Te

Kaunihera o Tai Tokerau ki te Raki

AGENDA

Assurance, Risk and Finance Committee Meeting

Wednesday, 17 June 2020

|

Time:

|

1.00 pm

|

|

Location:

|

Virtually via Microsoft Teams

|

Membership:

Cr John

Vujcich - Chairperson

Member Bruce

Robertson – Deputy Chairperson

Mayor John

Carter

Deputy Mayor

Ann Court

Member Mike

Edmonds

Cr Mate

Radich

Cr Kelly

Stratford

Cr Moko

Tepania

|

Assurance, Risk and Finance

Committee Meeting Agenda

|

17 June 2020

|

ASSURANCE, RISK

AND FINANCE COMMITTEE - MEMBERS REGISTER OF INTERESTS

|

Name

|

Responsibility (i.e. Chairperson

etc)

|

Declaration of

Interests

|

Nature of Potential

Interest

|

Member's Proposed

Management Plan

|

|

Hon John Carter QSO

|

Board Member of the

Local Government Protection Programme

|

Board Member of the

Local Government Protection Program

|

|

|

|

Carter Family Trust

|

|

|

|

|

John Vujcich (Chair)

|

Board Member

|

Pioneer Village

|

Matters relating to

funding and assets

|

Declare interest and

abstain

|

|

Director

|

Waitukupata Forest Ltd

|

Potential for council

activity to directly affect its assets

|

Declare interest and

abstain

|

|

Director

|

Rural Service Solutions

Ltd

|

Matters where council

regulatory function impact of company services

|

Declare interest and

abstain

|

|

Director

|

Kaikohe (Rau Marama)

Community Trust

|

Potential funder

|

Declare interest and abstain

|

|

Partner

|

MJ & EMJ Vujcich

|

Matters where council

regulatory function impacts on partnership owned assets

|

Declare interest and

abstain

|

|

Member

|

Kaikohe Rotary Club

|

Potential funder, or

impact on Rotary projects

|

Declare interest and

abstain

|

|

Member

|

New Zealand Institute

of Directors

|

Potential provider of

training to Council

|

Declare a Conflict of

Interest

|

|

Member

|

Institute of IT

Professionals

|

Unlikely, but possible

provider of services to Council

|

Declare a Conflict of

Interest

|

|

Member

|

Kaikohe Business

Association

|

Possible funding

provider

|

Declare a Conflict of

Interest

|

|

Bruce Robertson

(Deputy)

|

No Form Received

|

|

|

|

|

Deputy Mayor Ann

Court

|

Waipapa Business

Association

|

Member

|

|

Case by case

|

|

Warren Pattinson

Limited

|

Shareholder

|

Building company. FNDC

is a regulator and enforcer

|

Case by case

|

|

Kerikeri Irrigation

|

Supplies my water

|

|

No

|

|

Top Energy

|

Supplies my power

|

|

No other interest

greater than the publics

|

|

District Licensing

|

N/A

|

N/A

|

N/A

|

|

Top Energy Consumer

Trust

|

Trustee

|

Crossover in regulatory

functions, consenting economic development and contracts such as street

lighting.

|

Declare interest and

abstain from voting.

|

|

Ann Court Trust

|

Private

|

Private

|

N/A

|

|

Waipapa Rotary

|

Honorary member

|

Potential community

funding submitter

|

Declare interest and

abstain from voting.

|

|

Properties on Onekura

Road, Waipapa

|

Owner Shareholder

|

Any proposed FNDC

Capital works or policy change which may have a direct impact (positive/adverse)

|

Declare interest and

abstain from voting.

|

|

Property on Daroux Dr,

Waipapa

|

Financial interest

|

Any proposed FNDC

Capital works or policy change which may have a direct impact (positive/adverse)

|

Declare interest and

abstain from voting.

|

|

Flowers and gifts

|

Ratepayer 'Thankyou'

|

Bias/ Pre-determination?

|

Declare to Governance

|

|

Coffee and food

|

Ratepayers sometimes

'shout' food and beverage

|

Bias or

pre-determination

|

Case by case

|

|

Staff

|

N/A

|

Suggestion of not being

impartial or pre-determined!

|

Be professional, due

diligence, weigh the evidence. Be thorough, thoughtful, considered impartial

and balanced. Be fair.

|

|

Warren Pattinson

|

My husband is a builder

and may do work for Council staff

|

|

Case by case

|

|

Ann Court - Partner

|

Warren Pattinson

Limited

|

Director

|

Building Company. FNDC

is a regulator

|

Remain at arm’s

length

|

|

Air NZ

|

Shareholder

|

None

|

None

|

|

Warren Pattinson

Limited

|

Builder

|

FNDC is the consent

authority, regulator and enforcer.

|

Apply arm’s

length rules

|

|

Property on Onekura

Road, Waipapa

|

Owner

|

Any proposed FNDC

capital work in the vicinity or rural plan change. Maybe a link to policy

development.

|

Would not submit.

Rest on a case by case basis.

|

|

Mate Radich

|

No form received

|

|

|

|

|

Kelly Stratford

|

KS Bookkeeping and

Administration

|

Business Owner,

provides book keeping, administration and development of environmental

management plans

|

None perceived

|

Step aside from

decisions that arise, that may have conflicts

|

|

Waikare Marae Trustees

|

Trustee

|

Maybe perceived

conflicts

|

Case by case basis

|

|

Bay of Islands College

|

Parent Elected Trustee

|

None perceived

|

If there was a

conflict, I will step aside from decision making

|

|

Karetu School

|

Parent Elected Trustee

|

None perceived

|

If there was a

conflict, I will step aside from decision making

|

|

Maori title land

– Moerewa and Waikare

|

Beneficiary and husband

is a shareholder

|

None perceived

|

If there was a

conflict, I will step aside from decision making

|

|

Sister is employed by

Far North District Council

|

|

|

Will not discuss

work/governance mattes that are confidential

|

|

Gifts - food and

beverages

|

Residents and

ratepayers may ‘shout’ food and beverage

|

Perceived bias or

predetermination

|

Case by case basis

|

|

Kelly Stratford -

Partner

|

Chef and Barista

|

Opua Store

|

None perceived

|

|

|

Maori title land

– Moerewa

|

Shareholder

|

None perceived

|

If there was a conflict

of interest, I would step aside from decision making

|

|

Moko Tepania

|

Teacher

|

Te Kura Kaupapa

Māori o Kaikohe.

|

Potential Council

funding that will benefit my place of employment.

|

Declare a perceived

conflict

|

|

Chairperson

|

Te Reo o Te Tai Tokerau

Trust.

|

Potential Council

funding for events that this trust runs.

|

Declare a perceived

conflict

|

|

Tribal Member

|

Te Rūnanga o Te

Rarawa

|

As a descendent of Te

Rarawa I could have a perceived conflict of interest in Te Rarawa Council

relations.

|

Declare a perceived

conflict

|

|

Tribal Member

|

Te Rūnanga o

Whaingaroa

|

As a descendent of Te

Rūnanga o Whaingaroa I could have a perceived conflict of interest in Te

Rūnanga o Whaingaroa Council relations.

|

Declare a perceived

conflict

|

|

Tribal Member

|

Kahukuraariki Trust

Board

|

As a descendent of

Kahukuraariki Trust Board I could have a perceived conflict of interest in

Kahukuraariki Trust Board Council relations.

|

Declare a perceived

conflict

|

|

Tribal Member

|

Te Rūnanga

ā-Iwi o Ngāpuhi

|

As a descendent of Te

Rūnanga ā-Iwi o Ngāpuhi I could have a perceived conflict of

interest in Te Rūnanga ā-Iwi o Ngāpuhi Council relations.

|

Declare a perceived

conflict

|

2 Apologies

and Declarations of Interest

Members need to

stand aside from decision-making when a conflict arises between their role as a

Member of the Committee and any private or other external interest they might

have. This note is provided as a reminder to Members to review the matters on

the agenda and assess and identify where they may have a pecuniary or other

conflict of interest, or where there may be a perception of a conflict of

interest.

If a Member

feels they do have a conflict of interest, they should publicly declare that at

the start of the meeting or of the relevant item of business and refrain from

participating in the discussion or voting on that item. If a Member thinks they

may have a conflict of interest, they can seek advice from the Chief Executive

Officer or the Team Leader Democracy Support (preferably before the meeting).

It is noted

that while members can seek advice the final decision as to whether a conflict

exists rests with the member.

3 Deputation

No requests for deputations were received at the time of the

Agenda going to print.

4 Confirmation

of Previous Minutes

4.1 Confirmation

of Previous Minutes

File

Number: A2895497

Author: Casey

Gannon, Meetings Administrator

Authoriser: Aisha

Huriwai, Team Leader Democracy Services

Purpose of the Report

The minutes are attached to allow the Committee to confirm

that the minutes are a true and correct record of previous meetings.

|

Recommendation

That the Assurance, Risk and Finance Committee confirms

the minutes of the Assurance, Risk and Finance Committee meeting held 22 May

2020 as a true and correct record.

|

1) Background

Local Government Act 2002 Schedule 7 Section 28 states that

a local authority must keep minutes of its proceedings. The minutes of

these proceedings duly entered and authenticated as prescribed by a local

authority are prima facie evidence of those meetings.

2) Discussion and Options

The minutes of the meetings are attached.

Far North District Council Standing Orders Section 27.3

states that no discussion shall arise on the substance of the minutes in any

succeeding meeting, except as to their correctness.

Reason

for the recommendation

The reason for the recommendation is to confirm the minutes

are a true and correct record of the previous meetings.

3) Financial Implications and Budgetary

Provision

There are no financial implications or the need for

budgetary provision as a result of this report.

Attachments

1. 2020-05-22

Assurance, Risk and Finance Committee Minutes - A2887451 ⇩

Compliance schedule:

Full consideration has been given to the provisions of the

Local Government Act 2002 S77 in relation to decision making, in particular:

1. A

Local authority must, in the course of the decision-making process,

a) Seek

to identify all reasonably practicable options for the achievement of the

objective of a decision; and

b) Assess

the options in terms of their advantages and disadvantages; and

c) If

any of the options identified under paragraph (a) involves a significant

decision in relation to land or a body of water, take into account the

relationship of Māori and their culture and traditions with their

ancestral land, water sites, waahi tapu, valued flora and fauna and other

taonga.

2. This

section is subject to Section 79 - Compliance with procedures in relation to

decisions.

|

Compliance

requirement

|

Staff

assessment

|

|

State the level of significance

(high or low) of the issue or proposal as determined by the Council’s

Significance and Engagement Policy

|

This is a matter of low significance.

|

|

State the relevant Council

policies (external or internal), legislation, and/or community outcomes (as

stated in the LTP) that relate to this decision.

|

This report complies with the

Local Government Act 2002 Schedule 7 Section 28.

|

|

State whether this issue or

proposal has a District wide relevance and, if not, the ways in which the

appropriate Community Board’s views have been sought.

|

It is the responsibility of each

meeting to confirm their minutes therefore the views of another meeting are

not relevant.

|

|

State the possible implications for Māori

and how Māori have been provided with an opportunity to contribute to

decision making if this decision is significant and relates to land and/or

any body of water.

|

There are no implications for Māori in confirming minutes

from a previous meeting. Any implications on Māori arising from matters

included in meeting minutes should be considered as part of the relevant

report.

|

|

Identify persons likely to be

affected by or have an interest in the matter, and how you have given

consideration to their views or preferences (for example,

youth, the aged and those with disabilities).

|

This report is asking for minutes

to be confirmed as true and correct record, any interests that affect other

people should be considered as part of the individual reports.

|

|

State the financial implications

and where budgetary provisions have been made to support this decision.

|

There are no financial

implications or the need for budgetary provision arising from this report.

|

|

Chief Financial Officer review.

|

The Chief Financial Officer has

not reviewed this report.

|

|

Assurance, Risk and Finance Committee Meeting Agenda

|

17 June 2020

|

MINUTES OF Far North District Council

Assurance, Risk and

Finance Committee Meeting

held electronically,

via TEAMs

ON Friday, 22 May 2020

AT 9.32

am

PRESENT: Cr

John Vujcich, Member Bruce Robertson, Deputy Mayor Ann Court, Cr Kelly

Stratford, Cr Moko Tepania (from 11:02 am), Mike Edmonds (Kaikohe-Hokianga

Community Board Chairperson)

IN

ATTENDANCE: Cr Rachel Smith

STAFF

PRESENT: Shaun Clarke (Chief Executive Officer), Will Taylor (General

Manager Corporate Services), Darrell Sargent (General Manager Strategic

Planning and Policy), Andy Finch (General Manager Infrastructure and Asset

Management), Dr. Dean Myburgh (General Manager District Services).

1 Karakia

Timatunga – opening prayer

Councillor Vujcich commenced the meeting with a karakia.

2 Apologies

and Declarations of Interest

Apologies were noted from His Worship the Mayor and

Councillor Tepania for lateness.

3 Deputation

There were no deputations received for this meeting.

4 Confirmation

of Previous Minutes

|

4.1 Confirmation

of Previous Minutes

Agenda

item 4.1 document number A2860745, pages 10 - 14 refers.

|

|

Committee Resolution 2020/1

Moved: Cr John Vujcich

Seconded: Member Bruce

Robertson

That

the Assurance, Risk and Finance Committee confirms the minutes of the

Assurance, Risk and Finance Committee meeting held 12 February 2020 as a true

and correct record.

Carried

|

5 Information

Reports

|

5.1 Internal

Audit and Assurance Report - March 2020

Agenda

item 5.1 document number A2856441, pages 15 - 16 refers.

|

|

Committee Resolution 2020/2

Moved: Cr Kelly

Stratford

Seconded: Member

Bruce Robertson

That the Assurance, Risk and Finance Committee receive

the Internal Audit and Assurance Report - March 2020.

Carried

|

|

5.2 Internal

Audit and Assurance Report - April 2020

Agenda

item 5.2 document number A2871278, pages 17 - 18 refers.

|

|

Committee Resolution 2020/3

Moved: Deputy Mayor Ann

Court

Seconded: Cr

Kelly Stratford

That the Assurance, Risk and Finance Committee receive

the report Internal Audit and Assurance Report - April 2020.

Carried

|

|

5.3 Risk

Management

Agenda

item 5.3 document number A2857046, pages 19 - 28 refers.

|

|

Committee Resolution 2020/4

Moved: Deputy Mayor Ann

Court

Seconded: Cr John

Vujcich

That the Assurance, Risk and Finance Committee receive

the Risk Management Report.

Carried

|

|

5.4 BCA

Accreditation Update

Agenda

item 5.4 document number A2855393, page 29 refers.

|

|

Committee Resolution 2020/5

Moved: Cr Kelly

Stratford

Seconded: Cr John

Vujcich

That the Assurance, Risk and Finance Committee receive

the BCA Accreditation Update.

Carried

|

|

5.5 May

Risk Management

Agenda

item 5.5 document number A2875398, pages 30 - 47 refers.

|

|

Committee Resolution 2020/6

Moved: Cr Kelly

Stratford

Seconded: Deputy

Mayor Ann Court

That the Assurance,

Risk and Finance Committee receive the report May Risk Management.

Carried

|

|

5.6 Council

Financial Report for the Period Ending 30 April 2020

Agenda

item 5.6 document number A2881067, pages 48 - 71 refers.

|

|

Committee Resolution 2020/7

Moved: Member Bruce

Robertson

Seconded: Deputy

Mayor Ann Court

That the Assurance, Risk and Finance Committee receive

the report Council Financial Report for the Period Ending 30 April 2020.

Carried

|

|

5.7 Revenue

Recovery Report - March 2020

Agenda

item 5.7 document number A2876424, pages 72 - 74 refers.

|

|

Committee Resolution 2020/8

Moved: Deputy Mayor Ann

Court

Seconded: Cr

Kelly Stratford

That the Assurance, Risk and Finance Committee receive

the report “Revenue Recovery Report - March 2020.

Carried

|

|

5.8 Financial

Impact Assessment - Covid-19

Supplementary

Agenda item 1.1 document number A2887172, pages 4 - 6 refers.

At

11:38 am, Deputy Mayor Ann Court left the meeting and returned at 11:43am.

|

|

Recommendation

Moved: Member Bruce

Robertson

Seconded: Cr

Kelly Stratford

That the Assurance, Risk and Finance Committee receive

the report Financial Impact Assessment - COVID-19.

Carried

|

|

5.9 Level

of Service KPI Quarter 3 Performance Report

Agenda

item 5.8 document number A2876091, pages 78 - 104 refers.

|

|

Committee Resolution 2020/9

Moved: Cr Kelly

Stratford

Seconded: Member

Bruce Robertson

That the Assurance, Risk and Finance Committee receive

the report Level of Service KPI Quarter 3 Performance Report.

Carried

|

6 Public

Excluded

6.1 RESOLUTION TO EXCLUDE THE

PUBLIC

|

Recommendation

That the public be excluded from the following parts of

the proceedings of this meeting.

The general subject matter of each matter to be

considered while the public is excluded, the reason for passing this

resolution in relation to each matter, and the specific grounds under section

48 of the Local Government Official Information and Meetings Act 1987 for the

passing of this resolution are as follows:

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Ground(s) under section 48 for the

passing of this resolution

|

|

6.1 - Confirmation of Previous Minutes

|

s7(2)(h) - the withholding of the information is

necessary to enable Council to carry out, without prejudice or

disadvantage, commercial activities

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

6.2 - 2020 Far North District Council

Assurance Work Programme

|

s7(2)(f)(i) - free and frank expression of

opinions by or between or to members or officers or employees of any local

authority

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

6.3 - FNDC Current Legal Action

Potential Liability Claims

|

s7(2)(g) - the withholding of the information is

necessary to maintain legal professional privilege

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

The Assurance, Risk and Finance

Committee resolved to exclude the public at 11:49 am.

At the conclusion of the public excluded

discussion, the meeting confirmed the report and decision regarding the 2020

Far North District Council Assurance Work Programme can be publicly accessible.

7 karakia

whakamutunga – closing prayer

8 Meeting

Close

The meeting closed at 12:20pm.

The minutes of this meeting were confirmed at the Assurance, Risk and Finance Committee Meeting held on 17

June 2020.

...................................................

CHAIRPERSON

5 Reports

5.1 NZ

Audit Fraud Questionnaire

File

Number: A2889264

Author: Tanya

Reid, Manager - Transformation, Risk and Audit (Acting)

Authoriser: William

J Taylor MBE, General Manager - Corporate Services

Purpose of the Report

To seek

approval to provide response to NZ Audit fraud questionnaire.

Executive Summary

· As a part of their

audit programme the FNDC external auditor, Audit NZ, have supplied a series of

fraud questionnaires for completion.

· One of these fraud

questionnaires is to be completed by our elected members.

· This questionnaire

has been populated on your behalf and is presented for your review and

approval.

|

Recommendation

That the Assurance, Risk and Finance Committee:

a) approve the

proposed response.

|

1) Background

This report is required to ensure the Assurance, Risk and Finance

Committee is aware of, and approves, the proposed response to NZ Audit.

As an organisation FNDC have a number of controls in place to mitigate

fraud risk:

1. FNDC’s

Audit and Assurance Specialist undertakes internal audits on processes that are

commonly known to be susceptible to fraud.

2. The

current FNDC Assurance Work Programme includes providing assurance in areas

such as:

· Duplicate payments

· Supplier

Masterfile changes

· Delegated

financial authorisations

· Conflicts of

interest

· Vehicle fleet

management

· Network logon

accounts

· Accounts payable

and accounts receivable

· Payroll

· Contract/project

assurance, i.e. payments, variations and documentation.

If any fraud, or opportunities for

fraud, are identified through these audits, appropriate recommendations are

made for improvements.

3. Third

party external audits are also completed. These include:

· IANZ Building

Consent Authority Accreditation Assessment

· MPI Council Food

Act Recognised Agency

· Three Waters

Interim Alliance Agreement Review

· LGOIMA

Compliance and Practice Chief Ombudsman Report

4. Implementation

of the risk management framework through the organisation.

5. Review

of risk progress against the Organisational Top 12 Risk Dashboard by the

Assurance, Risk and Finance Committee put another lens over the controls we

have, and the strength of these controls.

6. A

suite of internal policies provides defined business practices and behavioural

expectations:

· Asset

Disposal Policy

· Dealing

with Complaints Policy

· Dress

Code Policy

· Drugs

and Alcohol Policy

· Email

Usage Policy

· Employee

Code of Conduct Policy (includes Conflicts of Interest)

· Equal

Employment Opportunities Policy

· Flexible

Ways of Working Policy

· Fraud,

Corruption and Whistle Blower Policy

· Gifts

and Inducements Policy

· Intranet,

Network Usage and Password Security Policy

· IT

Equipment Policy

· Learning

and Development Policy

· Leave

Provisions Policy

· Mobile

Phone and Desk Phone Usage Policy

· Overtime

- Toil Policy

· Payment

of Professional Fees Policy

· Performance

Management Policy

· Privacy

Policy

· Procurement

Policy

· Recruitment

Policy

· Remuneration

and Reward Policy

· Sensitive

Expenditure Policy

· Software

Usage and PC Standards Policy

· Workplace

Harassment, Discrimination and Bullying Prevention Policy

7. Two

Protected Disclosure Officers available to staff, as well as an external

whistleblowing hotline provided by EAP Services.

8. Other

procedures and processes that are in place to reduce the risk of fraud include:

· Dependent on their

role potential new staff members are both credit and Ministry of Justice checked

within the recruitment process. Some positions are also Police vetted

· Induction training

for all new starters that educates them on our policies

· Defined processes,

controls and regular reporting such as non-PO payment report, duplicate

payments, petty cash, staff expenses, training and travel approvals, and

delegated financial authorisations

· Separation of

duties which prevents a single person from approving financial transactions

· Conflicts of

Interest processes and management plans.

· Fraud insurance is

in place

· Completing lessons

learned when a fraud event is experienced

· We are

implementing a new asset management system.

9. In

response to the current COVID-19 pandemic situation we have stood up an eight

strong cross functional Fraud Task Force. The purpose of this Fraud Task Force

is to utilise our systems and processes to mitigate fraud risks as identified

by the organisation.

2) Discussion and Options

· This fraud

questionnaire was received from Audit NZ for elected members to complete.

· The fraud

questionnaire response has been reviewed and approved by SLT.

· The questionnaire

summarises fraud management and events over the last 12 months to end April

2020.

The Assurance, Risk and Finance Committee can:

1. Approve

the proposed response

2. Amend

the response

3. Decline

to make a response

Staff recommend that the proposed response be approved. Staff are

happy to take proposed amendments from the committee to have a final response

agreed at the meeting.

The benefit in responding is to in comply with the Audit NZ

annual 2020 audit requirements.

Reason

for the recommendation

The questionnaire is a fair and accurate reflection of

current fraud process, procedures and governance.

3) Financial Implications and Budgetary

Provision

There are no

financial implications.

Attachments

1. 2020 05 Draft

Fraud Risk Assessment Questionnaire to TCWG - A2889255 ⇩

Compliance schedule:

Full consideration has been given to the provisions of the

Local Government Act 2002 S77 in relation to decision making, in particular:

1. A

Local authority must, in the course of the decision-making process,

a) Seek

to identify all reasonably practicable options for the achievement of the

objective of a decision; and

b) Assess

the options in terms of their advantages and disadvantages; and

c) If

any of the options identified under paragraph (a) involves a significant

decision in relation to land or a body of water, take into account the

relationship of Māori and their culture and traditions with their

ancestral land, water sites, waahi tapu, valued flora and fauna and other

taonga.

2. This

section is subject to Section 79 - Compliance with procedures in relation to

decisions.

|

Compliance

requirement

|

Staff

assessment

|

|

State the level of significance

(high or low) of the issue or proposal as determined by the Council’s

Significance and Engagement Policy

|

Not applicable.

|

|

State the relevant Council

policies (external or internal), legislation, and/or community outcomes (as

stated in the LTP) that relate to this decision.

|

Not applicable.

|

|

State whether this issue or

proposal has a District wide relevance and, if not, the ways in which the

appropriate Community Board’s views have been sought.

|

Not applicable.

|

|

State the possible implications for Māori

and how Māori have been provided with an opportunity to contribute to

decision making if this decision is significant and relates to land and/or

any body of water.

|

Not applicable.

|

|

Identify persons likely to be affected

by or have an interest in the matter, and how you have given consideration to

their views or preferences (for example – youth, the aged and those

with disabilities.

|

Not applicable.

|

|

State the financial implications

and where budgetary provisions have been made to support this decision.

|

Not applicable.

|

|

Chief Financial Officer review.

|

The Chief Financial Officer has

reviewed this report.

|

|

Assurance, Risk and Finance Committee Meeting Agenda

|

17 June 2020

|

Fraud risk assessment – Direct enquiry

areas for Council members

Fraud

enquiries: Those charged with governance

|

Specific

enquiries

|

Response

|

|

Role in relation to fraud

|

|

|

What role do those charged with governance] have in monitoring

management’s exercise of its fraud prevention responsibilities?

|

The Assurance, Risk and Finance Committee has this governance

role. In this role the committee:

· ensures the appropriate

financial accounting and disclosure requirements are in place

· approves independent

external financial audit appointment

· receives direct

reporting by the external financial auditor to the committee with external

auditor lead staff excluded discussion with elected members

other

third party audits (BCA, Food) are by regulatory agencies with outcomes

reported to the Regulatory Compliance Committee. These audit recommendations

are entered into the central audit log for monitoring and reporting by the

Assurance and Audit Specialist to the Assurance, Risk and Finance Committee

· reviews and approves

internal audit and assurance work programme

· receives direct reports

from the internal Assurance and Audit Specialist including progress to close

out third party and internal audit findings and recommendations

· participates in the risk

management governance including identification risks on the top

organisational risk dashboard

· receives direct top

organisational risk progress reports

|

|

How does management communicate identified fraud risks? How do

they provide assurance that anti-fraud controls are in place and operating?

|

Management communicates identified fraud risk to the Assurance,

Risk and Finance Committee.

Assurance that anti-fraud controls are in place is provided, to

this committee, through the internal audit and assurance function and the

external third party audits.

|

|

If a fraud risk assessment has been completed, what input did

those charged with governance have?

Do you consider that the fraud risk assessment was a robust

process?

|

Fraud was assessed as a risk by the Assurance, Risk and Finance

Committee in 2018. With the controls, already in place, fraud was not

prioritised as a top organisational risk.

|

|

How are those charged with governance informed of actual,

suspected or alleged frauds?

|

Sponsored by the General Manager Corporate Services the

Transformation & Assurance team report investigated and proven fraud

events to the Assurance, Risk and Finance Committee.

|

|

Actual, suspected, or alleged frauds

|

|

|

Have any frauds been identified or are there any suspected or

alleged frauds?

|

Yes. In the last 12 months one fraud lessons learned report was

presented, on the 12 Feb 2020, to the Assurance, Risk and Finance Committee

agenda.

|

|

For any identified frauds, were these investigated by management

and have the results of the investigation been reported to those charged with

governance?

How did the fraud occur? How was it identified? What happened to

fraudster, how much was involved and were any monies or assets recovered?

|

In December 2019 FNDC was affected by a fraudulent request for a

bank account number to be changed. This request originated from one of our

contractors, Conhur Ltd (sludge dewatering specialist company). Their IT and

email systems had been maliciously hacked by an unknown party.

A payment for a legitimate invoice was made to Conhur Ltd for

$100,600.30 using Conhur Ltd’s new (fraudulent) bank account details.

This event was reported to the Police who subsequently opened

their own investigation.

|

6 Information

Reports

6.1 Internal

Audit and Assurance Report

File

Number: A2885033

Author: Lisa

Huria, Audit and Assurance Specialist

Authoriser: William

J Taylor MBE, General Manager - Corporate Services

Purpose of the Report

To provide the Assurance,

Risk and Finance Committee with an update on internal and external audits, and

any associated recommendations.

Executive Summary

This report provides an

update on internal and external audit recommendations that have recently been

completed, are almost complete, are underway, or are on hold. Since the last

report on 22 May, five recommendations have been completed.

|

Recommendation

That the Assurance, Risk and Finance Committee receive

the report Internal Audit and Assurance Report.

|

Background

Five audit

recommendations from the LGOIMA Compliance and Practice at FNDC Report have

recently been completed by the Legal Services team.

There are plans in place

to complete all other outstanding recommendations.

Audit recommendations as

at 22 May 2020:

|

ID

|

Audit Name

|

Title

|

Priority

|

Status

|

Description

|

|

23

|

Internal Audit - Information Security

|

External user access and authentication

|

Must do

|

Almost complete

|

The number of external

users with non-expiring passwords should be reviewed to:

1) Determine if they need access

2) Confirm with Pathway that user access

cannot be restricted to just the RFS's they are assigned to

3) Ensure an IT Asset Acceptance Letter is

signed by external users.

Progress:

1) Network logon account internal audit has

been completed. Findings to be actioned by the IT team.

2) User access to Pathway cannot be

restricted to just the RFS’s they are assigned to.

External

contractors are provided with limited access of ‘enquiry’ unless

otherwise requested.

User

Groups have been set up for external users.

External

contractors are de-activated when contract has terminated, and the

maintenance structures are removed.

3) An IT Asset Acceptance Letter is signed

by all external users.

|

|

28

|

Internal Audit - Information Security

|

Project Security Risks

|

Should do

|

Underway

|

Information security controls need to be factored into

FNDC's project management framework to ensure associated risks are

managed.

|

|

58

|

KPMG - Procurement

|

Spend Monitoring

|

Should do

|

Underway

|

Implement quarterly procurement spend analysis.

|

|

59

|

KPMG - Procurement

|

Spend Monitoring

|

Should do

|

Underway

|

As part of the spend analysis process, integrate category

spend management on a periodic basis.

|

|

64

|

KPMG - Procurement

|

Record-keeping

|

Should do

|

Underway

|

Centralised system for storing documentation.

Progress:

A Contracts Register has been set up in SharePoint.

|

|

65

|

KPMG - Procurement

|

Record-keeping

|

Should do

|

Underway

|

Establish naming conventions for consistent naming.

Progress:

This will be combined with number 64 above.

|

|

74

|

2017 Audit NZ Interim Annual Management Report

|

Legislative Compliance System

|

Should do

|

On hold

|

Audit NZ recommend a mechanism for monitoring compliance

with legislative requirements is put in place as part of the Council’s

overall risk management strategies.

Progress:

Stakeholder interviews have been completed. A range of

possible solutions have been investigated. The next step is to procure a

legislative compliance system and this will be considered in future budgets.

|

|

99

|

Contract Management Review

|

Set contract management guidelines

|

Must do

|

Underway

|

Focus is being placed on setting organisation wide contract

management guidelines, encompassing the three main contractual areas:

physical works, fixed term operational and maintenance, and goods and

services. This encompasses the four contract stages: contract planning and

development, contract execution, contract management and contract

review/close-out.

Progress:

Work on developing a Contract Management Policy and

Framework is progressing well.

|

|

105

|

2018 Audit NZ Final Annual Management Report

|

Resource Management Deposits (Bonds)

|

Must do

|

Almost complete

|

When testing the liability balance related to resource

management deposits, Audit NZ found some deposits in the listing were

received 18 years ago.

They recommended resource management deposits be reviewed

and an assessment made as to whether they still meet the definition of a

liability. If not, they should be released to revenue.

Progress:

The Compliance Team have undertaken analysis and site

inspections to determine which bonds can be refunded. This work is nearing

completion.

|

|

111

|

Three Waters Interim Alliance Agreement Review

|

Education of Alliance contracts and principles

|

Should do

|

Underway

|

Greater education provided for staff regarding expectations

of an Alliance contract and understanding of the Alliance principles.

Progress:

Toolbox sessions are held regularly with Far North Waters.

FNDC Asset Managers are going to be taken through the contract so they can

get a clear understanding of how it works.

|

|

115

|

Three Waters Interim Alliance Agreement Review

|

Agree on Key Performance Indicators (KPI)

|

Should do

|

Underway

|

Agree on the KPI’s through the Alliance Management

Team, including finance and contract performance, proactiveness and

innovation, and co-developed Health and Safety KPI’s.

Progress:

KPI’s will be agreed in early 2020.

|

|

123

|

2019 Audit NZ Final Annual Management Report

|

Deferral of capital expenditure

|

Must do

|

Underway

|

Audit NZ recommend that the Council give consideration to

the impact of deferred capital expenditure on asset condition and any

potential impact this may also have on Council’s asset valuations and

impairment assessments for future reporting cycles.

Progress:

Council has commenced Programme Darwin which is aimed at

addressing issues with asset management. Delivery of the capital programme

being one of these issues. Council is reviewing the capital programme to

ensure that it is achievable from inception and is limited to what can

reasonably be delivered.

|

|

132

|

LGOIMA Compliance and Practice Report

|

Develop a LGOIMA training programme tailored to the needs of

all staff, including induction training and more detailed training on the

application of LGOIMA withholding grounds

|

Must do

|

Complete

|

A LGOIMA Policy has been developed which acts as a training

tool. This will be embedded into induction training. Any additional training

required will be based on the LGOIMA Policy and will be delivered by the

Legal Services team.

|

|

136

|

LGOIMA Compliance and Practice Report

|

Develop a written policy on official information

|

Must do

|

Complete

|

A LGOIMA Policy has been developed. About to go through SLT

approval.

|

|

137

|

LGOIMA Compliance and Practice Report

|

Develop guidance resources for staff on how to apply LGOIMA

to information requests

|

Must do

|

Complete

|

A LGOIMA Policy has been developed which acts as a training

tool. This will be embedded into induction training.

Any additional training required will be based on the LGOIMA

Policy and will be delivered by the Legal Services team.

The policy itself is an excellent guidance tool for staff.

|

|

138

|

LGOIMA Compliance and Practice Report

|

Amend operational guidance on staff intranet to comply with

LGOIMA

|

Must do

|

Almost complete

|

The LGOIMA Policy will be placed on the intranet. Legal

Services will work with the Communications and IT teams to action this once

SLT approval is gained.

|

|

139

|

LGOIMA Compliance and Practice Report

|

Develop a Proactive Release policy

|

Must do

|

Almost complete

|

The Proactive Release Policy is nearing completion. As a

result of the adoption of this policy, Legal Services will commence work on establishing

the processes for proactive release of information, as well as how we manage

publicly excluded items according to the policy guidelines.

|

|

141

|

LGOIMA Compliance and Practice Report

|

Ensure that all public and media information requests are

handled in accordance with LGOIMA

|

Must do

|

Complete

|

This is embedded in the LGOIMA Policy.

|

|

142

|

LGOIMA Compliance and Practice Report

|

Ensure that requests from elected members are handled in

accordance with LGOIMA

|

Must do

|

Complete

|

This is embedded in the LGOIMA Policy.

|

|

151

|

LGOIMA Compliance and Practice Report

|

Consider ways to include contact centre, media, elected

member and property file requests in LGOIMA statistics

|

Must do

|

Underway

|

We are changing the way we report on LGOIMA to the Chief

Executive - this work is currently in development.

|

|

152

|

LGOIMA Compliance and Practice Report

|

Consider including more information about LGOIMA requests in

the report to the Chief Executive

|

Must do

|

Underway

|

We are changing the way we report on LGOIMA to the Chief Executive

- this work is currently in development.

|

Complete: 5

Almost complete: 4

Underway: 11

On hold: 1

Total: 21

Financial Implications and Budgetary

Provision

This report is for

information only.

Attachments

Nil

6.2 Risk

Register Update

File

Number: A2889879

Author: Tanya

Reid, Manager - Transformation, Risk and Audit (Acting)

Authoriser: William

J Taylor MBE, General Manager - Corporate Services

Purpose of the Report

To provide scheduled risk progress reports for the organisation’s

top risks and group risk. No decision required.

Executive Summary

Risk progress updates are provided for two of the top organisational

risks.

|

Recommendation

That the Assurance, Risk and Finance Committee receive

the report June 2020 Risk Register Update.

|

Background

The Transformation and Assurance team has

facilitated the development of treatment plans for the organisation’s top

risks. We are now in the phase where regular reporting of the

organisation’s top risks, and treatment plans, is in place.

A programme of deep dive workshops is

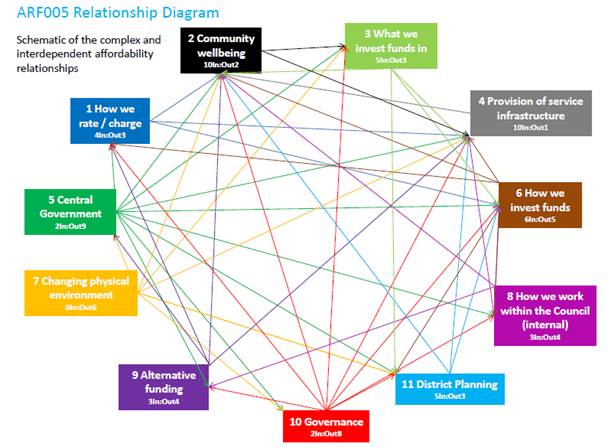

planned for these risks. The first of two deep dive workshops for ARF005

Affordability risk has been completed, with the second workshop to be

scheduled.

The Transformation and Assurance team continues

to work with the organisation to refresh / establish Group risk registers, with

treatment plans, and regular reviews.

Discussion and Next Steps

Two risk progress reports, with treatment

plans, are attached. Below is a summary of change to risk status. More detail

is available in the risk progress reports.

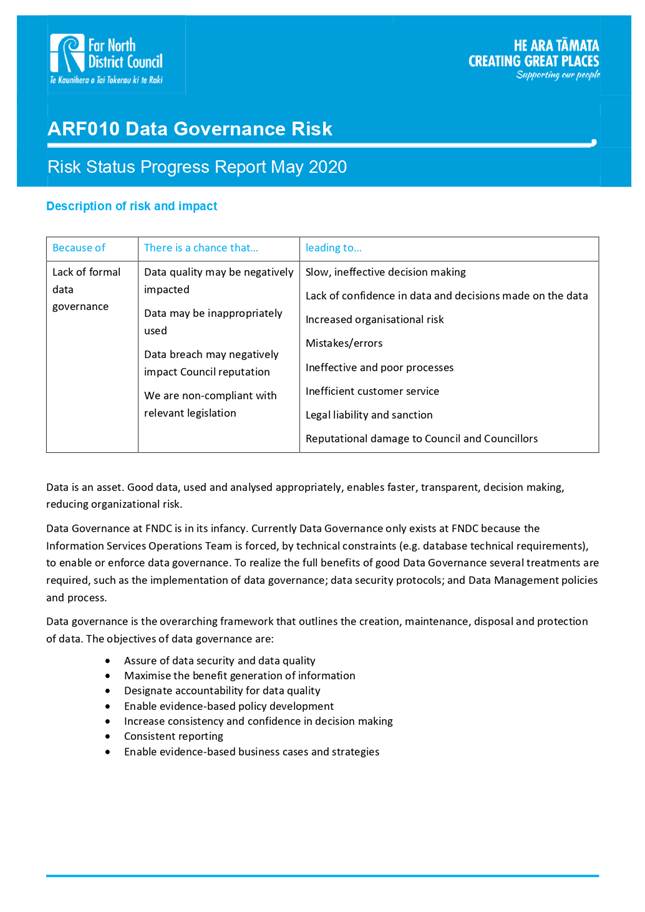

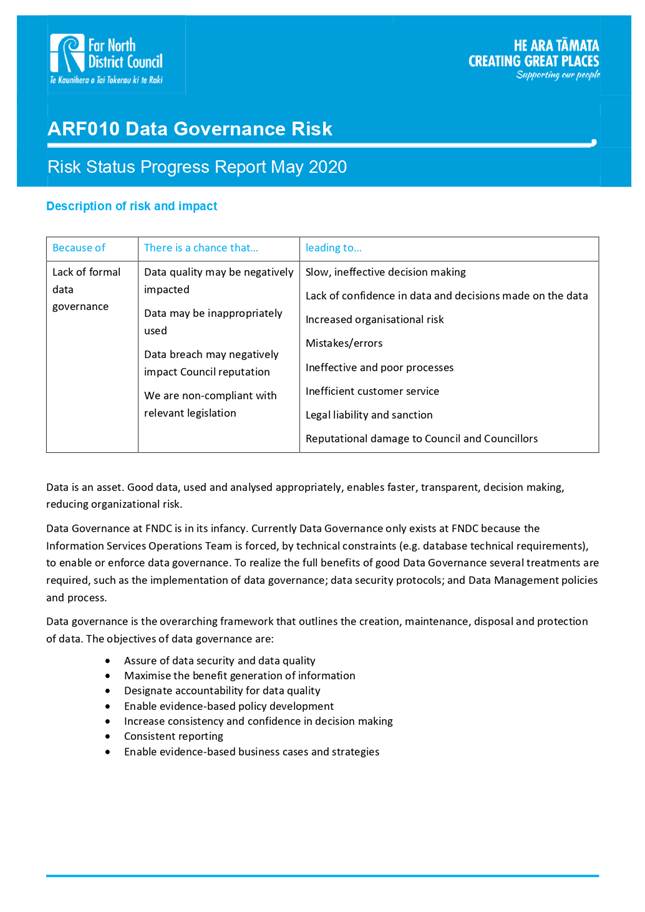

Both ARF010 Data Governance and ARF005

Delivery of Service (affordability) risks, have been assessed as increasing

level of risk.

The rationale for the increased level of

risk is due to the impact of the drought and COVID-19 pandemic and national

emergency. The negative impact is a result of:

1. Financial stress being experienced now and into the

short-medium term future due to the impact of loss of income on businesses; and

individuals and households.

2. Certnz have highlighted increased threat from criminals

taking advantage of the COVID-19 pandemic to create opportunistic online scams and

attacks.

An elected member workshop is to be

scheduled to cover the FNDC Risk Management Framework and to refresh the top

organisational risk dashboard.

The Transformation and Assurance team

continues to work through the organisation to establish and maintain Group Risk

Registers.

Financial Implications and Budgetary Provision

At this

stage no additional budgetary provision has been identified for the treatment

plans.

Attachments

1. 2020 05 ARF005

Delivery of Service Risk (affordability) Progress Report - A2889806 ⇩

2. 2020 05 ARF010

Data Governance Risk Progress Report - A2889997 ⇩

|

Assurance, Risk and Finance Committee Meeting Agenda

|

17 June 2020

|

Description

of risk and impact

·

Economic delivery

is the financial ability to deliver Council services, strategies and

initiatives to the community at affordable levels.

·

Affordability

of services is acknowledged as one of FNs key challenges. With a small rating

base, diverse socio-economic factors and large distributed infrastructure base

and service requirement, this will get worse over time without intervention.

·

Data

from the Ministry of Social Development shows that 19% of the Far North

District receives New Zealand Superannuation. In total, Infometrics

calculations show that 31% of the Far North population in March 2020 was either

on a main benefit or on New Zealand Superannuation. In 2018, the Far North

District had a usual residential population of 65,250, living in 22,761

households or around 2.9 people per household. Business Economic Research

Limited (BERL) analysis (Feb 2020) for the Far North provides a snapshot by

household type:

·

Table 1

Household counts by the eight usual household types, Far North District 2018

|

Household Type

|

Household count

|

As a percentage

|

|

·

Single

Superannuitant, no other income

|

·

2471

|

·

10.9%

|

|

·

Married

Superannuitant, no other income

|

·

2961

|

·

13.0%

|

|

·

Single

working person (no kids)

|

·

1504

|

·

6.6%

|

|

·

Single

adult, 2 children, on benefit

|

·

409

|

·

1.8%

|

|

·

Single

adult, 2 children, employed

|

·

102

|

·

0.4%

|

|

·

Couple,

2 children, one employed

|

·

749

|

·

3.3%

|

|

·

Couple,

2 children, both employed

|

·

1123

|

·

4.9%

|

|

·

Remaining

households

|

·

13442

|

·

59.1%

|

|

·

Total

occupied households

|

·

22761

|

·

|

|

·

Two

working adults, based in Auckland

|

·

763

|

·

3.4%

|

·

·

Ageing

infrastructure and the forecast impacts of climate change and natural hazards

present further delivery challenges. We do not fully understand our assets

– location, condition, capacity, long-range requirements. Unbudgeted

costs emerge frequently as a result of under-estimation and poor understanding

of requirements.

·

The

affordability of delivery relates predominantly to core infrastructure assets,

although services such as enforcement cannot be excluded as an area of risk.

·

Central

government’s productivity commission enquiry acknowledges affordability

as an issue for many councils, particularly for those without funding sources

beyond rates and charges. This has been further impacted by the COVID-19

pandemic. Infometrics forecast a 7.2% decline economic activity in the Far

North, for the year to March 2021, with the Far North likely see a 10.1% decline

in local employment, costing around 2,500 jobs.

Current situation (from

CEO’s memo to Elected Members 24 April 2020)

In

this financial year (2019/20), the cost to Council for drought-related works

is, at 24

April 2020,

sitting at approximately $4.2m with costs associated with COVID-19 costs so far

totaling approximately $88k.

·

So far,

we have been able to identify savings to offset $3.7m, many of which were taken

from areas of the business that have “slowed” due to drought or

stopped all together as a result of the shutdown. At this point it must be

noted that maintaining this level of saving in the slowed areas may not be

possible indefinitely; it is anticipated that as we move back down the Alert

Levels expenditure will start to increase, although it is too soon to estimate

how fast normal levels are likely to be reached.

·

It is

extremely difficult to estimate the quantum of impact on Council’s income

streams in the remaining few months of the current financial year as we move

back through the COVID-19 Alert Levels. At the time of writing, staff continue

to work on resource consents and building consents that were lodged prior to

shut down. Expected future lodgment rates are unknown, so the impact on future

income from consenting cannot yet be determined. Likewise, the cashflow impact

on rates income has not yet emerged. Invoices for the final instalment have

just been issued and a clearer picture of the impact is expected to develop in

the coming weeks.

Existing Treatments

·

Elected

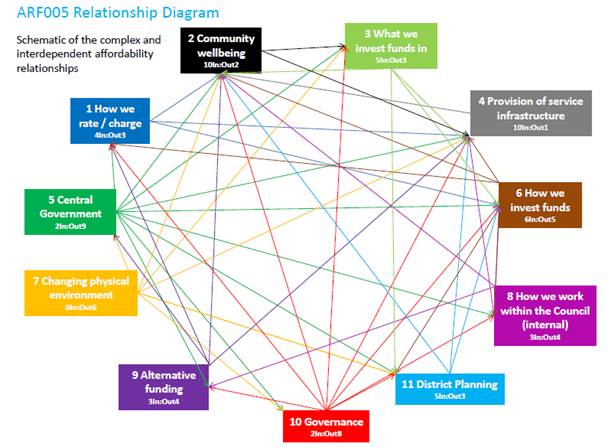

members have attended one of two risk deep dive workshops to unpack this risk. At this workshop elected member

identified ideas, opportunities, issues and risks. Based on natural

relationships these were grouped into 11 categories. An analysis of the complex

relationship among the 11 themes was completed and captured in a

“relationship” diagram. The main purpose of this diagram is to help

identify the relationships between the themes, the goal being to support the

understanding of the links between ideas or cause-and-effect relationships.

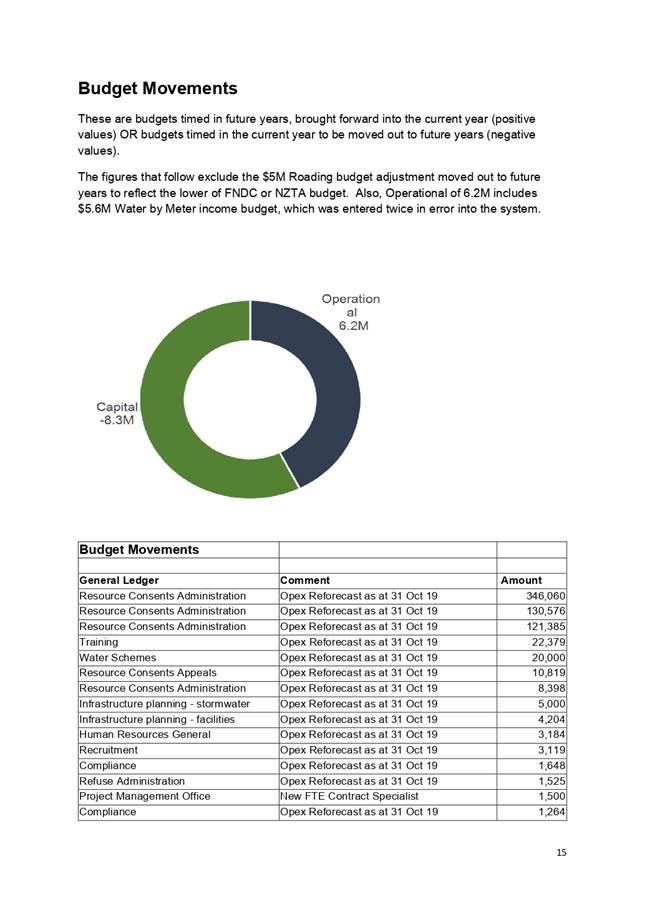

Diagram 1:

·

·

This

diagram shows a count of the arrows in and out for each theme

· Themes with the highest arrow count are key ideas;

· Themes with primarily out-going arrows ((10) Governance,

(7) Changing physical environment, and (5) Central Government) are basic

causes; and

· Themes with primarily in-coming arrows ((2) Community

wellbeing and (4) Provision of service infrastructure) are final effects

critical to address for this risk.

·

Council

has commissioned a report by BERL to inform our understanding of the rates

affordability for eight usual household types within the District to determine

the percentage of household income spent on rates at different rating levels,

for different household types.

·

FNDC

has a traditional financial model of budgeting for endorsed plans and

strategies such as the Long Term Plan, infrastructure and district plans

including Council resource and capability to deliver on these plans and core

service base.

·

These

plans and services are funded by mainly rating revenue, complemented by a small

return on some assets such as pensioner housing, and Council’s CCO, Far

North Holdings Limited, who provides a shareholder dividend back to council.

·

A

revenue and rating review is underway looking at aspects such as Land value vs.

Capital value to see if additional revenue can be derived from a more equitable

rating system for the district.

·

This

review is also planned in the near term to look at sources of revenue and investigate

new opportunities to grow and improve the funding base and potential.

·

Planned

enhancements such as; planning quality, business casing, project support, asset

condition and management and contract management will all assist with managing

costs, however it will take time for the cumulative benefits from these

initiatives to flow down to accurate budgeting and forecasting processes.

·

FNDC

has joined regional alliances such as the Northern Transport Alliance to share

costs and opportunities and the regional shared services model is one that will

be utilized more frequently.

·

Longer

term strategy work such as the "Far North 2100” initiative is

underway to assist with forecasting future services and costs.

·

High

level treatment plan:

1. CouncilMark:

18. Asset Management

Improvement

29. Capital Project Life

Report Improvement

16. Long Term Asset Funding

Improvement

2. Knowing

where new assets will be required and when, including:

• Location, timing and quantum of potential growth/decline

• Current capacity of assets and likely future demand

• The future/agreed strategy for the asset class

• Where change (unforeseen and/or uncontrollable) may force

action.

3. Accurate

and process-driven options assessment, with realistic budgets and timelines

(taking the guesswork out of corporate planning (LTP and Annual Plans).

4. Ensuring

that work practices across Council are free of waste, keeping the rates

requirement as low as possible.

5. Building

a rating system that is as fair and equitable as possible.

·

Where are the gaps? / what more could we be doing?

|

Inherent Risk:

|

Trend

|

Residual Risk:

|

Accountable:

|

CEO

|

Date raised:

|

29/11/18

|

Report frequency:

|

|

|

á

|

|

Responsible:

|

GM SPP

|

Date accepted:

|

30/05/19

|

Six monthly

|

|

Assurance, Risk and

Finance Committee Meeting Agenda

|

17 June 2020

|

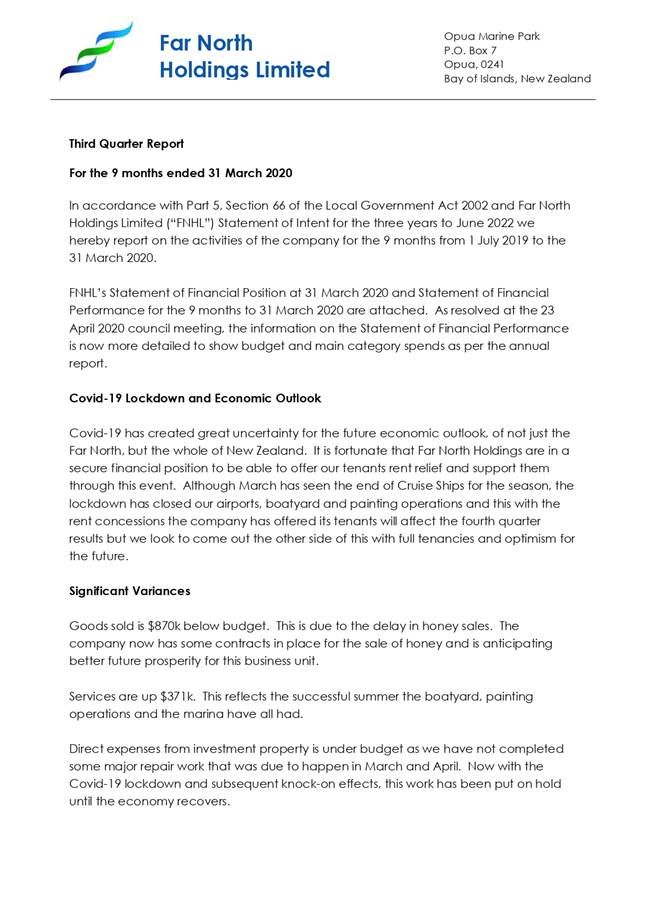

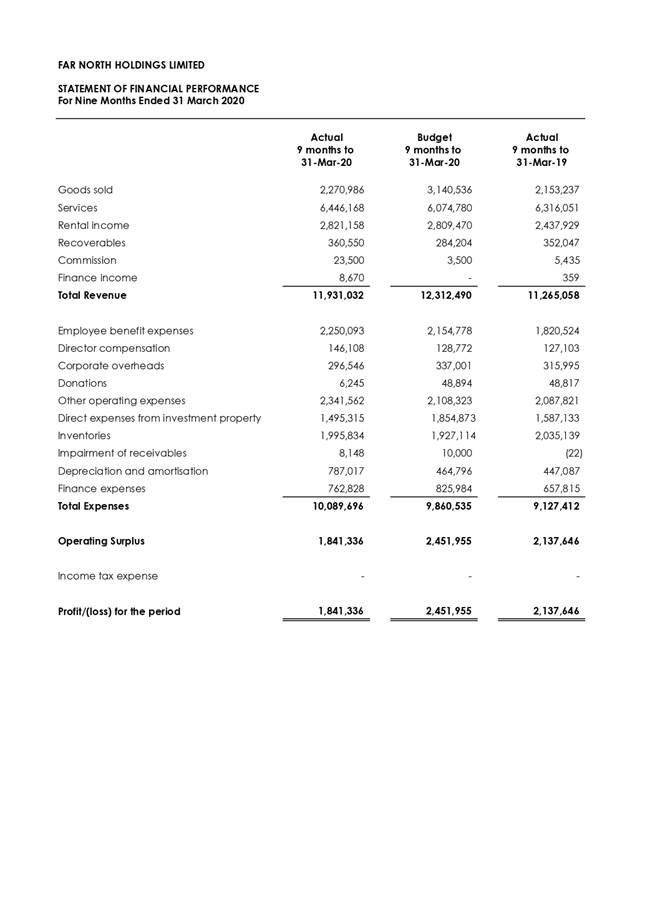

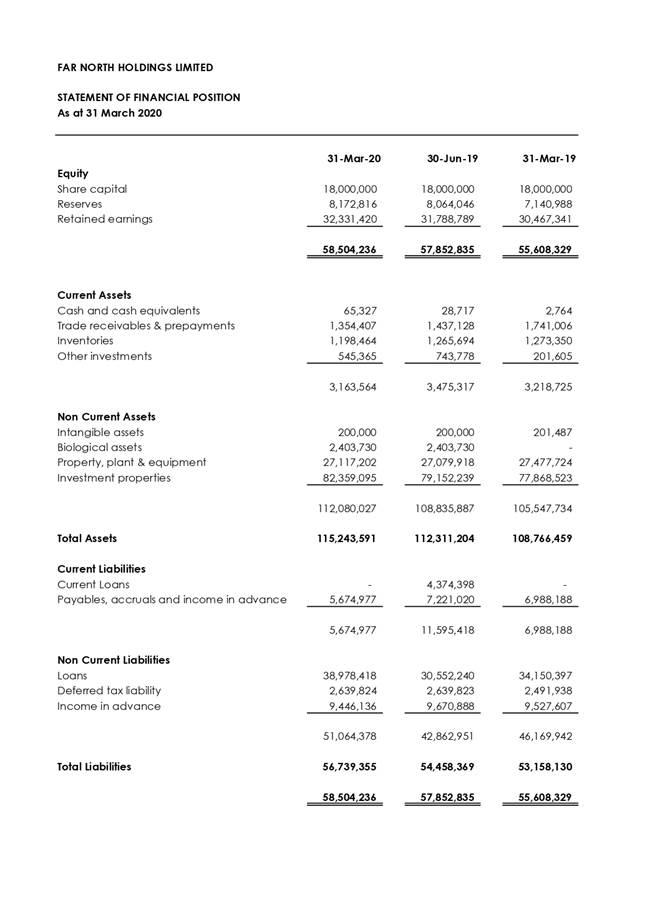

6.3 Far

North Holdings Limited - March 2020 Third Quarter Financial Report

File

Number: A2895646

Author: Janice

Smith, Chief Financial Officer

Authoriser: William

J Taylor MBE, General Manager - Corporate Services

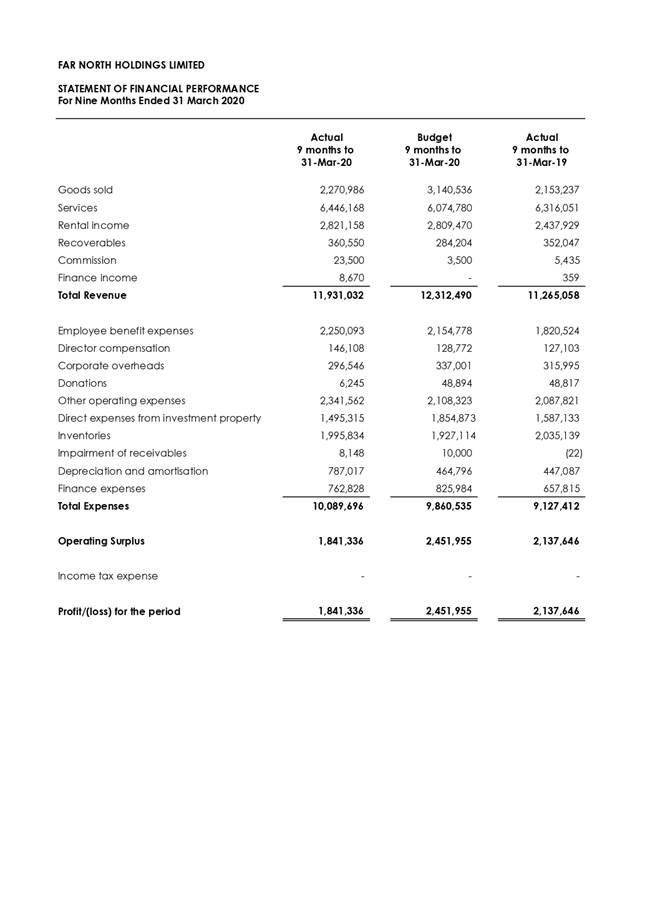

Purpose of the Report

To report the financial

position of Far North Holdings Limited as at 31 March 2020.

Executive Summary

At the Council meeting of

23 April 2020, Council requested that Far North Holdings Limited report on the financial

position on a quarterly basis. This report is the third quarter report for the

financial year 2019/20.

|

Recommendation

That the Assurance, Risk and Finance Committee receive

the report Far North Holdings Limited - March 2020 Third Quarter Financial

Report.

|

Background

At the Council meeting - 23 April 2020, Council resolved the

following:

Resolution 2020/21

Moved: Mayor

John Carter

Seconded: Cr Dave Collard

That Council:

a) accept

the Half Year Report from Far North Holdings Limited:

b) request

that future reports contain the following information;

i) annual and Year to Date

budget,

ii) commentary on any significant

variances, and

iii) detail of significant income and

expenditure, for example fees & charges and salaries to aid the shareholder

understanding of the financial position.

The March 2020 third quarter financial report is the first

report received following that resolution.

Discussion and Next Steps

The report as attached, now includes additional information

as requested by Council at the meeting of 23 April 2020.

The COVID-19 Level 4 shutdown occurred 25 March 2020;

therefore, the financial position shows limited impact for the quarter. The

final accounts at 30 June 2020 will show more detail of the impact associated

with the closure of the airport as well as the shortening of the cruise ship

season.

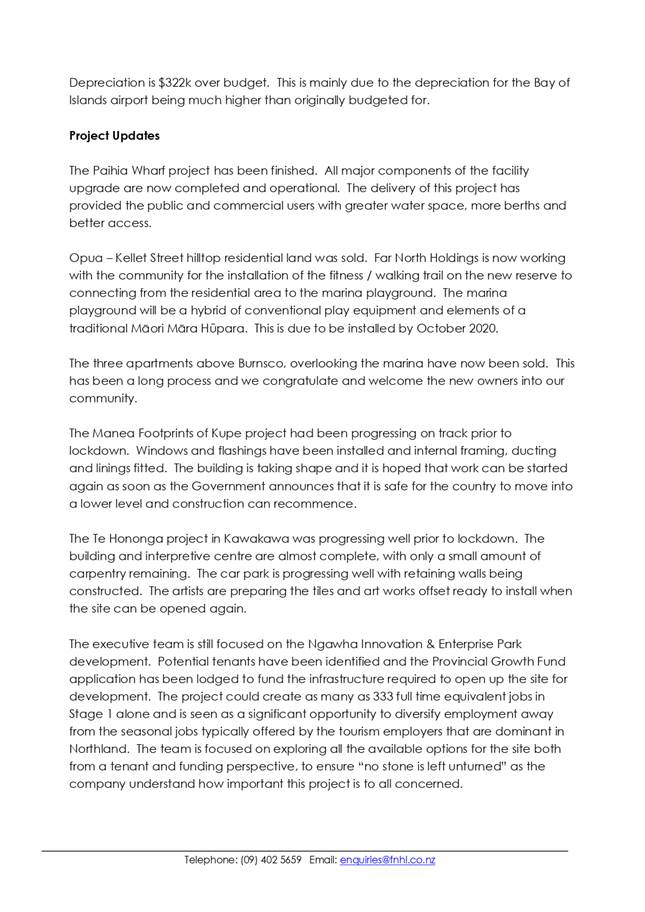

Overall, income is down for the third quarter by $381,458

and this is largely due to a reduction in goods sold.

Expenditure is ahead of budget in several places, the most

significant being depreciation with $322,221. Other areas showing greater than

$50k movement are Employee benefits (+$95,315), Inventory (+$68,720) and

Finance Expenses (-$63,156).

Overall the surplus is below budget by $610,619 which

equates to 24% of the budgeted surplus of $2,451,955.

Financial Implications and Budgetary Provision

The are no financial

implications arising from this report, however, it should be noted that a

continued decrease in the reported surplus will reduce the dividend payable to Council

at the end of the financial year.

Attachments

1. FNHL March 2020

Quarterly Report.final - A2895675 ⇩

|

Assurance, Risk and Finance Committee Meeting Agenda

|

17 June 2020

|

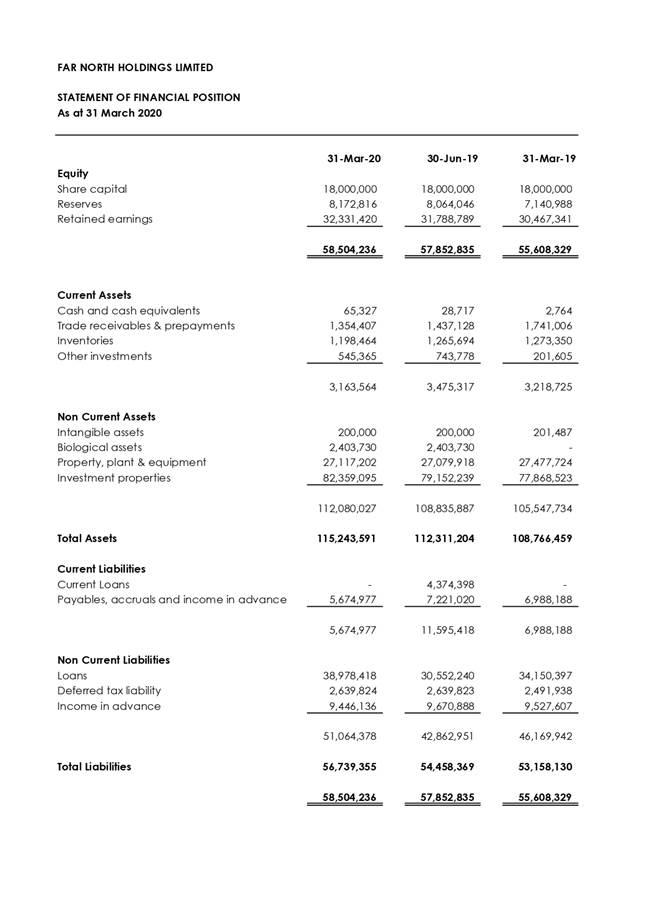

6.4 Far

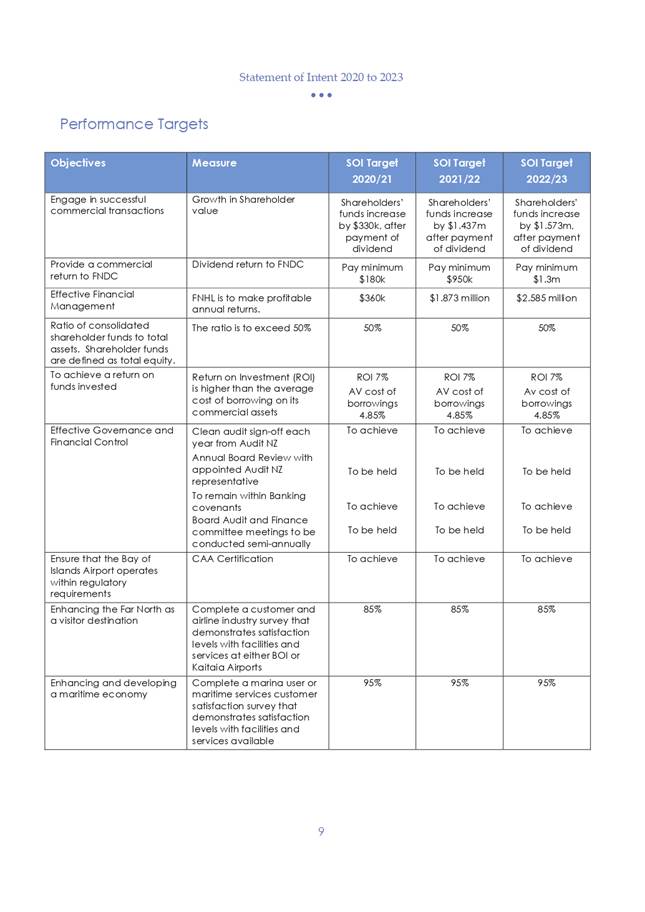

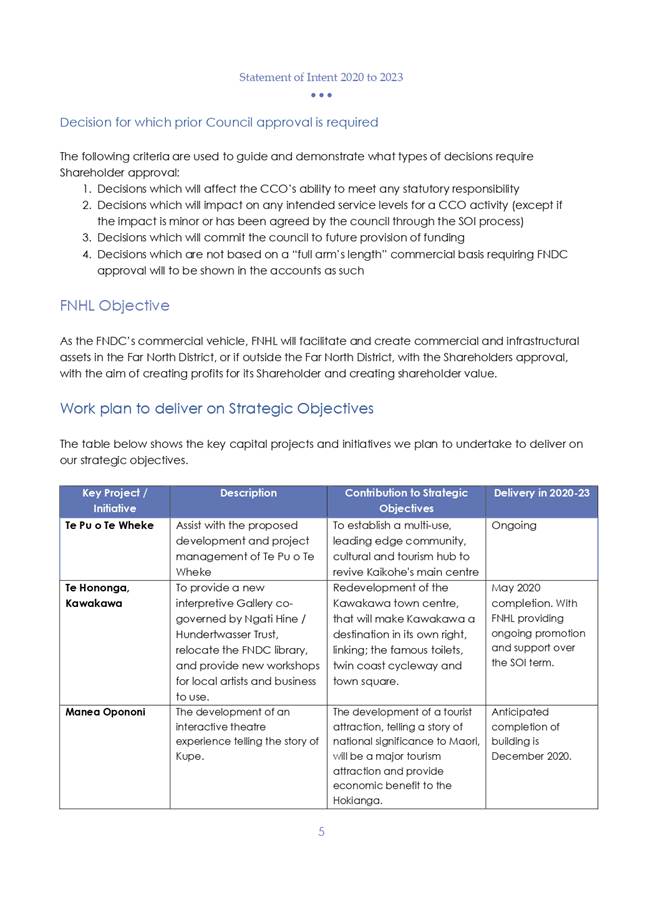

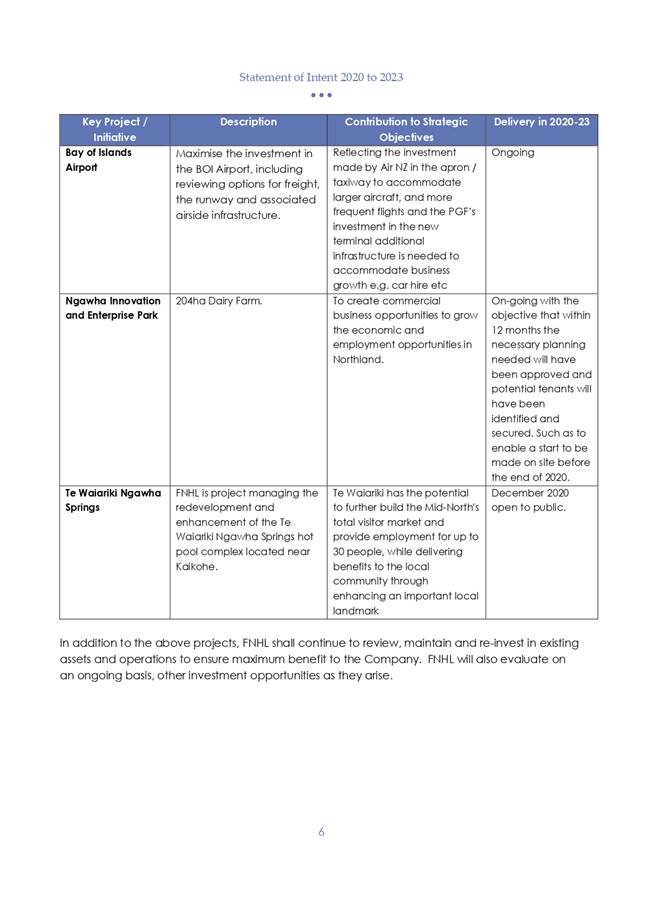

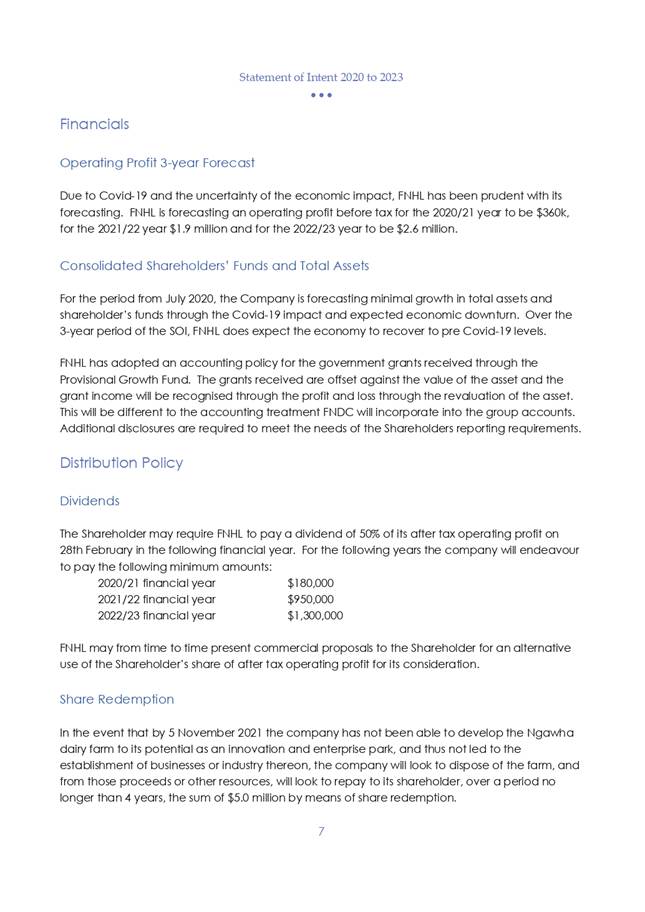

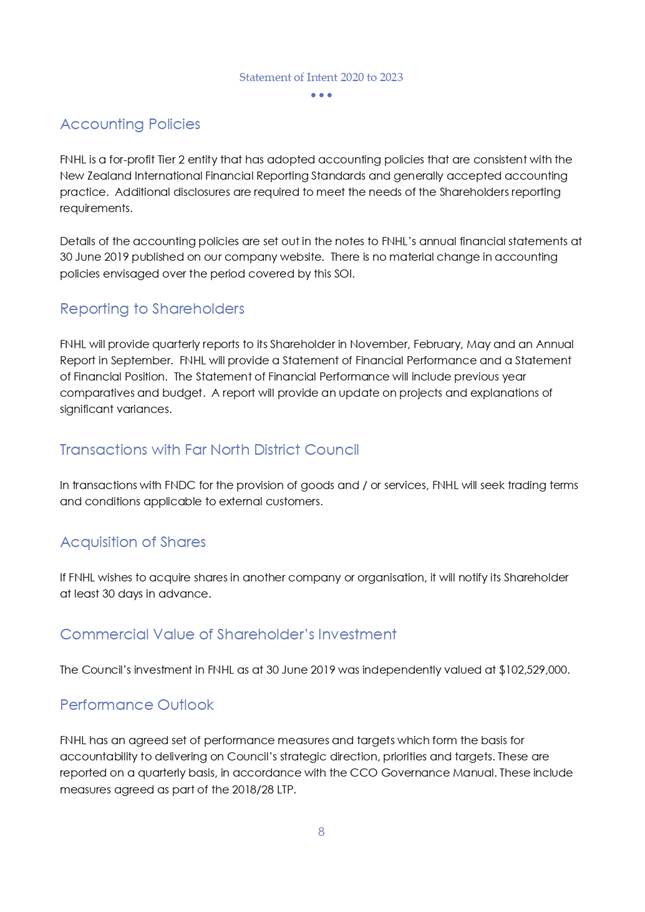

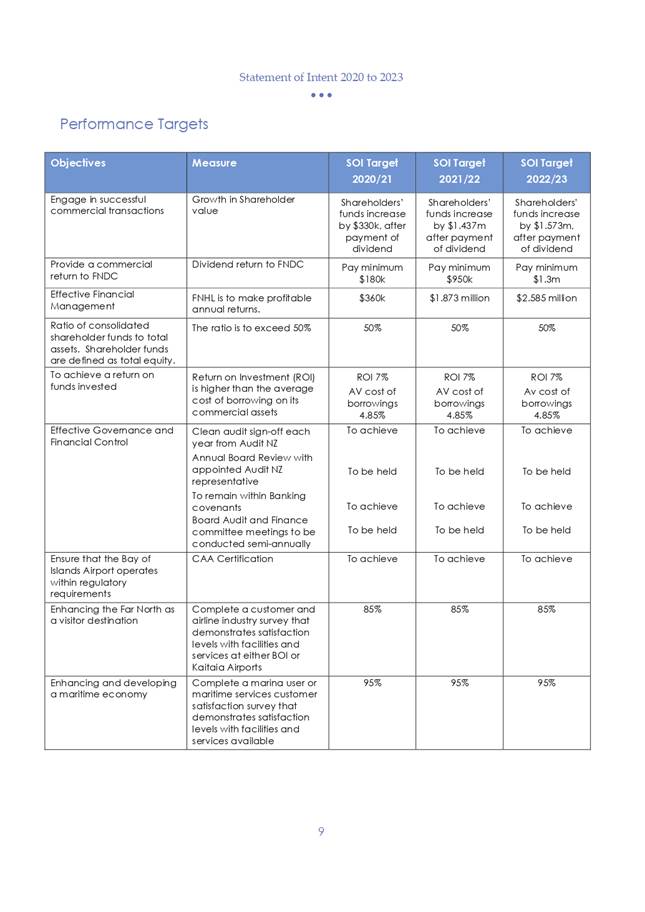

North Holdings Limited - Statement of Intent for the period 2020 to 2023

File

Number: A2895790

Author: Janice

Smith, Chief Financial Officer

Authoriser: William

J Taylor MBE, General Manager - Corporate Services

Purpose of the Report

The purpose of this

report is to receive the Far North Holdings Limited - Statement of Intent for

the period 2020 to 2023.

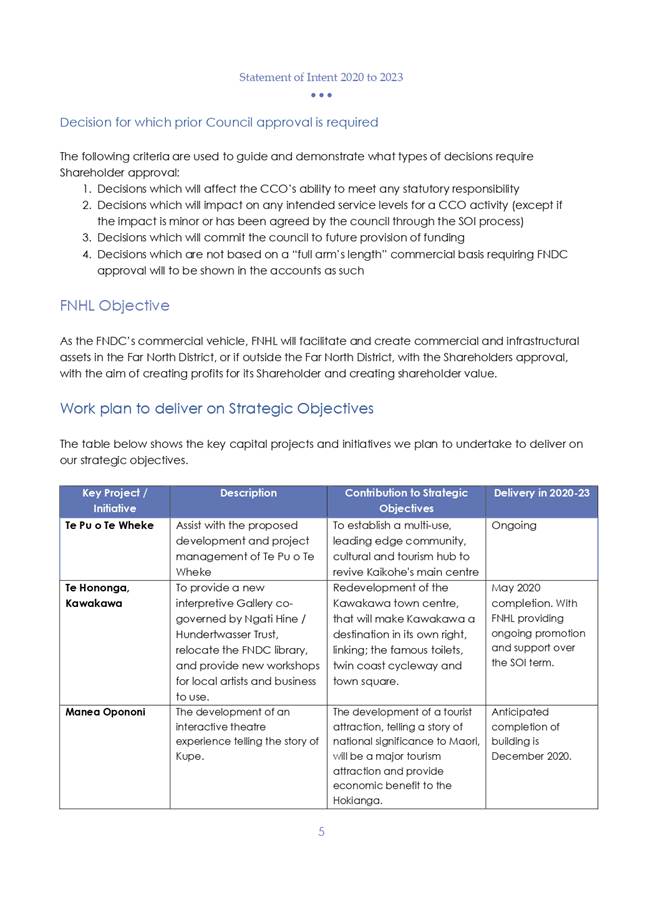

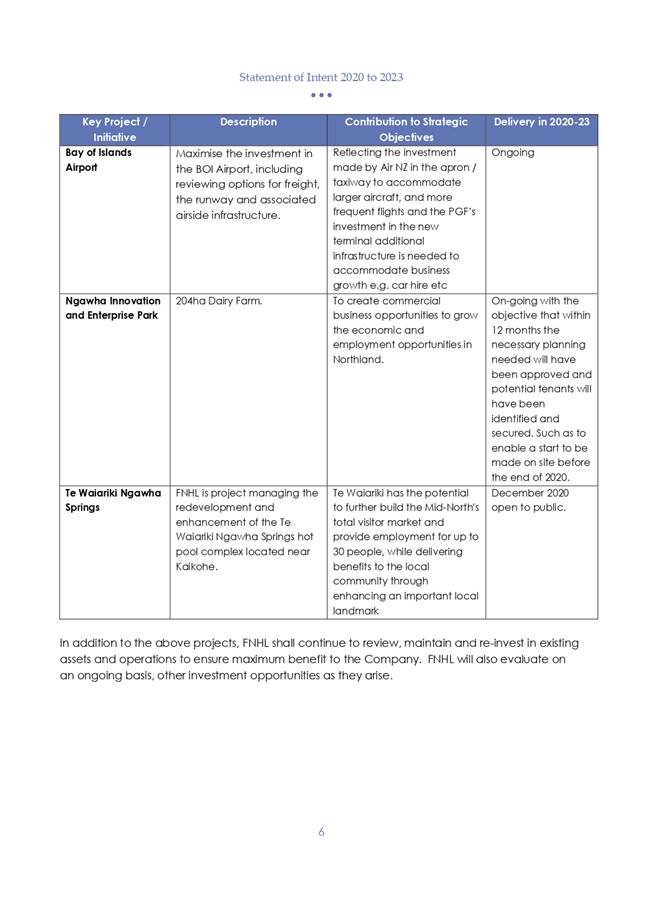

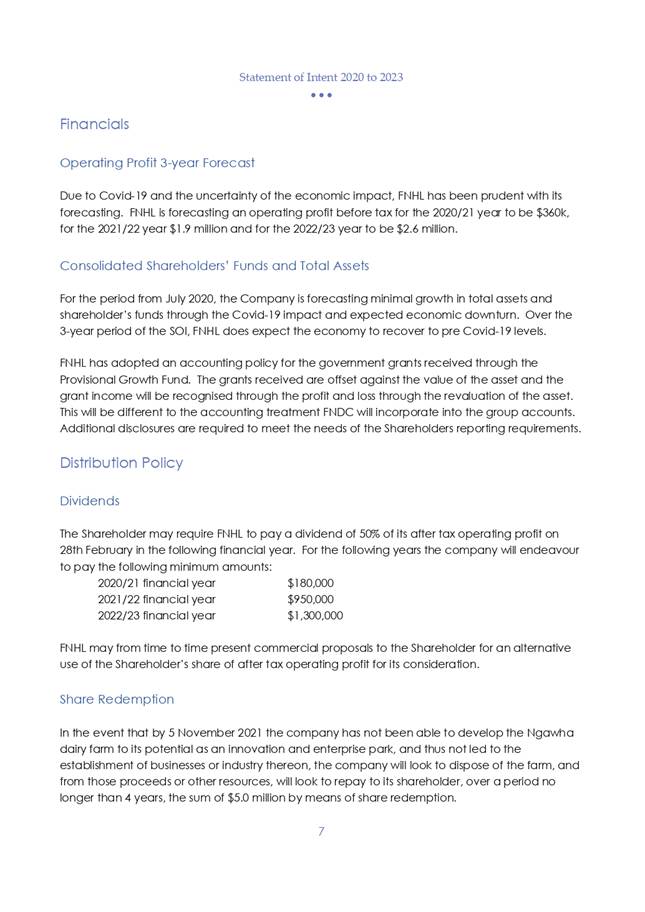

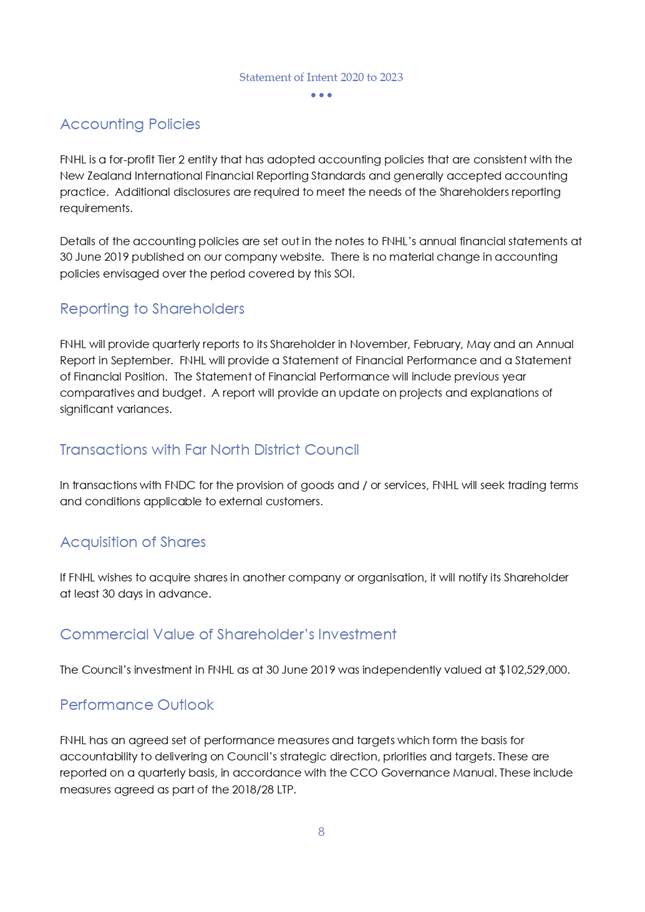

Executive Summary

The Schedule 8 (3) of the

Local Government Act 2002 requires Far North Holdings Limited to deliver a

final Statement of Intent to the Shareholder before the commencement of the

financial year to which it relates.

|

Recommendation

That the Assurance, Risk and Finance Committee receive

the report Far North Holdings Limited - Statement of Intent for the period

2020 to 2023.

|

Background

Far North Holdings

Limited delivered a draft Statement of Intent to the Shareholder and this was

reviewed at the Council meeting of 23 April 2020. At that meeting it was agreed

that a further workshop was required to enable the Shareholder to provide

feedback to the Board of Far North Holdings Limited on the Statement of Intent.

Discussion and Next Steps

A workshop was held 13

May 2020 where Board members of Far North Holdings Limited were in attendance.

To enable new elected members to understand the purpose of Far North Holdings

Limited a timeline that identified when and how Far North Holdings Limited came

into existence and the changes that had occurred over time was discussed.

It was agreed that the

Board of Far North Holdings Limited would review the draft Statement of Intent

to ensure that it responded to the issues raised in the resolution from the 23

April Council meeting:

Resolution 2020/22

Moved: Cr

John Vujcich

Seconded: Cr Mate Radich

That Council:

a) review

the comments from staff as identified and approve that:

i. the accounting policies needs

to advise that additional disclosures are required to meet the needs of the

Shareholders reporting requirements;

ii. the reference to a Statement of

Expectations be removed from the Statement of Intent as the Shareholder has not

yet taken any decisions in relation to the new sections of the Local Government

Act 2002;

iii. the Board membership section of the

Statement of Intent identifies which members will be retiring when and that all

appointments will be in line with Council policy.

b) advise

Far North Holdings Limited of any amendments that are suggested by the

shareholder, that are not covered in the report; and

c) that all amendments be notified, through

the Chief Executive, to the Board of Far North Holdings Limited prior to 30

April 2020.

And that Far North Holdings

Limited begin quarterly financial and risk reporting to the Assurance, Risk and

Finance Committee.’

It was also noted that

the impact that COVID–19 would need to be taken into consideration for

the dividend projections for the outer years of the statement.

Financial Implications and Budgetary Provision

There are no specific

financial implications arising from this report.

Attachments

1. FNHL Statement of

Intent 2020 - 2023 FINAL - A2895770 ⇩

|

Assurance, Risk and Finance Committee Meeting Agenda

|

17 June 2020

|

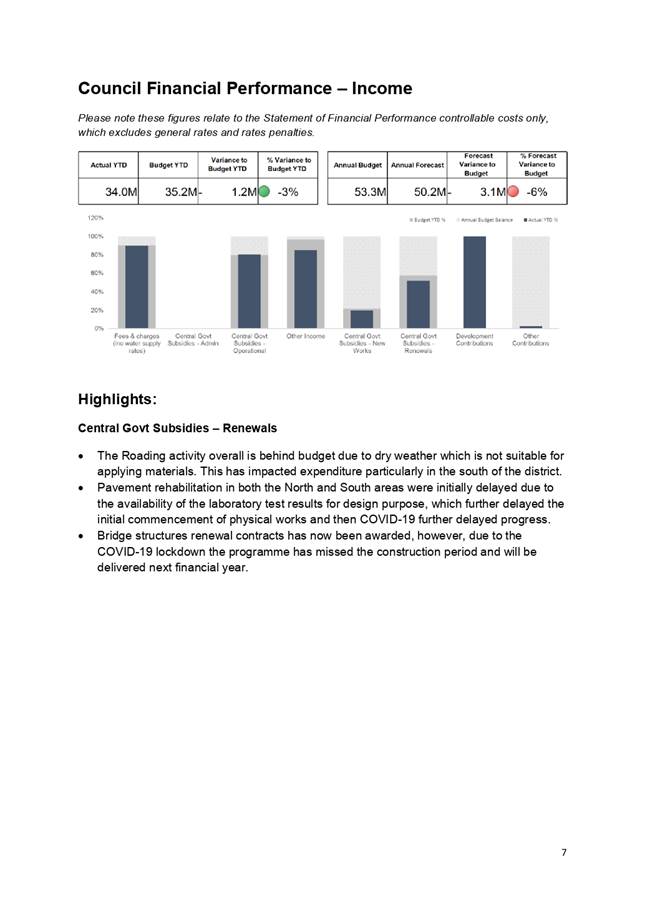

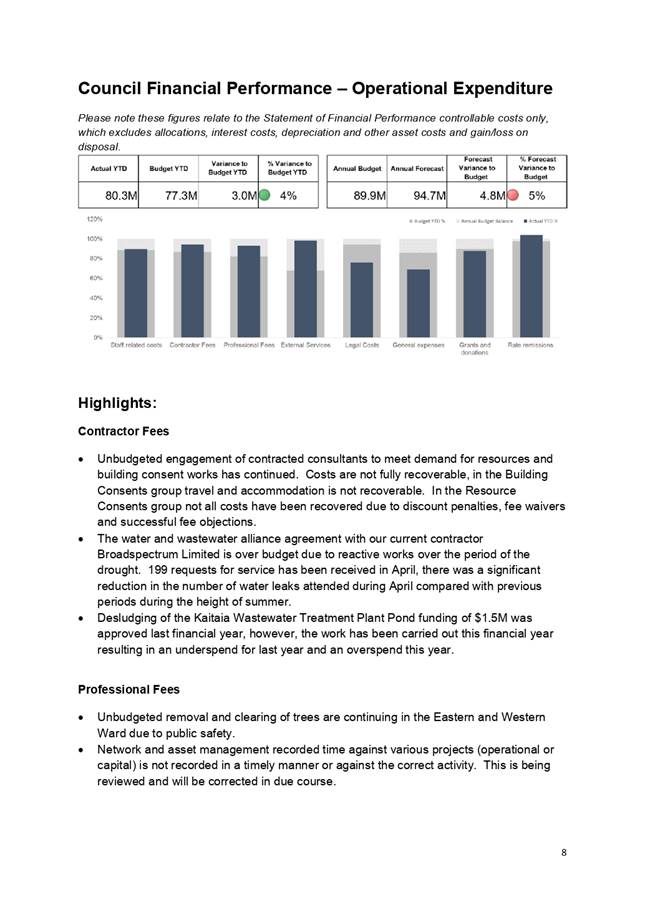

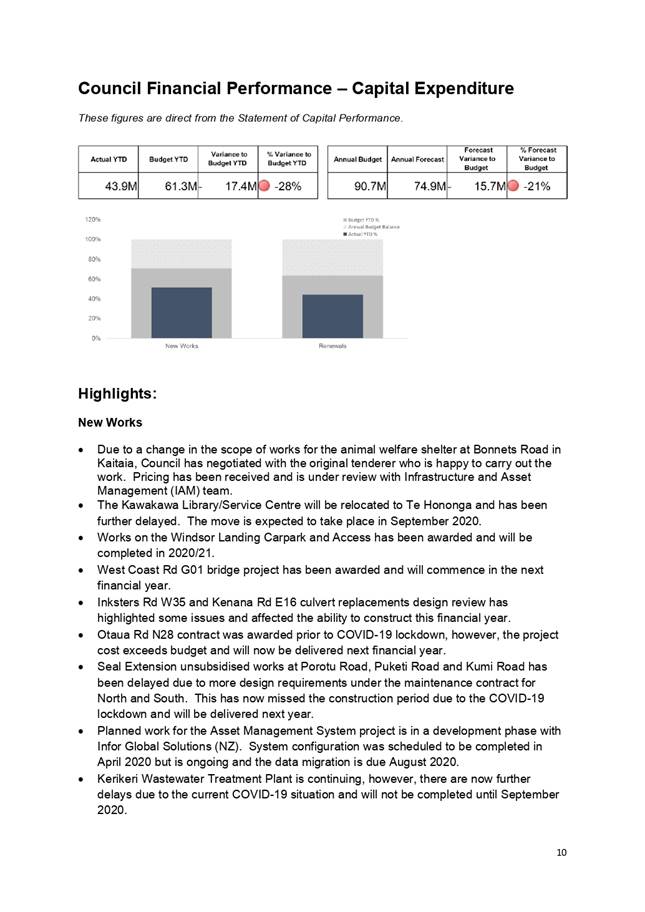

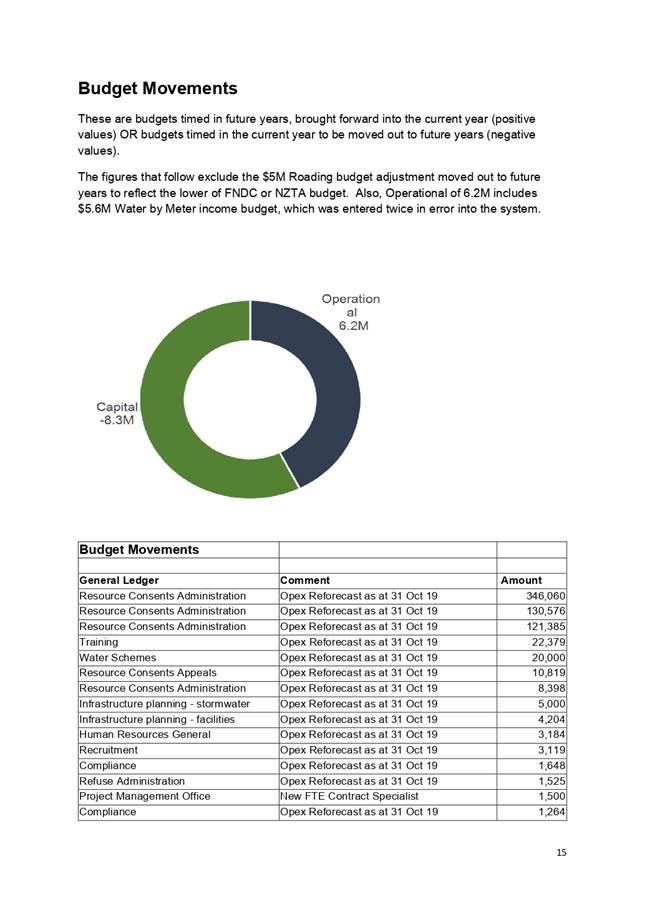

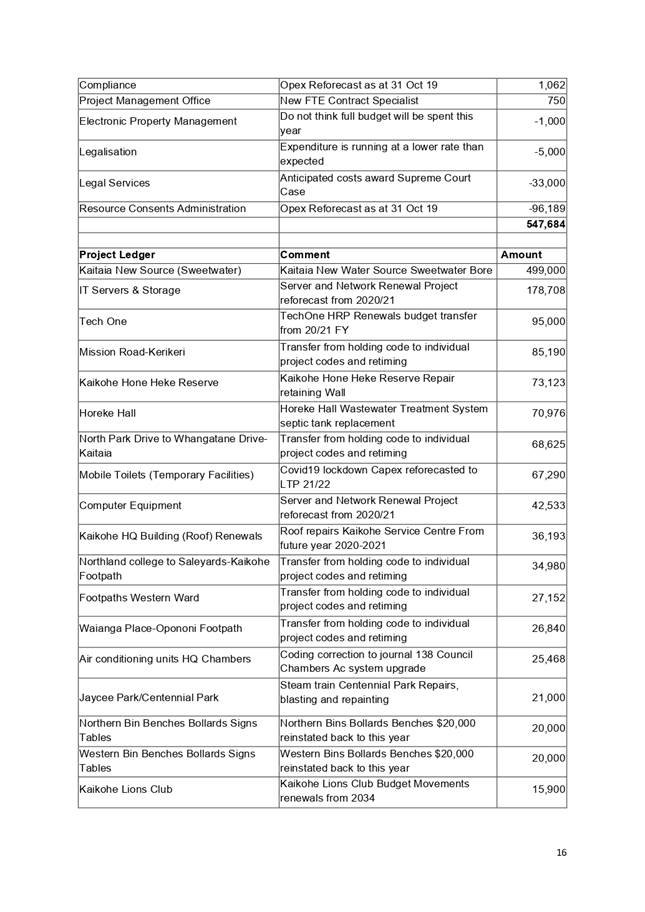

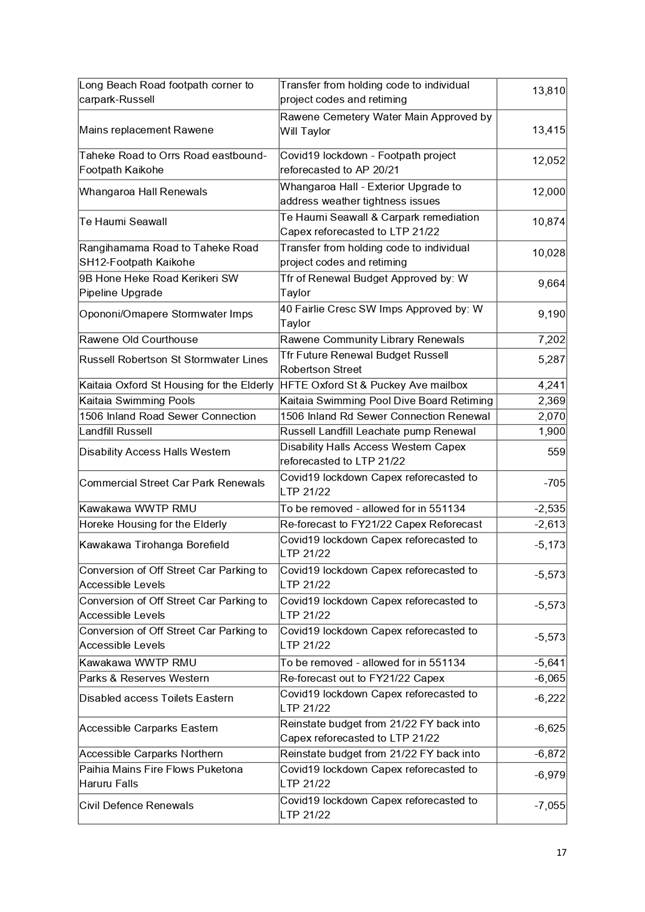

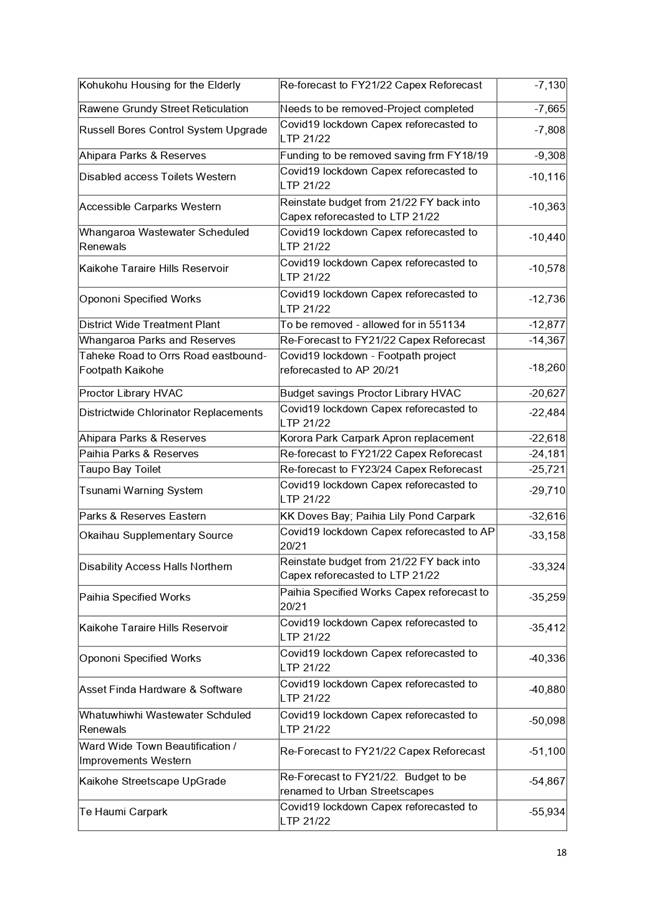

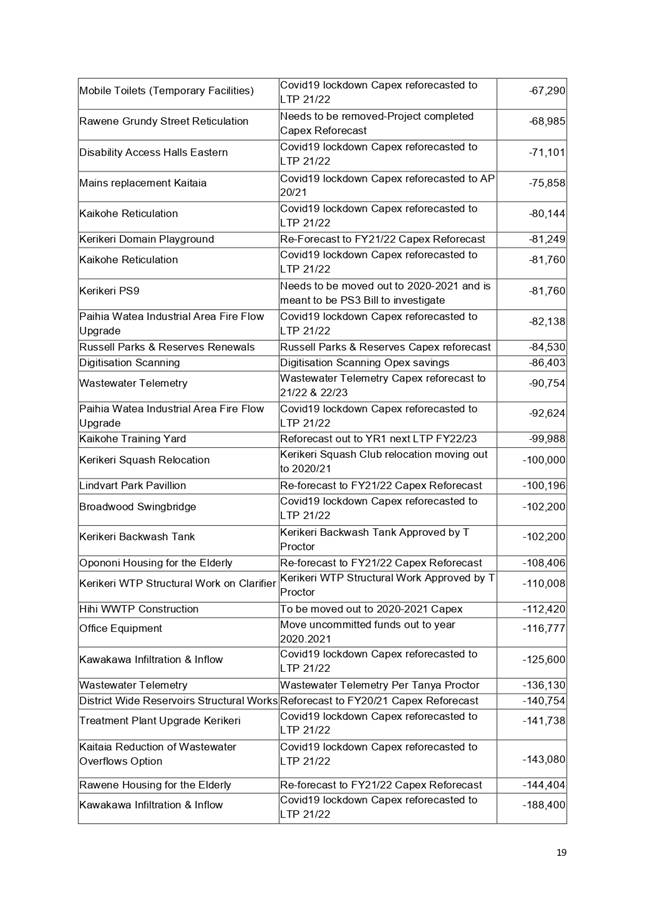

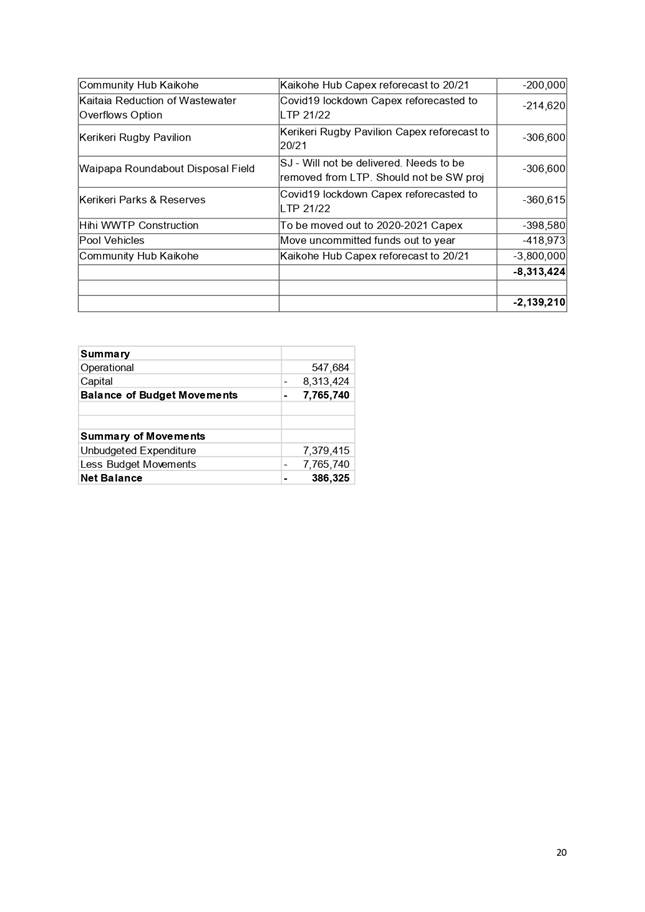

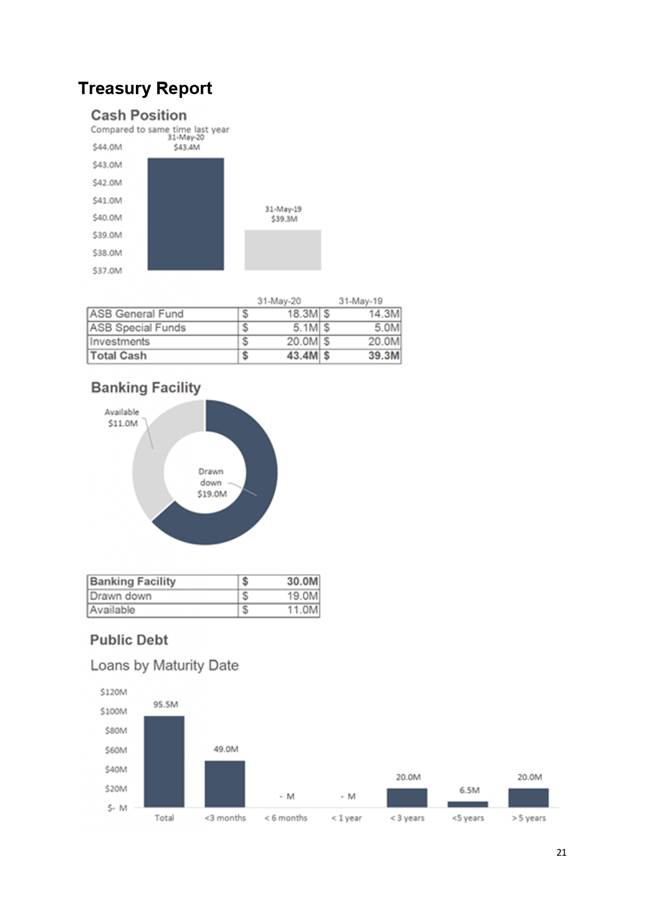

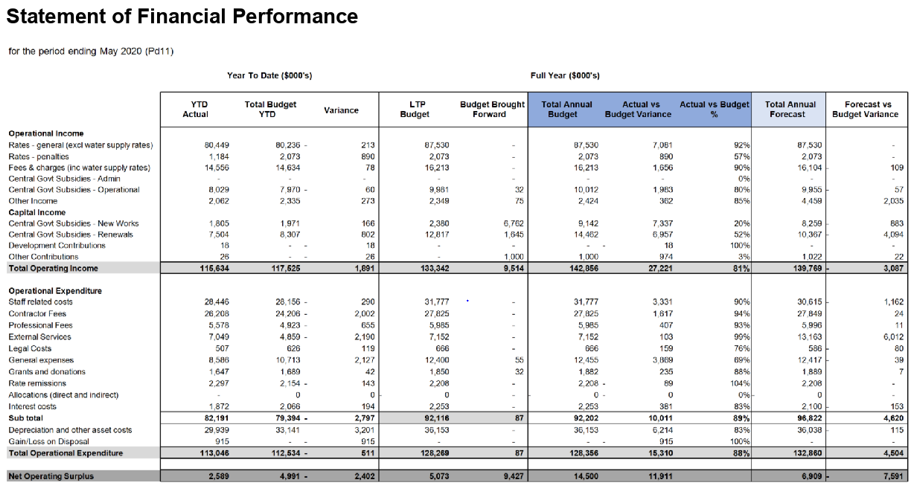

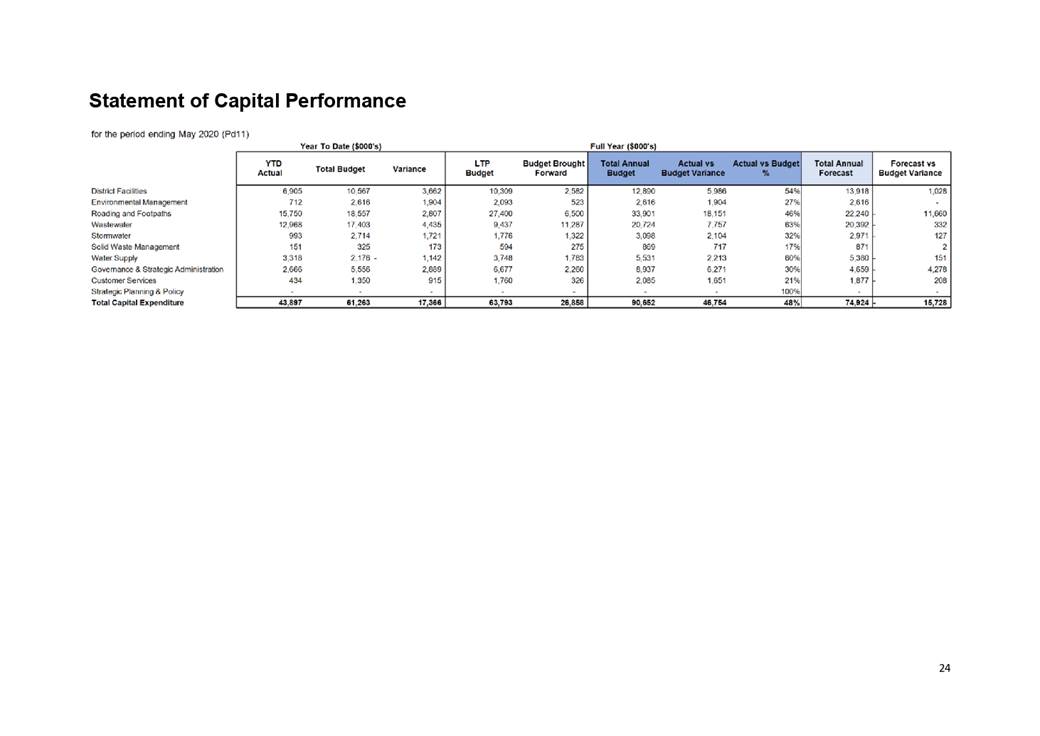

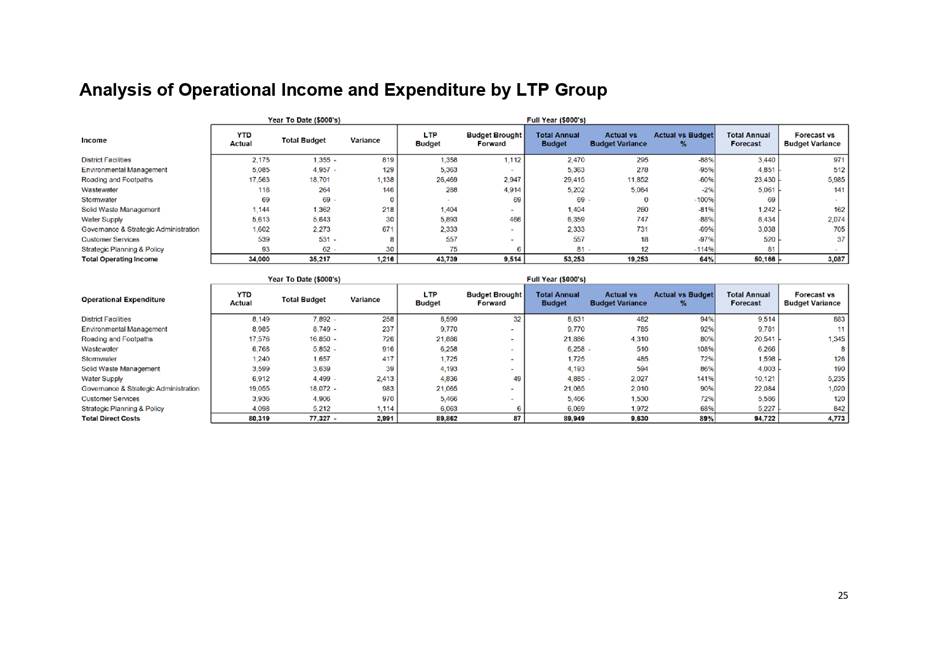

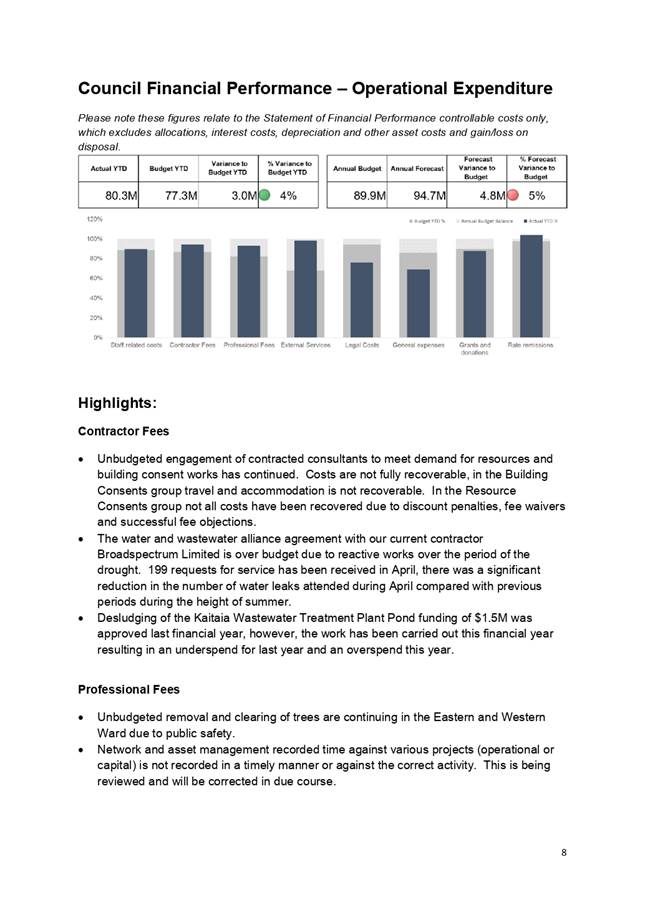

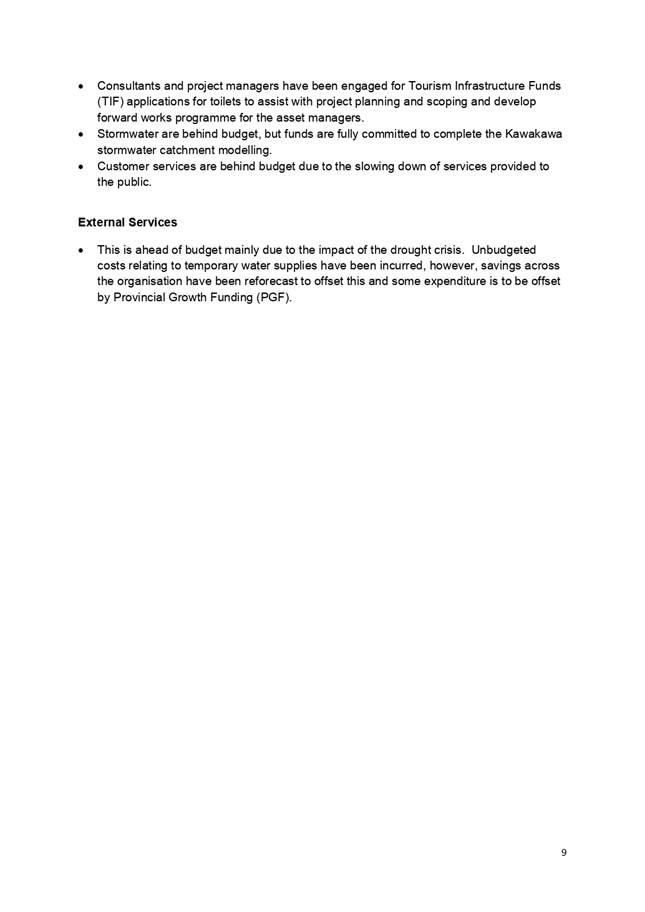

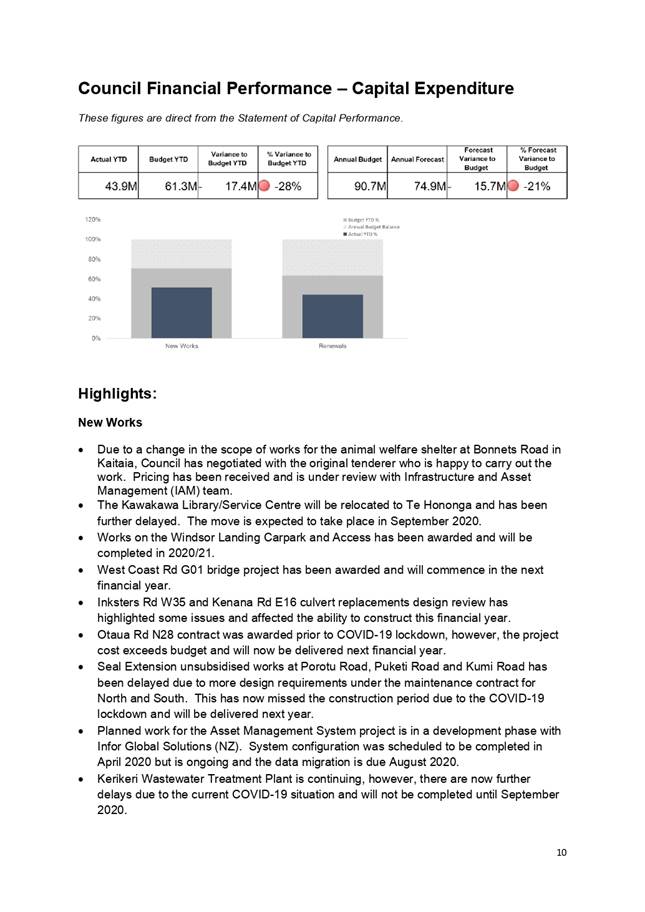

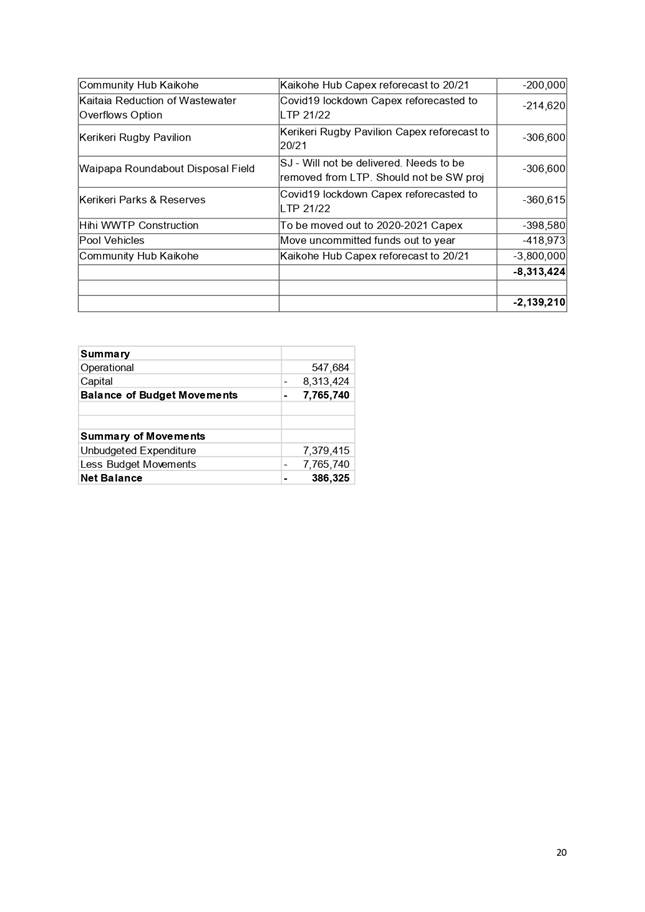

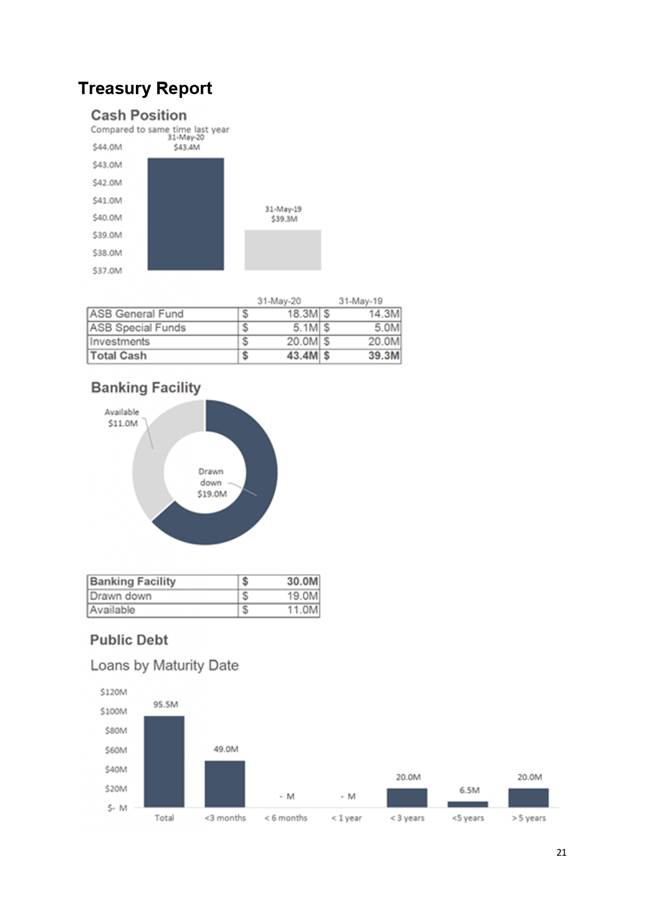

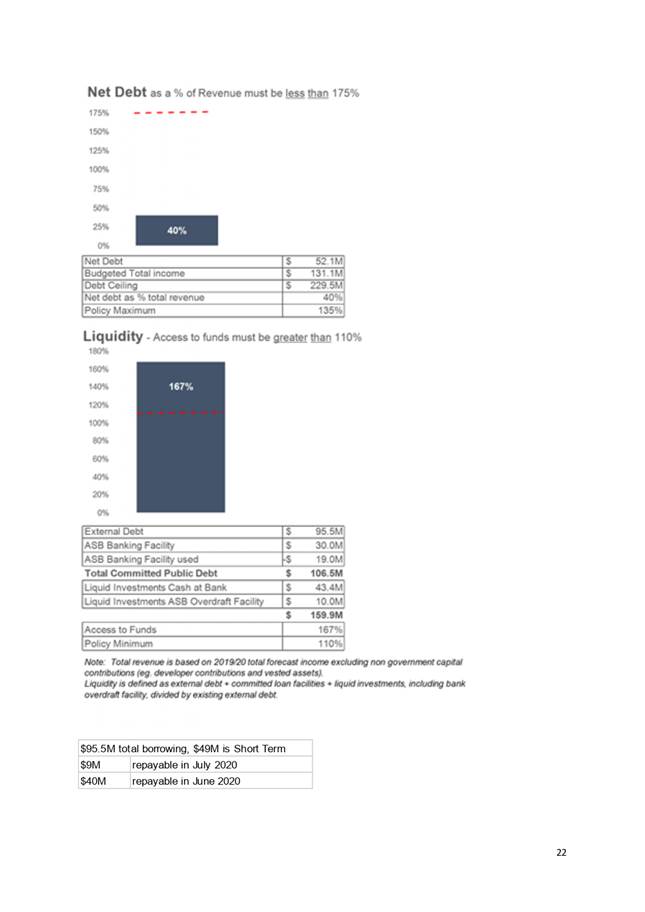

6.5 Council

Financial Report for the Period Ending 31 May 2020

File

Number: A2896330

Author: Angie

Thomas, Manager - Accounting Services

Authoriser: Janice

Smith, Chief Financial Officer

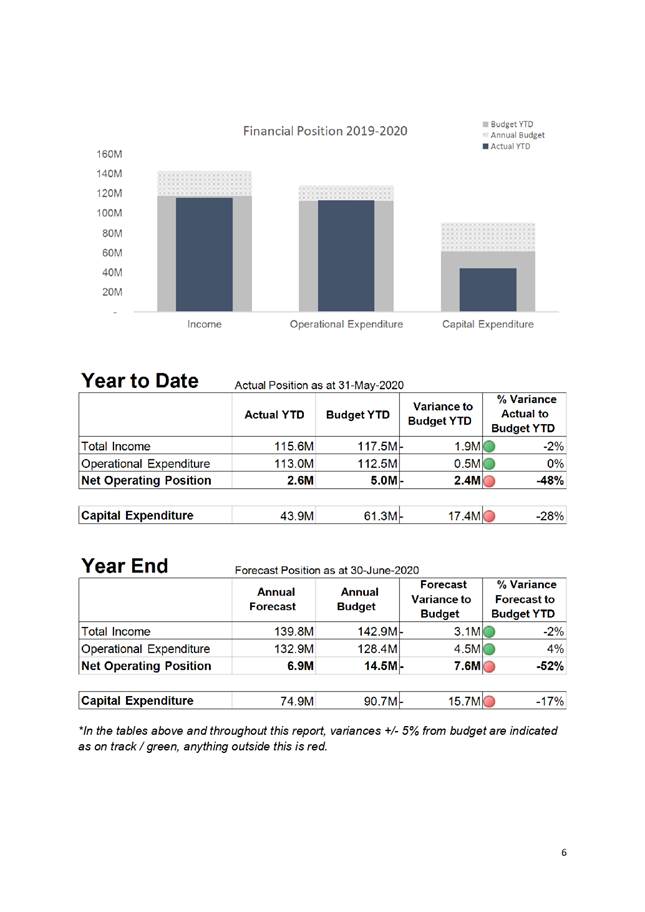

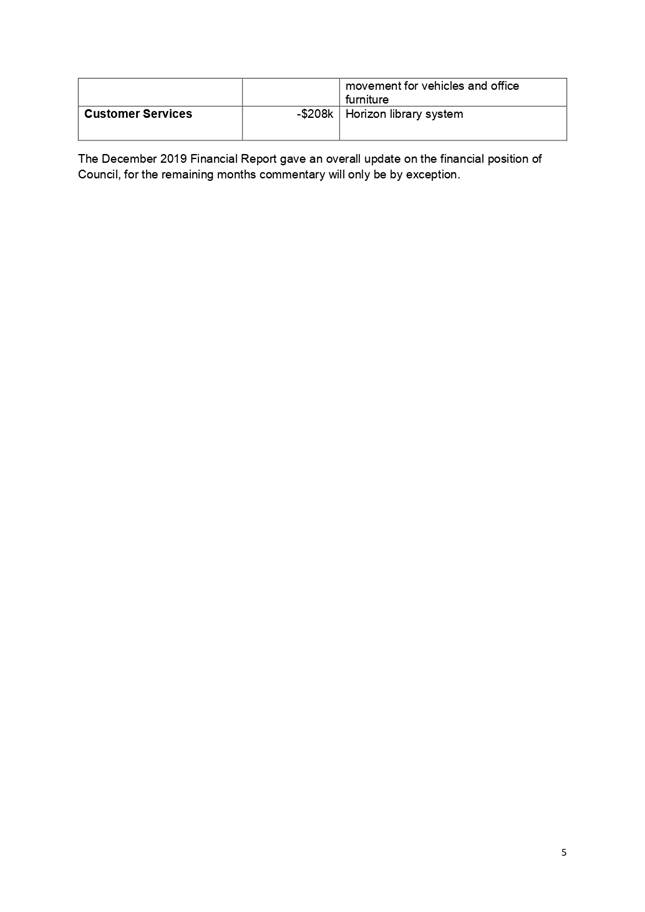

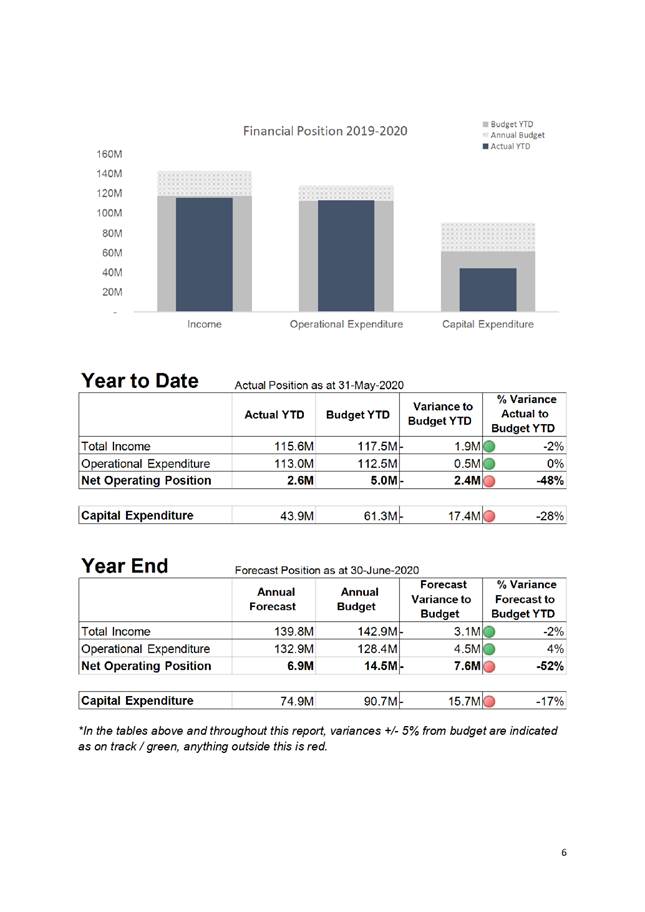

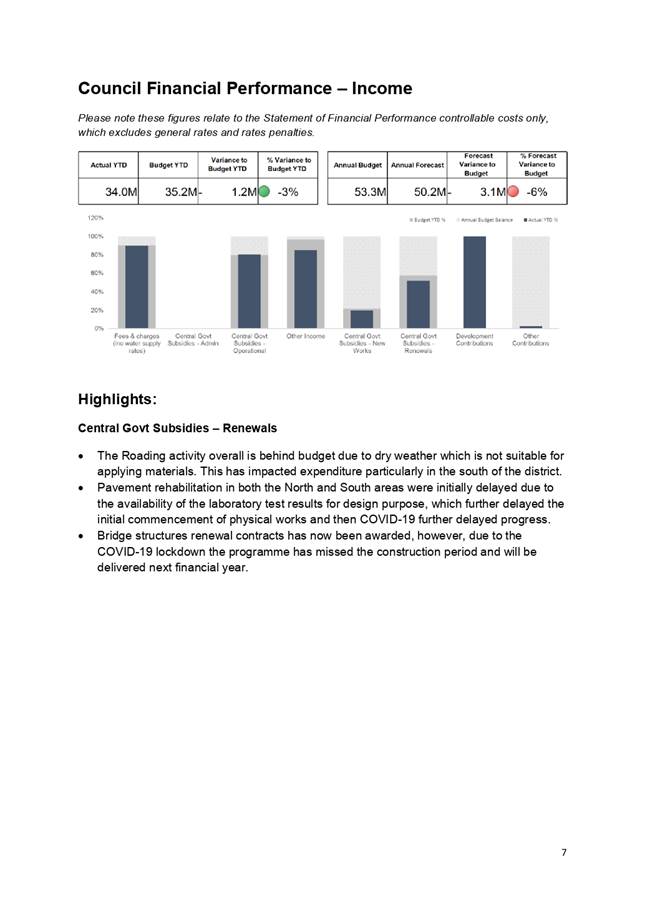

Purpose of the Report

To provide an overview

and information on the current financial position and performance of the Far

North District Council as at 31 May 2020.

Executive Summary

This report provides a summary overview,

Statement of Financial Performance, Capital Performance and Borrowing and

Investment reports.

|

Recommendation

That the Assurance, Risk and Finance Committee receive

the report Council Financial Report for the Period Ending 31 May 2020.

|

Background

This reports financial

information as at 31 May 2020.

Discussion and Next Steps

The report is for

information only.

Financial Implications and Budgetary Provision

There are no financial

implications or budgetary provisions required as a result of this report.

Attachments

1. Council Financial

Report May 2020 (Pd11) (003) - A2896529 ⇩

|

Assurance, Risk and Finance Committee Meeting Agenda

|

17 June 2020

|

7 Public

Excluded

RESOLUTION TO

EXCLUDE THE PUBLIC

|

Recommendation

That the public be excluded from the following parts of

the proceedings of this meeting.

The general subject matter of each matter to be considered

while the public is excluded, the reason for passing this resolution in

relation to each matter, and the specific grounds under section 48 of the

Local Government Official Information and Meetings Act 1987 for the passing

of this resolution are as follows:

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Ground(s) under section 48 for the

passing of this resolution

|

|

7.1 - Confirmation of Previous Minutes

|

s7(2)(h) - the withholding of the information is

necessary to enable Council to carry out, without prejudice or

disadvantage, commercial activities

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

7.2 - Far North Holdings Limited

Reappointment of Director

|

s7(2)(a) - the withholding of the information is

necessary to protect the privacy of natural persons, including that of

deceased natural persons

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

8 Karakia

Whakamutunga – Closing Prayer

9 Meeting

Close