AGENDA

Assurance, Risk and Finance Committee Meeting

Wednesday, 12 February 2020

|

Time:

|

1.00 pm

|

|

Location:

|

Council Chamber

Memorial Avenue

Kaikohe

|

Membership:

Councillor John

Vujcich - Chairperson

Mayor John

Carter

Member Bruce

Robertson

Councillor

Ann Court

Councillor

Mate Radich

Councillor

Kelly Stratford

Councillor

Moko Tepania

|

Assurance, Risk and Finance

Committee Meeting Agenda

|

12 February 2020

|

ASSURANCE, RISK

AND FINANCE COMMITTEE - MEMBERS REGISTER OF INTERESTS

|

Name

|

Responsibility (i.e. Chairperson

etc)

|

Declaration of

Interests

|

Nature of Potential

Interest

|

Member's Proposed

Management Plan

|

|

Hon John Carter QSO

|

Board Member of the

Local Government Protection Programme

|

Board Member of the

Local Government Protection Program

|

|

|

|

Carter Family Trust

|

|

|

|

|

John Vujcich (Chair)

|

Board Member

|

Pioneer Village

|

Matters relating to

funding and assets

|

Declare interest and

abstain

|

|

Director

|

Waitukupata Forest Ltd

|

Potential for council

activity to directly affect its assets

|

Declare interest and

abstain

|

|

Director

|

Rural Service Solutions

Ltd

|

Matters where council

regulatory function impact of company services

|

Declare interest and

abstain

|

|

Director

|

Kaikohe (Rau Marama)

Community Trust

|

Potential funder

|

Declare interest and abstain

|

|

Partner

|

MJ & EMJ Vujcich

|

Matters where council

regulatory function impacts on partnership owned assets

|

Declare interest and

abstain

|

|

Member

|

Kaikohe Rotary Club

|

Potential funder, or

impact on Rotary projects

|

Declare interest and

abstain

|

|

Member

|

New Zealand Institute

of Directors

|

Potential provider of

training to Council

|

Declare a Conflict of

Interest

|

|

Member

|

Institute of IT

Professionals

|

Unlikely, but possible

provider of services to Council

|

Declare a Conflict of

Interest

|

|

Member

|

Kaikohe Business

Association

|

Possible funding

provider

|

Declare a Conflict of

Interest

|

|

Bruce Robertson

(Deputy)

|

No Form Received

|

|

|

|

|

Deputy Mayor Ann

Court

|

Waipapa Business

Association

|

Member

|

|

Case by case

|

|

Warren Pattinson

Limited

|

Shareholder

|

Building company. FNDC

is a regulator and enforcer

|

Case by case

|

|

Kerikeri Irrigation

|

Supplies my water

|

|

No

|

|

Top Energy

|

Supplies my power

|

|

No other interest

greater than the publics

|

|

District Licensing

|

N/A

|

N/A

|

N/A

|

|

Top Energy Consumer

Trust

|

Trustee

|

Crossover in regulatory

functions, consenting economic development and contracts such as street

lighting.

|

Declare interest and

abstain from voting.

|

|

Ann Court Trust

|

Private

|

Private

|

N/A

|

|

Waipapa Rotary

|

Honorary member

|

Potential community

funding submitter

|

Declare interest and

abstain from voting.

|

|

Properties on Onekura

Road, Waipapa

|

Owner Shareholder

|

Any proposed FNDC

Capital works or policy change which may have a direct impact (positive/adverse)

|

Declare interest and

abstain from voting.

|

|

Property on Daroux Dr,

Waipapa

|

Financial interest

|

Any proposed FNDC

Capital works or policy change which may have a direct impact (positive/adverse)

|

Declare interest and

abstain from voting.

|

|

Flowers and gifts

|

Ratepayer 'Thankyou'

|

Bias/ Pre-determination?

|

Declare to Governance

|

|

Coffee and food

|

Ratepayers sometimes

'shout' food and beverage

|

Bias or

pre-determination

|

Case by case

|

|

Staff

|

N/A

|

Suggestion of not being

impartial or pre-determined!

|

Be professional, due

diligence, weigh the evidence. Be thorough, thoughtful, considered impartial

and balanced. Be fair.

|

|

Warren Patteinson

|

My husband is a builder

and may do work for Council staff

|

|

Case by case

|

|

Ann Court - Partner

|

Warren Pattinson

Limited

|

Director

|

Building Company. FNDC

is a regulator

|

Remain at arm’s

length

|

|

Air NZ

|

Shareholder

|

None

|

None

|

|

Warren Pattinson

Limited

|

Builder

|

FNDC is the consent

authority, regulator and enforcer.

|

Apply arm’s

length rules

|

|

Kurbside Rod and Custom

Club (unlikely)

|

President NZ Hot Rod Association

|

Potential to be linked

to a funding applicant and my wife is on the decision-making committee.

|

unlikely to materialise

but would absent myself from any process as would Ann.

|

|

Property on Onekura

Road, Waipapa

|

Owner

|

Any proposed FNDC

capital work in the vicinity or rural plan change. Maybe a link to policy

development.

|

Would not submit.

Rest on a case by case basis.

|

|

Mate Radich

|

No form received

|

|

|

|

|

Kelly Stratford

|

KS Bookkeeping and

Administration

|

Business Owner,

provides book keeping, administration and development of environmental

management plans

|

None perceived

|

Step aside from

decisions that arise, that may have conflicts

|

|

Waikare Marae Trustees

|

Trustee

|

Maybe perceived

conflicts

|

Case by case basis

|

|

Bay of Islands College

|

Parent Elected Trustee

|

None perceived

|

If there was a

conflict, I will step aside from decision making

|

|

Karetu School

|

Parent Elected Trustee

|

None perceived

|

If there was a

conflict, I will step aside from decision making

|

|

Maori title land

– Moerewa and Waikare

|

Beneficiary and husband

is a shareholder

|

None perceived

|

If there was a

conflict, I will step aside from decision making

|

|

Sister is employed by

Far North District Council

|

|

|

Wil not discuss

work/governance mattes that are confidential

|

|

Gifts - food and

beverages

|

Residents and

ratepayers may ‘shout’ food and beverage

|

Perceived bias or

predetermination

|

Case by case basis

|

|

Kelly Stratford - Partner

|

Chef and Barista

|

Opua Store

|

None perceived

|

|

|

Maori title land

– Moerewa

|

Shareholder

|

None perceived

|

If there was a conflict

of interest, I would step aside from decision making

|

|

Moko Tepania

|

Teacher at Te Kura

Kaupapa Māori o Kaikohe.

|

Potential Council

funding that will benefit my place of employment.

|

|

Declare a perceived

conflict

|

|

Chairperson at Te Reo o

Te Tai Tokerau Trust.

|

Potential Council

funding for events that this trust runs.

|

|

Declare a perceived

conflict

|

|

Tribal Member –

Te Rūnanga o Te Rarawa

|

As a descendent of Te

Rarawa I could have a perceived conflict of interest in Te Rarawa Council

relations.

|

|

Declare a perceived

conflict

|

|

Tribal Member - Te

Rūnanga o Whaingaroa

|

As a descendent of Te

Rūnanga o Whaingaroa I could have a perceived conflict of interest in Te

Rūnanga o Whaingaroa Council relations.

|

|

Declare a perceived

conflict

|

|

Tribal Member –

Kahukuraariki Trust Board

|

As a descendent of

Kahukuraariki Trust Board I could have a perceived conflict of interest in

Kahukuraariki Trust Board Council relations.

|

|

Declare a perceived

conflict

|

|

Tribal Member –

Te Rūnanga ā-Iwi o Ngāpuhi

|

As a descendent of Te

Rūnanga ā-Iwi o Ngāpuhi I could have a perceived conflict of

interest in Te Rūnanga ā-Iwi o Ngāpuhi Council relations.

|

|

Declare a perceived

conflict

|

Members need to

stand aside from decision-making when a conflict arises between their role as a

Member of the Committee and any private or other external interest they might

have. This note is provided as a reminder to Members to review the matters on

the agenda and assess and identify where they may have a pecuniary or other

conflict of interest, or where there may be a perception of a conflict of

interest.

If a Member

feels they do have a conflict of interest, they should publicly declare that at

the start of the meeting or of the relevant item of business and refrain from

participating in the discussion or voting on that item. If a Member thinks they

may have a conflict of interest, they can seek advice from the Chief Executive

Officer or the Team Leader Democracy Support (preferably before the meeting).

It is noted

that while members can seek advice the final decision as to whether a conflict

exists rests with the member.

2 Deputation

No requests for deputations were received at the time of the

Agenda going to print.

3 Information

Reports

3.1 Audit

Management Report for June 2019

File

Number: A2823691

Author: Janice

Smith, Chief Financial Officer

Authoriser: William

J Taylor MBE, General Manager - Corporate Services

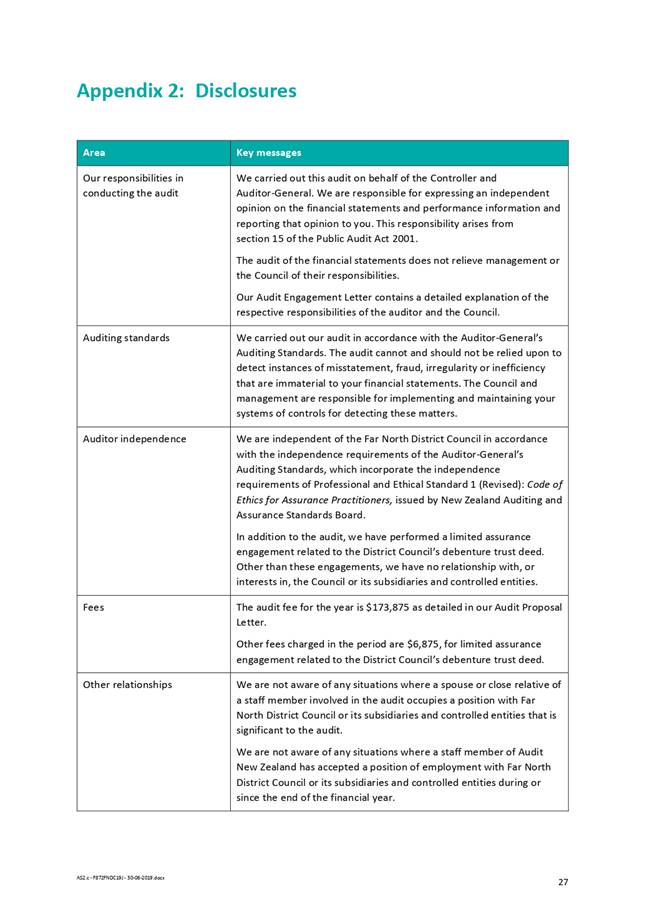

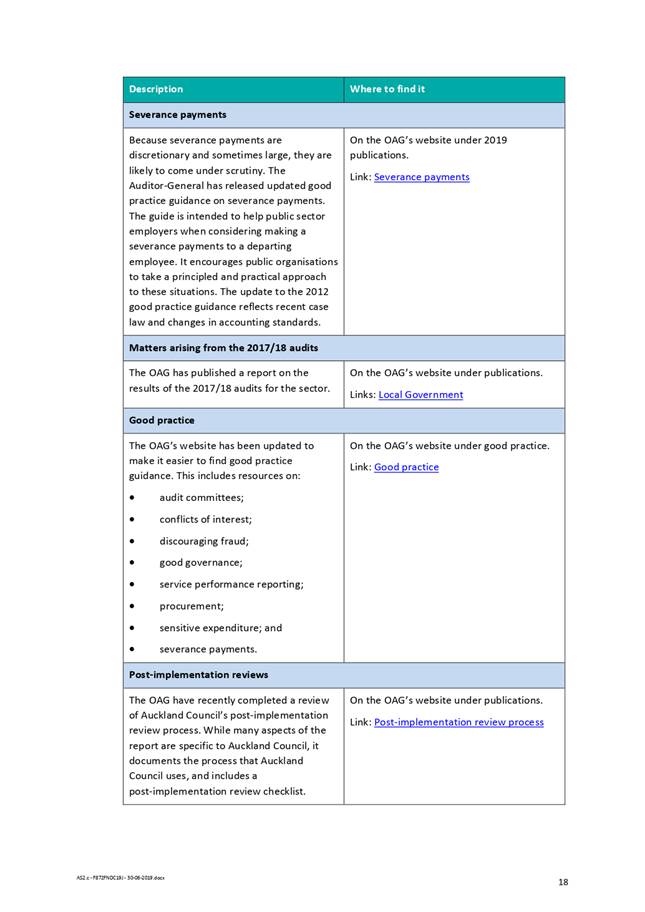

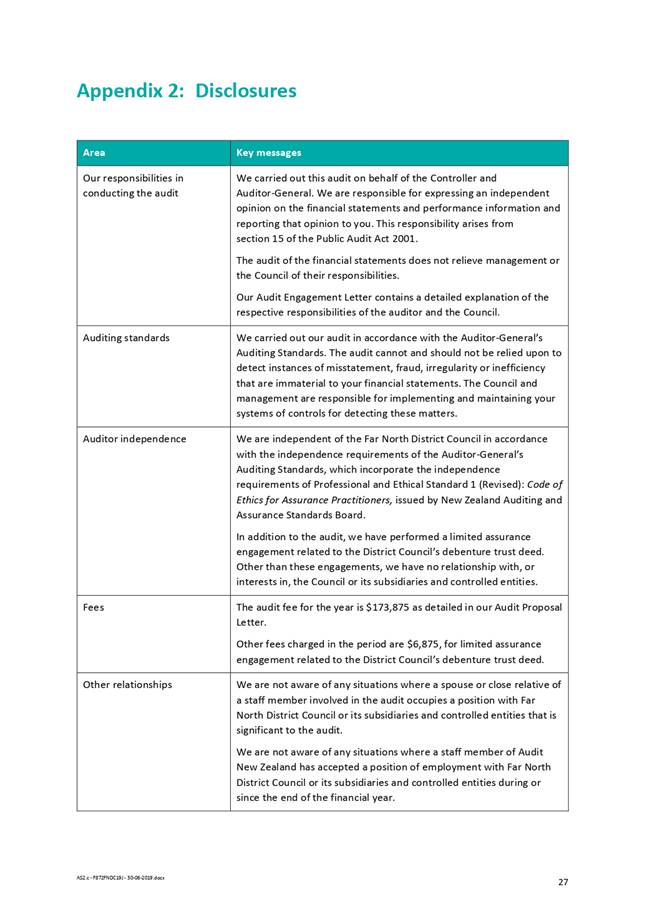

Purpose of the Report

To present the final

Audit Management Report for the Annual Report process for June 2019.

Executive Summary

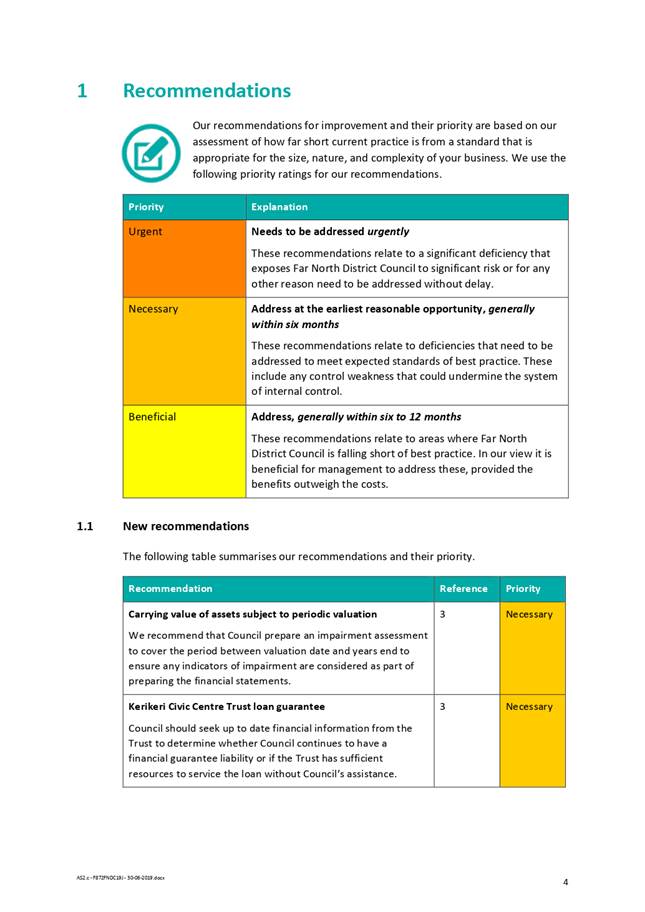

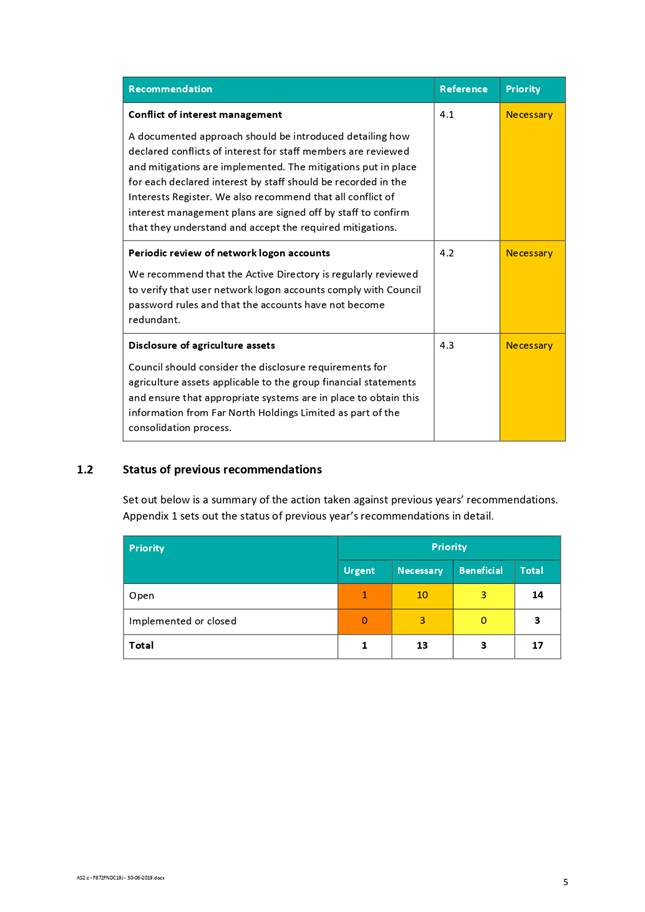

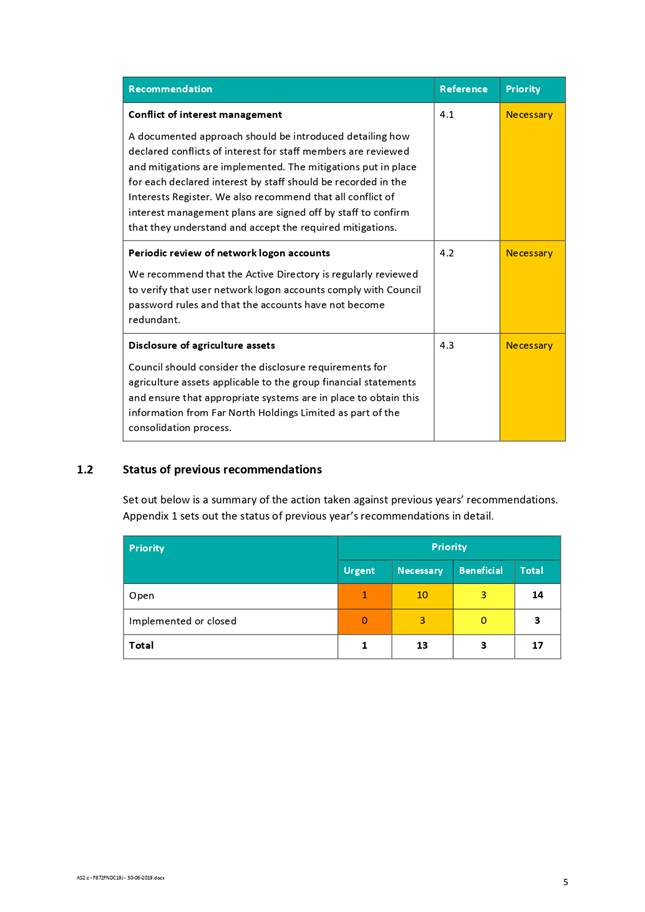

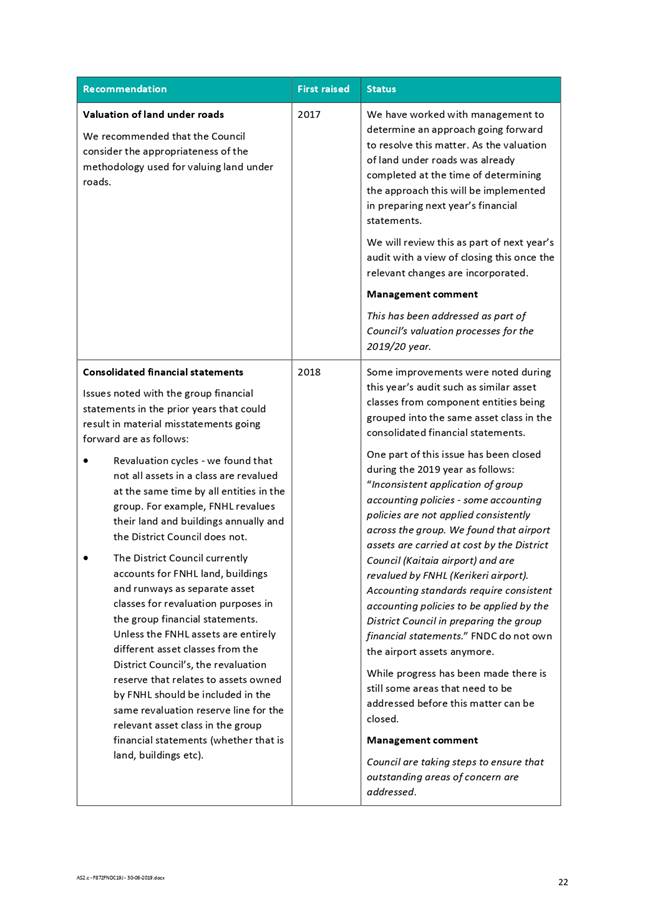

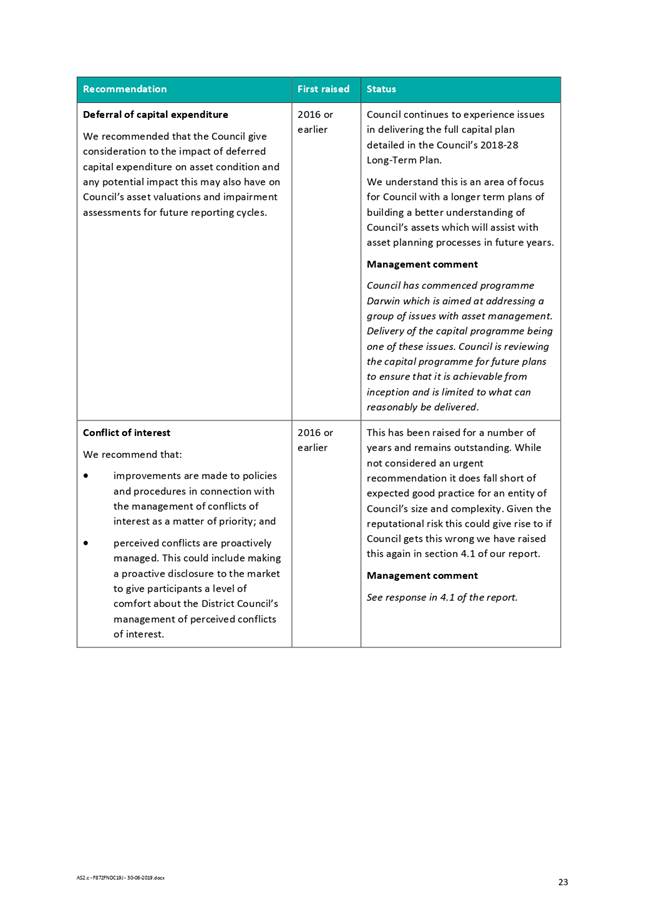

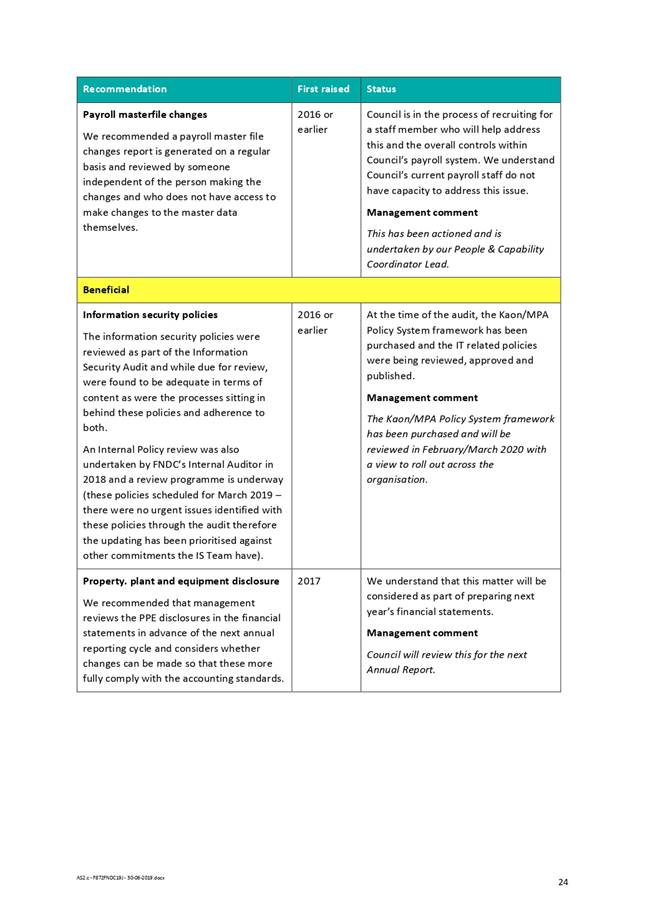

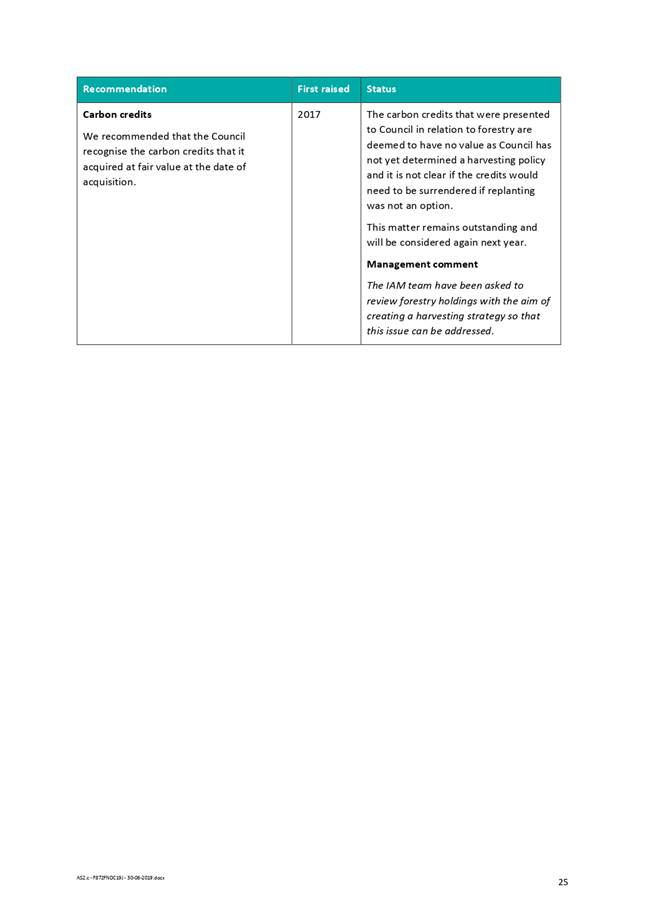

· Audit New Zealand prepares an Audit Management report upon the

closure of each Annual report audit. This contains issues that require

management response as well as issues that remain outstanding from previous

reports.

|

Recommendation

That

the Assurance, Risk and Finance Committee receive the report “Audit Management

Report for June 2019”.

|

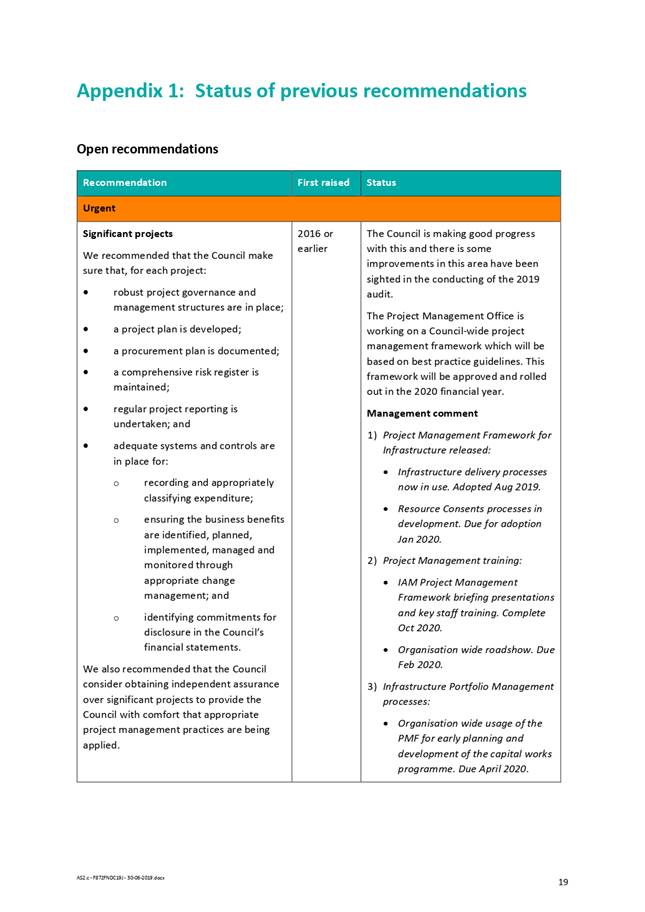

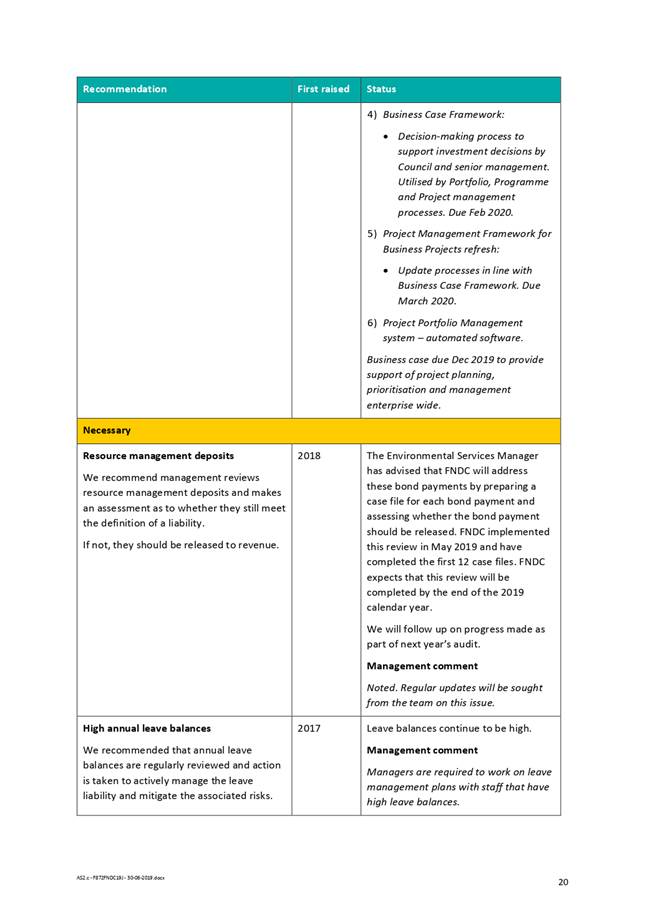

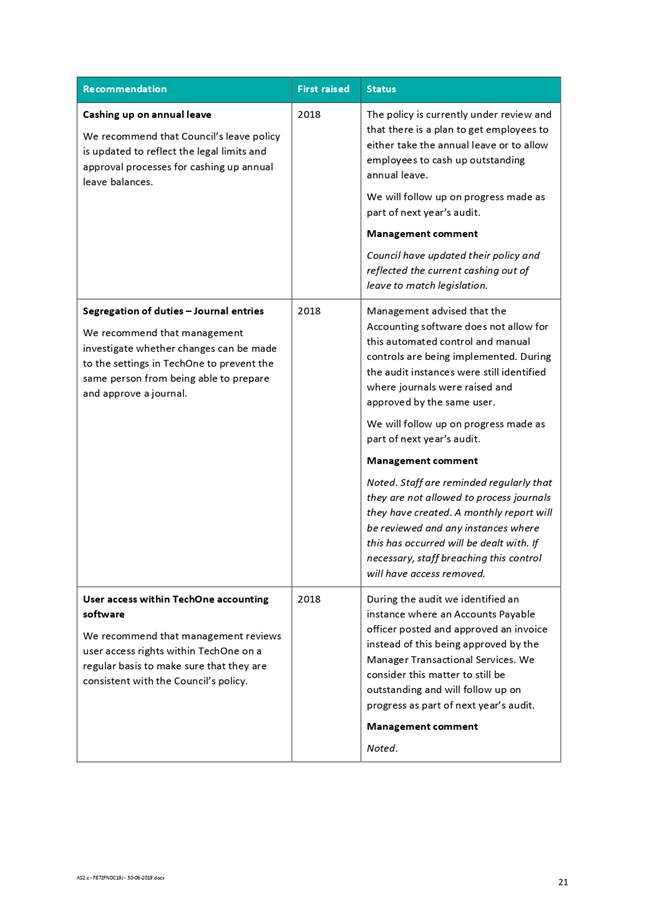

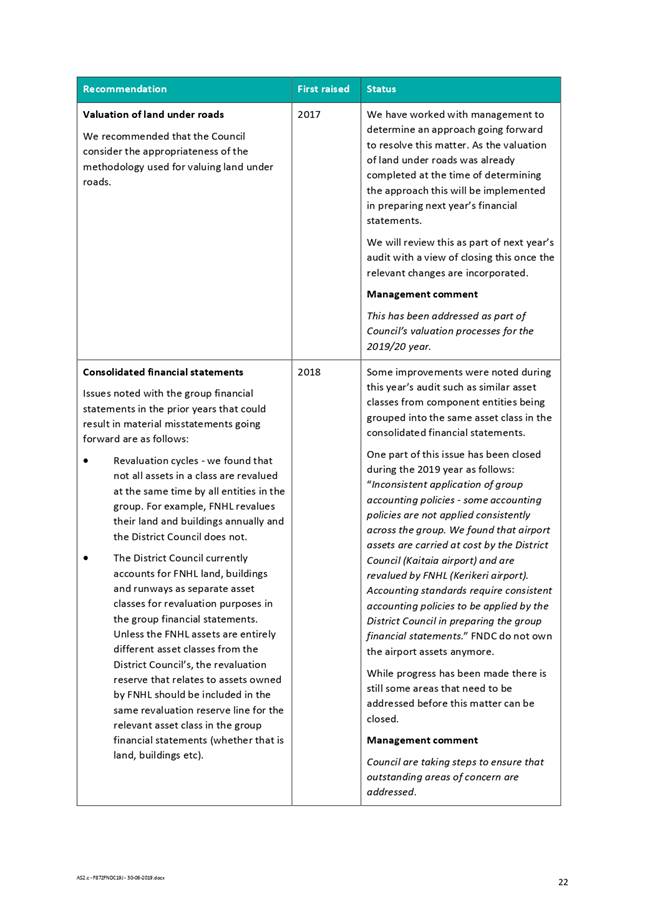

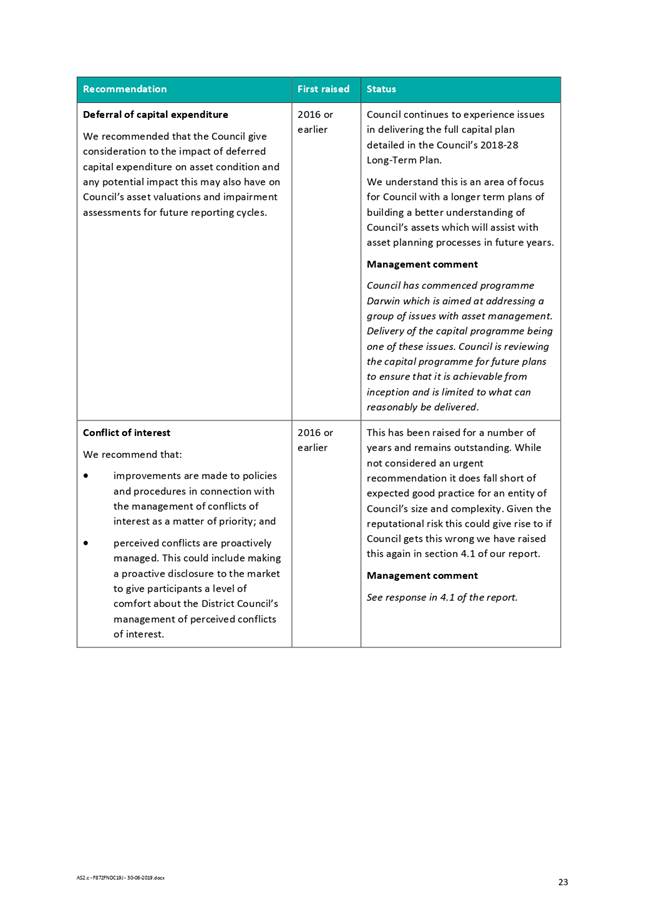

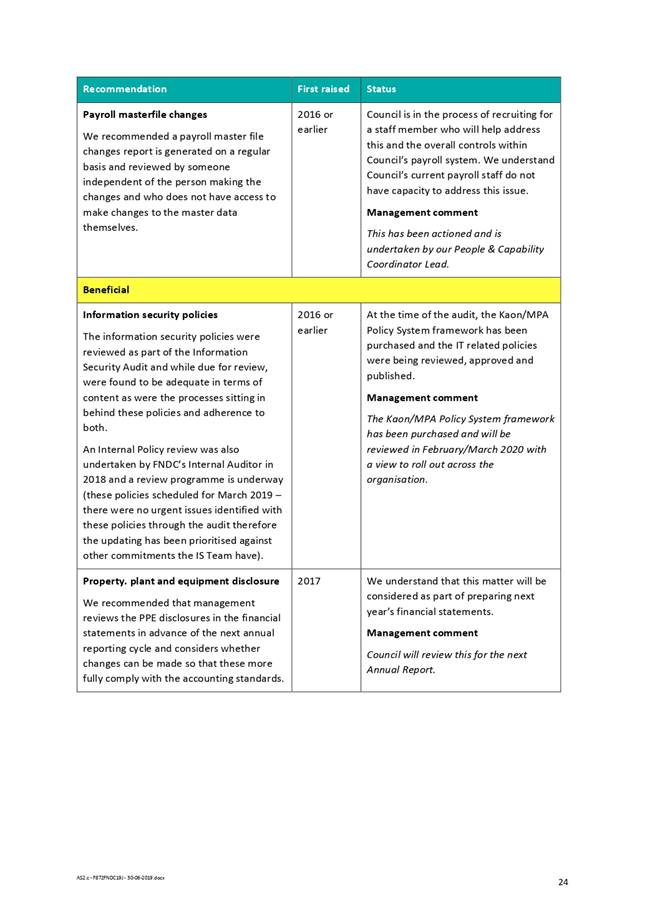

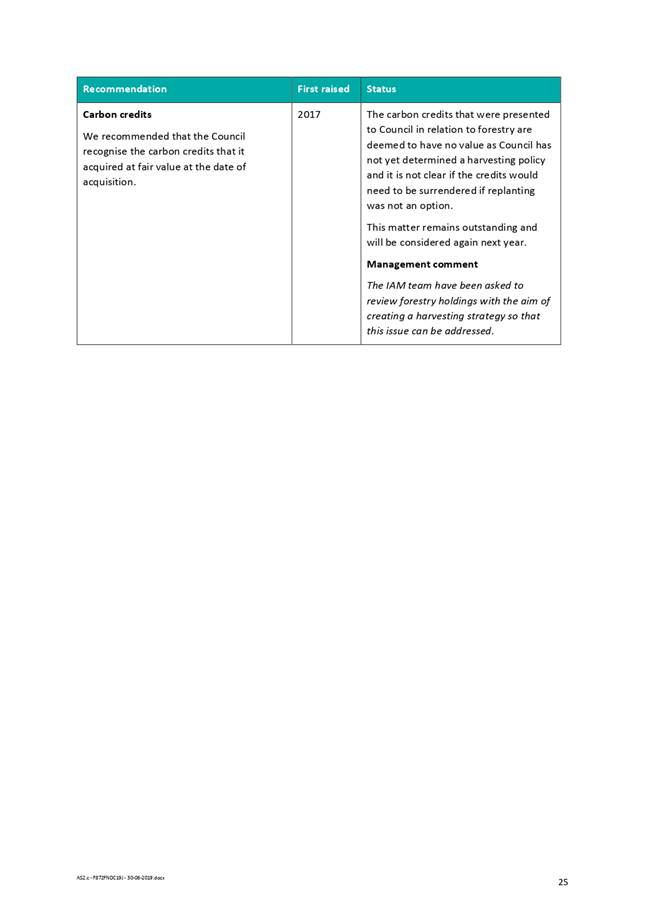

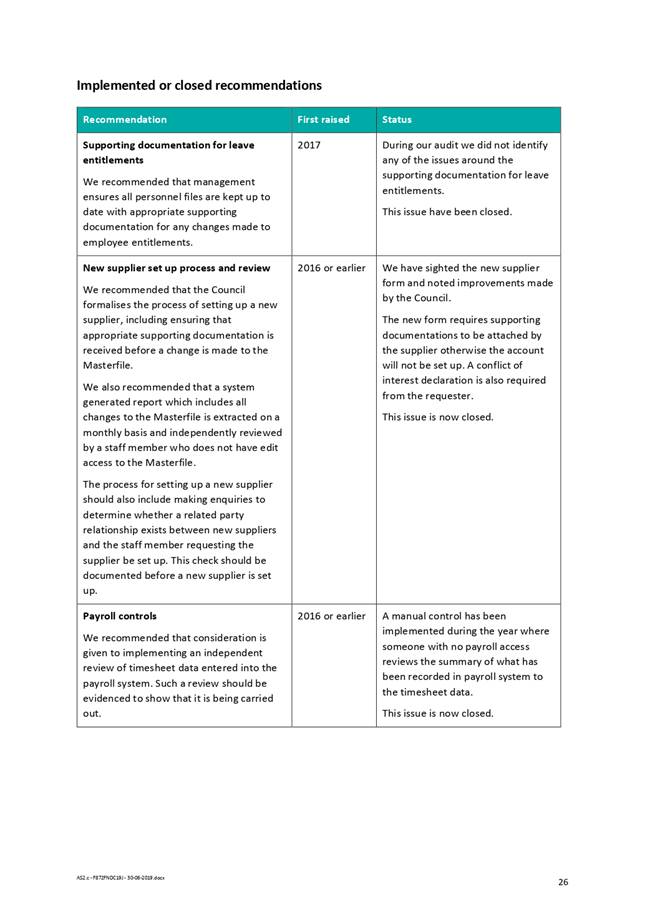

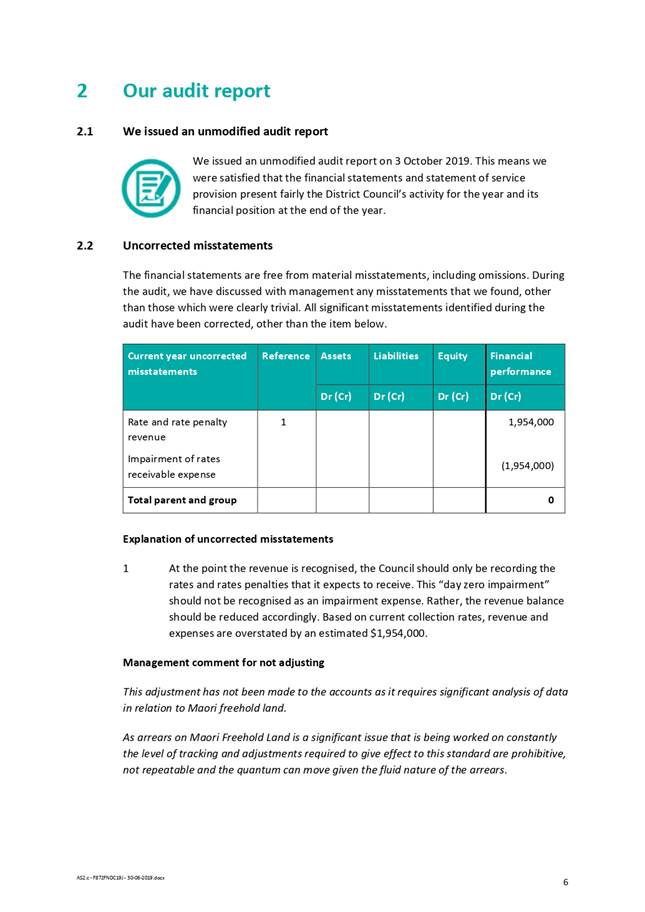

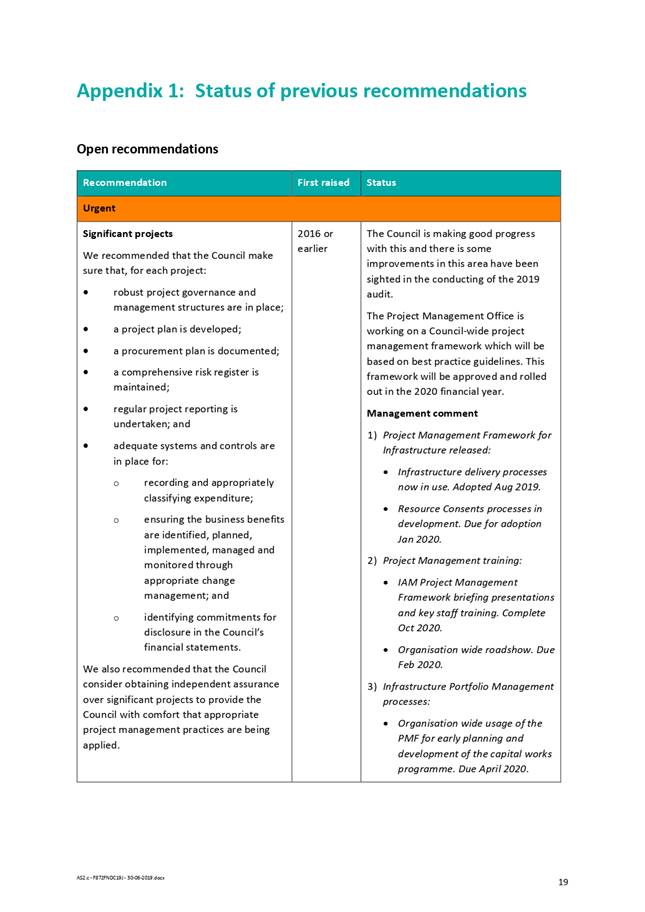

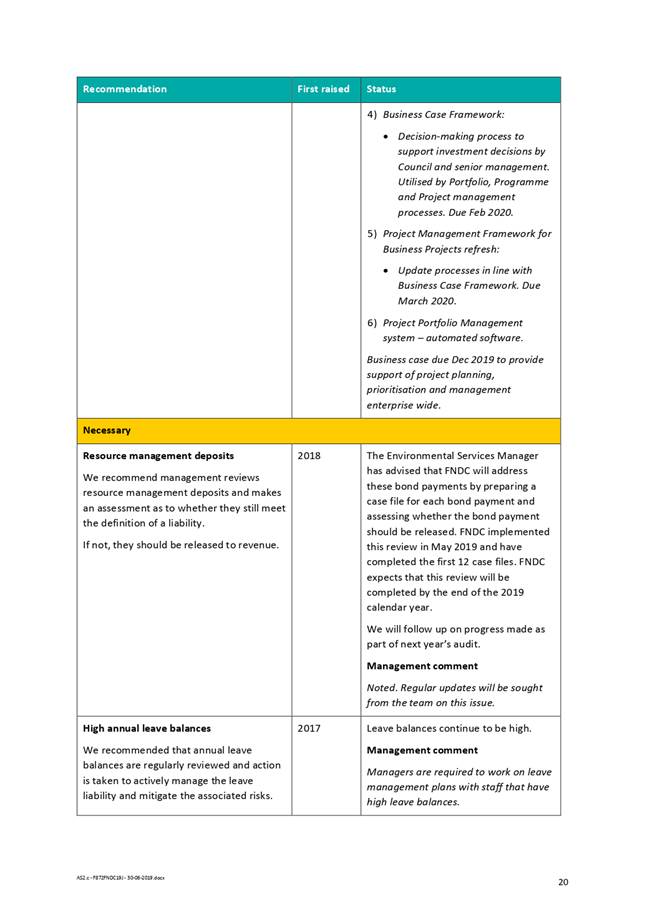

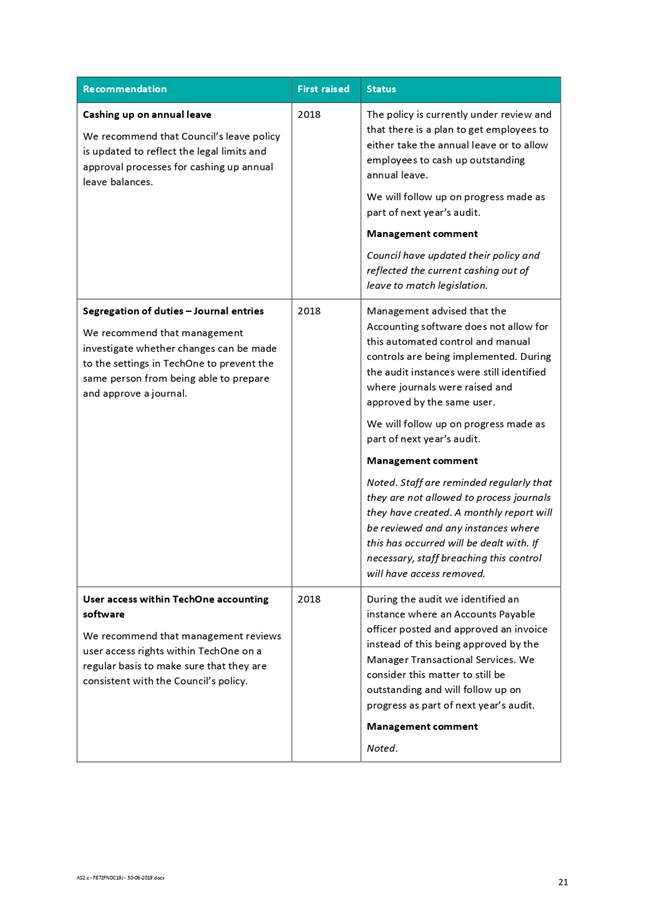

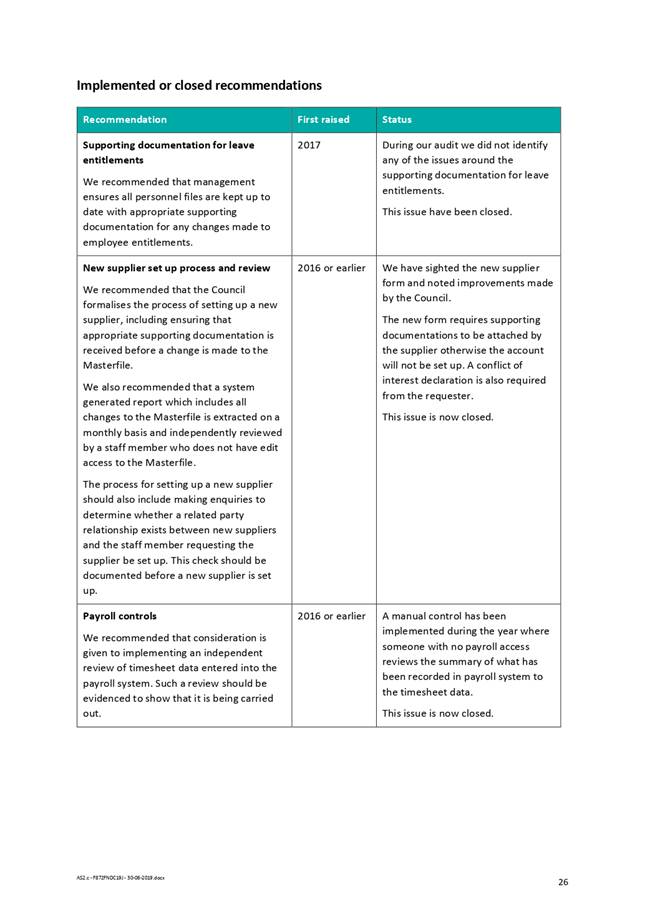

1) Background

Audit New Zealand

prepares an Audit Management report upon the closure of each Annual report

audit. This contains issues that require management response as well as issues

that remain outstanding from previous reports. The current report for June 2019

identifies five new issues which are deemed “necessary” with 17

issues from prior audits of which three are now closed with 14 remaining

“active” as part of this report.

2) Discussion and Options

The report was approved

for release to Council by the Audit Manager on the 28th November

2019.

The one

“urgent” item that remains open from prior audits relates to

project management. The Project Management Framework has now been rolled out in

the IAM team and it is anticipated that this issue will be either closed

completely or reduced to a lower level in the next audit management report.

The report contains

management’s response on all issues raised.

Reason

for the recommendation

The actions required in relation to this report are covered

separately in the Audit and Assurance reports to this committee.

3) Financial Implications and Budgetary

Provision

There are no specific financial implications associated with

this report.

Attachments

1. Audit

Management Report June 2019 - A2823685 ⇩

|

Assurance, Risk and Finance

Committee Meeting Agenda

|

12 February 2020

|

3.2 Revenue

Recovery Report - February 2020

File

Number: A2825732

Author: Margriet

Veenstra, Manager - Transaction Services

Authoriser: William

J Taylor MBE, General Manager - Corporate Services

Purpose of the Report

The purpose of this

report is to provide regular reporting to the Far North District Council

Assurance, Risk and Finance Committee.

Executive Summary

·

This is the first report for the financial year

2019/20 and provides information on action taken to collect the current and

arrears balances for rates, water and sundry debt, and to provide information

on how collection is tracking against targets.

|

Recommendation

That the Assurance, Risk and Finance Committee receive

the report “Revenue Recovery Report - February 2020”.

|

Background

This document has been

prepared to outline current and arrears balances for rates, water and sundry

debtors as at 31 December 2019 and the actions taken by the Debt Management

Team for the collection of the debt.

This information is part

of the standing items reported to the Committee on a regular basis.

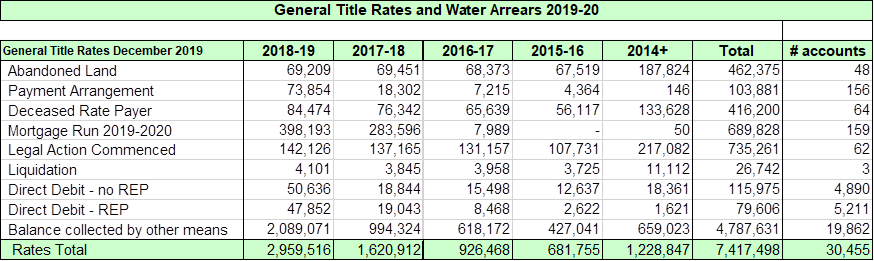

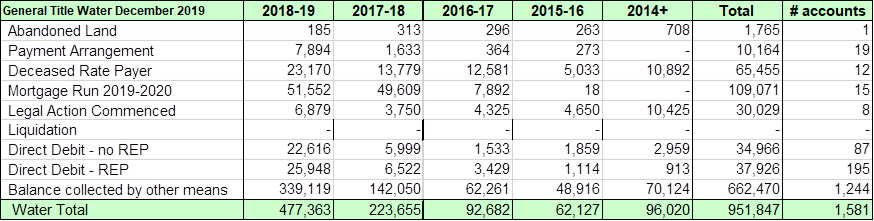

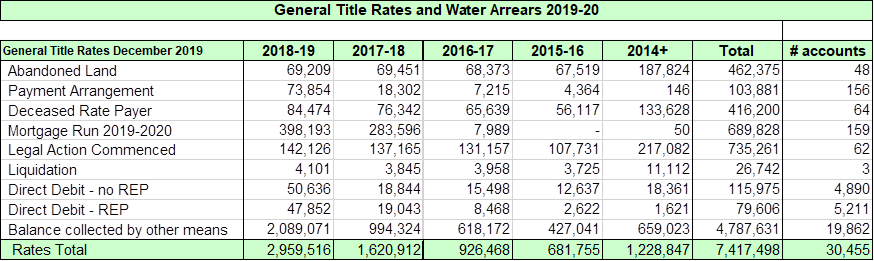

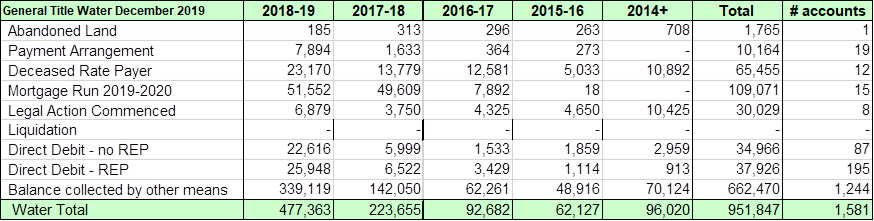

Discussion and Next Steps

The information has been

identified for general title and Māori Freehold Land rates and water accounts. Sundry debtors,

which is another revenue stream for council, is shown in a separate table.

The total arrears balance for

general title rates has reduced by 21% since 31 July 2019 and water by 35%. Māori Freehold Land

rates has reduced by 1% since 31 July 2019 and water by 8%.

Below are the actions and focus

areas for the first half of the rating year for the Debt Management Team for the collection of the general

title rates and water.

· Continuing from last rating year, there are 64 properties

currently with an external Law Firm to proceed with legal action for rates and

water arrears.

o Action

commenced on 45 properties;

§ Judgment

by default was received for one property and another 6 have been submitted this

month. A further 14 to be submitted in January 2020 once the deadline has

passed.

§ 5 were

paid in full and 11 have a Deed of Settlement agreement in place

§ Owners for

3 properties are to officially abandon the land

§ 5 require

additional action, including serving of substituted service.

o The

remaining 19 properties were withdrawn from legal proceedings as they were

deemed to be Māori Land or subject to the 1967 Act.

o Next

action(s) for properties where default judgment has been obtained, is to be

discussed and agreed with Council.

· First

phase of mortgage demand for general title properties commenced in December for

194 accounts with another 300 identified for the second phase for which

mortgage demand will be issued in February to ensure payment by the end of the

rating year.

· Continuous audit of existing Arrangements to Pay to ensure the

agreements are being met.

· Ongoing

promotion of the Internal Affairs Rates Rebates Scheme in day to day

communications with Ratepayers.

Of the total number of accounts marked as ‘Balance to

be collected by other means’:

· 56%

of the arrears balance is made up of last year’s outstanding rates and

65% of the last two years.

· Of

the 65%, we are due to commence the next tranche of Mortgage Demand for another

35% in February 2020.

· For

the remaining 35%, the arrears balance is split across several years. Those

with the highest debt balance, will have received Final Demand letters and are

waiting to be referred for Legal proceedings once the first groups have been

completed.

The Te Hono team

relations and development initiatives have opened communications about payment

of rates for Māori Freehold Land.

· Debt Management

have been asked to provide and discuss payment options for some property owners

in the past months.

· A list of 57 Māori Freehold land properties with Mortgages with a

debt totalling $373K have been passed to the Te Hono team to initiate

conversations prior to mortgage demand which is due to take place 20 February

2020.

Focus for the second half of the rating year for general

title rates and water will be:

· Mortgage

demand to be issued for a further 300 properties on 20 February 2020, together

with 57 Māori Freehold Land properties.

· A

letter to be sent to the remaining properties with mortgages but with low

arrears balances, notifying them that they will be included in mortgage demand

next rating year if the arrears balance is not addressed.

· Final

mortgage demand for the 1st phase of 194 accounts will be issued on

the 20th of March 2020.

· Details

for all identified Abandoned Land properties will be passed for feedback in

February 2020 to Council, Community Groups, Iwi, the NRC and Māori Land Court.

· Direct

Debit switch/set up offer supported by ASB to be introduced with option for

another offer next rating year to promote the Online Services launch.

· An article has been prepared in cooperation with the

Communications team for publication in all local papers in January/February to

explain Council is getting tougher on debt, outlining the options available to

rate payers who have arrears.

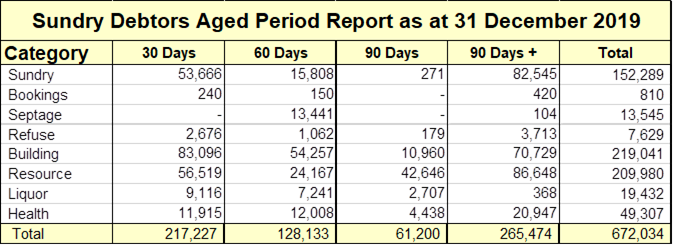

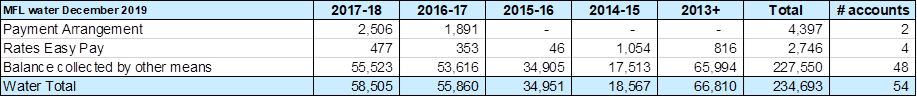

The total sundry debtors

aged debt has been reduced by 61% since 30 June 2019. The Debtors ledger was

split alphabetically between Debt Management Officers at the start of the

rating year, with each team member focussing on aged debt. Additionally, the

team have:

· Regular monthly meetings with Compliance Support and

Building Consents Support teams to resolve outstanding issues and implement

process improvement where applicable.

· Continued collaboration with Council Legal team for advice

and support for aged debt collection.

· Closed current accounts in Pathway without any activity for

more than a year to avoid incorrect invoicing.

Financial Implications and Budgetary Provision

Provision

is made annually for doubtful debts in relation to the arrears owed to council.

A higher provision for Māori Freehold land rates and water is made in comparison to

General Title rates and water due to the difference in collection options

available to Council.

Attachments

1. 2020-02-12 ARF

Revenue recovery Report attachment - A2825313 ⇩

|

Assurance, Risk and Finance Committee Meeting Agenda

|

12 February 2020

|

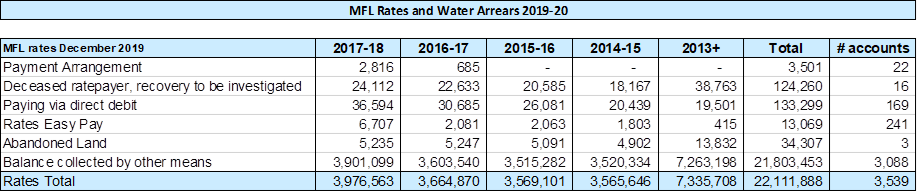

General

Title rates and water rates analysis by age at 31 December 2019

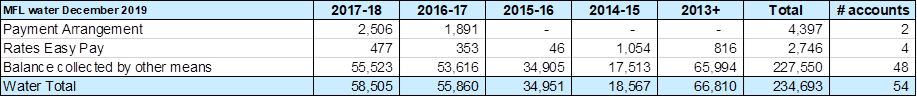

Māori Freehold Land rates and water analysis by age

at 31 December 2019.

Sundry Debtors by age for 31 December 2019.

3.3 Internal

Audit and Assurance Report

File

Number: A2826403

Author: Lisa

Huria, Audit and Assurance Specialist

Authoriser: William

J Taylor MBE, General Manager - Corporate Services

Purpose of the Report

To provide an update on work completed within the Far North District

Council Assurance Programme 2019.

Executive Summary

· This report

provides an update on work completed within the FNDC Assurance Programme 2019.

· Update on the

number of internal and external audit recommendations that have been completed

or are currently underway.

|

Recommendation

That the Assurance, Risk and Finance Committee receive

the report Internal Audit and Assurance Report.

|

Background

The Audit, Risk, and

Finance Committee approved the FNDC Assurance Programme 2019 at its March 2019 meeting.

This programme covered

several areas requiring assurance such as TechnologyOne User Access, Conflict

of Interest Management and the development and implementation of a Legislative

Compliance Framework.

TechnologyOne

User Access

As per Audit New Zealand

recommendation, a review was undertaken to ensure Chief Executive financial

delegations to staff were entered correctly into the TechnologyOne system.

The review found there

were some minor inconsistencies such as job titles that had changed slightly or

had become obsolete. These inconsistencies had occurred mainly because of

department and/or team realignments. In the future steps will be taken to

ensure the Register of Delegations and TechnologyOne is updated when necessary.

Conflict

of Interest Management

As per Audit New Zealand

recommendation, a review was undertaken to ensure conflicts of interest are

being managed for new and existing staff.

This review found that

Employee Interest Declaration forms had been completed and received for 97% of

298 current staff employed before 2019. Management plans for staff that

declared any perceived, potential or actual conflicts have been put in place

for a number of these staff but there are still some to be completed.

43% of 103 staff that

commenced employment during 2019 have yet to complete the Employee Interest

Declaration form which has highlighted the need to improve this process. This

improvement is now in progress. A follow up internal audit is scheduled for

2020.

Legislative

Compliance Framework

A Legislative Compliance

Framework is an essential part of managing risk in any organisation. It enables

Council to carry out its statutory functions and duties by establishing and

maintaining a system for monitoring and reporting on compliance with all relevant

legislation.

Research

to look at what other Councils are doing in this area has been completed. There

are a variety of systems in place such as:

· Responsibility

lies with departmental managers to manage themselves with no formal system or

process.

· A

document, spreadsheet or SharePoint list is created that lists all relevant

legislation, who is responsible and whether they comply or not. This list also

needs to be manually kept up to date with all legislation changes.

· An

online system which is kept up to date with legislation changes by the vendor;

maps responsibilities; translates law into plain English; identifies

compliance, corrective actions and legal risks; and provides high-level

overview infographics reporting.

Stakeholder interviews to

provide insight and feedback have been undertaken with relevant managers during

January 2020. A business case containing a recommendation will be going to the

Strategic Leadership Team for their approval in February/March 2020.

FNDC Assurance

Programme 2020

This programme is

currently being finalised and will be presented to the Assurance, Risk and

Finance Committee for their endorsement once approved by the Strategic

Leadership Team.

Audit

Recommendations

Good progress has been

made implementing recommendations from internal and external audits. There are

plans in place to complete outstanding recommendations.

|

Audit Name

|

Total Number of Recommendations

|

Recommendations Completed

|

Recommendations Underway

|

|

External Audit - KPMG -

Procurement 2017

|

34

|

29

|

5

|

|

External Audit - Audit

NZ - Annual Management Report - Interim 2017

|

18

|

15

|

3

|

|

Internal Audit -

Information Security 2018

|

15

|

12

|

3

|

|

Internal Audit -

Contract Management Review 2018

|

4

|

3

|

1

|

|

External Audit - Audit

NZ - Annual Management Report - Final 2018

|

5

|

4

|

1

|

|

External Audit - Audit

NZ - Annual Management Report - Final 2019

|

6

|

1

|

5

|

|

External Audit - Three

Waters Interim Alliance Agreement Review

|

6

|

4

|

2

|

|

External Audit - MPI

Council Food Act Recognised Agency Audit 2019

|

3

|

3

|

N/A

|

|

External Audit - LGOIMA Compliance

and Practice Report - 2019

|

30

|

13

|

17

|

|

External Audit - IANZ

– Building Consent Authority Accreditation Assessment Report 2019

*nb: significant actions have been taken on the audit

recommendations – these are currently being considered by IANZ and

expect to be cleared before 14 February 2020

|

11

|

*0

|

11

|

Financial Implications and Budgetary Provision

This report is for information only.

Attachments

Nil

3.4 Risk

Management Report

File

Number: A2826762

Author: Tanya

Reid, Manager Transformation, Risk and Audit (Acting)

Authoriser: William

J Taylor MBE, General Manager - Corporate Services

Purpose of the Report

To provide the organisation’s top 12 risk dashboard, risk progress

reports and group risk up-date.

No decision

required.

Executive Summary

·

Risk progress updates are provided for four of

the top 12 risk treatment plans.

·

Excellent progress has also been made on group

risk.

|

Recommendation

That the Assurance, Risk and Finance Committee receive

the report Risk Management Report.

|

Background

The Transformation and Assurance

team has facilitated the development of treatment plans for the

organisation’s top 12 risks. We are now in the phase where regular

reporting of the organisation’s top 12 risks, and treatment plans, is in

place.

A programme of deep dive

workshops is planned for these risks. The first of two deep dive workshops for

ARF005 Affordability Risk has been completed, with the second workshop to be

scheduled.

The Transformation and Assurance

team is working through the organisation to refresh / establish Group Risk

registers, with treatment plans, and regular reviews.

Discussion and Next Steps

Four risk progress reports, with

treatment plans, are attached. Risk ARF002, BCA

Status Risk, is the subject of a separate report.

The ARF005 Affordability deep

dive workshop has been split into two parts with the second part to be

scheduled. At the end of this workshop members will agree the next risk

“deep dive.”

An elected member workshop is to

be scheduled to cover the FNDC Risk Management Framework.

Nine group (District Services, IAMs and Corporate Services)

risk development workshops have been completed with a further eight workshops

scheduled for these groups, including Strategic Planning & Policy. Further

workshops are to be scheduled with the CEO Office.

Financial Implications and Budgetary Provision

At this

stage no additional budgetary provision has been identified for the treatment

plans.

Attachments

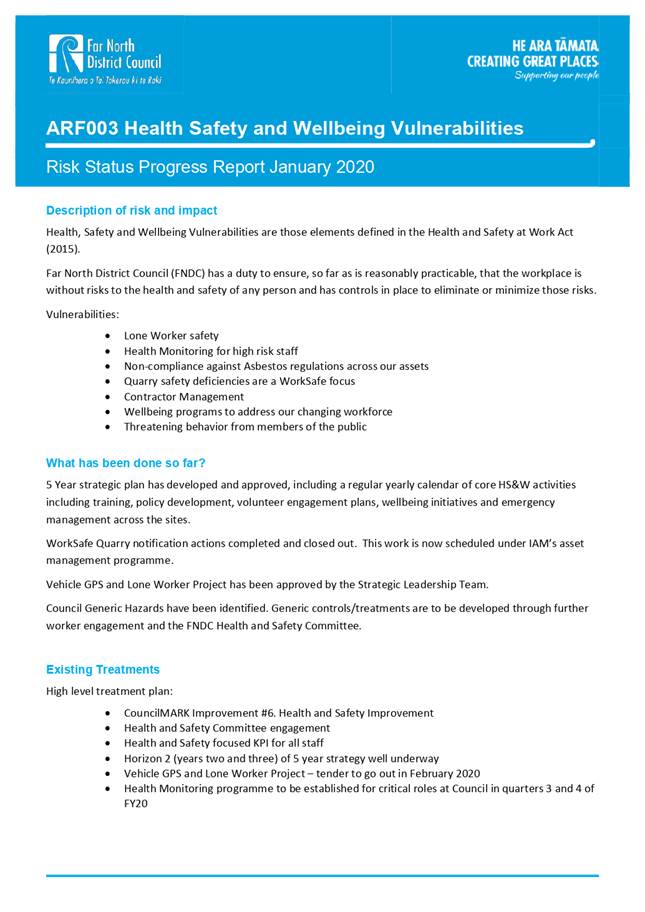

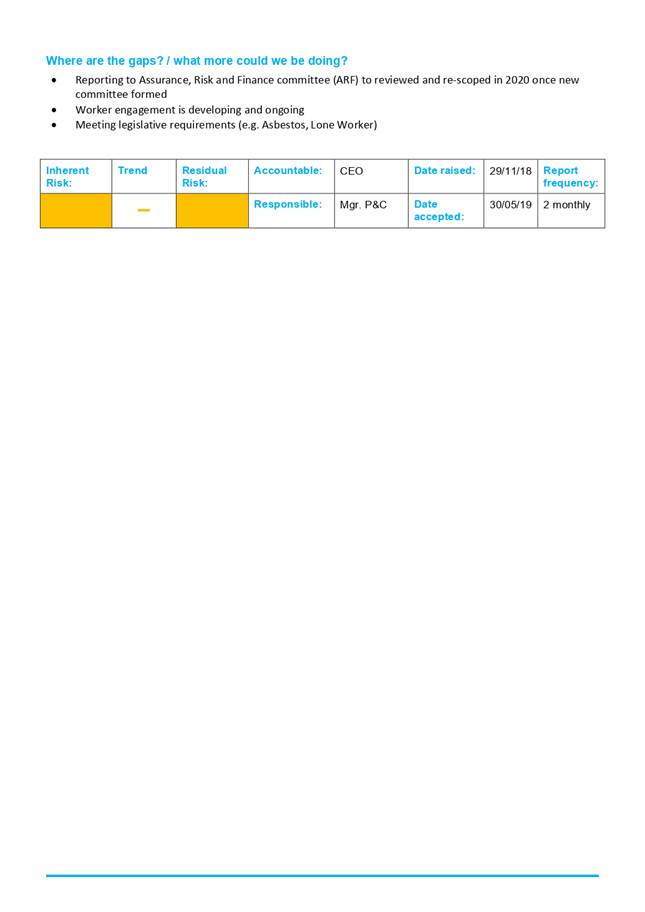

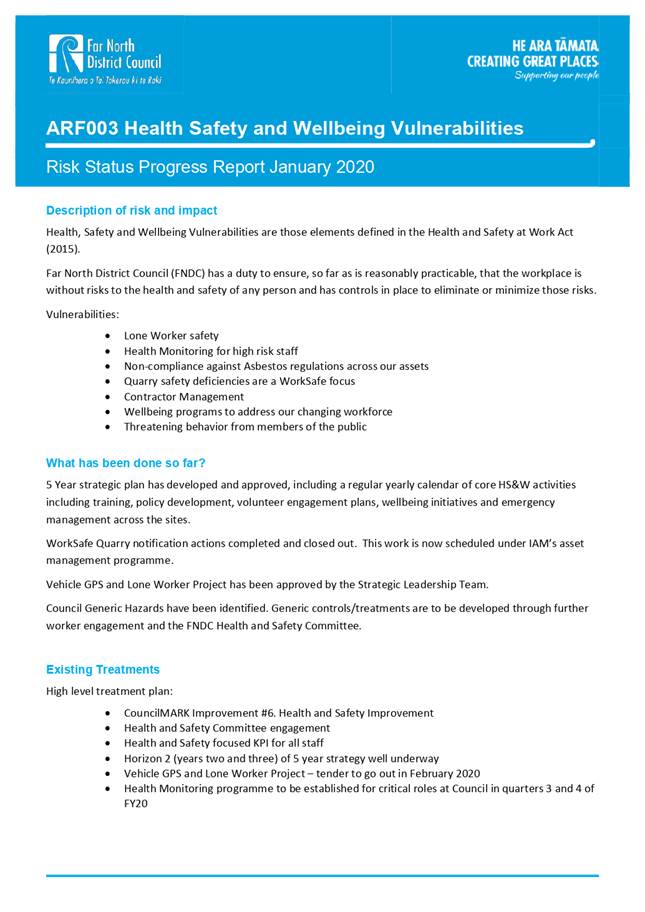

1. 2020 01 ARF003

Health Safety and Wellbeing Vulnerabilities Risk Progress Report - A2827712 ⇩

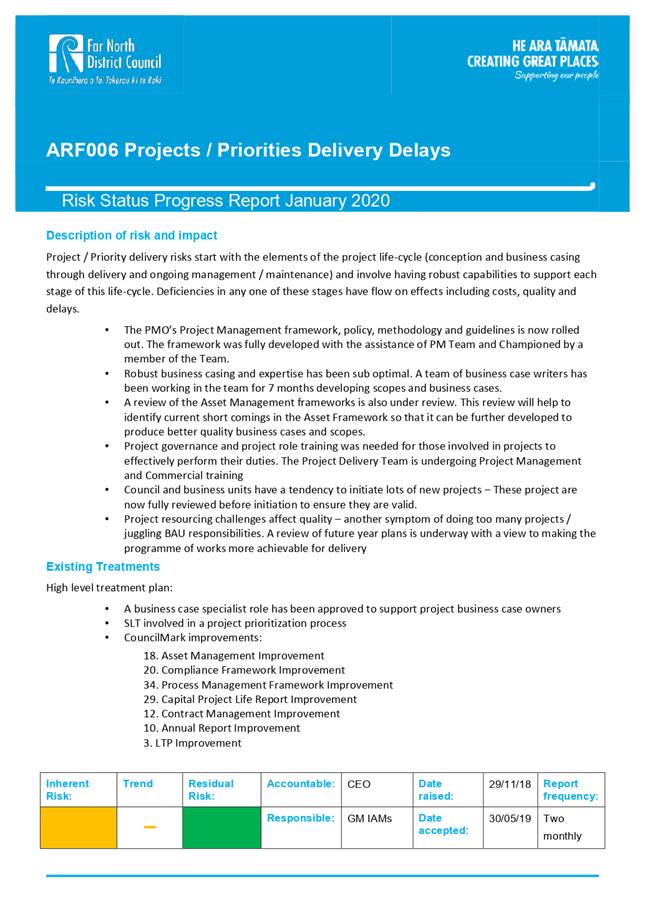

2. 2020 01 ARF006

Projects Priorities Delivery Delays Risk Progress Report - A2826766 ⇩

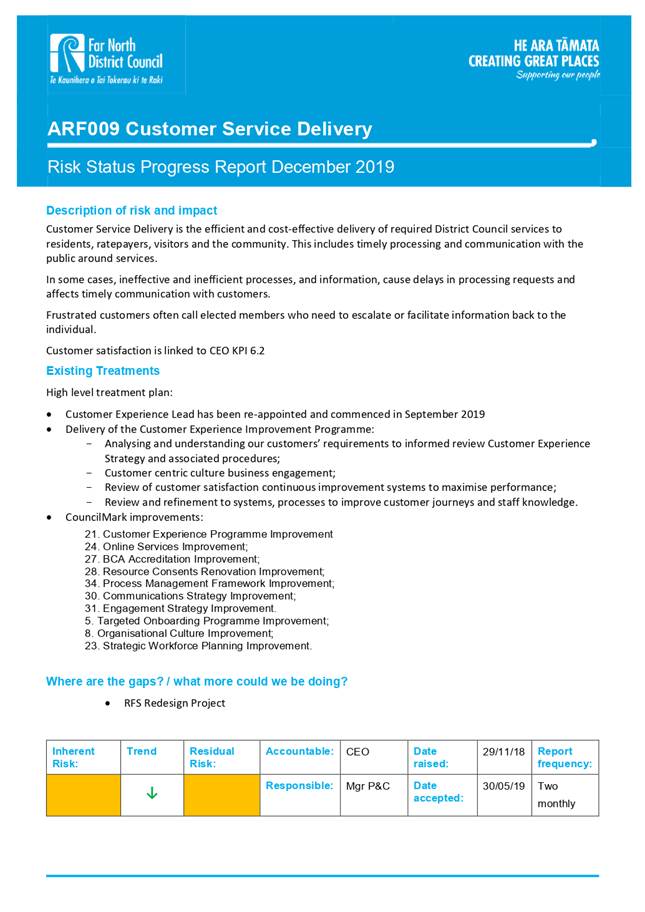

3. 2020 01 ARF009

Customer Service Delivery Progress Report - A2827520 ⇩

4. 2020 01 ARF012

Contract Management Risks Progress Report - A2827432 ⇩

|

Assurance, Risk and Finance Committee Meeting Agenda

|

12 February 2020

|

|

Assurance, Risk and

Finance Committee Meeting Agenda

|

12 February 2020

|

|

Assurance, Risk and Finance Committee Meeting Agenda

|

12 February 2020

|

|

Assurance, Risk and Finance Committee Meeting Agenda

|

12 February 2020

|

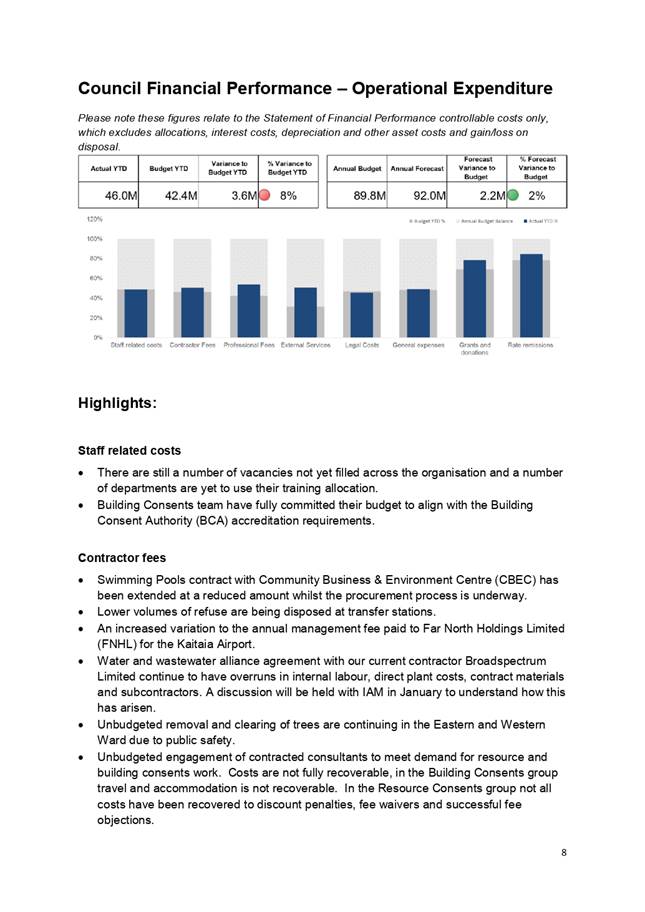

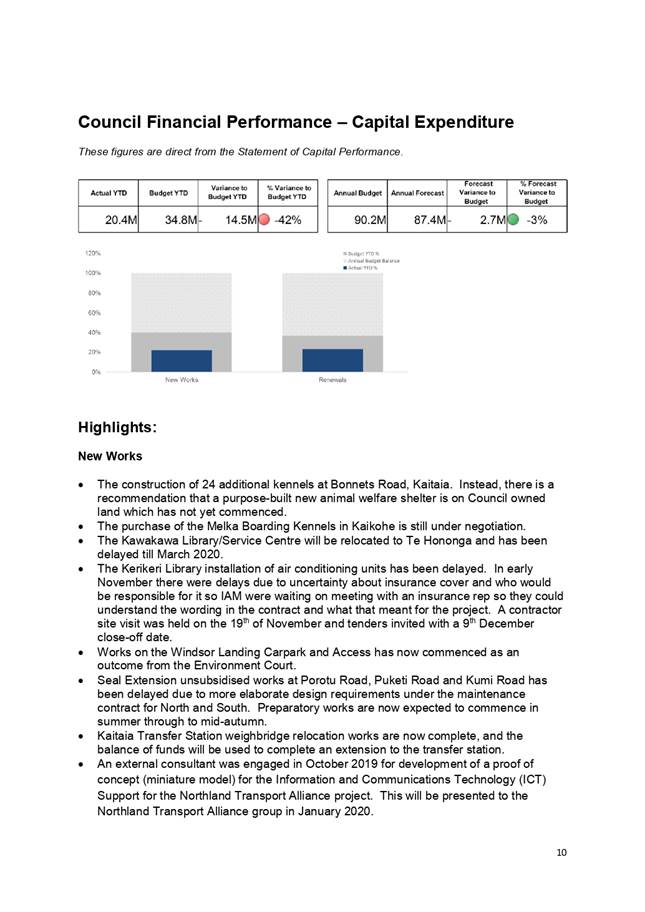

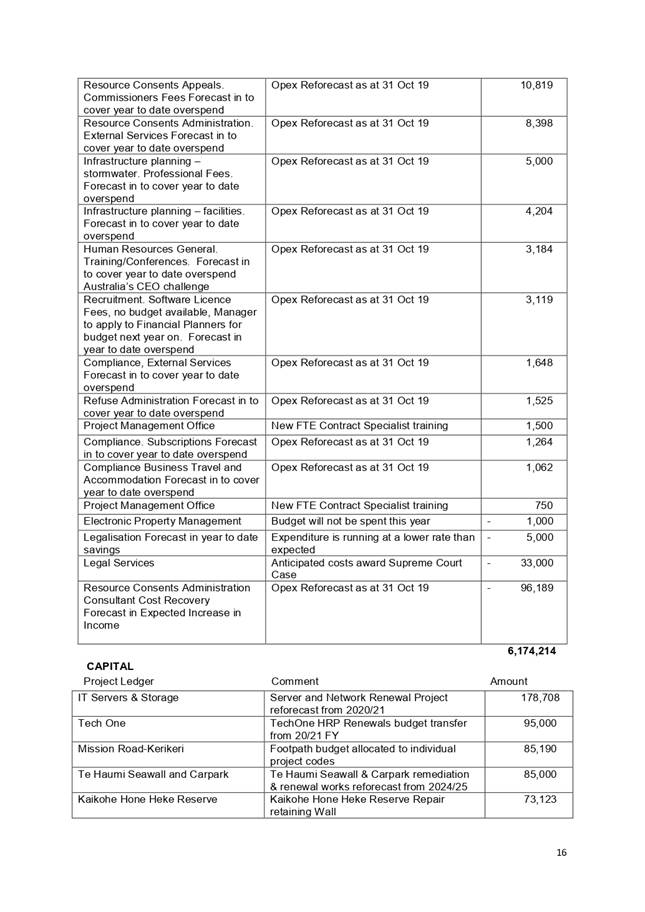

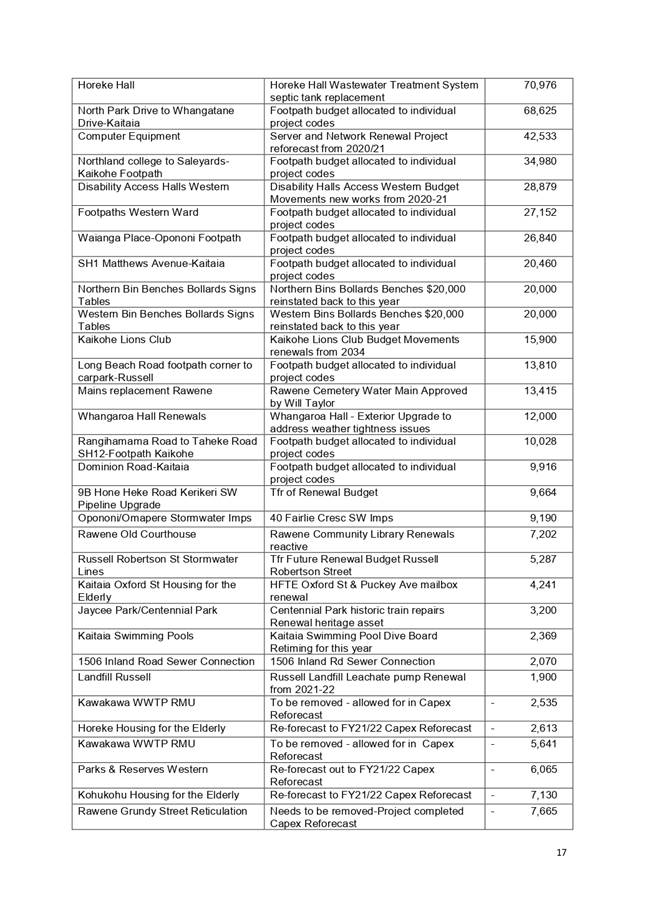

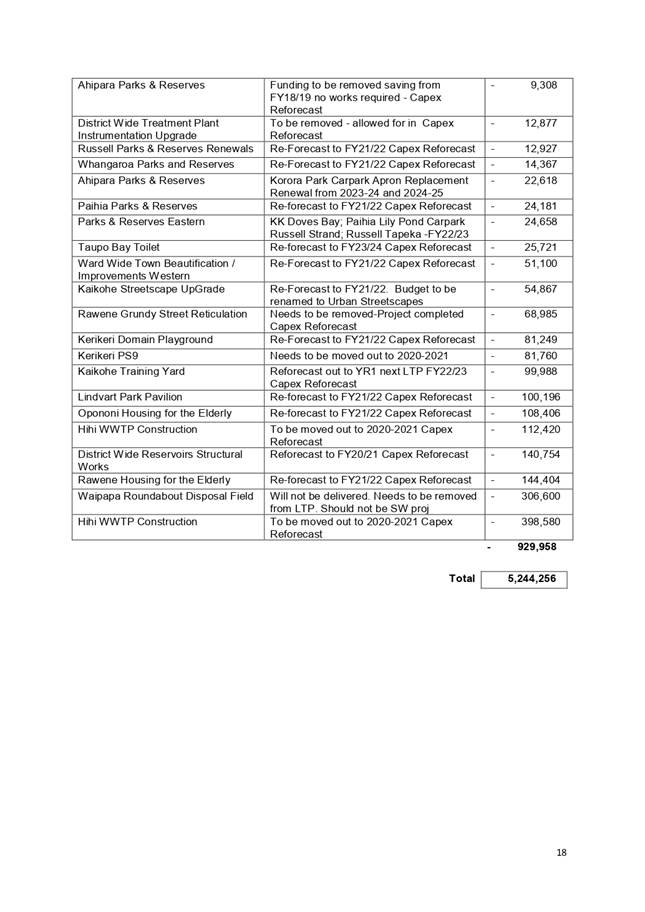

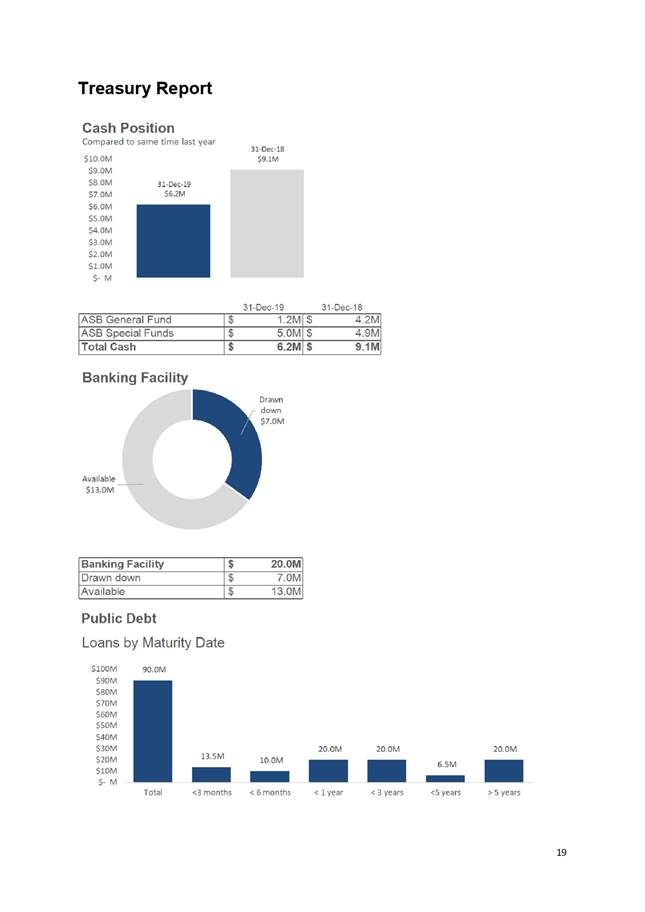

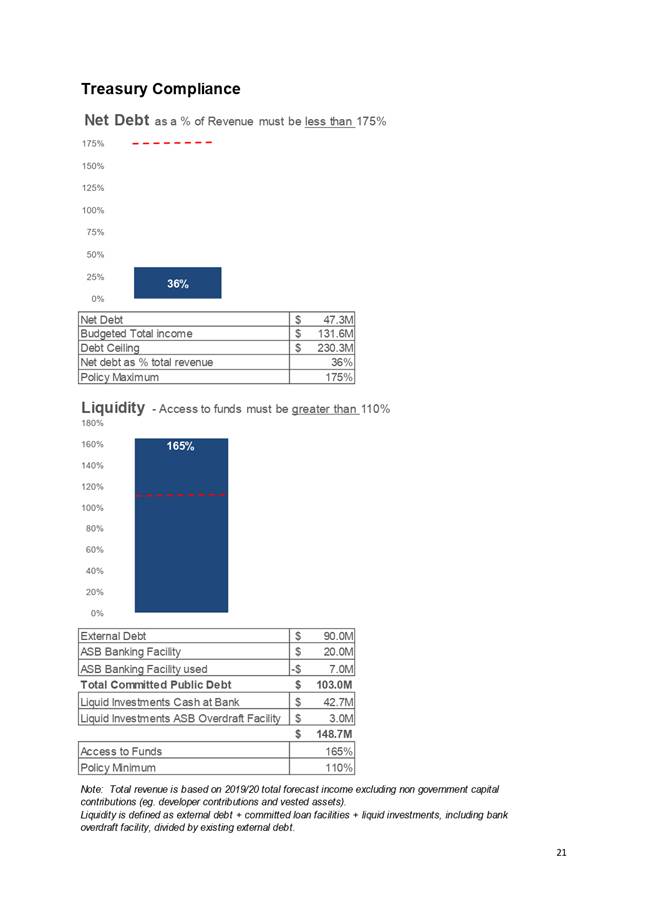

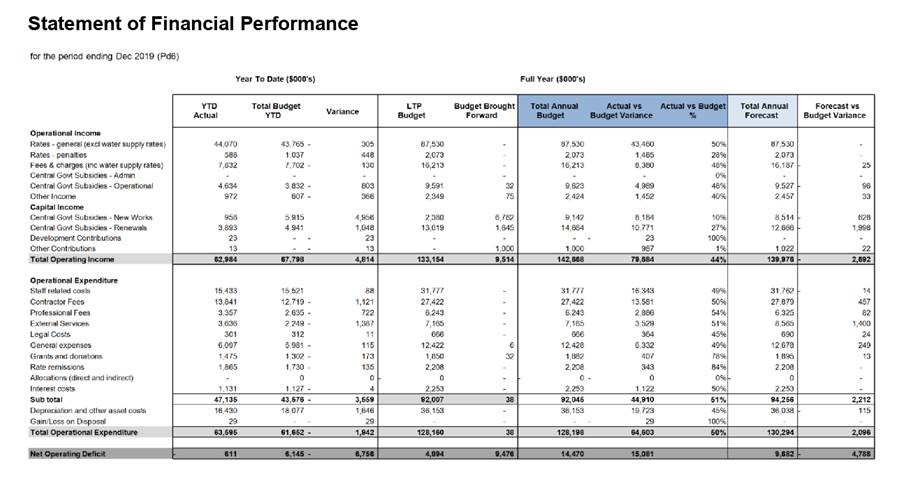

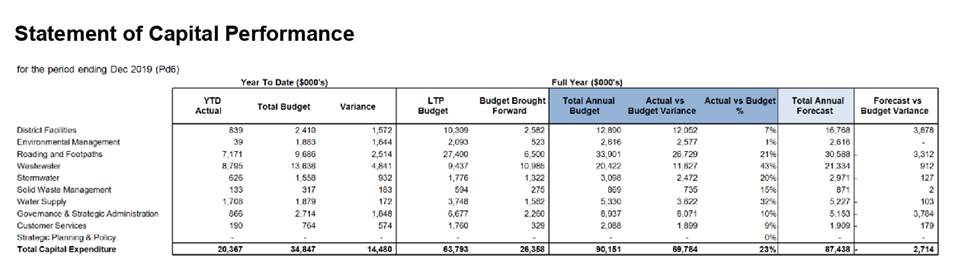

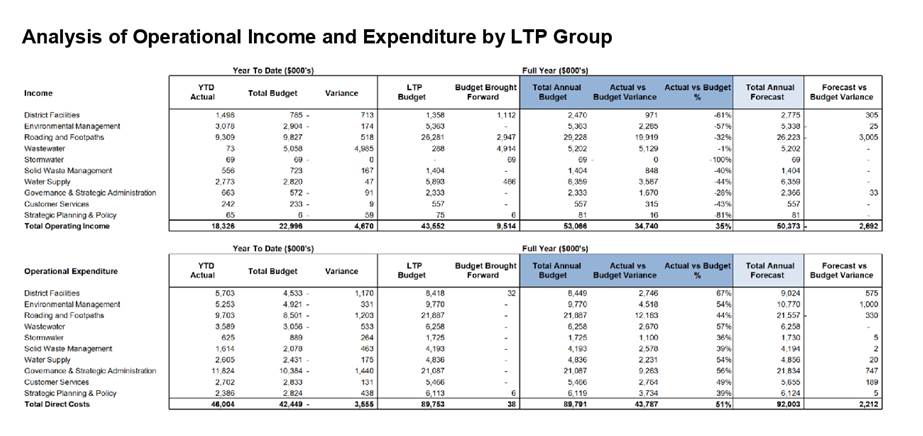

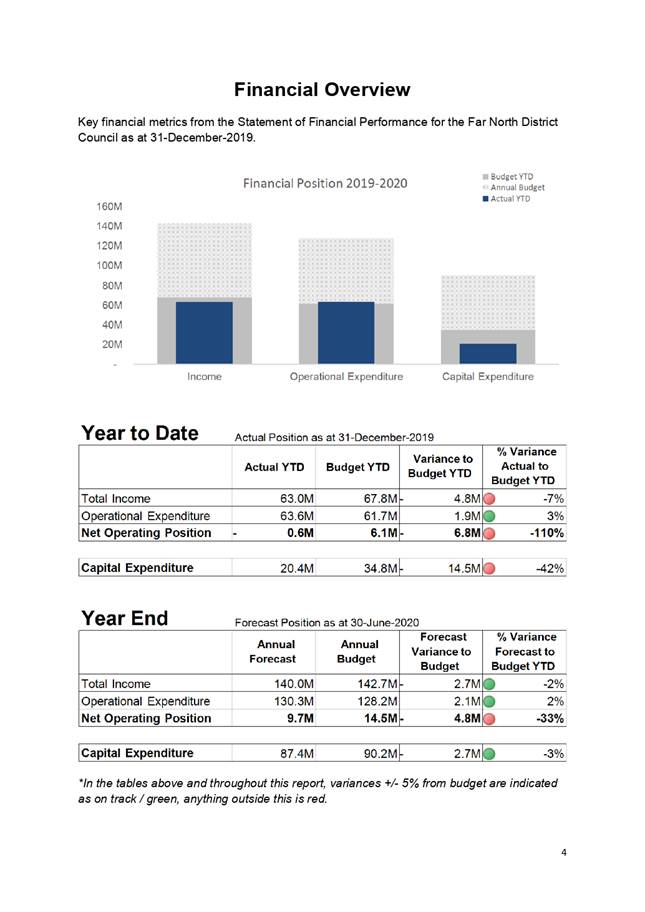

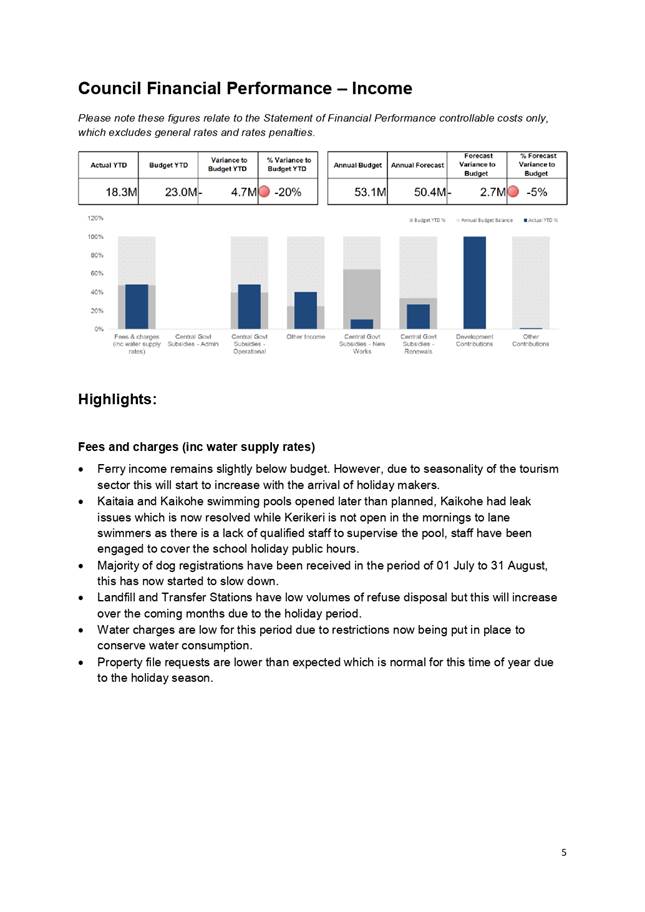

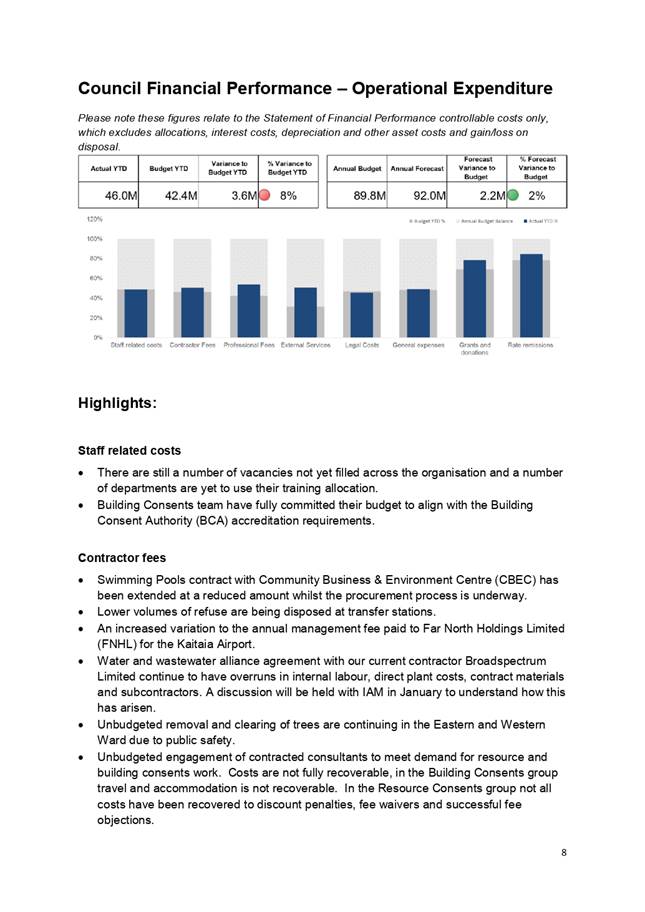

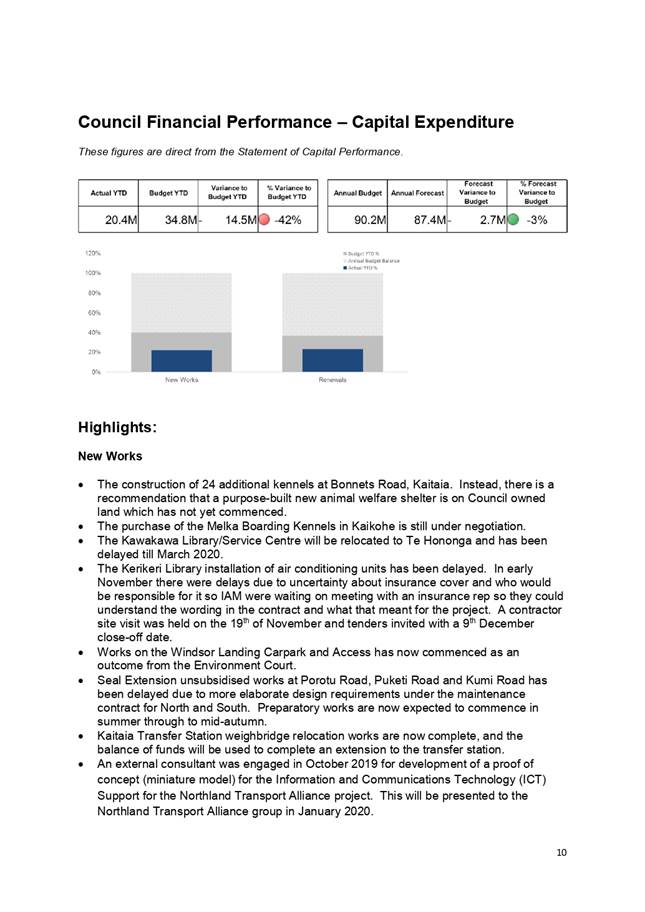

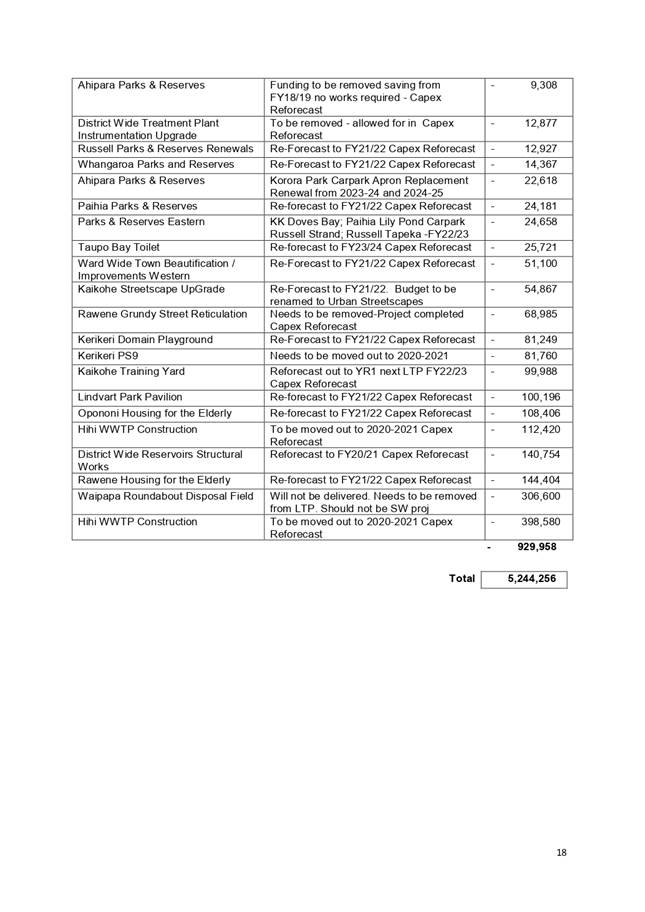

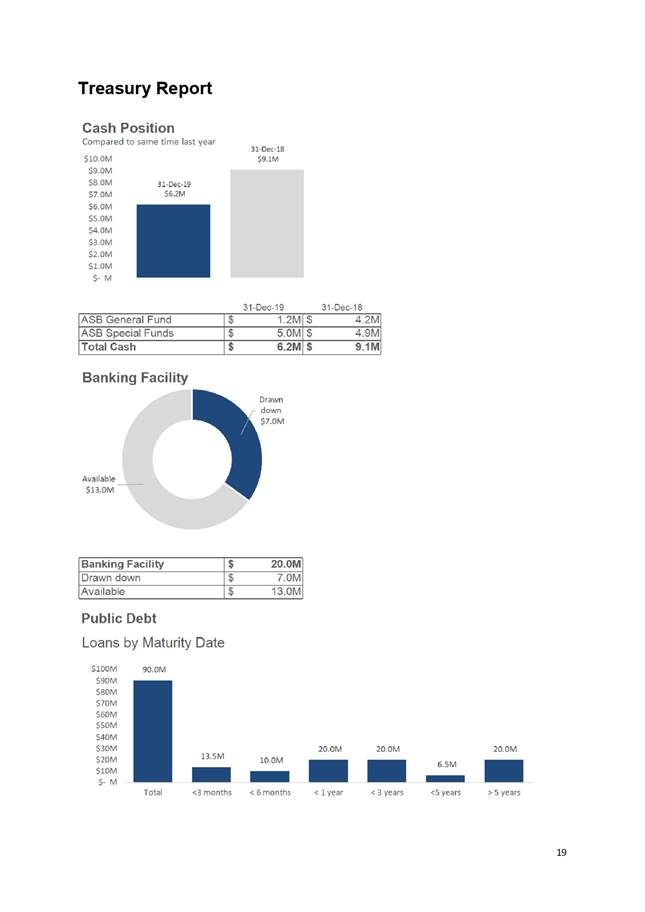

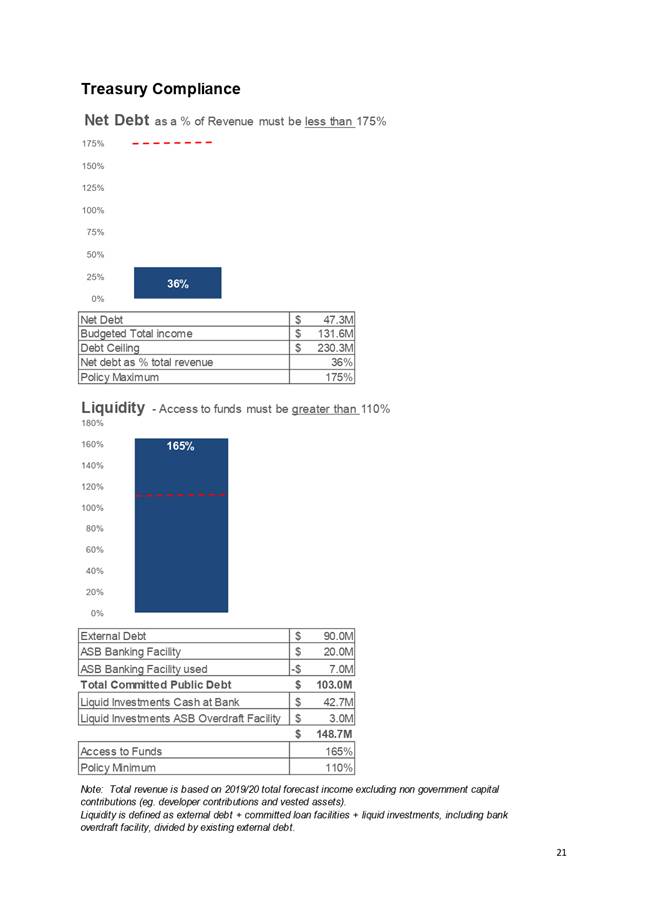

3.5 Financial

Report for the period ending 31 December 2019

File

Number: A2827848

Author: Angie

Thomas, Manager - Accounting Services

Authoriser: William

J Taylor MBE, General Manager - Corporate Services

Purpose of the Report

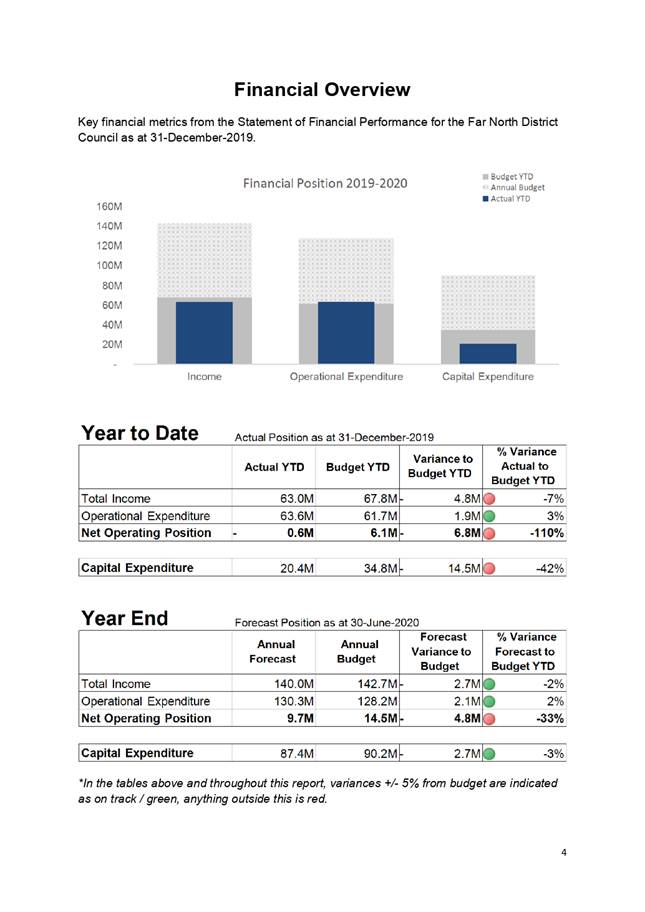

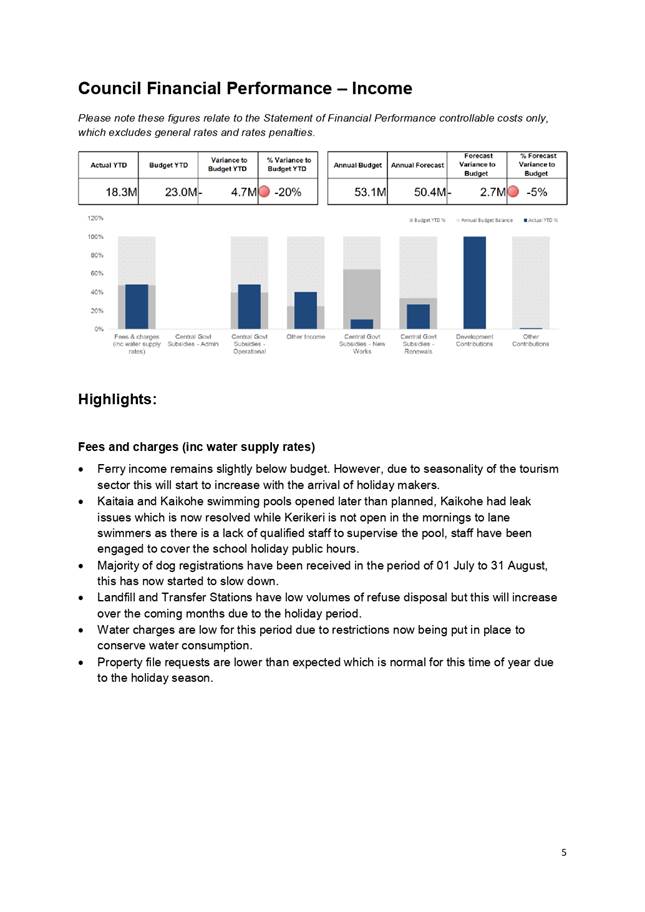

To provide an overview

and information on the current financial position and performance of the Far

North District Council as at 31 December 2019.

Executive Summary

·

Provid a summary overview, Statement of

Financial Performance, Capital Performance and Borrowing and Investment

reports.

|

Recommendation

That the Assurance, Risk and Finance Committee

receive the report “Financial Report for the period ending 31 December

2019”.

|

1) Background

This reports financial

information as at 31 December 2019.

2) Discussion and Options

The report is for

information only.

Reason

for the recommendation

The report is for information only.

3) Financial Implications and Budgetary Provision

There are no financial

implications or budgetary provisions required as a result of this report.

Attachments

1. Council

Financial Report December 2019 - A2831718 ⇩

|

Assurance, Risk and Finance

Committee Meeting Agenda

|

12 February 2020

|

.

4 Public

Excluded

RESOLUTION TO

EXCLUDE THE PUBLIC

|

Recommendation

That the public be excluded from the following parts of

the proceedings of this meeting.

The general subject matter of each matter to be considered

while the public is excluded, the reason for passing this resolution in

relation to each matter, and the specific grounds under section 48 of the

Local Government Official Information and Meetings Act 1987 for the passing

of this resolution are as follows:

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to

each matter

|

Ground(s) under section 48 for the passing of this

resolution

|

|

4.1 - Fraud Near Miss Report

|

s6(a) - the making available of the information

would be likely to prejudice the maintenance of the law, including the

prevention, investigation, and detection of offences, and the right to a

fair trial

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

4.2 - FNDC Current Legal Action

Potential Liability Claims

|

s7(2)(g) - the withholding of the information is

necessary to maintain legal professional privilege

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

4.3 - Rate arrears - collection

options

|

s7(2)(f)(i) - free and frank expression of

opinions by or between or to members or officers or employees of any local

authority

s7(2)(g) - the withholding of the information is

necessary to maintain legal professional privilege

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|