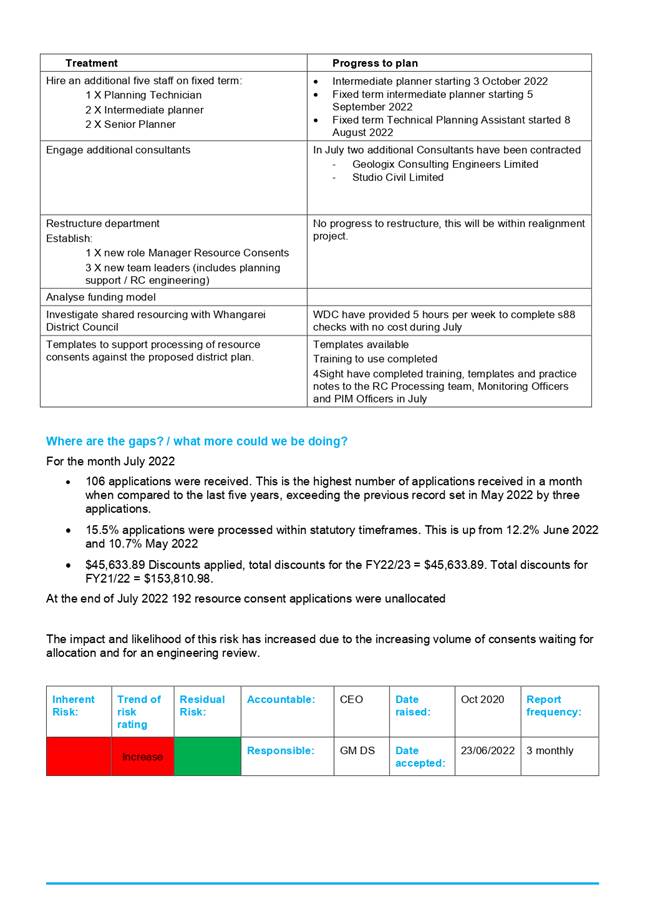

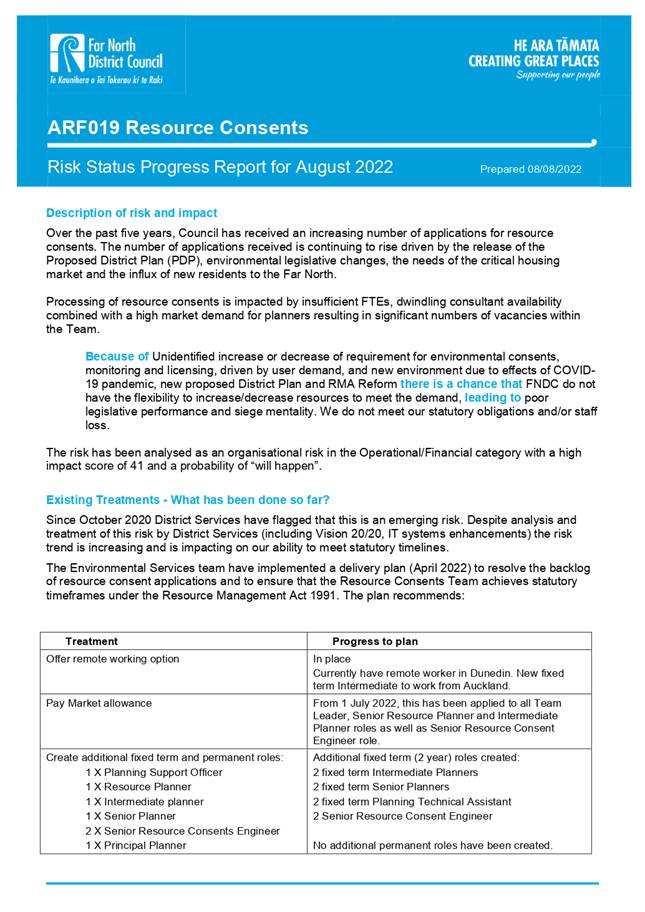

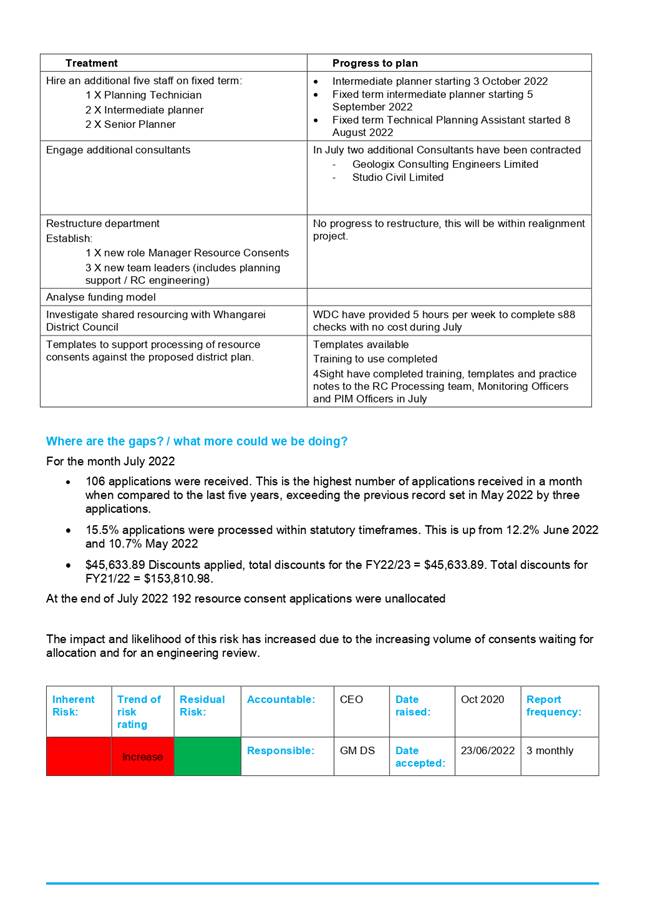

6. ARF019

Resource Consents risk progress report. The inherent risk rating trend has been

assessed as increasing as Council continues to receive an increasing number of

applications for resource consents while also needing to manage a significant

backlog. District Services provide a monthly resource consent status report to

Elected Members.

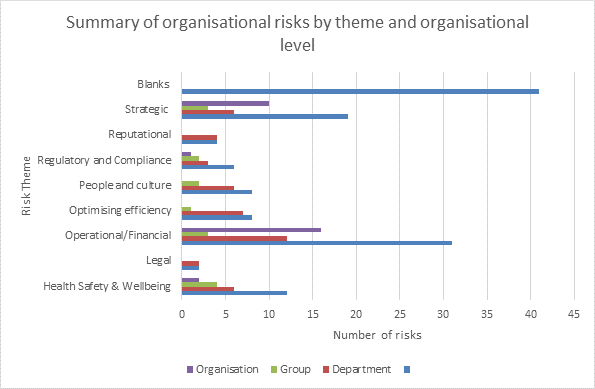

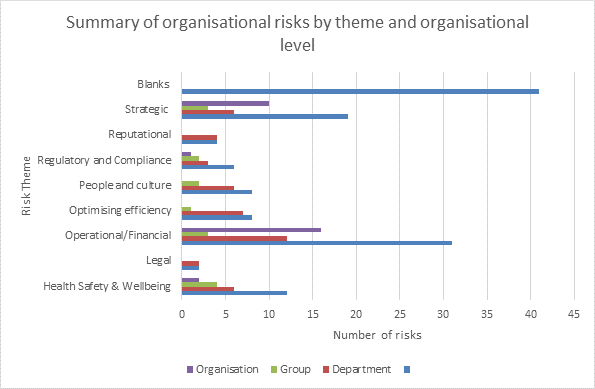

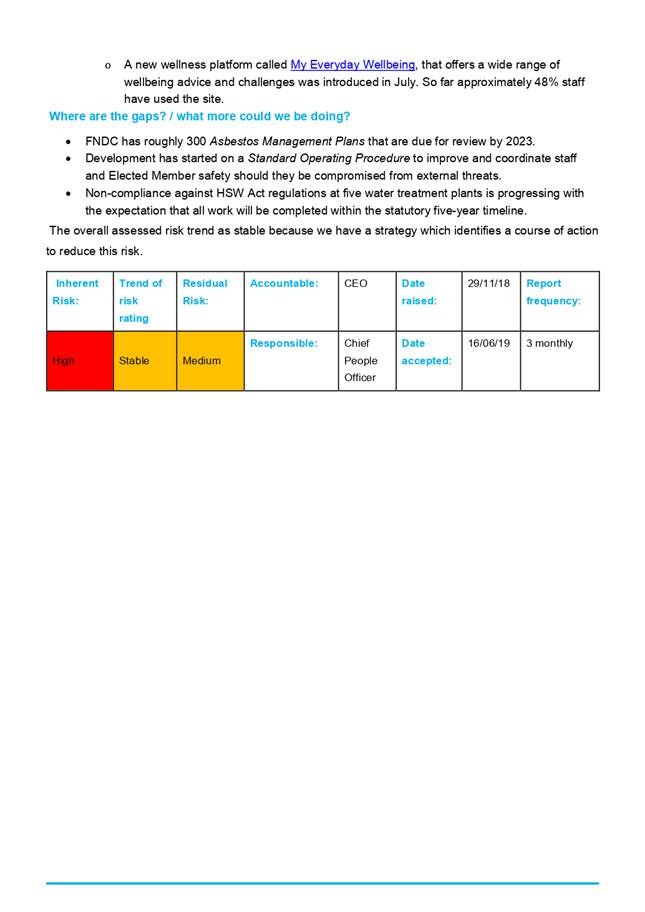

Organisational

Risk Up-date

Group risk

registers have been retired with the establishment of a SharePoint register

containing all identified organisational risks. An overview of total

organisation risk by risk theme is provided in table four. The largest number

of risks are in the operational/financial risk category and the majority of

risks are assessed as medium impact. Further business intelligence will

be provided once BI reporting has been implemented.

Protecting Council data

Two potential issues have occurred which could have

resulted in data security breaches:

1. FNDC received a security alert of a potential

cybersecurity breach involving 20 FNDC email addresses. This risk was

immediately mitigated with affected staff contacted and instructed to change

their passwords. The upside is that this event provides evidence that our cyber

security controls are working.

2. Privacy Act, potential privacy breach: the

K drive, available in citrix, is a shared network drive that all staff have

access to. Private and personal information was identified in some of the

records located in K drive. These records were promptly removed, and a cross

functional team established to investigate and mitigate this risk. After

a review by Legal, of the information and facts, it was determined that it was

highly unlikely that a privacy breach had occurred. Treatments in place include:

a. ongoing management of K drive by the

Information Management Team with the intention that K drive will likely be made

redundant and in the meantime a process for its short-term use, management and

destruction of information currently held in the K drive is underway

b. internal communication campaign (SharePoint

article, People Leaders notification, individual follow up with staff)

c. All of staff Friendly Fishing training on

the Privacy Act.

Table 4: Table of total organisation risk by risk theme

Key: description of

risk category:

· Health Safety & Wellbeing - a work environment

that is without risk to health and safety, so far as is reasonably practicable

· Legal - Application of the law (and its consequences)

to FNDC actions

· Operational/Financial - Whole of business view of FNDC

performance including service/services delivery, risk, finance, environmental,

· Optimising efficiency - Managing the present, lineal

response to what exists today such as system, Continuous Improvement, process

· People and culture - Capability, mindsets, behaviour

· Regulatory and Compliance- Conforming to rules,

external = law or regulation; internal = policies

· Reputational - The external estimation in which FNDC

and brand is held

· Strategic - Adapting to change: Innovation / create

the future / selectively forget the past.

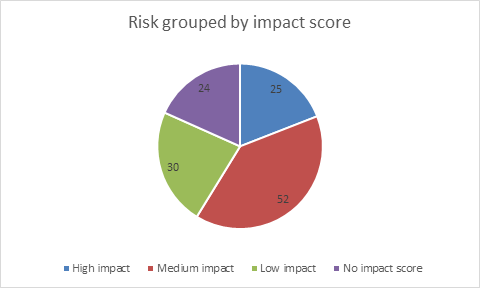

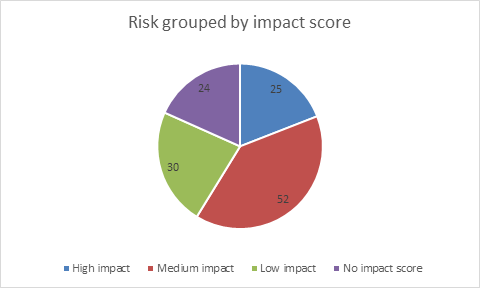

Table

five provides a few of total organisational risk by impact score (high, medium,

low). 19% of organisational risk has been scored as high impact, 40% medium

impact and 23% low impact. A number of risks are yet to be scored.

Table 5: Table of total organisation risk by impact score

(high, medium, low).

Work

continues at group level to understand where there is a greater than 70%

probability of the risk materialising within the next three years and to

regularly assess the risk trend, particularly for the high impact risks.

|

Assurance, Risk

and Finance Committee Meeting Agenda

|

31 August 2022

|

Business

continuity arrangements

The

COVID-19 crisis response and crisis management teams continue to manage the

Council’s COVID-19 response reviewing and up-dating protocols as the

Government changes measures in response to the omicron outbreak.

Business continuity arrangements for essential

services:

Business

continuity plans are all available at Business

Continuity Planning - Home (sharepoint.com)

PĀNGA PŪTEA ME NGĀ WĀHANGA

TAHUA / Financial Implications and Budgetary Provision

No additional budgetary

provision is requested.

Āpitihanga

/ Attachments

1. 2022

08 ARF003 Health Safety and Wellbeing Vulnerabilities Risk Progress Report -

A3844048 ⇩

2. 2022

08 ARF006 Projects Priorities Delivery Delays Risk Progress Report - A3832795 ⇩

3. 2022

08 ARF012 Contract Management Risk Progress Report - A3832792 ⇩

4. 2022

08 ARF013 Drinking Water Resilience Risk Progress Report - A3832799 ⇩

5. 2022

08 ARF0019 Resource Consents Risk Progress Report - A3834279 ⇩

6. 2022

08 Climate Change Risk Progress Report - A3832797 ⇩

|

Assurance, Risk

and Finance Committee Meeting Agenda

|

31 August 2022

|

|

Assurance, Risk and

Finance Committee Meeting Agenda

|

31 August 2022

|

|

Assurance, Risk

and Finance Committee Meeting Agenda

|

31 August 2022

|

|

Assurance, Risk and

Finance Committee Meeting Agenda

|

31 August 2022

|

|

Assurance, Risk and

Finance Committee Meeting Agenda

|

31 August 2022

|

|

Assurance, Risk and

Finance Committee Meeting Agenda

|

31 August 2022

|

6.4 Three

waters organisational risk report

File

Number: A3838008

Author: Tanya

Reid, Principal Advisor - Organisational Performance and Transformation

Authoriser: Janice

Smith, Acting General Manager - Corporate Services

TAKE PŪRONGO / Purpose of the Report

To

provide an information report on the impact of three waters reform on

organisational risk management and potential emergent risks.

WHAKARĀPOPOTO MATUA / Executive SummarY

This

information report, as requested by the Assurance, Risk and Finance Committee,

investigates potential impact of the three waters reform on Council’s

risk universe and organisational risks.

Three

risk have been identified. These are:

A. Three waters transition

risk

B. Risk if three waters

reform is rescinded

C. Risk if three waters reform

proceeds

Impact

on current organisational risk is also considered.

|

TŪTOHUNGA

/ Recommendation

That the Assurance, Risk and Finance Committee receive

the report Three waters organisational risk report.

|

tĀHUHU KŌRERO / Background

The

top organisational risks are risks that may impact on Council achieving its

vision, mission and community outcomes and are regularly reported to the

Assurance, Risk and Finance Committee to ensure they are being appropriately

managed.

Three

Waters reform will result in a change of focus for Council from a traditional

focus on infrastructure service delivery, and dependent on the outcome of the

Future for Local Government Review, to a focus on the complex wellbeing

challenges of the 21st century, including economic and social equity and

climate change action.

Three Waters Reform

02/06/2022

the Government introduced, to Parliament, the Water Services Entities Bill to

implement its decision to establish four public entities to take on the

delivery of drinking water, wastewater and stormwater services across New

Zealand from July 2024.

The

Water Services Entities Bill completed its first reading 09/06/2022 and is now

with Select Committee. The Select Committee finished receiving submissions on

the Water Services Entities Bill on 22 July. The Committee will now listen to

oral submissions from members of the public, local government and

organisations.

The

bill provides the legislative basis to establish four new publicly-owned water

services entities, and sets out the ownership, governance, and accountability

arrangements relating to these entities.

The

Bill also provides for transitional arrangements relating to the establishment

and governance of the new entities, including strategic direction, planning and

reporting, employment, and the oversight powers of the Department of Internal

Affairs during the establishment period. That period begins when the Bill is

enacted and runs until 1 July 2024 at the latest, after which point the water

services entities will take over delivery of three waters services.

It is

noted that Subpart 4 provides the Department of Internal Affairs with oversight

powers during the establishment period. These enable the Department to review

– and, where applicable, confirm – local government decisions if

these will significantly prejudice or constrain the water services reform, or

have a significant negative impact on assets or liabilities that will be

transferred to the entities.

Council

is also experiencing a changing risk universe with a need to plan for

disruption to cope with the uncertain and fast-changing environment which is

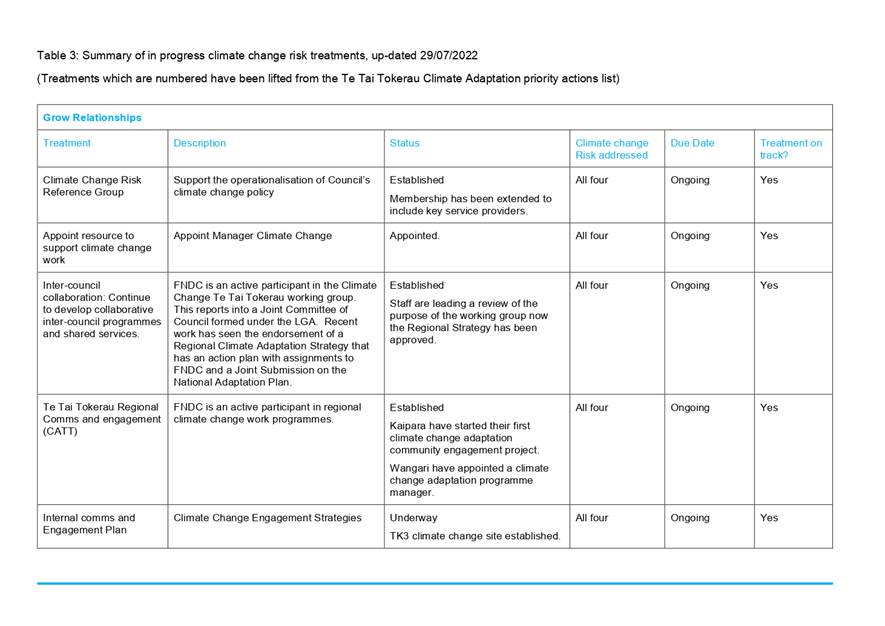

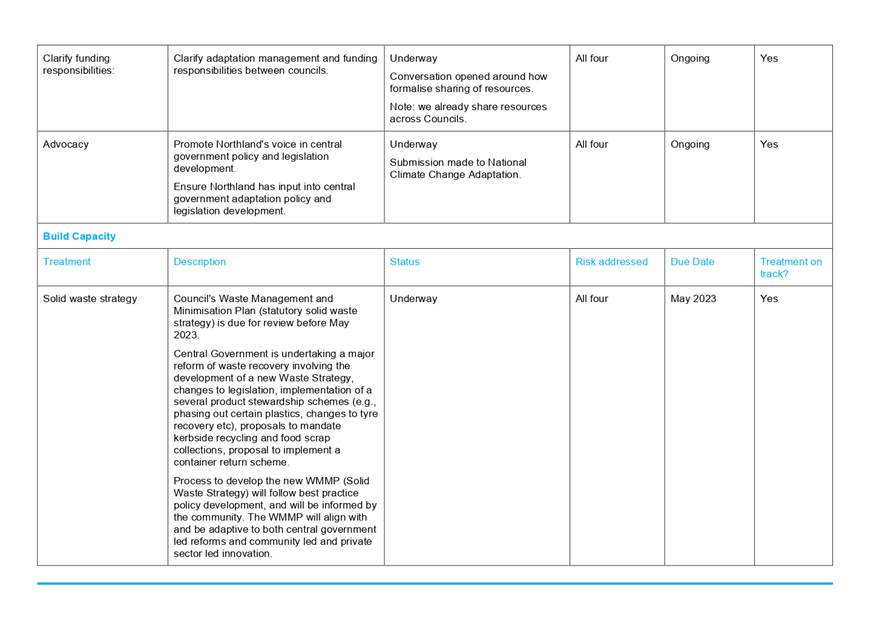

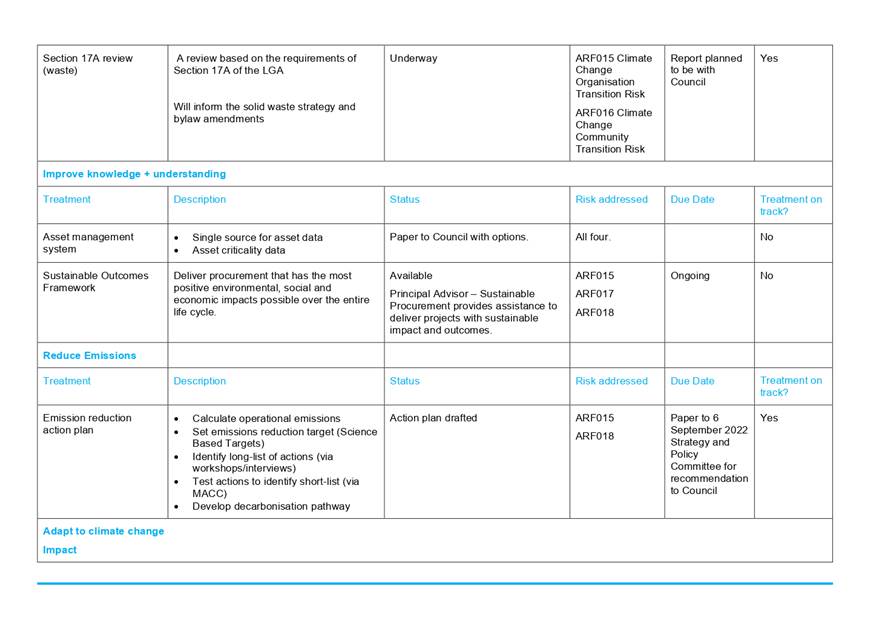

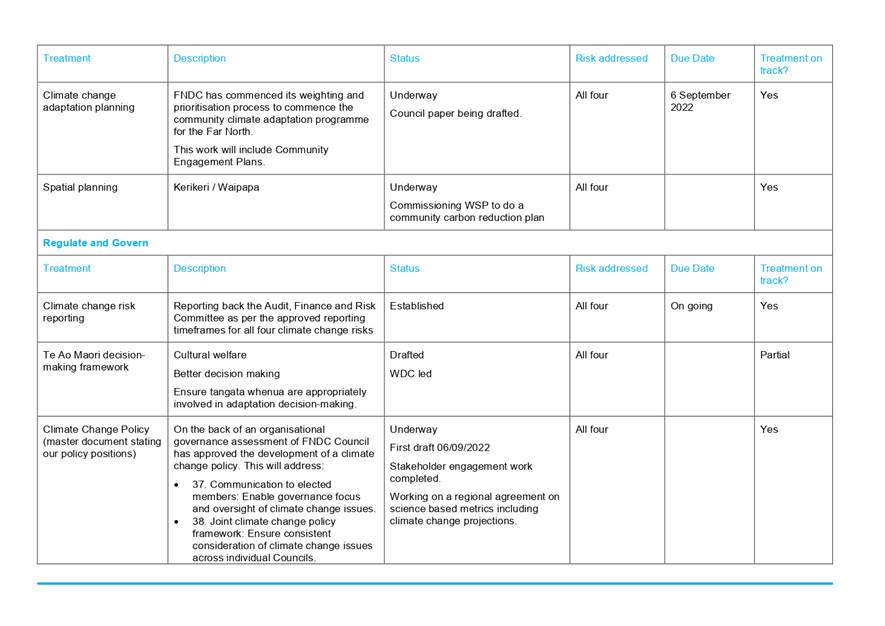

characterized by less stability and predictability: