Te

Kaunihera o Tai Tokerau ki te Raki

AGENDA

Assurance, Risk and Finance Committee Meeting

Wednesday, 29 July 2020

|

Time:

|

1.00 pm

|

|

Location:

|

Council Chamber

Memorial Avenue

Kaikohe

|

Membership:

Cr John

Vujcich - Chairperson

Mayor John

Carter

Deputy Mayor

Ann Court

Member Bruce

Robertson

Cr Mate

Radich

Cr Kelly

Stratford

Cr Moko

Tepania

Member Mike

Edmonds - Kaikohe-Hokianga Community Board Chair

|

|

Authorising Body

|

Mayor/Council

|

|

Status

|

Standing Committee

|

|

COUNCIL COMMITTEE

|

Title

|

Assurance, Risk and Finance

Committee Terms of Reference

|

|

Approval Date

|

19 December 2019

|

|

Responsible Officer

|

Chief Executive

|

Purpose

The purpose of the Assurance,

Risk and Finance Committee (the Committee) is to assist and advise the

Governing Body in discharging its responsibility and ownership of finance, risk

and internal control.

The Committee will review the

effectiveness of the following aspects:

·

The robustness of financial management

practices;

·

The integrity and appropriateness of

internal and external reports and accountability arrangements;

·

The robustness of the risk management

framework;

·

The robustness of internal controls and

the internal audit framework;

·

Compliance with applicable laws,

regulations, standards and best practice guidelines;

·

The establishment and maintenance of

controls to safeguard the Council’s financial and non-financial assets;

·

Data governance framework

To perform his or her role

effectively, each Committee member must develop and maintain

his or her skills and knowledge,

including an understanding of the Committee’s responsibilities, and of

the Council’s business, operations and risks.

Membership

The Council will determine the

membership of the Assurance, Risk and Finance Committee including at least one

independent appointment with suitable financial and risk management knowledge

and experience.

The Assurance, Risk and Finance

Committee will comprise of at least five elected members (one of which will be

the chairperson), and one independent appointed member.

|

Mayor

Carter

|

|

John

Vujcich – Chairperson

|

|

Bruce

Robertson – Deputy Chairperson and Independent Member of the Committee

|

|

Moko

Tepania

|

|

Mate

Radich

|

|

Kelly

Stratford

|

|

Ann

Court

|

|

Mike

Edmonds

|

|

Adele

Gardner

|

Non-appointed

councillors may attend meetings with speaking rights, but not voting rights.

Quorum

The quorum at a

meeting of the Assurance, Risk

and Finance Committee is 4 members.

Frequency of

Meetings

The Assurance, Risk and Finance Committee shall meet every 6

weeks, but may be cancelled if there is no business.

Power to

Delegate

The Assurance, Risk and

Finance Committee may not delegate any of its responsibilities, duties or

powers.

Committees

Responsibilities

The Committees responsibilities

are described below:

Financial

systems and performance of the Council

·

Review the Council’s financial

and non-financial performance against the Long Term Plan and Annual Plan

·

Review Council quarterly financial

statements and draft Annual Report

Far

North Holdings Limited (FNHL)

·

Recommend to Council the approval of

statement of intent and Annual Report (s67 LGA)

·

Receive 6 monthly report on operations

(s66 LGA)

·

Receive quarterly financial statements

·

Recommend appointment of directors of

FNHL

Risk

Management

·

Review appropriateness of

Council’s risk management framework and associated procedures for

effective risk identification, evaluation and treatment

·

Receive and review risk management

dashboard reports

·

Provide input, annually, into the

setting of the risk management programme of work

·

Receive updates on current litigation

and legal liabilities

Internal

Audit and Controls

·

Review whether management has in place

a current and comprehensive internal audit framework

·

Receive and review the internal audit

dashboard reports

·

Provide input, annually, into the

setting of the internal audit programme of work

·

Review whether there are appropriate

processes and systems in place to identify and investigate fraudulent behaviour

The

Committee will manage Council’s relationship with external auditor.

The

Committee will approve applications to declare land abandoned and any other

such matters under the Rating Act.

Rules and

Procedures

Council’s

Standing Orders and Code of Conduct apply to all the committee’s

meetings.

Annual reporting

The Chair of the Committee will

submit a written report to the Chief Executive on an annual basis. The

review will summarise the activities of the Committee and how it has contributed to the Council’s

governance and strategic objectives. The Chief Executive

will place the report on the next available agenda of the governing body.

ASSURANCE, RISK

AND FINANCE COMMITTEE - MEMBERS REGISTER OF INTERESTS

|

Name

|

Responsibility (i.e. Chairperson

etc)

|

Declaration of

Interests

|

Nature of Potential

Interest

|

Member's Proposed

Management Plan

|

|

Hon John Carter QSO

|

Board Member of the

Local Government Protection Programme

|

Board Member of the

Local Government Protection Program

|

|

|

|

Carter Family Trust

|

|

|

|

|

John Vujcich (Chair)

|

Board Member

|

Pioneer Village

|

Matters relating to

funding and assets

|

Declare interest and

abstain

|

|

Director

|

Waitukupata Forest Ltd

|

Potential for council

activity to directly affect its assets

|

Declare interest and

abstain

|

|

Director

|

Rural Service Solutions

Ltd

|

Matters where council

regulatory function impact of company services

|

Declare interest and

abstain

|

|

Director

|

Kaikohe (Rau Marama)

Community Trust

|

Potential funder

|

Declare interest and abstain

|

|

Partner

|

MJ & EMJ Vujcich

|

Matters where council

regulatory function impacts on partnership owned assets

|

Declare interest and

abstain

|

|

Member

|

Kaikohe Rotary Club

|

Potential funder, or

impact on Rotary projects

|

Declare interest and

abstain

|

|

Member

|

New Zealand Institute

of Directors

|

Potential provider of

training to Council

|

Declare a Conflict of

Interest

|

|

Member

|

Institute of IT

Professionals

|

Unlikely, but possible

provider of services to Council

|

Declare a Conflict of

Interest

|

|

Member

|

Kaikohe Business

Association

|

Possible funding

provider

|

Declare a Conflict of

Interest

|

|

Bruce Robertson

(Deputy)

|

No Form Received

|

|

|

|

|

Deputy Mayor Ann

Court

|

Waipapa Business

Association

|

Member

|

|

Case by case

|

|

Warren Pattinson

Limited

|

Shareholder

|

Building company. FNDC

is a regulator and enforcer

|

Case by case

|

|

Kerikeri Irrigation

|

Supplies my water

|

|

No

|

|

Top Energy

|

Supplies my power

|

|

No other interest

greater than the publics

|

|

District Licensing

|

N/A

|

N/A

|

N/A

|

|

Top Energy Consumer

Trust

|

Trustee

|

Crossover in regulatory

functions, consenting economic development and contracts such as street

lighting.

|

Declare interest and

abstain from voting.

|

|

Ann Court Trust

|

Private

|

Private

|

N/A

|

|

Waipapa Rotary

|

Honorary member

|

Potential community

funding submitter

|

Declare interest and

abstain from voting.

|

|

Properties on Onekura

Road, Waipapa

|

Owner Shareholder

|

Any proposed FNDC

Capital works or policy change which may have a direct impact (positive/adverse)

|

Declare interest and

abstain from voting.

|

|

Property on Daroux Dr,

Waipapa

|

Financial interest

|

Any proposed FNDC

Capital works or policy change which may have a direct impact (positive/adverse)

|

Declare interest and

abstain from voting.

|

|

Flowers and gifts

|

Ratepayer 'Thankyou'

|

Bias/

Pre-determination?

|

Declare to Governance

|

|

Coffee and food

|

Ratepayers sometimes

'shout' food and beverage

|

Bias or

pre-determination

|

Case by case

|

|

Staff

|

N/A

|

Suggestion of not being

impartial or pre-determined!

|

Be professional, due

diligence, weigh the evidence. Be thorough, thoughtful, considered impartial

and balanced. Be fair.

|

|

Warren Pattinson

|

My husband is a builder

and may do work for Council staff

|

|

Case by case

|

|

Ann Court - Partner

|

Warren Pattinson

Limited

|

Director

|

Building Company. FNDC

is a regulator

|

Remain at arm’s

length

|

|

Air NZ

|

Shareholder

|

None

|

None

|

|

Warren Pattinson

Limited

|

Builder

|

FNDC is the consent

authority, regulator and enforcer.

|

Apply arm’s

length rules

|

|

Property on Onekura

Road, Waipapa

|

Owner

|

Any proposed FNDC

capital work in the vicinity or rural plan change. Maybe a link to policy

development.

|

Would not submit.

Rest on a case by case basis.

|

|

Mate Radich

|

No form received

|

|

|

|

|

Kelly Stratford

|

KS Bookkeeping and

Administration

|

Business Owner,

provides book keeping, administration and development of environmental

management plans

|

None perceived

|

Step aside from

decisions that arise, that may have conflicts

|

|

Waikare Marae Trustees

|

Trustee

|

Maybe perceived

conflicts

|

Case by case basis

|

|

Bay of Islands College

|

Parent Elected Trustee

|

None perceived

|

If there was a

conflict, I will step aside from decision making

|

|

Karetu School

|

Parent Elected Trustee

|

None perceived

|

If there was a

conflict, I will step aside from decision making

|

|

Maori title land

– Moerewa and Waikare

|

Beneficiary and husband

is a shareholder

|

None perceived

|

If there was a

conflict, I will step aside from decision making

|

|

Sister is employed by

Far North District Council

|

|

|

Will not discuss

work/governance mattes that are confidential

|

|

Gifts - food and

beverages

|

Residents and

ratepayers may ‘shout’ food and beverage

|

Perceived bias or

predetermination

|

Case by case basis

|

|

Kelly Stratford -

Partner

|

Chef and Barista

|

Opua Store

|

None perceived

|

|

|

Maori title land

– Moerewa

|

Shareholder

|

None perceived

|

If there was a conflict

of interest, I would step aside from decision making

|

|

Moko Tepania

|

Teacher

|

Te Kura Kaupapa

Māori o Kaikohe.

|

Potential Council

funding that will benefit my place of employment.

|

Declare a perceived

conflict

|

|

Chairperson

|

Te Reo o Te Tai Tokerau

Trust.

|

Potential Council

funding for events that this trust runs.

|

Declare a perceived

conflict

|

|

Tribal Member

|

Te Rūnanga o Te

Rarawa

|

As a descendent of Te

Rarawa I could have a perceived conflict of interest in Te Rarawa Council

relations.

|

Declare a perceived

conflict

|

|

Tribal Member

|

Te Rūnanga o

Whaingaroa

|

As a descendent of Te

Rūnanga o Whaingaroa I could have a perceived conflict of interest in Te

Rūnanga o Whaingaroa Council relations.

|

Declare a perceived

conflict

|

|

Tribal Member

|

Kahukuraariki Trust

Board

|

As a descendent of

Kahukuraariki Trust Board I could have a perceived conflict of interest in

Kahukuraariki Trust Board Council relations.

|

Declare a perceived

conflict

|

|

Tribal Member

|

Te Rūnanga

ā-Iwi o Ngāpuhi

|

As a descendent of Te

Rūnanga ā-Iwi o Ngāpuhi I could have a perceived conflict of

interest in Te Rūnanga ā-Iwi o Ngāpuhi Council relations.

|

Declare a perceived conflict

|

2 Apologies

and Declarations of Interest

Members need to

stand aside from decision-making when a conflict arises between their role as a

Member of the Committee and any private or other external interest they might

have. This note is provided as a reminder to Members to review the matters on

the agenda and assess and identify where they may have a pecuniary or other

conflict of interest, or where there may be a perception of a conflict of

interest.

If a Member

feels they do have a conflict of interest, they should publicly declare that at

the start of the meeting or of the relevant item of business and refrain from

participating in the discussion or voting on that item. If a Member thinks they

may have a conflict of interest, they can seek advice from the Chief Executive

Officer or the Team Leader Democracy Support (preferably before the meeting).

It is noted

that while members can seek advice the final decision as to whether a conflict

exists rests with the member.

3 Deputation

No requests for deputations were received at the time of the

Agenda going to print.

4 Confirmation

of Previous Minutes

4.1 Confirmation

of Previous Minutes

File

Number: A2916341

Author: Casey

Gannon, Meetings Administrator

Authoriser: Aisha

Huriwai, Team Leader Democracy Services

Purpose of the Report

The minutes are attached to allow the Committee to confirm

that the minutes are a true and correct record of previous meetings.

|

Recommendation

That the Assurance, Risk and Finance Committee confirms

the minutes of the Assurance, Risk and Finance Committee meeting held 17 June

2020 as a true and correct record.

|

1) Background

Local Government Act 2002 Schedule 7 Section 28 states that

a local authority must keep minutes of its proceedings. The minutes of

these proceedings duly entered and authenticated as prescribed by a local

authority are prima facie evidence of those meetings.

2) Discussion and Options

The minutes of the meetings are attached.

Far North District Council Standing Orders Section 27.3

states that no discussion shall arise on the substance of the minutes in any

succeeding meeting, except as to their correctness.

Reason

for the recommendation

The reason for the recommendation is to confirm the minutes

are a true and correct record of the previous meetings.

3) Financial Implications and Budgetary

Provision

There are no financial implications or the need for

budgetary provision as a result of this report.

Attachments

1. 2020-06-17

Assurance, Risk and Finance Committee Minutes [A2899919] - A2899919 ⇩

Compliance schedule:

Full consideration has been given to the provisions of the

Local Government Act 2002 S77 in relation to decision making, in particular:

1. A

Local authority must, in the course of the decision-making process,

a) Seek

to identify all reasonably practicable options for the achievement of the

objective of a decision; and

b) Assess

the options in terms of their advantages and disadvantages; and

c) If

any of the options identified under paragraph (a) involves a significant

decision in relation to land or a body of water, take into account the

relationship of Māori and their culture and traditions with their

ancestral land, water sites, waahi tapu, valued flora and fauna and other

taonga.

2. This

section is subject to Section 79 - Compliance with procedures in relation to

decisions.

|

Compliance

requirement

|

Staff

assessment

|

|

State the level of significance

(high or low) of the issue or proposal as determined by the Council’s

Significance and Engagement Policy

|

This is a matter of low

significance.

|

|

State the relevant Council

policies (external or internal), legislation, and/or community outcomes (as

stated in the LTP) that relate to this decision.

|

This report complies with the

Local Government Act 2002 Schedule 7 Section 28.

|

|

State whether this issue or

proposal has a District wide relevance and, if not, the ways in which the

appropriate Community Board’s views have been sought.

|

It is the responsibility of each

meeting to confirm their minutes therefore the views of another meeting are

not relevant.

|

|

State the possible implications for Māori

and how Māori have been provided with an opportunity to contribute to

decision making if this decision is significant and relates to land and/or

any body of water.

|

There are no implications for Māori in confirming minutes

from a previous meeting. Any implications on Māori arising from matters

included in meeting minutes should be considered as part of the relevant

report.

|

|

Identify persons likely to be

affected by or have an interest in the matter, and how you have given

consideration to their views or preferences (for example,

youth, the aged and those with disabilities).

|

This report is asking for minutes

to be confirmed as true and correct record, any interests that affect other

people should be considered as part of the individual reports.

|

|

State the financial implications

and where budgetary provisions have been made to support this decision.

|

There are no financial

implications or the need for budgetary provision arising from this report.

|

|

Chief Financial Officer review.

|

The Chief Financial Officer has

not reviewed this report.

|

|

Assurance, Risk and Finance Committee Meeting Agenda

|

29 July 2020

|

MINUTES OF Far North District Council

Assurance, Risk and

Finance Committee Meeting

HELD VIRTUALLY VIA MICROSOFT TEAMS

ON Wednesday, 17 June

2020 AT 1.00

pm

PRESENT: Cr

John Vujcich, Member Bruce Robertson, Mayor John Carter, Cr Kelly Stratford, Cr

Moko Tepania, Member Mike Edmonds

IN

ATTENDANCE: Cr Rachel Smith

1 Karakia

TimatAnga – opening prayer

2 Apologies

and Declarations of Interest

Apologies received from Deputy Mayor Ann Court and a leave

of absence was granted.

3 Deputation

There were no deputations.

4 Confirmation

of Previous Minutes

|

4.1 Confirmation

of Previous Minutes

Agenda

item 4.1 document number A2895497, pages 10 - 15 refers.

|

|

Resolution 2020/1

Moved: Cr John Vujcich

Seconded: Member

Bruce Robertson

That the Assurance, Risk and Finance Committee confirms

the minutes of the Assurance, Risk and Finance Committee meeting held 22 May

2020 as a true and correct record.

Carried

|

5 Reports

|

5.1 NZ

Audit Fraud Questionnaire

Agenda

item 5.1 document number A2889264, pages 16 - 21 refers.

|

|

Resolution 2020/2

Moved: Member Bruce

Robertson

Seconded: Cr

Kelly Stratford

That the Assurance, Risk and Finance Committee approve

the proposed response.

Carried

|

6 Information

Reports

|

6.1 Internal

Audit and Assurance Report

Agenda

item 6.1 document number A2885033, pages 22 - 27 refers.

|

|

Resolution 2020/3

Moved: Cr Kelly

Stratford

Seconded: Mayor

John Carter

That the Assurance,

Risk and Finance Committee receive the report Internal Audit and Assurance

Report.

Carried

|

|

6.2 Risk

Register Update

Agenda

item 6.2 document number a2889879, pages 28 - 35 refers.

|

|

Resolution 2020/4

Moved: Cr Kelly

Stratford

Seconded: Mayor

John Carter

That the Assurance, Risk and Finance Committee receive

the report June 2020 Risk Register Update.

Carried

|

|

6.5 Council

Financial Report for the Period Ending 31 May 2020

Agenda

item 6.5 document number A2896330, pages 57 - 84 refers.

|

|

Resolution 2020/7

Moved: Cr John Vujcich

Seconded: Cr

Kelly Stratford

That the Assurance, Risk and Finance Committee receive

the report Council Financial Report for the Period Ending 31 May 2020.

In

Favour: Crs John Vujcich, John

Carter, Bruce Robertson, Kelly Stratford, Moko Tepania and Mike Edmonds

Against: Nil

Carried

|

7 Public

Excluded

|

ResOlUtion

to permit COUNCILLOR Smith into public excluded

|

|

Resolution 2020/8

Moved: Cr John Vujcich

Seconded: Cr

Kelly Stratford

That the Assurance, Risk and Finance Committee agree

that Councillor Smith be permitted to remain in the meeting with the public

excluded. Matters of Assurance, Risk and Finance encompass multiple

deliverables throughout the organisation, and as a Councillor, specific

knowledge can assist in the discussion related to strategic direction.

Carried

|

RESOLUTION TO

EXCLUDE THE PUBLIC

|

Resolution 2020/9

Moved: Cr John Vujcich

Seconded: Member

Bruce Robertson

That the public be excluded from the following parts of

the proceedings of this meeting.

The general subject matter of each matter to be

considered while the public is excluded, the reason for passing this

resolution in relation to each matter, and the specific grounds under section

48 of the Local Government Official Information and Meetings Act 1987 for the

passing of this resolution are as follows:

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Ground(s) under section 48 for the

passing of this resolution

|

|

7.1 - Confirmation of Previous Minutes

|

s7(2)(h) - the withholding of the information is

necessary to enable Council to carry out, without prejudice or

disadvantage, commercial activities

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

7.2 - Far North Holdings Limited

Reappointment of Director

|

s7(2)(a) - the withholding of the information is

necessary to protect the privacy of natural persons, including that of

deceased natural persons

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

In

Favour: Crs John Vujcich, John

Carter, Bruce Robertson, Kelly Stratford, Moko Tepania and Mike Edmonds

Against: Nil

Carried

|

|

Resolution 2020/10

Moved: Cr John Vujcich

Seconded: Cr

Kelly Stratford

That Council moves out of Closed Council into Open

Council.

Carried

|

8 karakia

whakamutunga – closing prayer

9 Meeting

Close

The meeting closed at 3:00 pm.

The minutes of this meeting were confirmed at the Assurance, Risk and Finance Committee Meeting held on 29 July 2020.

...................................................

CHAIRPERSON

5 Reports

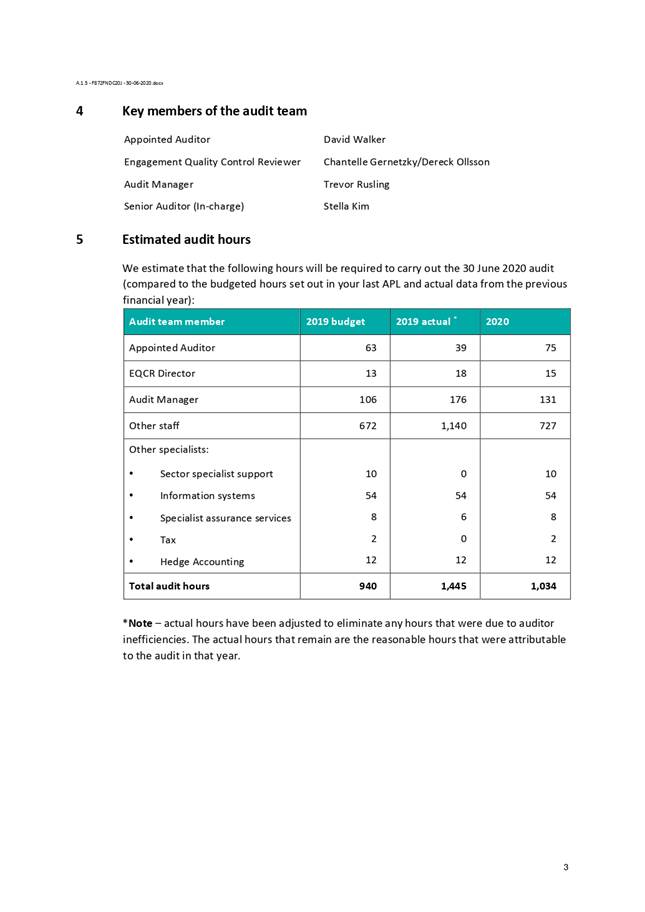

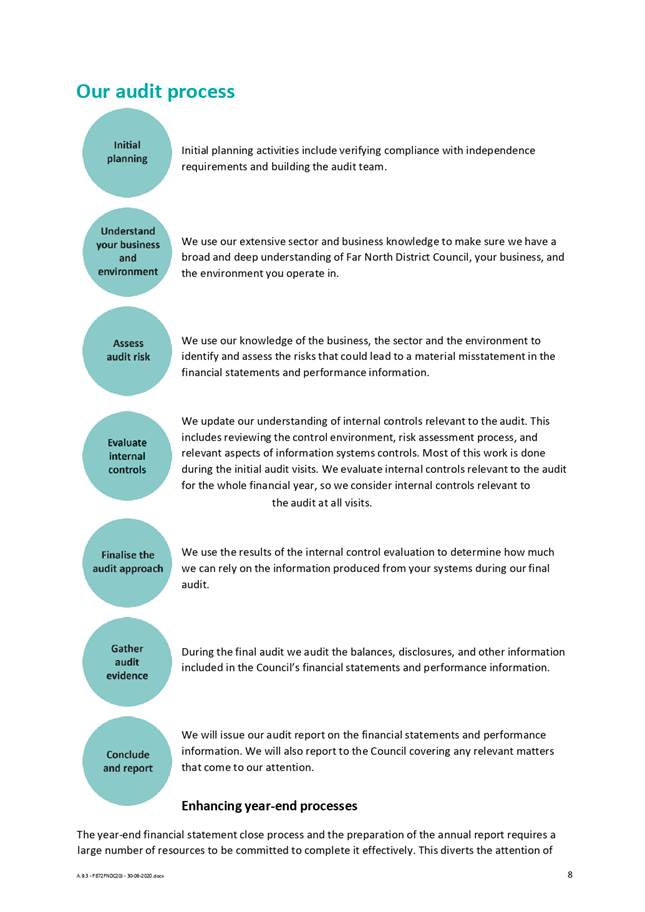

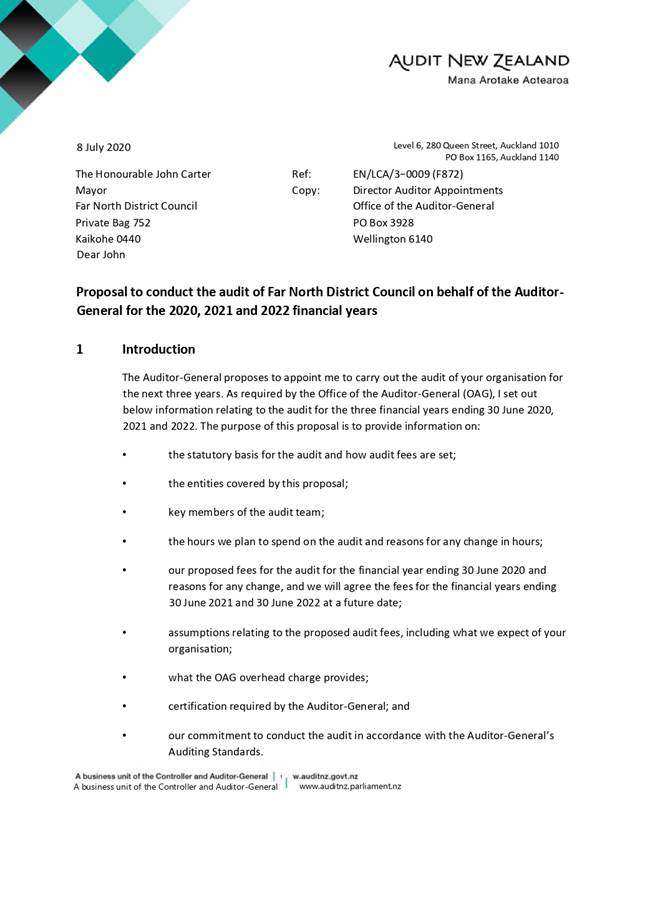

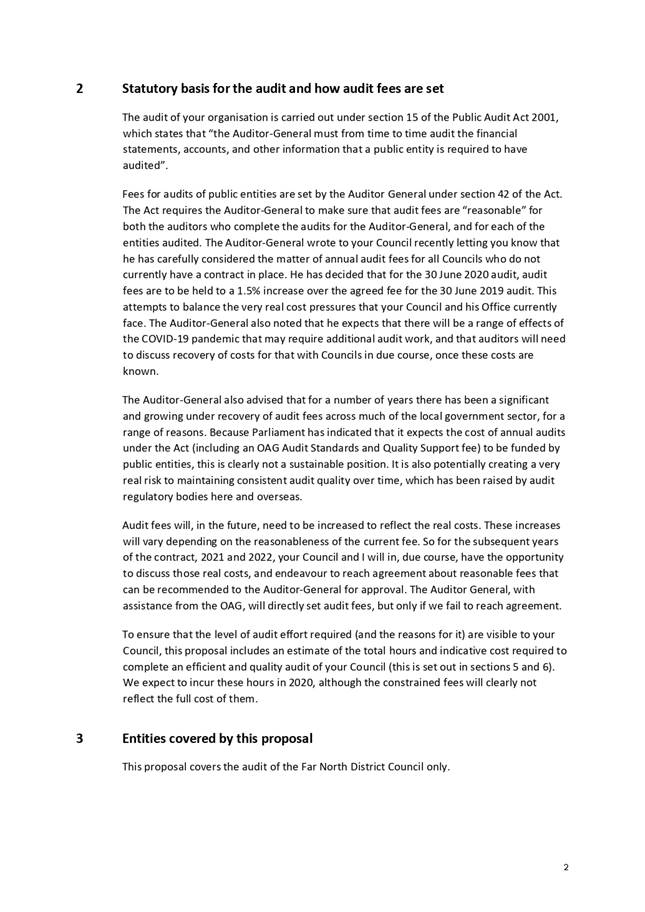

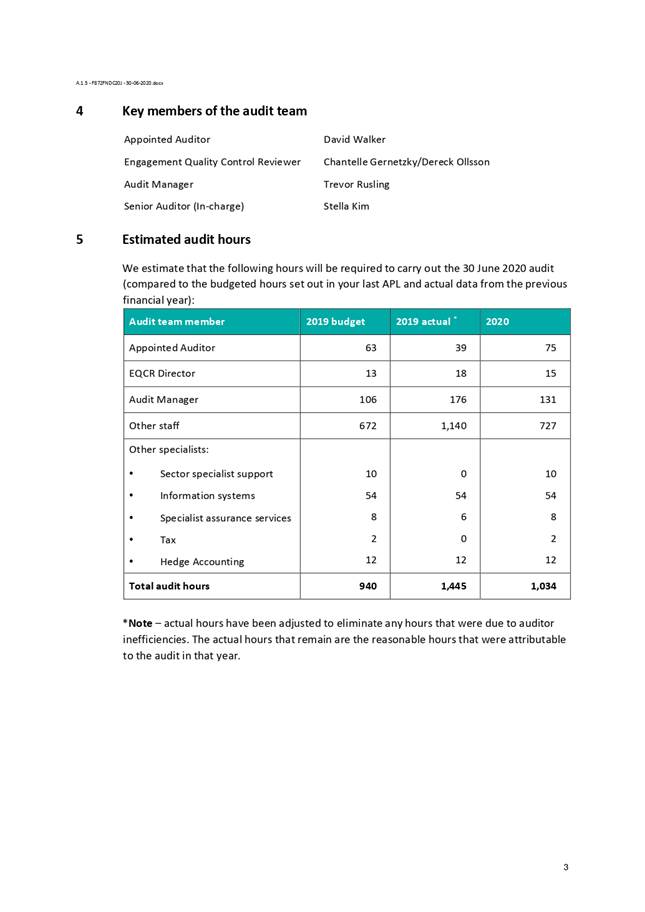

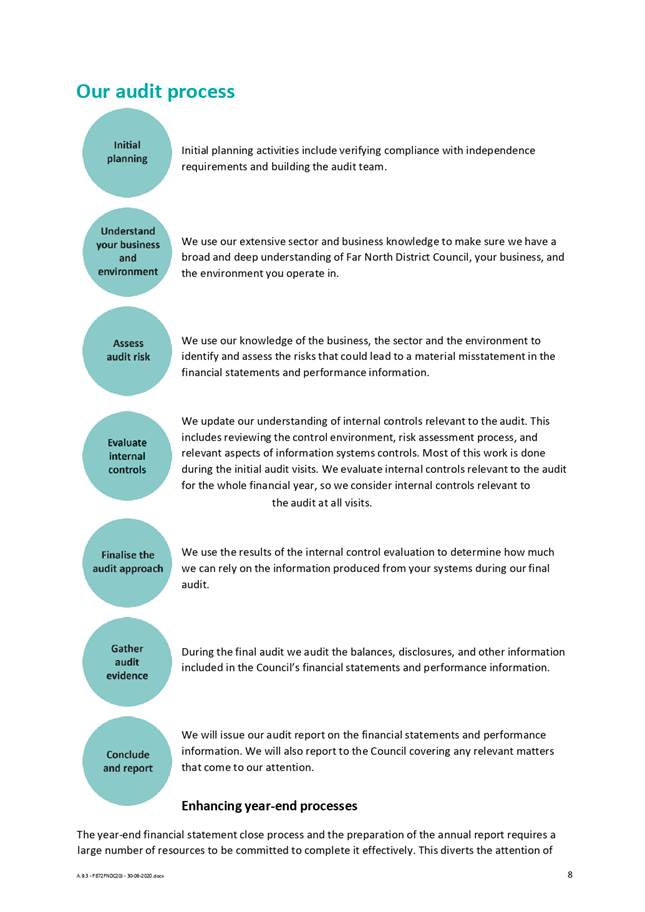

5.1 Audit

New Zealand documentation for the year ended 30 June 2020

File

Number: A2919893

Author: Janice

Smith, Chief Financial Officer

Authoriser: William

J Taylor MBE, General Manager - Corporate Services

Purpose of the Report

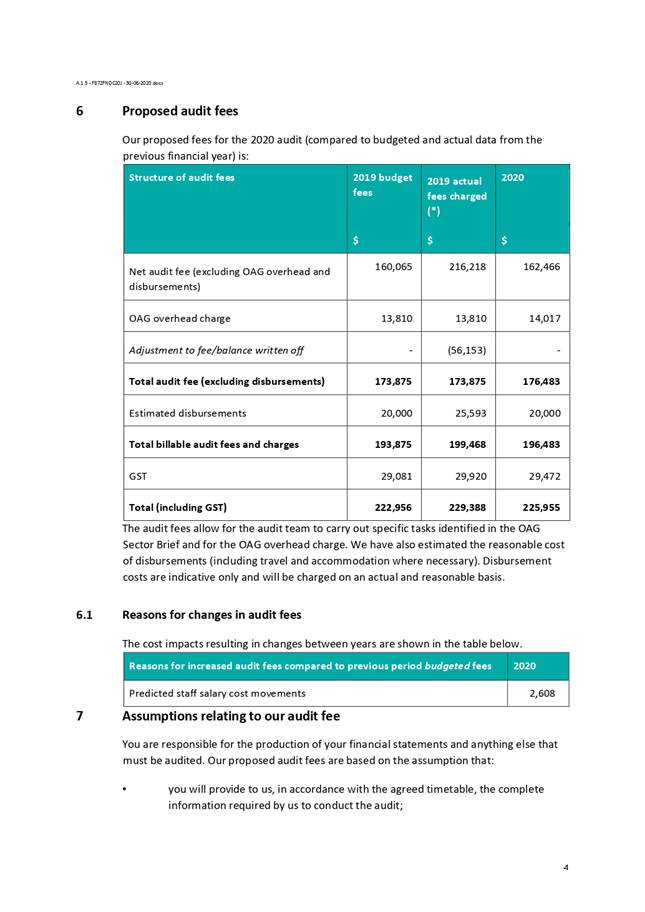

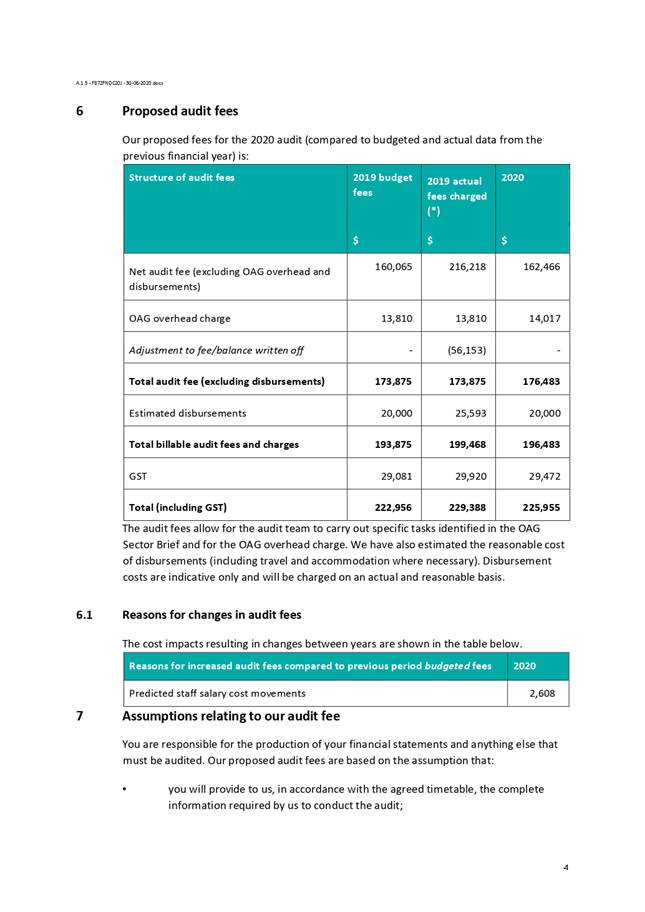

This

report presents the draft external audit proposal, plan and engagement letter

from Audit NZ. The Audit proposal includes fees for 2019/20 audit.

Executive Summary

· Far North District Council is required to be audited by the auditor

appointed by the Office of the Auditor General, which for Far North District

Council is Audit NZ.

|

Recommendation

That the Assurance, Risk and Finance Committee:

a) receive

the audit documents:

i) Audit

Engagement Letter for the year ended 30 June 2020;

ii) Audit

Proposal Letter for the June 2020, 2021 and 2022 financial years;

iii) Audit

Plan for the year ended 30 June 2020; and

iv) Confirmation

of Engagement – Limited Assurance Report in respect of FNDC’s

Debenture Trust Deed.

b) approve

the CEO and Mayor signing the documents on behalf of Council as appropriate.

|

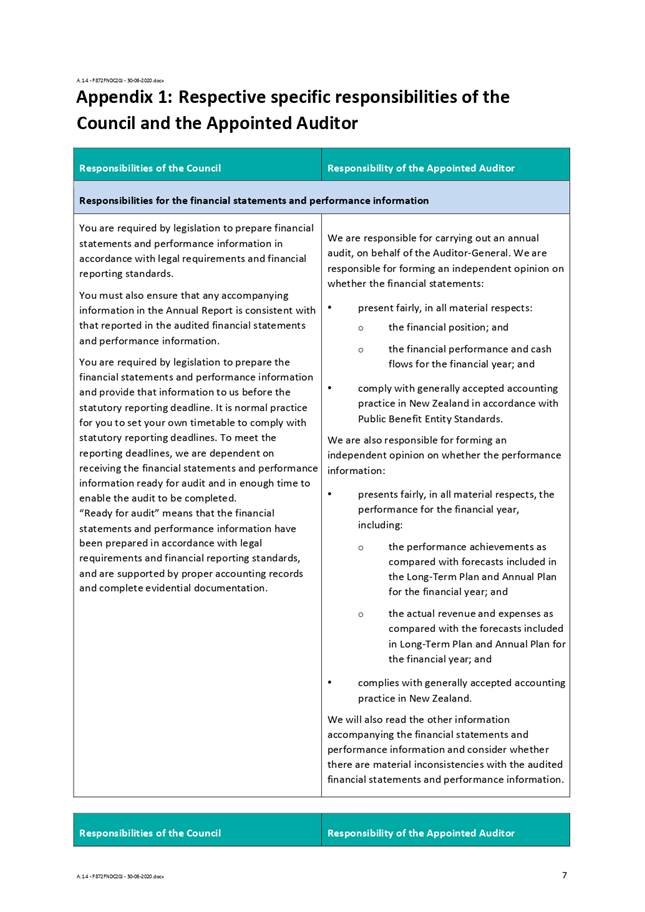

1) Background

Far North District Council, in compliance with the Local

Government Act 2002, prepares an Annual Report at the end of each financial

year. This is required to be audited by the appointed Auditor, which for

Far North District Council is Audit NZ. The schedule of dates agreed with Audit

NZ for the financial year 2019/2020, are as follows:

o Interim

Audit 1 – 6 April to 10 April 2020

o Interim

Audit 2 – 4 May 2019 to 8 May 2020

o Pre

final Audit – 22 June 2019 to 26 June 2020

o Final

Audit – the two weeks commencing 31 August 2020

Adoption of the Annual

Report is anticipated to be at the 29 October 2020 Council meeting.

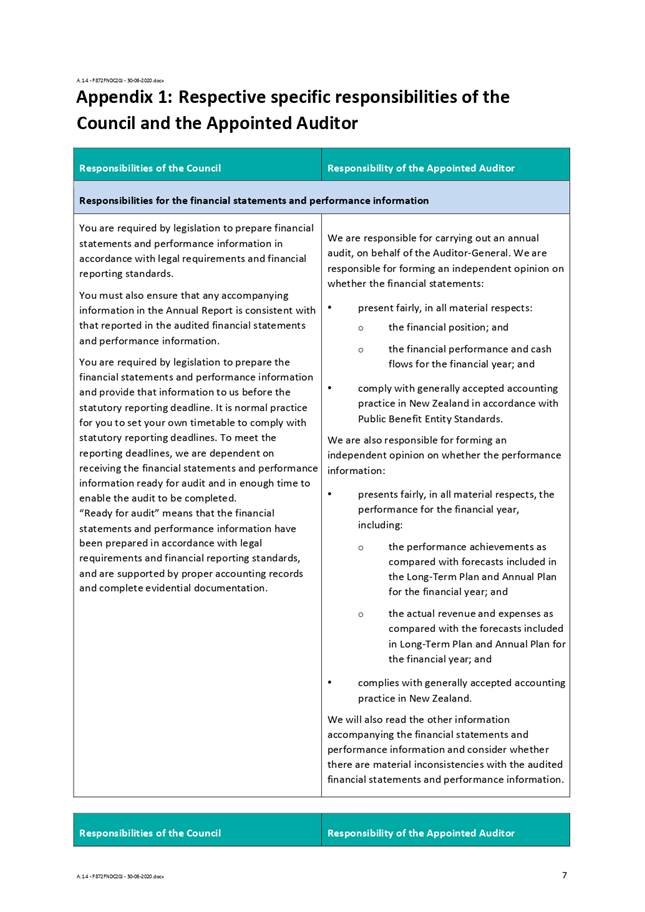

2) Discussion and Options

Attached to this report are the proposed audit plan, the

audit proposal letter for the financial years 2019/20, 2020/21 and 2021/22, the

audit engagement letter and the confirmation of engagement for the limited

independent assurance report for the Council’s debenture trust deed.

The relevant legislation in relation to this issue is as

follows:

a) Local Government Act

2002, Part 6, Section 98, Subpart 2 which requires Local Authorities to prepare

and adopt an Annual Report in respect of each financial year; and

b) Local Government Act

2002, Part 6, Section 99, which requires the Annual report to include the

Auditors Report outlining the authority’s compliance with Schedule 10 of

the Local Government Act 2002.

It

is recommended that the audit plan, the audit proposal, audit engagement

letters and the independent assurance letter for the debenture trust deed be

received and that the CEO and Mayor be authorised to sign on behalf of Council

as appropriate.

Reason

for the recommendation

To make the Committee aware of the documentation required to

formalise the audit processes for the financial year ended 30 June 2020.

3) Financial Implications and Budgetary

Provision

There are no specific financial implications other than the

fees proposed. These are budgeted and included in the Annual Plan each year.

Attachments

1. FNDC 2020-22

Audit Proposal Letter - one year fee - A2918796 ⇩

2. FNDC 2020-22

Audit Engagement Letter - A2918829 ⇩

3. FNDC 20J Audit

Plan - A2918819 ⇩

4. FNDC Tri-partite

engagement letter - Debenture Trust Deed - A2919890 ⇩

Compliance schedule:

Full consideration has been given to the provisions of the Local

Government Act 2002 S77 in relation to decision making, in particular:

1. A

Local authority must, in the course of the decision-making process,

a) Seek

to identify all reasonably practicable options for the achievement of the

objective of a decision; and

b) Assess

the options in terms of their advantages and disadvantages; and

c) If

any of the options identified under paragraph (a) involves a significant

decision in relation to land or a body of water, take into account the

relationship of Māori and their culture and traditions with their

ancestral land, water sites, waahi tapu, valued flora and fauna and other

taonga.

2. This

section is subject to Section 79 - Compliance with procedures in relation to

decisions.

|

Compliance

requirement

|

Staff

assessment

|

|

State the level of significance

(high or low) of the issue or proposal as determined by the Council’s

Significance and Engagement Policy

|

N/A

|

|

State the relevant Council policies

(external or internal), legislation, and/or community outcomes (as stated in

the LTP) that relate to this decision.

|

Local Government Act Part 6, Sub

Part 2, s98 and s99

|

|

State whether this issue or

proposal has a District wide relevance and, if not, the ways in which the

appropriate Community Board’s views have been sought.

|

District Wide

|

|

State the possible implications for Māori

and how Māori have been provided with an opportunity to contribute to

decision making if this decision is significant and relates to land and/or

any body of water.

|

N/A

|

|

Identify persons likely to be

affected by or have an interest in the matter, and how you have given

consideration to their views or preferences (for example – youth, the

aged and those with disabilities.

|

N/A

|

|

State the financial implications

and where budgetary provisions have been made to support this decision.

|

Audit fees are budgeted for

annually

|

|

Chief Financial Officer review.

|

The Chief Financial Officer

prepared this report

|

|

Assurance, Risk and Finance Committee Meeting Agenda

|

29 July 2020

|

|

Assurance, Risk and

Finance Committee Meeting Agenda

|

29 July 2020

|

|

Assurance, Risk and

Finance Committee Meeting Agenda

|

29 July 2020

|

|

Assurance, Risk and

Finance Committee Meeting Agenda

|

29 July 2020

|

6 Information

Reports

6.1 July

Risk Management

File

Number: A2906078

Author: Tanya

Reid, Business Improvement Specialist - Corporate Services

Authoriser: William

J Taylor MBE, General Manager - Corporate Services

Purpose of the Report

To provide scheduled risk progress reports for the organisation’s

top risks and group risk.

No decision

required.

Executive Summary

Risk progress updates are provided for four of the top organisational

risks.

Progress on

group risk continues.

|

Recommendation

That the Assurance, Risk and Finance Committee receive

the report July Risk Management.

|

Background

The Transformation and Assurance team has facilitated the development of

treatment plans for the organisation’s top risks. We are now in the phase

where regular reporting of the organisation’s top risks, and treatment

plans, are in place.

A programme of deep dive workshops is planned for these risks. The first

of two deep dive workshops for ARF005 Affordability risk has been completed,

with the second workshop to be scheduled.

The Transformation and Assurance team continues to work with the

organisation to refresh and establish group risk registers, with treatment

plans, and regular reviews.

Discussion and Next Steps

Four risk progress reports, with treatment plans, are provided with

highlights and analysis of risk trend below. More detail is available in the

attached risk progress reports.

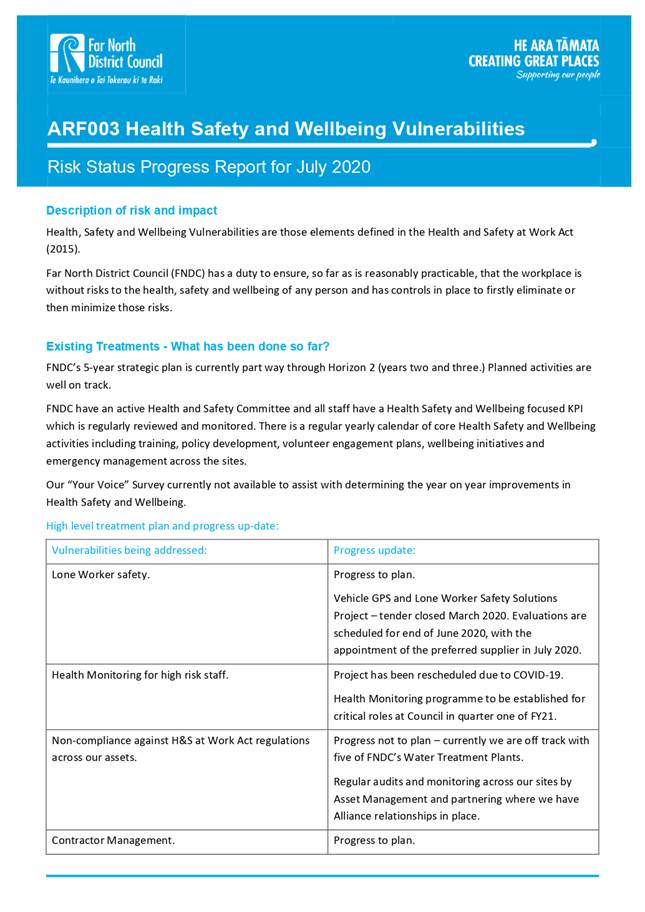

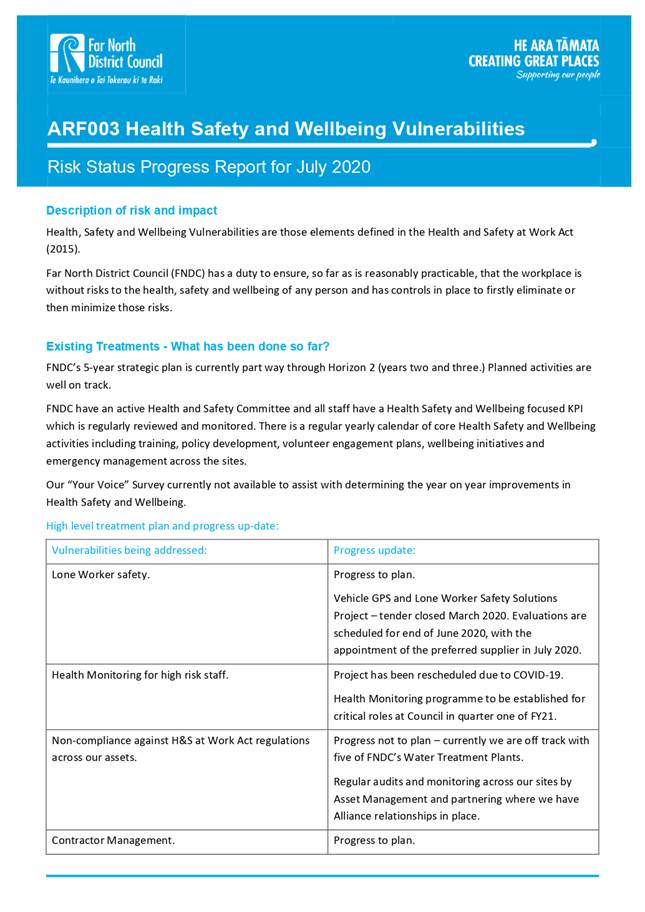

The risk trend for ARF003 Health Safety and

Wellbeing Vulnerabilities Risk has been assessed as neutral. The 5-year strategic plan is currently part way through Horizon 2 (years

two and three) with planned activities started. Environmental conditions have

impacted our planned response to this risk with delays on Vehicle GPS and Lone

Worker Safety Solutions Project, as well as Health Monitoring Programme.

Increased distributed working (including increased number and frequency of

“working from home”) will test our risk treatments. Monitoring

these impacts will occur during the pilot of Creating and Enabling Great

Workplaces.

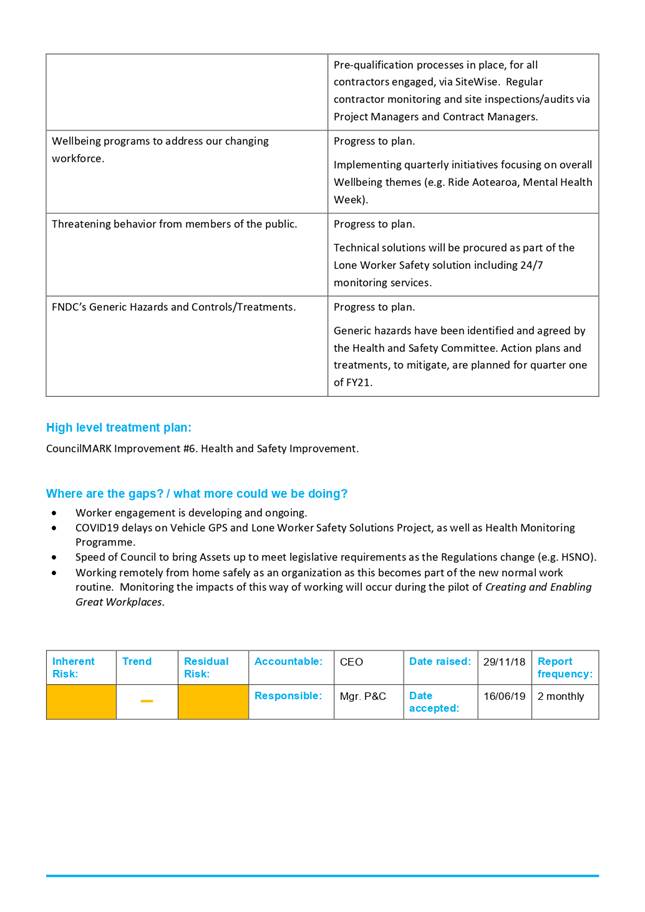

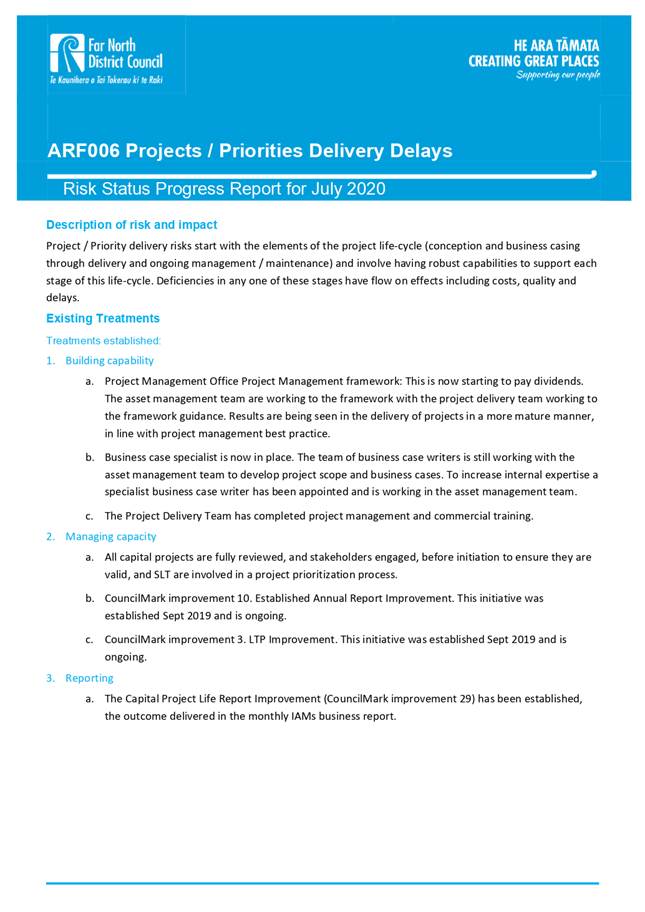

The risk trend for ARF006 Projects Priorities

Delivery Delays Risk has been assessed as neutral with several treatments now

established. Project resourcing will continue to be a challenge with an

expected increase in projects to be delivered as we successfully bid for new

channels of government funding for projects. A treatment to manage the

impact of this expected increase in projects has been proposed to SLT.

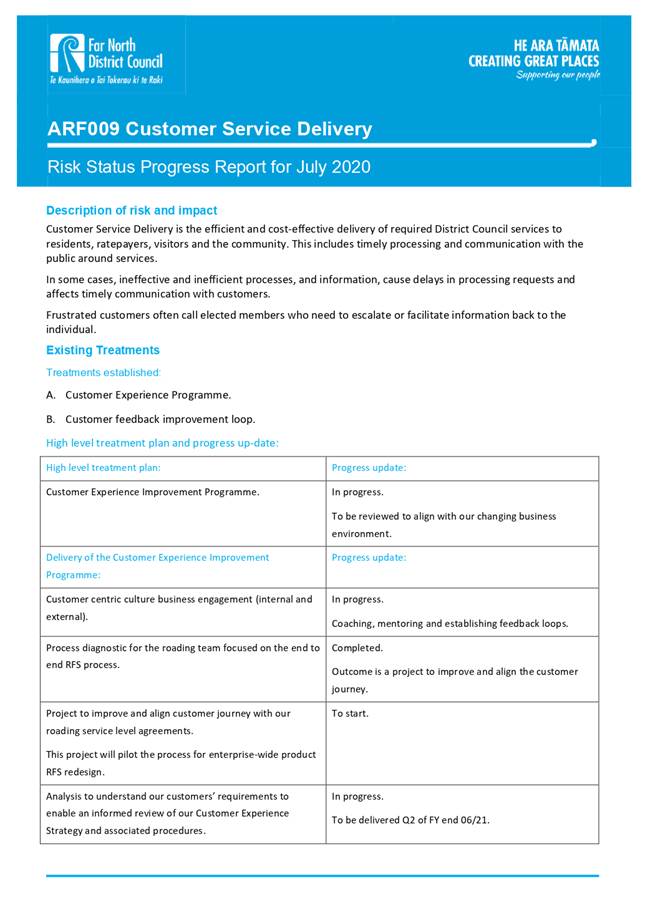

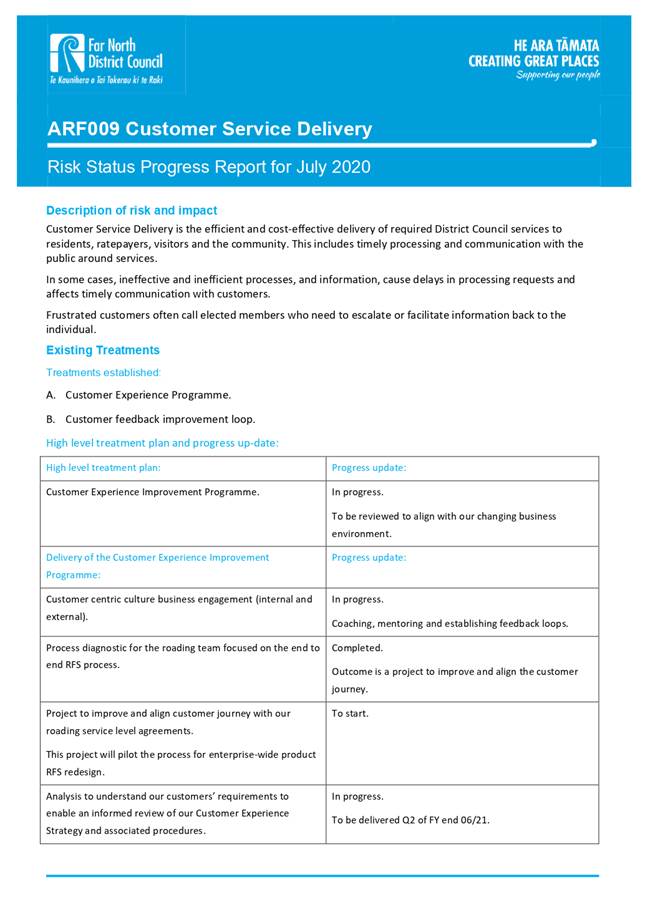

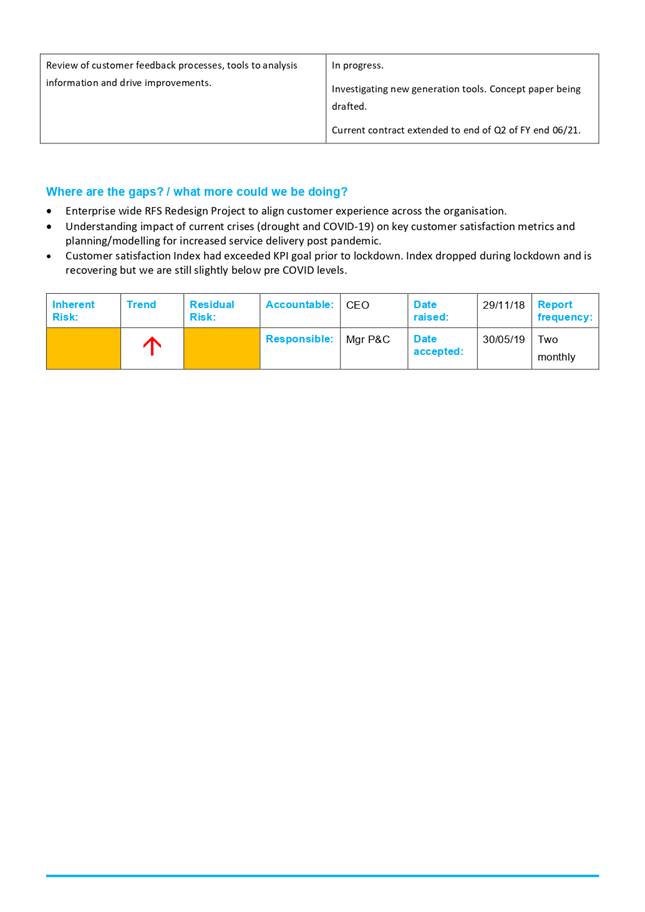

The risk trend for ARF009 Customer Service

Delivery Risk remains high (increasing risk). This is because of the negative

impact of the dual drought and COVID-19 crises on key customer satisfaction

metrics. However, there have been some excellent customer success stories over

the lockdown period, such the implementation of the COVID-19 Rates Relief

policy, which moved the rates team score from 60 (April 20) to 83 in May (a 38% increase).

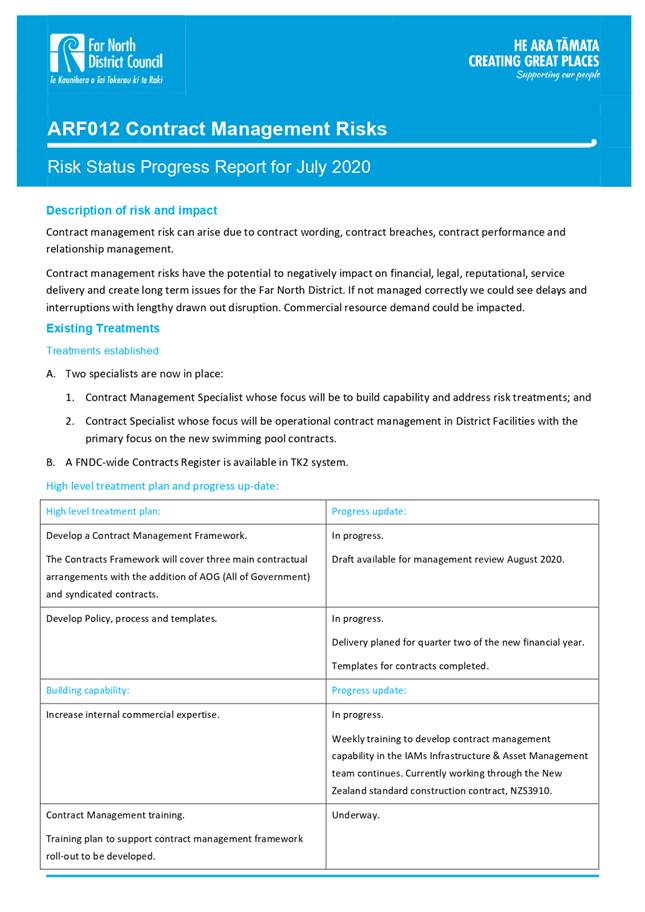

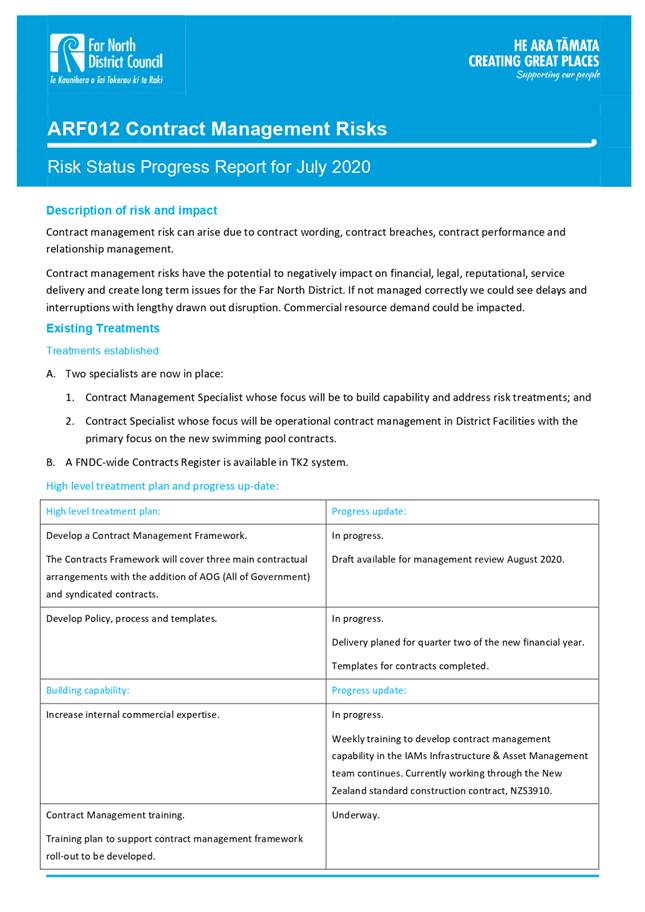

The risk trend for ARF012 Contract Management

Risk has been assessed as neutral, an improvement from the last report when the

impact of the COVID-19 pandemic could have resulted in disruption

to supply chains and work. This situation remains a watching brief. Treatments

have been established, with two specialists appointed and an FNDC-wide contract

register in place, with additional identified treatments in progress.

Re-evaluation of risk

The six-monthly risk progress report will be

provided in September for the ARF013 Potable Water Resilience Risk as approved

by Council on 7 May 2020.

We have requested scheduling of an elected member workshop to review the

Top Organizational Risk Dashboard using our bespoke IDEATE methodology.

Group Risk

The Transformation and Assurance team continues to work through the

organisation to establish and maintain Group Risk Registers. These registers

will be used to inform the elected member Top Organizational Risk Dashboard

workshop where there is proposed escalation and de-escalation of risk.

Financial Implications and Budgetary Provision

At this

stage no additional budgetary provision has been identified for the treatment

plans.

Attachments

1. FINAL 2020 07

ARF003 Health Safety and Wellbeing Vulnerabilities Risk Progress Report -

A2917474 ⇩

2. FINAL 2020 07

ARF006 Projects Priorities Delivery Delays Risk Progress Report - A2917494 ⇩

3. FINAL 2020 07

ARF009 Customer Service Delivery Risk Progress Report - A2917504 ⇩

4. FINAL 2020 07

ARF012 Contract Management Risk Progress Report - A2917512 ⇩

|

Assurance, Risk and Finance Committee Meeting Agenda

|

29 July 2020

|

|

Assurance, Risk and

Finance Committee Meeting Agenda

|

29 July 2020

|

|

Assurance, Risk and

Finance Committee Meeting Agenda

|

29 July 2020

|

|

Assurance, Risk and

Finance Committee Meeting Agenda

|

29 July 2020

|

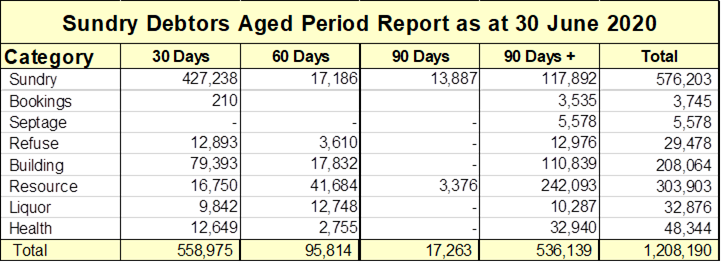

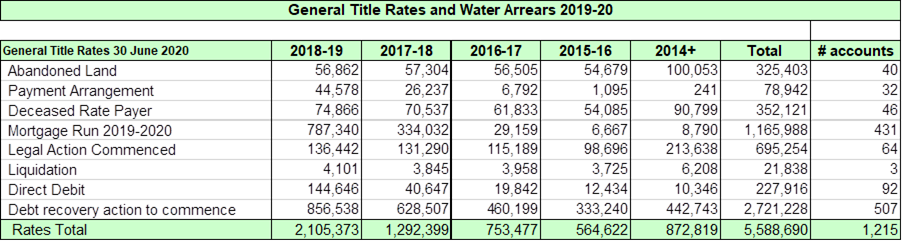

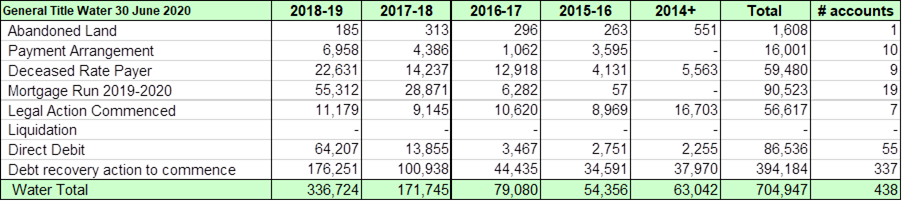

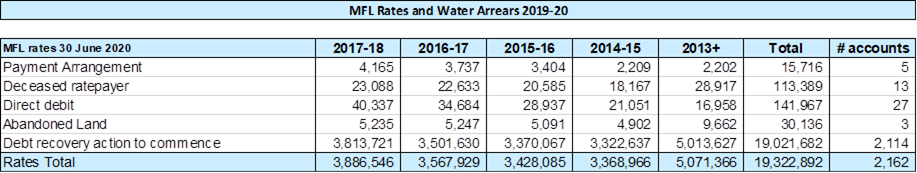

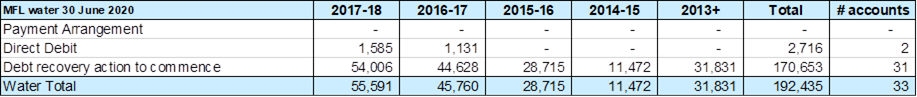

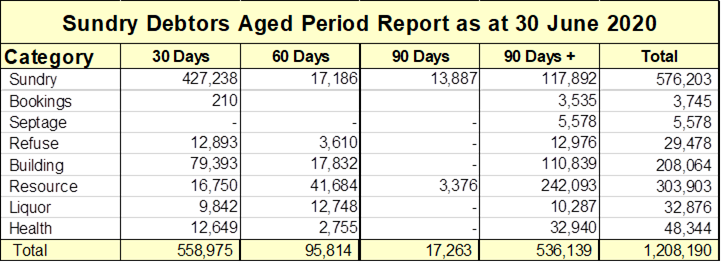

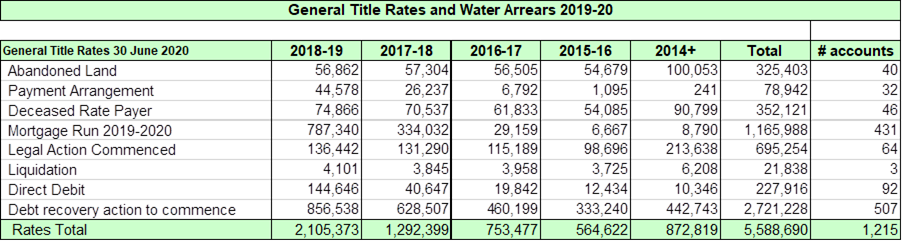

6.2 Revenue

Recovery Report

File

Number: A2913984

Author: Margriet

Veenstra, Manager - Transaction Services

Authoriser: William

J Taylor MBE, General Manager - Corporate Services

Purpose of the Report

The purpose of this

report is to provide quarterly reporting to the Far North District Council

Assurance, Risk, and Finance Committee.

Executive Summary

This is the fourth report for the financial year 2019/20 and

provides information on action taken to collect the current and arrears

balances for rates, water and Sundry Debt so far this year, and to provide

information on how collection is tracking against targets

|

Recommendation

That the Assurance, Risk and Finance Committee receive

the report “Revenue Recovery Report”.

|

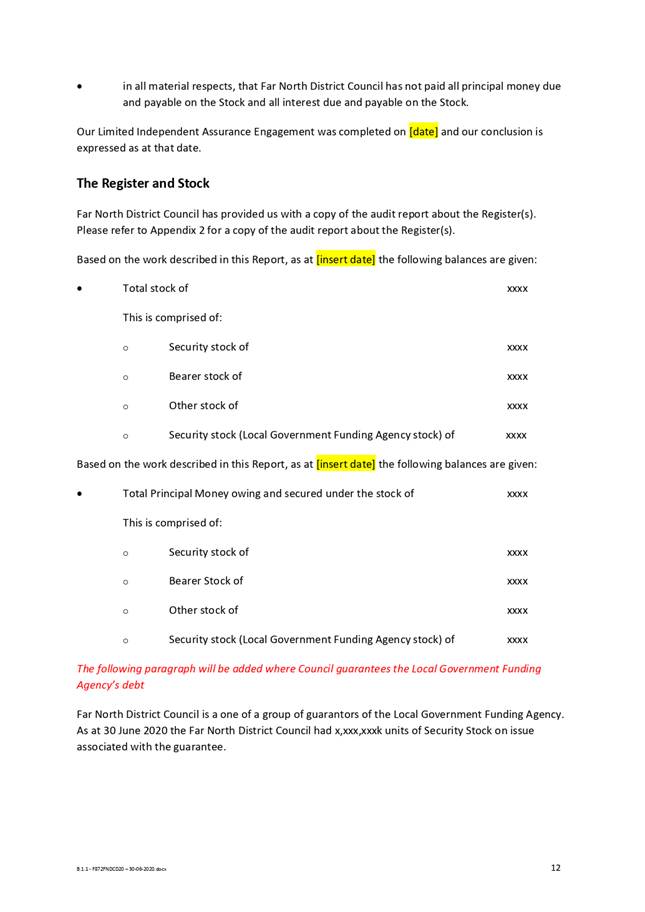

1) Background

This document has been prepared to outline current and

arrears balances for rates, water and sundry debt as at 30 June 2020 and the

actions taken by the Debt Management Team for the collection of the General

Title rates and water and Sundry Debt.

This

information is part of the standing items reported to the Committee on a

regular basis.

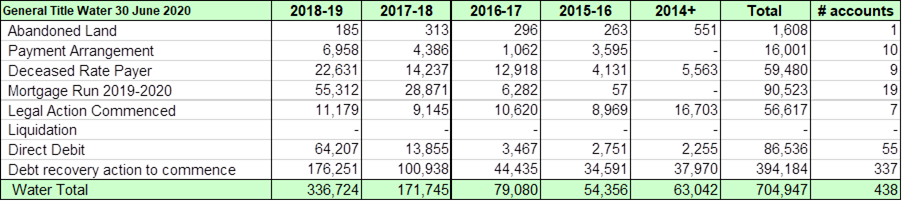

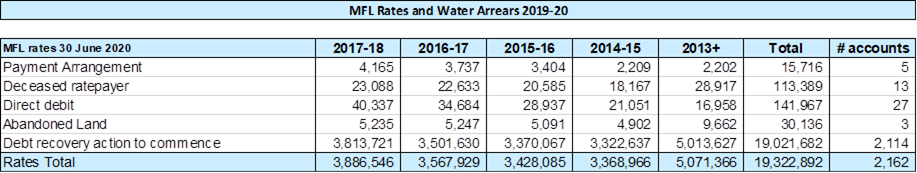

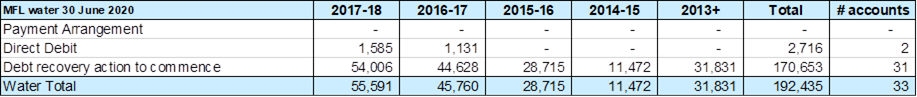

2) Discussion and Options

The

information has been identified for General Title and Maori Freehold Land rates

and water accounts. Sundry debtors, which is another revenue stream for

council, is shown in a separate table.

The total

arrears balance for General Title rates has been reduced by 34% since 31 July

2019 and water by 46%. Maori Freehold Land rates was reduced by 1% since 31

July 2019 and water by 9%.

Due to

the water crisis and subsequent Covid-19, focus changed for Debt Management

from active recovery of arrears, to monitor, contain and support during the

last four months of the rating year.

Four key

actions and focus areas for the first half of the rating year have been placed

on hold during the past four months.

· Legal action for rates and water arrears with an external

Law Firm.

· Policy for approval by Council of next actions post default

judgment from the courts.

· Council Legal team to commence legal proceedings for 10

accounts.

· Final Mortgage demand for rates and water for General Title

properties.

Debt

Management focused on the following actions:

· Contact rate payers who have requested Crisis Rating relief

and offer a suitable payment plan.

o A total of 284 Crisis Rating Relief RFS’s were

raised.

o All rate payers have been contacted and accounts with

agreed payment plans are being monitored.

o Requests for rating relief continue to be received, 20

since NZ moved to Alert Level 1 on the 8th of June.

· Contact rate payers who have recently cancelled or

dishonoured their direct debit.

· Contact owners, where possible, where mortgage demand was

issued and offer a payment arrangement to avoid final mortgage demand in the new

rating year.

· Contact business owners and others who would benefit from

Council’s rating relief resolution to offer support.

· Contact all rate payers who missed the 4th

Instalment only and incurred penalties. Set up payment plans and remit

penalties where payment was made, or plans set up.

For the total number of General

Title rates and water accounts marked as ‘Debt recovery action to

commence’:

· These are properties where there is no mortgage, no

payments have been made this current year and the owner has not contacted

council to discuss payment options.

· 46% of these accounts have arrears of more than 2 rating

years.

o 50% of these accounts have received final demand letters

from Council

o At the start of the new rating year, FNDC Legal Team will

register the debt against these properties and commence filing for debt

recovery through the courts.

o Debt Management will commence sending final demand letters

to the remaining 50%.

· 54% is for accounts with up to two years rates arrears.

o Debt Management to commence pro-active calling and sending

letters to customers to make contact.

o If no contact is made and no payment is received, final

demand letters will be sent.

There have not been any new

communications with the Te Hono team about payment of rates for Maori Freehold

Land as a result of their relations and development initiatives.

The total Sundry Debtors 60+ days

balance has been reduced by 47% since 30 June 2019. The Debtors ledger was

split alphabetically between Debt Management Officers at the start of the

rating year, with each team member focussing on aged debt. Although the focus

for the past 4 months has been on rates and water, the team have recommenced

debt collection since the start of this rating year.

3) Financial Implications and Budgetary

Provision

Provision is made annually for doubtful debts in relation

to the arrears owed to council. A higher provision for Maori Freehold land

rates and water is made in comparison to General Title rates and water due to

the difference in collection options available to Council.

Attachments

1. 29-07-2020 ARF

Revenue recovery Report attachment - A2913988 ⇩

|

Assurance, Risk and Finance Committee Meeting Agenda

|

29 July 2020

|

General

Title rates and water rates analysis by age at 30 June 2020.

Maori Freehold Land rates and water

analysis by age at 30 June 2020.

Sundry Debtors by age for 30 June 2020.